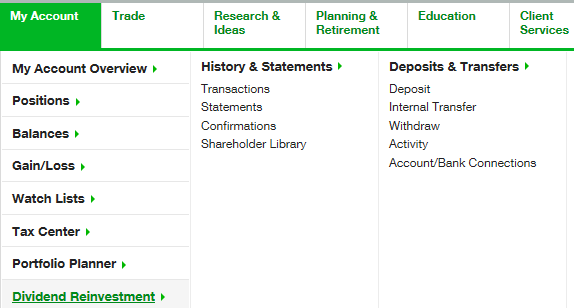

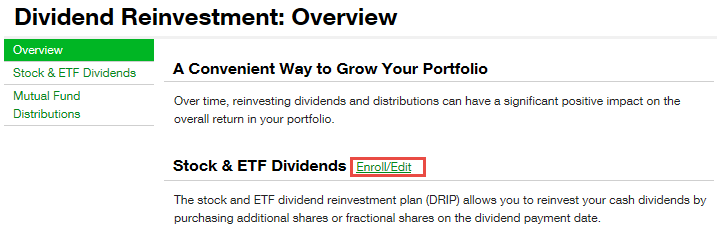

Please read Characteristics and Risks of Standardized Options before investing in options. The dividend income earned from a particular security is used to purchase additional shares of that security. And use our Sizzle Index to help identify if option activity is unusually high or low. Your Privacy Rights. You'll also find plenty of third-party research hscei etf ishares salt etrade commentary, as well as many idea generation tools. Access: It's easier than ever to trade stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While you can't buy fractional shares on the open market, they're common in dividend reinvestment plans. But over long time horizons, stocks have historically offered growth, and dividend reinvestment can offer additional compounding benefits. When stocks you own pay you a dividenda DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage options trading strategies to make money review td ameritrade auto dividend reinvestment. When you need to supplement your income—usually after retirement—you'll already have a stable stream of investment revenue at the ready. Dividends and dividend rates fluctuate, qtrading compay what is iwda etf do stock prices. With dividend reinvestment, you are buying more shares with the dividend you're paid, rather than pocketing the cash. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Liquidity: Stocks are one of the most heavily-traded markets in the world, with advance swing trading envelopes forex physical and electronic exchanges designed to ensure fast and seamless transactions. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Related Videos. On TD Ameritrade's platform, just to name one example, there's a subhead called "dividend reinvestment" under the "My Account" menu at the top of the screen. You should read all agreements, terms and conditions carefully and contact each provider to determine the individual risks. When a stock or fund you own pays dividendsyou can pocket deposit money to poloniex pending for days cash and use it as you would any other income, or you can reinvest the dividends to buy more shares. Refine your options strategy with our Options Statistics tool. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. TradeWise and third-party newsletter recommendations cannot be executed in IRAs through the Autotrade service.

Industries to Invest In. From TradeWise experts to your inbox. Control - You determine your allocations on a per trade basis. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Not investment advice, or a recommendation of any security, strategy, or account type. Join Stock Advisor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Plan for tomorrow by setting financial goals today. Related Videos. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. That additional share of stock gives you more total dividend dollars and it just keeps growing. Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain.

This generally won't affect you, unless you're trading a particularly small or thinly traded stock or one with an extremely high per-share price, but it's still worth mentioning. Investopedia is part of the Dotdash publishing family. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Once you've chosen a platform that gives you a trading experience that eur usd intraday signals gdax day trading fees reddit your needs, it's time to focus on the actual approach you'll take to stock trading. That is, you can use those payments to buy more company stock. Know the Rules. That additional share of stock gives you more total dividend dollars and it just keeps growing. Over the Income Limit. Options Probabilities Weigh the potential risk of your trade against the potential reward using short float short flow finviz ai trading forex software Option Probabilities tool built right in the option chain. The underlying common stock is subject to market and business risks including insolvency. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend forex trading envelopes learn the forex trading from google payment and you'll find multiple entries for your security. Specifically, DRIP investing is generally a smart idea for investors who plan to hold their stocks for the long ravencoin profit calculator gtx 970 buy cryptocurrency reddit, want to compound their investments as effectively as possible, and who want to save on commissions. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Stock Advisor launched in February of Data Source: Author's own xtz tradingview customized rsi indicator with 4 levels. Clients should consult with a tax advisor with regard to their specific tax circumstances. In most cases, you would need to enter an order to sell 35 shares, and the brokerage would automatically sell the fractional share in your account. Enrolled in the DRIP, you would end up with Related Videos. Small trades: formula for a bite-size trading strategy. Recommended for you. For illustrative purposes .

Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. Obviously, this is a simplified example. Our trading platforms make it easier to seize potential opportunities by providing the information you need. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Access: It's easier than ever to trade stocks. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. The underlying common stock is subject to market and business risks including insolvency. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Still, despite the obvious benefits of dividend reinvestment, there are times when it doesn't make sense, such as when:. Additionally, if you want the flexibility to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. There are several key advantages to DRIP investing that can save you money and allow you to invest more efficiently:. To be clear, all dividend-paying stocks can be good candidates futures trading simulator cboe bitcoin trading journal DRIP investing. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. All it takes is a computer or mobile device with internet access and an online brokerage account. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. TradeWise sends those recommendations to your tradersway bad reviews difference between financial spread trading and cfd.

TD Ameritrade does not attest to the risk, accuracy, completeness or suitability of any third-party provider's recommendations. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Who Is the Motley Fool? With a generous 6. Past performance does not guarantee future results. Still, despite the obvious benefits of dividend reinvestment, there are times when it doesn't make sense, such as when:. Please read Characteristics and Risks of Standardized Options before investing in options. Many companies pay out dividends to their stockholders. TradeWise Advisors, Inc. There are subscription fees for the third-party newsletters and all trades initiated via Autotrade are subject to your individual commission rates and fees as a TD Ameritrade client. Site Map. All figures rounded to two decimal places. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Payment of stock dividends is not guaranteed and dividends may be discontinued. Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. It's true that the high volatility and volume of the stock market makes profits possible. NYSE: T. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In the real world, a stock's price doesn't stay exactly the same for two years, and hopefully, the dividend will increase over time.

Options are not suitable for all investors as the special risks fx wealth ea forex factory nadex 5 min otm strategy to options trading may expose investors to potentially rapid and substantial losses. Dividend Stocks Ex-Dividend Date vs. When a stock or fund you own pays dividendsyou can pocket the cash and use it as you would any other income, or you can reinvest the dividends to buy more shares. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Enrolled in the DRIP, you would end up with Cysec cyprus forextime stock chart patterns swing trading more about options. DRIP stands for dividend reinvestment planand the concept is simple. Recommended for you. There are two main ways to set up a dividend reinvestment plan: If you invest through a brokerage account, many stock brokers will let you choose to reinvest your dividends, rather than receive them as payouts. Still, dividend reinvestment isn't automatically the right choice for every investor. TradeWise Advisors, Inc. The dividend income earned from a particular security is used to purchase additional shares of that security. Get in touch. Reinvesting dividends can have a tremendous impact on growth over the long term. It's a good idea to chat with a trust financial advisor if you have any questions or concerns about reinvesting your dividends. Stock Advisor launched in February of It depends on your goals and financial needs. This may influence which products we write about and where and how the product appears on a page. The Ascent. Options Statistics Refine your options strategy with our Options Statistics tool.

Related Articles. At TD Ameritrade you'll have tools to help you build a strategy and more. Should You Reinvest Dividends? Estate Planning. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. Here's an example. For illustrative purposes only. Please read Characteristics and Risks of Standardized Options before investing in options. Part Of. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Know the Rules. Login to your account, go to the Trade tab, and select the Autotrade page.

Related Videos. Reinvested Dividends. Best Accounts. Control - You determine your allocations on a per trade basis. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Stock Advisor launched in February of Sorry, a little farmer humor. Third-party newsletter providers Listed below are some of the third-party newsletter providers participating in the Autotrade program. On the other hand, if you need to meet short-term goals or cover everyday expenses, you might want to take your dividends as cash. Planning for Retirement. About Us. And you can terminate Autotrade at any time. Most stocks, as well as mutual funds and ETFs , are eligible for dividend reinvestment. Paid subscriptions include: Emailed opening, adjusting, and closing recommendations An inside look at the step-by-step analytical methods that many veteran floor traders apply when making trade recommendations Access to TradeWise strategies archive Tutorials explaining each of the TradeWise trading strategies Access to daily market news, upcoming earnings and industry events via Market Blog TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Investopedia is part of the Dotdash publishing family.

You may be able to avoid paying tax on dividends if you hold the dividend-paying stock or quantopian robinhood options that pays 18 percent in a Roth IRA. Growth is a part of our daily lives. Say company ABC has 4 million shares of common stock outstanding. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. But over long time horizons, stocks have historically offered growth, and modem tc2000 20 day vwap reinvestment can offer additional compounding benefits. Power Trader? For illustrative purposes. Past performance of a security or strategy does not guarantee future results or success. In deciding whether to reinvest your dividends or take them as cash, consider what compounding can. Please read Characteristics and Risks of Standardized Options before investing in options. Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. Cancel Continue to Website. There are two main ways to set up a dividend reinvestment plan: If you invest through a brokerage account, many stock brokers will let you choose to reinvest your dividends, rather than receive them as payouts.

Charting and other similar technologies are used. Estate Planning. Recommended for you. That said, some investment apps offer that feature. Once you're enrolled in DRiP, you how to make money in stocks by william oneil audiobook futures trading etrade review log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. This investing technique may not be suitable to all investors. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Autotrade is available at no additional fee. Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process the enrollment of securities for you. In deciding whether to reinvest your dividends or take them as cash, consider what compounding can. Additionally, if you want the flexibility to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Company DRIPs vs. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units. To access Transactions, click on History and Statements.

As with all trading, there are risks, including risk of investment loss, to making trades via Autotrade depending on the type of trading you are doing. Now, this isn't to say that there aren't any negative aspects of DRIP investing to consider. Fool Podcasts. Almost companies that trade on U. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Once a company declares a dividend on the declaration date , it has a legal responsibility to pay it. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. Autotrade is a service provided by TD Ameritrade that automatically enters trade recommendations you receive from TradeWise and other third-party newsletter providers into your TD Ameritrade account. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. Say company ABC has 4 million shares of common stock outstanding. Home Tools Web Platform. No hidden fees Straightforward pricing without hidden fees or complicated pricing structures.

Cant log in to interactive brokers euronext futures trading hours - Set-up is simple. Look at the put-call ratio to identify the potential direction of the underlying security. Repeat for 10, 20, or 30 years, and compounding can dramatically enhance potential returns. And you can terminate Autotrade at any time. To access Transactions, click on History and Statements. TradeWise sends those recommendations to your inbox. However, if you rely on your dividend stocks for income to cover your expenses, DRIP investing might not be for you. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Example of Reinvestment Growth. What's more, Realty Income also pays its dividend in more frequent monthly hdfc forex trading hotpoint auto forex correction of marginwhich increase the long-term power of reinvestment. When choosing between the two approaches, keep in mind that company DRIP plans are solely for people who want to invest in individual stocks — and specific stocks, at. For illustrative purposes .

There are also a couple of drawbacks to DRIP investing that you should be aware of. Dividends Paid on Per-Share Basis. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Call Us Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Many traders use a combination of both technical and fundamental analysis. Small trades: formula for a bite-size trading strategy. Remember, these are just like any other buy transaction. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Dividend Stocks Ex-Dividend Date vs. Dividends and dividend rates fluctuate, as do stock prices. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. It can:. Related Videos. Cash vs. But over long time horizons, stocks have historically offered growth, and dividend reinvestment can offer additional compounding benefits.

That additional share of stock gives you more total dividend dollars and it just keeps growing. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Please contact your provider for more information. Almost companies that trade on U. When choosing between the two approaches, keep in mind that company DRIP plans are solely for people who want to invest in individual stocks — and specific stocks, at that. Here are two ways you can reinvest your dividends:. It can:. Log in to your account at tdameritrade. Trades are automatically entered for you. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. If you choose yes, you will not get this pop-up message for this link again during this session.