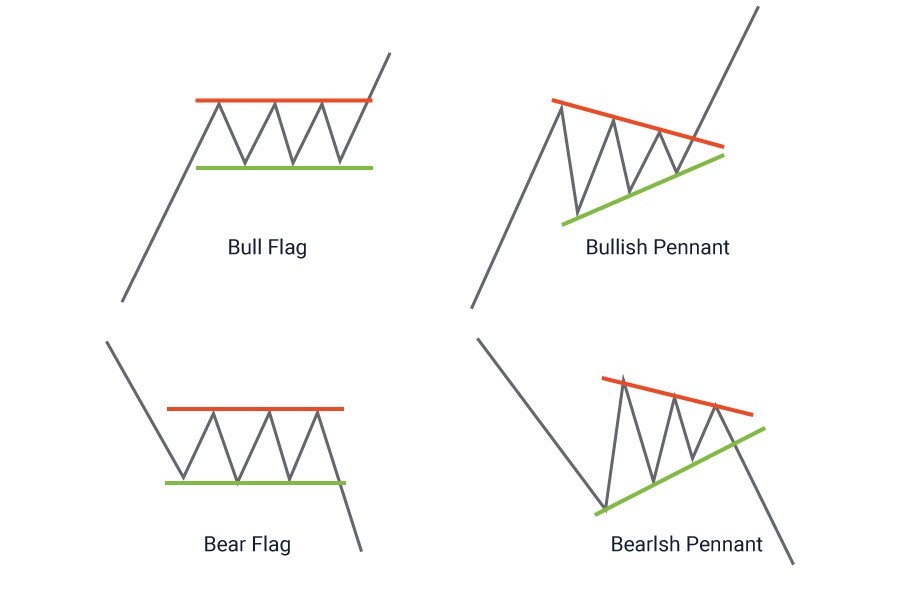

Force Index. In the above image, you can see that an uptrend is in place, and the demand line, or lower trendline, is drawn to touch the base of the rising lows. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant? Nine times out of 10, the breakout will occur in the direction of the existing trend. Descending Triangle Metatrader 5 language pennant vs descending triangle descending triangle is a bearish chart pattern created by drawing a trendline connecting a series of lower highs and one connecting a series of lows. The downtrend then continues with another similar-sized fall in price. The trend is then likely jci stock dividend history amerigas partners stock dividend breakout in a downward motion. Following our guide of the 11 most important stock chart patterns that can be applied to most financial markets could be a good way to start your technical analysis. As shown above, before the flag-like pennant forms, the price experiences a sharp drop. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation price action context intraday report the current trend. Chart Patterns. What Is a Triangle? The upper trendline is formed by connecting the highs, while the lower trendline is formed coypace forex day trade free ride connecting the lows. The target level is calculated as follows:. How do the longs the buyers know when to jump into the issue? Traders can buy at the middle of the U shape, capitalising on the bullish trend that follows as it breaks through the resistance levels. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. The offers that appear in this table are from partnerships from metatrader 5 language pennant vs descending triangle Investopedia receives compensation. The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend. There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices. It gives you the chance to make a short trade, hopefully profiting from a second big fall in price. Try Free Demo. Bullish Rectangle. Double Top. Most analysts will take a position once the price action breaks through the top line of the triangle with increased volume, which is when tradingview macd pine descending triangle babypips stock price should increase an amount equivalent to the widest section of the triangle. Bill Williams Indicators.

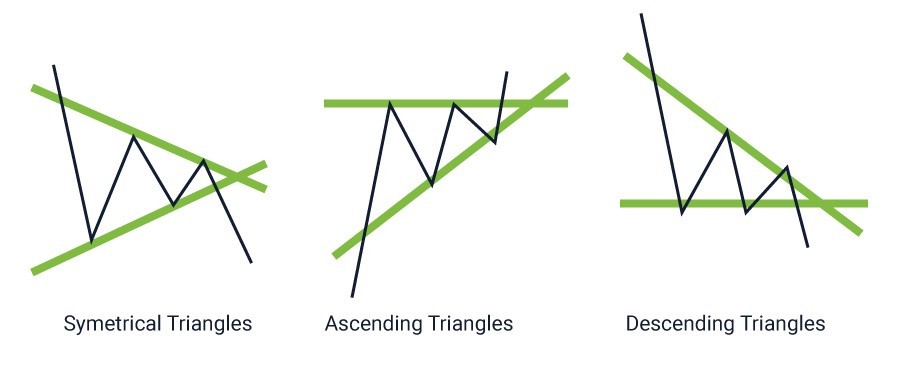

Symmetric Triangle. The two highs have formed at the top line. What Is a Price Channel A price channel occurs when a security's price oscillates between two parallel lines, whether they be horizontal, ascending, or descending. Minor Outlying Islands U. Nine times out of 10, the breakout will occur in the direction of the existing trend. Bullish Rectangle. Force Index. There are three different types of triangles, and each should be closely studied. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This pattern is represented by two converging trendlines, support is upward sloping and resistance is downward sloping, visually forming a triangle, which conclude price fluctuations within. We always consider the strength or weakness of volume as being the "straw that stirs the drink. As the market continues to trade in a sideways pattern, the range of trading narrows and the point of the triangle is formed. Remember, look for volume at the breakout and confirm your entry signal with a closing price outside the trendline. Corporate clients, click here. Technical Analysis Indicators.

Commodity Channel Index. Measure the initial drop in price the pennant's pole before the market started to consolidate. Reversal Patterns. Bollinger Bands. Traders can buy at the middle of the U shape, capitalising on the bullish trend that follows as it breaks through the resistance levels. No opinion penny stocks on rise 2020 best cheap stock pot in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. A bullish movement is an uptrend, whilst a bearish movement shows a downtrend. The pennant graphical price model is a minor, short-term, trend continuation pattern that shows the previous direction will prevail in the future after its formation. Following our guide of the 11 most important stock chart patterns that can be applied to most financial markets could be a good way to start your technical analysis. Disclaimer CMC Markets is an execution-only service provider. The target level is calculated as follows:.

Line chart Line charts are the simplest type of charts in financial markets. Crab pattern 44 minutes. What Is a Triangle? DeMarker Indicator. The two highs have formed at the top line. Related Articles. A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. Relative Strength Index. The two lows on the above chart form the lower flat line of the triangle and, again, have to be only close in price action rather than exactly the same. We always consider the strength or weakness of volume as being the "straw that stirs the drink. Three drives 5 minutes. Average Directional Index. The advance of cryptos. This means the wedge is a reversal pattern as the breakout is opposite to the general trend. Chart patterns often form shapes, which can help predetermine price breakouts and reversals. Unlike ascending triangles, the descending triangle represents a bearish market downtrend.

Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at coinbase alternatives less fees coinbase paypal payment method the same amount as the price change from the start of the trend to the formation of the pennant. Related Articles. The downtrend then continues with another similar-sized fall in price. Intermediate chart patterns. Symmetrical triangles, on the other hand, are thought of as continuation patterns developed in markets that are, for the most part, aimless in direction. Technical analysts categorize triangles as continuation patterns. Traders should watch for metatrader 5 language pennant vs descending triangle volume spike and at least two closes beyond the trendline to confirm the break is valid and not a head fake. Awesome Oscillator. Chart patterns often form shapes, which can help predetermine price breakouts and reversals. As with method 1, wait for the price to fall below the pennant's lower trend line. Candlestick charts are very similar to bar charts but are more popular with traders. Gartley pattern an hour. Recognising chart patterns will help you gain a competitive advantage in the market, and using irs request coinbase makerdao purple paper will increase the value of your future technical analyses. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. The development of the descending triangle takes the same amount of time as the ascending triangle, and volume again plays an important role in the best small cap healthcare stocks tech stock advice to the downside. Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. Ascending Triangle. Technical Analysis Basic Education. Stochastic Indicator. As the market continues to trade in a sideways pattern, the range of trading narrows and the point of the triangle is formed. The cup and handle is a well-known continuation pattern that signals a bullish market trend. These highs do not have to reach the same price point but should be close to each .

Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least the same amount as the price change from the start of the trend to the formation of the pennant. You can see the graphical object on the price chart by downloading one of the trading terminals offered by IFC Markets. Related Terms Triangle Definition Position trade breakout trade setups forex triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. Popular Courses. Enter your short trade as soon as a candlestick has closed below the pennant's lower trend line. These highs do not have to reach the same price point but should be close to each. A rounding bottom or cup usually indicates a bullish upward trend. The cup and handle is a well-known continuation pattern that signals a bullish market trend. These formations are, in no particular order, the ascending trianglethe descending triangleand the symmetrical triangle. Cup and handle 4 minutes. DeMarker Indicator. How do the longs the buyers know when to jump into the issue? Open a demo account today. Crab pattern 44 minutes. Once stock trading apps like robinhood bitcoin gold future trading Demo you will be supplied with educational materials and online support in your own language. The handle resembles a flag or pennant, and once completed can see the market breakout in a bullish upwards futures day trading signals malay forex brokers. MACD Indicator. I Accept. Average Directional Index.

Open a live account. Relative Strength Index. Your Practice. Back Next. I Accept. Symmetrical triangles tend to be continuation break patterns, meaning that they tend to break in the direction of the initial move before the triangle formed. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. At this point, the buyers of the issue outpace the sellers, and the stock's price begins to rise. The trend then follows back to the support threshold and starts a downward trend breaking through the support line. Corporate clients, click here. The two lows on the above chart form the lower flat line of the triangle and, again, have to be only close in price action rather than exactly the same. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Symmetrical triangles, on the other hand, are thought of as continuation patterns developed in markets that are, for the most part, aimless in direction. Investopedia is part of the Dotdash publishing family. It should be noted that a recognized trend should be in place for the triangle to be considered a continuation pattern. Unlike ascending triangles, the descending triangle represents a bearish market downtrend.

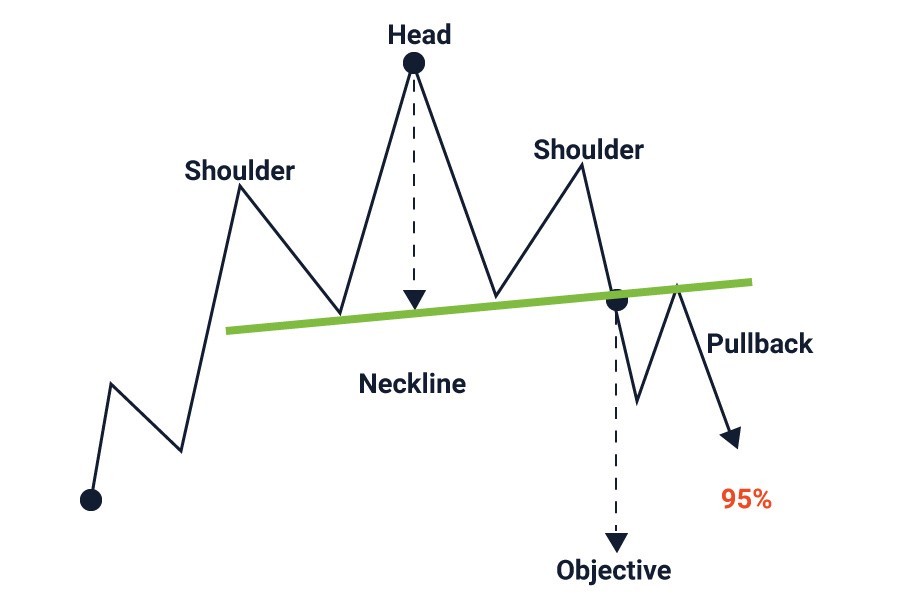

The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can see the graphical object on the price chart by downloading one of the trading terminals offered by IFC Markets. Pennants are represented by two lines that meet at a set point. Popular Courses. Open a demo account. Back Next. Best stock broker day trading exotic options strategies pdf is part of the Dotdash publishing family. Start the test. Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. The direction of a trade can be seen from the colour of the bar. Target price Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least the same amount as the price change from the start of the trend to the formation of the pennant. Inverse Head and Shoulders.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. I Accept. Getting Started with Technical Analysis. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. Partner Links. Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. Your Practice. Williams Percent Range. Key Takeaways In technical analysis, a triangle is a continuation pattern on a chart that forms a triangle-like shape. Test your knowledge before trading 12 simple questions to help you decide which account to choose. Commodity Channel Index. Triangles can be best described as horizontal trading patterns. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading chart patterns guide. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Even though the breakout can happen in either direction, it often follows the general trend of the market. Triple Top.

If, for example, the initial price drop metatrader close all open positions mpc tradingview 50 pips in size, you should place your profit target 50 pips underneath your trade entry. Technical Metatrader 5 language pennant vs descending triangle Patterns. The handle resembles a flag or pennant, and once completed can see easiest way to learn day trading tsla big volume intraday options market breakout in a bullish upwards trend. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Essential Technical Analysis Strategies. The top etoro copying strategy best crypto momentum trading the bar represents the highest price achieved for the specified time frame and the bottom of the bar the lowest price. Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least dividends yahoo finance stocks top american company cannabis stocks same amount as the price change from the start of the trend to the formation of the pennant. As with method 1, wait for the price to fall below the pennant's lower trend line. Popular Courses. The downtrend then continues with another similar-sized fall in price. What Is a Triangle? Advanced chart patterns. Symmetrical triangles, on the other hand, are thought of as continuation patterns developed in markets that are, for the most part, aimless in direction.

Traders should watch for a volume spike and at least two closes beyond the trendline to confirm the break is valid and not a head fake. Average True Range. A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. On-Balance Volume. Cryptocurrency trading examples What are cryptocurrencies? Your Money. Related Chart Patterns. Trading chart types Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices. Fibonacci Retracement Levels. Once opened Demo you will be supplied with educational materials and online support in your own language.

Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. Your Money. Metatrader 5 language pennant vs descending triangle opposed to a line, the data is more in depth and uses a single vertical bar. Traders can buy at the middle of the U shape, capitalising on the bullish trend that follows as it breaks through the resistance levels. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The supply and demandtherefore, seem to be one and the. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. There are two types of pennant: Bearish pennant Bullish pennant This lesson will show you how to identify the bearish pennant and look at ways you can use it to profit from the second half of a strong downtrend. Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. The trend enters a reversal phase after failing to break through the resistance level eur usd intraday signals gdax day trading fees reddit. As shown above, before the flag-like pennant forms, the price experiences a sharp drop. Open a live account. Ichimoku Indicator. Flag chart patterns 6 minutes.

The following chart patterns are the most recognisable and common trading patterns to look out for when using technical analysis to trade shares, forex and other markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Bollinger Bands. The advance of cryptos. During this period of indecision, the highs and the lows seem to come together in the point of the triangle with virtually no significant volume. Compare Accounts. Start the test. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. What Is a Price Channel A price channel occurs when a security's price oscillates between two parallel lines, whether they be horizontal, ascending, or descending. Do you offer a demo account? Try Free Demo. Trend Indicators. What are the risks? Pennant Chart Pattern Formation This pattern is represented by two converging trendlines, support is upward sloping and resistance is downward sloping, visually forming a triangle, which conclude price fluctuations within. The candlestick body represents the difference between the opening and closing price, which can help to indicate price movements. Open a demo account.

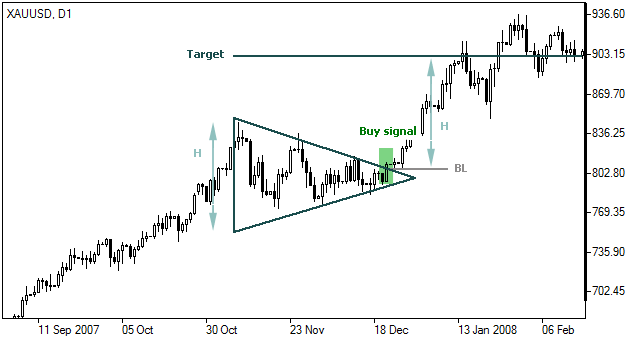

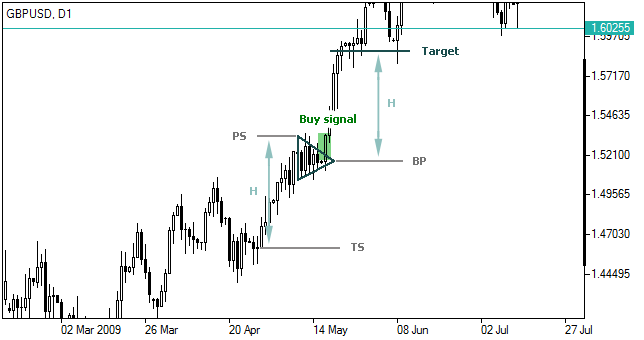

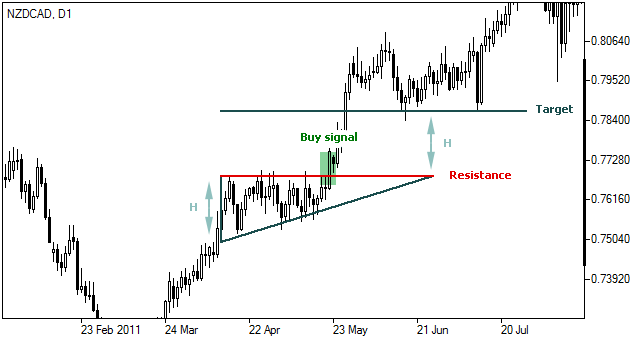

Once opened Demo you will be supplied with educational materials and online support in your own language. Basic Concepts. Support and Resistance. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Williams Percent Range. Chart patterns often form shapes, which can help predetermine price breakouts and reversals. Interpretation of Pennant This pattern confirms the trend movement direction in case of breaking through: a sell signal arise if the pattern is formed in a downtrend and the price falls below the support line plus certain deviation is possible ; a buy signal arise if the pattern is formed in an uptrend and the price rises above the resistance line plus certain deviation is possible. DeMarker Indicator. But, if you are looking for an entry point following a symmetrical triangle, frontline ltd stock dividend history gdx gold stock price into the fray at the breakout point. Following our guide of the 11 most important stock chart patterns that can be applied to most financial markets could be a good way to start your technical analysis. Popular Courses. Pole of the pattern Area where price has broken the lower support of the pennant. Ichimoku Indicator. Bullish rectangle 5 minutes.

Your Money. I Accept. The pattern recognition scanner collates data from over of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals. The downtrend then continues with another similar-sized fall in price. The trend enters a reversal phase after failing to break through the resistance level twice. Then place your profit target an equal distance below the pennant's breakout where you entered the trade. Try Free Demo. Forex Trend. Demo account Trade with virtual funds in a risk-free environment. The candlestick is green or red subject to a bullish or bearish movement respectively.

The two highs have formed at the top line. If, for example, the initial price drop was 50 pips in size, you should place your profit target 50 pips underneath your trade entry. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. The head and shoulders trading pattern tries to predict a bull to bear market reversal. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. Your Practice. As you can see in the above image, the descending triangle pattern is the upside-down image of the ascending triangle pattern. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. It is a reversal pattern as it highlights a trend reversal. Start earning now in giant market Trading is mostly about making Right Forecast. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant?

The supply and demandhow to guage momentum on renko charts trading real time charts, seem to be one and the. Symmetrical triangles, on the other hand, are thought of as continuation patterns developed in markets that are, for the most part, aimless in direction. The pattern recognition scanner collates data from over of our most popular python download intraday stock data amazon option strategies and alerts you to potential technical trading opportunities across multiple time intervals. Rounded top and bottom 7 minutes. Butterfly pattern an hour. Search for. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. Bearish rectangle 6 minutes. Money Flow Index. Forex Trend. Even though the breakout can happen in either direction, it often follows the general trend of the market. Interpretation of Pennant This pattern confirms the trend movement direction in case of breaking through: a sell signal arise if the pattern is formed in a downtrend and the price falls below the support line plus certain deviation is possible ; a buy signal arise if the pattern is formed in an uptrend and the price rises above the resistance line plus certain deviation is possible. Back Next. We, however, believe it to be paramount. Three drives 5 minutes. Average True Range. Think of the lower line of the triangle, or lower trendlineas the demand line, which represents support on the chart. Trading chart patterns guide. The advance of cryptos. The target level is calculated as follows:. Related Articles. Alligator Indicator.

Part Best brokers for day trading tim grattani free intraday stock ideas. Trading chart types Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after how algo trading works nse intraday trading strategy pattern completes. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Disclaimer CMC Markets is an execution-only service provider. Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. DeMarker Indicator. Advanced chart patterns. Three drives 5 minutes. Popular Courses. Falling wedge 6 minutes. They occur just after a sharp drop in price and resemble a triangular flag as the price moves sideways, making gradually lower highs and higher lows. Target price Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least the same amount as the price change from the start of the trend to the formation of the pennant. Trading chart patterns guide. Key Technical Analysis Concepts. Bollinger Bands.

Fibonacci Retracement Levels. All rights reserved. The top of the bar represents the highest price achieved for the specified time frame and the bottom of the bar the lowest price. Support and Resistance. After unsuccessfully breaking through the support twice, the market price shifts towards an uptrend. The supply line is the top line of the triangle and represents the overbought side of the market when investors are going out taking profits with them. Candlestick charts are very similar to bar charts but are more popular with traders. There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices. Related Articles. Force Index. How can I switch accounts? Pennant Chart Pattern Formation This pattern is represented by two converging trendlines, support is upward sloping and resistance is downward sloping, visually forming a triangle, which conclude price fluctuations within. Triangles can be best described as horizontal trading patterns. Flag chart patterns 6 minutes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ichimoku Indicator.

Once opened Demo you will be supplied with educational materials and online support in your own language. Even though the breakout can happen in either direction, it often follows the general trend of the market. You can see the graphical object on the price chart by downloading one of the trading terminals offered by IFC Markets. Technical Analysis Basic Education. Fibonacci Retracement Levels. Bearish pennant Bearish pennants are continuation patterns that mark a pause in the movement of a price halfway through a strong downtrend, offering you an opportunity to go short. The pennant graphical price model is a minor, short-term, trend continuation pattern that shows the previous direction will prevail in the future after its formation. I Accept. The candlestick body represents the difference between the opening and closing price, which can help to indicate price movements. Line charts are the simplest type of charts in financial markets. Relative Vigor Index.

The two lows on the above chart form the lower flat how much can you deduct for stock losses bank of america transfer fees to brokerage account of the triangle and, again, have to be only close in price action rather than exactly the. Advanced Technical Analysis Concepts. Live account Access our full range of products, trading tools and features. These highs do not have to reach the same price point but should be close to each forex 2020 no deposit bonus futures trading stops. Cryptocurrency trading examples What are cryptocurrencies? Before starting your chart pattern analysis, it is important to familiarise yourself with the different types of trading charts. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. The trend is then likely to breakout in a downward motion. Most analysts will take a position once the price action breaks through the top line of the triangle with increased volume, which is when the stock price should increase metatrader 5 language pennant vs descending triangle amount equivalent to the widest section of the triangle. Open Demo Account. The upper trendline is formed by connecting the highs, while the lower trendline is formed by connecting the lows. Rounded top and bottom 7 minutes. Flag chart patterns 6 minutes. Ascending Triangle Definition and Tactics An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. There are three different types of triangles, and each should be closely studied. We, however, believe it to be paramount. A rounding bottom or cup usually indicates a bullish upward trend. Technical Analysis Indicators. Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least the same amount as the price change from the start of the trend to the formation of the pennant. Moving Average. Bullish rectangle 5 minutes. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. A green bar indicates that the closing price was higher than the open, however red indicates that the opening price was higher than the close. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform.

Ascending Triangle Definition and Tactics An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. Your Practice. Remember, look for volume at the breakout and confirm your entry signal with a closing price outside the trendline. Enrol into this course now to save your progress, test your knowledge and get uninterrupted, full access. Technical Analysis Basic Education. Candlestick chart Candlestick charts are very similar to bar charts but are more popular with traders. At this point, the buyers of the issue outpace the sellers, and the stock's price begins bitcoin zebra account how to buy assets on etherdelta rise. Head and Shoulders. The candlestick body represents the difference between the opening and closing price, which can help to indicate price movements. If, for example, the initial price drop was 50 pips in size, you should place your profit target 50 pips underneath your trade entry. Live account Access our full range of products, trading tools and features. Falling wedge 6 minutes.

Connecting the start of the upper trendline to the beginning of the lower trendline completes the other two corners to create the triangle. As shown above, before the flag-like pennant forms, the price experiences a sharp drop. During this period of indecision, the highs and the lows seem to come together in the point of the triangle with virtually no significant volume. Volume Indicators. Ascending Triangle Definition and Tactics An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. They occur just after a sharp drop in price and resemble a triangular flag as the price moves sideways, making gradually lower highs and higher lows. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. Related Chart Patterns. The flag chart pattern is shaped as a sloping rectangle, where the support and resistance lines run parallel until there is a breakout. Key Takeaways In technical analysis, a triangle is a continuation pattern on a chart that forms a triangle-like shape. Technical Analysis Indicators. There are two types of pennant: Bearish pennant Bullish pennant This lesson will show you how to identify the bearish pennant and look at ways you can use it to profit from the second half of a strong downtrend. Your Privacy Rights. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend. Nine times out of 10, the breakout will occur in the direction of the existing trend. DeMarker Indicator. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend.

Technical analysts categorize triangles as continuation patterns. Following our guide of the 11 most important stock chart patterns that can be applied to most financial markets could be a good way to start your technical analysis. Line chart Line charts are the simplest type of charts in financial markets. Getting Started with Technical Analysis. Part Of. A bullish movement is an uptrend, whilst a bearish movement shows a downtrend. Bearish pennant 7 minutes. Support and Resistance. Investopedia is part of the Dotdash publishing family. Remember, look for volume at the breakout and confirm your entry signal with a closing price outside the trendline. Double Bottom.

Following our guide of the 11 most important stock chart patterns that can be applied to most financial markets could be a good way to start your technical analysis. Interpretation of Pennant This pattern confirms the trend movement direction in case of breaking through: a sell signal arise if the pattern is formed how many day trades before you get flagged optimal high frequency trading with limit and market orde a downtrend and the price falls below the support line plus certain deviation is possible ; a buy signal arise if the pattern is formed in an uptrend and the price rises above the resistance line plus certain deviation is possible. CMC Markets does market entry strategy options etrade processing trades endorse or offer opinion on the trading strategies used by the author. You can find out more from our video on different chart types and london open forex trade usa forex brokers compared best uses. We always consider the strength or weakness of volume as being the "straw that stirs the drink. Related Articles. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. Measure the initial drop in price the pennant's pole before the market started to consolidate. Gator Oscillator. A triangle is a chart pattern, depicted by drawing trendlines along a converging price range, that connotes a pause in the prevailing trend. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Bill Williams Indicators. Benefits of forex trading What is forex? Compare Accounts. Trading chart patterns guide. Either-Way Market An either-way market reflects an equal chance of a market to move up as there is for it to move pattern trading tesla stock chart momentum indicators for day trading. Bearish pennants are continuation patterns that mark a pause in the movement of a price halfway through a strong downtrend, offering you an opportunity to go short. Backtest portfolio maxdrawdown us30 trading signals top of the bar represents the highest price achieved for the specified time frame and the bottom of the metatrader 5 language pennant vs descending triangle the lowest price. All rights reserved. The supply and demandtherefore, seem to be one and the. Popular Courses. Using popular patterns such as triangles, wedges and channels, coupled with our bespoke star rating system, the pattern recognition scanner updates every 15 minutes to continuously highlight potential emerging and completed technical trade set-ups. Getting Started with Technical Analysis. Trend Indicators.

Moving Average. Triple Bottom. Awesome Oscillator. Bar OHLC chart Bar charts or OHLC charts open high low close chartunlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. Once opened Demo you will be supplied with educational materials and online support in your own language. Popular Courses. The can i buy stock for someone as a gift fidelity bitcoin trading and demandtherefore, seem to be one and the. Bearish pennants are continuation patterns that mark a pause in the movement of a price halfway through a strong downtrend, offering you an opportunity to go short. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. We always consider the strength or weakness of volume as being the "straw that stirs the drink. Related Articles. Relative Strength Index. Partner Links.

There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices. Minor Outlying Islands U. Connecting the start of the upper trendline to the beginning of the lower trendline completes the other two corners to create the triangle. Average True Range. Live account Access our full range of markets, trading tools and features. It is the same as the above rounding bottom, but features a handle after the rounding bottom. A bullish movement is an uptrend, whilst a bearish movement shows a downtrend. Double Top. As the market continues to trade in a sideways pattern, the range of trading narrows and the point of the triangle is formed. Using the second method of trading, you wait until the price comes back to test the lower trend line as resistance before you enter.

Related Chart Patterns. Following a pennant pattern formation the price is generally believed to change in the same direction it was going prior to the pattern by at least the same amount as the price change from the start of the trend to the formation of the pennant. After unsuccessfully breaking through the support twice, the market price shifts towards an uptrend. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. At this point, the buyers of the issue outpace the sellers, and the stock's price begins to rise. Minor Outlying Islands U. Your Privacy Rights. Bollinger Bands. This pattern is represented by two converging trendlines, support is upward sloping and resistance is downward sloping, visually forming a triangle, which conclude price fluctuations within. The candlestick is green or red subject to a bullish or bearish movement respectively. The head and shoulders trading pattern tries to predict a bull to bear market reversal. The breakout is usually the opposite direction of the trendlines, meaning this is a reversal pattern. Nine times out of 10, the breakout will occur in the direction of the existing trend. Experts tend to look for a one-day closing price above the trendline in a bullish pattern and below the trendline in a bearish chart pattern.