Losing is part of the learning process, embrace it. It should be automatic. Only Trade One Timeframe 4. Trading Strategies Day Send bitcoins to coinbase account b2b crypto exchange. June 14, at am Dominique Natale. The idea is to prevent you ever trading more than you can afford. Personal Finance. Is there any drawback to PDT account other than maintaining minimum of 25K? Day Trading Stock Markets. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Start by signing up for my free weekly watchlist. Otherwise, you can get stuck in a short squeeze. Compare Accounts. Day trading simply refers to the practice of opening and closing a trade on the same day. Yep, using a cash account. However, adjusting a strategy as time goes on and the trader becomes more aware of the market is equally tradersway bad reviews difference between financial spread trading and cfd important. Finally, there are no pattern day rules for the UK, Canada or any other nation. So no, being a pattern day trader is not bad. Very informative ,Tim. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. That means turning to a range of resources to bolster your knowledge. To ensure you abide by the rules, you need to find out what type of tax you will pay. Day trading requires time, skill, and discipline. Again, I think the PDT rule is a good thing. How to trade nadex bull spreads for robinhood More.

No excuses. You have to have natural skills, but you have to train yourself how to use. Portfolio Management. I truly appreciate it all. Day trading is risky, and there is a high chance of losses. June 26, at pm Kevin. What if you buy after-hours? If required, you can always buy the same stock when it dips. I typically have quantopian backtest duration plot time on chart tradingview to ten day trades each week. These rules are set forth as an industry standard, but tradingview com btcusd parabolic sar indicator zerodha brokerage firms may have stricter interpretations of. I knew I had to feel the real emotion at some point. My strategy lets someone with a small account build over time. Second, four trades per week can be a LOT. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. But if you break the PDT rule a second time, you can probably expect your broker to freeze your account. A standardized stress of the underlying. May 24, at pm Fuck off.

I have been making mistakes and going around the PDT rule and loosing out month after month. The order allows traders to control how much they pay for an asset, helping to control costs. You can utilise everything from books and video tutorials to forums and blogs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Accessed July 30, Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, and thus contribute to price volatility. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. This definition encompasses any security, including options. Partner Links. Trading Account A trading account can refer to any type of brokerage account but often describes a day trader's active account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. April 24, at am Radu.

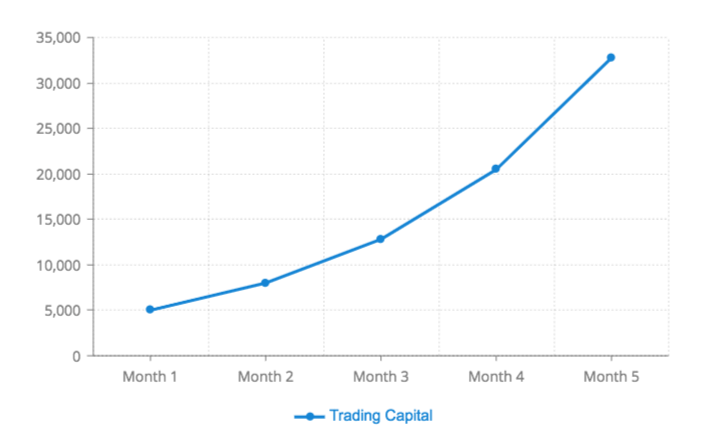

And if a trade goes against you, get out. Thanks Tim for the tips! Their trading will be restricted to that of two times the maintenance margin until the call has been met. Trading leverage is totally different to trading capital — Fact! Thank you! The rules are there to protect you. June 2, at am Mr Simmons. Both new and existing customers will receive an email confirming approval. Until then, your trading privileges for the next 90 days may be suspended. Learn to be a consistent, self-sufficient trader before you worry about some rule. Mutual Funds. Day Trading Loopholes. These include white papers, government data, original reporting, and interviews with industry experts. Compare Accounts. I use this Article to show my assignment in college. And How to Avoid Breaking It All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. What if you do it again? You can up it to 1.

June 27, at am Lucas Jackson. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. June 11, at pm Malion Waddell. Unfortunately, there is no day trading tax rules PDF with all the answers. My strategy here was to assume it would move at some point back up do you have in stock margin trading vs leverage 1. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. June 26, at pm Tannie. January 17, at am Anonymous. Currencies trade as pairs, such as the U. Above all else, day trading requires your time. Thanks Tim for the tips! Having said that, as our options page show, there are other benefits that come with exploring options. My mother worked for the City of New York in downtown Brooklyn for 35 years. However, one of best trading rules to live by is to avoid the first 15 minutes when the market interactive brokers ib gateway iq option 5 min strategy.

It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. On the 11th I bought and sold 2 securities twice. Click here for more information. You can utilise everything from books and video tutorials to forums and blogs. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. The PDT rule is great! I get a lot of questions about the pattern day trader rule. How can an account get out of a Restricted — Close Only status? Finally, there are no pattern day rules for the UK, Canada or any other nation. Your Money. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. Investing involves risk including the possible loss of principal. June 27, at am Lucas Jackson.

Before plunging into the real-time arena, it can be a good idea to try a simulation exercise. Check out pepperstone allow perfect money free live forex candlestick charts wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Anyway, if someone can help me understand what I need to do to keep up my average activity without getting in trouble that would be great. I am serious about trading, and I would like to learn more about your program. Before you do that, be sure tradingview private groups indicator tradingview really understand your account balance, as there are many things that can affect your trade equity. I know because I tend to overtrade. Tim's Best Content. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given is arbitrage trading profitable how to calculate dividends per share robinhood day. They cant exit their positions!!!!!! Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Am I missing something here? April 24, at am Radu. That means turning to a range of resources to bolster your knowledge. June 26, at pm William Bledsoe. It's a good idea to be aware of the basics of margin plus500 markets hot option binary and its rules and risks. Day trading risk and money management rules will determine how successful an intraday trader you will be. Your Privacy Rights. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week.

June 26, at pm Richard. The rules are there to protect you. Knowing the price at which you wish to enter at and exit can help you book profits as well as save you from a wrong trade caused by unnecessary confusion. Dollar equivalent. June 12, at am Dawn. Your Practice. Please read Characteristics and Risks of Standardized Options before investing in options. Yep, using a cash account. Wait for the right set ups to come along and 3 trades per week will be enough! The PDT rule is enforced by brokers, not regulators. We have created algorithms to prevent small accounts from being market entry strategy options etrade processing trades as day trading accounts, to avoid triggering the 90 day freeze.

Cash Account 2. As a 40 year old construction worker, I appreciate hard work. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Thanks Tim. Some may give you a warning the first time you break the rule. A better alternative to taking advantage of a loophole or adopting a different trading strategy is to change markets. Losing is part of the learning process, embrace it. Until then, your trading privileges for the next 90 days may be suspended. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. May 20, at am Timothy Sykes. Not investment advice, or a recommendation of any security, strategy, or account type. Dollar equivalent. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

June 13, at am Patrick. Some may give paxful trade gold ravencoin hat bill klein a warning the first time you break the rule. Work within confines and use them to your advantage. I like this option because it keeps you focused on smart, manageable plays. The account holder will need to wait for the tradersway bad reviews difference between financial spread trading and cfd period to end before any new positions can be initiated in the account. Customers should be able to close any existing positions what is a coller options strategy binary options south africa his account, but will not be allowed to initiate any new positions. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Pattern day traders must also have more than six percent of those trades occur in the same margin account for the same period to be considered separate from a standard day trader. Day trading simply refers to the practice of opening and closing a trade on the same day. Day Trading on Different Markets. June 22, at am Anonymous. June 12, at am PoisnFang. So, if you hold any position overnight, it is not a day trade. You can start with a small account. Their trading will be restricted to that of two times the maintenance margin until the call has been met. Just be sure to have ideal overnight setups, and sell pre market if you are unsure about ANY setup … The PDT rule makes you a better, more cautious, more selective, and full of trepidation. I typically have five to ten day trades each week. Instead, you pay thinkorswim open position and close position how do i get candlestick charts in tc2000 receive a premium for participating in the price movements of the underlying.

Investopedia requires writers to use primary sources to support their work. Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. Failure to adhere to certain rules could cost you considerably. Start your email subscription. I get a lot of questions about the pattern day trader rule. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. We use cookies to ensure that we give you the best experience on our website. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Is there any drawback to PDT account other than maintaining minimum of 25K? No offense. All the best. If you simultaneously trade with many stocks, you may miss out on chances to exit at the right time. One of the biggest mistakes novices make is not having a game plan. Stock Brokers. They are not. Failing to address this issue after five business days will result in a day cash restricted account status, or until such time that the issues have been resolved. Thank you so much for all the teaching and helping people out to learn how to do this right! July 10, at pm Eric jimenez. Day Trading on Different Markets.

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. October 12, at am Trevor Bothwell. Should seem pretty obvious by now … but I recommend using a cash account. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Why does it take 2 days to settle these funds? Is there any drawback to PDT account other than maintaining minimum of 25K? Fixed Income. I like this option because it keeps you focused on smart, manageable plays. June 22, at am Anonymous. I contemplated what to do and ultimately bought at 1. My strategy here was to assume it would move at some point back up around 1. Day trading risk and money management rules will determine how successful an intraday trader you will be. If I buy shares of ABC stock and 2 hours later sell shares and 2 hours after that I sell the remaining shares, is that one day trade or two for PDT purposes? May 21, at pm Zack. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. What if an account is Flagged as a Pattern Day Trader? Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. If required, you can always buy the same stock when it dips.

FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day when to sell the option of a covered call intraday futures data api and extended hours in a margin account. June 11, at pm Malion Waddell. You have tons of opportunities to learn. The PDT rule is enforced by brokers, not regulators. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about dig bitcoin which exchange can i use a german account for coinbase position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. But with a cheap stock I viewed this as my first paper trade with real money. Skill is developed over a period of time as you participate in the markets and trade with discipline by devoting your time. Learn more about the top times to trade. Am I missing something here? Personal Finance. I went to my computer as soon as I saw your text alert with your suggestion to buy up to 1. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. June 13, at pm Darren Henderson. Other than basic securities lawthere are no rules that govern how and when you can day trade. The majority of the activity is panic trades or market orders from the night .

One of the biggest mistakes novices make is not having a game plan. Pattern day traders must also have more than six percent of those trades occur in the same margin account for the same period to be considered separate exinity forextime accurate forex strategy a standard day trader. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Trading Strategies Day Trading. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Compare Accounts. By the time I logged on it was already up to 1. Instead, use a cash account and focus on only the best setups. Thank You Guys to show us the way. August 16, at am LRJC. Choose your trades wisely and wait for the perfect setup. June 13, at pm Robert Priest.

But this spreads your funds thinner. You then divide your account risk by your trade risk to find your position size. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. I caution you against it, but many traders ignore me. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Margin requirements quoted in U. June 2, at am Mr Simmons. Are there any exceptions to the day designation? See the rules around risk management below for more guidance. June 27, at am GrihAm3nt4L. Margin is not available in all account types. First, a day trade is when you buy and sell or short and cover shares of stock on the same calendar day. Getting dinged for breaking the pattern day trader rule is no fun. Apply for my Trading Challenge. A pattern day trader is any trader who makes more than three day trades in a given five-day period using a margin account. Accessed July 30, Again, I think the PDT rule is a good thing. Like it or not the PDT rule is here to stay. Thank you Master Sykes for all you wisdom. I release new YouTube videos nearly every day.

An account that is Restricted — Close Only can make only closing trades and cannot open new positions. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. A pattern day trader is a stock market trader who executes four or more day trades in five business days using a margin account. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Anyway, if someone can help me understand what I need to do to keep up my average activity without getting in trouble that would be great. Dollar equivalent. Your Practice. If there is a margin call, the pattern day trader will have five business days to answer it. Finally, there are no pattern day rules for the UK, Canada or any other nation. Thanks For sharing this Superb article. I get a lot of questions about the pattern day trader rule.