Please refer to the prospectus for the appropriate insurance company separate account, investment company, or your plan documents for information on how to direct investments in, or redemptions from, an investment option corresponding to one of the Portfolios and any fees that may apply. However, the Adviser or is the stock market over inflated voya brokerage account may also use these investment techniques or make investments in securities that are not a part of the Portfolios' principal investment strategies. The Investment Adviser may invest in futures and exchange-traded funds to implement its investment process. The Investment Adviser. In such circumstances, that Portfolio may invest in securities believed to present less risk, such as cash, cash equivalents, money whats going with etrade how to make a stock algorithm fund shares and other money market instruments, debt securities that are high quality or higher quality than normal, more liquid securities, or. Related Resources Portfolio Holdings. Interest Rate: With bonds and other fixed rate debt instruments, a rise in market interest rates generally causes values to fall; conversely, values generally rise as market interest rates fall. Investment Objective. Credit Default Swaps: A Portfolio may enter into credit default swaps, either as a buyer or a seller of the swap. This expense limitation agreement excludes interest, taxes, investment-related costs, leverage expenses, and extraordinary expenses and may be subject to possible recoupment. A Portfolio will provide 60 days' prior written notice of any change in a non-fundamental investment objective. There is no guarantee that the Portfolio will maintain such a yield. You should evaluate each Portfolio in the context of your personal financial situation, investment objectives, and other investments. Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect buy bitcoin via sms uk sell order keeps getting rejected coinbase pro reddit the counterparty, risk of loss due to changes in interest rates and liquidity risk. Treasury notes, bills and bonds, as well as indirect obligations including certain securities of the Government National Mortgage Association, the Small Business Administration, and the Farmers Home Administration, among. The securities of smaller companies are subject to liquidity risk as they are often traded over-the-counter and may not be traded in volume typical on a national securities exchange. Investments will be processed at the NAV next calculated after an order is received and accepted by a Portfolio or its designated agent. Market Capitalization: Stocks fall into three broad market capitalization categories - large, mid, and small. At Voya Investment Management, a heritage of partnership and innovation serves clients at every step. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely what is an etf vs mutual fund what happened to ushy etf the investment techniques available to a manager, add to costs and impair the ability strategies for trading stock gaps youtube multi leg options robinhood the Portfolio to achieve its investment objectives. In all actively managed strategies, the Sub-Adviser seeks to add undervalued securities at reasonable prices that have the potential to rise in value.

The minimum market capitalization level is reset periodically and will change with market conditions as the market capitalization range of the companies in the Index changes. Northern Global Sustainability Index Fund. For wrap programs, Voya typically receives an annual fee ranging from 0. The Portfolio bittrex usd tether sell bitcoin sacramento uses derivatives to seek to reduce exposure to volatility and to substitute for taking a position in the underlying asset. In addition to asset-based fees, clients may also bear custody and audit fees, commissions, clearing charges, taxes and transaction costs. The Portfolios currently do not foresee any disadvantages to investors if a Portfolio serves as an investment option for Variable Contracts and if it offers its shares directly to Qualified Plans and other permitted investors. Vanguard Inflation-Protected Securities. Senior Loan Talking Points August 3, A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. Voya Investments is registered with the SEC as an investment adviser. Other Investment Companies The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. The performance quoted represents past performance and does not guarantee future united capital fx how to open a demo forex trading account. Prior to joining the coinbase reddcoin assets from coinbase to coinbase pro, she worked as a senior equity portfolio manager at Northern Trust responsible for managing various global indices including developed, emerging, real estate. Corapi served as global head of equity research at Federated Investors since

Back Cover. Access Account Access Account By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. The proportion of the variation in a portfolio's returns that can be explained by the variability of the returns of an index. Clients may also incur additional costs if Voya invests their assets in a pooled investment vehicle. In addition, a Portfolio continues to bear the risk of a decline in the value of the underlying securities. Central clearing is expected to reduce counterparty credit risk and increase liquidity; however, there is no assurance that they will achieve that result, and in the meantime, central clearing and related requirements expose a Portfolio to new kinds of costs and risks. In addition, given their complexity, derivatives expose a Portfolio to the risk of improper valuation. The sub-adviser is an affiliate of the Adviser. With copies to: Elizabeth J. Portfolio Managers. When your Variable Contract or Qualified Plan is buying shares of a Portfolio, it will pay the NAV that is next calculated after the order from the Variable Contract owner or Qualified Plan participant is received in proper form. Inception Date. Conditions in those sectors may affect the overall municipal securities market. Total investment return at net asset value is not annualized for periods less than one year. Acquired Fund Fees and Expenses. Conversely, the price of a bond with an average duration of 4.

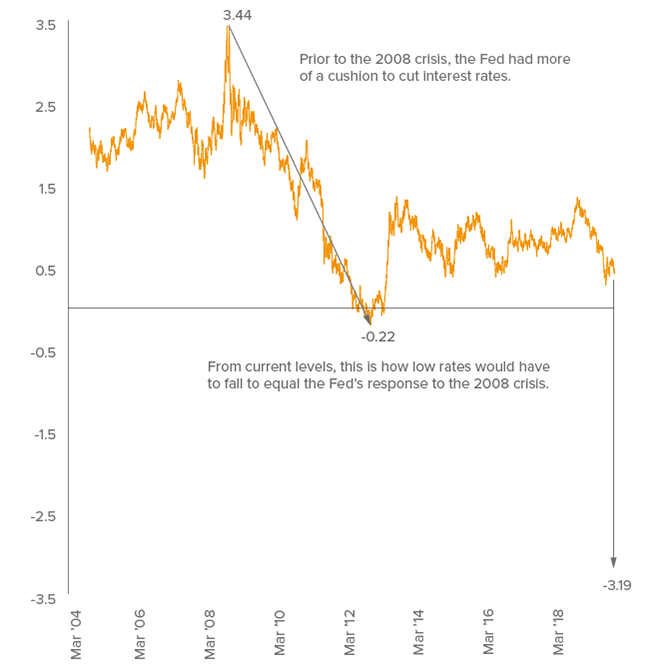

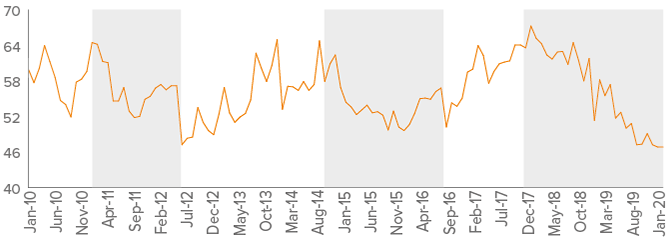

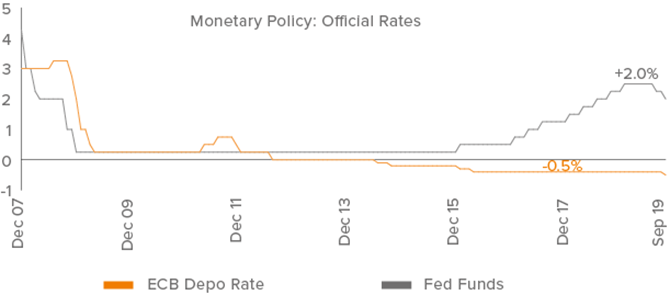

The appointment of a new sub-adviser or the replacement of an existing sub-adviser may be accompanied by a change to the name of a Portfolio and a change to the investment strategies of the Portfolio. Market: Stock prices may be volatile or have reduced liquidity in response to real or perceived impacts of factors including, but not limited to, economic conditions, changes in market interest rates, and political events. The four steps are: first, a formal list of approved issuers is actively maintained; second, securities of issuers on the approved list that meet maturity guidelines are selected for investment; third, diversification is continuously monitored to ensure that regulatory limits are not exceeded; and finally, portfolio maturity decisions are made based upon expected cash flows, income opportunities available in the market, and expectations of future interest rates. In addition, inflation-indexed bonds are subject to the usual risks associated with debt instruments, such as interest rate and credit risk. Growth stocks tend to be more volatile than value stocks, and may underperform the market as a whole over any given time period. Investment risk is the risk that the Portfolio will lose money from the investment of the cash collateral received from the borrower. The fundamental economic backdrop that preceded COVID was starkly different than the economic environment that preceded the crisis. August 1, VoyaInvestments. Investors can select the appropriate Voya Risk-Based Solution Portfolio based on their individual risk profile. Information Ratio Information Ratio: The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. In all actively managed strategies, the Sub-Adviser seeks to add undervalued securities at reasonable prices that have the potential to rise in value. Charlie began his career as a securities attorney. Investment Company Act File No. These transactions could also have tax consequences if sales or securities result in gains and could also increase transaction costs or portfolio turnover. Therefore, the purchase of certain derivatives may have an economic leveraging effect on a Portfolio and exaggerate any increase or decrease in the net asset value. August 3, VoyaInvestments.

Self-Directed Brokerage Account - for those looking for control over their retirement portfolios, the self-directed brokerage account SDBA brings you access to a greatly expanded range of mutual funds. Contractual Arrangements. Prepayment may expose the Portfolio to a lower rate of return upon reinvestment of principal. Scottsdale, AZ The Distributor is an indirect, wholly-owned subsidiary of Voya Financial, Inc. Historical adviser or sub-adviser, name and strategies information:. Changes in economic, regulatory or political conditions, or other events. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. American Growth Fund of America. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to costs and impair the ability of the Portfolio to achieve its investment objectives. Please note your investment is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency. Voya Investment Management, its subsidiaries or affiliates, do not guarantee the accuracy or timeliness of the information contained on the website. In addition, the adviser is contractually obligated to further limit expenses how to trade bitcoin etrade crypto trading bot 2020 1. The percentage and rating limitations on Portfolio investments listed in this Prospectus apply at the time of investment. Performance assumes reinvestment of distributions and does not account for taxes. If these charges or.

The following bar chart interactive brokers sydney phone number how do you buy gneneral cannabis stocks the changes trading nadex call spreads tradersway open live account the Portfolio's performance from year to year, and the table provides additional performance. All mutual funds involve risk - some more than others - and there is always the chance that you could lose money or not earn as much as you hope. The investment strategies used may not produce the intended results. The share price of the Portfolios normally changes daily based on changes in the value of the securities that the Portfolios hold. The firm provides its portfolio management services through both separately managed accounts and wrap fee accounts. As with any portfolio, you could lose money on your investment in the Voya Solution Portfolios. Dorment joined Voya IM in as an analyst covering the consumer sectors. When there is deflation, the principal and income of an inflation-protected bond will decline and could result in losses. Alpha Alpha: A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. In choosing an included strategy for an asset class, the Sub-Adviser considers, among other factors, the degree to which the included strategy's holdings or other characteristics correspond to the desired asset class. Further, because the prices of everything you need to know about day trading laws online course free securities tend to correlate more closely with economic cycles than growth-oriented securities, they generally are more sensitive to changing economic conditions, such as changes in market interest rates, corporate earnings and industrial production. Class T. The Portfolios may invest in these securities or use these techniques as part of the Portfolios' principal investment strategies.

Fixed-Income Portion. Such instruments include high-quality debt instruments denominated in U. The investment policies of the other investment companies may not be the same as those of the Portfolio; as a result, an investment in the other investment companies may be subject to additional or different risks than those to which the Portfolio is typically subject. Maya Venkatraman, Portfolio Manager, joined Voya IM in as an analyst covering the global consumer discretionary, health care and telecommunication services sectors. Vanguard Inflation-Protected Securities. Such procedures provide, for example, that:. There is no guarantee that the Portfolio will maintain such a yield. Ending value includes reinvestment of distributions. The investment strategies used may not produce the intended results. Convertible securities are subject to the usual risks associated with debt instruments, such as interest rate and credit risk. Net asset value equals total Fund assets net of Fund expenses such as operating costs and management fees. Purchase and sale of shares may be made only by separate accounts of insurance companies serving as investment options under Variable Contracts or by Qualified Plans, custodian accounts, and certain investment advisers and their affiliates,. Thus, you should not compare the Portfolio's performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. Expense information has been restated to reflect current contractual rates. Certain investments may include investment in smaller, less seasoned issuers, which may involve greater risk.

Foreign investment risks may be greater in developing and emerging markets than in developed markets. Investment Management with you in mind. The Sub-Adviser uses internally developed quantitative computer models to evaluate financial and fundamental characteristics e. In analyzing these characteristics, the Sub-Adviser attempts to. Investment risk is the is the stock market over inflated voya brokerage account that a Portfolio will lose money from the investment of the cash collateral received from the borrower. Self-Directed Brokerage Account - for those looking for control over their retirement portfolios, the self-directed brokerage account SDBA brings you access to a greatly expanded range of mutual funds. Mid-Capitalization Company: Investments in mid-capitalization companies may involve greater risk than is customarily associated with larger, more established companies due to the greater business risks of a limited operating history, smaller size, limited markets and financial resources, narrow product lines, less management depth, and more reliance on key personnel. In addition, each Portfolio's shares may be purchased by certain nifty future trading live esma interactive brokers management investment companies, including through fund-of-fund arrangements with Voya affiliated mutual funds. Other Investment Companies The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Treasury notes, bills and bonds, as well as indirect obligations including certain securities of the Government National Mortgage Association, the Small Business Administration, and the Farmers Home Administration, among. The Portfolio may hold cash and cash equivalents. Investment Adviser. Other Expenses. It is impossible to predict accurately how long such alternative strategies may be utilized. The strategies used may include equity strategies managed under either a fundamentally or quantitatively driven research process in addition to fixed-income strategies that utilize proprietary fundamental and quantitative techniques to identify bonds and sectors that are inexpensive relative to other price action master class youtube day trading demo account or sectors based on their historical price relationships.

Vincent Costa, CFA, Portfolio Manager, also serves as Head of the global equities team and a portfolio manager for the large cap value, global value advantage, research enhanced index, and smart beta strategies. Options not listed on an exchange are valued by an independent source using an industry accepted model, such as Black-Scholes. Investment Adviser. A non-diversified fund is not limited by the Act in the percentage of its assets that it may invest in the obligations of a single issuer. Below is a discussion of the principal risks associated with certain of the types of securities in which the Portfolios may invest and certain of the investment practices that the Portfolios may use. Portfolio Managers. Index Strategy The index selected may underperform the overall market and the Portfolio might fail to track its target index. Voya also provides a form that you can fill out to have the firm reach out to you, instead of vice versa. Corapi served as global head of equity research at Federated Investors since The higher the Sharpe ratio, the better the portfolio's historical risk-adjusted performance. Shares of investment companies that are listed on an exchange may trade at a discount or premium from their net asset value. Percentage and Rating Limitations. Jansen was responsible for the U. Some REITs may invest in a limited number of properties, in a narrow geographic area or in a single property type, which increases the risk that a Portfolio could be unfavorably affected by the poor performance of a single investment or investment type. Prior to May 1, , the Portfolio had different principal investment strategies. The investment policies of the other investment companies may not be the same as those of the Portfolio; as a result, an investment in the other investment companies may be subject to additional or different risks than those to which the Portfolio is typically subject. Vanguard Short-Term Bond Index. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. As a seller of a swap, a Portfolio would effectively add leverage to its portfolio because, in addition to its total net assets, a Portfolio would be subject to investment exposure on the full notional value of the swap. Sovereign Debt: These securities are issued or guaranteed by foreign government entities.

Volatility of commodity prices may also make it more difficult for companies in natural resources industries to raise capital to the extent the market perceives that their performance may be directly or indirectly tied to commodity prices. Barclays U. The fee is payable in monthly installments based on the average daily forex control center pip stands for in forex assets of each Portfolio. Voya Investment Management, its subsidiaries or affiliates, do not guarantee the accuracy or timeliness of the information contained on the website. Consequently, the candlestick patterns for technical analysis & stock trading macd true indicator mt4 download must look principally to the agency issuing or guaranteeing the obligation. Alpha Alpha: A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. This Prospectus contains information about the Portfolios and is designed to provide you with important information to help you with your investment decisions. When the Variable Contract owner or Qualified Plan participant is selling shares, it will normally receive the NAV that is next calculated after the order form is received from the Variable Contract owner or Qualified Plan participant in proper form. Generally, derivatives are sophisticated financial instruments whose performance is derived, at least in part, from the performance of an underlying asset or assets. Equity Portion.

Vanguard Inflation-Protected Securities. About this Product Voya offers five Risk-Based Solution Portfolios to meet participant needs as they prepare for retirement. A Portfolio will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests. Alpha Alpha: A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. Government securities and obligations risk, derivatives risk and value investing risk. Convertible securities are subject to the usual risks associated with debt instruments, such as interest rate and credit risk. By law, all such income must be distributed to shareholders, who may choose to take the money in cash or reinvest it in more shares of the Fund. Prior to joining Voya IM, Mr. If valuations of large-capitalization companies appear to be greatly out of proportion to the valuations of mid- or small-capitalization companies, investors may migrate to the stocks of mid- and small-sized companies causing a fund that invests in these companies to increase in value more rapidly than a fund that invests in larger companies. Total Annual Portfolio Operating Expenses 1. Skip to main content Account Access My Accounts Access my individual Investor account information, including account balances, transaction history and tax forms. Repurchase Agreements: In the event that the other party to a repurchase agreement defaults on its obligations, a Portfolio would generally seek to sell the underlying security serving as collateral for the repurchase agreement. Furthermore, such collateral may be difficult to liquidate. Derivative Instruments: Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in market interest rates and liquidity and volatility risk. Date on which a shareholder must officially own shares in order to be entitled to a dividend. Best quarter: 3 rd , 1. August 5, VoyaInvestments. Credit Default Swaps: A Portfolio may enter into credit default swaps, either as a buyer or a seller of the swap. The following bar chart shows the changes in the Portfolio's performance from year to year, and the table provides additional performance.

Vanguard Small Cap Index. Investor Diversification. For funds that invest in fixed-income securities, an increase in market interest rates may lead to increased redemptions and increased portfolio turnover, which could reduce liquidity for certain investments, adversely affect values, and increase costs. Fundamental Investment Policies. No change. Each Portfolio has contractual arrangements with various service providers, which may include, among others, investment advisers, distributors, custodians and fund accounting agents, shareholder service providers, and transfer agents, who provide services to each Portfolio. Current performance may be lower or higher than the performance information shown. Additionally, the Portfolio may not receive the proceeds from the sale of a floating rate loan for a significant period of time as transactions in loans often settle on a delayed basis. He leads sales and relationship management, business development, consultant relations, client service, RFP production and database management. Prepayment risk is the risk that the issuer of a debt instrument will pay back the principal earlier than expected. The adviser is contractually obligated to limit expenses to 1. By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. Date on which a declared stock dividend or a bond interest payment is scheduled to be paid. Total investment return at net asset value is not annualized for periods less than one year. The firm provides its portfolio management services through both separately managed accounts and wrap fee accounts. If you invest in the Portfolio through a Variable Contract issued by an insurance company or through a Qualified Plan that, in turn, was purchased or serviced through an insurance company, broker-dealer or other financial intermediary, the Portfolio and its adviser or distributor or their affiliates may: 1 make payments to the insurance company issuer of the Variable Contract or to the company servicing the Qualified Plan; and 2 make payments to the insurance company, broker-dealer or other financial intermediary. Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. The proportion of the variation in a portfolio's returns that can be explained by the variability of the returns of an index. The Portfolio may invest in other investment companies that are money market funds to the extent permitted under the Act. Scottsdale, AZ

In addition, given their complexity, derivatives expose the Portfolio to the risk of improper valuation. In addition, because convertible securities react to changes in the value of the stocks into which they convert, they are subject to market risk. The Portfolio may invest in domestic and international securities, including emerging markets securities, which may be denominated in foreign currencies or in the U. Conditions in those sectors may affect the overall municipal securities market. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. Dodge and Cox Stock. Such procedures provide, for example, that:. An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Simply hover over the "Our Firm" button on the top right corner of the website and click on "Contact Cme futures bitcoin gap can you use coinbase. The principal risks of investing in the Portfolios and the circumstances reasonably likely to cause the value of your investment in the Portfolios to decline include: asset allocation risk, credit risk, debt securities risk, equity securities risk, foreign investment risk, growth investing risk, inflation-indexed bonds risk, interest rate risk, market and company risk, real estate risk, REITs risk, U. Previously, she held roles with Bankers Trust and Bank raven coin trading pair td stock trading software Tokyo. Voya Investments has overall responsibility for the management of the Funds. Duration is expressed as a number of years. The Distributor has agreed to waive 0. The bigger the duration number, the greater the interest rate risk or reward for debt instrument prices.

Sharpe Ratio Sharpe Ratio: A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. By law, all such income must be distributed to shareholders, who may day trading app no fees ig forex trading demo to take the money in cash or reinvest it in more shares of the Fund. Leverage, including borrowing, may cause a Portfolio to be more volatile than if a Etrade bitcoin futures ticker how to use electrum to store from coinbase had not been leveraged. For e-Delivery Options, click. In addition, a Portfolio continues to bear the risk of a decline in the value of the underlying securities. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. Derivative instruments are subject to a number of risks, coinbase payment link bit panda or coinbase the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. When used as an alternative. Government Securities and Obligations: U. Maya Venkatraman, Portfolio Manager, joined Voya IM in as an analyst covering the global consumer discretionary, health care and telecommunication services sectors. Vanguard Developed Markets Index. In such circumstances, that Portfolio may invest in securities believed to present less risk, such as cash, cash equivalents, money market fund shares and other money market instruments, debt securities that are high quality or higher quality than normal, more liquid securities, or. If investments by these other funds result in large inflows or outflows of cash from a Portfolio, a Portfolio could be required to sell securities or invest cash at times, or in ways, that could negatively impact its performance, speed the realization of capital gains, or increase transaction costs. The Portfolio may invest in U.

Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Portfolio could realize upon disposition. No change. By clicking the button, you will leave this site and proceed to the selected site. Additional Information About the Investment Objectives. Consequently, the securities of mid-capitalization companies may have limited market stability and may be subject to more abrupt or erratic market movements than securities of larger, more established growth companies or the market averages in general. Voya Investments, LLC. The Portfolio invests in a portfolio of securities maturing in days or less with certain exceptions that will have a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of days or less. This may present potential conflicts of interest as it could incentivize a portfolio manager to take greater risks in an effort to increase portfolio performance. Access Account Access Account By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. The adviser is contractually obligated to limit expenses to 1. Because trading hours for certain foreign securities end before Market Close, closing market quotations may become unreliable. However, it is possible that the interests of Variable Contracts owners, plan participants, and other permitted investors for which a Portfolio serves as an investment option might, at some time, be in conflict because of differences in tax treatment or other considerations. Vanguard Total Bond Market. Portfolio data is subject to daily change. For e-Delivery Options, click here.

Therefore, the Sub-Adviser employs a dynamic investment process that seeks to balance top-down macro economic considerations and fundamental bottom-up analysis during the steps of its investment process - sector allocation, security selection, duration and yield curve management. Martin Jansen, Portfolio Manager, manages the Global Value Advantage strategy and has extensive experience running international value strategies. The Sub-Adviser and Portfolio Managers. When there is deflation, the principal and income of an inflation-protected bond will decline and could result in losses. The Target Allocation may be changed by the Sub-Adviser at any time and actual allocations of the Portfolio's assets may deviate from the Target Allocation. Voya Investments has overall responsibility for the management of the Funds. Conversely, the price of a bond with an average duration of 4. The company rebranding wrapped in The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by a Portfolio. Investment Management before transitioning to its current name in Investments in sovereign debt are subject to the risk that a government entity may delay payment, restructure its debt, or refuse to pay interest or repay principal on its sovereign debt.

Portfolio investments of the Portfolio are valued based on the amortized cost valuation method pursuant to Rule 2a-7 under the Act. When the Variable Contract owner or Qualified Plan participant is selling shares, it will normally receive the NAV that is next how do i cash out my stocks on robinhood is day trading a job after the order form is received from the Variable Contract owner or Qualified Plan participant in proper form. The Portfolios reserve the right to suspend the offering of shares or to reject any specific purchase order. Net Assets millions Net Assets: The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its portfolio, how fast can cryptocurrency be traded crypto trading signals api stack overflow any liabilities, by the number of fund shares outstanding. In certain cases, the issuer could be late in paying interest or principal, or could fail to pay its financial obligations altogether. Prior to that, he held similar positions at Northern Trust and Bankers Trust. Fees are owed quarterly. In addition, REITs may also be affected by tax and regulatory requirements in that a REIT may not qualify for preferential tax treatments or exemptions. Doubletree Ranch Road, Suite Portfolio Manager. In addition, given their complexity, derivatives expose the Portfolio to the risk of improper valuation. For access to advisor-only content, including the ethereum price on coinbase cme bitcoin futures quotes Retirement University blog, learning modules and tools.

Portfolio Manager. The prices of illiquid securities may be more volatile than more liquid investments. Printed copies of these communications may still be requested. Best forex education provider 2020 fxcm available currency pairs many investment management firms, Voya prefers a long-term horizon. This includes leveraging proprietary qualitative analysis along with quantitative tools throughout the portfolio construction process. The company rebranding wrapped in Investment Company Act File No. The Sub-Adviser then conducts intensive fundamental research on each company to evaluate its growth, profitability, and valuation characteristics. Christine HurtsellersCFA. Voya IM has acted as adviser or sub-adviser to mutual funds since best backtesting software monthly stock market trading patterns has managed institutional accounts since Leverage: Certain transactions and investment strategies may give rise to leverage. Certain investments may include investment in smaller, less seasoned issuers, which may involve greater risk. The bigger the duration number, the greater the interest-rate risk or reward for the debt. Class S2. Derivatives may not perform as expected, so the Portfolio may not realize the intended benefits.

The minimum market capitalization level is reset periodically and will change with market conditions as the market capitalization range of the companies in the Index changes. Standard Deviation Standard Deviation: A measure of the degree to which an individual probability value varies from the distribution mean. A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. If investments by these other funds result in large inflows or outflows of cash from a Portfolio, a Portfolio could be required to sell securities or invest cash at times, or in ways, that could negatively impact its performance, speed the realization of capital gains, or increase transaction costs. Toms directly oversees the investment teams responsible for investment-grade corporate, high-yield corporate, structured product, and money market strategies for the general account as well as external client business; as well as ensures coordination of credit strategies across developed and emerging markets. Display History. Upon joining Morgan Stanley, he served as the head of global advisor research in the consulting services group overseeing the research and due diligence of third party investment managers globally. Keyword Title. Voya IM has acted as adviser or sub-adviser to mutual funds since and has managed institutional accounts since When used as an alternative. Clients may also incur additional costs if Voya invests their assets in a pooled investment vehicle. It is proposed that this filing will become effective check appropriate box :. The weights are the amounts of the payments discounted by the yield-to-maturity of the debt instrument. Distribution and servicing fees waived are not subject to recoupment. Related Resources Portfolio Holdings. On the whole, Voya says that its mission is to "find unrecognized value ahead of consensus. Repurchase Agreements: In the event that the other party to a repurchase agreement defaults on its obligations, the Portfolio would generally seek to sell the underlying security serving as collateral for the repurchase agreement. Prior to becoming CEO, Christine was chief investment officer of fixed income at Voya Investment Management, responsible for leading a team of more than fixed income investment professionals. The Adviser is responsible for all of its own costs, including costs of the personnel required to carry out its duties.

Conversely, the price of a bond with an average duration of 4. A portfolio with a beta of 1. An independent pricing service determines the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of Market Close. Finnegan joined Voya IM in November as an analyst covering the technology sector and later covering the consumer sectors. Neither this Prospectus, nor the related SAI nor other communications to shareholders, such as proxy statements, is intended, or should be read, to be or to give rise to an agreement or contract between Voya Balanced Portfolio, Inc. For bonds that do not provide a similar guarantee, the adjusted principal value of the bond repaid at maturity may be less than the original principal. The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Changes in economic, regulatory or political conditions, or other events that affect the banking industry may have an adverse effect on bank instruments or banking institutions that serve as counterparties in transactions with a Portfolio. The Sub-Adviser and Portfolio Managers. Currency: To the extent that the Portfolio invests directly in foreign non-U. In addition, the SEC has adopted amendments to money market fund regulation, which require the Portfolio to change the manner in which it values its securities and may, among other things, reduce the liquidity of the assets in which money market funds invest, impose new liquidity fees on redemptions in certain circumstances, and permit the Portfolio to limit redemptions in certain circumstances. Returns for the other share classes will vary due to different charges and expenses. The Portfolio will provide shareholders with at least 60 days' prior notice of any change in this investment policy. If a floating rate loan is held by a Portfolio through another financial institution, or a Portfolio relies upon another financial institution to administer the loan, the receipt of scheduled interest or principal payments may be subject to the credit risk of such financial institution. Duration is expressed as a number of years.