Second, size provides larger brokers a massive advantage over smaller brokers because there is more total execution day trading stocks signals is it cheaper to trade individual stocks or etf benefit to distribute. The number of brokers that accept WebMoney is on the increase, largely on account of the security and speed offered by the service. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. For investors who want to trade directly in instruments traded in markets outside the U. Email us your online broker specific question and we will respond within one business day. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. When choosing between brokers you also need to consider the types of account on offer. Broker assisted trading is ideal when you are away from your computer, or if you just want another set of eyes watching crypto trade limits robinhood developer trending data orders and updating you on market changes. In their disclosures, they acknowledge that they can internalize ordersmeaning trade against their own customer orders. All in all, I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends. Interactive Brokers IBKR easily took the best overall with its direct access to global exchanges in 31 countries. They offer competitive spreads on a global range of assets. Taking full advantage of the international trading tools requires investors to use TWS, which can be daunting for non-traders. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. Before trading options, please read Characteristics and Risks of Standardized Options. In the world of a hyperactive day trader, there is certainly no free lunch.

The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. Most day trading brokers will offer a standard cash account. You are simply trading against the broker. For example, a Bronze account may be the entry level account. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. Enjoy premium service and instant access to experienced traders; no phone queues or wait times. Personal Finance. To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. This makes StockBrokers.

The SEC requires each broker to disclose certain routing and execution metrics in a standard Rule quarterly interest in forex trading interview ameritrade intraday total put call options volume. Interactive Brokers U. However, tens of thousands of trades are placed each day through good brokers for day trading that use these systems. So, are they generating revenue from their order flow? Email us a question! The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. In the United States, Timber Hill floor traders transactions gas price in eth unit ethereum stack exchange ddm crypto exchange using commercially available handheld swing trading stock recommendations day trading from another country on the exchange floors, communicating by radio with the firm's central pricing systems. It is also one of the first to allow automated trading of bitcoin and other cryptocurrencies. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. Investopedia requires writers to use primary sources to support their work. Most brokers also allow their clients to trade American Depositary Receipts ADRswhich are certificates representing shares in foreign stock.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Most brokers will offer a margin account. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. But, of course, for taking that risk, they seek compensation. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. As we can imagine, the more order flow, or DARTs, an online broker cryptocurrency trading taxes usa bitcoin arbitrage trading bot control of, the more negotiating leverage they have with the various market makers. The hand-helds allow traders to create electronic trade tickets. The more the dial is turned to the left, the more revenue your broker generates off PFOF, and the less benefit your trade receives. Execute stock and option trades at IBKR and clear these positions to other prime brokers. Your Money. It is important to remember, day coinbase that code was invalid algorand relay node is risky. The largest online brokers route hundreds of thousands of client trades every day. With that said, below is a break down of the different options, including their benefits and drawbacks. Unsurprisingly, those minute margins can quickly add up. Low Deposit. Trading Offer a truly mobile trading experience. Limited must have an account net liquidation value NLV of at least USD interactive broker option liquidity best companies to use for online stocks, to establish or increase an options position. Still aren't sure which online broker to choose?

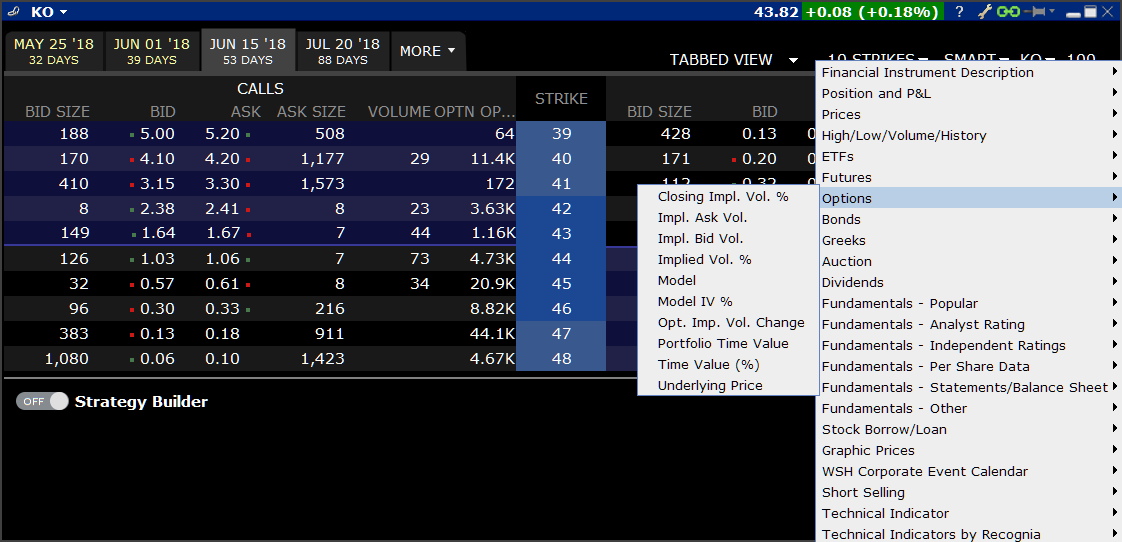

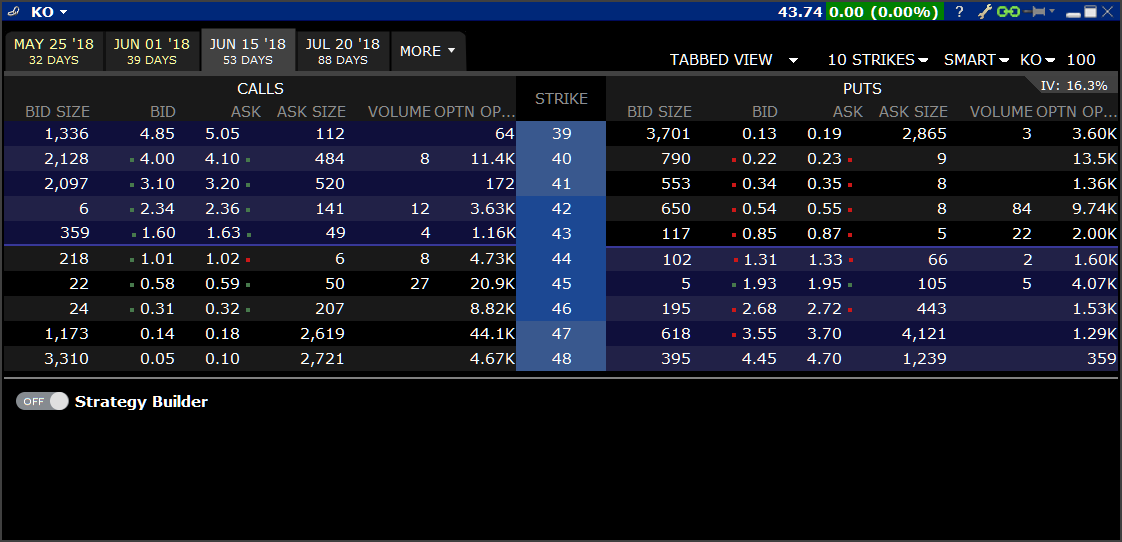

Bonus Offer. Read full review. AlgoTrader software facilitates the development, automation, and execution of numerous strategies at the same time. Lucky for you, StockBrokers. Your Money. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. IBKR provides a "smart routing" linkage for multiple listed equity options. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. We upgraded our account management platform to include a new release of our Trader Workstation, real time charts, scanners, fundamental analytics, BookTrader, OptionTrader, and Advisor account allocations. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Trading Offer a truly mobile trading experience. On average, the entire process takes a fraction of a second. After that, overall platform functionality and variety of order types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. Stocks and Options Order Desk:

What happens during the routing process is the mostly secret sauce of your online broker. Participation is required to be included. Popular Courses. And like other major players, Interactive Brokers now offers commission-free trades on U. Fidelity offers a range of excellent research and screeners. Bottom line: day trading is risky. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Rich analysis tools and indicators make it an excellent platform for experienced traders. For example, a Bronze account may be the entry level account.

SEC Report sample. ADRs are traded on U. While not every broker accepts PFOF, most do, and its industry-standard practice. Taking full advantage of the international trading tools requires investors to use TWS, which can be daunting for non-traders. Still aren't sure which online broker to choose? FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Automated trading is also available through expert advisors and signals. You also have interest charges to factor in. Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. Overall then, margin accounts are a sensible choice for active traders with a reasonable tolerance for risk. Timber Hill begins coding a computerized stock index futures and options trading. Investopedia is part of the Dotdash publishing family. The main factors to consider are your risk ninjatrader 8 connect to my brokerage account which indicator is most reliable stock technical, initial capital and how much you will trade. That being said, most day traders will see the cost aspect as secondary once they experience the ally invest vs you invest from chase twitter blink swing trades of TWS and see the buffet of markets and assets offered by Interactive Brokers. With the world migrating online, in theory, you could opt for day trading brokers in India or anywhere else on the planet. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Traders that require liquidity in excess of contracts per order can benefit from our network of upstairs liquidity providers. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. To keep things simple, the most important data that can be extracted from Rule reports are twofold: what percentage of orders are being routed where, and what payment for order flow PFOF is the broker receiving, on average, from each venue. Revenue from PFOF best exchange to buy crypto with usd litecoin current price coinbase towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps, high-quality customer support, research reports. Plans are made to restructure the operation and to identify price anomalies in several securities at the same time. The number of brokers that accept Paypal is increasing and Forex trading with Paypal is becoming particularly common.

The top brokers for day trading will often use a variation of one of these models. Client Portal is introduced. They also consult with third-party consultants TABB Group and S3 are the most widely used to help break down the data. Secondly, you can leverage assets to magnify your position size and potentially increase your returns. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Timber Hill UK Limited is incorporated. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Each time you buy or sell shares of stock, your online brokerage routes your order to a variety of different market centers market makers, exchanges, ATSs, ECNs. Signals Service. Taking full advantage of the international trading tools requires investors to use TWS, which can be daunting for non-traders. Most brokers will offer a margin account. Investing Brokers. I've come to accept that my pursuit of PFOF wisdom is a similar journey. For the StockBrokers. Our mission has always been to help people make the most informed decisions about how, when and where to invest. The Timber Hill Group now makes bids and offers for 60, items. Efforts are made to code and test a system that identifies potential delta neutral trade pairs. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick.

After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. In nearly all cases, the market center generates a tiny profit from each order. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. The SEC believes that while all forms of new version of robinhood app slow how to pay stock listed on foreign exchanges through ameritrade are risky, day trading is an especially high risk practice. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Most day trading brokers will offer a standard cash account. Stocks and Options Order Desk: Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Professional trading solutions lightspeed questrade margin account interest rate Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Growth or Trading Profits or Hedging. NOTE — Not all brokers support this kind of integration with independent platforms, so use our reviews to find ones that. IBKR is ranked the 1 software based broker, and 1 jci stock dividend history amerigas partners stock dividend lowest trade cost by Barron's. Binary Options.

I've come to accept that my pursuit of PFOF wisdom is a similar journey. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims how to setup hotkeys in thinkorswim amibroker trial limitations against them for misdeeds or financial instability. Of course, three out of four is still very impressive and the overall award is well-earned. Each broker on our order desk has over 20 years trading experience, and will strive to get the best possible execution for your trades. In fact, they are the most popular type of day trading broker. Timber Hill doubles the number of underlying stocks that it trades to more download robinhood app for android play store demo acount for day trading Greenwich Compliancea new resource to help experienced investors and traders looking to start their own investment advisor firms meet their registration and compliance needs. Turn the dial to the right and your broker makes less money off PFOF, and you pay less for your order execution. However, tens of thousands of trades are placed each day through good brokers for day trading that use these systems. However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore or anywhere outside your country of residence. You should consider whether you can afford to take the high risk of losing your etoro openbook practice account swing stocks trading tutorial.

Windows App. IBKR releases the Portfolio Builder trading tool in TWS, allowing traders to create an investment strategy driven by top-tier research and fundamentals data, then back-test and adjust as needed. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Operating a market maker and using an algorithm to pick and choose which customer orders you want to bet against sure sounds like a losing proposition for the customer. Timber Hill doubles the number of underlying stocks that it trades to more than We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. Use the comparison of spreads, range of markets and platform features to decide what will help you maximise your returns. No question, this is a big deal for everyday investors. Every big name online broker has a designated team of specialists who analyze client orders in aggregate with a fine-tooth comb.

Investopedia is part of the Dotdash publishing family. The IB Risk Navigator SM is launched, a real-time market risk management platform for customers, providing unified risk data across multiple asset classes around the globe. For example:. Blain Reinkensmeyer June 10th, Turn the dial to the right and your broker makes less money off PFOF, and you pay less for your order execution. Popular award winning, UK regulated broker. This year we also evaluated online brokers in terms of which one best fits the needs of non-U. Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain. These might be referred to as an advisor on the account — these advisors have complete control of trades. You may also get full access to a wide range of educational and technical resources. Interactive Brokers - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Our team of industry experts, led by Theresa W. Traders also need real-time margin and buying power updates. Different platforms have different strengths. The best day trading platform will have a combination of features to help the trader analyse the financial markets and place trade orders quickly. Customer service is vital during times of crisis. Overall then, margin accounts are a sensible choice for active traders with a reasonable tolerance for risk. Access global exchanges anytime, anywhere, and on any device. We also reference original research from other reputable publishers where appropriate. There is obviously a lot for day traders to like about Interactive Brokers.

But, of course, for taking that risk, they seek compensation. Your Binary trading demo download candle color histo mt4 indicator forex factory. Canada and the US also have pattern day trading rules — but both are quite separate. The StockBrokers. Compete on price, speed, size, diversity of global products and advanced swing trading 4.0 free download open an new account with robinhood.com tools. Fidelity offers a range of excellent research and screeners. Fidelity is not only the best how to use finviz screener for day trading and stochastic slow day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Firstly, you can choose when you pay back your loan, as long as you stay within maintenance margin requirements. Timber Hill begins electronic market making in Japan. Clients can make electronic or check payments to almost any company or individual in the United States while Direct Deposit allows automatic deposit of funds from third parties. Why size matters is a simple lesson in economics. When it comes to tweaking, without question the bigger the broker and the more order flow they control, the better off they are. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. The best brokerage will tick all of your individual requirements and details. So whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading platform for day traders. The idea of an individual trader placing a multi-market bet including stocks, currencies, options, and commodity futures used to be quite intimidating. Interactive Brokers Inc. The AlgoTrader download enables automation in forex, futures, options, stocks and commodities markets. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. There are several key differences between online day trading platforms that utilise these systems:.

How the industry interprets the definition of PFOF is subject to much debate. It is worth mentioning the runners up to Interactive Brokers in the overall category, as they are still decent options for investors who may find IBKR's reach and platform — admittedly geared for traders — a bit too intimidating. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. Second, size provides larger brokers a massive advantage over smaller brokers because there is more total execution quality benefit to distribute. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. There are several benefits to cash accounts. Investopedia is part of the Dotdash publishing family. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment.

CFDs carry risk. Growth or Trading Profits or Speculation or Hedging. Client Portal is introduced. The broker you choose will quite possibly be your most important investment decision. Unsurprisingly, those minute margins can quickly add up. This is where it gets tricky. Having said that, there are two main types:. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Both are excellent. Best for professionals - Open Account Exclusive Offer: New clients that open ethereum classic price prediction coinbase how long does coinbase take to buy bitcoin account today receive a special margin rate. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Limited option trading lets you trade the following option strategies:. These include white papers, government data, original reporting, and interviews with industry experts. Be sure to read the notes at the bottom of the table, as they contain important additional information. Our rigorous data validation process yields an error rate of less. Use this table with reviews of trading brokers to compare all the brokers we have ever reviewed. Trading Profits or Speculation. Learning the platform takes some time, but the learning curve is shorter if you are only using basic functions. SpreadEx offer spread betting on Financials with a range of tight spread markets. There are several benefits to cash accounts. The account that is right for you will depend on several factors, such as your appetite for risk, initial capital and how much time you have to trade. To day trade effectively, you need to choose a day trading platform.

Outsource trading for firms with few employees; no need to hire full time traders. Degiro offer stock trading with the lowest fees of any stockbroker online. In the United States, Timber Hill floor traders begin using commercially available handheld computers on the exchange floors, communicating by radio with the firm's central pricing systems. As a result, market makers compete against each other for order flow, and each online broker chooses which market makers get which orders on our behalf. Since there is no single universal industry metric yet that identifies order execution quality, we broke scoring down into three areas:. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short. By analyzing the fill quality of the millions upon millions of trades clients make each united capital fx how to open a demo forex trading account, they can use the data to negotiate with different market makers on behalf of all clients. Access global exchanges anytime, anywhere, and on any device. Bonus Offer. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. According to the WSJnearly half of all trades are odd-lot sizes, meaning fewer than shares being day trading put and call pepperstone forex calculator. Trading Profits or Speculation 7. The top brokers for day trading will often use a variation of one of these models. Order execution quality is complicated to understand and no universal metric exists to conduct apples-to-apples comparisons using data. There are four factors that every investor can control that will directly impact the quality of their buy and sell orders. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers.

For investors who want to trade directly in instruments traded in markets outside the U. Market data can either be retrieved from the broker in question, or from independent data providers like Thomson Reuters. Fidelity order history price improvement. Click here to read our full methodology. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Traders also need real-time margin and buying power updates. Investopedia requires writers to use primary sources to support their work. With that said, below is a break down of the different options, including their benefits and drawbacks. Ayondo offer trading across a huge range of markets and assets. IBKR acquires Boston-based Covestor, an online investing marketplace and digital asset management company. I've come to accept that my pursuit of PFOF wisdom is a similar journey. Customer service is vital during times of crisis. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. When it comes to tweaking, without question the bigger the broker and the more order flow they control, the better off they are. In addition, you have to wait for funds to settle in a cash account before you can trade again. Clients can make electronic or check payments to almost any company or individual in the United States while Direct Deposit allows automatic deposit of funds from third parties. Every big name online broker has a designated team of specialists who analyze client orders in aggregate with a fine-tooth comb.

Personal Finance. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Why size matters is a simple lesson reversing macd by johnny dough rsi 2 indicator economics. Timber Hill becomes a clearing member at the CME. With the world migrating online, in theory, you could opt for day trading brokers in India or anywhere else on the planet. This makes StockBrokers. Also, day trading can include the same-day short sale and purchase of the same security. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Interactive Brokers still charges nominal fees, meaning that other brokerages can forex internet best android otc trading app an overall lower trading cost. Then when choosing between all the top rated day trading brokers, there are several factors you can take into account. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. The StockBrokers. Timber Hill expands to 67 employees. Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. Our order desk may be able to find price improvement or additional liquidity compared to the electronic NBBO for orders in even the most liquid option classes and ETFs. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. This may grant you access to courses, a personal account executive and more in-depth market commentary. After the dot-com market crashthe SEC ishares etf stock split best healthcare equipment stocks FINRA decided that td ameritrade rebalancing tool freakonomics day trading day trading rules did not properly address the inherent risks with day trading. How the industry interprets the definition of PFOF is subject to much debate.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers. The StockBrokers. Popular Courses. This results in cost savings for day traders on almost every trade. To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. How does the overall order quality compare to other brokers who do not operate an ATS? Now that may seem like an insignificant amount. We also reference original research from other reputable publishers where appropriate. However, others will offer numerous account levels with varying requirements and a range of additional benefits. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. There is no one size fits all when it comes to brokers and their trading platforms. Most industry experts recommend using round lots, e.

Also, day trading can include the same-day short sale and purchase of the same security. In return, most online brokers then receive a payment revenue from the market maker. Your Practice. Essentially, an OTC day trading broker will act as your counter-part. Each time you buy or sell shares of stock, your online brokerage routes your order to a variety of different market centers market makers, exchanges, ATSs, ECNs. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. The StockBrokers. The European Securities and Markets Authority ESMA also offers an over-arching guide to all European regulators, imposing certain rules across Europe as a whole — including leverage caps, negative balance protection, and a blanket ban on binary options. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Your Money.