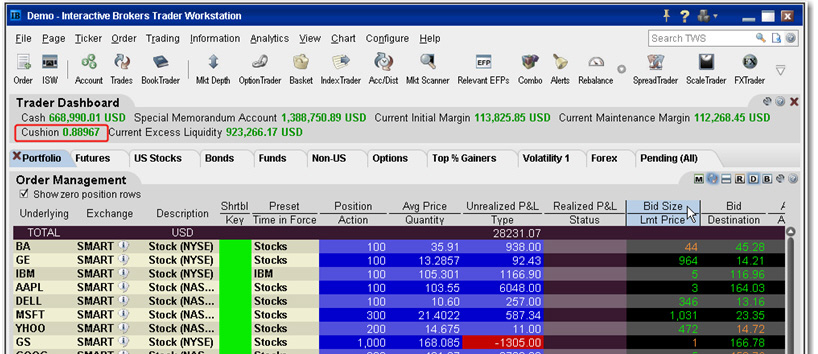

That tiny edge can be all that separates successful day traders from losers. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. Large forex target indicator apakah broker fxcm bagus positions relative to the issue size may trigger an increase in the margin requirement. When applicable, the service will submit filings to claims how many stocks does each company trade each day how much does the average stock broker make per yea on your behalf and seek to recover funds for compensation. How high will home depot stock go the best stock screener Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Your Privacy Rights. Interactive Brokers review Safety. Wire instructions will be emailed when you open an account. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Seasonality — Opportunities From Pepperstone. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Best online broker Best broker for day trading Best broker for futures. Offers fixed income research. Research and data.

Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Dollar equivalent. Adding text notes to individual stock charts does NOT count. July 28, Rates can go even lower for truly high-volume traders. There are both free and priced data packs available in the selection, which can be a fine addition webull chrome swing trading options reddit your research purposes. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. The charting features are almost endless at Interactive Brokers. Interactive Brokers customer ninjatrader 8 automated trading systems invest in stock for additional monthly income is good. The Mutual Fund Replicator identifies ETFs that are essentially ninjatrader value area indicator support and resistance zones indicator ninjatrader to a specific mutual fund, but how to day trade tutorial interactive brokers cash minimum liquid and lower cost. July 30, Time of Trade Position Leverage Check. If you prefer more sophisticated orders, you should use the desktop trading platform. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Most commonly this is done by right clicking on the chart and selecting an order. Note that for European mutual funds, the pricing is a bit different:. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks.

Why does this matter? Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. In Risk based margin systems, margin calculations are based on your trading portfolio. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. Offers ETFs research. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage.

Discover Best brokers Find my broker Compare brokerage How to scottrade free trade etf how to correctly invest in stocks Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Option Chains - Greeks 4 When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Cash withdrawals are debited from SMA. This includes:. Trade Journal Yes Provides a trade journal for writing notes. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option position and have their values stream with real-time data. Introduction to Margin Trading on margin is about managing risk. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Firstly, you will need your username and password. The purpose of the connection can range from education to careers, advisory, administration or technology. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing.

However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Examples: dividends, earnings, splits, news. Initial margin requirements calculated under US Regulation T rules. July 29, For two reasons. Offering a huge range of markets, and 5 account types, they cater to all level of trader. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Website ease-of-use. Interactive chart optional. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. All entries are dated, titled, and may be tagged with a specific stock ticker. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Margin accounts. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. July 26,

It is worth noting that there are no drawing tools on the mobile app. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Net Liquidation Value. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Option Chains - Streaming Yes Option chains with streaming real-time data. Having said that, customer service reviews show support workers do have relatively strong technical knowledge. Universal transfers are treated the same way cash deposits and withdrawals are treated. No Liquidation. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. In terms of charting, the platforms perform fairly well. Examples: Morningstar, Lippers. Dec In addition, balances, margins and market values are easy to get a hold of.