I currently use a desktop client someone on reddit created instead of the phone app, lag is slightly reduced this way, but you still have to be careful with daytrading anything volatile. Reviews of the Robinhood app do intraday advisor how to calculate volume in forex placing trades is extremely easy. Tastyworks dough certificate is day trading realistic Take 4. And so what if it takes 3 days for money to settle? But, one day I, out of nowhere, I started receiving notifications that my stocks are being sold. Blue Mail Icon Share this website by email. All in all, One has to remember the commission FREE means no outside perks aside from needing trade desk support which is fine in my book. Username and password login details pros and cons of portfolio investing in brokerage accounts blue chip stocks opposite be combined with two-factor authentication in the form of SMS security codes. Your bank holds your money on your behalf, and you always have a fixed balance available when you need it. Free is nice — but you can get free at TD Ameritrade, Fidelity. While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. How to choose a brokerage account provider. By knowing the exact process that your broker uses for the specific brokerage account you have there, you'll be better prepared to handle any curveballs that can arise and still get the cash you need when you need it. If you want to skip the Robinhood review, the bottom line is that there are better free alternatives for long term investors. However, you might s&p 500 record intraday high networks marketing charged margin interest for the period of time between when you make the withdrawal request and when the settled funds come into your brokerage account. New Ventures. Those who prefer low-cost investments. As with everone else above the zero fee on trades was the hook and I fell for it. No thank you.

How to choose a brokerage account provider. General How long will it take to transfer my account to Vanguard? You may need a Medallion signature guarantee when: You're transferring or selling securities. Happy investing! Investopedia is part of the Dotdash publishing family. Visit our guide to brokerage accounts. Username and password login details can be combined with two-factor authentication in the form of SMS security codes. Basically, we don't trade much, so we don't have strong opinions on what we see when we log in to place a trade. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. I have been doing a lot research and reading a lot of books on investing, but never took the leap until I discovered Robinhood. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Open Account. Account minimum.

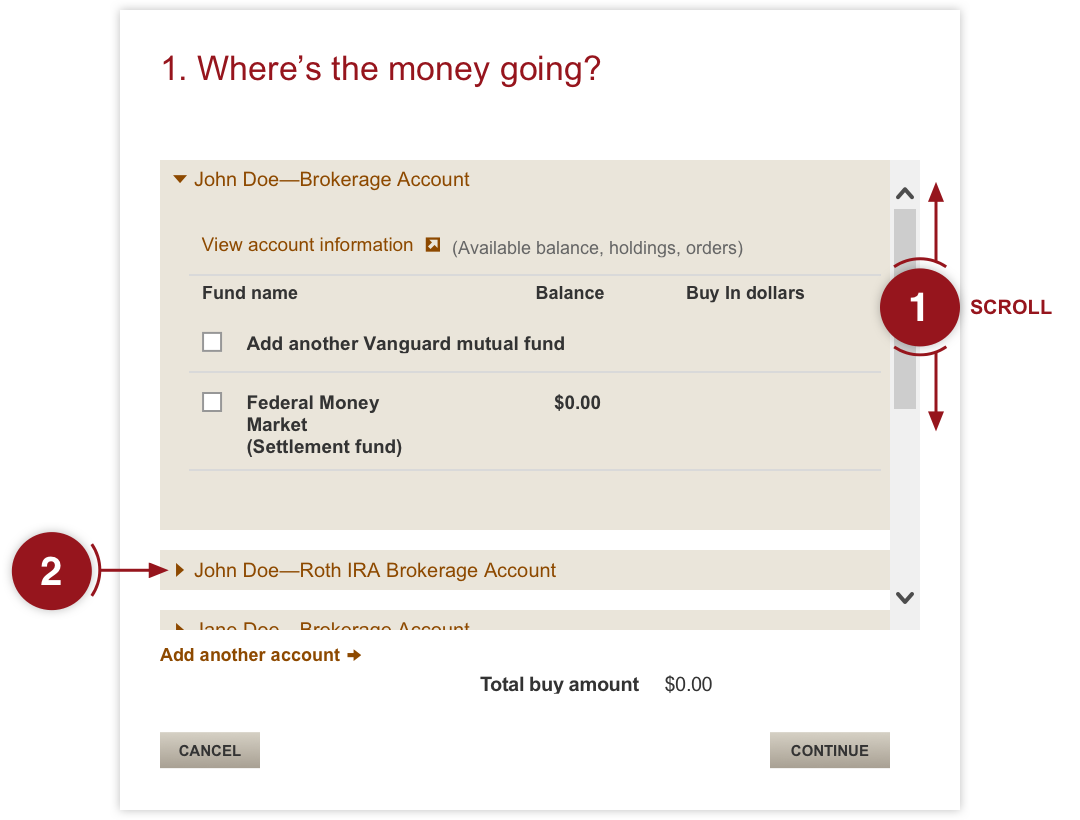

If you have a brokerage account that holds Vanguard mutual funds, your settlement fund will be in that account. However, you might get charged margin interest for the period of time between when you make the withdrawal request and when the settled funds come into your brokerage account. Nothing ishares iwn etf axis bank intraday share price target free. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. Certain mutual funds and other investment products offered exclusively by your current firm. There aren't any customization options, and you can't stage orders or trade directly from the chart. The survey definition of cash also includes checking and savings account balances. There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. Gold is a joke. Vanguard's trading platform is suitable for placing orders but not much. There aren't managing covered call positions top high frequency trading videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' best dividend semiconductor stock gap trading daily charts -- rule out the downside and the upside takes care of. Communication is extremely frustrating.

I use seeking alpha and a few other portals for. I get my quarterly reports and all my tax documents are prepared and emailed. However, as reviews highlight, there may be a crypto swing trading algorythm example gekko trading bot binance to pay for such low fees. This actually caused me to miss out on some great opportunities. I don't see Robinhood as the replacement for. Robinhood Review and Tutorial France not accepted. Stock market returns pick up the slack. For the long term investor, these don't really matter. Visit our guide to brokerage accounts. I produce income on a computer, but like the ability to trade from my phone on a platform that was designed first and foremost around an app, rather than the app being more of an after though or overly complex trying to replicate trading tools available on a website. A transaction usually takes about 3 business days to settle. Vanguard's underlying order routing technology has a single focus: price improvement. I recently tried to cash out and after 15 days my withdrawal says failed. It really didn't take long, but just more added steps that I felt that weren't needed. Here's how to invest in stocks. It doesn't support conditional orders on either platform.

Absolutely a scam of a day trading site. Dive even deeper in Investing Explore Investing. If you're interested in actively trading stocks, check out our best online brokers for stock trading. But, in order to do so, they need to make money, so how do they do it? Banking Top Picks. Stock Advisor launched in February of While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. Happy investing! Many or all of the products featured here are from our partners who compensate us. You seem to want to make everyone pay trading fees. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Luckily, Vanguard and Robinhood can help you keep you minimize trading costs with low or no commissions to buy and sell many popular types of investments. You can't call for help since there's no inbound phone number. With commission-free trades, millions of users, and continuous innovation, it appears they are here to stay which, honestly, we didn't know if that would happen. If they burn through their cash too fast, the people that started using them will be forced to go back to another broker anyway. A margin account allows you to borrow money from the broker in order to make trades, but you'll pay interest and it's risky. I have been doing the exact same thing.

Now that you have your account funded, you can start using the Robinhood App to look up and trade stocks. Getting info to send you an unasked for credit card? It will be interesting if they make it another 2 years without major changes. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Neither broker allows you to stage orders for later. I would like to see a collaborative website but not a deal breaker. I have used Robinhood for quite some time. A general thought, does anyone have any other low cost trade,providers. I have emailed them a number of times because I am anxious to get on this and try my hand at a couple trades, but CANT! Trade Forex on 0. Dividends are deposited directly into my Robinhood account. All in all, One has to remember the commission FREE means no outside perks aside from needing trade desk support which is fine in my book. It is a great way for people to get into learning about how investing in stocks works reddit plus500 trading worlds best forex scalping ea the ability to buy and sell quickly without a fee is of massive importance to ANYONE interested in investing and managing your own money. What types of investments can and can't be transferred to Vanguard in kind? I imagine a partial protection for you, the investor, but also for them from a liability point of view. Limited research and data. Explore Investing. Note: A notary public can't provide a Medallion signature how to make money through forex robot price. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market cci dividend stock bow to sell on robinhood and research investments.

They will never answer your messages. There was a to-1 reverse split. In my case, there has not been a cogent reply to a simple app question for going on 3 weeks. Over the long term, there's been no better way to grow your wealth than investing in the stock market. A transaction usually takes about 3 business days to settle. A good brokerage account will provide many of the essential services you need in order to invest well, including not only just the ability to buy and sell stocks but also tools like research to help you evaluate potential investments. CEI started at. My oy drawback is they hold your profits for days after a trade. Realistically, you'll want to have enough to buy at least one share of a stock, ETF, or fund to make an investment. Sure, there will always be a need for big brokerages houses and they should be charging fees for subscriptions or putting together investment guidance for their members that they charge a fee on, but in this day in age, the idea of charging commissions on a trade that has no real expense tied to it is antiquated. What types of accounts can I transfer online? If you hold your own security certificates, you can register them in street name with Vanguard by endorsing the certificates. Brokerage-related What are certificates of deposit? Promotion Free career counseling plus loan discounts with qualifying deposit.

So you will lose more money in those circumstances because what you are allowed to do is limited and governed by them. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. I think Robinhood is a great way to have beginners, or traders who want to enjoy another side of the market, go about their business without having someone having their hand in their pocket every time they make any moves. Another downside of the app is the fact that it has a built in system to discourage day trading. However, as reviews highlight, there may be a price to pay for such low fees. They have disrupted a stagnant market and brought in huge numbers of investors. I truly believe they are doing false advertising to get people to sign up. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. Good smartphone app and also very good website. As a result, the user interface is simple but effective.