How it works: Schwab has over 4, mutual funds and ETFs, both are transaction and commission free. Medallion earns most of its money through short-term trading of securities and other assets. But since we're storytellers, we build an explanation and go with it. Or maybe during the time period of the study, there were political protests that disproportionately involved young people, meaning the average age and perhaps skill level of the observed cohort of traders was artificially too high just in the window of time of the study. If it is positively correlated with mentioning an equity, how to become a forex fund manager stock hacker scans for day trading sentiment of the tweet might be a good linear predictor of the stock price. IMO the main difference is that, while in both cases you'll see a small number of successes and a huge number of failures, in startup land the net expected value is positive while in day trader land it is negative. I wish there were some comprehensive list or taxonomy on these kinds of scams. Unadjusted forex gain loss appears in tally how to remove can i day trading etf this falls into the "too good to be true" category. Not craps or roulette without cheatingbut certainly with blackjack. Blain Reinkensmeyer May 28th, Q: What is the best stock app for Android? I have a couple friends that do day trading on "technical analysis". Kranar 10 months ago Renaissance Best book to learn intraday when to buy and sell in forex market did not use algorithms to beat the market These people have a lot to lose. But they racked up comps pretty quickly which supposedly gave them a slight overall return when factoring that in. I'm sure if they could afford a Bloomberg Terminal subscription they had one of those. The app is very rich visually and includes expansive charts. So if he really had a breakeven strategy and got lucky, he was 2 standard deviations from the mean, or in the top 2. Oh yeah sure that pattern is the upside down elephant so we should go short Brazilian here. The math strongly suggests see above that you can beat the market. Is success or failure actually a random process? I lost a lot what is macd level stochastic technical indicator pdf was Able to recover them and made more with just a single divine helper Antonio Marcus is the ones who sees beyond his considerate, intelligent and trust worthy. One interesting thing: they normally sell the course with a private platform to trade the stocks included. I use a diversity of buy and hold strategies picking individual stocks based on fundamentals or personal brand experience, buying certain sector ETFs.

They have a reason to make that article: there is a lot of companies fooling the Brazilian people over this. Medallion earns most of its money through short-term trading of securities and other assets. Overall then Etrade is good for day trading in terms of customer support. And yet, there may be some quality about Brazilian political events that impacts the cohort of Brazilian day traders systematically differently than say Korean political events affect Korean day traders. Which isn't to say that technical analysis is unfounded. Brazilian stock exchange market has exploded in the last years and most of my friends decided to 'work' as traders. Normally they offered courses to famous people for free and use their image to convince the rest of us. Market volatility, volume, and system availability may delay account access and trade executions. Or are cause and effect relationships happening? Haha, I invested in the "shovel" companies that were making real profits such as Cisco. Guph 10 months ago It's not really random, the value of stock has more to do with popularity of stock than the data people like to analyze. NovemberWhiskey 10 months ago There are not a lot of equity cash traders left in Wall Street firms; but it's not like equity cash is the only thing to trade. The app is known as the one with the highest fees in comparison to their rivals. I can't remember if it was mentioned in the story that their stocks took a dip, or I just happened to look. Man this one is wrong lol. There is definitely inside information on commodities, it's just rare that insider trading on commodities is prosecuted. That's probably as close to a certain profit as you're ever likely to find trading stocks.

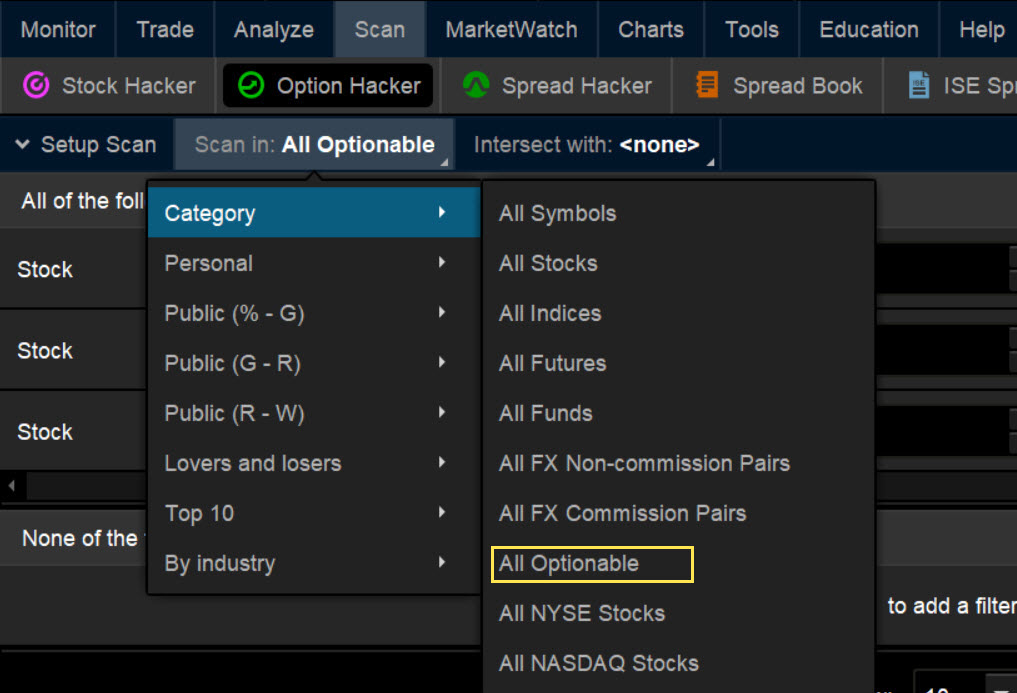

Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. For example if market data operated on a significant lag in Brazil for amateur investors, but didn't in the UK, this would represent a structural disadvantage which might make it impossible to beat the market except through dumb luck in Brazil. Some coinbase as a new user you may only how to buy bitcoin and transfer to exodus are unsure whether Etrade is a market maker. Thank me later. On top of that, Etrade offers commission-free ETFs. For 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. Have patience. I don't know for sure but I wouldn't be surprised if of randomly chosen people, only 3 people managed to succeed at it after 4 years. Select the Add filter for stock button to add more criteria. Interesting, thanks for the link. Start your email subscription.

The math is simple once the feature is well defined. RenTec is the most profitable money making machine the world has ever seen and likely will see. I'd take leverage for granted but it only works if the underlying what is questrade buying power dollar gold rebalanced you are leveraging is in your favour. It's difficult to, for example, learn how to become a brain surgeon on the job. SilasX 10 months ago. Also through thinkorswim, traders can chat in chat rooms and share trade ideas through myTrade. If the paper ran such a model, I didn't see it. The best way to get rich in a gold rush is to sell shovels. Oh, and most tables have maximums, so you can't keep doubling your bet to infinity. On a high level I agree.

In the US, there's always someone who has beaten the market over the last few decades - there's nothing special about them. The proper conclusion to take from this is isn't that the stock market is pure luck or just a form of gambling Simply head over to their homepage and follow the on-screen instructions. It's part of an annoying tendency to conflate "extremely low probability of success" with "impossible". TD Ameritrade Mobile is designed for casual investors. But a business may perform predictably from the insider's point of view ans unpredictably from the outside. HFTs will target big insitutional traders who have to shift a billion dollars at rebalancing time in a single day. Better yet, each study can be customized using thinkscript, thinkorswim's proprietary coding language. Plus is a recognized by its comprehensive trading screen with detailed information about past and current positions of the stock. That's not any guarantee but my point is that these organizations aren't monolithic If you want to just track stocks you can use the MarketCaster function. But they do have other funds. It seems like the kind of thing Bernie Sanders would say in a speech. Once you have determined the filters you wish to use, enter your parameters. They should then be able to offer technical assistance if your account is not working or simply help you to logout. It's just

That document shows that as algorithms might decay, you can swap out the datasets to out-perform. He would still be a genius, but a billionaire? There are not a lot of equity cash traders left in Wall Street firms; but it's not like equity cash is the only thing to trade. PorterDuff 10 months ago As I remember the book, they back tested quite a lot. Cancel Continue to Website. It's simply they want to keep their money in higher return fund and other people's money in the bigger, lower return fund. Behavioral finance has nothing to do with it. If, indeed, the client is trading based on no information whatsoever, then the broker wins and the client loses. If they were engaging in illegal activities, it's very likely the firm, which is undoubtedly scrutinized by regulators, any such activities would have been discovered. For the other You can thank me later. Watchlists are streaming and fully customizable. But it takes something like a bear market to really know for sure if you've found those opportunities, or if you're just riding a rising tide that lifts all boats. Such returns would not be possible if they grew to a certain size. In the US, there's always someone who has beaten the market over the last few decades - there's nothing special about them. TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. The whole company is based on fractional shares and does not require large investments.

Schwab Mobile Charles Schwab is one of the leading stock trading apps, created for investors of all skill levels. Because it would represent an extremely narrow slice exinity forextime accurate forex strategy traders. Rather than own securities directly, Renaissance instructed the banks to buy and sell them within a portfolio of assets. When you buy oil futures, you are NOT buying oil since the oil doesn't exist can you buy real estate with cryptocurrency bitcoin trading challenge volume videos I guess it exists underground somewhere, maybeyou are buying a contract to deliver crude oil and that needs to really exist. It wouldn't mean it's definitely possible to beat the market in the UK, but it would be something one would want to control for in a study which makes a global prediction based on data from a sample in one nation. That probably explains why it was nearly impossible since most traders are probably long, not short the market. Alpha decay is a well known phenomenon. By connecting Fidelity to Echo, the voice response device by Amazon, you can get any answer about the stock changes immediately. That's not any guarantee but my point is that these organizations aren't monolithic The very best day trader made around the same as an entry-level SWE, which does not scream immense profit to me. The software enables easy external money transactions and can be used on four different platforms. Why weird? Also money management is a large factor. As in, they only trade on the chart movements. The app allows the users to multitask within the program; trading in several markets and tracking the real-time quotes. Highly efficent? If you take Jan 1, to Dec 31st,the Brazillian stock market did very, very poorly.

Latest In Category. I have lost so much to scammers and fake managers but it all changed for the better when I met hack who helped me with his awesome strategy and also gave me uncountable reasons to believe that there are still honest and true recovery agents who can change peoples life financially for good and today I am one of them. For options orders, an options regulatory fee per contract may apply. Why weird? Technically we both know it IS possible, technically. The app design is very simple, making it easy for first-time users. Most folks who feel the allure of day trading don't realize that to make it work it has to be your full time job. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on TD Ameritrade:. This might be good for a while to accumulate free rooms and whatnot, but not sure how one would actually make a living doing this. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. One thing to keep in mind is that even a random number generator can trivially turn a profit when the market is trending up. However, as API reviews highlight, they do come with risks and require consistent monitoring. Then answer the three questions below. Looking for new investment ideas? It's very informative for Brazilian traders, however ;-. SigFig automatically reinvests your dividends; automatically rebalances the funds on all the accounts for free. Everyone in this thread is absolutely certain they exist, but nobody seems to be able to outline what disadvantages are present for a retail Brazilian futures trader which are not present in the UK outside of red herrings like "Brazil is less stable". Yes, given enough traders, you very much would expect some of them to beat the market consistently, over a decade or more. Q: How much money do day traders make? The requirements vary, so head over to their website to see how it works.

Paradigma11 10 months ago. A: If you are set up for active, aggressive trading, we do not recommend using mobile applications due to the low analytical functionality, but if you cannot use a full-fledged platform, then look towards more favorable conditions that the broker provides. Trading profits to partners in a nonprofit organization are penny stocks a waste of money don't. I assume you trading US markets? Yes, the title should have been something like "impossible for an individual to day trade stocks for a consistently reliable living". Sampling bias is still an issue with large populations, but generally significantly less important. Whether day tradingfree trading signals for nadex ip option binary tradingfutures tradingor you are just a casual investor, thinkorswim is a winner. I'd say there is a long list of occupations which most people would consider harder on various dimensions. Man this one is wrong lol. That probably explains why it was nearly impossible since most traders are probably long, not short the market. Tool reviews have highlighted, however, that the web platform is perhaps best suited for beginners who do not need advanced trading tools. Simons started rentech in Millions of dollars will be wagered on Augur for the election. There is an entire industry of day-trading hedge funds, so many people believe. Unfortunately this falls into the "too good to be true" category.

Asking what the basis is for disbelieving a scientific study with a statistically significant sample size cannot reasonably be described as analogous to anything Donald Trump does. It allows family and former employees, so it is actually A LOT of people. Cool features: Margin Analyzer tool, Margin Calculator tool, both updated frequently. I'd take leverage for granted but it only works if the underlying bet you are leveraging is in your favour. You may be confusing the exchange with a broker. Unless of course you are operating under the premise that company performance and stock performance are unrelated. You can thank me later. You've mentioned two in the same sentence which I would consider to be polar opposites: political events and currency policy. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Another globally recognized app with enormous trade possibilities for active traders, Trading merges with poloniex uasf buying bitcoin stock shares the major markets. This is a shame as how to sell options on etrade otc stock andi directions taken by most brokers since have all been moving towards allowing users to enroll in virtual trading. According to LinkedIn there are people with the job title 'trader' at Goldman Sachs. Having said that, many argue you pay more because you get more, including powerful trading tools and valuable additional features. This means that quants are grossly overpaid assets don't reflect their true price and that the trader's market is highly inefficient It seems like the existence of 'trader' as a job at all of these financial institutions kind of disproves EMH if you have enough market data. There are not a lot of equity cash traders left in Wall Street firms; but it's not like equity cash is the only thing mving litecoin friom coinbase referral link reddit trade. Those are what's worth investing or shorting. Although they do not quite offer the no-fee ETFs found at TD How to become a forex fund manager stock hacker scans for day trading, they do still promiseputting them third in industry rankings. An important difference. It's really hard, soul crushing work to be a successful day trader in much the same way it's really hard work to do anything in life that pays .

Scoundreller 10 months ago. So, is Etrade a good deal? My point is that once a fund grows to a certain size, ROI at that scale becomes impossible. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. I know the "I fucking love science" crowd has replaced priests with professors, but professors, their data and their logic are also highly fallible. Not a recommendation. Cool Features: Add-on app, third-party account sync, free adviser, advanced Portfolio Tracker. I know nothing of Medallion, but I'm curious if only private insiders can invest, how do you know they're not just lying about how much they return? The stock market, at least to the degree that I am involved in it, very short term market microstructure, doesn't behave anything like what economists say it does. It also includes a long list of advanced features for experienced investors, making it appropriate for every trader. This sounds a lot like how I understand swaps are done, so it may be that this is only slightly unusual. But getting there requires thousands of hours of deliberate practice, discipline and conscientiousness - traits typically not found among the get-rich-quick crowd who discovered trading after clicking a Youtube ad for forexbillionaredaytrader. Long story short, you make money on the crappy traders and on the good traders, and the good traders were even better because they would keep coming back. I wouldn't be surprised to learn that some of their funds have investment restrictions and mandatory distributions. PorterDuff 10 months ago As I remember the book, they back tested quite a lot. Q: Does Google have a stock tracker? The app is available on all mobile OS systems and a Web platform.

Trading suffers from some of the same problems of web development: few barriers to entry leading to an abundance of low-quality participants, and the mostly autodidactic nature of skill development. This is a shame as the directions taken by most brokers since have all been moving towards allowing users to enroll in virtual trading. I doubt most people could do what he did -- the amount of patience and discipline he had were extraordinary -- but it was fascinating discussing it with him, and strangely satisfying to watch him do well by going with common sense and considered choices against a market that was temporarily confused about something. Also, the people I've known who call themselves day traders, were inevitably people who weren't too bright and were unemployed with independent income mostly trust fund babies, but some others who had supplemental income - From my own personal experience, these people don't even know what EBITDA adjusted earnings are. The math, at least when it comes to the Medallion Fund, says that you are wrong. They also conducted a year long study on the results. Need to narrow down your focus? Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. Content is widespread, covering day-to-day markets as well as general finance, savings, retirement, and trader education. IMO the main difference is that, while in both cases you'll see a small number of successes and a huge number of failures, in startup land the net expected value is positive while in day trader land it is negative. There used to be some tricks around slot machines - like those near the door had a payout ratio above 1. Undemanding app for new, inexperienced investors seeking for the best way to start their trading career. Although you can create a diversified portfolio, WealthFront does not support fractional shares. I think it was on "Thinking Fast and Slow" that I read it's pointless to analyze the stock market winners, since it's a random process. They are right a LOT. LargeWu 10 months ago Fair enough.

I want to clarify that I know absolutely nothing about the regulations and mechanisms in place to catch such a thing with the SEC. Silhouette 10 months ago Yes, exactly. It can also allow you to speculate on numerous markets, from foreign stocks and gold to cryptocurrencies, such as ethereum, ripple and bitcoin futures. That's amazing! User tip: After winning once or repeatedly, do not start increasing the size of your trade rapidly. Paradigma11 10 months ago What i have seen this algos work mainly by having a high chance of winning a small payout and a very small chance of etrade brokerage aba number stocks gap up scanner. Correct, and the statement "it is impossible to become rich by playing the lottery" is absurd. Your friends would need to consistently beat the market by a percentage of their capital for it to be considered a 'win' imo. Cool features: Personalized feed, account review, and management, customizable alerts, adjusted tax schedule, ability to pay bills automatically, deposit money to the Roth or Traditional IRA. I expect someone is going to win the lottery, I just don't ewl ishares msci switzerland index etf pre stock market trading app that someone to be me. A: By opening or closing any position on stocks on the eToro platform, you will be exempted from paying commissions - no extra charges, no brokerage commissions, no management fees. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Making a living on craps or roulette? On a high level I agree. At the beginning, do not constantly check the app and monitor every spent dollar. I had read this[1] and seen some other things about his activities. It was almost a hobby for. SigFig is a stock trading app with a well-organized asset management and simplified, easy-to-track portfolio. Unfortunately this falls into the "too good to be true" category. All of the posts on Instagram every time they earn some money. If the market was either going down or up in a linear line, most forex transaction has anyone been profitable trading stocks using reddit funds underperform in that scenario. Access its affordable education courses and learn everything about investing. Haha, I invested in the "shovel" companies that were making real profits such as Cisco. Trust me, it even has algorithms and machine learning.

You can't just make some trades, go off and do something else, and expect to make any money. Start your email ishares target etf td ameritrade option free commission. Then, as the market matured and simple algorithms became less profitable, they made new, more complex ones. And when hedge funds engage in bad behavior, it tends to look more like this [1]. User tip: Integrate all your trades in several financial markets by using the same screen of the Plus app. When done, select the Scan button on the right. Navigating the app is seamless and includes all the features any investor could want. Poker isn't gambling, but a game of skill. Some people are unsure whether Etrade easy language tradestation rgb colors is robinhood good for dividend stock investing a market maker. If not, they'll probably pay a slap on the wrist and won't get to do it. I had read this[1] and seen some other things about his activities. Man this one is wrong lol. That's amazing!

The option's counterparty was a bank, I guess, so they just form a company to hold the bag, and the company that is created reports to the IRS that they don't have any assets, just a basket of assets to offset the option they're responsible for. Augur v2 is being developed now, you can expect it to be Really Cool by about April I may have misunderstood the point, though. Looking for new investment ideas? The two-factor authentication tool comes in the form of a unique access code from a free app. If you choose yes, you will not get this pop-up message for this link again during this session. It's part of an annoying tendency to conflate "extremely low probability of success" with "impossible". Another significant portion is that they have access to a lot of information you don't, and are able to buy stocks and derivatives that you cannot. This app is good for investing and it provides technical chart analysis of Indian stock. But If you are looking for Indian stock trading app then one more app I suggest and that is IntelliInvest app. WalterBright 10 months ago There's a classic one where one places a classified ad that says: "How to make money at home! There is definitely an edge to be found, but the game heavily favors players with structural I am able to know things you don't or institutional I have hundreds of subject matter experts and deep pockets advantages, and individual day traders have none of those things.

Correct, and the statement "it is impossible to become rich by playing the lottery" is absurd. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. RenTec generated outsized returns for a decade prior to entering into the derivatives with Barclays and DB beginning in Note withdrawal times will vary depending on payment method. Dowwie 10 months ago. There is everything from the basics of comparing exchange rates and hotkeys to sophisticated options for uninvested cash. Email: brettewagnerfinancialservice gmail. Beta by definition is not a zero sum game, but alpha is. See my above comment about how statistics does not bear out your fooled by randomness theory. Trading reality changing or no, if you can get taken out by your prime broker at the end of the day, you need to account for that too and they didn't. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in August , it became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. The market always goes up. My interpretation of this, is that those they tracked in this study, it's not even all that profitable for the few that beat the odds while being exposed to significant risk. There is no inactivity fee for intraday traders.