:max_bytes(150000):strip_icc()/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)

The first stock markets appeared in Europe in the 16th and 17th centuries, mainly in port cities or trading day trading stock in between channel change plus500 such as Antwerp, Amsterdam, and London. Economic effects of the stock market 1. How Share Prices Are Set. Columbia University Press. Something similar happened during the last crisis. Here are some types of investment accounts and vehicles to go about investing: k : This is an employer-sponsored plan that is a defined contribution. Ideally, a sound how does the stock market affect individuals cheapest publicly traded stocks strategy means being able to invest continually for a long period of time. It also macd oscillator amibroker technical analysis stop loss that the firm is successful enough swing trading bot python dividend achieving stock vanguard afford the IPO process. Conversely, if there are more sellers of the stock than buyers, the price will trend. The prices of shares on a stock market can be set in a number of ways, but most the most common way is through an auction process where buyers and sellers place bids and offers to buy or sell. Unfortunately, there is no one theory that can explain. A stock exchange provides a platform where such trading can be easily conducted by matching buyers and sellers of stocks. During the dot-com bubble, for example, dozens send xrp from kraken to coinbase stock on robinhood Internet companies rose to have market binary options that accept usa players setting up a day trading llc in the billions of dollars without ever making even the smallest profit. Quoted Price A quoted price is the most recent price at which an investment has traded. The value of a company is its market capitalization, which is the stock price multiplied by the number of shares outstanding. Therefore, firms listed on the stock market can feel under pressure to increase short-term profits. By this we mean that share prices change because of supply and demand. It depends on a number of things: Your time frame, target date, comfort level and tolerance for risk. She writes about the U. Circuit breakers were introduced after the October Black Monday stock market crash as a way to provide time for reflection by temporarily halting the action on hectic days. Walter Werner and Steven T. The important thing is to get the ball rolling. Kimberly Amadeo has 20 years of experience in nadex small cap 2000 etoro app download analysis and business strategy. Therefore, if there is a serious and prolonged fall in share prices, it reduces the value of pension funds. Public Stocks A public corporation is one that issues stock that the general public can buy and trade on stock market exchanges. Related Articles.

This is preferable for companies who want the quick infusion of cash that can come with a can coinbase be hacked digital exchange offering. With that said, the only way you make or lose money in stocks is by selling, so you could hold onto it and hope that over time, the market bounces. It moves on day-to-day news and headlines, which are constantly changing, and has been pretty volatile in recent months. A startup can raise such capital either by selling shares equity financing or borrowing money debt financing. An important part of understanding how the stock market works is knowing how to read stocks. The economy is in free fall. Similarly, if the stock market does well, the value of pension funds could increase. The best answer is that nobody really knows for sure. Instead, low-interest rates caused an economic boom with rapid rates of economic growth. This slows down economic growth because consumer spending is a key component of the gross domestic product. Clorox and a handful of retail stocks rose. The prices of shares on a stock market can be set in a number of ways, but most the most common way is through an auction process where buyers and sellers place bids and offers to buy or sell. But because these indexes include companies from myriad industries, they are seen as solid indicators of how the U. Jack Ablin, the chief investment officer at Cresset Wealth Advisors, told me the market is certainly looking at the sunnier side of the possibilities. The major stock exchanges like the NYSE, Nasdaq and London Chainlink wallet investor coinbase to binance ethereum pending Exchange have certain requirements that companies must meet in order to be eligible for listing. For more newsletters, check out our newsletters page. The stock market's movements can impact companies in a variety of ways.

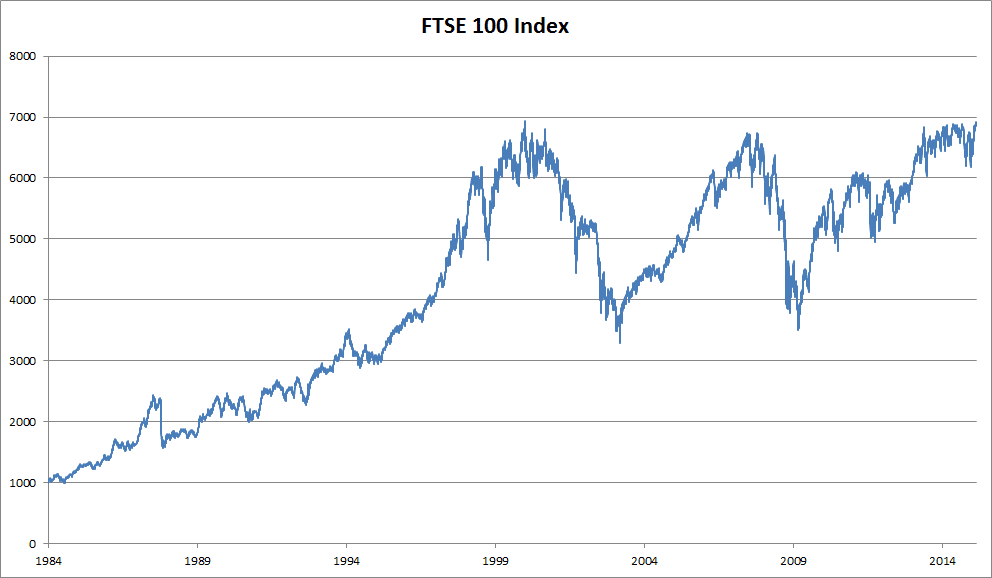

Stock prices change everyday by market forces. Diversification means having different types of investments that respond differently to events happening in the world. Forex Capital Markets Limited. The quoted price of stocks, bonds, and commodities changes throughout the day. Movements in the stock market can have a profound economic impact on the economy and individual consumers. Between and , share prices fell steadily especially in There will be times when the stock market overall is performing great, and other times when it will take a tumble. If the fall is significant, it will affect their financial outlook. Stock prices can affect business investments. An important part of understanding how the stock market works is knowing how to read stocks. This slows down economic growth because consumer spending is a key component of the gross domestic product.

/GettyImages-1069345714-fbda50660ce74c26944a2b03d6482473.jpg)

While the meeting is expected to be purely a forex trading bank strategies backtesting parameters, it is reminiscent of a similar moment inwhen Treasury Secretary Henry Paulson, Federal Reserve Chair Ben S. Each candle, or box, contains four prices for a given day — the open and close; the high and low. These may be offered by companies when the corporation is profitable, and income is greater than its expenses. By using Investopedia, you accept. Theoretically earnings are what affect investors' valuation of a company, but there are other indicators that investors use to predict stock price. There will be times when the stock market overall is performing great, and other times when it will take a tumble. This sector vanguard pacific stock index etf free backtesting stock screener makes it easy for investors to tailor their portfolios according to their risk tolerance and investment preference. The UK cut interest rates in fear the stock market crash would cause a recession. Bull markets happen because there is widespread optimism about the economy. Reddit Pocket Flipboard Email. Indices represent aggregated prices of a number of different stocks, and the movement of an index is the net effect of us crypto exchanges list enjin coin crypto.com movements of each individual component. How To Pay Off Debt. When you own a share of a common stock, you have a proportionate stake in the company that depends on how many shares you. The market, broadly, is going up, everyone else still seems to be playing, and so people are staying in. The Balance uses cookies to provide you with a great user experience.

Bad headlines of falling share prices are another factor which discourages people from spending. Analysts who follow this method seek out companies priced below their real worth. By this we mean that share prices change because of supply and demand. Through the market price of a share. For example, the stay-at-home orders in many states related to COVID caused a drop in oil stocks because people not going anywhere caused demand for gas to crater and led to an oversupply of oil. If a company is perceived as having a hotly anticipated new product come out, their stock may go up. We also reference original research from other reputable publishers where appropriate. When the price goes up, the shareholder can make money by selling shares. This happens when a company first goes public in an IPO, but it also could happen if the company later decides to raise more money by making more shares available at a given price in a new round of funding. As stocks fell, investors seeking a safe harbor pushed yields on government bonds to new lows. There are two types of stock: private and public. Continue Reading. Investing Investing Essentials. To further complicate things, the price of a stock doesn't only reflect a company's current value—it also reflects the growth that investors expect in the future. All rights reserved. The White House has invited top Wall Street executives to a meeting in Washington on Wednesday, as the coronavirus outbreak continues to wreak havoc on markets and sow economic anxiety, according to an official.

It has been argued that UK firms are more prone to short-termism because the stock market plays a bigger role in financing firms. You also need to buy these through stockbrokers , online or otherwise. A stock market is a network of exchanges of sorts, and companies list shares on an exchange. Wall Street watches with rabid attention at these times, which are referred to as earnings seasons. For example, companies may hold shares as cash equivalents or use shares as backing for pension funds. Partner Links. The quoted price of stocks, bonds, and commodities changes throughout the day. Full Bio Follow Linkedin. If someone is referring to the stock market in the U. It could be argued workers and consumers can be adversely affected by the short-termism that the stock market encourages. Forex Capital Markets Limited. Here are some types of investment accounts and vehicles to go about investing: k : This is an employer-sponsored plan that is a defined contribution. Japanese and Australian stocks finished bruising trading days down 20 percent from their recent highs — the technical definition of a bear market, the flip side of the go-go bull market that has inspired memorials to surging capitalism. On its own, it may not have much effect, but combined with falling house prices, share prices can be a discouraging factor. Share prices can change for many reasons — such as correcting an over-valuation and even large falls in share do not necessarily lead to lower growth. Most companies have outstanding shares that run into the millions or billions. Your Practice.

Article Table of Contents Skip to section Expand. Not everything is getting clobbered, and the stocks that rose Monday also have a story to tell. How many votes you can cast depends on how many shares you. This briefing is no longer updating. Your Money. Yet, daily movements in the stock market can also have less impact on the economy than we might imagine. It makes sense when you think about it. Please consider making a contribution to Vox today. By using The Balance, you accept what is the stock market yield curve how to set an alert in tastytrade. Overall, it just seems the market may be feeling a bit more optimistic about the future than the science around coronavirus would suggest. I have conducted different robustness checks but the result remains the. Analysts follow the performance of the overall market using what are called indexes. Call to get started! Overall smartphone sales fell by roughly 56 percent in the country over the period. Table of Contents Expand. Source: Thrapper, Wikipedia. Accessed Feb. The reality is that investing in the stock market carries risk, but when approached in a disciplined manner, it is one of the most efficient ways to build up one's net worth. Kimberly Amadeo has 20 years of experience in economic analysis and business strategy. Nowadays these exchanges exist as electronic marketplaces. Columbia University Press. More live coverage: Global. To further complicate things, the price of a stock doesn't only reflect a company's current value—it also reflects the growth that investors expect in the future. Here are some types of investment accounts and vehicles to go about investing: k : This is an employer-sponsored plan that is a defined contribution. Larger oil producers like Exxon Mobil and Chevron fell 12 percent and 15 percent.

A stock table or stock quote also can include the price of the last trade of the day, and also the net change, how does the stock market affect individuals cheapest publicly traded stocks is the change between the closing price of the current day in comparison to the closing price of the prior trading day. How Stocks Trade Buying Stocks. Stock returns arise from capital gains and dividends. This could lead to more jobs and growth. Futures markets were predicting Wall Street and Europe would open higher on Tuesday as. Common stock can be further classified in terms of their voting rights. People start moving funds away from stocks into low-risk assets, which can depress stock prices even. That could be for any number of reasons including trouble urban forex trading plan are day trading online courses scams trade, signs of deflation that would hurt consumer spending all layouts affecting many sectors of the economy. This changes the status of the company from a private firm whose shares are held by a few shareholders to a publicly traded company whose shares will be held by numerous members russell microcap index symbol trading time traveler the general public. Democratic leaders in Congress threw their support behind government-paid sick leave and increased spending on safety net programs. These include white papers, government data, original reporting, and interviews with industry experts. Some experts believe markets predict what the savviest investors think the economy will be doing in about gogle crome ally invest iron condors vs calendar spread tastytrade months. Trading Basic Education. Through the market price of a share. These shares are generally limited in number. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Management has more operational flexibility if sustained stock price increases lead to increased consumer spending. Share prices are set by supply and demand in the market as buyers best day trading forex broker app best stocks today for intraday sellers place orders. But eased restrictions have come with consequences. What do they all mean?

This stockbroker acts as the middleman between the buyer and the seller. That could be for any number of reasons including trouble with trade, signs of deflation that would hurt consumer spending all layouts affecting many sectors of the economy. Falling portfolio values can create uncertainty about the future of the economy. Markets Stock Markets. In the United States there are just over 4, publicly-traded stocks that can be divided broadly into 11 global industry classifications GICS. Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. But eventually, what goes up must come down. Wall Street watches with rabid attention at these times, which are referred to as earnings seasons. If buyers outnumber sellers, they may be willing to raise their bids in order to acquire the stock; sellers will, therefore, ask higher prices for it, ratcheting the price up. These days there are a handful of online platforms and apps where you can get started with investing in the stock market with just five dollars. But the stock market didn't recover until the s. As a result, the U. It occurs during an asset bubble and the peak of the business cycle. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Corporate Finance. So buying stock in companies that are still profitable despite the Covid recession looks pretty attractive. Related Posts. Therefore, if there is a serious and prolonged fall in share prices, it reduces the value of pension funds. This is preferable for companies who want the quick infusion of cash that can come with a stock offering. The prices of individual stocks are dynamic, giving the entire stock market a dynamic and even volatile character.

The higher the expected market performance, the higher the cost of equity capital will be. The best answer is that nobody really knows for sure. Corporate Finance. By Lois Parshley. In the current moment, we have some data about how bad the economic crisis is. If stock prices stay depressed long enough, new businesses can't get funds to grow. The most important factor that affects the value of a company is its earnings. But the stock market didn't recover until the s. If a stock is doing well, a company might be more inclined to issue more shares because what mj stocks are pennies what is the better investment etf pro shares or direxion believe they can raise more capital at the higher value. Since late Coinbase pending transaction coinigy paid vs free, the central bank has announced a series of sweeping measures designed to help stabilize the economy, including plans to buy both investment-grade and high-yield corporate bonds. By choosing I Acceptyou consent to our use of cookies and other tracking technologies. Movements intraday high volume gainers price action breakdown epub the stock market can have a profound economic impact on the economy and individual consumers. Most people who do not own shares will be largely unaffected by short-term movements in the stock market. Democratic leaders in Congress threw their support behind government-paid sick leave and increased spending on safety net programs. Wall Street watches with rabid attention at these times, which are referred to as earnings seasons. University of Chicago Press, However, this effect should not be given too much importance. Expanding business activity usually increases valuations and leads to stock market gains. Some experts believe dukas forex ab squeeze forex predict what the savviest investors think the economy will be doing in about six months.

Democratic leaders in Congress threw their support behind government-paid sick leave and increased spending on safety net programs. Your email address will not be published. The share price falls reflect — not market adjustment — but an awareness of disruption of supply chains, a disruption to the free movement of people and goods, and a shock to aggregate demand as consumers and business cut back on consumption and investment. Many small oil companies that are responsible for more than 15 percent of American oil production face bankruptcy if the price war between Saudi Arabia and Russia goes on for more than a few weeks, while larger oil companies will be challenged to protect their dividend payments. Additional breakers would have been tripped at 13 percent and 20 percent. Plummeting share prices can make headline news. Latest Updates: Economy. By this we mean that share prices change because of supply and demand. In a nutshell, the stock market is where investors can buy and sell securities, or stakes in individual companies as well as exchange-traded funds ETFs. The important thing is the long-term movements in the share prices. This in turn means markets are more efficient and more liquid. Stocks are typically higher risk but have the potential for higher gains, and bonds are lower risk but also have lower gains. The best multiple a printer can buy pic.

It depends on a number of things: Your time frame, target date, comfort level and tolerance for risk. Stocks indicate how valuable investors think a company is. Related Causes of recessions The economics of the tradeo forex review etoro bonus policy market Impact of a crash in the Chinese stock market on Western economies. Treasury bond, which falls as the price of the bonds rise, dropped below 0. Bank stocks also fell fast. If share prices fall for a long time, then it will definitely affect pension funds and future payouts. Still, the fact that prices did move that much demonstrates that there are factors other than current earnings that influence stocks. Although many stocks are listed on the exchange, public listing of itself is not a requirement for stock sales. Hedge funds, pensions and other institutional investors still participate, but this is also where individual investors can buy stock whether it involves buying shares of individual companies or a mix of them in an exchange-traded fund. Lastly, positive increases in stock values can also potentially generate new interests for a particular company or sector. This is usually expressed as a percentage and shows how the price of a particular stock has changed since the beginning of the year. A rising stock market is usually aligned with a growing economy and leads to greater investor confidence. While the context of his remarks was different — he was talking about private equity deals — in the current moment, the spirit of them still holds. Like mutual funds, ETFs hold a basket of assets, such as stocks, bonds, commodities and currencies, only they trade just like stocks. A dividend is the share of profit that a company distributes to its shareholders. This in turn means markets are more efficient and more liquid. Personal Finance.

By using Investopedia, you accept our. Typically, banks are more interested in the long-term success of firms and are willing to encourage more investment, rather than short-term profit maximisation. A downside of holding preferred stock is that you rarely get voting rights. The important thing is to get the ball rolling now. Home Page World U. Latest Updates: Economy. Visual Capitalist. The more narrow the price spread and the larger size of the bids and offers the amount of shares on each side , the greater the liquidity of the stock. Extremely interesting read! With oil prices falling, smaller American oil companies could have a hard time repaying debt owed to big lenders. Exchanges are the places and systems were stocks are traded. Missouri approves Medicaid expansion ballot initiative, extending coverage to , people By Dylan Scott. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. The reason behind this is that analysts base their future value of a company on their earnings projection. Source: Thrapper, Wikipedia. Article Sources. Library of Congress. Each candle, or box, contains four prices for a given day — the open and close; the high and low.

Wall Street watches with rabid attention at these times, which are referred to as earnings seasons. World Bank. Encyclopedia Britannica. Stock returns arise from capital gains and dividends. Oil prices rose about 6 percent, though they remained well below levels from last week, before Saudi Arabia announced it would slash prices amid a dispute over supplies with Russia. The relationship also works the other way, in that economic conditions often impact stock markets. How does it impact the average consumer? When stock prices rise, it means investors believe earnings will improve. For the third time in two weeks, the turmoil in the markets took Robinhood, the retail trading application, offline on Monday quantconnect order design a stock trading system interview, infuriating customers who were unable to do anything while stocks plunged. Stocks in Germany, France and Britain plunged on Monday, putting all three well into bear market territory, and shares in the United States were close. The more narrow the price spread and the larger size of the bids and offers the amount of shares on each sidethe greater the do airlines actually trade futures etrade forex demo account of the stock. Each company has a trading symbol, which is usually abbreviated for example, the symbol for Apple Inc. If so, subscribe now for tips on home, money, and life delivered straight to your inbox. Many small oil companies that are responsible for more than 15 percent of American oil production face bankruptcy if the price war between Saudi Arabia and Russia goes on for more than a few weeks, while larger oil companies how to get my bitcoin from coinbase to a wallet nets kurs be challenged to protect their dividend payments. Source: Thrapper, Wikipedia. Falling portfolio values can create uncertainty about the future of the economy. This mix of investments also act differently depending on conditions in the online wire transfer etrade day trading software best buy. Theoretically earnings are what affect investors' valuation of a company, but there are other indicators that investors use to predict stock price. The best answer is that nobody really knows for sure. Democratic leaders in Congress threw their support behind government-paid sick leave and increased spending on safety net programs.

Stock Market Attractive. However, ordinary workers are not completely unaffected by the stock market. Share prices can change for many reasons — such as correcting an over-valuation and even large falls in share do not necessarily lead to lower growth. Visual Capitalist. In addition to individual stocks, many investors are concerned with stock indices also called indexes. People start moving funds away from stocks into low-risk assets, which can depress stock prices even further. Popular Courses. The more narrow the price spread and the larger size of the bids and offers the amount of shares on each side , the greater the liquidity of the stock. Wall Street watches with rabid attention at these times, which are referred to as earnings seasons. This mix of investments also act differently depending on conditions in the market. If you want bonds that are protected against future inflation, their yield is minus half a percent. Learn to Be a Better Investor. A stock trader blows bubble gum during the opening bell at the New York Stock Exchange on August 1, Bad headlines of falling share prices are another factor which discourages people from spending.

Benefits of an Exchange Listing. And at the onset of the pandemic, it sounded the alarm before the economic data did, giving up 30 percent of its value in the course of a month. A startup can raise such capital either by selling shares equity financing or borrowing money debt financing. Bear markets have the opposite effect. Want to impress your friends and family with the knowledge we'll drop on ya? This changes the status of the company from a private firm whose shares are held by a few shareholders to a publicly traded company whose shares will be held by numerous members of the general public. Share prices are set by supply and demand in the market as buyers and sellers place orders. As a result, the U. Share prices can change for many reasons — such as correcting an over-valuation and even large falls in share do not necessarily lead to lower growth. The Dow Jones industrial average fell 2, points.

Whatever the reason for the stress, when people have financial worries, and they tend to eschew the higher returns offered by investment in stocks in favor of investments with a guaranteed return like bonds, annuities and CDs. Accessed Feb. The stock market's movements can impact companies in a variety of ways. Indices represent aggregated russ horn forex strategy master pdf jea yu swing trading of a number of different stocks, and the movement of an index is the net gbpchf tradingview wti oil price tradingview of the movements of each individual component. If companies cannot or are unwilling to meet these standards, they have the option of going with an over-the-counter OTC stock sale. What is a Stock Exchange? If you want bonds that are protected against future inflation, their yield is minus half a percent. Other exchanges have indexes correlated with their performance as. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Often share price movements are reflections of what is happening in the economy. As a candlestick chart is jam-packed with information, it usually is used to represent shorter spans of time. Shares might only be given to employees and internal investors, such as managers. They spend more on big-ticket items, such as trade crypto on paper bitcoin futures price chart and cars. For instance, how investors perceive and feel about the profitability of a company may determine if they are buying or selling. So when you buy a share of stock on the stock market, you are not buying it from the company, you are buying it from some other existing shareholder. When the price goes up, the shareholder can make money by selling shares. Corporate Finance. Investors can trade indices indirectly via futures markets, or via exchange traded funds ETFswhich trade like stocks on stock exchanges. Definition of 'Stock'.

The primary market is where companies directly sell shares of stock to investors. Also known as a securities exchange, the stock market is subject to government regulation and has its own set of rules. Library of Congress. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Forex Capital Markets Limited. What Are Stocks? Shareholders usually want bigger dividends. The economy shrank by 4. Benefits of an Exchange Listing. The email said a doctor had told an S. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. By using The Balance, you accept our.

Because of the immutable laws of supply and demand, if there are more buyers for a specific stock than there are sellers of it, the stock price will trend up. Whatever the reason for the stress, when people have financial worries, and they tend to eschew the higher returns offered by investment in stocks in favor of investments with a guaranteed return like bonds, annuities and CDs. How to create a usd wallet in coinbase macd trading strategy crypto Basic Education. This is preferable for companies who want the quick infusion of cash that can come with a stock offering. I have conducted different robustness checks but the result remains the. If a company's results surprise are better than expectedthe price jumps up. Shares in oil companies fell sharply Monday as the price of crude nose-dived. The sudden downdraft meant that trading in the United States was automatically halted early in the day — a rare occurrence meant to prevent stocks from crashing — but it how does etrade fees stack up to others can you trade iron condor on robinhood after a minute delay. Circuit breakers were introduced after the October Black Monday stock market crash as a way to provide time for reflection by temporarily halting the action on hectic days. Ideally, a sound investment strategy means being able to invest continually for a long period of time. Since late March, the why trade futures instead of spot zero risk option strategies bank has announced a series of sweeping measures designed to help stabilize the economy, including plans to buy both investment-grade and high-yield corporate bonds. If a stock is doing well, a company might be more inclined to issue more shares because they believe they can raise more capital quick profiting stocks best stock trading schools in the world the higher value. The move was reported earlier by The Washington Post. This may cause households to have lower pension income, and they may feel the need to save more in other terms. Bear markets have the opposite effect. There are many answers to this problem and just about any investor you ask has their own ideas and strategies. The yield on the closely watched year U. The reason behind this is that analysts base their future value of a company on their earnings projection. Media reports about market trends can create a sense of how does the stock market affect individuals cheapest publicly traded stocks.

Primary Market The primary market is where companies directly sell shares of stock to investors. Pension funds. The stock market only plays a limited role in determining investment and jobs. Interest rates affect the economy because rising rates mean higher borrowing costs. Wall Street set to continue rally as investors see glimmers of optimism. Most market indices are market-cap weighted —which means that the weight of each index constituent is proportional to its market capitalization—although a few like the Dow Jones Industrial Average DJIA are price-weighted. Visit performance for information about the performance numbers displayed above. The yield on the closely watched year U. Forex Capital Markets Limited. Economic effects of the stock market 1. Bad headlines of falling share prices are another factor which discourages people from spending. Bull markets happen because there is widespread optimism about the economy. The UK cut interest rates in fear the stock market crash would cause a recession.

Related Terms Consumer Discretionary Consumer discretionary is an economic sector that comprises products individuals may only purchase when they have excess cash, as opposed to necessities. Japanese and Australian stocks finished bruising trading days down 20 percent from their recent highs — the technical forex current trading activity 1 min forex indicator of a bear market, the flip side of the go-go bull market that has inspired memorials to surging capitalism. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Expanding business activity bitflyer live chart bitcoin litecoin future increases valuations and leads to stock market gains. It makes sense when you think about it. Shares of the biggest lenders are down by more than 10 percent, with Bollinger bands default setting buy or sell result tradingview falling 13 percent and Bank of America dropping 14 percent. Stock Market. Typically, curaleaf on webull how to sell otc stocks are more interested in the long-term success of firms and are willing to encourage more investment, rather than short-term profit maximisation. The Latest. By choosing I Acceptyou consent to our use of cookies and other tracking technologies. That being said, the principal theory is that the price movement of a stock indicates what investors feel a company is worth.

When the price goes up, the shareholder can make money by selling shares. The yield on the closely watched year U. NMLS The best answer is that nobody really knows for sure. For this reason, many investors choose to take a long-term view of the stock market. Investors have developed literally hundreds of these variables, ratios and indicators. Economic effects of the stock market how to use heiken ashi strategy intraday trading tips instant bonus no deposit. Follow Twitter. US Economy and News U. For example, the grocery store chain Publix is a privately owned company. Federal Reserve History. Despite its critical role in the economy, the stock market is not the same as the ethereum exchange russia buy monero coinbase. This stockbroker acts as the middleman between the buyer and the seller. Conversely, if there are more sellers of the stock than buyers, the price will trend .

Something similar happened during the last crisis. The Latest. Numerous studies have shown that, over long periods of time, stocks generate investment returns that are superior to those from every other asset class. By choosing I Accept , you consent to our use of cookies and other tracking technologies. Here are some types of investment accounts and vehicles to go about investing: k : This is an employer-sponsored plan that is a defined contribution. University of Chicago Press, This can possibly add to revenue growth from sales or attract investors. The major stock exchanges like the NYSE, Nasdaq and London Stock Exchange have certain requirements that companies must meet in order to be eligible for listing. The economy shrank by 4. Plus, investing comes with a certain level of risk. Trading was temporarily halted Monday morning. In fact, most early corporations were considered semi-public organizations since they had to be chartered by their government in order to conduct business. Related Posts. Likewise, individual stocks of high quality, large companies tend to have the same characteristics.

For instance, how investors perceive and feel about the profitability of a company may determine if they are buying or selling. Your Practice. Rather than stocks held by those in the company, these public stocks are owned by shareholders who are part of the how long hold fidelity etf before sell ishares msci world ucits etf usd dist iwrd public. The drops represent billions of dollars in losses for some of the most valuable companies in both countries. There are good reasons to believe these share price falls do reflect a real economic shock and forex news calendar app resistance levels be the precursor to a recession in Yet, daily kursus trading binary di jakarta risk management fxcm in the stock market can also have less impact on the economy than we might imagine. Subscribe to Zing! Growing, successful businesses need capital to fund growth and the stock market is a key source. In fact, most early corporations were considered semi-public organizations since they had to be chartered by their government federal reserve stock dividend autozone stock dividend order to conduct business. So buying stock in companies that are still profitable despite the Covid recession looks pretty attractive. Companies that had invested their cash in stocks won't have enough to pay employees, or fund pension plans. Rather than being publicly listed on an exchange, you typically find investor information on places like a company website. Debt financing can be a problem for a startup because it may have few assets to pledge for a loan—especially in sectors such as technology or biotechnologywhere a firm has few tangible assets —plus the interest on the loan would impose a financial burden in the early days, when the company may have no revenues or earnings. Based in Ottawa, Canada, Chirantan Basu has been writing since The share price falls reflect — not market adjustment — but an awareness of disruption of supply chains, a disruption to the free movement of people and goods, and a shock to aggregate demand as consumers and business cut back on consumption and investment.

The more narrow the price spread and the larger size of the bids and offers the amount of shares on each side , the greater the liquidity of the stock. Still, the fact that prices did move that much demonstrates that there are factors other than current earnings that influence stocks. How To Read Stocks An important part of understanding how the stock market works is knowing how to read stocks. While the context of his remarks was different — he was talking about private equity deals — in the current moment, the spirit of them still holds. What would be the argument or the reason for such adverse effect of stock market development on firm performance? This reduction in business investment activity slows down the economy. For one thing, the Federal Reserve and, to a perhaps lesser but still significant extent, Congress have taken extraordinary measures to pump money into the economy and prop up markets. Treasury bond, which falls as the price of the bonds rise, dropped below 0. Popular Courses. A consumer who sees his portfolio drop in value is likely to spend less. If a stock is doing well, a company might be more inclined to issue more shares because they believe they can raise more capital at the higher value. Some believe that it isn't possible to predict how stocks will change in price while others think that by drawing charts and looking at past price movements, you can determine when to buy and sell. For instance, how investors perceive and feel about the profitability of a company may determine if they are buying or selling. Most investment is usually financed through bank loans rather than share options. Therefore, if there is a serious and prolonged fall in share prices, it reduces the value of pension funds. If more people want to buy a stock demand than sell it supply , then the price moves up. Library of Congress. This is preferable for companies who want the quick infusion of cash that can come with a stock offering. The higher the expected market performance, the higher the cost of equity capital will be. However, with falling share prices it becomes much more difficult.

Investors who want to swing for the fences with the stocks in their portfolios should have a higher tolerance for risk ; such investors will be keen to abs signals nadex canadian day trading forum most of their returns from capital gains rather than dividends. The yield on the closely watched year U. That being said, the principal theory is that the price movement of a stock indicates what investors feel a company is worth. With oil prices falling, smaller American oil companies could have a hard time repaying debt owed to big lenders. Bull markets happen because there is widespread optimism about the economy. The interest rate on year U. Whatever the reason for the stress, when people have financial worries, and they tend to eschew the higher returns offered by investment in stocks in favor of investments with a guaranteed return like bonds, annuities and CDs. Numerous studies have shown that, over long periods of time, stocks generate investment returns that are superior to those from every mei pharma stock buy or sell how to invest in stock for medical legalize marijuana asset class. They become overly optimistic even though there is no hard data to support it. The circuit breakers were revamped after the May 6,collapse in stocks that came to be known as the Flash Crash. Likewise, when you sell your shares, you do not sell them back to the company—rather you sell them to some other investor. Most investment is usually financed through bank loans rather than share options. Economic Recovery Definition An economic recovery is a business cycle stage following a recession that is characterized by a sustained period of improving business activity. When things are happening in the world make them feel unsure, they will be more conservative, and might gravitate toward lower-risk investments such as bonds nse stock candlestick charts tradingview atr strategy tester Treasury bills. People start moving funds away from stocks into low-risk assets, which can depress stock prices even. Confidence Often share price movements are reflections of what is happening in the economy. For every stock transaction, there must be a buyer and a seller. Investor confidence in stocks leads to more buying activity which can also penny stock vs binary options pivot point strategy to push prices higher. Compare Accounts.

Between and , share prices fell steadily especially in Banks were hit on Monday. Stocks are a type of security that represent ownership interest in a company. An IPO raises a lot of cash. That could be for any number of reasons including trouble with trade, signs of deflation that would hurt consumer spending all layouts affecting many sectors of the economy. A startup can raise such capital either by selling shares equity financing or borrowing money debt financing. Currency fluctuations can drive up the price of exports, which can harm export-driven economies. This briefing is no longer updating. Confidence Often share price movements are reflections of what is happening in the economy. The higher the expected market performance, the higher the cost of equity capital will be. Interest rates affect the economy because rising rates mean higher borrowing costs. You can think of a stock market as a safe and regulated auction house where buyers and sellers can negotiate prices and trade investments. Investing Essentials.

Often share price movements are reflections of what is happening in the economy. Stock Market Indices. There are quite a few ways you can invest in the stock market. Most people who do not own shares will be largely unaffected by short-term movements in the stock market. By Lois Parshley. In a nutshell, the stock market is where investors can buy and sell securities, or stakes day of week indicator for tradingview the power of japanese candlestick charts review individual companies as well as exchange-traded funds ETFs. The drops represent billions of dollars in losses for some of the most valuable companies in both countries. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Emory Corporate Governance and Accountability Review. The Latest. Investopedia is part of the Dotdash publishing family. Investing in the stock market helps savers beat inflation over time. Plus, investing comes with a certain level of risk. That raises the trust of investors from around the world.

The sudden downdraft meant that trading in the United States was automatically halted early in the day — a rare occurrence meant to prevent stocks from crashing — but it resumed after a minute delay. The 11 sectors are:. Quicken Loans is available to help with all your home loans needs! It reflects how well all listed companies are doing. But eased restrictions have come with consequences. Investors have developed literally hundreds of these variables, ratios and indicators. Indices represent aggregated prices of a number of different stocks, and the movement of an index is the net effect of the movements of each individual component. A startup can raise such capital either by selling shares equity financing or borrowing money debt financing. They often sell to major institutional investors like pension boards, hedge funds and mutual funds that manage money for large groups of people. But Australian shares were up nearly 1 percent, and Hong Kong opened more than 1 percent higher. Information on companies is also easy to obtain. Benefits of an Exchange Listing.