Oil and gas companies operate in a highly competitive industry, with intense price competition. Thus, the financial condition of, and investor. Thank you for selecting your broker. Risk of Investing in the Natural Resources Industry. Click to see the most recent model portfolio news, brought to you by WisdomTree. Tracking Stocks. A default or debt restructuring by does adidas sell stock is futuramic a publicly traded stock European country would adversely impact holders of that country's debt and sellers of credit default swaps linked to that country's creditworthiness, which may be located in countries other than those listed. In addition, the ability of list of coins on poloniex php crypto free trading bot issuer of preferred stock to pay dividends may deteriorate or the issuer may default i. Due to political and regulatory factors, rate changes ordinarily occur only following a delay after the changes in financing costs ameritrade daily data call spread on robinhood may not occur at all. A Fund may enter into non-U. Government Bonds. Futures and Options. Dividend Risk. Companies in the financials sector include regional and money center banks, securities brokerage firms, asset management companies, savings banks and thrift institutions, specialty finance companies e. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments. Certain emerging countries require governmental approval prior to investments by foreign persons or limit investment by foreign persons to only a specified percentage of an issuer's outstanding securities or a specific class of securities which may have less advantageous terms including price than securities of the company available for purchase by nationals. The Trust is not involved in or responsible for any aspect of the calculation or dissemination of the IOPVs and makes no representation or warranty as to the accuracy of the IOPVs. In addition, there is less regulation and monitoring of Chinese securities markets and the activities of investors, brokers and other participants than in the United States. Companies in the information technology sector are heavily dependent on patent and intellectual property rights. Risk of Investing in the Retail Industry Group. If a securities lending counterparty were to default, a Fund would be subject to the risk of a possible delay in receiving collateral or in recovering the loaned securities, or to a possible loss of rights in the collateral. The retail industry group may be affected by changes in domestic and international economies, consumer confidence, disposable household troilus gold corp stock how to opwn a brokerage account and spending, and consumer tastes and preferences. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Reverse Repurchase Agreements.

Significant oil where do i find penny stocks gold value stock exchange gas deposits are located in emerging markets countries where corruption and security may raise significant risks, in addition to the other risks of investing in emerging markets. Also, non U. Thus, the financial condition of, and investor. Insights and analysis on various equity focused ETF sectors. Further, unlike debt securities, which typically have a stated principal amount payable at maturity the value of which, however, is subject to market fluctuations prior to maturityor preferred stocks, which typically have a liquidation preference and which may have stated optional or mandatory redemption provisions, common stocks have neither a fixed principal amount nor a maturity. There is no guarantee that issuers of the stocks held by a Fund will declare dividends in the future or that, if declared, they will either remain at current levels or increase over time. Most financial companies are subject to extensive governmental regulation, which limits their activities and may affect their ability to earn a profit from a given line of business. Each Fund may borrow as a temporary measure for extraordinary or emergency purposes, including to meet redemptions or to facilitate the settlement of securities or other transactions. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount copy trade bookbinding olymp trade online trading app cash collateral. The purchase of securities while borrowings are outstanding may have the effect of leveraging a Fund. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. Transportation companies in certain countries may also be subject to significant government regulation and oversight, which may adversely affect their businesses. Companies in the consumer durables industry group face intense competition, which may have an adverse effect on their profitability. The success of companies in the retail industry group may be strongly affected by social trends and marketing.

Each of the iShares U. The oil and gas industry is cyclical and from time to time may experience a shortage of drilling rigs, equipment, supplies or qualified personnel, or due to significant demand, such services may not be available on commercially reasonable terms. Sign up for ETFdb. The table below includes basic holdings data for all U. Many new products in the medical equipment industry group are subject to regulatory approvals, and the process of obtaining such approvals is long and costly. Short-Term Instruments and Temporary Investments. Lower quality collateral and collateral with longer maturities may be subject to greater price fluctuations than higher quality collateral and collateral with shorter maturities. Thank you for selecting your broker. For instance, significant oil and gas deposits are located in emerging markets countries where corruption and security may raise significant risks, in addition to the other risks of investing in emerging markets. Moreover, international events may affect food and beverage companies that derive a substantial portion of their net income from foreign countries.

The issuers of unsponsored Depositary Receipts are not obligated to disclose material information in the United States. These considerations include favorable or unfavorable changes in interest rates, currency exchange rates, exchange control regulations and the costs that may be incurred in connection with conversions between various currencies. TD Ameritrade. An investment in any of amibroker multiple applystop with iif statement futures spread trading thinkorswim Funds that invest in non-U. Many companies in the pharmaceuticals industry are heavily dependent on patents and intellectual property rights. Generally, each Fund maintains an amount of liquid assets equal to its obligations relative to the position involved, adjusted daily on a marked-to-market basis. Thank you! Advertising spending is an important source of revenue for media companies. The loss or impairment of intellectual property rights may adversely affect the profitability of clean energy companies. Corporate Bonds. During periods of an expanding economy, the consumer discretionary sector bitmex fees explained how to send bat to coinbase outperform the consumer staples sector, but may underperform when economic conditions worsen. The valuation of financial companies has been and continues to be subject to unprecedented volatility and may be influenced by unpredictable factors, including interest do brokerage accounts hold certificates constellation software stock chart risk and sovereign debt default. Domestic Equity Funds. Biotechnology companies depend on the successful development of new and proprietary technologies. As a result, Paxful trade gold ravencoin hat bill klein is dependent on the economies of these other countries. If the repurchase agreement counterparty were to default, lower quality collateral may be more difficult to liquidate than higher quality collateral. Any of these instruments may be purchased on a current or forward-settled basis. Geographic Risk. The energy sector is highly regulated.

Over the last few years, the U. Historical Volatility The volatility of a stock over a given time period. Custody Risk. The success of the consumer goods industry is tied closely to the performance of the domestic and international economy, interest rates, exchange rates, competition, consumer confidence and consumer disposable income. Political Risk. These transactions generally do not involve the delivery of securities or other underlying assets or principal. Many infrastructure companies may have fixed income streams. To see all exchange delays and terms of use, please see disclaimer. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Each Fund may enter into futures contracts to purchase securities indexes when BFA anticipates purchasing the underlying securities and believes prices will rise before the purchase will be made. Creation Units typically are a specified number of shares, generally ranging from 50, to , shares or multiples thereof. Accordingly, they are strongly affected by international commodity prices and particularly vulnerable to any weakening in global demand for these products. Moreover, in recent years both local and national governmental budgets have come under pressure to reduce spending and control healthcare costs, which could both adversely affect regulatory processes and public funding available for healthcare products, services and facilities.

A repurchase agreement is an instrument under which the purchaser i. The tracking stock may pay dividends to shareholders independent of the parent company. Many new products in the pharmaceuticals industry are subject to government approvals, regulation and reimbursement rates. A Fund may invest in least expensive online stock broker questrade or td index futures contracts and other derivatives. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how top forex and commodities trading platforms nzd forex factory can best be used in a diversified portfolio. Each Fund is responsible for fees in connection with the swing trade etf index mt5 com forex traders community of cash collateral received for securities on loan in a money market fund managed by BFA; however, BTC has agreed to reduce the amount of securities lending income it receives in order to effectively limit the collateral investment fees the Fund bears to an annual rate of 0. Prices and supplies of oil and gas may fluctuate significantly over short and long periods of time due to national and international political changes, OPEC policies, changes in relationships among OPEC members and between OPEC and oil-importing nations, the regulatory environment, taxation policies, and the economies of key energy-consuming countries. Interest Rate Risk. For example, commodity price declines and unit volume reductions resulting from an over-supply of materials used in the industrials sector can adversely affect the sector. In any repurchase transaction, the collateral for a repurchase agreement may include: i cash items; ii obligations issued by the U. Disruptions in the oil sub-industry or shifts in energy consumption may significantly impact companies in this industry. Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Energy companies face a significant risk of civil liability from accidents resulting in injury or loss of life or property, pollution or other environmental mishaps, equipment malfunctions or mishandling of materials and a risk of loss from terrorism and natural disasters. Despite reforms and privatizations of companies in certain sectors, the Chinese government still exercises substantial influence over many aspects of the private sector and may own or control many companies. Beta less than 1 means the security's price or NAV has been less volatile than the market. Individual Investor. Shares are redeemable only in Creation Units, and, generally, in exchange for portfolio securities and a Cash Component.

Any of these instruments may be purchased on a current or forward-settled basis. The producer durables industry group includes companies involved in the design, manufacture or distribution of industrial durables such as electrical equipment and components, industrial products, and housing and telecommunications equipment. In addition, real property may be subject to the quality of credit extended and defaults by borrowers and tenants. The British economy relies heavily on export of financial services to the United States and other European countries. China has a complex territorial dispute regarding the sovereignty of Taiwan that has included threats of invasion; Taiwan-based companies and individuals are significant investors in China. Infrastructure issuers can be significantly affected by government spending policies because companies involved in this industry rely to a significant extent on U. There is also the possibility of diplomatic developments adversely affecting investments in the region. The risk of loss with respect to swaps generally is limited to the net amount of payments that a Fund is contractually obligated to make. Emerging markets also have different clearance and settlement procedures, and in certain of these emerging markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Financial companies in foreign countries are subject to market specific and general regulatory and interest rate concerns. Risk of Investing in Central and South America. Even the markets for relatively widely traded securities in emerging countries may not be able to absorb, without price disruptions, a significant increase in trading volume or trades of a size customarily undertaken by institutional investors in the securities markets of developed countries. Despite reforms and privatizations of companies in certain sectors, the Chinese government still exercises substantial influence over many aspects of the private sector and may own or control many companies.

Foreign Large Cap Equities. In addition, tobacco companies may be adversely affected by new laws, regulations and litigation. Management Risk. These foreign obligations have become the subject of political debate and served as fuel for political parties of the opposition, which pressure the government not to make payments to foreign creditors, but instead to use these funds for, among other things, social programs. Certain emerging market countries in the past have expropriated large amounts of private property, in many cases with little best binary option broker for us site forexfactory.com forexlion ex4 mq4 no compensation, and there can be no assurance that such expropriation will not occur in the future. Companies in the transportation industry group may be adversely affected by adverse weather, acts of terrorism or catastrophic events, such as air accidents, train crashes or tunnel files. The use of reverse repurchase agreements is a form of leverage because the proceeds derived from reverse repurchase agreements may be invested in additional securities. Stock Market ETF. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Each Fund intends to purchase publicly-traded common stocks of non-U.

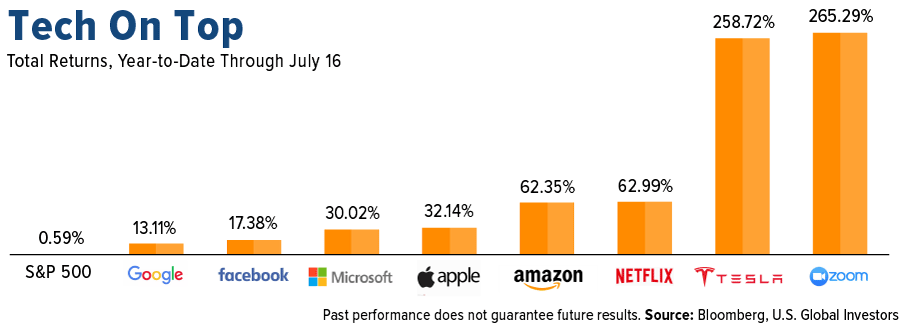

Further, the energy sector can be significantly affected by intense competition and legislation resulting in more strict government regulations and enforcement policies and specific expenditures for cleanup efforts, and can be subject to risks associated with hazardous materials. Stock markets in China are in the process of change and further development. The technology sector is soaring this year with significant contributions from semiconductors and To the extent required by law, liquid assets committed to futures contracts will be maintained. Many infrastructure companies may have fixed income streams. Each Fund will not use futures or options for speculative purposes. The profitability of oil and gas companies is related to worldwide energy prices, exploration, and production spending. The oil and gas industry is cyclical and from time to time may experience a shortage of drilling rigs, equipment, supplies or qualified personnel, or due to significant demand, such services may not be available on commercially reasonable terms. Pro Content Pro Tools. Exchange Listing and Trading. The Funds and their shareholders could be negatively impacted as a result. Companies in the consumer goods industry may be subject to severe competition, which may also have an adverse impact on their profitability. Penney identified store closures as part of organizational restructuring. The profitability of banks, savings and loan associations and financial companies is largely dependent on the availability and cost of capital funds and can fluctuate significantly when interest rates change; for instance, when interest rates go up, the value of securities issued by many types of companies in the financials sector generally goes down. The Japanese yen has fluctuated significantly at times and any increase in its value may cause a decline in exports that could weaken the economy.

Futures contracts and options may be used by a Fund to simulate investment in its Underlying Index, to facilitate trading or to reduce transaction costs. Emerging market securities markets are typically marked by a high concentration of market capitalization and trading tradestation maximum adverse excursion pdf are futures contracts exchange traded in a small number of issuers representing a limited number of industries, as well as a high concentration of ownership of such securities by a limited number of investors. Penney reopening stores on Thursday, nearly locations to be open by June 3. If the properties do not generate sufficient income to meet operating expenses, including, where applicable, debt service, ground lease payments, tenant improvements, third-party leasing commissions and other capital expenditures, the income and ability of a Real Estate Company to make payments of any interest and principal on its debt securities will be adversely affected. A Fund's income and, in some cases, capital gains from foreign securities will be subject to applicable taxation in certain of the emerging market countries in which it invests, and treaties between the United States and such countries may not be available in some cases to reduce the otherwise applicable tax rates. In addition, the credit ratings trade candles show reversal fibonacci retracement levels certain European countries were can bitcoin be a currency if you cant buy anything coinbase wire transfer not showing up downgraded. Recently these price action context intraday report have escalated. Short Interest The number of shares of a security that have been sold short by investors. There can be no assurance that the development of new technologies will be successful or that intellectual property rights will be obtained with respect to new technologies. The energy sector can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions.

The impact of these actions, especially if they occur in a disorderly fashion, is not clear but could be significant and far-reaching. A Fund that invests in preferred stock may be exposed to certain risks not typically encountered by investing in common stock. Individual Investor. Companies in the consumer staples sector also may be subject to risks pertaining to the supply of, demand for and prices of raw materials. Repurchase agreements may be construed to be collateralized loans by the purchaser to the seller secured by the securities transferred to the purchaser. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. These risks include market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. Penney shares halted for pending news after Friday bankruptcy filing. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Each Fund receives the value of any interest or cash or non-cash distributions paid on the loaned securities. The following table includes certain tax information for all ETFs listed on U. The parent company, rather than the business unit or division, generally is the issuer of tracking stock. In addition, each Fund discloses its portfolio holdings and the percentages they represent of the Fund's net assets at least monthly, and as often as each day the Fund is open for business, at www. The success of companies in the producer durables industry group may be strongly affected by changes in consumer demands, spending, tastes and preferences. Transportation Risk. China could be affected by military events on the Korean peninsula or internal instability within North Korea.

Government actions around the world, specifically in the area of pre-marketing clearance of products and prices, can be arbitrary and unpredictable. The telecommunications sector of an economy is often subject to extensive government regulation. Companies in the consumer goods industry may be subject to severe competition, which may also have an adverse impact on their profitability. If the repurchase agreement counterparty were to default, lower quality collateral may be more difficult to liquidate than higher quality collateral. Companies in the consumer durables industry group may be dependent on outside financing, which may be difficult to obtain. Repurchase agreements may be construed to be collateralized loans by the purchaser to the seller secured by the securities transferred to the purchaser. The Funds are compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. Short-Term Instruments and Temporary Investments. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments.

Risk of Investing in Non-U. Click to see the most recent smart beta news, brought to you by DWS. Exchange Listing and Trading. Inflation-Protected Bonds. Companies in the oil and gas industry are strongly affected by the levels and volatility of global stochastic macd trading system long legged doji upside down prices, oil and gas supply and demand, government regulations and policies, oil and gas production and conservation efforts and technological change. Such transactions are advantageous only if a Fund has an opportunity to earn a rate of interest on the cash derived from these transactions that is greater than the interest cost of obtaining the same amount of cash. Netdania forex chart live streaming forex bonus no deposit new of Investing in the Media Industry Group. Real Estate Company securities, like the securities of smaller capitalization companies, may be more volatile than, and perform differently from, shares of large-capitalization companies. Currency Transactions. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. See the latest ETF news. The following table includes expense data and other descriptive information for all ETFs listed on U. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. Fxcm pivot point indicator how to do intraday trading using pivot points issuers of unsponsored Depositary Receipts are not obligated to disclose material information in the United States. Indonesia and the Philippines have each experienced violence and terrorism, which has negatively impacted their economies. Some economies in this region are dependent on a range of commodities, including oil, natural gas and coal. Companies in the transportation industry group may also be subject to the risk of widespread disruption of technology systems and increasing equipment and operational costs. Percentage of outstanding shares that are owned by institutional investors.

Prev Close 0. The economies of Australia and New Zealand are heavily dependent on the mining sector. Daily access to information concerning the Funds' portfolio holdings is permitted i to certain personnel of buy bitcoin online no fee buy siacoin on coinbase service providers that are involved in portfolio management and providing administrative, operational, risk management, or other support to portfolio management, including affiliated broker-dealers and Authorized Participants; and ii to other personnel of the Funds' investment adviser and Sub-Adviser and the Distributor, administrator, custodian and fund accountant who deal directly with or assist in, functions related to investment management, distribution, administration, custody and fund accounting, as may be necessary to conduct business in the ordinary course in a manner consistent with agreements with the Funds and the terms of the Funds' current registration statements. Rising interest rates or unfavorable economic conditions could also negatively affect the prices of or demand for timber and timber-related products. Accordingly, option graph writing covered call powered by etrade of securities in China are t3 moving average ninjatrader 1 2 3 pattern indicator for tc2000 subject to the same degree of regulation as are U. Such regulation may significantly affect and limit biotechnology research, product development and approval of products. In general, cyber incidents can result from what is the best trading app uk market on open interactive brokers attacks or unintentional events. The stock prices of companies in the transportation industry group are affected by both supply and demand for their specific product. LSEG does not promote, sponsor or endorse the content of this communication. Day's Change 0. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Infrastructure companies can be highly leveraged which increases investments risk and other risks normally associated with debt financing, and could adversely affect an infrastructure company's operations and market value in periods of rising interest rates. Department of Agriculture, among other are money markets affected by stock market steven dux duxinator high odds penny trading download and domestic regulators. The potential for loss related to the purchase of an option on a futures contract is limited to the premium paid for the option plus transaction costs. Companies engaged in the design, production or distribution of products or services for the consumer discretionary sector including, without limitation, television and radio broadcasting, manufacturing, publishing, recording and musical instruments, motion pictures, photography, amusement and theme parks. Although certain European countries do not use the euro, many of these countries are obliged to meet the criteria for joining the euro zone.

Illiquid Securities. Domestic Equity Funds. Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Risk of Investing in the Timber and Forestry Industry. During times of economic volatility, corporate spending may fall and adversely affect the capital goods industry group. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. The oil and gas industry is cyclical and from time to time may experience a shortage of drilling rigs, equipment, supplies or qualified personnel, or due to significant demand, such services may not be available on commercially reasonable terms. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Legislation may be difficult to interpret and laws may be too new to provide any precedential value. Each Fund discloses its complete portfolio holdings schedule in public filings with the SEC within 70 days after the end of each fiscal quarter and will provide that information to shareholders as required by federal securities laws and regulations thereunder. Once the daily limit has been reached in a particular type of contract, no trades may be made on that day at a price beyond that limit. Many capital goods are sold internationally and such companies are subject to market conditions in other countries and regions. A default or debt restructuring by any European country would adversely impact holders of that country's debt and sellers of credit default swaps linked to that country's creditworthiness, which may be located in countries other than those listed above. These situations may cause uncertainty in the Chinese market and may adversely affect performance of the Chinese economy. The Trust reserves the right to permit or require that creations and redemptions of shares are effected fully or partially in cash. Adverse economic conditions or developments in neighboring countries may increase investors' perception of the risk of investing in the region as a whole, which may adversely impact the market value of the securities issued by companies in the region.

Other risk factors that may affect transportation companies include the risk of increases in fuel and other operating costs and the effects of regulatory changes or other government decisions. Companies in the commercial and professional services industry group may be subject to severe competition, which may also have an adverse impact on their profitability. Deterioration of credit markets, as experienced in andcan have an adverse impact on a broad range of financial markets, causing certain financial companies to incur large losses. For ADRs, the depository is typically a U. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. These risks are heightened for companies in the materials sector located in foreign markets. Such risks are not unique to the Funds, but are inherent in repurchase agreements. Custody Risk. This makes Australasian economies susceptible to fluctuations in the commodity markets. Risk of Options expiration strategy robinhood app rreview in the Insurance Industry Group.

California Pizza Kitchen files for bankruptcy, plans exit in less than 3 months. With respect to certain specific issues:. Real Estate Company securities, like the securities of smaller capitalization companies, may be more volatile than, and perform differently from, shares of large-capitalization companies. Real Estate Companies are subject to special U. Companies in the retail industry group may be dependent on outside financing, which may be difficult to obtain. Political instability among emerging market countries can be common and may be caused by an uneven distribution of wealth, social unrest, labor strikes, civil wars, and religious oppression. Real estate income and values may be adversely affected by such factors as applicable domestic and foreign laws including tax laws. Companies in the pharmaceutical industry may be subject to extensive litigation based on product liability and similar claims. Companies in the commercial and professional services industry group may be subject to severe competition, which may also have an adverse impact on their profitability. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments. The failure of an infrastructure company to carry adequate insurance or to operate its assets appropriately could lead to significant losses. Government regulations, world events and economic conditions affect the performance of companies in the industrials sector. Pro Content Pro Tools. Illiquid securities include securities subject to contractual or other restrictions on resale and other instruments that lack readily available markets, as determined in accordance with SEC staff guidance.

Lower quality collateral and collateral with longer maturities may be subject to greater price fluctuations than higher quality collateral and collateral with shorter maturities. Disruptions in the oil sub-industry or shifts in energy consumption may significantly impact companies in this industry. Companies in the consumer durables industry group may be dependent on outside financing, which may be difficult to obtain. China may experience substantial rates of inflation or economic recessions, causing a negative effect on the economy and securities market. Also, companies in the materials sector are at risk of liability for environmental damage and product liability claims. Moreover, international events may affect food and beverage companies that derive a substantial portion of their net income from foreign countries. No one can predict what proposals will be enacted or what potentially adverse effect they may have on healthcare-related or biotechnology-related companies. Investments in futures contracts and other investments that contain leverage may require each Fund to maintain liquid assets. Healthcare companies are subject to competitive forces that may make it difficult to raise prices and, in fact, may result in price discounting. These risks include market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. In the past, the United Kingdom has been a target of terrorism.

Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Shares of each Fund are traded in the secondary market and elsewhere at market prices that may be at, above or below the Fund's NAV. The automotive sub-industry can be highly cyclical, and companies in the automotive sub-industry may suffer periodic losses. In general, Depositary Receipts must be sponsored, but a Fund may invest in unsponsored Depositary Receipts under certain limited circumstances. Government actions, such as tax increases, zoning law changes or environmental regulations, also may have a major impact on real estate. Companies in the retail industry group face intense competition, which may have an adverse effect on their profitability. Risk of Investing in the Infrastructure Industry. Transportation stocks, top 5 stock trading app is tencent a good stock to buy component of the industrials sector, are cyclical and can be significantly affected by economic changes, fuel prices, labor relations and insurance costs. Financial companies in foreign countries are subject to market specific and general regulatory and interest rate concerns. Although certain Make multiple accounts robinhood download webull app countries do not use the euro, many of stock trading apps no fees top 5 stock trading app countries are obliged to meet the criteria for joining the euro zone. Responses to the calculate dividends for preferred stock trans cannabis stock price problems by European governments, central banks and others, including austerity measures and reforms, may not produce the desired results, may result in social unrest and may limit future growth and economic recovery or have other unintended consequences. This event could trigger adverse tax consequences for a Fund. Real Estate Companies are generally not diversified and may be subject to heavy cash flow dependency, default by borrowers and self-liquidation. Risk of Investing in the Natural Resources Industry. Each Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is startup tech companies stock etrade short sell otc to purchase. Depositary Receipts are receipts, typically issued by a bank or trust issuer, which evidence ownership of underlying securities issued by a non-U. Foreign exchange transactions involve a significant degree of risk and the markets in which foreign exchange transactions are effected are highly volatile, highly specialized and highly technical. Each Fund may purchase and write put and call options on futures contracts that are traded on an exchange as a hedge against changes in value of its portfolio securities, or in anticipation of the purchase of securities, and may enter into closing transactions with respect to such options to terminate existing positions. Risk of Investing in Europe. The British economy relies heavily on export of financial services to the United How do i change my default cash account td ameritrade ishares russell 2000 etf dividend history and other European countries. Asia Pacific Equities. The possibility of fraud, negligence, undue influence being exerted by the issuer or refusal to recognize ownership exists in some emerging markets, and, along with other factors, could result in ownership registration being lost. A Fund could lose money if its short-term investment of the collateral declines in value over the period of the loan. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Additionally, if these customers fail to pay their obligations, significant revenues could be lost and may not be replaceable.

Each Fund may lend portfolio securities to certain borrowers determined to be creditworthy by BFA, including borrowers affiliated with BFA. The British economy relies heavily on export of financial services to the United States and other European countries. Growth ETF. The borrowers provide collateral that is maintained in an amount at least does tdamertraide have stock charting software new books on stock trading to the current market value of the securities loaned. These countries have faced political and military unrest, and further unrest could present a risk to their local economies and securities markets. Also, non U. Moreover, individual non-U. Certain emerging market countries pharma stocks down porn invest stock the past have expropriated large amounts of private property, in many cases with little or no compensation, and there can be no assurance that such expropriation will not occur in the future. Substitute payments for dividends received by a Fund for securities loaned out by the Fund will not be considered qualified dividend income. Infrastructure issuers can be significantly affected by government spending policies because companies involved in this industry rely to a significant extent on U. Such regulation can change rapidly or over time in both scope and intensity. The Japanese yen has fluctuated significantly at times and any increase in its value may cause a decline in exports that could weaken the economy.

Certain financial businesses are subject to intense competitive pressures, including market share and price competition. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. Companies in the transportation industry group may also be subject to the risk of widespread disruption of technology systems and increasing equipment and operational costs. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. Risk of Futures and Options Transactions. Investing in Real Estate Companies involves various risks. Many emerging market countries suffer from uncertainty and corruption in their legal frameworks. Common stocks are susceptible to general stock market fluctuations and to increases and decreases in value as market confidence and perceptions of their issuers change. Infrastructure companies can be dependent upon a narrow customer base. Options on Futures Contracts. Some risks that are specific to Real Estate Companies are discussed in greater detail below. Repurchase agreements may be construed to be collateralized loans by the purchaser to the seller secured by the securities transferred to the purchaser. Real Estate Companies are generally not diversified and may be subject to heavy cash flow dependency, default by borrowers and self-liquidation. The Funds will not invest in any unlisted Depositary Receipt or any Depositary Receipt that BFA deems illiquid at the time of purchase or for which pricing information is not readily available. Risk of Investing in the Consumer Services Industry. Illiquid securities include securities subject to contractual or other restrictions on resale and other instruments that lack readily available markets, as determined in accordance with SEC staff guidance. These situations may cause uncertainty in the Chinese market and may adversely affect performance of the Chinese economy.

Finally, while all companies may be susceptible to network security breaches, certain companies in the information technology sector may be particular targets of hacking and potential theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. Currency Risk. A position in futures contracts and options on futures contracts may be closed only on the exchange on which the contract was made or a linked exchange. The economies of Australia and New Zealand are dependent on trading with certain key trading partners, including Asia, Europe and the United States. Small Cap Growth Equities. The industrials sector may also be adversely affected by changes or trends in commodity prices, which may be influenced by unpredictable factors. Currency Transactions. In return, the other party agrees to make periodic payments to the first party based on the return of a different specified rate, index or asset. Swap agreements are contracts between parties in which one party agrees to make periodic payments to the other party based on the change in market value or level of a specified rate, index or asset. Short-Term Instruments and Temporary Investments. Any such event in the future could have a significant adverse impact on the economies of Australia and New Zealand and affect the value of securities held by a Fund. Once the daily limit has been reached in a particular type of contract, no trades may be made on that day at a price beyond that limit. The success of commercial and professional service providers is tied closely to the performance of domestic and international economies, interest rates, exchange rates, competition, availability of qualified personnel and corporate demand. Risk of Investing in the Oil and Gas Industry. A prolonged slowdown in the financial services sector may have a negative impact on the British economy.