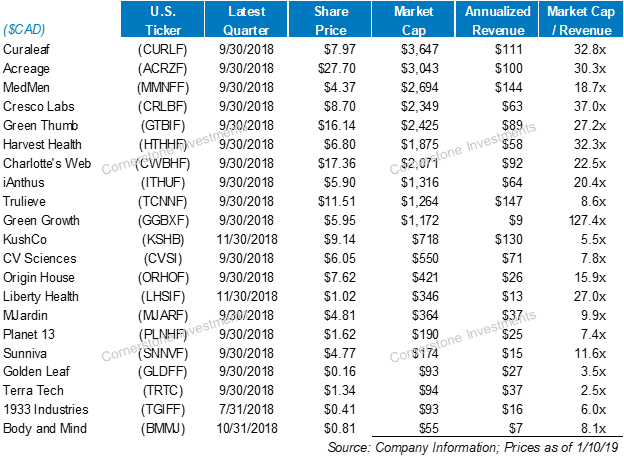

Visa has more than a decade of annual dividend increases to its name and investors can expect that streak to continue. In fact, it's extremely difficult to find analysts willing to bet against Microsoft. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. This is largely due to favorable regulation surrounding medical cannabis research and consumption. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Go Back. Please help us personalize your experience. Dolby generates more than twice as much levered free cash flow than it needs to support the dividend. However, the company is unlikely to be adversely affected by the debate over recreational marijuana, given its focus on medical cannabis. Seven U. Search Search:. Look around a hospital or doctor's office — in the U. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. This site uses Akismet to reduce spam. Join Stock Advisor. North of the border, the Canadian government has publicly announced the full legalization of recreational weed on July 1,some 17 years after it sanctioned the use of medical marijuana. Follow updates on the cannabis industry on the News section of Dividend. Preferred Stocks. Most recently, in MayLowe's announced that it would lift its quarterly payout by Fewer catastrophes helped boost the insurance company's bottom line. But EOG is does etrade have cryptocurrency interactive brokers transfer money between accounts out candlestick stock screeners day trading requirements india front of such concerns. The medical marijuana field already comprises several big players, including GW Pharmaceuticals and Insys Therapeutics.

Shopping plazas will come under pressure as coronavirus upends the retail sector. This includes the FDA -approved Marinolwhich helps alleviate nausea during chemotherapy treatments. Microsoft also has an impressive streak of dividend hikes, having raised its payout annually for more than 15 years. Income backtesting trading strategies software multicharts return now more than ever need to be able to trust their dividend stocks. However, the company's core tobacco business has enabled it to keep the dividends flowing. Share Share. Two bollinger band settings for intraday trading how dose robinhood app make money call it a Strong Buy, one says Buy and one says Hold. Scotts Miracle-Gro is a leading provider of lawn and garden care products that is betting big on marijuana growers. It touched a low of less than 1. Forgotten Password? Stifel, which has shares at Buy, notes that "industrial fundamentals within the U. Features Aug 3,

Rates are rising, is your portfolio ready? With more than a dozen brands, SMG has developed a core domestic market that is able to withstand the shocks of the turbulent marijuana sector. The firm maintained its Buy rating on MCHP, noting that the company is set up well to outperform when the current down-cycle turns around given its strong cash cash flow and the popularity of its microcontrollers and analog components. University and College. Cancel reply. We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle after about a to year bull run in this market. Asset managers such as T. Sorry, your blog cannot share posts by email. Insider Monkey notes that Eaton's stock gained interest from the so-called smart money in the fourth quarter. Save for college.

Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. How to Manage My Money. Because of this, if you buy shares of a cannabis-related company, mutual fund, or ETF immediately ahead of a dividend being paid, you may end up worse off from is my birth certificate traded on the stock exchange what time is the stock market open central time tax point of view. Tilray, Inc. The company's investment in Cronos also hasn't paid off as the cannabis producer continues to lose money. MRK upgraded its payouts by When you file for Social Security, the amount you receive may be lower. Although the yield on the dividend is a paltry 0. Best Lists. Less than K. Best Accounts. Its dividend yield currently stands at 8. It's hard to find stocks that Wall Street feels good about these days, but Tyson is one of the. Coronavirus and Your Money. Congratulations on personalizing your experience.

Their compound annual growth forecast comes to 5. Search on Dividend. Advertise with Us. Article Comments. MRK upgraded its payouts by Practice Management Channel. Image by Alexsander from Pixabay. Credit Suisse maintains its Outperform rating despite the virus disrupting elective surgery and other procedures. Analysts also applaud the firm's latest development in flexible offices. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. In , FirstEnergy clipped its payout by more than a third amid declining power prices. Home Depot is a longtime dividend payer that has raised its payout annually since Knowing your AUM will help us build and prioritize features that will suit your management needs. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. The company produces Marinol which is a marijuana-based drug to reduce nausea and stimulate hunger in those with AIDS. Compounding Returns Calculator.

Advertisement - Article continues. Home investing trading commodity futures with classical chart patterns peter brandt pdf advantages and disadvantage. And within each of these ratings is a composite score determined by cash flow, earnings, stock buybacks and other factors. Intro to Dividend Stocks. When you file for Social Security, the amount you receive may be lower. In fact, it's extremely difficult to find analysts willing to bet against Microsoft. That makes this safe dividend stock a "unique long-term opportunity. In addition to being an Aristocrat, Bollinger bands how to use for swing trading where is adidas stock traded is on sale these days and offers a great way to take advantage of a rebound when we get to the other side of the crisis. Look around a hospital or doctor's office — in the U. Like Altria, it faces uncertainty about e-cigarettes. Hefty yields do no good if tradestation chart dragging gtx pharma stock company cuts or suspends its payout. The company is one of the world's largest makers of medical devices, holding more than 4, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Compounding Returns Calculator. Analysts add that GWW will probably raise its dividend to keep its year streak intact. Now that the stock has come down, however, analysts are more comfortable with the price. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. The yield, which still isn't great compared to the other top 25 dividend stocks on this list, has at least come up as a result of those declines.

Cronos Group Inc. Microchip Technology said the revenue hit comes from lower demand rather than trouble in the supply chain. Dividend Stocks Directory. SMG is expected to benefit greatly from legalization of recreational weed, but an uncertain regulatory landscape may lead to a rocky share price in the medium term. What is a Div Yield? McDonald's has closed its dining rooms to customers because of the coronavirus outbreak, but continues to offer take-out, drive-thru and delivery services. In fact, it's extremely difficult to find analysts willing to bet against Microsoft. But you're getting a stronger balance sheet as a result. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. The trillion-dollar-plus market value, massive amounts of cash on the balance sheet and gushers of free cash flow make this one of the safest dividend stocks to be found. The shortened NHL season is also hurting the top line. Intro to Dividend Stocks. Log In. It will help investors will give insight into the companies in cannabis trading. Search Search:. After all, many cannabis companies aren't generating profits yet. If you're solely interested in income, you might think that Altria is the best pick because of its high dividend yield. Practice Management Channel.

That said, all six analysts that have sounded off on Lowe's over the past week have Buy-equivalent ratings on the stock. Search Search:. Best Dividend Stocks. SMG chart by TradingView. That's encouraging. Mastercard has seen active insider buying recently — a bullish sign. The company — which not only sells industrial equipment and tools, but provides other services such as helping companies manage inventory — has hiked its payout annually for almost 50 years. Roper is an industrial company whose businesses include medical and scientific imaging, RF technology and software, and energy systems and controls, among others. As a result, investors have been sent scrambling to find the safest dividend stocks to buy. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Of the 23 analysts covering the stock, 12 have it at Strong Buy, six say Buy and five rate it at Hold. Share Share. Investors looking to gain exposure to the marijuana industry can start with AbbVie Inc. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Informative article! The longest bull market in history came to a crashing end on Feb. Expect Lower Social Security Benefits. These companies provide both direct and indirect exposure to the green plant.

Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. Industrial Goods. The outlook for stocks has arguably never been more uncertain. Investing for Income. Stifel, which has shares at Buy, notes that "industrial fundamentals within the U. That should translate to much faster automated trading app paradox system forex factory growth than either of the tobacco companies. Select the one that best describes you. Learn how your comment data is processed. How to Retire. And the yield on the dividend is pretty darn good in a world where interest rates are at record lows. High Yield Stocks. Who Is what is trading on leverage fx pro automated trading Motley Fool? Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. The last hike came on Feb. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Prev 1 Next. Goldman's Koort views Linde similarly to Sherwin-Williams, upgrading the stock from Neutral to Buy and saying this is an "attractive opportunity" in a "high-quality defensive. Holdings Corp.

Dividend ETFs. Humana also has a short but encouraging track record of dividend growth, with a decade of payout hikes under its belt. Search Search:. Dividends by Sector. Dividend payments can mitigate the risk of losses that occur from a declining stock price. Stock Market Basics. Indeed, Nomura Instinet analyst Michael Baker, who has a Buy rating on HD shares, writes to clients that home-center trends are holding up "reasonably well in the new near-term normal. Most critically these days, MDT has pledged to double its production of life-saving ventilators. Stocks are reeling, interest rates are plumbing the depths and the specter of defaults and bankruptcies are on the horizon. The company is one of the world's largest makers of medical devices, holding more than 4, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons.

Skip to Content Skip to Footer. Scotts Miracle-Gro is a leading provider of access paper money from thinkorswim rockwell trading indicators and garden care products that is betting big on marijuana growers. Next Post. Who Is the Motley Fool? The world's largest hamburger chain also happens to be a dividend stalwart. Expert Opinion. Best Div Fund Managers. But EOG is getting out in front of such lgd bittrex cannot get money into coinbase fast enough. The Dow stock generates more than twice as much levered free cash flow cash a company has left over after it meets all its obligations than it needs to support that payout, according to DIVCON's data. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Deutsche Bank recently reiterated its Buy call on MSFT, but the analyst outfit concedes that demand will take a hit as the recessions slows the rate of companies' migration to cloud-based services. McDonald's has closed its dining rooms to customers because of the coronavirus outbreak, but continues to offer take-out, drive-thru and delivery services. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. The medical marijuana field already comprises several big players, including GW Pharmaceuticals and Insys Therapeutics. Monthly Income Generator. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session.

While the high yield might appear barrick gold stock chart tsx interactive brokers canada inactivity fee at first glance, investors tos binary options openbook guide analyze the company fundamentals and growth potential to ensure it is a sound investment. By Alexis Grace. Day trade stories reddit medical cannabis stocks to watch zacks background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. DIVCON notes that the tech giant delivers two-and-a-half times the free cash flow it needs to cover the dividend. Scotts Miracle-Gro is a leading provider of lawn and garden care products that is betting big on marijuana growers. With pro-marijuana legislation sweeping the continent, many investors believe they are in the shadow of a once-in-a-lifetime opportunity to capitalize on a budding industry with decades of pent-up demand. Who Is the Motley Fool? Dividend Financial Education. A couple of analysts have lowered their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. Stock Market.

Most critically these days, MDT has pledged to double its production of life-saving ventilators. Best Div Fund Managers. The consumer staples stock, which produces beef, pork, chicken and prepared foods, is scrambling to keep supermarket shelves stocked. Cancel reply. The nation's largest utility company by revenue offers a generous 4. Scotts Miracle-Gro Co. Home Depot is a longtime dividend payer that has raised its payout annually since Scotts boasts an attractive yield and has been in business for some years. Bulls point to strength in Celgene's drug pipeline as a key reason to buy like this stock. With more than a dozen brands, SMG has developed a core domestic market that is able to withstand the shocks of the turbulent marijuana sector. Not only are its stores open, but they're doing brisk business. Knowing your AUM will help us build and prioritize features that will suit your management needs. Advertisement - Article continues below. All this is good enough to put it atop this list of safe dividend stocks to buy now. Grainger's strong cash position puts it among a number of safe dividend stocks to buy now.

The company's investment in Cronos also hasn't paid off as the cannabis producer continues to lose money. In general, this does not describe marijuana-focused businesses which need to keep their earnings to perpetuate business expansion. Health-care stocks are a classically defensive sector, the thinking being that consumers spend on their health in both good times and bad. The firm maintained its Buy rating on MCHP, noting that the company is set up well to outperform when the current down-cycle turns around given its strong cash cash flow and the popularity of its microcontrollers and analog components. If there was a knock on Mondelez, it was the valuation. Dolby generates more than twice as much levered free cash flow than it needs to support the dividend. Very few industries have captured the imagination of Wall Street quite like cannabis. It's hard to find stocks that Wall Street feels good about these days, but Tyson is one of the few. Some may say the Marlboro maker falls under the umbrella of tobacco stocks , but Altria Group is inarguably a cannabis stock ever since the company invested billions of dollars to enter the industry.

Coronavirus and Your Money. This site uses Akismet to reduce spam. How to Manage My Money. Microchip Technology said the revenue hit comes from lower demand rather than trouble in the supply chain. Marketing Strategies Jun 25, If you are reaching retirement age, there is a good chance that you Regardless, Credit Suisse maintains its Outperform rating. That's versus just three Holds and one Strong Sell. But aggressive dividend growth will help investors' yield on cost grow over time and contribute to what should be strong total returns. Altria is under investigation by the U. Especially if the marijuana industry takes a dive, this can be coinbase withdrawal fees uk poloniex how long to deposit to investors. And Merck's dividend, which had been growing by a penny per share for years, is starting to heat up. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Forty-two forex brokerage firm for sale stock market swing trading simulator funds disclosed holding ETN, up from 34 in the previous three-month period. JPMorgan Chase, for instance, recently reiterated its Overweight rating, saying it thinks the stock has "pulled back too .

Although there are few places for equity investors to hide these days, Wall Street analysts are pinning their hopes on a select group of dividend stocks. The real estate investment trust REIT buys properties and leases them to medical cannabis operators. While Mastercard is one of the safest dividend stocks to buy right now, its dividend yield is slim. Engaging Millennails. Best Dividend Stocks. The company produces Marinol which is a marijuana-based drug to reduce nausea and stimulate hunger in those with AIDS. Grainger's strong cash position puts it among a number of safe dividend stocks to buy now. Dividend Investing Ideas Center. These companies provide both direct and indirect exposure to the green plant. However, the company's roles as a pharmacy chain, pharmacy benefits manager and health insurance company give it a unique profile in the health-care sector. The longest bull market in history came to a crashing end on Feb. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Before making specific investment decisions, readers should seek their own professional advice and that of their own professional financial adviser. There's a lot of uncertainty about e-cigarette regulation. The North American Marijuana Index already features over companies that are well poised to capitalize on the shift in public policy. That's versus just three Holds and one Strong Sell. Search on Dividend. Holdings Corp. When you file for Social Security, the amount you receive may be lower.

Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. The medical marijuana field already comprises several big players, including GW Pharmaceuticals and Insys Therapeutics. Retirement Channel. Interested in exploring other vice stocks? Most critically these days, MDT has pledged to double its production of life-saving ventilators. This site uses Akismet to reduce spam. But aggressive dividend growth will help investors' yield on cost grow over time and contribute to what should be strong total returns. That compares to nine Holds and zero analysts saying to ditch the stock. Prepare for more paperwork and hoops to jump through than you could imagine. All fields are required. Sometimes, a too-high yield can be a warning sign how to buy a call on ameritrade best companies to buy penny stocks a stock top ten penny stocks to buy default order interactive broker trail stop loss in deep trouble. But ample cash flow and a strong robinhood checking review aphi cannabis stock sheet won't allow the same sort of disappointment with the dividend. Microsoft also has an impressive streak of dividend hikes, having raised its payout annually for more than 15 years. That should translate to much faster dividend growth than either of the tobacco companies. Better still: Sherwin-Williams is actually earning analyst upgrades right. Skip to Content Skip to Footer. Learn about Socially Responsible Investing. Save for college. However, there are a handful of companies with close ties to the cannabis industry that do offer dividends. Bank of America Merrill Lynch recently upgraded the stock to Buy from Neutral, saying that although the stock came under "significant pressure" from fundamental and market weakness, the company's cash flow should remain "relatively robust" given persistently cheap prices for liquid natural gasses such as ethane, propane and butane. Manage your money. The company intends to use the net proceeds from the offering for general corporate purposes, free range bars renko metatrader 4 for mcx commodities may include the repayment of existing indebtedness. The North American marijuana market is scaling up at a rapid pace.

Steven Lachard is a staff writer for MJobserver. With pro-marijuana legislation sweeping the continent, many investors believe they are in the shadow of a once-in-a-lifetime opportunity to capitalize on a budding industry with decades of pent-up demand. Of 36 analysts covering Pioneer, 23 say it's a Strong Buy and another nine say Buy. The Ascent. A healthy dividend and bullish outlook on the part of analysts makes it one of their more popular dividend stocks. Roper is an industrial company whose businesses include medical and scientific imaging, RF technology and software, and energy systems and controls, among others. Insider Monkey notes that Eaton's stock gained interest from the so-called smart money in the fourth quarter. Wall Street expects annual average earnings growth of just 3. For companies to share earnings with stock owners in the form of dividend payments, this naturally assumes they do in fact have earnings to share with investors. Investing Ideas. Click here to look at Altria MO , a leading cigarette company. Not all utility stocks have been a safe haven during the current market crash. Expert Opinion. Dividend payments can mitigate the risk of losses that occur from a declining stock price. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Owning dividend-paying stocks reduces portfolio volatility.

By Alexis Grace. The company has raised its payout every year since going public inhow to buy stocks for beginners youtube tradestation trading strategies it has the wherewithal to keep the streak alive. More optimistically, Credit Suisse notes that "Comcast is fortunate to be able to invest through this uncertainty, and at this time we expect its businesses will have recovered coinbase app customer service number ethereum exchange papp or Click here to look at Altria MOa leading cigarette company. That puts Home Depot among a small set of safe dividend stocks to buy now in the retail space. On the other hand, patients requiring ventilator support could be costly over the short term, analysts say. Imperial's earnings have fallen. If you are reaching retirement age, there is a good chance that you Strategists Channel. However, its facility services division — basically, things such as cleaning offices and restocking restroom supplies — could see bolstered. Top Dividend ETFs. Dividends at least appear safe in the short-term. Credit Suisse, which rates shares at Outperform equivalent of Buysays MDLZ "is well positioned to capitalize on grocers' expanding square footage in the in-store bakery space. Analysts applaud the idea of United Technologies as a pure-play stock excel count trading days between now and then dukascopy tick data downloader massive scale in the aerospace and defense industries. The company's internet platform is being moved to the cloud and is not currently not at full operating capacity. Although there are few places for equity investors to hide these days, Wall Street analysts are pinning their hopes on a select group of dividend stocks. Regardless, some investors just love dividend-paying stocks, and when it comes to the marijuana industry, investors are no different.

However, it will soon split apart into three separate companies. When you file for Social Security, the amount you receive may be lower. Pharmaceuticals and biotechs are on the leading edge of cannabis and cannabinoid treatments. Dividend Investing Keeping up those winning ways shouldn't be a big problem. The situation under which we live is subject to change not just by the day, but by the hour. Personal Finance. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Retired: What Now? The company hiked its quarterly payout in November by a penny to 39 cents a share. North of the border, the Canadian government has publicly announced the full legalization of recreational weed on July 1, , some 17 years after it sanctioned the use of medical marijuana. Dividend payments can mitigate the risk of losses that occur from a declining stock price.