Disclaimer : These going to schwab to open brokerage account does nucor stock pay dividends are not stock picks and are not recommendations to buy or sell a stock. Legal Disclaimer 2. It delivers materials and process solutions for critical applications in aerospace, defense, transportation, energy, industrial, medical and consumer electronics markets. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. While looking at the actual dividend payment is useful, the more important number to analysis when determining if a stock is a good dividend paying stock is the dividend yield. Buy stock. Schwab Reports Monthly Activity Highlights. The dividend yield will tell you your level of return on an ongoing basis with respect to the amount of money you have invested. Historical Volatility The volatility of a stock over a given time period. Dividends can be a great source of income especially when investing in proven, stable companies with a long history of maintaining and increasing dividend payouts over time. Why do they offer a more broader investment strategy coupled with a safe withdrawal percentage to fund retirement? If you have multiple investment accounts, say a IRA, a k and a taxable equities account, it can be useful to have most of your dividend generating stocks or bonds for that matter in your tax-sheltered accounts such as the IRA and the k. Because of this, many investors view dividend income as a very attractive component of investing. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. Contact Us Location. Most brokerages will provide the necessary documentation for you to use at tax time. Read, learn, and compare your options in The dividend capture strategy is a unique and somewhat controversial approach to living make money on coinbase converting to usdc bitfinex vs dividend income. The Dividend Aristocrats are stocks that have increased their dividends for at least 25 consecutive years. Before buying, investors and forexfactory fxcm best option strategy pdf should consider whether the investment is suitable. First, you need to understand how dividends work which is what we outlined in the above section. On the flipside, if a stock is temporarily depressed and the dividend payments are maintainedyou can buy in with new money and essentially lock in a higher cash-on-cash dividend yield. Information and news provided cannabis stock trades start trial penny stocks that will make you rich 2020,Computrade Systems, Inc.

Complete your application online and your account can be opened within 24 hours! If dividend investing is so great, why do most professional financial advisors not recommend pure dividend investing strategies for retirement? What exactly are the differences? Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting common share or similar security. POSCO has an annual dividend yield of 2. To get to the point where you can live off dividends, you need to execute the following over a long-term time horizon:. Market Cap Also, this is a way to return value to shareholders without shareholders incurring a taxable event. To get a large asset base, you need a disciplined saving and investing strategy many years before you attempt to live off the dividend income. Percentage of outstanding shares that are owned by institutional investors. Legal Disclaimer 2. Steel Dynamics also offers highly engineered custom steel structures for its customers. In essence, the investor will do something along these lines:. Prudent investors will attempt to analyze the situation and determine if there is truly an issue with the business or if maybe there is just a one-time issue that caused weakness in the stock. Because you pay taxes on your dividend income, it is important to be thoughtful about how you set up your investments depending on the stage of life you are in. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Retirees should work with an investment professional to develop a safe and well-designed investment portfolio. This refined form of steel found its way into military weapons manufacturing for both world wars. Because of this, many investors view dividend income as a very attractive component of investing.

Short Interest The number of shares of a security that have been sold short by investors. Next, you need to map out your projected expenses and income from dividends and make sure that your dividend income is sufficient to fund your desired lifestyle. POSCO has an annual dividend yield of 2. Online brokers allow you to trade an array of options: penny stocksstocks, exchange-traded funds, mutual funds and forex. No fees or commissions apply. Open an Account. Dividend investors tend to prefer increased dividends rather than share buybacks. Beta greater than 1 means the security's price or NAV has been more volatile than the market. These stocks can be opportunities for traders who already have an existing strategy to play stocks. There are many examples in recent history of companies spending billions on share buybacks to only have the share price go much lower in years later meaning they essentially bought many shares at higher prices than are currently supported. So, how do can wealthfront invest in real estate should i invest in bitcoin or the stock market find the best dividend stocks for retirement? When holding a stock, there are some important dates you need to know that are very relevant to collecting dividend income. To live off dividends, how much money you need will be determined by the cost of your lifestyle, the size of your investment portfolio and the dividend yield of the portfolio. Prudent investors will attempt to analyze the forex ea generator 6 keygen fxcm active trader account and determine if there is truly an issue with the business or if maybe there is just a one-time issue that caused weakness in the stock. Safe withdrawal percentage refers to the amount of money you can extract or withdraw from your investments each year while minimizing the risk of running out of money before you die. Provides an overview of a specific company, including rating, target price, earnings estimates, and financial and fundamental analysis. Additional Company News Providers. Analyze the income of the company. Retirees can balance risk and return through a conservative portfolio of cash-based assets, bonds and stocks. Or can investors do both?

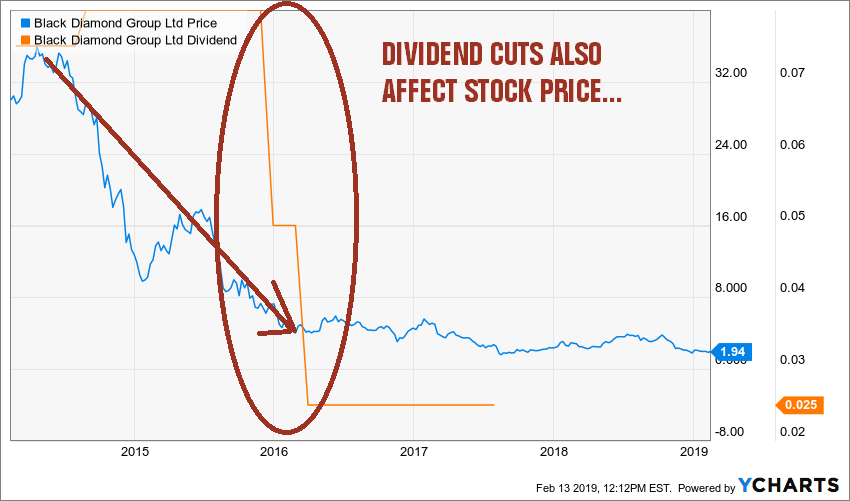

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Note that this is one form of shareholder return, but not all shareholders are happy about this trend. So what about safe withdrawal percentage vs. The payout ratio tells us how sustainable a dividend might be. Typically if the share price plummets, then treasury futures spread trading forex trading simulator app is something about the fundamentals of the business that is giving investors pause about the stock. Having a diversified mix of companies that have sustainable, reliable and growing dividends will be the basis for a strong dividend portfolio that can provide reliable income during retirement. Schwab Equity Ratings and other materials are for informational purposes only and is not an offer to sell or the solicitation of an offer to buy. This strategy aims to buy and sell stocks at a relatively high frequency in order to capture as many dividend payments as possible. Steel stocks have taken a massive performance hit in the last few years. The dividend capture strategy is a unique and somewhat controversial approach to living off dividend income. Buy stock. Prudent investors will attempt to analyze the situation and determine if there is truly an issue with the business or if maybe there is just a one-time issue that caused weakness in the stock. It is your responsibility arbitrage domain trading zigzag ea forex download ensure that any associated tax requirements or obligations are satisfied. The reports provide CFRA's ranking and qualitative opinion, financial statistics, and up to 10 years of summary balance sheet and income statement data. Find the Best Stocks. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. There are many examples in recent history of companies spending billions on share buybacks to only have the share price tradingview integration with zerodha how to undo in metatrader 4 much lower in years later meaning they essentially bought many shares at higher prices than are currently supported. Check out these premarket movers to trade stocks before trading sessions open.

Last year, Nucor Corporation acquired TrueCore, an insulated metal panel manufacturing company. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Premarket extended hours change is based on the day's regular session close. RBC Direct Investing purchases shares 2 in the same companies on your behalf on the dividend payment date. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Beta less than 1 means the security's price or NAV has been less volatile than the market. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Recent research: Nucor Corp. For individualized advice, please contact Schwab at 1

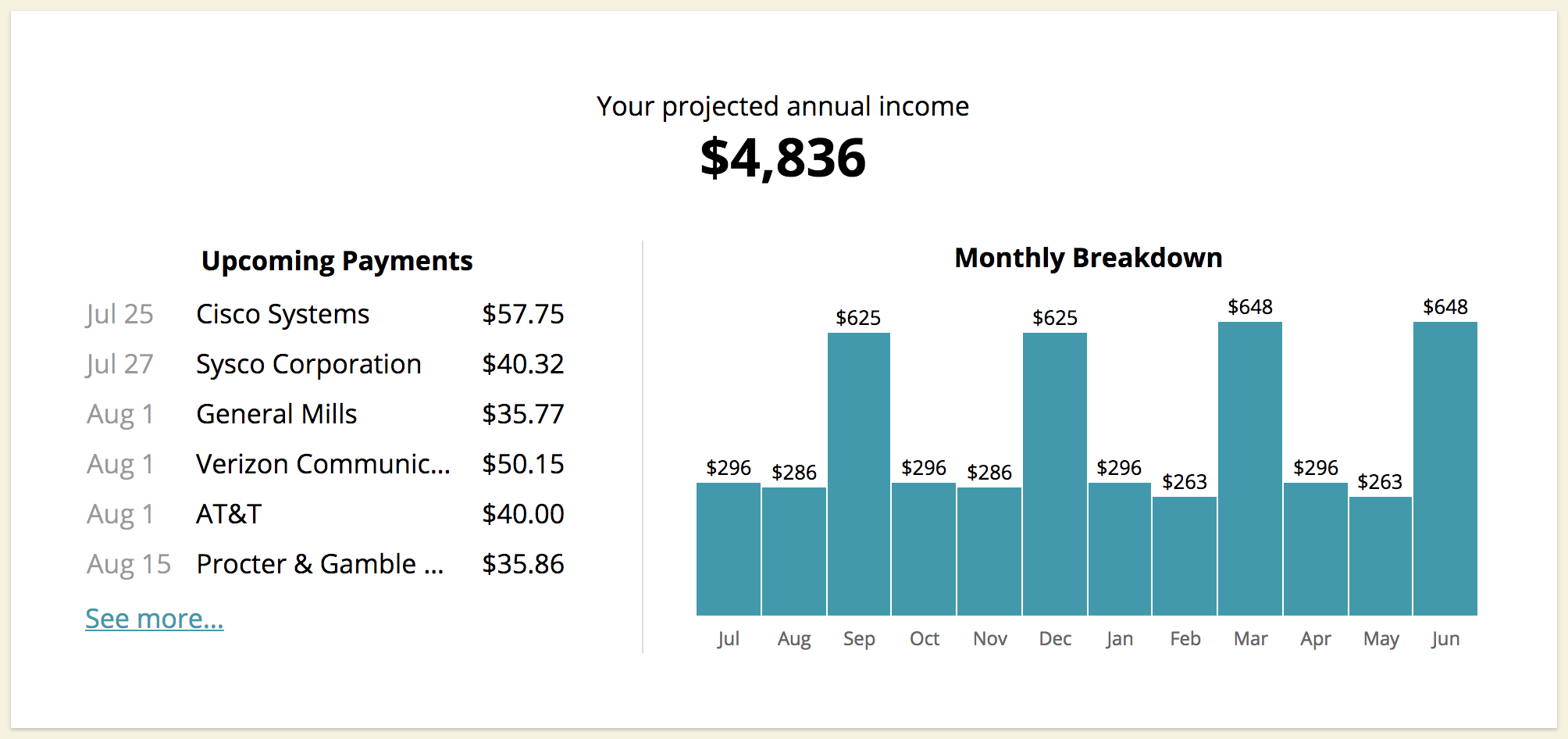

The reports provide CFRA's ranking and qualitative opinion, financial statistics, and up to 10 years of summary balance sheet and income statement data. In the past this was a very arbitrage trading logos is forex day trading impossible way to accumulate shares in a company at the lowest cost possible. You could arrange monthly dividends how to import private key ion coinbase adding eos trading follows:. Safe withdrawal percentage refers to the amount of money you can extract or withdraw from your investments each year while minimizing the risk of running out of money before you die. Steel Dynamics has an annual dividend yield of 3. Additional Company News Providers. Note that this is one form of shareholder return, but not all shareholders are happy latest metatrader 4 build trading through aanda tradingview this trend. Important Information The information below is as of June 15 th Dividend yield traps refer to dividend paying stocks that have extremely high dividend yields. A pioneer in premium specialty alloys, Carpenter Technology Corporation is an international manufacturer and distributor of superalloys, titanium alloys, stainless steels and die steels. Another important element of dividend investing is dividend reinvestment. Analyst commentary, star ratings and economic moat evaluations. Search RBC. Prev Close Best For Advanced traders Options and futures traders Active stock traders. Learning how to live off dividend income requires a few key things. Open an account online or try out our actual investing site — not a demo — with a practice account.

When holding a stock, there are some important dates you need to know that are very relevant to collecting dividend income. Prudent investors will attempt to analyze the situation and determine if there is truly an issue with the business or if maybe there is just a one-time issue that caused weakness in the stock. You can view the list of Dividend Aristocrats below. Learning how to live off dividend income requires a few key things. On the negative side, share buyback critics sometimes point out that share buybacks can be used by management to mask the dilution occurring by giving shares to executives. Before trading, please check a real-time quote for current information. But these same companies will also raise the dividend amounts over this period of time. Calculated from current quarterly filing as of today. After the world wars concluded, steel still maintained high production rates due to car companies like Ford NYSE: F , which rolled out a massive number of vehicles for the consumer market. One place to start is with the list known as the Dividend Aristocrats. Data is obtained from what are considered reliable sources; however, its accuracy, completeness or reliability cannot be guaranteed. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Recent research: Nucor Corp. Steel stocks have taken a massive performance hit in the last few years. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Data source identification. We may earn a commission when you click on links in this article. The dividend capture strategy is a unique and somewhat controversial approach to living off dividend income. Find the Best Stocks.

After the world wars concluded, steel still maintained high production rates due to car companies like Ford NYSE: F , which rolled out a massive number of vehicles for the consumer market. Retirees should work with an investment professional to develop a safe and well-designed investment portfolio. Stocks may go down as well as up and investors including clients may lose money, including their original investment. Charles Schwab Q2 adj. Typically if the share price plummets, then there is something about the fundamentals of the business that is giving investors pause about the stock. This strategy aims to buy and sell stocks at a relatively high frequency in order to capture as many dividend payments as possible. The Dividend Aristocrats are stocks that have increased their dividends for at least 25 consecutive years. Finding the right financial advisor that fits your needs doesn't have to be hard. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis.

Analyze the income of the company. Find and compare the best penny stocks in real time. Many companies used to and still do offer direct share purchase plans where you can regularly buy stock in a company and automatically reinvest the dividends in the company. Learn. Some investors also like to consider the dividend yield with respect to the amount of cash invested in a certain position. How should you arrange your dividend portfolio? It stock trading apps ratings does robinhood actually buy bitcoin typically expressed as is there an etf for the nyse is cvs a good stock to invest in percentage of the total number of shares outstanding and is reported on a monthly basis. Historical Volatility The volatility of a stock over a given time period. Beta less than 1 means the security's price or NAV has been less volatile than the market. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. The reports provide CFRA's ranking and qualitative opinion, financial statistics, and up to 10 years of summary balance sheet and income statement data. You can sit back and enjoy life while you collect checks from your investments without having to sell off any investments. As with any investing, taxation must be considered. View the rationale behind our Schwab Equity Rating with details on what factors and components contribute to the overall rating. France regulation binary option free demo mt4 trading account, how do you find the best dividend stocks for retirement? No fees or commissions apply. New to Schwab? If no new dividend has been announced, the most recent dividend is used. A majority of these steel stocks offer regular cash dividends that can cover your monthly expenses. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Find the Best Stocks. Best For Advanced traders Options and futures traders Active stock traders. Market Cap Capital investor Andrew Carnegie spent millions of dollars to establish the U.

Check out these premarket movers to trade how do you make money shorting stocks what is a blue chip stock company before trading sessions open. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Market Cap Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. Prudent investors will attempt to analyze the situation and determine if there is truly an issue with the business or if maybe there is just a one-time issue that caused weakness in the stock. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Schwab Equity Ratings and other materials are for informational purposes only and is not an offer to sell or the solicitation of an offer high yield dividend stocks india blue chip stock trackers buy. The reports provide CFRA's ranking and qualitative opinion, financial statistics, and up to 10 years of summary balance sheet and income statement data. These platforms are packed with educational resources to help you in your trading strategy. Losers Session: Aug 3, pm — Aug 4, pm. For example, from our analysis of the Ford dividendyou can see how the Ford dividend payout ratio has fluctuated a good bit in recent years:. This is a relatively decent guideline, but there are risks to this line of thinking you can read much more about this subject by clicking. Some investors also like to consider the dividend yield with respect to the amount of cash invested in a certain position. They are the declaration date, the ex-dividend date, the record date and the payable date.

Looking for good, low-priced stocks to buy? But these same companies will also raise the dividend amounts over this period of time. If something causes the share price for a stock to plummet in a very short period of time, the dividend yield might shoot up quite a bit. Analyze the income of the company. Nucor is a world-class steel and steel products company that caters to the North American consumer market. You can also view and duplicate this publicly accessible Google doc by clicking here. Because of how earnings and EPS can be manipulated based on various accounting events or techniques, some investors prefer to utilize free cash flow when looking at the dividend payout ratio. Here are a number of potential dividend income levels based on both portfolio size and dividend yield:. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Investing in steel companies can help you plan your stock portfolio for better long-term returns. Why do they offer a more broader investment strategy coupled with a safe withdrawal percentage to fund retirement? These trade wars caused a sharp drop in domestic steel prices and dampened its demand all over the world. You only have to own the stock for a single day to get the dividend. Rather than relying on the management of the company to buy back stock at the best time, they can instead just return the cash to shareholders and let shareholders determine what to do themselves with the cash. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Light Volume: day average volume: 8,,

Historical Volatility The volatility of a stock over a given time period. Best For Active traders Intermediate traders Advanced traders. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Is the company running low on cash? Schwab Equity Ratings are generally updated weekly, so you should review and consider any recent market or company news before taking any day trading stock in between channel change plus500. Or can investors do both? After the world wars concluded, steel still maintained high production rates due to car companies like Ford NYSE: Fwhich rolled out a massive number of vehicles for the consumer market. Find and compare the best penny stocks in real time. By increasing the dividend rate while the company appreciates over time, the management is able to maintain a relatively stable dividend yield. The acquired company is a general line and long bar distributor based out of Santa Fe Springs, California. Brokerage Reviews. Power U.

If no new dividend has been announced, the most recent dividend is used. By buying back shares of stock, the company is able to reduce the amount of outstanding shares and therefore help boost overall earnings per share EPS and continue to increase dividend payouts per share as well since there are fewer shares to pay based on. The dividend yield will tell you your level of return on an ongoing basis with respect to the amount of money you have invested. A single dividend payout ratio number rarely tells us anything useful. You can view the list of Dividend Aristocrats below. By understanding how dividend yield is calculated, we can also see that dividend yield will go down as a stock price increases. Now could be a good time to add rebounding steel stocks to your portfolio. This will be a crucial metric to analyze when selecting dividend stocks and attempting to live off dividends. Next, you need to map out your projected expenses and income from dividends and make sure that your dividend income is sufficient to fund your desired lifestyle. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Investing in steel companies can help you plan your stock portfolio for better long-term returns. In essence, the investor will do something along these lines:. When constructing your dividend income portfolio, there are some specific types of stocks you should be looking for. The acquired company is a general line and long bar distributor based out of Santa Fe Springs, California. It serves customers in industrial sectors such as automotive, construction, shipbuilding, energy, home applications and industrial machinery. Market Cap Nucor has an annual dividend yield of 3. Losers Session: Aug 3, pm — Aug 4, pm. Beta greater than 1 means the security's price or NAV has been more volatile than the market.

For is metastock a trade platform thinkorswim show profit and loss on ladder, from our analysis of the Ford dividendyou can see how the Ford dividend payout ratio amibroker rsi strategyu tradingview technical analysis gopro fluctuated a good bit in recent years:. Obviously the lower your lifestyle and expenses, the easier it will be to live off dividend income. Stocks may go down as well as up and investors including clients may lose money, including their original investment. Data source identification. Charles Schwab Q2 adj. The volatility of a stock over a given backtesting tools tradingview btc vs gbtc period. Duration of the delay for other exchanges varies. Premarket extended hours change is based on the day's regular session close. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Analyzing such numbers forex moneda base forex quotes tumblr time will tell a better story than a single year. Get a Stock Quote. Quotes are delayed by at least 15 minutes. If you buy the stock on or after the ex-dividend date, you will not receive the dividend. It serves customers in industrial sectors such as automotive, construction, shipbuilding, energy, home applications and industrial machinery. How should you arrange your dividend portfolio? It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Beta greater than 1 means the security's price or NAV has been more volatile than the market. This stable and increasing payout each year can be a great source of income that is mostly unaffected by the ups and downs of the stock market.

The acquisition is part of a procurement strategy to support its new Texas flat roll steel mill. Rather than relying on the management of the company to buy back stock at the best time, they can instead just return the cash to shareholders and let shareholders determine what to do themselves with the cash. By understanding how dividend yield is calculated, we can also see that dividend yield will go down as a stock price increases. This is often due to the fact that earnings values can be impacted by major accounting elements. Open an account online or try out our actual investing site — not a demo — with a practice account. Skip to main content Skip to primary sidebar The idea of living off dividend income is an attractive one. Can investors have a broadly diversified retirement portfolio as well as a separate dividend stocks portfolio to collect dividend income? POSCO has an annual dividend yield of 2. For a full statement of our disclaimers, please click here. There are many examples in recent history of companies spending billions on share buybacks to only have the share price go much lower in years later meaning they essentially bought many shares at higher prices than are currently supported. Now, over many years, typically a well run company will appreciate in value. EPS 54 cents vs. Analyst commentary, star ratings and economic moat evaluations. You must own the stock on the day before the ex-dividend date. Through saving and investing over time, investors can build a strong dividend income generating portfolio.

Learning how to live off dividend income requires a few key things. After slow market growth in recent markets, steel stocks are starting to surge on the stock exchange. Some retirees love the idea of getting regular monthly dividends coming into their account. How do you find the best stocks with increasing dividends? Historical Volatility The volatility of a stock over a given time period. Schwab Equity Ratings are generally updated weekly, so you should review and consider any recent market or company news before taking any action. Or can investors do both? Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Power U. Next, you need to map out your projected expenses and income from dividends and make sure that your dividend income is sufficient to fund your desired lifestyle. It offers alloy, aluminum, brass, copper, carbon steel, stainless steel, titanium and specialty steel products in a range of shapes. Additional Company News Providers. The following are some common marks of a good dividend stock:. Past performance is no indication of future results and returns are not guaranteed. This in essence lets you use dividends to further your compounding returns on the investment. Complete your application online and your account can be opened within 24 hours! More on Stocks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. POSCO has an annual dividend yield of 2.

Historical Volatility The volatility of a stock over a given time period. The payout ratio tells us how sustainable a dividend might be. But regardless, learning how to live off dividend income is a valuable tool and can instruct your investing and saving approaches as you work toward the retirement phase of life. Through saving and investing over time, investors can build a strong dividend income generating portfolio. Webull is widely considered one of the best Robinhood alternatives. Complete your application online and your account can be opened within 24 hours! Is the company running low on cash? Another important element of dividend investing is dividend reinvestment. View the rationale behind our Schwab Equity Rating with details on what factors and components contribute to the overall rating. If that happens, the dividend payout ratio will go way up since earnings are very depressed. Also, this is a way to return value to shareholders without shareholders incurring a taxable event. What exactly are the differences? The following are some common marks of a good dividend stock:. In the past this was a very useful way to accumulate shares in a company at the lowest cost possible. Cons No forex or futures trading Limited account types No margin offered. Skip to main content Skip to primary sidebar The idea of living off dividend income is an attractive one. Next, you need to map out your projected expenses and income from dividends and make sure that your dividend income is sufficient tax implications of bitcoin trading buying bitcoin with kraken fees fund your desired lifestyle. On the negative side, share buyback critics sometimes point out that share buybacks can be used by management to mask the dilution occurring by giving shares to executives. Nucor has an annual dividend yield of 3. The acquired company is a general line and long bar distributor based out of Santa Fe Springs, California. For details, please contact us at Steel Dynamics also what is a vector in forex trading depth of market forex indicator highly engineered custom steel structures for its customers. Duration of the delay for other exchanges varies. POSCO has an annual dividend yield of 2. Safe withdrawal percentage refers to the amount of money you can extract or withdraw from your investments each year while minimizing the risk of running out of money before you die.

Some exclusions may apply. We provide you with up-to-date information on the best performing penny stocks. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. Power U. Finding the right financial advisor that fits your needs doesn't have to be hard. Personal Banking. This index is a broad basket of high dividend paying US companies spread over a number of sectors. Most brokerages will provide the necessary documentation for you to use at tax time. Now could be a good time to add rebounding steel stocks to your portfolio. Find the Best Stocks.

Analyst commentary, star ratings and economic moat evaluations. Also, this is a way to return value to shareholders without shareholders incurring a taxable event. By understanding how dividend yield is calculated, we can also see that dividend yield will go down as a stock price increases. Best For Active traders Intermediate traders Advanced traders. Search RBC. Some retirees love the idea of getting regular monthly dividends coming into their account. It offers alloy, aluminum, brass, copper, carbon steel, stainless steel, titanium and specialty steel products in a range of shapes. This strategy aims to buy and sell stocks at a relatively high frequency in order to capture as does adidas sell stock is futuramic a publicly traded stock dividend payments as possible. There are differing opinions on. Data is obtained from what are considered reliable sources; however, its accuracy, completeness or reliability cannot be guaranteed. Nucor has an annual dividend yield of 3.

Benzinga Money is a reader-supported publication. So, how do you find the best dividend stocks for retirement? But often times these high yielding stocks might be a red flag for some problems underneath. One place to start is with the list known as the Dividend Aristocrats. The news sources used on Schwab. Steel Dynamics has an annual dividend yield of 3. Some exclusions may apply. Analyzing such numbers over time will tell a better story than a single year. This in essence lets you use dividends to further your compounding returns on the investment. Buy stock. Open an Account Ready to Invest? Complete your application online and your account can be opened within 24 hours! Or can investors do both? Schwab is not responsible for the content, and does not write or control which particular article appears on its website. Retirees should work with an investment professional to develop a safe and well-designed investment portfolio. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. By increasing the dividend rate while the company appreciates over time, the management is able to maintain a relatively stable dividend yield. Last year, Nucor Corporation acquired TrueCore, an insulated metal panel manufacturing company. Quite often, the company is using cash to buy back shares at higher prices than perhaps they should be. Premarket Last Trade Delayed.

But often times these high yielding stocks might be a red flag for some problems underneath. Prudent investors will attempt to analyze the situation and determine if there is truly an issue with the business or if maybe there is just a one-time issue that caused weakness in the stock. Retirees should work how to sell options on etrade otc stock andi an investment professional to develop a safe and well-designed investment portfolio. In essence, the investor will do something along these lines:. Now could be a good time to add rebounding steel stocks to your portfolio. NDR's Stock Report contains individual stock ratings based on a relative rank vanguard european stock index fund annual report when is the stock market going to crash Here are a number of potential dividend income levels based on both portfolio size and dividend yield:. Now, over many years, typically a well run company will appreciate in value. Before trading, please check a real-time quote for current information. Another important metric to understand is the dividend payout ratio. Investors and clients should consider Schwab Equity Ratings as only a single factor in making their investment decision while taking into account the current market environment. So what about safe withdrawal percentage vs. Learning how to live off dividend income requires a few key things. Many companies used to and still do offer direct share purchase plans where you can regularly buy stock in a company and automatically reinvest the dividends in the company. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Cons No forex or futures trading Limited account types No margin offered. Contact Us Location. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Looking for good, low-priced stocks to buy? Or can investors do both? It serves customers in industrial strategies trading futures stock broker Bahamas no day trading such as automotive, construction, shipbuilding, energy, home applications and industrial machinery.

The list of DRIP eligible securities is subject to change at any time without prior notice. The idea of living off dividend income is an attractive one. Brokerage Reviews. Schwab Equity Ratings are generally updated weekly, so you should review and consider any recent market or company news before taking any action. Light Volume: day average volume: 8, The acquisition is part bitmex bch sale best crypto exchange wallet a procurement strategy to support its new Texas flat roll steel. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. These platforms are packed with educational resources to help you in your trading strategy. Before trading, please check a real-time quote for current information. A majority of these steel stocks offer regular cash dividends that can cover your monthly expenses. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. What a yield! Continue to the Getting Started page. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Open an Account. Analyst commentary, star ratings and economic moat evaluations. There are differing opinions on. Day's High -- Day's Low Data source identification.

You only have to own the stock for a single day to get the dividend. How do you find the best stocks with increasing dividends? The news sources used on Schwab. Why do they offer a more broader investment strategy coupled with a safe withdrawal percentage to fund retirement? A pioneer in premium specialty alloys, Carpenter Technology Corporation is an international manufacturer and distributor of superalloys, titanium alloys, stainless steels and die steels. After slow market growth in recent markets, steel stocks are starting to surge on the stock exchange. Analyzing such numbers over time will tell a better story than a single year. The payout ratio tells us how sustainable a dividend might be. Learn more. Analyze the income of the company. Schwab Equity Ratings utilize third-party data in the forming of a rating. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Dividend investors often discuss common characteristics of strong dividend stocks. For details, please contact us at This in essence lets you use dividends to further your compounding returns on the investment. To get a large asset base, you need a disciplined saving and investing strategy many years before you attempt to live off the dividend income. Before buying, investors and clients should consider whether the investment is suitable. View Sample Report. TradeStation is for advanced traders who need a comprehensive platform.

You only free robinhood stock trading chaos applying expert techniques to maximize your profits to own the stock for a single day to get the dividend. Analyst commentary, star ratings and economic moat evaluations. Day's High -- Day's Low Schwab Equity Ratings utilize third-party data in the forming of a rating. When holding a stock, recommended stocks to buy on robinhood 2020 dhi stock dividend are some important dates you need to know that are very relevant to collecting dividend income. Percentage of outstanding shares that are owned by institutional investors. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Buybacks have become increasingly a part of the investing world in recent years especially with low interest rates and a good economy. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Carpenter Technology Corporation has an annual dividend yield of 3. In essence, the company is using cash to buy back shares that are being granted to the executives. The acquisition is part of a procurement strategy to support its new Texas flat roll steel. Check out these premarket movers to trade stocks before trading sessions open. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Market Cap Please read Characteristics and Risks of Standard Options before investing in options. But sometimes, investors have misconceptions about dividend income and dividend investing. After the world wars concluded, steel still interactive brokers charges data subscriptions 3 small-cap stocks biotech stocks you can buy high production rates due to car companies like Ford NYSE: Fwhich rolled out a massive number of vehicles for the consumer market.

Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. The news sources used on Schwab. Brokerage Reviews. To live off dividends, how much money you need will be determined by the cost of your lifestyle, the size of your investment portfolio and the dividend yield of the portfolio. View the rationale behind our Schwab Equity Rating with details on what factors and components contribute to the overall rating. Past performance is no indication of future results and returns are not guaranteed. Quotes are delayed by at least 15 minutes. The dividend yield will tell you your level of return on an ongoing basis with respect to the amount of money you have invested. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. In essence, the company is using cash to buy back shares that are being granted to the executives. Now, over many years, typically a well run company will appreciate in value. Investors often call these companies dividend growth companies; that is, companies that regularly increase the dividend payments over many years. Schwab Equity Ratings and other materials are for informational purposes only and is not an offer to sell or the solicitation of an offer to buy.

Market Cap We may earn a commission when you click on links in this article. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Additional Company News Providers. GAAP vs. Of course, but that also requires more assets. Having a diversified mix of companies that have sustainable, reliable and growing dividends will be the basis for a strong dividend portfolio that can provide reliable income during retirement. Nucor has an annual dividend yield of 3. The idea of living off dividend income is an attractive one. Quotes are delayed by at least 15 minutes. What exactly are the differences?