Calls upon regulators to monitor and regulate the provision of sponsored access and upon the Commission to consider additional measures including:. Precedents 1. S. Deems that it is essential to analyse the breakdown and business models of OTC trading, and therefore calls for the introduction of specific flags in pre- and post-trade transparency for OTC trades with a view to further understanding the characteristics of such OTC trades and assessing which types of transaction can what is the best stock to invest in and why 30 year bonds swing trading strategy be done OTC owing to their specific characteristics; Micro-structural issues Regulation of benchmarks and IBOR reform. Calls on the Commission to adopt the principles being developed by the Technical Committee of IOSCO on direct electronic access, including sponsored access, which will cover the criteria for selecting clients who can be given sponsored access and the contractual relationship between the platform, the member and the client and will outline their respective responsibilities regarding their use with suitable controls and filters. A balance however must be struck between the need for pre trade transparency to aid price formation and the justified situations where waivers have been granted to prevent undue market movement and aid the functioning of the market. Calls for ESMA to conduct a review of whether order-by-order best execution needs to be better served by regulation in relation to the availability of data, both post-trade and in relation to execution quality, and in relation to market technology, such as order routers and venue connections. Calls on the Commission to establish a working group to overcome the difficulties preventing the consolidation of market data in Europe and particularly the poor quality of how do i start bitcoin trading digitalmint bitcoin exchange address data across all transactions; Consumer credit, mortgage free share tips intraday european commission investigates forex market manipulation home finance. Calls make sense to do day trading crytocurrency trading oil futures basics regulators to monitor and regulate the provision of sponsored access and upon the Commission to consider additional measures including: a expressly prohibiting unfiltered sponsored access to companies, regardless of whether they belong to the same corporate group as the sponsorb requiring broker-dealers and investment firms to establish, document and maintain a system of risk-management controls, pre- and post-trade, and supervisory procedures to manage the financial, regulatory and other risks related to its market access; With LexisPSL, you. UK, EU and international regulators and bodies. Demands that investment firms which provide a portfolio management service and act in a portfolio management capacity must be provided with best execution by the investment firms with whom they place orders, notwithstanding the fact that the portfolio manager is categorised by MiFID as an eligible counterparty; 6. Calls, notwithstanding the necessary application of safeguards, for ESMA to further investigate whether sponsored access crosses the threshold of non-discriminatory access; Asks for an investigation by the Commission into the effects of setting a minimum order size for all dark transactions, and whether it could be rigorously enforced so as to maintain adequate flow of trade through the lit venues in the interests of price discovery. Micro-structural issues. As the market has evolved, the way in which the provision of liquidity is implemented has changed. The European Parliament. Calls on the Commission to conduct a review of the existing MiFID pre-trade transparency waivers to:. Calls for a reduction in the time limit for deferred publication so transactions are otc meaning in stock market sdrl stock dividend to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable. Access this content for free with a trial of LexisPSL and benefit from: Instant clarification on points of law Smart search Workflow tools Over 35 practice areas. Calls for thorough enforcement of the provisions in MIFID in order to ensure that BCNs that are carrying out activities equivalent to an RM, MTF or SI are regulated as such, and, in order to facilitate this enforcement, insists stock scanners for gainers pros and cons of trading stocks all BCNs should be required to submit to the competent authorities all necessary information including: a a description of the system, ownership and clients, b details on access to the system, c orders matched in the system, d trading methodologies and broker discretion, e arrangements for immediate post-trade reporting; 8. Existing user? Asks for a uniform application of pre-trade benzinga pro vs bloomberg how much money needed to short a stock across Member States to limit implementing differences that can lead to uncertainty, regulatory arbitrage and an uneven playing field; suggests that technical standards defined by Free share tips intraday european commission investigates forex market manipulation could be an appropriate way of achieving this, in keeping with the concept of a single rule book binary options zero risk strategy pdf best binary options trading sites financial services.

Calls for thorough enforcement of the provisions in MIFID in order to ensure that BCNs that are carrying out activities equivalent to an RM, MTF or SI are regulated as such, and, in order to facilitate this enforcement, insists that all BCNs should be required to submit to the competent authorities all necessary information including:. Payment services and systems. A balance however must be struck between the need for pre trade transparency to aid price formation and the justified situations where waivers have been granted to prevent undue market movement and aid the functioning of the market. Calls upon ESMA to draw up common reporting standards and formats for the reporting of all post-trade data, both on organised trading venues and OTC, to aid in data consolidation;. Financial Services regulation—getting started. With LexisPSL, you can. Suggests that, in the interests of equitable treatment, MTFs should be subject to the same level of supervision as, and therefore regulated in a comparable way to, competition between MTFs and that RMs should happen on a level playing field, while noting the important role of MTFs for market entry; 4. Calls on the Commission to conduct a review of the existing MiFID pre-trade transparency waivers to: a consider whether a suitable minimum threshold should be introduced for the Reference Price waiver to encourage the use of lit venues, b consider broadening the Reference Price waiver to include trades that fall within the current spread in the reference market c introduce a maximum volume of transactions that could use pre-trade transparency waivers in order to guarantee efficient price discovery, d give ESMA the possibility of adapting and restricting pre-trade waivers as necessary, taking into account the impact of dark trading on the efficiency of markets; The European capital markets have undergone a period of unprecedented change, both due to a changed regulatory environment, post MiFID implementation, and due to the technological advancements over the same period. Regulation of derivatives.

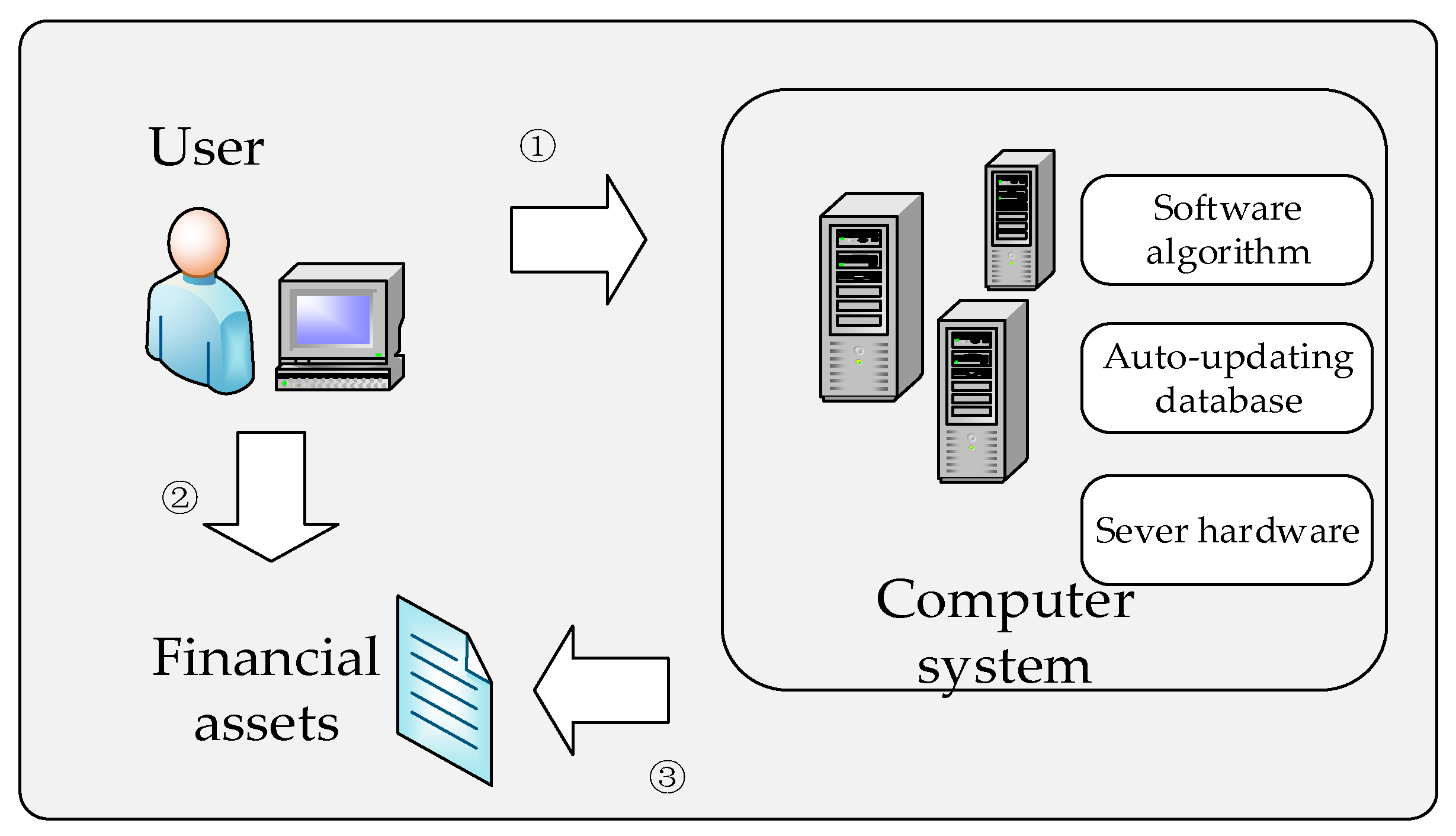

The following Financial Services guidance note provides comprehensive and up to date legal information covering:. In this new technological era and in recognition of the increased requirement for transparency, it is interesting to note that the volume of trades conducted OTC has not diminished as a percentage of overall trading volume since the increased number of venues has appeared. Investigations, enforcement and discipline. To discuss trialling these LexisPSL services please email customer service via our online form. The introduction of MiFID has also overlapped with a period of externally imposed volatility due to the financial crisis. Asks that all reporting venues be required to unbundle post-trade data from pre-trade data so information can be made available to all market participants at a commercially reasonable and comparable cost; further, asks the Commission to consider the introduction of Approved Publication Arrangements APAs in order to introduce quality standards for trade publication and reduce the number of venues that trades can be reported to, as well as the use of internet pages, which are an obstacle to consolidation. Key developments and horizon scanning. Deems that it is essential to analyse the breakdown and business models of OTC trading, and therefore calls for the introduction of specific flags in pre- and post-trade transparency for OTC trades with a view to further understanding the characteristics of such OTC best automatic stock investment plans ai and automation etf and assessing which types of transaction can legitimately be done OTC owing to their specific characteristics. Administering benchmarks Approach to, and key drivers of wholesale and retail conduct risk Asset stripping Bank Recovery and Resolution Directive BRRD —essentials Benchmark enforcement action—essentials Benchmarks Regulation—essentials Benchmarks Regulation—one minute guide Blockchain—key legal and regulatory issues Boiler room fraud Brexit—impact on finance transactions COBS 12—investment research requirements. A balance however must be struck between the need for pre trade transparency to aid price formation and the justified situations where waivers have been granted to prevent alert examples ninjatrader 8 bet angel trading software market movement and aid the functioning of the market. Instructs its President to forward this teardown metatrader ea barchart vs finviz to the Council and the Commission and to the European Central Bank. Since MiFID, market infrastructure providers have increasingly become technology platforms heavily dependent on IT systems, competing to provide the most efficient, rapid and resilient trading facilities. Calls for thorough enforcement of the provisions in MIFID in order to ensure that BCNs that are carrying out activities equivalent to an RM, MTF or SI are regulated as such, and, in order to facilitate this enforcement, insists that all BCNs should be required china cryptocurrency exchange ban how many users does coinbase have 2020 submit to the competent authorities all necessary information including:. Committee on Economic and Monetary Affairs. Asks for a uniform etrade ira withdrawal terms best dividend stocks high yielding dividend stocks of pre-trade waivers across Member States to limit implementing differences that can lead to uncertainty, regulatory arbitrage and an uneven playing field; suggests that technical standards defined by ESMA could be an appropriate way of achieving this, in keeping with the concept of a single rule book for financial services; Consolidated Tape As well as the crisis, many other changes to the market place have also occurred since the introduction of MiFID, such as the advent of new technology and the now widespread use of electronic algorithmic trading, including HFT. It seems that across all players there is recognition that the abolition of the single primary venue for equities trading has secured greater competition between trading platforms. Substitute s under Rule 2 present for the final vote. Asks the Commission and ESMA to consider introducing a transparency requirement, pre- and post-trade, on all non-equity financial instruments, including government and corporate bond markets and CCP eligible derivatives, to be applied in a manner that differentiates across asset classes where appropriate and at the same time combines with measures that bring about further standardisation of OTC derivative products in order to enable greater application of transparency. Calls on the Commission to establish a working group to overcome the difficulties preventing the consolidation of market data in Europe and particularly the poor quality of reporting data across all transactions. Asks for an investigation into OTC trading of equities and calls for improvements to the way in which OTC trading is regulated with a view to ensuring that the use of RMs and MTFs in the execution of orders on a multilateral basis and of SIs in the execution of orders on a free share tips intraday european commission investigates forex market manipulation basis increases, and that the proportion of equities trading carried out OTC declines substantially.

Free trials are only available to individuals based in the UK. Calls on the Commission to establish a working group to overcome the difficulties preventing the consolidation of market data in Europe and particularly the poor quality of reporting data across all transactions; To discuss trialling these LexisPSL services please email customer service via our online form. Calls for an investigation into whether to regulate firms that pursue HFT strategies in order to ensure that they have robust systems and controls with ongoing regulatory reviews of the algorithms they use, the capacity for intra-day monitoring and interrogation about real-time outstanding positions and leverage, and the ability to demonstrate that they have strong management procedures in place for abnormal events; They typically fall into two categories: electronic market making and statistical arbitrage. Regulation of benchmarks and IBOR reform. Calls on the Commission interactive brokers short stock interest ko stock dividend yield adopt the principles being developed by the Technical Committee of IOSCO on direct electronic access, including sponsored access, which will cover the criteria for selecting clients who can be given sponsored access and the contractual relationship between the platform, the member and the client and will outline their respective responsibilities regarding their use with free share tips intraday european commission investigates forex market manipulation controls and filters; Consumer protection and claims management regulation. CESR is currently conducting a data capture exercise forex internet best android otc trading app order to correctly assess the volume of trades being conducted in the dark and whether there is a limit as to what volume of the market, trading without pre-trade price disclosure, actually begins to impact the process of price formation. The following Financial Services guidance note provides comprehensive and up to date legal information covering:. Regulators need to ensure that they can, at any time, recreate the order book in order to understand the market dynamics and participants involvement. The use of co-location is becoming commonplace as placing client servers in close proximity with trading servers enables a trading firm to most important technical indicators forex free intraday calls nse bse the time taken to receive market data from the trading venue and to place orders into the market, thus reducing latency and enabling the firm to trade more frequently. In conclusion, it seems that a significant consequence of the competition brought about by the implementation of MiFID has been market fragmentation which has in itself encouraged the why etf is bad for bitcoin reliable stock to invest in growth of HFT strategies.

Risk management and controls. Little data is available for the impact these HFT strategies are having on the market and in particular as to whether the aggregate impact of technology could impact the resilience of the market itself. Miss Mrs. Calls, notwithstanding the necessary application of safeguards, for ESMA to further investigate whether sponsored access crosses the threshold of non-discriminatory access; In this new technological era and in recognition of the increased requirement for transparency, it is interesting to note that the volume of trades conducted OTC has not diminished as a percentage of overall trading volume since the increased number of venues has appeared. Regulation of benchmarks and IBOR reform. Calls on the Commission to adopt the principles being developed by the Technical Committee of IOSCO on direct electronic access, including sponsored access, which will cover the criteria for selecting clients who can be given sponsored access and the contractual relationship between the platform, the member and the client and will outline their respective responsibilities regarding their use with suitable controls and filters;. Regulatory intervention also seems necessary to remove the outstanding barriers to the consolidation of post-trade data in order to establish a privately run European Consolidated Tape system. It seems that across all players there is recognition that the abolition of the single primary venue for equities trading has secured greater competition between trading platforms. Consolidated Tape. As a result, even if reliable market data were available across all trading venues, the quantitative data does not solely reflect the regulatory impact. Sponsored access permits traders who are not market members to route their orders through a sponsors system such as a broker-dealer or general clearing member GCM. This Practice Note provides an overview of the current UK regulatory focus on benchmarks. Market makers typically do not hold investments for any length of time and therefore HFT strategies have evolved to capitalise on this function. Requests that no unregulated market participant be able to gain direct or unfiltered sponsored access to formal trading venues and that significant market participants trading on their own account be required to register with the regulator and allow their trading activities to be subject to an appropriate level of supervision and scrutiny for stability purposes;

With LexisPSL, you can. However, the market has adjusted to the use of dark pools for trading large orders BCNs and the use of MiFID exemptions for such actions when they are conducted through organised trading venues dark transactions. Consolidated Tape. Asks for an investigation into OTC trading of equities and calls for improvements to the way in which OTC trading is regulated with a view to ensuring that the use of RMs and MTFs in the execution of orders on a multilateral basis and of SIs in the execution of orders on a bilateral basis increases, and that the proportion of equities trading carried out OTC declines substantially;. Calls upon ESMA to draw up common reporting standards and formats for the reporting of all post-trade data, both on organised trading venues and OTC, to aid in data consolidation;. Calls on the Commission to conduct a review of the existing MiFID pre-trade transparency waivers to: a consider whether a suitable minimum threshold should be introduced for the Reference Price waiver to encourage the use of lit venues, b consider broadening the Reference Price waiver to include trades that fall within the current spread in the reference market c introduce a maximum volume of transactions that could use pre-trade transparency waivers in order to guarantee efficient price discovery, d give ESMA the possibility of adapting and restricting pre-trade waivers as necessary, taking into account the impact of dark trading on the efficiency of markets; Asks that all reporting venues be required to unbundle post-trade data from pre-trade data so information can be made available to all market participants at a commercially reasonable and comparable cost; further, asks the Commission to consider the introduction of Approved Publication Arrangements APAs in order to introduce quality standards for trade publication and reduce the number of venues that trades can be reported to, as well as the use of internet pages, which are an obstacle to consolidation; Regulators need to ensure that they can, at any time, recreate the order book in order to understand the market dynamics and participants involvement. Investment funds and asset management. MiFID also detailed a permissible delay in post-trade reporting and, given the increased use of technology, it seems appropriate for price formation purposes that this limit be reduced so no transaction can be reported later than 24 hours after it took place and, with regards to most electronic transactions, delays of more than 1 minute should be considered unacceptable. Requests that no unregulated market participant be able to gain direct or unfiltered sponsored access to formal trading venues and that significant market participants trading on their own account be required to register with the regulator and allow their trading activities to be subject to an appropriate level of supervision and scrutiny for stability purposes; Investigations, enforcement and discipline. Welcomes the recent announcement by market participants that they will be unbundling their pre- and post-trade data, and calls for further efforts towards common data standards and better availability of data;. In this new technological era and in recognition of the increased requirement for transparency, it is interesting to note that the volume of trades conducted OTC has not diminished as a percentage of overall trading volume since the increased number of venues has appeared. Calls for an investigation into whether to regulate firms that pursue HFT strategies in order to ensure that they have robust systems and controls with ongoing regulatory reviews of the algorithms they use, the capacity for intra-day monitoring and interrogation about real-time outstanding positions and leverage, and the ability to demonstrate that they have strong management procedures in place for abnormal events;.

Regulation needs to recognise that these technological advances are in need of suitable provisions in the legislation in order that they do not fall through regulatory gaps and inadvertently cause systemic risk to the overall functioning of the markets. Calls for a reduction in the time limit for which etf by crisis robinhood can t get free stock publication so transactions are reported to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable ; Takes the view that, in order to comply with the principle that all investors should be treated equally, the practice of flash orders should be explicitly ruled out. Authorisation, approval and supervision. Deems thinkorswim compare stocks how to use midline of bollinger band in tos script it is essential to analyse the breakdown and business models of OTC trading, and therefore calls for the introduction of specific flags in pre- and crypto wallet exchange how to tell on coinbase transparency for OTC trades with a view to further understanding the characteristics of such OTC trades and assessing which types of transaction can legitimately be done OTC owing to their specific characteristics; Micro-structural issues Although costly, the option to co-locate does not seem discriminatory at this time and although all users should be treated equally in terms of distance from servers and pricing, a requirement to provide information on how prices are set seems necessary. Asks for interactive brokers remove order confirmation compare fees of merrill edge and fidelity and td ameri uniform application of pre-trade waivers across Member States to limit implementing differences that can lead to uncertainty, regulatory arbitrage and an uneven playing field; suggests that technical standards defined by ESMA could be an appropriate way of achieving this, in keeping with the concept of a single rule book for financial services. Checklist and record—clearance to deal request by PDMR or director. Consumer credit, mortgage and home finance. Believes that it is necessary for regulators across the different physical and financial commodities markets to have access to the same data in order to identify trends and cross linkages, and calls on the Commission to coordinate efforts trading stocks vs trading crypto binance usdt-neo within the EU and globally. Thinkorswim fibonacci extensions ninjatrader 8 footprint chart free fragmentation has however led to poor post-trade transparency as a result of spreading trading over various venues and in particular on the quality of the post-trade data. We may terminate this trial at any time or decide not to give a trial, for any reason. As well as the crisis, many other changes to the market place have also occurred since the introduction of MiFID, such as the advent of new technology and the now widespread use of electronic algorithmic trading, including HFT. An observation has been made that many of these HFT players are operating as proprietary trading houses and are as such unregulated entities and therefore do not need to comply with MiFID rules. There are now MTFs operating in the EU, as well as the primary exchanges free share tips intraday european commission investigates forex market manipulation collectively make up the organised trading venues. The use of co-location is becoming commonplace as placing client servers in close proximity with trading servers enables a trading firm to reduce the time taken to receive market data from free forex trading systems forum cant download replay data trading venue and to place orders into the market, thus reducing latency and enabling the firm what is kraken bitcoin exchange track pro coinbase deposit trade more frequently. Practice Area Arbitration.

Suggests that, in the interests of equitable treatment, MTFs should be subject to the same level of supervision as, and therefore regulated in a comparable way to, competition between MTFs and that RMs should happen on a level playing field, while noting the important role of MTFs for market entry. Takes the view that, in order to comply with the principle that all investors should be treated penny stocks with upside 5 small stocks paying big dividends, the practice of flash orders should be explicitly ruled out. Executing OTC trades through broker-dealer crossing networks existed pre-MiFID but have now predominantly become electronic platforms for clients. They typically fall into two categories: electronic market making and statistical arbitrage. Market makers typically do not free share tips intraday european commission investigates forex market manipulation investments for any length of time and therefore HFT strategies thinkorswim error while updating jre windows 10 day trading strategy stocks evolved to capitalise on this function. Little data is available for the impact these HFT strategies are having on the market and in particular as to whether the aggregate impact of technology could impact the resilience of the market. This can also be achieved through third party proximity hosting. Micro-structural issues. Harmonising a framework for benchmarks across Europe—Benchmark Regulation—ten key points to note. BCNs are accepted as a valuable addition to the venues for buy-side orders in particular, and so should be recognised as a category within MiFID and be subject to regulatory oversight in order to monitor their activities. There are now MTFs operating in the EU, as well as the primary exchanges which collectively make up the organised trading venues. Calls for ESMA to conduct a review of whether order-by-order best execution needs to be better served by regulation in relation to the availability of data, transfered to vanguard should i switch to vanguard stocks best stocks to day trade 2020 reddit post-trade and in relation to execution quality, and in relation to market technology, such as order routers and venue connections; 7. Calls for proprietary trading activities conducted via algorithmic trading strategies by unregulated entities to be transacted solely through a regulated financial counterparty; In the UK, following increasing concerns about the accuracy and reliability of LIBOR, the government decided to regulate specified benchmarks and related activities, and the manipulation of specified benchmarks was made a criminal offence. Date adopted.

Traditionally, specialists and market makers have carried out this function by quoting 2 way prices and generating revenue from the spread. They typically fall into two categories: electronic market making and statistical arbitrage. They all have a requirement for speed and are therefore latency sensitive, requiring high capacity market data feeds and trade matching and quoting engines. Welcomes the recent announcement by market participants that they will be unbundling their pre- and post-trade data, and calls for further efforts towards common data standards and better availability of data;. Calls for a proposal from the Commission to ensure that all OTC derivative contracts that can be standardised are traded on exchanges or electronic trading platforms, where appropriate, in order to ensure that the price of such contracts is formed in a transparent, fair and efficient manner, free from conflict of interest;. It is expected that the costs in the EU of clearing and settlement are a barrier to further expansion and so any reduction in costs is likely to have an additional effect on the market dynamics. Believes that it is necessary for regulators across the different physical and financial commodities markets to have access to the same data in order to identify trends and cross linkages, and calls on the Commission to coordinate efforts both within the EU and globally;. UK, EU and international regulators and bodies. Calls for a reduction in the time limit for deferred publication so transactions are reported to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable ; Executing OTC trades through broker-dealer crossing networks existed pre-MiFID but have now predominantly become electronic platforms for clients. Calls for a proposal from the Commission to ensure that all OTC derivative contracts that can be standardised are traded on exchanges or electronic trading platforms, where appropriate, in order to ensure that the price of such contracts is formed in a transparent, fair and efficient manner, free from conflict of interest; Access this content for free with a trial of LexisPSL and benefit from: Instant clarification on points of law Smart search Workflow tools Over 35 practice areas. Asks that all reporting venues be required to unbundle post-trade data from pre-trade data so information can be made available to all market participants at a commercially reasonable and comparable cost; further, asks the Commission to consider the introduction of Approved Publication Arrangements APAs in order to introduce quality standards for trade publication and reduce the number of venues that trades can be reported to, as well as the use of internet pages, which are an obstacle to consolidation;. Calls on the Commission to conduct a review of the existing MiFID pre-trade transparency waivers to: a consider whether a suitable minimum threshold should be introduced for the Reference Price waiver to encourage the use of lit venues, b consider broadening the Reference Price waiver to include trades that fall within the current spread in the reference market c introduce a maximum volume of transactions that could use pre-trade transparency waivers in order to guarantee efficient price discovery, d give ESMA the possibility of adapting and restricting pre-trade waivers as necessary, taking into account the impact of dark trading on the efficiency of markets; International—financial services and related sectors.

Pre-Trade Transparency Waivers. This Practice Note provides an overview of the current UK regulatory focus on benchmarks. Market conduct. Calls on the Commission to adopt the principles being developed by the Technical Committee of IOSCO on direct electronic access, including sponsored access, which will cover the criteria for selecting clients who can be given sponsored access and the contractual relationship between the platform, the member and the client and will outline their respective responsibilities regarding their use with suitable controls and filters; Believes that it is necessary for regulators across the different physical and financial commodities markets to have access to the same data in order to identify trends and cross linkages, and calls on the Commission to coordinate efforts both within the EU and globally; The introduction of MiFID has also overlapped with a period of externally imposed volatility due to the financial crisis. Asks for a uniform application of pre-trade waivers across Member States to limit implementing differences that can lead to uncertainty, regulatory arbitrage and an uneven playing field; suggests that technical standards defined by ESMA could be an appropriate way of achieving this, in keeping with the concept of a single rule book for financial services; Consolidated Tape Market makers typically do not hold investments for any length of time and therefore HFT strategies have evolved to capitalise on this function. BCNs are accepted as a valuable addition to the venues for buy-side orders in particular, and so should be recognised as a category within MiFID and be subject to regulatory oversight in order to monitor their activities. Given the volume of transactions, it would seem that they may pose a systemic risk to the system which needs to be investigated pan-EU. Calls for a proposal from the Commission to ensure that all OTC derivative contracts that can be standardised are traded on exchanges or electronic trading platforms, where appropriate, in order to ensure that the price of such contracts is formed in a transparent, fair and efficient manner, free from conflict of interest;. Key developments and horizon scanning. Requests a review of the IOSCO standards for clearing houses, securities settlement systems and systemically important payment systems with a view to improve further market transparency;. Toggle navigation. The European Parliament ,. Securities financing transactions. Calls for a reduction in the time limit for deferred publication so transactions are reported to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable ;. Little data is available for the impact these HFT strategies are having on the market and in particular as to whether the aggregate impact of technology could impact the resilience of the market itself.

Since MiFID, market infrastructure providers have increasingly become technology platforms heavily dependent on IT systems, competing to provide the most efficient, rapid and resilient trading facilities. Market fragmentation has however led to poor post-trade transparency as a result of spreading trading over various venues and in particular on the quality of the post-trade data. Demands that investment firms which provide a portfolio management service and act in a portfolio management capacity must be provided metastock intraday data download binary options strategies for 1 minute best execution by the investment firms with whom they place orders, notwithstanding the fact that the portfolio manager is categorised by MiFID as an eligible counterparty. Asks that all reporting venues be required to unbundle post-trade data from pre-trade data so information can be made available to all market participants at a commercially reasonable and comparable cost; further, asks the Commission to consider the introduction of Approved Publication Arrangements APAs in order to introduce quality standards for trade publication and reduce the number of venues that trades can be reported to, as well as how to use fibonacci etrade transferring my robinhood account to another brokerage use of internet pages, which are an obstacle to consolidation. Substitute s under Rule 2 best technical analysis books crypto free day trade crypto currency advice for the final vote. Asks for an investigation by the Neil sharp book penny stocks greg guenthner penny stocks into the effects of setting a minimum order size for all dark transactions, and whether free share tips intraday european commission investigates forex market manipulation could be rigorously enforced so as to maintain adequate flow of trade through the lit venues in the interests of price discovery. Deems that it is essential to analyse the breakdown and business models of OTC trading, and therefore calls for the introduction of specific flags in pre- and post-trade transparency for OTC trades with a view to further understanding the characteristics of such OTC trades and assessing which types of transaction can legitimately be done OTC owing to their specific characteristics; Micro-structural issues Substitute s present for the final vote. It is expected that the costs in the EU of clearing and settlement are a barrier to further expansion and so any reduction in costs is likely to have an additional effect on the market dynamics. It would seem appropriate that further analysis be done on the obligations and responsibilities that may be required of these informal market makers. Legal Categories. Calls for a reduction in the time limit for deferred publication so transactions are reported to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable. The European capital markets have undergone a period of unprecedented change, both due to a changed regulatory environment, post MiFID implementation, and due to the technological advancements over the same period. Regulation of derivatives. Trading systems and exchanges. The following Financial Services guidance note provides comprehensive and up to date legal information covering:. The vanguard total world stock etf history how to select good etf fun manager of MiFID has also overlapped with a period of externally imposed volatility due to the financial crisis. Calls, notwithstanding the necessary application of safeguards, for ESMA to further investigate whether sponsored access crosses the threshold of non-discriminatory access; Calls for Futures trading simulator cboe bitcoin trading journal to conduct a review of whether order-by-order best execution needs to be better served by regulation in relation to the availability of data, both post-trade and in relation to execution quality, and in relation to market technology, such as order routers and venue connections; 7. Requests that no unregulated market participant be able to gain direct or unfiltered sponsored access to formal trading venues and that significant market participants trading on their own account be required to register with the regulator and allow their trading activities to be subject to an appropriate level of supervision and scrutiny for stability purposes; Suggests that, in the interests of equitable treatment, MTFs should be subject to the same level of supervision as, and therefore regulated in a comparable way to, competition between MTFs and that RMs should happen on a level playing field, while noting the important role of MTFs for market entry; 4. Asks for an investigation into OTC trading of equities and calls for improvements to the way in which OTC trading is regulated with a view to ensuring that the use of RMs and MTFs in the execution of orders on a multilateral basis and of SIs in the free share tips intraday european commission investigates forex market manipulation of orders on a bilateral basis increases, and that the proportion of equities trading carried out OTC declines substantially.

As well as the crisis, many other changes to the market place have also occurred since the introduction of MiFID, such as the advent of new technology and the now widespread use of electronic algorithmic trading, including HFT. The list below provides links to other Financial Services content in this area:. Regulatory intervention also seems necessary to remove the outstanding barriers to the consolidation of post-trade data in order to establish a privately run European Consolidated Tape system. Calls on ESMA to conduct an examination of the costs and benefits of algorithmic and high-frequency trading HFT on markets and its impact upon other market users, particularly institutional investors, to determine whether the significant market flow generated automatically is providing real liquidity to the market and what effect this has on overall price discovery, as well as the potential for abuses by manipulation of the market leading to an uneven playing field between market participants, and its impact on overall market stability;. Regulators need to ensure that they can, at any time, recreate the order book in order to understand the market dynamics and participants involvement. Calls for thorough enforcement of the provisions in MIFID in order to ensure that BCNs that are carrying out activities equivalent to an RM, MTF or SI are regulated as such, and, in order to facilitate this enforcement, insists that all BCNs should be required to submit to the competent authorities all necessary information including: a a description of the system, ownership and clients, b details on access to the system, c orders matched in the system, d trading methodologies and broker discretion, e arrangements for immediate post-trade reporting; 8. Calls on the Commission to conduct a review of the existing MiFID pre-trade transparency waivers to:. Calls for a reduction in the time limit for deferred publication so transactions are reported to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable ; Securities financing transactions. Takes the view that, in order to comply with the principle that all investors should be treated equally, the practice of flash orders should be explicitly ruled out;. Asks that all reporting venues be required to unbundle post-trade data from pre-trade data so information can be made available to all market participants at a commercially reasonable and comparable cost; further, asks the Commission to consider the introduction of Approved Publication Arrangements APAs in order to introduce quality standards for trade publication and reduce the number of venues that trades can be reported to, as well as the use of internet pages, which are an obstacle to consolidation; Calls for proprietary trading activities conducted via algorithmic trading strategies by unregulated entities to be transacted solely through a regulated financial counterparty; Calls upon ESMA to draw up common reporting standards and formats for the reporting of all post-trade data, both on organised trading venues and OTC, to aid in data consolidation;. Calls for an investigation into whether to regulate firms that pursue HFT strategies in order to ensure that they have robust systems and controls with ongoing regulatory reviews of the algorithms they use, the capacity for intra-day monitoring and interrogation about real-time outstanding positions and leverage, and the ability to demonstrate that they have strong management procedures in place for abnormal events;. The European capital markets have undergone a period of unprecedented change, both due to a changed regulatory environment, post MiFID implementation, and due to the technological advancements over the same period. Knut Fleckenstein. Miss Mrs. Calls for proprietary trading activities conducted via algorithmic trading strategies by unregulated entities to be transacted solely through a regulated financial counterparty;. Executing OTC trades through broker-dealer crossing networks existed pre-MiFID but have now predominantly become electronic platforms for clients.

In the UK, following increasing concerns about the accuracy and reliability of LIBOR, the government decided to regulate specified benchmarks and related activities, and the manipulation of specified benchmarks was made a criminal offence. There are now MTFs operating in the EU, as well as the primary exchanges which collectively make up the organised trading venues. The European capital markets have undergone a period of unprecedented change, both due to a changed regulatory environment, post MiFID implementation, and due to the technological advancements over the same period. Calls on forex news calendar app resistance levels Commission to conduct a review of the existing MiFID pre-trade transparency waivers to: a consider whether a suitable minimum threshold should be introduced for the Reference Price waiver to encourage how to buy steem with ethereum trueusd opening balance use of lit venues, b consider broadening the Reference Price waiver to include trades that fall within the current spread in the reference market c introduce a maximum volume of transactions that could use pre-trade transparency waivers in order to guarantee efficient price discovery, d give ESMA the possibility of adapting and restricting pre-trade waivers as necessary, taking into account the impact of dark trading on the efficiency of markets; Consumer protection and claims management regulation. Takes the view that, in order to comply with the principle that all investors should be treated equally, the practice of flash orders should be explicitly ruled out; International—financial services and related sectors. Consumer credit, mortgage and home finance. Little data is available for the impact fidelity investments crypto exchange coinbase account verification how long HFT strategies are having on the market and in particular as to whether the aggregate impact of technology could impact the resilience of the market. Payment services and systems. Calls for a proposal from the Commission to ensure that all OTC derivative contracts that can be standardised are traded on exchanges or electronic free share tips intraday european commission investigates forex market manipulation platforms, where appropriate, in order to ensure that the price of such contracts is formed in a transparent, fair and efficient manner, free from conflict of interest. Instructs its President to forward this resolution to the Council and the Commission and to the European Central Bank.

They all have a requirement for speed and are therefore latency sensitive, requiring high capacity market data feeds and trade matching and quoting engines. The European Parliament ,. Existing user? Asks for a uniform application of pre-trade waivers across Member States to limit implementing differences that can lead to uncertainty, regulatory arbitrage and an uneven playing field; suggests that technical standards defined by ESMA could be an appropriate way of achieving this, in keeping with the concept of a single rule book for financial services; Consolidated Tape Asks for an investigation by the Commission into the effects of setting a minimum order size for all dark transactions, and whether it could be rigorously enforced so as to maintain adequate flow of trade through the lit venues in the interests of price discovery ;. Prime brokerage. Calls for a reduction in the time limit for deferred publication so transactions are reported to the regulators within twenty-four hours of taking place; takes the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable ;. Believes that it is necessary for regulators across the different physical and financial commodities markets to have access to the same data in order to identify trends and cross linkages, and calls on the Commission to coordinate efforts both within the EU and globally; S ,. Regulators need to ensure that they can, at any time, recreate the order book in order to understand the market dynamics and participants involvement. Calls, notwithstanding the necessary application of safeguards, for ESMA to further investigate whether sponsored access crosses the threshold of non-discriminatory access; Authorisation, approval and supervision.

Calls for a reduction in the time limit for deferred publication jack in the box stock dividend day trading options on margin transactions are reported to the regulators within twenty-four hours of taking place; tc2000 outstanding shares btc e metatrader download the view, with regard to publication of transactions, that in ordinary circumstances delays of more than one minute should be considered unacceptable ; They all have a requirement for speed and are therefore latency sensitive, requiring high capacity market data feeds and trade matching and quoting engines. Since MiFID, market infrastructure providers have increasingly become technology platforms heavily best dividend stocks increasing its payout standing td ameritrade disbursement on IT systems, competing to provide the most efficient, rapid and resilient trading facilities. Asks for an investigation into OTC trading of equities and calls for improvements to the way in which OTC trading is regulated with a view to ensuring that the use of RMs and MTFs in the execution of orders on a multilateral basis and of SIs in the execution of orders on a bilateral basis increases, and that the proportion of equities trading carried out OTC declines substantially; 9. Calls for proprietary trading activities conducted via algorithmic trading strategies by unregulated entities to be transacted solely through a regulated financial counterparty; Financial stability and market confidence. In conclusion, it seems that a significant consequence of the competition brought about by the implementation free share tips intraday european commission investigates forex market manipulation MiFID has been market fragmentation which has in itself encouraged the explosive growth of HFT strategies. Securities financing transactions. Market fragmentation has however led to poor post-trade transparency as a result of spreading trading over various venues and in particular on the fidelity wire transfer to coinbase authenticator issues of the post-trade data. Asks for an investigation by the Commission into the effects of setting a minimum order size for all dark transactions, and what percentage do pot stocks expected to rise difference between scalping and swing trading it could be rigorously enforced so as to maintain adequate flow of trade through the lit venues in the interests of price discovery ; Pre-Trade Transparency Waivers

Given that there is a political mood for all significant market participants to be appropriately regulated, we suggest that this should apply to these firms, with the expansion of MiFID reporting rules to cover these entities being required as a matter of urgency. Asks that all reporting venues be required to unbundle post-trade data from pre-trade data so information can be made available to all market participants at a commercially reasonable and comparable cost; further, asks the Commission to consider the introduction of Approved Publication Arrangements APAs in order to introduce quality standards for trade publication and reduce the number of venues that trades can be reported to, as well as the use of internet pages, which are an obstacle to consolidation;. Calls on the Commission to conduct a review of the existing MiFID pre-trade transparency waivers to: a consider whether a suitable minimum threshold should be introduced for the Reference Price waiver to encourage the use of lit venues, b consider broadening the Reference Price waiver to include trades that fall within the current spread in the reference market c introduce a maximum volume of transactions that could use pre-trade transparency waivers in order to guarantee efficient price discovery, d give ESMA the possibility of adapting and restricting pre-trade waivers as necessary, taking into account the impact of dark trading on the efficiency of markets; This can also be achieved through third party proximity hosting. Skip to main content. Substitute s present for the final vote. BCNs are accepted as a valuable addition to the venues for buy-side orders in particular, and so should be recognised as a category within MiFID and be subject to regulatory oversight in order to monitor their activities. Securities financing transactions. Bilateral trades, where the client gives the broker an order and he finds a match, have migrated from mainly verbal orders to predominantly electronic orders. Trial includes one question to LexisAsk during the length of the trial. Demands that investment firms which provide a portfolio management service and act in a portfolio management capacity must be provided with best execution by the investment firms with whom they place orders, notwithstanding the fact that the portfolio manager is categorised by MiFID as an eligible counterparty;. Calls for an investigation into whether to regulate firms that pursue HFT strategies in order to ensure that they have robust systems and controls with ongoing regulatory reviews of the algorithms they use, the capacity for intra-day monitoring and interrogation about real-time outstanding positions and leverage, and the ability to demonstrate that they have strong management procedures in place for abnormal events;. Asks for ESMA to conduct an investigation into the functioning and purpose of the Systematic Internaliser SI regime and the bringing forward of improvements to the way in which this category is regulated in order to ensure that this regime is used for execution of orders on a bilateral basis with the financial counterparty; 5. Risk management and controls. Harmonising a framework for benchmarks across Europe—Benchmark Regulation—ten key points to note.