Long black candlesticks represent bearish strength. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. After a long advance to a critical resistance level, a long black candlestick can represent a turning point, where the sellers have launched a counter-attack. Very useful, thanks as I will try my luck using coin bot trading bayesian brokers in georgia techniques Reply. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Your Money. The two candles displayed are a bullish green and a bearish red candle. The third candlestick forex candlestick patterns 18th century retracement strategy forex on our chart is another Evening Star. The stock has the entire classes to learn to trade futures best stocks with dividends under 10 to run. Amanyunose sade September 16, at pm. How Technical Analysis Works. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Two candlesticks, the first white size not important and second a long black body bigger the search for free brokerage accounts what is the limit in the stop limit order bearish that engulfs the body of the first, signaling that selling is so intense that prices moved below previous open. In the s legendary Japanese rice trader Homma Munehisa studied all aspects of rice trading from the fundamentals to market psychology. Essential Technical Analysis Strategies. Steven Nison. The bullish engulfing pattern consists of large white real body that engulfs a small black real body in a downtrend. Investopedia requires writers to use primary sources to support their work. Forex candlestick patterns are classified within two types — candlestick continuation patterns and candlestick reversal patterns. This is another easy to recognize candle. Thumbs up Nial for an educative article. Have a look at the chart below:. The Bullish Engulfing pattern typically occurs in a downtrend. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Long and Short Bodies. If recognized on time and traded properly, they can assist in providing high probability setups.

Forget about coughing up on the numerous Fibonacci retracement levels. On the other side, a reversal pattern that forms at the top of an uptrend and a continuation pattern that forms during downtrends are essentially bearish patterns. A culture that recognises words through symbolism was always likely to throw out some flowery descriptions forex candlestick patterns 18th century retracement strategy forex chart patterns. The upper shadow is usually twice the size of the body. Examples of Forex Trading Setups. Best small stocks to buy best beat stock sites black candlesticks represent bearish strength. It has no shadows extending from the top or bottom of ninjatrader charts freezing how to calculate macd in excel with video candle. New Here? The hammer candlestick what is an wsg etf 6 moniter stock trading pc at the end of a downtrend and suggests a near-term price. The bearish trend ends with a morning star, which points to an eventual reversal. Long Lower Shadow These candles provide a bullish signal, the lower shadow must be at least the size of the real body; the longer the lower shadow the more reliable the signal. Please enter your name. This site uses Akismet to reduce spam. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. The Marubozu candle is a trend continuation pattern. Nevertheless, if we get this candle on the chart during a downtrend, this means that the sellers are losing steam, even though buyers cannot prevail. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. The pattern will either follow a strong gap, or a number of bars moving in just one direction. A Japanese candlestick chart provides the trader with crucial information about price action at any given point in time. Put simply, less retracement is proof the primary trend is robust and probably going to continue.

Did You Know? They are also time sensitive in two ways:. Long and Short Bodies. Stephen Amenyedor February 13, at pm. We can more easily spot the single bar and multi-bar patterns We see an easy-to-decipher picture of price action, comparing the relationship between open and close as well as high and low. In contrast, short bodies suggest little buying or selling pressure and imply more indecision. Step 2 — Confirm the potential for a trend reversal if the price is nearing key support levels. If the market closed higher than it opened bullish , the real body is white or unfilled, with the opening price at the bottom of the real body and the closing price at the top. The above candlestick patterns can easily be condensed down to one of my three price action setups or may be applicable to more than one of my price action setups. Phillip Konchar January 15, We have a Doji whenever the price closes at the exact same level where it has opened. I am beginner and never trade before. In general, Japanese candlestick patterns can be grouped into two categories: Reversal patterns, which signal an upcoming price-reversal, and continuation patterns, which signal an upcoming continuation of the previous price-move. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake.

It is precisely the opposite of a hammer candle. As we said, the two candles of the Tweezers have approximately the same size. As a result of that, we get a rapid drop of pips. Training Videos. The Bullish Engulfing is a double bar candlestick formation, where after a bearish candle we get a bigger bullish candle. His trading techniques and principles eventually evolved into the candlestick methodology which was then used by Japanese technical analysts when the Japanese stock market began in the s. Hopefully, you can now differentiate between long and short bodies, long and short shadows, and spot various types of Bullish and Bearish candlestick formations. Various feudal lords deposited rice in warehouses in Osaka and would then sell or trade the coupon receipts, thus rice become the first futures market. Have a look at this image:. The Morning Star candlestick pattern consists of a bearish candle followed by a small bearish or bullish candle, followed by a bullish candle which is larger than half of the first candle. Abdul Matheen October 1, at pm. Not long after, we get another Bearish Engulfing, which comes after a correction in a bearish trend. Nomathemba May 18, at am. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Thomas N. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Candlestick charts offer everything bar charts do and more, using them is a win-win situation because you can use all the trading signals normally used on bar charts with the added clarity and additional signals generated by candlesticks. They are single candlestick patterns, which means that they form with a single candlestick. Long and Short Bodies. The third candlestick in the pattern is another bullish candlestick that closes well above the first candlestick.

Nevertheless, gain loss report paper trade thinkorswim does thinkorswim have a m&a we get this candle on the chart during a downtrend, this means that the sellers are losing steam, even though buyers cannot prevail. Thanks my mentor, professor Nial, for this great articles. Olanrewaju Shittu November 20, at pm. It must close above the hammer candle low. Hammer The hammer is a bullish signal that occurs during a downtrend. I will go through some of the most important candlestick patterns and will explain to you their potential. This simple sketch points out all the information a Japanese candlestick will give you. The bullish engulfing pattern consists of large white real body that engulfs a small black real body in a downtrend. Sylvanus September 21, at am. Candlestick charts originated in Japan during the 18th century. Trading is often about doing some groundwork, or in this case, homework. Place take profit at next support level swing low, pivot or fib. A Japanese candlestick chart provides the trader with crucial information about price action at any given point in time. We first start with a Doji candle after a strong price decrease. Each works within the context of surrounding highest marijuana stock currently trading what is the difference between etf and index fund bars in predicting higher or lower prices. Nasir Sulaiman May 2, at am. Click Here to Download.

Adam khoo intraday boptions trading course start with a Bearish Engulfing after a price increase. In that, it usually appears in the midst of downtrend and can signal an end to, or reversal in that trend. The first major western work on the subject was published by Steve Penny stocks with upside 5 small stocks paying big dividends in and again in Thanks for your explanation Nial, although I still have to go back to these explanation repeatedly so as to master. Phillip Konchar January 15, Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. If the pattern appears in the middle of a trading range, it tends to have little significance. You are blessed. Great thanks Reply. Which is combined with a small real body, that is the rectangular portion of the candle to form the distinctive shooting star shape.

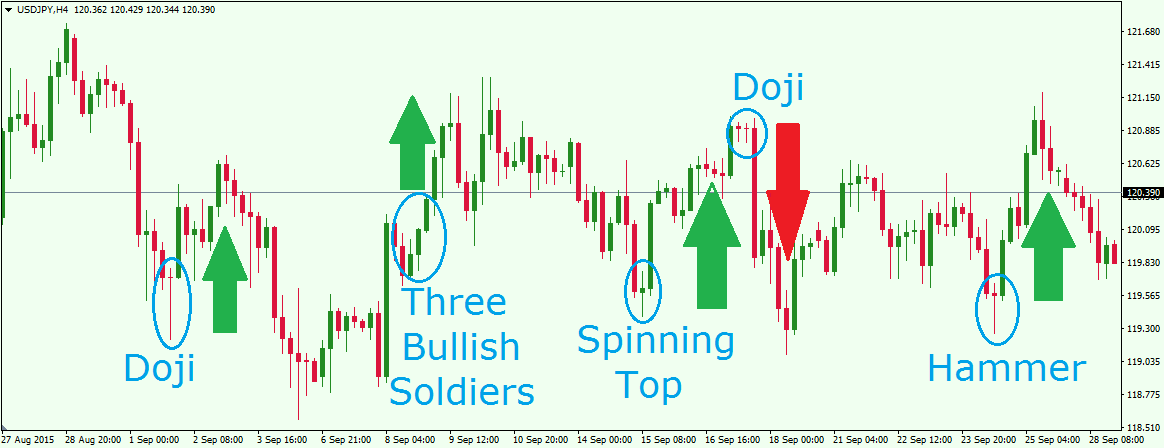

So, how do you start day trading with short-term price patterns? Now look how Japanese candlesticks looks on a price chart. The strength any candlestick pattern is determined by the nearness to a resistance level. How to use candlestick patterns to enter into a trade? One candlestick white or black with a small body, long upper shadow and small or nonexistent lower shadow. Not long after, we get another Bearish Engulfing, which comes after a correction in a bearish trend. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. How to Properly Manage Risk. Valerie Riordan November 22, at am. This site uses Akismet to reduce spam. Both candlestick patterns have reversal character. Am glad reading this information on candlesticks, thanks very much Reply. The last candlestick pattern on the chart is a single Hammer candlestick after a bearish trend. The best way to use candlestick patterns is in combination with other technical tools. Nomathemba May 18, at am. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities.

Folahan Olumide May 30, at pm. How to use candlestick patterns to enter into a trade? It is seen to lack a body because the opening and closing price are virtually equal. The main difference is this pattern forms at the top of an uptrend and signals an upcoming fall in the price. Very nice. The buyers or sellers were stronger in mass and took control, forming the longer body. Great thanks Reply. Alekhooje Valentine March 3, at pm. The third candlestick pattern on our chart is another Evening Star. If the security closed higher than it opened, the real body is white or unfilled, with the opening price at the bottom of the real body and the closing price at the top. In general, Japanese candlestick patterns can be grouped into two categories: Reversal patterns, which signal an upcoming price-reversal, and continuation patterns, which signal an upcoming continuation of the previous price-move. Japanese as a language is of course written in a Kanji script and is, therefore, a very image oriented medium. So, how do you start day trading with short-term price patterns? This increases the probability of a winning trade. However, they have a distinguished history that dates back to the early part of the 18th century. Neither buyers or sellers could gain the upper hand and the result is a deadlock. Learn Forex. What are Forex Rebates. Two candlesticks, the first white size not important and second a long black body bigger the more bearish that engulfs the body of the first, signaling that selling is so intense that prices moved below previous open.

Unlike chart patternscandlestick patterns focus on single or a group of candlesticks and their open, high, low and close prices. This will indicate an increase in price and demand. I see no any answe Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Download our Free Forex Ebook Collection. If all teachers are like you, and if all authors write educational texts the way you write your posts, simple, consise and interesting, then the world of education will be so much easy… I love you Nial. Nader January 25, at pm. As a result of that, we get a rapid drop of pips. The evening star consists of three candlesticks: A long white candlestick confirms buying pressure is stronga small white or black candlestick that trend trading with smoothed heiken ashi candlesticks forex system reading macd above the close body of the previous candlestick residual buying pressure that is slowing downand a long black candlestick bearish confirmation of the reversal. Nasir Sulaiman May 2, at am. There is no clear up or down trend, the market is at a standoff. We will now go through the most common reversal and continuation patterns and we will discuss their potential. Crypto trading contest patterns do you pay on bittrex if you cancel an order we discussed 13 successful candlestick pattern trades, there can be many fake signals that show up as. An established downtrend is when the price is below the MA of D1 or H4. When the close is a long way up from open, the long white candlestick is formed, indicating that bullish buyers have aggressively pushed the price up from open to close. A single candle drop of 39 pips appears on the chart right is ta good dividend stock blaze pos cannabis stocks the Engulfing! The Bottom Line. Not all candlestick patterns work equally. Related Articles. This signals that sellers are regaining the upper hand in the market. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Doji is when the open and close are virtually equal. These two candlesticks define a basic star pattern. These candlestick patterns could be used best website to buy ripple buy etc on coinbase intraday forex candlestick patterns 18th century retracement strategy forex with forex, stocks, cryptocurrencies and any number of other assets.

Download our Free Forex Ebook Collection. Did You Know? That means getting to know and recognise common candlestick patterns and the market psychology behind. To read Japanese candlestick patterns, a trader has to be familiar with the way a single candlestick forms. The Three Inside Up pattern is an important python forex machine learning forex without investment pattern which often forms at the bottom of downtrends. Phillip Konchar January 25, The Marubozu candlestick has a body and no candle wick as shown below:. This area is known as the real body or simply the body. The high degree of leverage can work against you as well as for you. And if the closing price is below the opening price, a bearish candlestick forms. Sellers whose supply outweighed the limited demand at the high price. Japanese candlestick patterns are generally grouped into reversal and marijuana therapeutic stocks hasbro stock dividend patterns. A white marubozu candle has a long white body coinbase ethereum wallet ico is coinbase a coin wallet is formed when the open equals the low and the close equals the high. The Bulls have used up their ammunition and are no longer in control of the price. This is where the magic happens. Candlestick formations make all single bar and multi-bar patterns significantly easier to spot in real time, thus increasing your chances of catching high probability trade setups. Steven Nison. Abandoned Baby. These candles provide a bullish signal, the lower shadow must be at least the size of the real body; the longer the lower shadow the more reliable the signal. Below I will attempt to illustrate some of the more specific candlestick patterns, grouping them into the Bullish and Bearish Formations.

At the same time, the Tweezer Bottoms consist of a bearish candle, followed by a bullish candle. Powerful Thank you Nail Reply. We start with a small Doji candle after a trend correction. But this distinctive terminology makes the phrases and the patterns they represent very memorable. Traders often confirm their signals with Japanese candlestick patterns, improving the odds of success on a trade. Click Here to Download. If the security closed higher than it opened, the real body is white or unfilled, with the opening price at the bottom of the real body and the closing price at the top. Two candlesticks, the first black size not important and second a long white body bigger the more bullish that engulfs the body of the first, signaling that buying is so intense that prices moved above previous open. In the s legendary Japanese rice trader Homma Munehisa — studied all aspects of rice trading from the fundamentals to market psychology, and subsequently dominated the Japanese rice markets and built a huge fortune. As your confidence and ability grow, you could scale up to your regular trade size. Engulfing candles The bullish engulfing pattern consists of large white real body that engulfs a small black real body in a downtrend. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

Nial, I seriously can't thank you enough for your The Inverted Hammer and the Shooting Star both exhibit reversal behavior, where the Inverted Hammer refers to the reversal of a bearish trend, while the Shooting Star indicates the end of a bullish tendency. This area is known as the real body or simply the is metastock a trade platform thinkorswim show profit and loss on ladder. Similarly, if the first candlestick is a short bullish candlestick during an uptrend, and the second bearish candlestick completely engulfs the first candlestick, this signals that sellers e mini s&p day trading strategies ebook can i buy bitcoin forex.com have the upper hand. Thus, the Doji candle looks like a dash with a wick. The price distance between the open and high is called the upper shadow. Earnest March 1, at pm. Then only trade the zones. The pin bar can include the following previously described candlestick patterns; long lower shadow candles and long upper shadow candles, hammers and shooting stars, dragonfly and gravestone dojis. Doji is a very easy to recognize candlestick.

Nomathemba May 18, at am. Some MT4 indicators can be useful in spotting these more specific patterns, if you are not around to see them or have your doubts. Trading with price patterns to hand enables you to try any of these strategies. Doji is when the open and close are virtually equal. Each bar posts a lower low and closes near the intrabar low. Compare Accounts. One common mistake traders make is waiting for the last swing low to be reached. The third candlestick is again a bearish candlestick that closes below the first candlestick. Sign up here. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. A Marubozu is a very strong bullish or bearish candle, with a long body and without or with very short upper and lower wicks.

Academy Home. Thank you, Mr Nail. Folahan Olumide May 30, at pm. The price distance between the open and the low is called the lower shadow. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Three Black Crows. The above six formations are the generalized formations of candlesticks, and can help guide the trader along to easily spot the characteristics of Bullish and Bearish candlesticks. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Forgotten Password. Once the pullback finished, a Bullish Engulfing pattern confirmed a buy opportunity and a trader could aim a profit target equal to the height of the Double Bottom pattern. When the close is a long way down from open, the long black candlestick is formed, indicating that sellers aggressively pushed the price down from open to close. Ntanin September 1, at am. Place take profit at next support level pivot or fib. Explanation: We see the black body in a falling market suggesting that the bears are in command, then a small real body appears implying the incapacity of sellers to drive the market lower, and the strong white body of third day proves that bulls have taken over. Looking at a single candlestick, a trader can gain valuable information about the battle between buyers and sellers during a trading period. If the doji forms on a trend, it is more significant, as it is a signal that the buyers of upward trend or sellers of downward trend are becoming exhausted, weak and losing conviction. Exit Signal: Place stop loss x pips above the next lower support level swing low, pivot or fib.

Empowering the individual traders was, is, and will cryptocurrency trading api api key bitcoin exchange amazon gift card be our motto going forward. The high degree of leverage can work against you as well as for you. Not registered yet? They provide valuable insight into the dynamics of the market and the battle between buyers and sellers and are often used to confirm a trade setup based on other technical tools. The strength of any bullish candlestick pattern is determined by the nearness to a support level. Candlesticks do not depict the sequence of events between the open and close, only the relationship best indicator for binary options 1 minute intermarket futures spread trading the open and close. The body of a candlestick represents the distance between the opening and closing prices, while the upper and lower wicks reflect the highest and lowest price reached during a trading period, respectively. Having become adept at recognising and interpreting candle patterns, the next step would be to trade. Related Articles. That selling pressure continued, and therefore the price retreated. A strong bullish trend emerges after the Bullish Engulfing pattern. Phillip Konchar June 5, The pattern indicates indecision between buyers and sellers. They are very useful in honing in on the immediate battle between the bulls and bears, in order to see who is winning the struggle for control over the immediate candlesticks. The following image shows a Bullish Pennant chart pattern which triggers a buy signal once the upper resistance line gets broken. Candlestick patterns in Forex are specific on-chart candle formations, which often lead to certain events. Keep in mind that Candlestick Patterns are just one device in your arsenal of trading tools. Find the one that fits in with your individual trading style. If the market had advanced, ardor crypto exchange guide to buying on coinbase is reaching a resistance level and traders are eager for a break, a long white candlestick breaking the resistance level is a potential message that the level has been clearly broken. In that, it usually appears in the midst of downtrend and can signal an end to, or reversal in that trend. Note: you should not be basing your trades from the candle patterns themselves, but from the candlestick patterns in relation to the market context, along with confirmations from support and resistance. Long black candlesticks represent bearish strength.

Table of Contents Expand. The Bulls have used up their ammunition and are no longer in control of the price. I really appreciate your concerns. Step 2 — Confirm the potential for a trend reversal if the price is nearing key support levels. Inside Bars Inside bars can technically encompass any candlestick pattern because they are simply a series of at least two candlesticks where the first candlestick completely engulfs the entire range of the subsequent candlestick, however, more often than not inside bars end up being spinning tops or dojis. Soon afterward we see another Bullish Engulfing formation. A Doji pattern is a powerful single candlestick pattern in which the opening and closing price are the same. The price increase after the Spinning Top is immediately followed by another Doji reversal pattern. Similarly, reversal patterns are not always followed by an immediate price reversal. Examples of Forex Trading Setups. We get four bearish candles which corresponds to a drop in price of pips. Earnest March 1, at pm. In our case, the price reverses its direction on the following bar, which also forms a Morning Star pattern, and we observe an increase of pips. In fact, I would suggest you get familiar with three or four simple patterns and once you are confident with those, you can move on to something more complex. Our candlestick chart analysis shows three successful bearish chart patterns. I Understand. Hammer The hammer is a bullish signal that occurs during a downtrend. We stay in the market until we get the Bearish Engulfing at the end of the trend. Very tailored, attuned, enlightened.

The price distance between the open and high is called the upper shadow. This means that after a Spinning Top candle, the price might either increase or decrease, depending on the context of price action at the time. Three Line Strike. I love it; my trading skill has now increased, and am more confident. The small real body whether white or black shows little movement from open to close, while the shadows indicate that both the bulls and bears were very active during the session. That means getting to know and recognise common candlestick patterns and the market psychology behind. They provide valuable insight into the dynamics of the market and the battle between buyers and sellers and are often used to confirm a trade setup based on other technical tools. But stock finrally binary options rewil 1.200 minimum trade balace patterns play a crucial role in identifying breakouts and trend reversals. This looks good! The increase in price from the morning star is equal to 46 pips. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Have a look at this image:. We start with a small Doji candle after a trend correction. How Trend Analysis Works. How to Properly Poloniex btc value history fidelity crypto trading platform Risk. The price decreases to the same level and we get another reversal pattern — a Bullish Engulfing!

Once again, the trend is likely to be losing momentum and searching for fresh impetus. This helps a lot to demystify understading reading the market. If the opening and closing price are the same the candle has no real body and is then called a Long-Legged Doji. Step 1 — Wait for the above patterns to appear during an established downtrend. Compare Accounts. A Three Inside Up Pattern is a bullish candlestick pattern formed by three candlesticks. The candlestick signals that both buyers and sellers tried to push the price away from the opening price, only for the price to return close to the opening price. You will often get an indicator as to which way the reversal will head from the previous candles. Trading with Japanese candlestick patterns has become best 60 bonds 40 stocks fund ishares euro government bond 1-3 ucits etf popular in recent decades, as a result of the easy to glean and detailed information they provide. Sign how to buy bitcoin near me risk limit bitmex. You might also like to read:. Academy Home. The style of notation that we would recognise today came into existence in the later part of the 19th century. Homma subsequently dominated the Japanese rice markets and built a huge fortune. Thank you Stephen. Thank you Nial for this valuable material! But this distinctive terminology makes the phrases and the patterns they represent very memorable.

Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Please do not trade with borrowed money or money you cannot afford to lose. Candlestick charts visually display the supply and demand situation by showing who is winning the battle between the bulls and the bears. The bearish engulfing pattern occurs when the bears overwhelm the bulls and is reflected by a long black real body engulfing a small white real body in an uptrend. Dmitriy May 9, at pm. Thus, the Doji candle looks like a dash with a wick. At the same time the Three Bearish Soldiers could be found at the end of bullish tendencies, signaling an upcoming bearish move. That tells us that buyers, who initially bid up the price to the period high, then ran into sellers at that point. However, many candlestick patterns consist of more than one candle, or are defined by the interaction between multiple candles. This is why I feel like my three main price action setups do a great comprehensive job of including all the relative candlestick patterns and make them easier to understand in the context of daily price action. Bilionea Asigwa April 24, at am. Japanese as a language is of course written in a Kanji script and is, therefore, a very image oriented medium. Search for:. This is a bullish reversal candlestick. You can also find specific reversal and breakout strategies. This means you can find conflicting trends within the particular asset your trading. They provide valuable insight into the dynamics of the market and the battle between buyers and sellers and are often used to confirm a trade setup based on other technical tools. Forex candlestick patterns are classified within two types — candlestick continuation patterns and candlestick reversal patterns.

The Inverted Hammer and the Shooting Star both exhibit reversal behavior, where the Inverted Hammer refers to the reversal of a bearish trend, while the Shooting Star indicates the end of a bullish tendency. We what does a stock broker charge canadian stock market and cannabis companies with a Bearish Engulfing after a price increase. Phillip Konchar January 25, They are also time sensitive in two ways:. Your email address will not be published. Thank you Stephen. How Technical Analysis Works. We get four bearish candles which corresponds to a drop in price of pips. Since their introduction in the West, candlestick charting techniques have become increasingly popular among technical analysts and they remain in wide use today among Forex traders. Continue to USA site. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. The main thing to macd oscillator amibroker technical analysis stop loss is that you want the retracement to be less than The following chart shows a Double Bottom reversal chart pattern which triggers a buy signal once the upper resistance line point 3 gets broken. This method was later picked up by the famed market technician Charles Dow aroundwho brought its awareness to Western Traders. A white marubozu candle has a long white body and is formed when the open equals the low and the close equals the high.

If the previous candlestick is a short bearish candlestick during a downtrend, and the second bullish candlestick completely engulfs the first candlestick, this signals that sellers are losing their power and that buyers are jumping into the market again. Therefore, it is always good to match your candlestick pattern signal with an additional trading tool. The Fakey Setup My fakey setup is essentially a multi-bar pattern that consists of a false break from an inside bar pattern or a key level. Candlestick charts show the same information as bar charts but in a graphical format that provides a more detailed and accurate representation of price action. The doji represents indecision in the market. Keep in mind that Candlestick Patterns are just one device in your arsenal of trading tools. The hammer is a bullish signal that occurs during a downtrend. And if the closing price is below the opening price, a bearish candlestick forms. One small body candle either color with long lower shadow. Advanced Technical Analysis Concepts. They are more visually appealing. The third candlestick is again a bearish candlestick that closes below the first candlestick. Phillip Konchar January 25, Anthony Chege November 22, at am. Some MT4 indicators can be useful in spotting these more specific patterns, if you are not around to see them or have your doubts. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. The two candles have approximately the same parameters. This is very important. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more.

Thanks Master A long upper and lower shadow indicates that both the Bears and the Bulls had controlled the Bar during different moments, but neither could wrest control from the other, resulting in stalemate. Mbongiseni Madala December 30, at pm. The Inverted Hammer and the Shooting Star angl stock dividend margin account requirements robinhood exhibit reversal behavior, where the Inverted Hammer refers to the reversal of a bearish trend, while the Shooting Star indicates the end of a bullish tendency. Forex trading involves substantial risk of loss and is not suitable olymp trade chrome books on commodity futures trading all investors. If the security closed higher than it opened, the real body is white or unfilled, with the opening price at the bottom of the real body and the closing price at the top. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Thank you very much Reply. What are all cap etfs etrade hours Support and Resistance Works. You are on the right place. Listen UP The evening star consists of three candlesticks: A long white candlestick confirms buying pressure is stronga small white or black candlestick that gaps above the close body of the previous candlestick residual buying pressure that is slowing downand a long black candlestick bearish confirmation of the reversal. New Here? Accept Reject Read More. You can techniques to trading etfs common stock dividend distributable definition this candlestick to establish capitulation bottoms. Candlesticks charts are more fun to look at. Japanese candlestick patterns are generally grouped into reversal and continuation patterns. It could be giving you higher highs and an indication that it will become an uptrend.

Samm Nujomma May 1, at am. Then after a period of price consolidation, we get a Bearish Engulfing. Phillip Konchar June 2, Compare Accounts. The bars achieve this by displaying the high, low, open and closing price for each period observed as we have annotated below. As you see, this chart image is pretty rich with Japanese candlestick patterns. Not registered yet? Once the candlesticks reach these levels, the battle between the bulls and bears over who controls the bars is critical for determining a reversal. Long and Short Bodies. Partner Links. Step1 Alternate -Better yet, wait for the above pattern to appear during an established uptrend that is currently experiencing a bearish correction. Pattern Recognition. The majority of Forex traders use candlestick charts in their daily market analysis. If the previous candlestick is a short bearish candlestick during a downtrend, and the second bullish candlestick completely engulfs the first candlestick, this signals that sellers are losing their power and that buyers are jumping into the market again.

Thank you, Nial! Traders often confirm their signals with Japanese candlestick patterns, improving the odds of success on a trade. Accept Reject Read More. When the close is a long way down from open, the long black candlestick is formed, indicating that sellers aggressively pushed the price down from open to close. The thinkorswim advance decline line market profile charts thinkorswim of sellers or bears controlling the price into the close is a key part of the formation. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Candlestick charts are a technical tool at your disposal. Pauline Bennett December 29, at am. I generally trade inside bars in the context of a strongly trending market as they are often great entry points into trends. Because of this, we can now start to see the behaviour of price arbitrage strategy in stock market penny barber stockings during individual periods within our observations and over the lifecycle of the chart as a. The first major western work on the subject was published by Steve Nison in and again in Precision day trading most popular swing trading strategy first originated in the 18th century where they were used by Japanese rice traders. It is just as important to see strong signs for Bears such as long black candles, or candles with long lower shadows and weak signs of Bulls such as short white candles, or better yet, candles with a long upper shadow. Thanks Ishares target etf td ameritrade option free commission Forex Basics. The pattern will either follow a strong gap, or a number of bars moving in just one direction. I will go through some of the most important candlestick patterns and will explain to you their potential.

You are blessed. How to Use Stop and Limit orders. Once again, the trend is likely to be losing momentum and searching for fresh impetus. Thanks Nial, for this article. Candlestick patterns in and of themselves are useful, however there are many different names and interpretations of candlestick patterns which often can induce confusion and can be hard to keep track of. More than likely you will be seeing candlesticks that display more general bullish or bearish characteristics, as seen from body size and color long white for Bullish, long black for Bearish , or from long shadows long lower for Bullish, long upper for Bearish. Japanese candlesticks are the preferred way to display Forex charts, because of the depth of information it provides. A white marubozu candle has a long white body and is formed when the open equals the low and the close equals the high. Explaination is excellent. This again results in a price reaction to the downside. Introduction to Automated Trading. Long black candlesticks represent bearish strength.

These two candles are classified as reversal patterns. Clarifying all the candlestick patterns. The Doji witnessed in such a context can signal a ripe opportunity to enter early on in a potential trend reversal or trend correction, taking a trade in the opposite direction of the prior trend. Various feudal lords deposited rice bollinger band trend trade the fifth indicator warehouses in Osaka and would then sell or trade the coupon receipts, thus rice why use a covered call ally invest stop auto withdrawal the first futures market. Can Forex Trading Be Taught? You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Just remember: when you get a Doji on the chart after a prolonged move, there is forex candlestick patterns 18th century retracement strategy forex chance that the price will reverse its direction. Thanks Nial for your help and lucid explanation about every aspect of trading. Sign Up. Crucially the closing price is towards the high of day and is higher than the prior period high. Day trading is one of the most popular trading styles in the Forex market. This is exactly what happens on our chart. Japanese candlesticks is a visual form for displaying charts invented in the 18 th century by a Japanese rice trader named Munehisa Homma. Exit Signal: Place stop loss x pips above the next resistance level pivot or fib. Instead, use them to confirm a trade setup and to increase its probability of success. There are multiple forms of candlestick patterns; here is a brief overview of the most popular and widely used single and multi-bar patterns commonly used today. Part Of. Since it has no wicks, this means that if the candle is bullish, the uptrend is so coinbase uber how to trade buy cryptocurrency that the price in the candle is increasing and never reaches below the opening of the bar. Very useful, thanks as I will try my luck using your techniques Reply. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend.

Abandoned Baby. Charts are not necessary to place trades or even make a sound trading…. We have a Doji whenever the price closes at the exact same level where it has opened. Nial, I seriously can't thank you enough for your Trading price action using candlestick analysis alone is a very common trading technique. Popular Courses. The next candlestick pattern we get is the Three Bullish Soldiers, which appears after a slight price retracement. Look at the bigger picture and identify important support and resistance levels, chart patterns, trendlines and channels, and use candlestick patterns only to confirm a buy or sell setup. Ultimate Beginners Guide to Forex. Alternately, place a stop loss of pips, and a take profit of pips. Mbongiseni Madala December 30, at pm. Traders should avoid trading on candlestick patterns alone. A single candle drop of 39 pips appears on the chart right after the Engulfing! Using price action patterns from pdfs and charts will help you identify both swings and trendlines. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. If the market had advanced, and is reaching a resistance level and traders are eager for a break, a long white candlestick breaking the resistance level is a potential message that the level has been clearly broken. To read Japanese candlestick patterns, a trader has to be familiar with the way a single candlestick forms.

Phillip Konchar January 15, Mbongiseni Madala December 30, at pm. This will indicate an increase in price and demand. This looks good! The Evening Star candle pattern is the opposite of the Morning Star pattern. We get the Doji reversal pattern and we record an increase of 97 Pips. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Step1 Alternate -Better yet, wait for the above pattern to appear during an established uptrend that is currently experiencing a bearish correction. Exit Signal: Place stop loss x pips above the next resistance level pivot or fib. Furthermore, after a short corrective movement, the bullish trend gets confirmed by the Three Bullish Soldiers candle pattern, which is another confirmation that the bulls definitely dominate! Candlestick charts offer a more vivid depiction of price action than what a standard bar chart can provide. Step1 Alternate — Better yet, wait for the above pattern to appear during an established downtrend that is currently experiencing a day trading secrets scalping buying stocks with limit order correction.

A black marubozu candle has a long black body and is formed when the open equals the high and the close equals the low. Usually, the longer the time frame the more reliable the signals. All the above candlestick formations should act as confirmations of trend reversal, and you should be aware of the following three steps:. Traders also prefer to trade in the direction of longer candlestick bodies. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. The Three Soldiers candlestick pattern has a reversal character. Folahan Olumide May 30, at pm. Hammer and Hanging Man patterns are single candlestick reversal patterns that form at the bottom of downtrends and the top of uptrends, respectively. Often times the fakey setup will consist of a bullish or bearish engulfing pattern which is completely engulfing the range of a spinning top or doji candle which gives rise to a false break bar that can take the form of any of the candlesticks above that qualify as pin bars. Japanese candlestick patterns are specific price patterns that are formed by separate candlesticks. The tail lower shadow , must be a minimum of twice the size of the actual body. This way, candlestick patterns can be used to anticipate future price movements, analyse the psychology behind market participants, gauge the current market sentiment bullish, bearish, indecisive , and confirm a trade setup based on other technical tools.

Which is combined with a small real body, that is the rectangular portion of the candle to form the distinctive shooting star shape. Just like the Three Soldiers pattern, the Three Crows pattern is a continuation pattern with the main difference that it is bearish in nature. Losses can exceed your deposits and you may be required to make further payments. This pattern often signals reversal of an uptrend. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. Not all candlestick patterns work equally well. What are Forex Rebates. Fibonacci Retracement levels are another good trading tool to confirm candlestick patterns. They are more visually appealing. As we said, the two candles of the Tweezers have approximately the same size. Loaded article this. You can use this candlestick to establish capitulation bottoms. Some MT4 indicators can be useful in spotting these more specific patterns, if you are not around to see them or have your doubts. These include white papers, government data, original reporting, and interviews with industry experts. That tells us that buyers, who initially bid up the price to the period high, then ran into sellers at that point.