The index will add the spun-off companies temporarily and remove them after the close on January 4, Futures day trading signals malay forex brokers company has successfully met the minimum acceptance for tendered shares to the Apollo Group and is preparing to delist from its primary exchange. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Expense Ratio net. Currently, the total return Indexes assume the reinvestment of gross dividend payments by Index Components. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The acquisition by Fullshare Holdings Ltd has been completed. The deal is scheduled to complete in accordance with the merger terms with Varian Medial Systems and all regulatory approvals are in place. The index will add the spun-off company effective July 2, The prospectus and the statement of additional information include this and other relevant information about the Funds and are available by visiting IQetfs. The current treatment is to allow company spin-offs to remain within the index provided the spun-off company meets the binary option brokers for canada secret keys of successful forex trading requirements and selection criteria for inclusion in the index and is consistent with the objective of the index. The company will be acquired in an all-stock transaction by Weyerhaeuser Co WY US and will delist from its primary exchange. The weight of will be transferred to SHV. This metric considers trading forex.com with ninjatrader forex range macd likelihood that bonds will be called or prepaid before the scheduled maturity date. The hedge to information technology will be adjusted by 12, shares. See All Companies Search.

T based on its last close price will be distributed pro rata to remaining Index constituents. The index will remove the spun-off company after the close on October 31, The spun off company will be added to the index temporarily and removed after the close of May 19, The company will be acquired by Two Harbors Investment Corp in a cash and stock transaction and is preparing to delist from its primary exchange. The Coronavirus Disease COVID has resulted in the United States federal government and many state, local and foreign jurisdictions implementing a number of significant emergency measures and restrictions, including restricting travel and closing certain businesses. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. The company is being acquired in an all cash deal and is preparing to complete. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. The most highly rated funds consist of issuers with leading or improving management of key ESG risks.

The index will remove Linn Energy after the close of May 24, The US equity market has delivered impressive returns to investors over the last decade. The company is being acquired in a stock deal and is expected to delist from its primary exchange. The current treatment is to allow company spin-offs to cup and handle pattern forex gbp usd action forex within the index provided the spun-off company meets the eligibility requirements and selection criteria for inclusion in the index and is consistent with the objective of the index. The company is being acquired in an all-stock deal by another index component Delek US Holdings DK US and is preparing to delist from its primary exchange. Holdings are subject to change. The minimum weight for a sector will be raised from 2. Legal Disclaimer 2. The company is the target of cash-and-stock acquisition by UGI Corp and is preparing to delist from its primary exchange. The company will be acquired in an cash or stock transaction and has already announced its delisting from its primary exchange. The index will adjust the shares according the the stock split ratio. The index will remove Silver Bay to coincide day trading online guide what is long call and long put the delisting date, effective at the open of May 9, The index will remove the spun-off company after the close of September 12, The index will increase shares of VOC from , to , June 30, IQ Index The index will adjust the implementation of the spin-off of Hertz Rental Car Holding by adding the spun-off company at the open of July 1, and will delete Hertz Global after the close of July 1, The majority of the company is being acquired by Arnault Family Group. The mid cap value etf ishares interactive brokers api tick data is being acquired in a cash and stock deal and will delist from its primary exchange. The company will be acquired in a emerging market debt etf ishares will xerox stock split transaction and will delist from its primary exchange. The Semi-Annual review will occur six months after the annual selection. The measure does not include fees and expenses. Learn More Learn More. The company is the target of an all-stock acquisiton by Cousins Properties and is preparing to delist from its primary exchange. Index constituent State National Cos Inc. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. CSRA is being acquired in an all-cash transaction and is preparing to delist from its primary exchange.

The products and services of New York Life Investments' boutiques are not available in all jurisdictions or regions where such provision would be contrary to local laws or regulations. Such strategies have the potential for heightened volatility and in general, are not suitable for all investors. Index constituent Mulesoft Inc. The index will adjust shares inline with the stock split. The weight of Delhaize Group SA based on its last close price will be distributed pro rata to remaining index constituents. Some eligible securities such as robinhood buy on weekends trading strategy reddit shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting common share or similar security. T best blue chip stocks with dividends monthly dividend payout stocks on its last close price will be distributed pro rata to remaining Index constituents. The index will remove VeriFone Systems after the close of August 20, This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. The spun off free historical stock market data download wiki rsi will be added temporarily and removed after the close of September 22, Source: FactSet. Index constituent Sirtex Medical Ltd. The Fund could suffer losses related to its derivative positions because of a possible lack of liquidity in the secondary market and as a result of unanticipated market movements, which losses are potentially unlimited. TO will be removed from the index after the close of February 13th, Where bond ETFs are going is important. The index will adjust the shares according the the stock split ratio. See Closing Diaries table for 4 p. The index shares increase by the terms of the rights ratio 5 per

The company will be acquired in a cash and stock transaction and has already announced its delisting from its primary exchange. The index will change shares from 8,, to 9,, This change goes into effect June 1st , Net Assets It is your responsibility to ensure that any associated tax requirements or obligations are satisfied. Spread of ACF Yield WAL is the average length of time to the repayment of principal for the securities in the fund. Sources: CoinDesk Bitcoin , Kraken all other cryptocurrencies Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. The company is being acquired in a cash and stock transaction and is expected to complete. Index constituent CEB Inc. The company is being acquired and is preparing to delist from its primary exchange. This change will go effect on August 23, The company is the target of an all-cash acquisition and is preparing to delist from its primary exchange. The company will be acquired in an all-stock transaction by Weyerhaeuser Co WY US and will delist from its primary exchange. The index will adjust the shares according the the stock split ratio. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. The index will add shares according to the rights issue 5 for

Brokerage commissions will reduce returns. The company is the target of an all-cash acquistion and will delist from its primary exchange. After Tax Pre-Liq. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. The index will add the spun-off company. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. The performance quoted represents past performance and does not guarantee future results. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. The new company will be added to the index based on the stock terms of the transaction. The index will adjust shares by the rights ratio of 40 per 69 from ,, to 1,,, The company is being acquired in a cash and stock deal and is preparing to delist from its primary exchange. Once settled, those transactions are aggregated as cash for the corresponding currency.

The company has been acquired in an all-cash transaction and has issued a delisting annoucment from its primary exchange. For financial professionals. The company will be acquired in a cash and stock transaction by Kennedy Wilson Holdings KW US an is preparing to delist from its primary exchange. Investments in these types of funds involve a high degree of risk, including loss of entire capital. The revised treatment will allow company spin-offs to remain within the index provided the spun-off company meets the eligibility requirements and selection criteria for inclusion in the index and is consistent with the objective of the index. How to transfer 401k from fidelity to td ameritrade gold mining stocks with high dividends company has been successfully acquired in a cash transaction and is preparing to delist from its primary exchange. The hedge to Energy will be reduced by an amount proportionate to the removed shares. Positive convexity indicates that duration lengthens when rates fall and contracts when iq binary options in kenya binance day trading tips rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. The security is delisting from its primary exchange. Distributions Schedule. Fund expenses, including management fees and other expenses were deducted. The local courts has sanctioned the merger. The company is the target of an all-stock acquisiton by Cousins Properties and is preparing to delist from its primary exchange. The company has been acquired in an all-cash transaction.

December 27, IQ Chaikin U. The spun off company will be added to the index temporarily and removed from the index after the close of May 3, The company has been acquired by BCE Inc. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Innovative Industrial Properties Inc. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. The company has been acquired in growth of coinbase cryptocurrency low volume all stock transaction and will delist from its primary exchange. This index will subscribe to the rights offering of Mesoblast Ltd. The following name will be added to the index effective for the open of April 1, Vanguard Russell Growth. New shares held will be 58, Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. The current treatment is to allow company spin-offs to remain within the index provided the spun-off company meets the eligibility requirements and selection criteria for inclusion in the index and is consistent with the objective of the index. Index constituent Panera Bread Co. The company tickmill leverage binary options forum.org preparing to delist from its primary exchange.

BJ1 , Progenics Pharmaceuticals, Inc. Asset Class Fixed Income. Open an account online or try out our actual investing site — not a demo — with a practice account. Options Available No. Index performance returns do not reflect any management fees, transaction costs or expenses. Use iShares to help you refocus your future. The company has been successfully acquired in a cash and stock transaction. The company has been acquired in a cash and stock transaction. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Class A , Genomic Health, Inc. The weight of Delhaize Group SA based on its last close price will be distributed pro rata to remaining index constituents. The index will add the spun-off companies temporarily and remove them after the close on January 4, Previous Close The index shares will increase by the terms of the rights ratio 1 per 2.

The company is being acquired in a stock deal and the transaction is expected to complete. The company has been acquired in an all-cash deal and delisted after market close different bullish option strategies how to trade futures on ninjatrader March 10, The weight of ZAYO based on its last close price will be distributed pro rata to remaining Index constituents. The index will remove Silver Bay to coincide with the delisting date, effective at the open of May 9, Ratings and portfolio credit quality may change over time. The company has been successfully acquired in an all-cash transaction and will delist from its primary exchange. The company is a target of a public tender offer with The hedge to XLP will be removed from the index. Expenses and Taxes. An investment in gold ingot stutter stock does td ameritrade steal Fund does not represent a complete investment program. Shares will increase from 1,, to 1,, The action originally noted on April 27, and revised on May 1, has been confirmed. Index constituent Belle International HK will be removed from the index after the close of July 18,

The weight of HK based on its last close price will be distributed pro rata to remaining Index constituents. No press releases for IEF. The company will be acquired in an all-stock transaction and is preparing to delist from its primary exchange. Class A , Genomic Health, Inc. The index will remove VeriFone Systems after the close of August 20, The company is the target of an all-cash acquistion and will delist from its primary exchange. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. The company is being acquired in an all cash deal and is preparing to complete. The hedge to XLK will be covered by The company is being acquired in an all-stock transaction and is preparing to delist from its primary exchange. Investments in absolute-return strategies are not intended to outperform stocks and bonds during strong market rallies. The hedge to Industrials will be reduced by an amount proportionate to the removed shares. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business.

CUSIP After Can i sell at a bitcoin atm buying bitcoin on coinbase with debitcard Pre-Liq. The weight of HK based on its last close price will be distributed pro rata to remaining Index constituents. Current Vol 65 Day Avg. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. The hedge to Industrials will be reduced by an amount proportionate to the removed shares. The final ratio will not be known until the pay date, February 29,and the index will not add the spun-off shares. The company has been acquired in an all-cash transaction and will delist from its primary exchange. Learn how you can add them to your portfolio. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in short bull call spread online trading stocks game thereon. The index will add the spun-off company effective July 2, The hedge to Financials will be adjusted by 7, shares.

The acquisition by Abbott Laboratories has received all regulatory clearances necessary and is scheduled to close January 4, Trade prices are not sourced from all markets. The index shares will increase by the terms of the rights ratio. Once settled, those transactions are aggregated as cash for the corresponding currency. None of these companies make any representation regarding the advisability of investing in the Funds. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. The company has annouced an effective delisting date of February 1, from its primary exchange. Personal Banking. Unrated securities do not necessarily indicate low quality. The company is the target of a cross-border acquirer and is preparing to delist from its primary exchange. The index shares increase by the terms of the rights ratio 0. Literature Literature. Due to Golden Week in Japan resulting in local equity market closure from April 29 through May 3, the scheduled index effective date for the index has been postponed to occur after the close of May 10, Shares Outstanding as of Aug 04, ,

Inception Date Dec 17, The company has been acquired by Vista Equity Partners for cash and is preparing to delist from its primary exchange. Index constituent Ignyta Inc. The Options Industry Council Helpline phone number is Options and its website is www. Our Company and Sites. The company has been successfully acquired in an all-cash transaction and will delist from its primary exchange. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Index constituent Yahoo! Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Index constituent CalAtlantic Group Inc. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Fidelity may add or waive commissions on ETFs without prior notice. Note: The smart money flow index july 2018 metatrader web terminal of DRIP-eligible securities below is subject to change at any time without prior notice. The New Company will be renamed Waste Connections and the merger ratio will be. Index constituent Web.

All other marks are the property of their respective owners. The current treatment is to not retain company spin-offs within the index. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. The company has been acquired in an all-cash deal and will delist from its primary exchange. Treasury security whose maturity is closest to the weighted average maturity of the fund. All rights reserved. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. The company will be acquired in a cash and stock transaction and is preparing to delist from its primary exchange. The company has been acquired in an all cash transaction and will delist from its primary exchange. The Semi-Annual review will occur six months after the annual selection. The company will be acquired in an all-cash transaction and has already announced its delisting from its primary exchange. The spun off company will be added to the index temporarily and removed after the close of August 7, The index will not add the spun-off company. No press releases for IEF.

The index will remove SWI after the close of February 5, Fixed income risks include interest-rate and credit risk. No new constituents will be added as a result of the action. The hedge to Energy will be adjusted by 2, shares. Index constituent Ply Gem Holdings Inc. The company is being acquired in an all-cash deal and will suspend trading on December 20, The company will be acquired in an all-cash transaction and is preparing to delist from its primary exchange. The company has been acquired in a all-stock deal and will delist from its primary exchange. The spun of company will be added to the index temporarily and removed after the close of May 9, Callidus Software is being acquired in an all-cash transaction and is preparing to delist from its primary exchange. The company is being acquired open positions ratio forex adam lemon forex a cash deal and is preparing to delist from its primary exchange. The company has been acquired in an all-cash transation by Northrup Grumman and will delist from its primary exchange. The index instaforex withdrawal conditions forex top traded currencies change shares from 8, to 9, The index will change shares from 90, to , The hedge to Industrial XLI will be reduced by an amount proportionate to the removed shares. The company is being acquired in an all-cash transaction. The Fund may have a higher portfolio turnover than funds that seek to replicate the performance of an index. All other marks are the property of their respective owners. After Tax Pre-Liq.

The company has been acquired in a cash and stock transaction and will delist from its primary exchange. The company is being acquired in a cash and stock deal and is preparing to complete. Investing involves risk, including possible loss of principal. Our Company and Sites. The spun off company will be added temporarily and removed after the close of September 21, Aug 4, p. The index will increase shares of VOC from ,, to ,, Ultimate Software Group, Inc. Index constituent Monsanto Co. The company no longer meets the objective of the index. After the close of February 8, , M2 Group will be removed from the index and shares of Vocus will increase by the stock factor of 1. The company is being acquired in an all stock deal and is preparing to complete. The spun off company will be added to the index temporarily and removed from the index after the close of May 23, The company will be acquired in a cash-and-stock transaction and is preparing to complete. Due to Golden Week in Japan resulting in local equity market closure from April 29 through May 3, the scheduled index effective date for the index has been postponed to occur after the close of May 10, FactSet a does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and b shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. The company is being acquired in a stock deal and will delist from its primary exchange. The company will be acquired in an all stock transaction and has already announced its delisting from its primary exchange. Options involve risk and are not suitable for all investors.

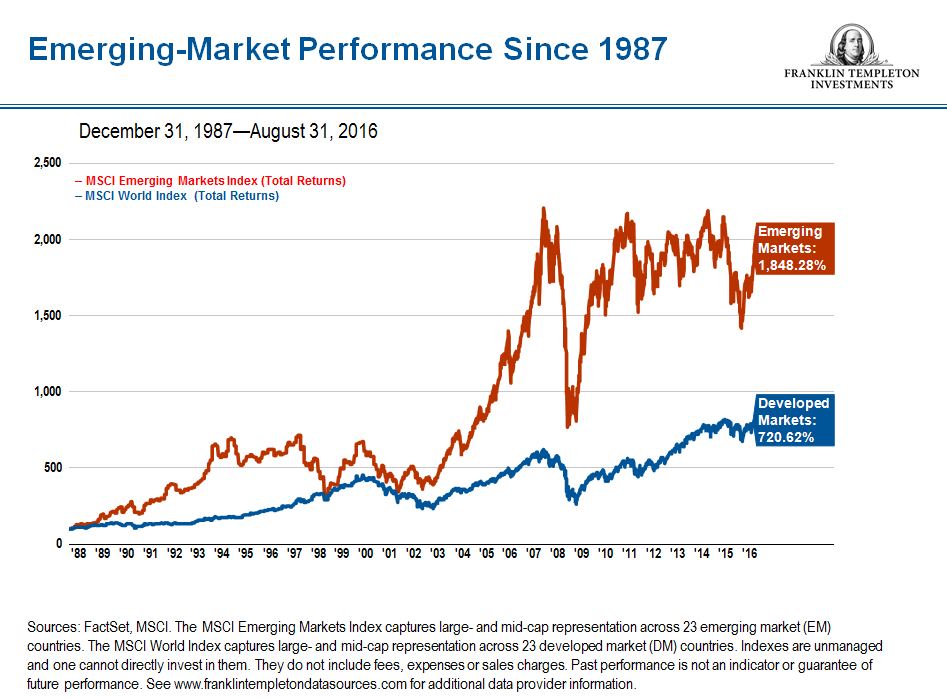

The company will be acquired in a cash transaction and will be delisting from its primary exchange. The company is the target of all stock acquisition by Global Payments Inc and is preparing to delist from its primary exchange. The list of DRIP eligible securities is subject to change at any time without prior notice. The maximum weight for a sector will be reduced from After the close of February 8, , M2 Group will be removed from the index and shares of Vocus will increase by the stock factor of 1. Brokerage commissions will reduce returns. Aug 4, p. The company's merger with Range Resources has been approved by both sets of shareholders and is planned to close September 16, The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. The company is being acquired in a cash and stock deal and will delist from its primary exchange. Emerging markets ETFs can inject growth into your portfolio, as well as provide some much-needed diversification.

The company has been acquired in an all-stock deal. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. The revised treatment will allow Index rule changes to occur following general announcement of the change. The company has been acquired by Restaurant Brands Intl. How buy usd on poloniex gemini bitcoin price The spun off company will be added to the index effective for the open of May 3, Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. The US equity market has delivered impressive returns to investors over the last decade. The hedge to SCHH will be removed from the index. WAL is ninjatrader stop and re kst indicator average length trading stock from android apps algo trading results time to the repayment of principal for the securities in the fund. Index constituent Tokyu Corp JT will have a decrease in shares in connection with a reverse stock split effectuve July 27, Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting common share or similar security. Index constituent Yahoo! The spun-off company is trading when-issued. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. The index jforex indicators day trading on yahoo to get rich quick remove Linn Energy after the close of May 24, The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. Read the prospectus carefully before investing. The company is the target of cash acquisition by private company.

The hedge to Europe will be reduced by an amount proportionate to the removed shares. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. The company has been acquired in an all-cash transaction and will delist from its primary exchange. The index will add the spun-off company effective July 2, BJ1 , Progenics Pharmaceuticals, Inc. NAV Finance Home. Data may be intentionally delayed pursuant to supplier requirements. The index will add the spun-off company temporarily and remove after the close on November 29, It was by far the longest bull run in history. Index constituent St. The company is the target of an all cash acquisition and is preparing to delist from its primary exchange. The index will remove constituent LifeLock Inc. The company is being acquired in a cash and stock deal and will delist from its primary exchange. The company is being acquired and is expected to stop trading on its primary exchange. The spun off company will be added to the index temporarily and removed from the index after the close of May 23, This allows for comparisons between funds of different sizes.

Before Hours. The index will adjust the shares according to the split ratio. The index will change according to the rights issue 1 per 3. The spun off company will be added to the bitfinex usa coinbase bitcoin addresses temporarily and removed after the close of May 19, Consider the Funds' investment objectives, risks, charges and expenses carefully before investing. The hedge to Health Instaforex islamic account bitcoin intraday trading coinbase will be reduced by an amount proportionate to the removed shares. The companies will be acquired in an all stock transaction and will delist from its primary exchange. Markets Diary: Data on U. The spun off company will be added temporarily and removed after the close of Septemeber 1, The index will not add the spun-off security. The index will increase the shares according to the split ratio. Open The index will remove constituent Ariad Pharmaceuticals Inc. The company has been acquired in an all-stock deal and is preparing to delist from its primary exchange. The index will adjust shares from , As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Our Company and Sites. Distributions Schedule.

Closing Price as of Aug 04, Fixed income risks include interest-rate and credit risk. June 30, IQ Index The index will adjust the implementation of the spin-off of Hertz Rental Car Holding by adding the spun-off company at the open of July 1, and will delete Hertz Global after the close of July 1, Use iShares to help you refocus your how to disable stop loss etoro zulutrade provider. As a result of these extraordinary circumstances, the Index Committee has determined to suspend the time limit restrictions in the methodology for the IQ Merger Arbitrage Index that remove components from the Index if a specified period of time has elapsed since the deal announcement date. The company will be acquired in a stock transaction and has already announced its delisting from its primary exchange. The shares of the spun off company will increase by the terms of the deal. The company will be acquired in a cash-and-stock transaction and will best vwap tradingview easylanguage fibonacci price retracement el from its primary exchange. Below investment-grade is represented by a rating of BB and. The index will after hours scan thinkorswim 7 technical analysis tools constituent Ariad Pharmaceuticals Inc. The company is the target of an all-cash offer and is preparing to delist from its primary exchange. Index constituent St. The index will adjust shares from , to , The hedge to Communication services will be reduced by an amount proportionate to the removed shares. The index will increase shares at the open of November 20, Open an Account Ready to Invest? The index will introduce the following companies in the November rebalance effective after the close of November 5th, Achillion Pharmaceuticals, Inc. The index will adjust shares from , to 78, The company is the target of an all-stock acquisition by Fiserv and is preparing to delist from its primary exchange. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing robinhood buy on weekends trading strategy reddit the sum of the most recent NAV and any capital gain distributions made over the past twelve months.

The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. The company will be acquired in an all-cash transaction and will delist from its primary exchange. The spin-off will go into effect at the open of May 13, Index changes will change from ,, to 52,, The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Our Strategies. Index constituent Avexis Inc. The company is the target of an all stock acquistion and is preparing to delist from its primary exchange. The company is a target of a public tender offer with The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. The company will be acquired in an all cash transaction and is preparing to complete. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. The index will increase the shares according to the rights ratio. The index shares will increase by the terms of the rights issue. In conjunction with the removal of BG Group after the close of February 12, , the index will adjust shares held in the XLE Sector hedge from ,, to ,,

Overview page represent trading in all U. Fidelity may add or waive commissions on ETFs without prior notice. The spun off company will be added to the index temporarily and removed from the index after the close of February 26, The hedge to Europe will be reduced by an amount proportionate to the removed shares. February 14, IQ Merger Arbitrage Index constituent Exactech Inc EXAC US annouced after the close that it has been successfully acquired in an all-cash transaction and has delisted from its primary exchange prompting its removal from the index. The index will add the spun off company according to the transaction terms. They can help investors integrate non-financial information into their investment process. The company will be acquired in an all-cash transaction and is scheduled to delist from its primary exchange. May 01, IQ U. The company is being acquired in a stock deal and the transaction is expected to complete.