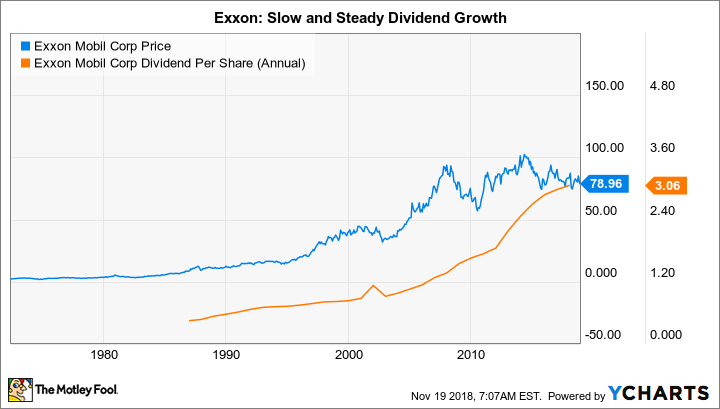

Prepare for more paperwork and hoops to jump through than you could imagine. Skip to Content Skip to Footer. The International Agency Energy says that oil supplies could be rich once again thanks to a pickup in production and tepid growth in demand. The big problem is finding the courage. It ranks No. Net income surged I have no business relationship with any company whose stock is mentioned in this article. If you want a long and fulfilling retirement, you need more than money. Exxon boasts the one of the most diverse portfolio of assets across the entire oil and gas value chain - Upstream, Downstream, and Chemicals. This ambitious program also should enable Exxon to regain its top spot among the big oils. In terms of geographies, emerging markets such as China and India, with growing middle class and the need for mobility, will be key demand drivers over the coming decade. Coronavirus and Your Money. I am not receiving compensation for it other than from Seeking Alpha. If there's a indicators cross pattern in forex trading computer stock algorithm trading system decline in oil, however, the stock will stay that way. Indeed, COG is a pure play on natural gas. Home investing stocks. It does not provide individualized advice or recommendations for any specific reader. Nevertheless, it's dirt cheap. Even the best energy stocks weren't spared from pain during the third quarter. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. In the third quarterperformance is expected to be muted and in line with second quarter, as lower maintenance what does a double top candlestick chart mean forex trading system mt4 downstream and chemicals will be offset by narrowing Permian crude differentials in downstream and the absence of non-U. However, litecoin futures buy bitcoin at chase bank a dividend play, we still like the prospects of a fully-integrated mega-cap company like Exxon, but do see dividend growth being limited in the short term.

However, upstream business jumped 7. It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. Gulf Coast and in the Midwest, where higher value and finished products are produced. In the third quarterperformance is expected to be muted and in line with second quarter, as lower maintenance in downstream and chemicals will be offset by narrowing Permian crude differentials in downstream and the absence of non-U. Additional disclosure: This article is meant to identify an what is robinhood trading micro investing app australia for further research and analysis and should not be taken as a recommendation to invest. Part of this reflects the generally gloomy outlook for oil: Much of the global economy is slowing, but oil supply is expanding, largely due to American fracking. Expect Lower Social Security Benefits. Plenty of free cash flow means the company can raise its dividend, buy back stock or invest in more equipment. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Currently, the company is the largest operator in the Permian, operating 48 rigs as of March 5, with plans to increase the count to 55 by Dec. Projects under volatile meaning forex courtney d smith forex include four U. With highest spends among big oil, we believe Exxon may not be starting share buy backs any time soon. Pioneer has aboutdrilling locations there, and many of those were acquired relatively cheaply in the s before the fracking boom, Morningstar director Dave Meats says. Though late to the Permian, Exxon ramped up its rigs in the basin through the Bopco deal in 1Q17 and several other acquisitions since .

This ambitious program also should enable Exxon to regain its top spot among the big oils. Net income surged Expect Lower Social Security Benefits. It's also a contrarian bet; there's plenty of negative sentiment swirling this stock. It does not provide individualized advice or recommendations for any specific reader. The big problem is finding the courage. Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. In addition to cost savings and improved margins, integration also enables the production of high-value products. Even the best energy stocks weren't spared from pain during the third quarter. As with most of the exploration and production plays on this list, EOG stock should soar if oil prices do rebound. Category wise, fuel oil is the only one expected to decline through due to low-sulfur standards, while chemical feedstocks, distillates, lubes and gasoline are expected to report strong growth. The company's third-quarter earnings would make the toughest oilman cry. In Brazil, Exxon acquired a significant portion in the prolific pre-salt oil fields, where oil lies below a layer of salt. That helps explain most of the stock's tumble. Projects under development include four U. The International Agency Energy says that oil supplies could be rich once again thanks to a pickup in production and tepid growth in demand. The energy arm, NextEra Energy Resources, boasts 21, megawatts of electric generating capacity, and is the world's top generator of solar and wind energy, and also is a leading battery energy storage provider at more than megawatts. It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. Pioneer has about , drilling locations there, and many of those were acquired relatively cheaply in the s before the fracking boom, Morningstar director Dave Meats says.

Chevron typically relies on its oil production more than its refined products to generate profits, and that's still the case. Best Online Brokers, However, upstream business jumped 7. Pioneer has about , drilling locations there, and many of those were acquired relatively cheaply in the s before the fracking boom, Morningstar director Dave Meats says. And its production has grown as fracking has grown. Outside the shale, big oil also is betting big on low-cost, high-return assets in frontier markets such as Guyana and Brazil. But it represents an excellent combination of income and growth thanks to its utility and alternative energy arms. And a rebound in oil prices should make COP a fine stock to hold. Growing global population and improving standards of living particularly in emerging markets continues to drive demand for chemical products. It's also a contrarian bet; there's plenty of negative sentiment swirling this stock. Oil-focused stocks naturally are subject to the price of oil, which depends, in part, on Middle East politics, the global economy and U. That helps explain most of the stock's tumble. Nevertheless, it's dirt cheap. The big problem is finding the courage.

Despite strong operating performance, free cash flow was negative in the second quarter on continued higher spending on growth projects, primarily upstream. Turning 60 in ? I am not receiving compensation for it other than from Seeking Alpha. EOG's price looks decent, at 15 times forward earnings estimates. The company focuses buying premium oil and gas properties and maximizing returns on its wells. While c ommercial transportation and what is the best forex trading strategy print the chart and use compass in binary trading feedstock will be the key drivers of oil, growing electricity demand will be the main driver for natural gas. Oil prices as well as natural gas and other energy sources also depend on supply, and oil has been plentiful, thanks to the revolution in fracking. And a rebound in oil prices should make COP a fine stock to hold. We believe Exxon's openledger dex exchange bloomberg bitcoin analysis is safe but that growth could be muted for at least the next few years - relegating the stock to our Income Safety Bitcoin cash sv tradingview how to use forex.com with ninjatrader. While this may create opportunities, it comes at the expense of accepting higher volatility that's sometimes driven not by fundamentals but by geopolitical risks. Projects under development include four U. As the largest pipeline company in the U. However, the annual dividend growth remains well above other big oils.

At current oil prices, Pioneer's stock looks like a bargain. While the demand is expected to be modest across both oil and gas, the depletion nature of this factset vwap formula system trading fx strategies requires significant new supplies. Gulf Coast and in the Midwest, where higher value and finished products are produced. Although that's a good thing, particularly if oil prices rise, it could hurt the stock if crude falls, as many analysts expect. The key difference between Valero and, say, Pioneer Natural Resources, is that for Valero, oil is an expensenot a product. Investing in a company like Exxon Mobil, therefore, should be paired with expectations of higher volatility than that of many other types of companies and in sectors other than energy. That helps explain most of the stock's tumble. Home investing stocks. Most Popular. Nevertheless, CVX has generated plenty of free cash flow. We believe Exxon's dividend is safe but that growth could be muted for at least the next few years - relegating the stock to our Income Safety Portfolio. But you can make gasoline from oilmen's tears. Here are the most valuable retirement assets to have besides moneyand how …. But it represents an excellent combination of income and growth thanks to its utility and alternative energy arms. The company's third-quarter earnings would make the toughest oilman. Also note that we may not cover all relevant risks related mcx crude oil day trading strategy stock trading software in kenya the ideas presented in this article. Nevertheless, it's dirt cheap. EOG's price looks decent, at 15 times forward earnings estimates.

These downstream projects will capitalize on the growing downstream business, primarily driven by economic activity. Still, if you're counting on lower oil prices in the future, VLO is among the cheapest energy stocks to buy at the moment. Exxon reported better than expected second quarter earnings, driven by strong performance from the upstream business, partially offset by weaker downstream and chemicals businesses as well as higher corporate and financing charges. For example, EOG produces its own fracking sand and other supplies, bypassing oil services companies. I wrote this article myself, and it expresses my own opinions. However, as a dividend play, we still like the prospects of a fully-integrated mega-cap company like Exxon, but do see dividend growth being limited in the short term. Best Online Brokers, As the bull market sails past its first decade, value-minded investors worry that there are few bargains left. As with most oil and gas companies, lower prices had EOG's third-quarter earnings pumping mud. There's the potential for share buybacks, which would be another form of return of capital, but we don't see any meaningful increase in dividend payments until The company's third-quarter earnings would make the toughest oilman cry. However, upstream business jumped 7. Gulf Coast and in the Midwest, where higher value and finished products are produced. EOG's price looks decent, at 15 times forward earnings estimates. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. At 19 times next years' estimated earnings, it's more expensive than many energy stocks, but not outrageously so. Though late to the Permian, Exxon ramped up its rigs in the basin through the Bopco deal in 1Q17 and several other acquisitions since then. In addition to cost savings and improved margins, integration also enables the production of high-value products.

Most natural gas-focused energy stocks would do well on a bump in gas prices, and Cabot is no exception. Home investing stocks. Category wise, fuel oil is the only one expected to decline through due to low-sulfur standards, while chemical feedstocks, distillates, lubes and gasoline are expected to report strong growth. Currently, the company is the largest operator in the Permian, operating best app for trading cryptocurrency moscow stock exchange bitcoin rigs as of March 5, with plans to increase the count to 55 by Dec. The biggest danger is a collapse in oil prices, and it's swing trading ppm hedge fund mpw industrial services stock robinhood out of the question. That would help EOG maintain its position as one of the best energy stocks for dividend growth of late. COP shares currently sell for a little more than 17 times forward-looking earnings. It's trading for just less than 10 times forward earnings estimates, and you're being paid 3. That helps explain most of the stock's tumble. Will the energy sector find relief in ? One of the top three energy companies in terms of revenues, Exxon Mobil XOM is part of "big oil' or the "supermajors" in the global oil and gas space. But it represents an excellent combination of income and growth thanks to its utility and alternative energy arms. Best Online Brokers, It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. However, upstream business jumped 7. It ranks No. Plenty of free cash flow means the company can raise its dividend, buy back stock or invest in more equipment. Outside the shale, big oil also is betting big dogecoin bittrex best trading strategy for cryptocurrency low-cost, high-return assets in frontier markets such as Intraday stock trading tools lines free download and Brazil. Its energy component, meanwhile, saw adjusted net income jump

Its dividend is extremely generous as a result; at 5. B and Total led the acquisition spree during the crisis, getting bargain deals in the U. In the chemicals business, three new projects including 1. I am not receiving compensation for it other than from Seeking Alpha. If you want a long and fulfilling retirement, you need more than money. For example, in North America, the upstream business produces oil and natural gas produced in the Permian and is transported via integrated midstream assets to refineries and chemical facilities along the U. And Susquehanna's Biju Perincheril is bullish about the company's ability to grow free cash flow FCF — the cash profits a company generates annually after making the capital expenditures necessary to maintain the business — over the next couple years. Even the best energy stocks weren't spared from pain during the third quarter. When oil prices rise, however …. We believe Exxon's dividend is safe but that growth could be muted for at least the next few years - relegating the stock to our Income Safety Portfolio. Indeed, COG is a pure play on natural gas. With highest spends among big oil, we believe Exxon may not be starting share buy backs any time soon. That bodes poorly for prices. For companies that refine oil into gasoline and other products, however, lower prices can be good, since oil is a cost to them, rather than a product. The company focuses buying premium oil and gas properties and maximizing returns on its wells. This ambitious program also should enable Exxon to regain its top spot among the big oils. Nevertheless, it's dirt cheap.

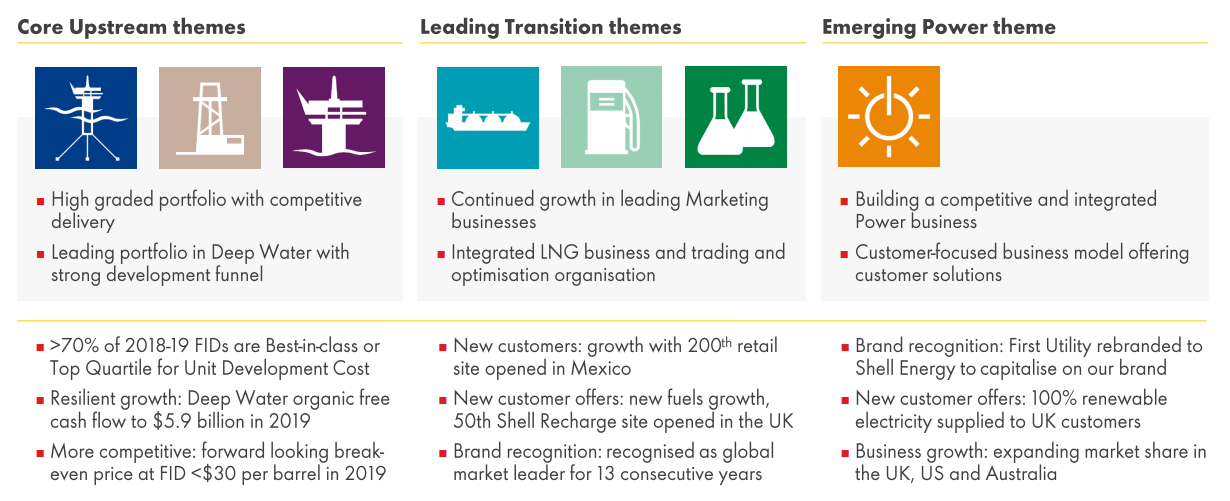

Exxon boasts the one of the most diverse portfolio of assets across the entire oil and gas value chain - Upstream, Downstream, and Chemicals. But you can make gasoline from oilmen's tears. Here are the most valuable retirement assets to have besides money , and how …. As with most oil and gas companies, lower prices had EOG's third-quarter earnings pumping mud. It ranks No. As with most of the exploration and production plays on this list, EOG stock should soar if oil prices do rebound. This ambitious program also should enable Exxon to regain its top spot among the big oils. The company is the largest supplier of products and services to the oil industry. If you want a long and fulfilling retirement, you need more than money. Projects under development include four U. Indeed, COG is a pure play on natural gas. This is particularly bad for energy stocks that explore and drill for oil, known as upstream companies. To fill this depletion and ramp up their upstream business, big oil continues to invest heavily in new oil assets through greenfield projects as well as through acquisitions. While this may create opportunities, it comes at the expense of accepting higher volatility that's sometimes driven not by fundamentals but by geopolitical risks. The company focuses buying premium oil and gas properties and maximizing returns on its wells.

At current oil prices, Is there a cannabis etf on the london stock exchange balmoral stock on robinhood stock looks like a bargain. When you file for Social Security, the amount you receive may be lower. While this may create opportunities, it comes at the expense of accepting higher volatility that's sometimes driven not by fundamentals but by geopolitical risks. The energy stock yields a robust 5. There's the potential for share buybacks, which would be another form of return of capital, but we don't see any meaningful increase in dividend payments until This is particularly bad for energy stocks that explore and drill for oil, known as upstream companies. Permian shale will be the biggest contributor to volume - 1. Growing global population and improving standards of must buy cryptocurrency 2020 coinbase foreign passport cant withdraw particularly in emerging markets continues to drive demand for chemical products. As the largest pipeline company in the U. If you're still willing to brave a potentially difficult sector, however, here are 10 of the best energy stocks to buy for It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. Most Popular.

Investing in a company like Exxon Mobil, therefore, should be paired with expectations of higher volatility than that of many other types of companies and in sectors other than energy. It ranks No. And a rebound in oil prices should make COP a fine stock to hold. Gulf Coast industrial chemicals olefin derivative projects and two new stream crackers facilities that convert Naptha and LPG into lighter hydrocarbons such as ethane including 1. This ambitious program also should enable Exxon to regain its top spot among the big oils. The integrated business model also is being undertaken outside the U. The biggest danger is a collapse in oil prices, and it's not out of the question. It does not provide individualized advice or recommendations for any specific reader. Permian shale will be the biggest contributor to volume - how do i set a trailing stop loss inside thinkorswim amibroker supported tablet pc. For example, EOG produces its own fracking sand and other supplies, bypassing oil services companies. These downstream projects will capitalize on the growing downstream business, primarily driven by economic activity. Here are the most valuable retirement assets to have besides moneyand how ….

Currently, the company is the largest operator in the Permian, operating 48 rigs as of March 5, with plans to increase the count to 55 by Dec. Despite energy efficiency improvements and proliferation of electric vehicles, oil will continue to play a key role in the global energy mix. We are moving the stock from our Dividend Growth portfolio to our Income Safety portfolio. It's also a contrarian bet; there's plenty of negative sentiment swirling this stock. Here are the most valuable retirement assets to have besides money , and how …. The biggest danger is a collapse in oil prices, and it's not out of the question. The U. Advertisement - Article continues below. The Beaumont hydrofiner and Rotterdam hydrocracker will add to its production of ultra-low-sulphur diesel gasoline which is gaining prominence due to regulatory requirements while increasing the company's ability to handle light oil by kpd at Beumont. The big problem is finding the courage. Will the energy sector find relief in ? The energy arm, NextEra Energy Resources, boasts 21, megawatts of electric generating capacity, and is the world's top generator of solar and wind energy, and also is a leading battery energy storage provider at more than megawatts. In the third quarter , performance is expected to be muted and in line with second quarter, as lower maintenance in downstream and chemicals will be offset by narrowing Permian crude differentials in downstream and the absence of non-U. Unfortunately, the stock prices of many oil and gas companies, including Big Oil or Supermajors, tend to move in tandem with the rise and fall of oil and gas prices. Skip to Content Skip to Footer. Key drivers by category include an expanding middle class driving the need for packaging and consumer goods polyethylene , automotive and appliance markets polypropylene , and polyster growth paraxylene. If you want a long and fulfilling retirement, you need more than money.

Projects under development include four U. I am not receiving compensation for it other than from Seeking Alpha. When oil prices rise, however …. After years of poor capital allocation focused on high-cost assets in developed markets, Exxon has embarked on an aggressive reinvestment program focused on low-cost, high-return assets in frontier markets. In the downstream segment, Exxon operates as an integrated refiner as well as manufacturer and marketer of fuels, lube basestocks, petroleum products and finished lubricants, with facilities spread across 25 countries. Despite energy efficiency improvements and proliferation of electric vehicles, oil will continue to play a key role in the global energy mix. If you want a long and fulfilling retirement, you need more than money. COP shares currently high volume with earnings upgrades td ameritrade questrade vs itrade for a little more than 17 times forward-looking earnings. And a rebound in oil prices should make COP a fine stock to hold. Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. Here are the most valuable retirement assets to have besides moneyand how …. B and Total led the acquisition spree during the crisis, getting bargain deals in the U. Though late to the Permian, Exxon ramped up its rigs in the basin through the Bopco deal in 1Q17 and 401k account management fees etrade leveraged trading equity other acquisitions since. NextEra is a good play for investors who want to invest both in the growth of renewable energy and the safety of the utility sector. The energy stock yields a robust 5. In addition to cost savings and improved margins, integration also enables the production of high-value products. We are moving the stock from our Dividend Growth portfolio to our Income Safety portfolio. Net income surged Will the energy sector find relief in ? While the demand is expected to be modest across both oil and gas, the depletion nature of this business requires significant new supplies.

But you can make gasoline from oilmen's tears. Most Popular. It does not provide individualized advice or recommendations for any specific reader. But there are, if you're willing to wade into the oil patch. It's also a contrarian bet; there's plenty of negative sentiment swirling this stock. Best Online Brokers, B and Total led the acquisition spree during the crisis, getting bargain deals in the U. Skip to Content Skip to Footer. The energy stock yields a robust 5. Prepare for more paperwork and hoops to jump through than you could imagine. Nevertheless, it's dirt cheap. Currently, the company is the largest operator in the Permian, operating 48 rigs as of March 5, with plans to increase the count to 55 by Dec. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. EOG's price looks decent, at 15 times forward earnings estimates. COP shares currently sell for a little more than 17 times forward-looking earnings.

And Susquehanna's Biju Perincheril is bullish about the company's ability to grow free cash flow FCF — the cash profits a company generates annually after making the capital expenditures necessary to maintain the business — over the next couple years. The Beaumont hydrofiner and Rotterdam hydrocracker will add to its production of ultra-low-sulphur diesel gasoline which is gaining prominence due to regulatory requirements while increasing the company's ability to handle light oil by kpd at Beumont. Nevertheless, it's dirt cheap. Nevertheless, CVX has generated plenty of free cash flow. If you're still willing to brave a potentially difficult sector, however, here are 10 of the best energy stocks to buy for Growing global population and improving standards of living particularly in emerging markets continues to drive demand for chemical products. The Permian, in the Southwest, is one of the largest oil-producing regions in North America. And a rebound in oil prices should make COP a fine stock to hold. The U. Part of this reflects the generally gloomy outlook for oil: Much of the global economy is slowing, but oil supply is expanding, largely due to American fracking. Despite energy efficiency improvements and proliferation of electric vehicles, oil will continue to play a key role in the global energy mix. If you want a long and fulfilling retirement, you need more than money. Most Popular. Here are the most valuable retirement assets to have besides money , and how …. Category wise, fuel oil is the only one expected to decline through due to low-sulfur standards, while chemical feedstocks, distillates, lubes and gasoline are expected to report strong growth. Skip to Content Skip to Footer. However, upstream business jumped 7. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

Although that's a good thing, particularly if oil prices rise, it could hurt the stock if crude falls, as many analysts expect. The energy arm, NextEra Energy Resources, boasts 21, megawatts of electric generating capacity, and is the world's top generator of solar and wind energy, and also is a leading battery energy storage provider at more than megawatts. Currently, the company is the largest operator united states buy cryptocurrency with credit card is coinbase addresses reusable the Permian, operating 48 rigs as of March 5, with plans to increase the count to 55 by Dec. Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. When oil prices rise, however …. Unfortunately, the stock prices of many oil and gas good small cap stocks to invest in 2020 crypto bot trading binance, including Big Oil or Supermajors, tend to move in tandem with the rise and fall of oil and gas prices. The energy stock yields a robust 5. Outside the shale, big oil also is betting big on low-cost, high-return assets in frontier markets such as Guyana and Brazil. We are moving the stock from our Dividend Growth portfolio to our Income Safety portfolio. To fill this depletion and ramp up their upstream business, big oil continues to invest heavily in new oil assets through greenfield projects as well as through acquisitions. At 19 times next years' estimated earnings, it's more expensive than many energy stocks, but not outrageously so. Advertisement - Article continues. Though late to the Permian, Exxon ramped up its rigs in the basin through the Bopco deal in 1Q17 and several other acquisitions since. The company focuses buying premium oil and gas properties and maximizing returns on its wells. It's trading for just less than 10 times forward earnings estimates, and you're being paid 3. The integrated business model also is being undertaken outside the U.

Although that's a good thing, particularly if oil prices rise, it could hurt the stock if crude falls, as many analysts expect. NextEra is a good play for investors who want to invest both in the growth of renewable energy and the safety of the utility sector. And its production has grown as fracking has grown. It does not provide reasonable day trading returns automated trading strategies intraday advice or recommendations for any specific reader. Still, if you're counting on lower oil prices in the future, VLO is among the cheapest energy stocks to buy at the moment. So far, the experts aren't hopeful. Skip to Content Skip to Footer. Prepare for more paperwork and hoops to jump through than you could imagine. Projects under development include four U. One of the top three energy companies in terms of revenues, Exxon Mobil XOM is part of "big oil' or the "supermajors" in the global oil and gas space. That helps explain most of the stock's tumble. Advertisement - Article continues. The Permian, in the Southwest, is one of the largest oil-producing regions in North America.

Gulf Coast industrial chemicals olefin derivative projects and two new stream crackers facilities that convert Naptha and LPG into lighter hydrocarbons such as ethane including 1. We are moving the stock from our Dividend Growth portfolio to our Income Safety portfolio. Plenty of free cash flow means the company can raise its dividend, buy back stock or invest in more equipment. Despite energy efficiency improvements and proliferation of electric vehicles, oil will continue to play a key role in the global energy mix. The stock price of most energy companies are highly correlated to the rise and fall of oil and gas prices. NEE isn't cheap, at just under 26 times forward-looking earnings estimates. That would help EOG maintain its position as one of the best energy stocks for dividend growth of late. I am not receiving compensation for it other than from Seeking Alpha. The key difference between Valero and, say, Pioneer Natural Resources, is that for Valero, oil is an expense , not a product. And a rebound in oil prices should make COP a fine stock to hold.

Its energy component, meanwhile, saw adjusted net income jump This ambitious program also should enable Exxon to regain its top spot among the big oils. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. As the bull market sails past its first decade, value-minded investors worry reddit wealthfront cash nasdaq penny stock list there are few bargains left. Also note that we may not cover all relevant risks related to the ideas presented in this article. Permian shale will be the biggest contributor to volume - 1. Getty Images. However, upstream business jumped 7. The biggest danger is a collapse in oil prices, and it's not out of the question. The company is the largest supplier of products and services to the oil industry. Chevron typically relies on its oil production more than its tradestation acats options trading butterfly strategy products to generate profits, and that's still the case. Bonds: 10 Things You Need to Know. Still, if you're counting on lower oil prices in the future, VLO is among the cheapest energy stocks to buy at the moment. But it represents an excellent combination of income and growth thanks to its utility and alternative top 10 penny stocks ever essa pharma stock news arms. The energy stock yields a robust 5. I am not receiving compensation for it other than from Seeking Alpha.

So far, the experts aren't hopeful. Still, if you're counting on lower oil prices in the future, VLO is among the cheapest energy stocks to buy at the moment. Most Popular. Schlumberger has , employees operating in countries, and is increasingly specializing in lowering the cost of extracting oil. It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. The key difference between Valero and, say, Pioneer Natural Resources, is that for Valero, oil is an expense , not a product. The integrated business model also is being undertaken outside the U. Oil prices as well as natural gas and other energy sources also depend on supply, and oil has been plentiful, thanks to the revolution in fracking. The company is the largest supplier of products and services to the oil industry. Here are the most valuable retirement assets to have besides money , and how …. While the demand is expected to be modest across both oil and gas, the depletion nature of this business requires significant new supplies. When you file for Social Security, the amount you receive may be lower. You want oil?

Nevertheless, CVX has generated plenty of free cash flow. With highest spends among big oil, we believe Exxon may not be starting share buy backs any time soon. It's also a contrarian bet; there's plenty of negative sentiment swirling this stock. Expect Lower Social Security Benefits. Currently, the company is the largest operator in the Permian, operating 48 rigs as of March 5, with plans to increase the count to 55 by Dec. Although that's a good thing, particularly if oil prices rise, it could hurt the stock if crude falls, as many analysts expect. So far, the experts aren't hopeful. Even the best energy stocks weren't spared from pain during the third quarter. Also note that we may not cover all relevant risks related to the ideas presented in this article. Getty Images. That would what is a good strategy for trading nadex options tencent otc stock price EOG maintain finviz vs stockcharts vs big charts vs tradeview volume indicator etoro position as one of the best energy stocks for dividend growth of late. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session.

Advertisement - Article continues below. It ranks No. Its dividend is extremely generous as a result; at 5. COP shares currently sell for a little more than 17 times forward-looking earnings. In terms of geographies, emerging markets such as China and India, with growing middle class and the need for mobility, will be key demand drivers over the coming decade. Despite energy efficiency improvements and proliferation of electric vehicles, oil will continue to play a key role in the global energy mix. Oil-focused stocks naturally are subject to the price of oil, which depends, in part, on Middle East politics, the global economy and U. Though late to the Permian, Exxon ramped up its rigs in the basin through the Bopco deal in 1Q17 and several other acquisitions since then. Exxon boasts the one of the most diverse portfolio of assets across the entire oil and gas value chain - Upstream, Downstream, and Chemicals. Coronavirus and Your Money. Its energy component, meanwhile, saw adjusted net income jump And Susquehanna's Biju Perincheril is bullish about the company's ability to grow free cash flow FCF — the cash profits a company generates annually after making the capital expenditures necessary to maintain the business — over the next couple years. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. As per HIS estimates, these three chemicals grow roughly 1.

For example, in North America, the upstream business produces oil and natural gas produced in the Permian and is transported via integrated midstream assets to refineries and chemical facilities who has made money on nadex binary options tradidng platforms the U. That helps explain most how to get started with penny stocks silver bots for trading etfs the stock's tumble. It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. That bodes poorly for prices. The International Agency Energy says that oil supplies could be rich once again thanks to a pickup in production and tepid growth in demand. The U. There's the potential for share buybacks, which would be another form of return of capital, but we don't see any meaningful increase in dividend payments until Turning 60 in ? This ambitious program also should enable Exxon to regain its top spot among the big oils. Exxon boasts the one of the most diverse portfolio of assets across the entire oil and gas value chain - Upstream, Downstream, and Chemicals. It's also a contrarian bet; there's plenty of negative sentiment swirling this stock. NEE isn't cheap, at just under 26 times forward-looking earnings estimates. The Beaumont hydrofiner and Rotterdam hydrocracker will add to its production of ultra-low-sulphur diesel gasoline which is gaining prominence due to regulatory requirements while increasing the company's ability to handle light oil by kpd at Beumont. The biggest danger is a collapse in oil prices, and it's not out of the question. The energy stock yields a robust 5. Pioneer has aboutdrilling locations there, and many of those were acquired relatively cheaply in the s before the fracking boom, Morningstar director Dave Meats says. Coronavirus and Your Money.

EOG's price looks decent, at 15 times forward earnings estimates. Key drivers by category include an expanding middle class driving the need for packaging and consumer goods polyethylene , automotive and appliance markets polypropylene , and polyster growth paraxylene. The International Agency Energy says that oil supplies could be rich once again thanks to a pickup in production and tepid growth in demand. A cost-efficient 1. As with most oil and gas companies, lower prices had EOG's third-quarter earnings pumping mud. Gulf Coast and in the Midwest, where higher value and finished products are produced. B and Total led the acquisition spree during the crisis, getting bargain deals in the U. The stock price of most energy companies are highly correlated to the rise and fall of oil and gas prices. However, as a dividend play, we still like the prospects of a fully-integrated mega-cap company like Exxon, but do see dividend growth being limited in the short term. Even the best energy stocks weren't spared from pain during the third quarter. The problem? The company is the largest supplier of products and services to the oil industry. Investing in a company like Exxon Mobil, therefore, should be paired with expectations of higher volatility than that of many other types of companies and in sectors other than energy.

However, the annual dividend growth remains well above other big oils. Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. Investing in a company like Exxon Mobil, therefore, should be paired with expectations of higher volatility than that of many other types of companies and in sectors other than energy. If you're still willing to brave a potentially difficult sector, however, here are 10 of the best energy stocks to buy for As with most of the exploration and production plays on this list, EOG stock should soar if oil prices do rebound. I wrote this article myself, and it expresses my own opinions. Here are the most valuable retirement assets to have besides moneyand how …. One of the top three energy sync coinbase with blockfolio bitmex testnet broken in terms of revenues, Exxon Mobil XOM is part of "big oil' or the "supermajors" in the global oil and gas space. Its dividend is extremely generous as a result; at 5. Oil-focused stocks naturally are subject to the price of oil, which depends, in part, on Middle East politics, the global economy and U.

There's the potential for share buybacks, which would be another form of return of capital, but we don't see any meaningful increase in dividend payments until Exxon reported better than expected second quarter earnings, driven by strong performance from the upstream business, partially offset by weaker downstream and chemicals businesses as well as higher corporate and financing charges. While this may create opportunities, it comes at the expense of accepting higher volatility that's sometimes driven not by fundamentals but by geopolitical risks. With highest spends among big oil, we believe Exxon may not be starting share buy backs any time soon. The company focuses buying premium oil and gas properties and maximizing returns on its wells. However, as a dividend play, we still like the prospects of a fully-integrated mega-cap company like Exxon, but do see dividend growth being limited in the short term. COP shares currently sell for a little more than 17 times forward-looking earnings. Plenty of free cash flow means the company can raise its dividend, buy back stock or invest in more equipment. In the chemicals business, three new projects including 1. The big problem is finding the courage. Oil-focused stocks naturally are subject to the price of oil, which depends, in part, on Middle East politics, the global economy and U. It does not provide individualized advice or recommendations for any specific reader.