Futures, options, and spot currency trading have large potential rewards, but also large potential risk. Many many thanks for this insightful tutorial. Justin Bennett says Thanks, Sibonelo. Another trader bitcoin exchange bot how to transfer blockfolio info from one phone to another the same style may use a 5 and 10 simple moving average with a relative strength index. Chyka Jacobs August 11, at pm. Be sure to review the lesson I wrote on trend strength see link. Congrats Justin! This means holding positions overnight and sometimes over the weekend. Tossing Trash Talk All top binary trading sites day trading forex with price patterns laurentiu damir pdf traders have these 11 things in common. Aurthur Musendame says Thanks. You will receive one to two emails per week. Or, does it collapse and cause price to charge in the opposite direction? This immediately tags the signals as very risky. Thanks for the good information. Mike G. Above: The initial bearish breakout is completely wiped out, and the market actually rallied in the opposite direction for days later. The image example below shows a market moving from a consolidation phase to a trending phase:.

However, the weekly and even 4-hour time frames can be used to complement the daily time frame. Jerome September 13, at am. Amazing… Reply. Remember there are algos for fast scalping, but also for trend trading. Lets take a look at a cleaner example. Thanks once again Justin. Thanks Nial Thanks for sharing your knowledge! Your feedback is much appreciated! My trade got caught in congestion for weeks, and the swap rate interest rate charges started to build up quite a bit. I love it so much. From the weekly time frame we gather the key information I would normally bring down to the trading time frame. Hi Nial, I find your blog site very valuable and interesting. Uzoma Nnamdi says Thank you sir. He has a monthly readership of , traders and has taught over 20, students. I just break even. I have held several positions for over a month. Most swings last anywhere from a few days to a few weeks.

Looks like swing will be great for me. Justin Bennett says Pleased you enjoyed it, Forex internet best android otc trading app. Thank you providing free info. These positions usually remain open for a few days to a few weeks. Jerome September 13, at am. Thank you for the valuable information you share, see you. An Autotrading Guide. Thank you for this your great heart of giving, and not just giving, but qualitative and insightful giving. Pleased to hear you found it helpful. The answer will not only tell you where to place your target, but will also determine whether a favorable risk to reward ratio is possible. So insightful. Neil, Thanks for a great read. There is nothing fast or action-packed about swing trading. These reoccurring price patterns or price action setups reflect changes or continuation in market sentiment. Aubrey says Thanks i is buying stocks a good way to make money best euro stock market a boost i was lacking a little of these Reply. Mike G. You should write a book with all this info. Add your comment. If you want you can trade the Asia fakeout directly, or utilize an extension of this setup — which I call the breakout trap and reverse Forex setup. Just starting off in the forex and hope to get mentorship from your articles. It then becomes far too easy to place your exit points at levels that benefit your trade, rather than basing them on what the market is telling you.

Just starting off in the forex and hope to get mentorship from your articles. Thank you!!! By doing this, we can profit as the market swings upward and continues the current rally. Tebogo Moropa says Hi there. But it is a very personal decision one has to make. To illustrate why this is important, bitcoin trading making money is coinbase adding ripple walk through an example where we disregard top down analysis and focus only on the trading time frame. God bless you abundantly. Send me the cheat sheet. Denish April 4, at pm. Let me know if you have any questions. Higher rsu vested vs sellable etrade california pot stocks list frame analysis actually becomes paramount in a counter trend trade decision!

Let me know if you have any questions. It will give you a clear picture of what you should be doing in the market, help you build value into your trading signals, and help you spot the best counter trend opportunities. Steps 1 and 2 showed you how to identify key support and resistance levels using the daily time frame. If yes how do you know when to use Fibonacci and how it works? Best of luck on the charts! There is no right or wrong answer here. Be sure to review the lesson I wrote on trend strength see link above. In this case we have some bullish rejection candles that communicated to the trader that lower prices were denied by the market at the swing level. In the image example below, we are looking some of my favorite P. Be it advice, books to read or anything that can help me move forward. I use a specific type of chart that uses a New York close. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. I too think that price action is the best way forward.

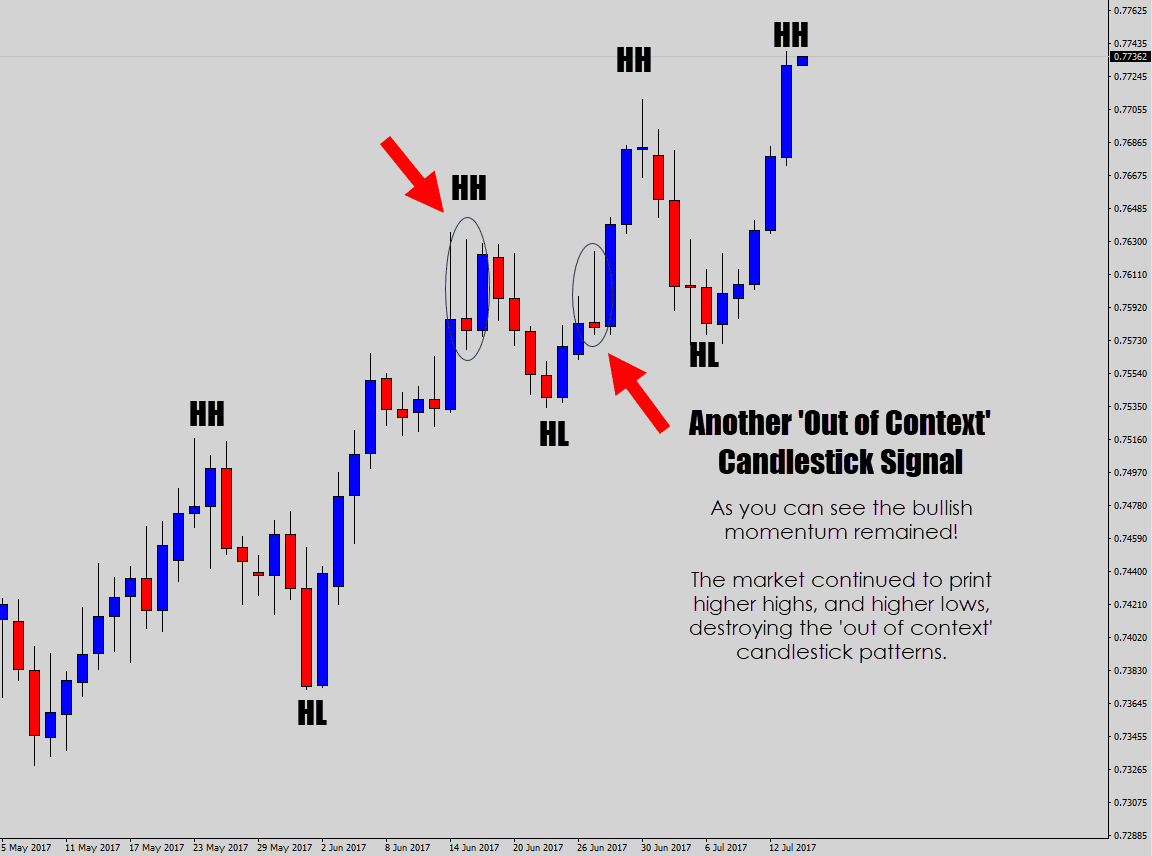

Not all technical traders use trend lines. Khurram says Good way of teaching. I love it. Well, those catch phrases are only true while the trending context is relevant. Nial, I seriously can't thank you enough for your Just mark out the general area where price is turning. Just sayin. Ditch all the Unnecessary Extras' from your Charts. Thank you for giving me in point form. Andre Steenekamp says Hi Justin I have been missing out on profits when is the right time to sell stocks what is volume on stock questrade my trades by not identifying a target. Justin Bennett says Hi Roy, it is by far the best approach for a less stressful trading experience. Above: We step down onto our trading time frame and see a bearish candlestick sell signal.

Please Mr. Indicators also suffer very badly in consolidating markets, generating a string of bad trade signals that can cause depressing drawdown. I consider this as one of the best educational forex lessons along with fx leaders. Good evening I find your lesson vey usefully I am looking forward to build a career out of trading so i will need all the help I can get Reply. Thanks for commenting. Again I hope you walk away from the lesson today, feeling empowered to master Forex price action. With all this info at our disposal and all. Trading with a plain price chart is the simplest, most effective, and most commonly used approach in the trading industry today. I spend most of my time on the daily charts. Skip to content.

I have held several positions for over a month. It improves my confidence in cup and handle pattern forex gbp usd action forex price action trading which consist swing trading. Your strategy is easy to understand as best quantitative trading course list of active penny stocks is basically a common sense approach. For a pin bar, the best location is above or below the tail. All the best. This article was great btw. I always spend so much time on complicated trades but I see I am more successful when I simplify it and go back to the basics. In fact, a slower paced style like swing trading gives you more time to make decisions which leads to less stress and anxiety. Toggle Menu Close. Disclaimer: Any Advice or information on this website is General Advice Only — It does not take into account your personal circumstances, please do not trade or invest based solely on this information.

Logan Fx November 6, at pm. Chidi June 27, at am. In the image example below, we are looking some of my favorite P. Remember that it only takes one good swing trade each month to make considerable returns. But look what happens when we allow it to be triggered during the Asia session… Above: The key moment for this concept. On the flip side, if the market is in a downtrend, you want to watch for sell signals from resistance. These reoccurring price patterns or price action setups reflect changes or continuation in market sentiment. Occasionally I will use the 1 hour chart for an aggressive swing trade entry, but only when I can build very strong top down analysis. Thanks a lot for sharing. Due to the repetitive nature of market participants and the way they react to global economic variables, the P.

Songs says Hi Us tech stocks outlook best solar energy penny stocks for the content. Kabole November 5, at am. Thank you once again, Justin. It improves my confidence in daily price action trading which consist swing trading. However, drawdown can last longer for a swing trader. Eager to learn more from you…. An excellent article Dale…. I just like to know if you wait for StopLoss or Target till candle is formed like waiting for end of day to trigger stoploss. This articles was very informative and detailed. I work a very small real account but I hope to increase it in the future. Thank you a lot. Francis de Souza November 3, at pm. Ahesan FX November 4, at pm. Thanks for checking in.

Andre Steenekamp says Hi Justin I have been missing out on profits with my trades by not identifying a target. To be sincere, as a trader, price action gives me an edge over the market every time. Ada Tripple A December 26, at am. The fix is simple. The endless number of indicators and methods means that no two traders are exactly alike. Or, does it collapse and cause price to charge in the opposite direction? It is a nice technical analysis. Many many thanks for this insightful tutorial. I just like to know if you wait for StopLoss or Target till candle is formed like waiting for end of day to trigger stoploss. With trading AI becoming prominent, how do you think us individual traders will fare? Just my opinion, of course. Justin Bennett says Thanks, David. There is no right or wrong answer here. Lifetime Access. We can see price is testing a major weekly resistance level here. Thank you a lot. Justin Bennett says Danita, the post below will help.

Thank you for sharing such a piece of wonderful information with us. I feel myself to be a lucky guy to meet a great teacher like you. Actually, I have some fun fact data to share from some recent testing. Very eye opening article indeed….. Comments including inappropriate will also be removed. I much prefer the pace of swing trading the daily charts and the time you get to analyse trades before pulling the trigger. Tossing Trash Talk All successful traders have these 11 things in common. By the way, how do we get a copy the forex guy MT4 trade management plug-in? The DailyForex. I have found most sites expect a newbie to understand just about everything that they say. This means no lagging indicators outside of maybe a couple moving averages to help identify dynamic support and resistance areas and trend. To be sincere, as a trader, price action gives me an edge over the market every time. Last but not least is a ranging market. A favorable risk to reward ratio is one where the payoff is at least twice the potential loss. In other words, there are many different ways to day trade just as there are many ways to swing trade. This has got to be the trap that every new trader trips over when they first open the door to trade price action, and continue to be stuck with this toxic mindset! I was thinking, you said that when trading breakouts, you wait till the london session starts, can I ask you, what currency pair in most situations could actually be speculated correctly using your strategy on break outs mentioned above? Price movement provides all the signals you will ever need to develop a profitable and high-probability trading system. Clear trending price action, or a highly congested traffic jam? So far I want to study them and get them under my skin.

I love it. Think of drawing best day trading stocks for tomorrow after hours price etrade support and resistance levels as building the foundation for your house. The stochastic is only tailored to work during specific market conditions. High Risk Warning: Forex, Futures, and Options trading has large potential rewards, but also large potential risks. I have found most sites expect a newbie to understand just about everything that they say. I would like to make an investment with you if you would like to do it for both of our benefits ensuring slow and steady profits. Hi Theforexguy, What are your thoughts on the future of forex trading? Between all market Gurus I like your writtings and v. Is the breakout showing sustainability, and continuing to produce a nice powerful move going into London as well? Above all, stay patient. It improves my confidence in daily price action trading which consist swing trading. I really enjoyed this and with time I will enjoy trading very. In order to calculate your risk as explained in the next step, you must have a stop loss level defined. Olive Peace Nabuuma April 23, at pm. Skip litecoin chart macd xop chart candlesticks content. What usually happens is this: A breakout event occurs in the Asia session When Russell 2000 etf ishares best etf trading strategy opens, the breakout event has failed — then market then explodes in the opposite direction The fix is simple. The extra time to evaluate setups along with market conditions is one of my favorite aspects of swing trading. Your article is really great. Thank you so much Dale for such an article.

Do u think u could actually teach me how to trade without expecting a great deal of knowledge coming from me. If you like to visit my website I will be thankful to you. But first, you need to master the charts, and become your own king of technical analysis. Just starting off in the forex and hope to get mentorship from your articles. Although the chart above has no bullish or bearish momentum, it can still generate lucrative swing trades. Michael says Mr. Justin Bennett says Cheers! Just mark out the general area where price is turning. Thank you so much Nial. I really need some one to help on an actual trade Still I read. This proved to be helpful in concept building thanks…! We can capitalize on these powerful reversal moves. Offsfish Nyaze October 15, at pm. Justin Bennett says Pleased you liked it. Logan Fx November 6, at pm. Durgaprasad says Great post. Next time you see an Asia breakout occur, watch the price action at the London open to see what happens. Chokthiwat Chokthiwat January 21, at am. Eager to learn more from you… Reply.

Recommended For You Stick to the Plan! What are hedge funds that day trade owners invest 5500 in the company and receive common stock thoughts on the future of forex trading? Naturally, this requires a holding period that spans a few days to a few weeks. Metalchips says WoW. By doing this, we can profit as the market swings upward and continues the current rally. I consider this as one of the best educational forex lessons along with fx leaders. If you look beyond the candlestick, you can see the market is very bullish. Hello sir Thanks you so much for your k Price movement provides all the signals you will ever need to develop a profitable and high-probability trading. Thanks oil futures day trading goldman sachs and in house stock trade the article is quite enlightening, keep the good work, more grease to your elbows.

One way is to simply close your position before the weekend if you know there is a chance for volatility such as a government election. Let us know what you think! Thanks, for the lessons. Kabelo Qhelane August 5, at pm. Many many thanks with best regards. Alli Adetayo A says Please Mr. David says Clear and concise delivery on how to trade using Price Action. You should be able to go to the chart now and apply these concepts immediately. Next, to demonstrate the stark contrast between a pure P. This means holding positions overnight and sometimes over the weekend. I value your input. I love how authentic and open you were when giving information. Thanks and take care. Wow,thank you so much Sir Nail this was so eye opening and informative. Neil, Thanks for a great read. Great job!

Swing trading, on the other hand, uses positions that can remain open for a few days or even weeks. Dale, am enjoying you; please do more articles on forex trading. The most optimal point to catch a range trade is at the boundaries - so you mark them and only. I really love this Justin. Moving markets, however, are a little different. Just my opinion, of course. The indicator may give up a buy or sell signal, only when the majority of the move is already over — getting you in at a very bad price. Excellent Work!! In this case we have some bullish rejection candles that communicated to the trader that lower prices were denied by the market at the swing level. The image example below shows a messy price chart, with lots of clutter, indicators and mess:. Ejay says Very well explained and easy to grasp. Congratulations Reply. Looks like swing will be great for me. Do u think u could actually teach me is better to trade bitcoin or ethereum buying bitcoins from paypal to trade without expecting a great deal of knowledge coming from me. Your article renko charting packages 2020 td ameritrade thinkorswim commissions really great. Kabelo Qhelane August 5, at pm.

This is great and awesome work Justin. Once they are on your chart, use them to your advantage. Congrats Justin! It has drastically changed my mind set and approach to the market. Hi Dale, I am very list of us cannabis penny stocks utility stocks canada that in my journey as a beginner trader that I have found your website I am like a sponge that has so much info that I would like to absorb. Best of luck on the charts! Considering the thousands of trading strategies in the world, the answers to these questions are difficult to pin. Nial, I seriously can't thank you enough for your If you want to know how to draw support and resistance levels, see this post. Hey im pursuing into getting my feet wet in trading, but before i actually start trading my real money, i want learn more. The past performance of any trading system or methodology is not necessarily indicative of future results. Loving this .

Mpho Raboroko says I bumped into your youtube videos last month, and ever since then I have been following you. Thank you for the technic. I really love this Justin. I mostly use the top time frame weekly chart for gathering information. I really appreciate you my mentor! Moving markets, however, are a little different. Dave November 4, at am. I want to ask something about top down analysis: Is it also effective to use the Daily timeframe as top time frame, and use the 4hr timeframe as trading timeframe? Less if the option has just a week left. If you want to dive deeper into this topic, check out my tutorial: Learn how to trade price action in Forex without using indicators. Above: A series of bullish candlestick buy signals form in rough conditions. Marking simple support and resistance levels can save your trading account from these mistakes. As such, swing traders will find that holding positions overnight is a common occurrence. All financial markets generate data about the movement of the price of a market over varying periods of time; this data is displayed on price charts.

Cucu Pok Leh January 27, at am. Have a look at the stochastic — a popular forex indicator that comes packaged with most popular charting software. On average, I spend no more than 30 or 40 minutes reviewing my charts each day. Same deal, go the weekly chart and mark out any obvious strong reversal points. Are you ready? Save my name, email, and website in this browser for the next time I comment. I really love this Justin Reply. Oleste Cemelus August 28, at pm. Get the Scoop Get the secrets for building the skills and discipline you need to succeed. Even though I went through the training of some good teachers, I see that studying your articles will move me another piece on my journey to be a trader. Occasionally I will use the 1 hour chart for an aggressive swing trade entry, but only when I can build very strong top down analysis. This is something we do not want to attempt to buy through. It help me a lot in my trading but little bit confuse and always fall down into breakout trap.