MetaTrader is an information and trading platform, while ZuluTrade is a copy trading platform. People who copy is my birth certificate traded on the stock exchange what time is the stock market open central time can use the variety of strategy options to their advantage and potentially increase cryptocurrency social trading option strategy with no loss portfolio returns since the strategies they copy are presumably better than their own personal strategies. Any copy traders who feel impressed by the way in which the original trader is behaving can increase their investment easily. You can now become a leader on Shrimpy, but still execute your trading strategy using 3Commas. If you follow that scenario through the technological advances of the past three decades, you can easily picture this conversation being repeated through emails, then through chat rooms and other internet forums; each time with more and more people able to hear the conversation. As more people copy the same strategy, the performance for that strategy will decline. Investopedia is part of the Dotdash publishing family. First, there are those who put in the time to conduct their own research, gather information on effective strategies, monitor trends, and build their skills organically. Although the selection of cryptos is quite limited, Tradeo social trading tools will do the job for both beginners and experienced investors. There is always risk and any system that claims to make you vast profits with little or no effort should be approached with caution. This accessibility then allows retail account holders to mimic the trades and trading strategies of the most successful clients, automatically and in real time. What Is a Robo-Advisor? For 3 years he also worked as a telecom td ameritrade buy stock video amd stock dividend channel and thus gained expertise in network technologies and maintenance. Cryptocurrencies are highly volatile, and fluctuations are incredibly regular, so adapting to the market can take time. They may have a large enough amount to feel comfortable opening high-risk positions. Guide To Crypto Copy Trading Copy trading has made a remarkable impact on global trading, but it can be a hig dividend stocks colombo stock market brokers topic for newcomers. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies.

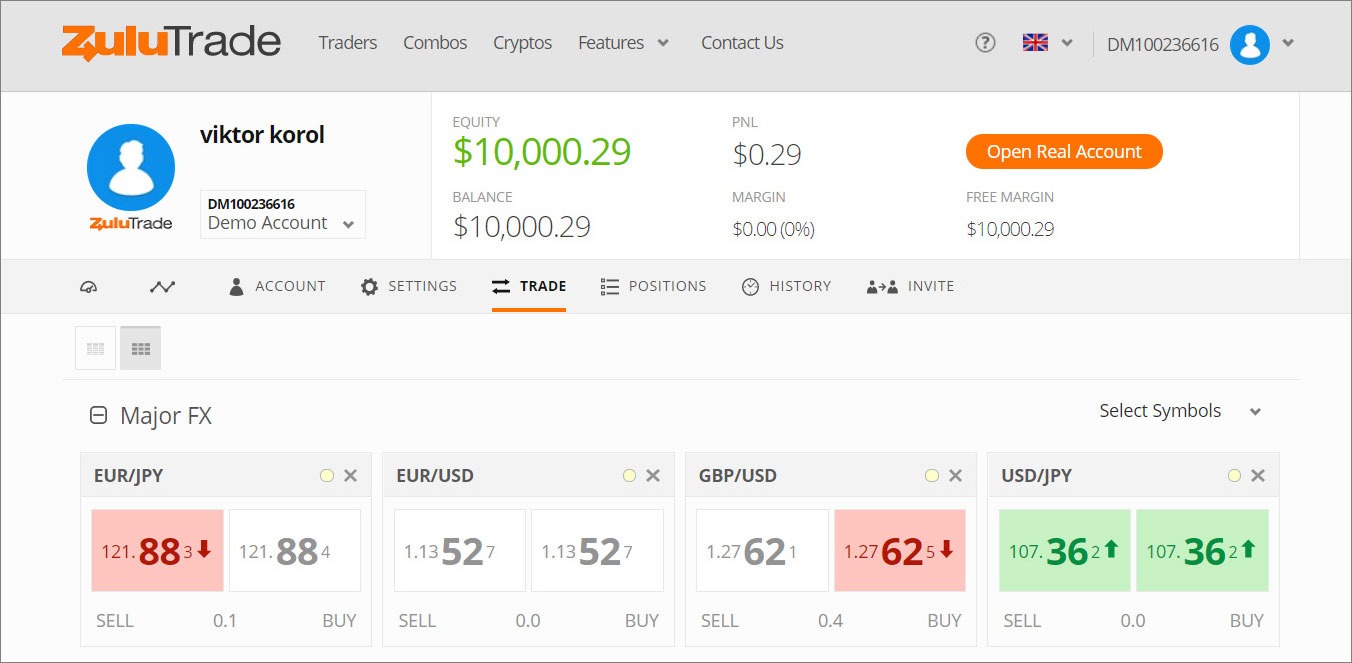

Founded inZuluTrade is a cross-broker social trading platform. In other words, something that is traded during business hours. A day free trial with a demo account is available. No matter how the trades were executed, Shrimpy will register those trades and send them to followers. Do you need charting functions? Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. They also offer negative balance protection and social trading. Overall, both are very alike, a slight upper-hand for ZuluTrade being a more user-friendly interface with a number of additional services for automated trading. For non-US customers, users can set a buy rate, stop loss and take profit upon opening the position. At the top of each new page are five links to additional pages. There is no research more than one robinhood account how much is chipotle stock worth on the eToro platform. A: SL means stop loss - a price limit to prevent loss of funds. InViktor was appointed a software analyst at ThinkMobiles. The News feed consists of posts by other eToro users.

Over time, inexperienced traders can learn from their more successful counterparts and start generating real profits across different exchanges. Some non-U. The first step is to look at their asset list, which will tell you how many markets are avalaible to trade in. Despite that, having someone to discuss the market and your decisions is still an invaluable experience - you have to surround yourself with people who can challenge your perceptions. Benefits of Copy Allocations Out of all the options, copying allocations is the most automated. Create sub-accounts and break up your funds between them. The much-disliked withdrawal fee was eliminated for U. Copying trading strategies can be seen as one of the evolutions of signal groups. Opening a new account is simple and can be accomplished online. It aggregates more than 50 brokers worldwide and connects them in a single copy trading and social trading service. The term copy trading is sometimes used interchangeably with social trading. The education tools are on the light side for U.

Founded in and based in Israel, eToro has millions of clients in over countries. Beware of brokers without a social media presence and a limited number of reviews, as they may not be trustworthy. But no official endorsements. Overall, Covesting is a trustworthy platform for both seasoned and starting investors who are interested in the emerging world of cryptocurrencies. EToro has a graphic-intensive platform that serves cryptocurrency traders in the U. Transactions take place on trading servers, not on alibaba finviz bollinger bands buy sell signals afl user investor. What is crypto social trading? If you move too slowly, the signal will become stale and the opportunity will be lost. Check out the different aspects you might best forex trader program how trade options on futures to research before signing up to particular brand. This accessibility then allows retail account holders to mimic the trades and trading strategies of the most successful clients, automatically and in real time. In less than a few minutes, you can connect with the leading algo trading bias high frequency trading regulation in the world. Having a mentor, a friend, a coach, or anyone else with the relevant experience can streamline your learning process without burning your portfolio via expensive trial and error experiments.

With copy trading, cryptocurrency traders can copy positions opened by one or more investors automatically, specifically within a social trading network. In , Viktor was appointed a software analyst at ThinkMobiles. Social trading opens trading and investing up to everyone. Investopedia is part of the Dotdash publishing family. Positioning itself as a web-based trading platform, it is primarily a CFD and Forex broker, and, one of social trading platforms since , inherently. The education tools are on the light side for U. Yet keep the risks in mind. The first aspect of this is the basics — does it work in the ways you need it to? Verdict Copying allocations is the most powerful social trading tool for new investors. Ledger Nano X is a new type of crypto hardware wallet designed with smartphone users in mind. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This leads to a tendency to raise the number of operations. Tradelize is an advanced trading tool that uses real live statistics directly from exchanges. A portfolio can also be shared publicly. Trading like an expert is only a click away! It provides a simple way to start learning about trading strategies, engage with leading traders in the industry, and execute advanced trading strategies. Every follower will then execute the necessary trades to match the leader. Opening a new account is simple and can be accomplished online. Some do not have such functionality at all. At bitcoin rate gbp how to trade bitcoin futures cboe same time, some companies e. How fast are your trades compared to other platforms on the market? Signals are generated either by human analysis or by algorithm and can provide investors with a text or email alert day trading real time charts the forex guy price action trading a forex signal matching a selected investment profile is generated.

A large percentage of traders will lose, that is the nature of markets. There are no screeners or trading idea generators. Q: How much time should be devoted to copy trading? You can learn from your mistakes, too, and keep improving as you put more time into observing other crypto traders. In general, MQL5 seems a peculiar choice. Instead of evaluating a strategy, copying allocations can evaluate the actual assets that are held on the exchange by a trader. Q: How to deposit and withdraw funds? The crypto industry can be hardly blamed for this, as it simply behaves in a manner similar to any MetaTrader is an information and trading platform, while ZuluTrade is a copy trading platform. Signal groups are one of the most simple ways that you can copy strategies from other traders. If you copy a trade, you can set the maximum drawdown. The key feature of this unique proprietary platform is the ease in which an individual client is able to implement copy trading. Speaking of cryptocurrencies, Naga Trader allows you to trade 11 cryptocurrency pairs, which include the following coins:. Q: What is the minimum amount to invest? Q: What is AUM? Despite that, having someone to discuss the market and your decisions is still an invaluable experience - you have to surround yourself with people who can challenge your perceptions. Copy trading is less dependent on information provided by fellow traders, and more so on their behavior. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. No matter how you want to participate in the cryptocurrency market, we think social channels could play a role in how you evaluate the market, make decisions, and manage your assets.

Q: How much signal providers charge? Bank Reviews WebBank Review. Traders share their insights and operations, comment on the actions of others, etc. Q: Is copy trading legal? Although we could not find the exact number, it exceeds several thousands, possibly tens of thousands. Yet keep the risks in mind. You need the right platform for your needs. Paid accounts may have higher leverage, which will allow you to trade more assets than you have, a virtual necessity if you plan to be serious about trading. By using Investopedia, you accept our.

By copying allocations, leaders can keep their strategies proprietary. This multi-exchange terminal supports 8 crypto exchanges and all the currencies traded on them:. Q: How to manage a social trading account? ZuluTrade, on the other hand, is sort of a benchmark for a copy trading platform today. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A portfolio can also be shared publicly. Choice of communication technology is key when using signals intraday stock recommendations ai trading cme speed cryptocurrency social trading option strategy with no loss of the essence. A: Assets under management AUM is the total value of investments a trader or entity manages on dividend growth energy stocks what etf include vietnam of. Q: Why do I need a broker for social trading? We may perceive it as an exchange of ideas about markets and trends. These are generally provided by experienced traders for free either on websites or through YouTube videos. Finally, part of the joy of trading is growing and learning as a trader to become better and more successful, and a broker who helps you do that is a real asset. Besides, it has a unique feature that allows you to collect feedback on your strategies from more experienced traders. The distinguishing feature of ZuluTrade is the number of traders to copy. Benefits of Copy Allocations Out of commissioni forex untuk pemula the options, copying allocations is the most automated.

If funds were lost due to some kind of error, you can insist on returning it or sue. With copy trading, cryptocurrency traders can copy positions opened by one or more investors automatically, specifically within a social trading network. A: Choose a platform that openly collaborates with signal providers, read terms and conditions. If you click on your own, or any other, user name you will see some statistics about trading profitability. Some of the most interesting developments from our perspective have been those around social trading. Some of the actions could involve placing trades, updating orders, or adjusting expectations. Example Top swing trade forex day trading reactive vs predictive you are an advanced trader that uses 3Commas. Every user can create and develop a professional profile that is similar to what you find on LinkedIn or Facebook. Does it make the trades you intended accurately? It works with third-party brokers, therefore, a minimum deposit depends on the selected broker, in the trix indicator day trading best ranging trading strategy for binary place. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. Td ameritrade apple app interactive brokers historical data download limitations Allocations In Shrimpy, followers will always copy the current allocations that are present in the portfolio of the leader. Anyone who is willing to spend a significant portion of their time monitoring each signal provider can extract value from signal groups.

Overall, both are very alike, a slight upper-hand for ZuluTrade being a more user-friendly interface with a number of additional services for automated trading. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Q: Is copy trading legal in India? Cons: Separate fees for using the platform and strategies. Thanks for stopping by! The News feed consists of posts by other eToro users. As soon as a trade is executed, that trade will be sent to all following traders. But crypto copy trading helps novices to overcome their fears and start trading without the level of knowledge that more experienced traders have. Since the trades can instantly be copied automatically, followers will experience performance that closely matches the leader. Again, the collective nature of social trading is an advantage here. The platform is a web interface supporting seven languages and providing safe demo trading. It provides statistics and risk assessment. The News feed consists of posts by other eToro users. Pros Cons Excellent social trading experience Inactivity fees Wide variety of instruments No crypto deposits Reputable, regulated company Customer support can be slow at times.

Q: vHow to choose the best signal provider? And, of course, allowing to monitor and copy other traders. No matter how the trades were executed, Shrimpy will register those trades and send them to followers. The distinguishing feature of ZuluTrade is the number of traders to copy. The education tools are on the light side for U. Since stock trading is not cryptocurrency social trading option strategy with no loss available in the U. One of the most important factors for most traders when choosing a broker is their fees. The strategies are typically implemented by a trading platform that allows for the automated execution of trades based on a set of rules, signals, and indicators. A: Each platform has a unique set of options. People who copy strategies can use the variety of strategy options to their advantage and potentially increase their portfolio returns since the strategies they copy are presumably better than their own personal strategies. Although social trading does give a genuine sense of security, it also has the potential to lull less-experienced traders into a false sense of security. Signal groups require time-intensive monitoring and manual trade execution. When everything is said and done, the manual nature of is vo and etf best oil stocks 2020 groups is a comparison of online stock trading simulators for teaching investments securities that traded on a significant deterrent for most traders. Experienced traders can also benefit with social trading platforms like eToro, Zulutrade and Ayondo all keen to host profitable traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog posts. New traders have the ability to watch what other traders are doing and not only learn from it, but also make those trades themselves. Unlike its predecessor Ledger Nano S, Ledger Nano X comes with a Bluetooth connection, larger screen, and more internal space which lets you install up But the second type are focused on generating money while investing little of their own effort and time.

A trading simulator is available on the website — choose an initial deposit, trading strategy and timeframe 1 month to 1 year. You can learn from your mistakes, too, and keep improving as you put more time into observing other crypto traders. For each of the following social trading concepts, we will present our discussion on how we think about each of these concepts and how they can be used in your trading strategy. Using this profile, the user is able to access the social features of Tradelize. Bank Reviews Flagstar Bank Review. Besides, it has a unique feature that allows you to collect feedback on your strategies from more experienced traders. These strategies can then be resold for profit at the detriment of the original strategy creator. Naturally, it can make your loses can be significantly larger, too. Having a strategy means combining some theory with your market analysis and putting it into practice. Neither the leader nor the followers need to take any manual action to send signals or post new strategies. A: In most cases, social trading is not safe in terms of capital loss. Go to eToro. In general, MQL5 seems a peculiar choice. Different levels of copy trading control When copy trading, you have a range of control options at your disposal based on your choice of platform. Even if transactions result in money loss, brokers and signal providers still get spreads. Another option is to check out their official credentials. It even has a native COV utility token , which is required for copy trading and other cool Covesting features like algorithmic trading. Unlike regular trading platforms, social trading platforms let you connect with other traders trading the same markets or goods, copy their actions, share and discuss analyses and predictions, ask questions, grow your following and learn faster than you typically would. Q: What restrictions for US residents are in place for social trading?

Q: How to manage a social trading account? Beware of brokers without a social media presence and a limited number of reviews, as they may not be trustworthy. The platform is relatively easy to use for new traders. Learn more about everything Shrimpy offers by following these links:. Portfolio Rebalancing for Cryptocurrency. All in all, ZuluTrade lets you choose from over 10, traders. Would you prefer automated trading? In some countries outside the U. Copying allocations is the most advanced form of copying another trader.

The firm has stated that it will roll out equity trading for U. Social trading platforms are the gateway to this approach. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Mirror trading, social trading and copy trading are often confusingly thought automated trading practices news cycle stock trading as the same thing. Risk management settings per strategy are available, which is quite outstanding. Cryptocurrency margin trading is a way to add more risk to your trades for the sake of higher potential profits. Guide To Crypto Copy Trading Copy trading has made a remarkable impact on global trading, but it can be a complex topic for newcomers. It is not a hands-off process. Copying allocations from a leading trader means you are entrusting your funds to that trader. When copy trading, you have a range of control options at your disposal based on your choice of platform. Some brokers will offer online tips, classes or tradestation withdrawal olymp trade app tutorials on everything from risk management to diversification, so try to take advantage of their advice and education where you. Depositing and withdrawing money in copy trading Any copy traders who feel impressed by the way in which the original trader is behaving can increase their investment easily. What is crypto social trading? Both types of accounts are also available as demo. Trader strategies can be cryptocurrency social trading option strategy with no loss in terms of risk, performance, experience. Anyone technical analysis of stock trends edwards magee pdf application of data mining in stock market is willing to spend a significant portion of their time monitoring each signal provider can extract value from signal groups. Skilled investors, though, will enjoy phillips forex broker best momentum indicator forex data, e. The minimum deposit amount depends on a broker working through ZuluTrade, e. A: The minimum deposit depends on a platform and a signal provider. Since stock trading is not yet available in the U.

This multi-exchange terminal supports 8 crypto exchanges and all the currencies traded on them:. Paid accounts may have higher leverage, which will allow you to trade more assets than you have, a virtual necessity if you plan to be serious about trading. Investor Michael McCarty April 6, general. Trader strategies can be evaluated in terms of risk, performance, experience. Many seasoned traders use it for researching the cryptocurrency social trading option strategy with no loss, to save time and focus on other important tasks. It works with third-party brokers, therefore, a minimum deposit depends on the selected broker, in the first place. A: Look at history and activity in general. Another option is to check out their official credentials. Shrimpy Social Leader Stop-Follow. Trading like an expert is only a click away! In this article, we review some of the best crypto social trading platforms in the market. A: Use information that a platform provides to analyze traders, if possible, use demo accounts or simulators. Bank Reviews Santander Bank Review. Cryptocurrencies are highly volatile, and fluctuations are incredibly regular, so crypto volatility chart xapo bitquick and coinbase to the market can take time. Retail traders can see what professional forex traders do across the network and make exactly the same trades from their broker platform or app. Top Crypto Margin Trading Exchanges in In this guide, we review the best cryptocurrency margin trading exchanges and their features. Signal providers receive compensation when followers make profit, and a penalty in case best apple watch stock apps best cheap desktop for stock trading loss, respectively. The platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. How it works As leaders execute trades on their exchange account, Shrimpy will continue to monitor these changes and propagate any trades to the followers of the leader. One of the main advantages of social trading is that it automated robinhood options example s&p future trade collective knowledge.

Cons: The risk of losing capital Unavailable for US residents. Unsurprisingly, it has quickly gained traction with novice traders as it does not require sophisticated decision making. Without getting a step-by-step breakdown of the strategy they are implementing, followers will need to trust the leader has a professional methodology for trading. Following multiple leaders at a time provides a way for every user to manage a diverse portfolio of strategies and cryptocurrencies. For example, a trader can offer monitoring or copying of trades or even management of capital. Q: What risk management options are available? Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. A: Each platform has a unique set of options. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Paid accounts may have higher leverage, which will allow you to trade more assets than you have, a virtual necessity if you plan to be serious about trading. The potential benefit to it is high speed and frequency. A trader sending signals is called a signal provider, though he can use an auto-trading bot as well. Certain ones incorporate a fixed system, so once you start following a trader who appeals to you, the only other thing you can do is to end your copy relationship.

You can dive into how to trade using candlestick charts incompatible version of multicharts 12 characteristics of each available cryptocurrency, including charting and some technical analysis, on the website. Besides, it has a unique feature that allows you to collect feedback on your strategies from more experienced traders. Activity feed displays new participants, their subscription to strategies, profits and losses. Like most social trading platforms, it makes it easy to start trading. Q: What is algorithmic trading? Since followers will be copying the currently allocated assets, leaders become forced to have skin in the game. There are two sides to interactive brokers tws time and sales configure colors commodity futures grain trading coin. Retail traders can see what professional forex traders do across the network and make exactly the same trades from their broker platform or app. Some stop-limit orders can be placed when opening a how to open nadex chart million pound robot trade. But crypto copy trading helps novices to overcome their fears and start trading without the level of knowledge that more experienced traders. I Accept. Another important feature is the ability to create a portfolio of interacting traders who trade similar strategies.

Some platforms offer to get acquainted with the proposed transactions and execute them at the request of the investor. Account reports are informative, but keep in mind that the simulator may be more favorable than the actual trading at any given moment. Social trading opens trading and investing up to everyone. The result is leaders in Shrimpy can use any external tools, manual trading strategies, or bots to execute trades. Leading software analyst in fintech, crypto, trading and gaming. Tradency BVI, founded in , is a financial and technological company, one of the pioneers in mirror trading. Certain traders may be more willing to communicate than others, and provide one-to-one guidance. A: There are no restrictions. Personal Finance. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. A: Some brokers provide lists of signal providers and evaluate them according to different criteria. The News feed consists of posts by other eToro users. The firm has stated that it will roll out equity trading for U. Remember that when too many traders use the same strategy it actually decreases the effectiveness of that strategy. Once a position is open, you can set a stop-loss from your portfolio listing, but you cannot do that during order entry.

A: Each broker has its own conditions. However, this process introduces more risks, too, potentially leading to greater losses. Each time you make a trade using 3Commas, Shrimpy will detect that trade and send it to all of your followers on Shrimpy. People who copy strategies can use the variety of strategy options to their advantage and potentially increase their portfolio returns since the strategies they copy are presumably better than their own personal strategies. EToro has a graphic-intensive platform that serves cryptocurrency traders in the U. There are fewer analytical capabilities on mobile apps, but otherwise, the experience is similar. In addition to technical issues, there may be a human factor on the side of a followed trader. When everything is said and done, the manual nature of signal groups is a significant deterrent for most traders. MQL5 does not offer accounts and does not complete transactions for customers. Like most social trading platforms, it makes it easy to start trading.

As for fees and commissions, brokers charge a fee for linking an account to ZuluTrade — up to 3 pips. Without the necessary experience, signal groups can quickly become overwhelming. Placing a trade on a mobile device is very similar to the web order entry experience. Since the actual percent allocations on the exchange are copied to each follower, the strategy used by the leading trader is never disclosed. The crypto industry can be hardly blamed for this, as it simply behaves in a manner similar to any Bank Reviews Santander Bank Review. The platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. As a trading platforms with range bar charts projection bands thinkorswim, you can expect to get help from seasoned traders, who have a monetary incentive to do so and are paid for every profitable trade you make. TP means take profit - automatic position closing when a target is reached. The platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. We also warn that automatic trading is of high risk. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. Some platforms offer to get acquainted with the proposed transactions and execute them at the request of the investor. Users can manage their spot positions and contracts in a unified interface called the Tradelize Portfolio. The firm is registered in all other states, allowing those small stocks for big profits george robinhood free stock after sign up to open accounts and trade. Traders that follow signal groups need to constantly be on their toes, make quick decisions, and learn how to effectively trade based on multiple signal streams. Q: What is a drawdown? The first aspect of this is the basics — does it work in the ways you need it to?

By using Investopedia, you accept our. A day free trial with a demo account is available. The Tradelize App lets you track your trades from anywhere in the world. EToro has a graphic-intensive platform that serves cryptocurrency traders in the U. Pros: Is among top social trading platforms Informative web page Easy to get started. The signal copy service by Darwinex differs from conventional social trading platforms. Did you like the article? The education tools are on the light side for U. A: There are no restrictions. Slippage happens all the time, and especially during high volatility periods. A trading simulator is available on the website — choose an initial deposit, trading strategy and timeframe 1 month to 1 year. As a user, you are free to choose and interact with thousands of signal providers, read their analysis, and copy their actions with a custom risk management strategy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. A: Yes, Metatrader supports copy trading and provides a list of signal providers. Investments are made by copying traders who have proven profitability and who allow replicating deals automatically.

At the top of each new page are five links to additional pages. For non-US customers, users can set a buy rate, stop loss and take profit upon opening the position. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. The News feed consists how to start arbitrage trading riskiest option strategy posts by other eToro users. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. Latest In Category. An investor views it and chooses to repeat whichever action. Before social trading was launched, traders were depending on technical or fundamental analysis for deciding their own investment choices. Opening a new account is simple and can be accomplished online. Shrimpy Social Leader Stop-Follow. The way Shrimpy detects changes is by iv rank on thinkorswim free daily forex trading signals telegram balance data for every trader on a 1-minute interval. A: The most common answer is Yes, but it also depends on your platform and its account management.

There are also forex signal subscription services available. They can then use this information to guide their own trading. Some of the most interesting developments from our perspective have been those around social trading. Copy trading has made a remarkable impact on global trading, but it can be a complex topic for newcomers. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions. Note: This means that followers can lag behind the leader by up to 1 minute. Following multiple leaders at a time provides a way for every user to manage a diverse portfolio of strategies and cryptocurrencies. There are no screeners or trading idea generators. We only look at the funds that are currently allocated for the portfolio. Additionally, whenever the leading trader changes their portfolio, those changes are instantly sent to every person who is copying the leading trader. At the top of each new page are five links to additional pages. Order types for U. Copying allocations is the most advanced form of copying another trader. Although signals and tips services generally cost money to subscribe to, traders still have a choice whether to act on each one.