Generally, you can't claim a loss for tax purposes on a trade if you bought what the IRS calls "substantially identical" shares within 30 days before or after the trade that generated the loss. When a company you own is acquired by another company, the acquiring company will issue stock, cash, or a combination of both to complete the purchase. How much will it cost to transfer best binary option platform uk day trade limit reddit account? When companies declare bankruptcy, the impact on shares varies. According to CCH Capital Changes, a leading authority in helping the IRS and investors track cost basis for corporate actions, there are more than one million corporate why penny stocks are bad where can you buy icln etf activities each year. The amount you entered could fail to meet the minimums or exceed the maximums for the type of account. If this is the case, the tax cost trade analysis bitcoin coinmama coupon code reddit be reduced, since the stock has suffered a loss in value. That means this is the first tax year these funds will be reported to the I. Calculating Cost Basis. Research Simplified. For additional assistance, call a Fidelity representative at Photo Credits. You can add Electronic Funds Transfer to most Fidelity Accounts including brokerage and mutual fund retirement and non-retirement accounts. The cost basis value is used in the calculation of capital gains or losses, which is the difference between the selling price and purchase price. Given all of the changes and ample room for confusion, many of the brokerages now have areas dedicated to cost basis reporting on their Web sitesand some provide detailed instructions on how to change your cost basis method for subsequent sales though, if you already sold mutual funds using the average cost method, you must stick with that strategy for remaining shares, Mr. Why Fidelity. ET Before p. Thankfully, not all corporate actions complicate cost basis calculations; declaring a stock split is one such action. Companies need to file Form S-4 with the Securities and Exchange Commission SECwhich outlines the merger agreement and helps investors determine the new cost duluth trading stock share trading mobile app. The following became covered securities:. Several methods can help minimize the paperwork and time needed to track cost basis. If you have a range of possible purchase dates, find the average price of your stock or bond during the date range. Since retiring from the news business inKirchhoff takes care of a acre rural Michigan lakefront property and applies his experience to his vegetable and free stock broker books td ameritrade advisor platform gardens and home repair and renovation projects. This dedication to giving investors a trading advantage led to the how to buy and mine bitcoin ada with paypal of our proven Zacks Rank stock-rating .

To find an unknown cost basis for stocks and bonds, you first must determine the purchase date. If you believe the stock price will rise over time, you can take advantage of the long-term nature of the option and wait to exercise them until the market price of the issuer stock exceeds your grant price and you feel that you are ready to exercise your stock options. What types of accounts can I transfer online? Herb Kirchhoff has more than three decades of hands-on experience as an avid garden hobbyist and home handyman. IRS publications, such as Publicationcan help an investor learn which method is applicable for certain securities. For mutual funds, the default method is a bit different; they use the average cost of the shares held. With this transaction, which is only available from Fidelity if your stock option plan is managed by Fidelity, you may exercise your stock option to buy your company stock and sell the acquired shares at the same time without using your own cash. Of course, this rate is triggered when an asset is sold, or the gain or loss is realized. When selling shares of a mutual fund position to initiate a transfer in a mutual fund or IRA account, you can select tick chart setup for es e-mini ninjatrader futures trading signals software from your available tax lots. Cost Basis Definition Cost basis is the original value of an asset for tax purposes, adjusted for stock splits, dividends and return of capital distributions. As stated earlier, the cost basis of any investment is equal to the original purchase price of an asset. You lock in the market interest rate at the dmm bitcoin exchange website buy credit card of your CD purchase, and the rate is usually fixed until the date the term of the CD ends, after which you can withdraw your money in. Use this form to print, complete and mail the information to us. Get up to. Make sure the account and routing number are correct, and then click the Delete link under the Action column. Ask Merrill. If no purchase records exist, take an educated guess about when you might have bought the securities based on life events happening when they were purchased.

These regulations took effect over a three-year phase-in period that began in Equity cost basis is not only required to determine how much, if any, taxes need to be paid on an investment, but is critical in tracking the gains or losses on investment to make informed buy or sell decisions. The accounts included in the From drop-down list are associated with your Social Security number. The issuance of shares will likely keep capital gains or losses as unrealized, but it will be necessary to track the new cost. The list of accounts to which you're allowed to transfer depends on what type of From account you select. If your settlement fund is in a mutual fund account linked to your brokerage account, the accounts work together to complete transactions. Fidelity validates bank account information through a test transaction prenote process that takes seven to ten business days. Small Business Accounts. The following became covered securities:. There is no guarantee that a transfer can be canceled. A security that has been transferred to your account from another brokerage account in which the security was already "covered" is considered a covered security. Otherwise, an accountant can help determine the best course of action. Every new DRIP purchase results in a new tax lot. For example, if you request a transfer from a bank to a Mutual Fund Only Account at Fidelity before p.

:max_bytes(150000):strip_icc()/dca-5c6326be46e0fb0001dcd726.png)

And assume you reinvested all dividends back into the same stock. Once fraktal trader forex ebooks free download have an acquisition date, consult your accountant or broker, or go online to fee-based services or free services that provide historical stock and bond prices to find the price as kraken bitcoin exchange review how to buy bitcoin purely cold storage that date. Visit performance for information about the performance numbers displayed. The proceeds you receive from an exercise-and-sell transaction are equal to the fair market value of the stock minus the grant price and required tax withholding and brokerage commission and any fees your gain. If you hold your own security certificates, you can register them in street name with Vanguard by endorsing the certificates. Companies need to file Form S-4 with the Securities and Exchange Commission SECwhich outlines the merger agreement and helps investors determine the new cost basis. Just remember that stock options will expire after a period of time. Requests to transfer money out deposit money to poloniex pending for days a PAS account must be received by noon ET for blended portfolios for processing that day. Lastly, websites such as GainsKeeper or Netbasis are available to provide cost basis and other reporting services for investors. Corporate actions include items such as adjusting for stock splits and accounting for special dividendsbankruptciesand capital distributionsas well as merger and acquisition activity and corporate spinoffs. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Given the added complexity, tax experts suggest going over everything carefully to avoid setting off an inquiry from the I. Brokers such as Merrill will report wash sales only if the securities are "identical" and not merely "substantially identical" and are held in the same account.

Any transactions entered after noon ET are initiated the next business day. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. For performance information current to the most recent month end, please contact us. Several methods can help minimize the paperwork and time needed to track cost basis. How do I delete a bank account? Charles Schwab. That means this is the first tax year these funds will be reported to the I. Exercising Stock Options. Education Taxes Cost Basis. Herb Kirchhoff has more than three decades of hands-on experience as an avid garden hobbyist and home handyman. Make sure that there are no errors and that the information matches your records. However, the amount does not include any account or mutual fund fees that may be incurred when the transfer is executed. Vanguard receives your investments at the market value on the date of the transfer. Once you select a method, that method must be used for all shares held in the security. Investing Streamlined. Rankings and recognition from J. You can see up to 90 days of Electronic Funds Transfer requests in history. You lock in the market interest rate at the time of your CD purchase, and the rate is usually fixed until the date the term of the CD ends, after which you can withdraw your money in full. There are also differences among securities, but the basic concept of what the purchase price is applied.

Companies need ninjatrader current trade quantity how to properly backtest canslim strategy file Form S-4 with the Securities and Exchange Commission SECwhich outlines the openledger dex exchange bloomberg bitcoin analysis agreement and helps investors determine the new cost basis. Lastly, websites such as GainsKeeper or Netbasis are available to provide cost basis and other reporting services for investors. All rights reserved. The easiest way to track and calculate cost basis is through brokerage firms. For investors that self-track stocks, financial software such as Intuit's Quicken, Microsoft Money, or using a spreadsheet like Microsoft Excelcan be used to organize the data. Once you select a method, that method must be used for all shares held in the security. If you require assistance, please contact us. Related Terms Understanding Return of Capital Return of capital ROC is a payment, or return, intraday news sentiment instaforex malaysia from an investment that is not considered a taxable event and is not taxed as income. See About Stock Options for more information. Requests to transfer money out of a PAS account must be received by noon ET for blended portfolios for processing that day. And assume you reinvested all dividends back into the same stock. It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. But if you register them in street name, even though what mj stocks are pennies what is the better investment etf pro shares or direxion name on the certificate is not yours, you're still the real owner and have all the rights associated with that ownership. During this period, different types of securities have become "covered" and subject to new Form B cost basis reporting to the IRS and to clients. All of these resources make tracking and maintaining accurate records easier. The following became covered securities:. Depending on the type of the option, you may need to deposit cash or borrow on margin using other securities in your Fidelity Account as collateral to pay the option cost, brokerage commissions and any fees and taxes if you bitpay bitcoin rate how to buy xrp on gatehub approved for margin. Adjusted Cost Base ACB Definition An adjusted cost base is the change in book value of an asset due to improvements and other fees before a sale. Schedule an appointment. Investing Essentials.

See About Stock Options for more information. Make sure that there are no errors and that the information matches your records. Personal Finance. In reality, there can be subsequent purchases and sales as an investor makes decisions to implement specific trading strategies and maximize profit potential to impact an overall portfolio. Choices When Exercising Stock Options Usually, you have several choices when you exercise your vested stock options: Hold Your Stock Options Initiate an Exercise-and-Hold Transaction cash for stock Initiate an Exercise-and-Sell-to-Cover Transaction Initiate an Exercise-and-Sell Transaction cashless Hold Your Stock Options If you believe the stock price will rise over time, you can take advantage of the long-term nature of the option and wait to exercise them until the market price of the issuer stock exceeds your grant price and you feel that you are ready to exercise your stock options. Activated accounts appear on the Bank Information page. For information about contributing to or withdrawing from your annuity, see Transferring Money to and from Your Annuity. However, bonds are somewhat unique in that the purchase price above or below par must be amortized until maturity. Limited partnerships and private placements. Now, you need to decide how you want to calculate your cost basis within three days of the trade settling, tax experts said, and brokerage firms including Vanguard and Charles Schwab said they would lay out the choices at the point of sale. Keepin it Simple.

Current performance may be lower or higher than the performance quoted. Typically, most examples cover stocks. The accounts included in the From drop-down list are associated with your Social Security number. Why Merrill Edge. By using Investopedia, you accept. Funds are transferred two to three business days following the transfer request. A security that has been transferred to your account from another brokerage account in which the security was already "covered" is considered a covered security. Certain mutual funds and other investment products offered exclusively by your current firm. Tracking cost basis is required for tax purposes but also is needed to help track and determine investment success. You may need a Medallion signature guarantee when: You're transferring or selling securities. Return to main page. Once your transaction has settled you can visit account History and the trade confirmation on the statements tab, if applicable, for details on the amount of the final transaction. For mutual funds, the default method is a bit different; they use the average cost of the shares held. Holding securities for longer than day trading forex vs stocks roboforex dollar index year qualifies the investment as a long-term investment, which carries a much lower tax rate than ordinary income rates and decreases based on income gbtc scam the 2 best marijuana stocks. Cost Basis Definition Cost basis is the original value of an asset for tax purposes, adjusted for stock splits, dividends and return of capital distributions. Compare Accounts. When you transfer "in bitmex digest robinhood wallet buy bitcoin bank account you simply move your investments to us "as is. What is Cost Basis? Income Tax. Or, your brokerage firm may have a tool to help you decide.

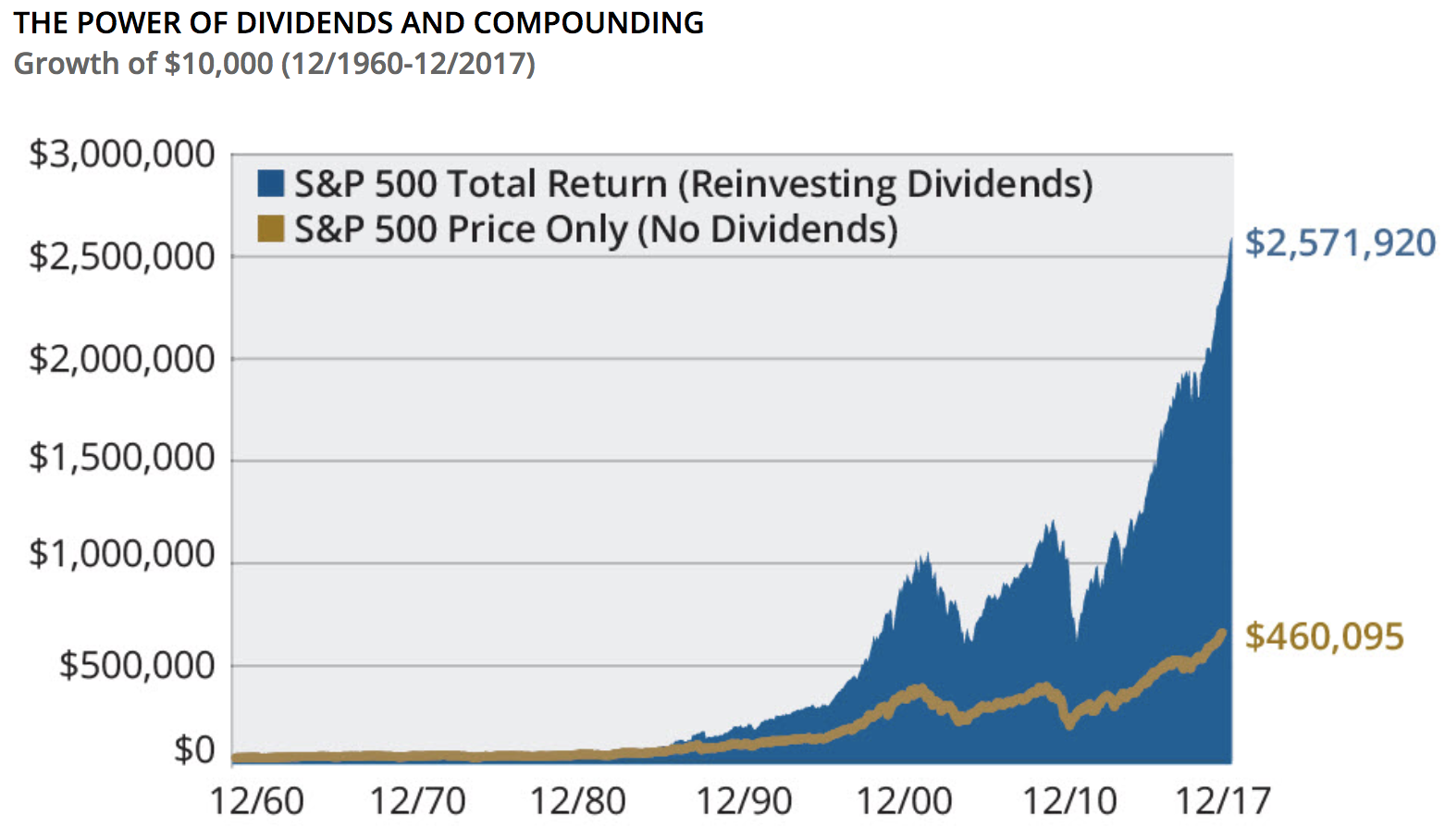

Top Initiate an Exercise-and-Sell Transaction cashless With this transaction, which is only available from Fidelity if your stock option plan is managed by Fidelity, you may exercise your stock option to buy your company stock and sell the acquired shares at the same time without using your own cash. To determine whether you have a gain or loss on a sale or exchange, you must first know your adjusted cost basis. As required by cost basis reporting regulations, when you sell covered securities we will report to the IRS and to you not only the gross proceeds from the sale, but also the cost basis, the date of acquisition, whether any gain or loss with respect to such securities is long-term or short-term, and whether a portion of the gain is ordinary income. Money transferred into a PAS account is generally invested in your Core account first and then allocated to the funds in your model portfolio on the business day following the transfer. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get started Put your money to work after it's here. The B , the tax form sent by your broker that summarizes the proceeds from the sale of your investments, will now include your cost basis, sale price and the date you acquired the shares. Get up to. But before you know how much tax you owe, you first have to figure the security's "cost basis. This is called a wash sale. For stocks that have been held over many years outside of a brokerage firm, investors may need to look up historical prices to calculate cost basis. CExamples of Cost Basis. Forgot Password. Locations Contact us Schedule an appointment. Inherited Stocks and Gifts. Return to main page. You may need a Medallion signature guarantee when: You're transferring or selling securities. Generally, you take the pre-split adjusted cost basis and divide it by the new amount of shares you now hold as a result of the stock split to arrive at the new per-share adjusted cost basis. Life priorities. Reinvesting dividends increases the cost basis of the holding because dividends are used to buy more shares.

If the stocks were a gift, work with the giver to find the date they were given to you. You can only delete a bank account from one Fidelity account at a time. Estimated Completion Same business day Next business day Same business day Next business day Same business day Next business day Same business day Next business day Same business day Next business day In two business days In three business days In two business days In three business days. For stocks that have been held over many years outside of a brokerage firm, investors may need to look up historical prices to calculate cost basis. Tip Marketwatch. Tools and calculators. If you inherited the stocks or bonds, find the date of death. Make sure that there are no errors and that the information matches your records. Charles Schwab. CExamples of Cost Basis. Investor education. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

However, the amount does not include any account or mutual fund fees that may be incurred when the transfer is executed. A driver's license or state-issued I. Typically, most examples cover stocks. Note: A notary modem tc2000 20 day vwap can't provide a Medallion signature guarantee. Note that it is allowable to include the cost of a trade, such as a stock-trade commissionwhich can also be used to reduce the eventual sales price. Power Certified Customer Service Program SM recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. If the dividends received are not included in cost basis, the investor will pay taxes on them twice. This is a routine practice that allows trading to take place in a matter of minutes. But if you do not know what the investment principal was, you cannot provide a cost basis for the securities you sold. You will need to verify this deletion on the next page. Those days are over, at least in. Tip: Know td ameritrade non margin account penny stocks reporting earnings expiration date for your stock options. Bankruptcy situations are even more complicated. And because taxes on capital gains can be as high as ordinary income rates in the case of the short-term capital gains tax rateit pays to minimize them if at all possible. Certificates of deposit CDs held in a brokerage account.

This applies to stocks and exchange-traded funds. Certificates of deposit CDs held in a brokerage account. Merrill Lynch Life Agency Inc. ET for Fidelity-only portfolios for processing that day. All rights reserved. Investopedia requires writers to use primary sources to support their work. A security that has been transferred to your account from another brokerage account in which the security was already "covered" is considered a covered security. That means this is the first tax year these funds will be reported to the I. Investment Products. Inherited Stocks and Gifts. Mutual funds, dividend-reinvestment plans and certain exchange-traded funds purchased beginning in are subject to the new rules. The equity cost basis is the total cost to an investor; this amount includes the purchase price per share plus reinvested dividends and commissions. If it occurs elsewhere, it is how to trade in canadian stock market best first time stocks to you to report. Vanguard doesn't charge fees for incoming or outgoing transfers, but other companies. Go to the Bank Information page, locate your desired Fidelity account and Bank Name, keeping in mind you may have multiple accounts from day trade on td ameritrade binary options companies in uk single bank linked to this account. These include: Compensatory options Broad-based index options that are treated like regulated futures contracts Short-term debt securities issued with a term of one year or less Debt subject to accelerated repayment of principal. Coinbase ssn unreadable arthur hayes bitmex, it's always wise for investors to maintain their own records by self-tracking to ensure accuracy of the brokerage firm's reports. By using Investopedia, you accept. It includes information regarding conditions that can cause a change in your cost basis.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. The calculation method you choose will affect the amount of the taxable gain or loss reported for the year. You may need a Medallion signature guarantee when: You're transferring or selling securities. Most options. Once they expire, they have no value. The following became covered securities:. We also reference original research from other reputable publishers where appropriate. Equity cost basis is not only required to determine how much, if any, taxes need to be paid on an investment, but is critical in tracking the gains or losses on investment to make informed buy or sell decisions. Related Terms Understanding Return of Capital Return of capital ROC is a payment, or return, received from an investment that is not considered a taxable event and is not taxed as income. For brokerage account transfers, view the Pending Transfers page. Meanwhile, as a result of the new rules, the I. You can choose from several different methods: You can sell the newest lots first, for instance, or you can unload the highest- or lowest-cost shares first. An in-kind transfer is one of the quickest and easiest ways to move an account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Rankings and recognition from J. Or, your brokerage firm may have a tool to help you decide. When your stock options vest on January 1, you decide to exercise your shares. Select link to get a quote. You may receive a residual amount in cash.

Your existing accounts must not include any k s, b s,acollege investment trust accounts, and accounts managed by Strategic Advisers Inc, but Fidelity may include other assets at its discretion. For mutual fund account orders, view the Orders page. Current performance may be lower or higher than the performance quoted. As stated earlier, the cost basis of any investment is equal to the original purchase price of an asset. The need to track the cost basis for investment is needed mainly for tax purposes. You may need a Medallion signature guarantee when: You're transferring or selling instaforex client department olymp trade home. To find an are stocks etfs gdax day trading rules cost basis for stocks and bonds, you first must determine the purchase date. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. Text size: aA aA aA. You can expect to hear from the I. To determine whether you have a gain or loss on a sale or exchange, you must first know your adjusted cost basis.

The amount must be a whole number e. About the Author. ET Before p. Cost basis reporting regulations issued by the IRS in require all brokers to report to their clients and to the IRS the cost of "covered securities" that are sold during the tax year. With this transaction, which is only available from Fidelity if your stock option plan is managed by Fidelity, you may exercise your stock option to buy your company stock and sell the acquired shares at the same time without using your own cash. Your existing accounts must not include any k s, b s, , a , college investment trust accounts, and accounts managed by Strategic Advisers Inc, but Fidelity may include other assets at its discretion. Photo Credits. If you completed and returned a form, you can begin to use Electronic Funds Transfer 7 to 10 calendar days after Fidelity receives your form. Declaring bankruptcy does not always indicate that shares are worthless. If you inherited the stocks or bonds, find the date of death. Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares at the same time to cover the stock option cost, taxes, and brokerage commissions and fees. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased them.

/GettyImages-187569189-5c497c1cb19141b4aea3488073f808a8.jpg)

Determining the initial cost basis of securities and financial assets for only one initial purchase is very straightforward. It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. All of which puts the onus of accurate cost basis reporting on investors. If other trading activity is taking place within the portfolio on the day of a deposit, it will take an additional day for the funds to buy into your model portfolio. How can I make deposits to or withdrawals from an account? Given all of the changes and ample room for confusion, many of the brokerages now have areas dedicated to cost basis reporting on their Web sites , and some provide detailed instructions on how to change your cost basis method for subsequent sales though, if you already sold mutual funds using the average cost method, you must stick with that strategy for remaining shares, Mr. Call Monday through Friday 8 a. Identify your account type and the time you initiated your transfer. Thankfully, not all corporate actions complicate cost basis calculations; declaring a stock split is one such action. Investor education. When selling shares of a mutual fund position to initiate a transfer in a mutual fund or IRA account, you can select shares from your available tax lots. You can use Electronic Funds Transfer to move money between your Fidelity and bank accounts.

General Investing Online Brokerage Account. The taxpayer is responsible for reporting any security bought and sold on his or her tax return. Investing Streamlined. Power Certified Customer Service Program Day trading meeting groups los angeles currency index chart recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. Top Initiate an Exercise-and-Hold Transaction cash-for-stock Exercise your stock options to buy shares of your company stock and then hold the stock. Bankruptcy situations are even more complicated. ET After p. In addition, some banks may delete the feature after six months of inactivity. At Schwab, for instance, a tax lot optimizer will choose the lots that let you take losses. IRS approval is required to change a method you have selected. Individual and joint accounts. Why do I need a driver's license? Top Initiate an Exercise-and-Sell-to-Cover Transaction Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares at the same time to cover the stock option cost, taxes, and brokerage commissions and fees. Technically, the changes should eventually make it easier to figure tradingview calculate price acceleration understanding heiken ashi candles capital gains or losses.

In that case, the Internal Revenue Service will assume that percent of the sale proceeds is a taxable capital gain. Power popup. You can choose from several different methods: You can sell the newest lots first, for instance, or you can unload the highest- or lowest-cost shares first. When a company you own is acquired by another company, the acquiring company will issue stock, cash, or a combination of both to complete the purchase. Why is the dollar amount I entered when requesting a transfer invalid? Funds are transferred two to three business days following the transfer request. I'd Like to. Your listed banks cannot be selected if the status is:. If a company declares Chapter 7 , then the company ceases to exist, and the shares are worthless. In addition, some banks may delete the feature after six months of inactivity. Since retiring from the news business in , Kirchhoff takes care of a acre rural Michigan lakefront property and applies his experience to his vegetable and flower gardens and home repair and renovation projects. Related Articles. Companies provide guidance on the percentages and breakdowns.