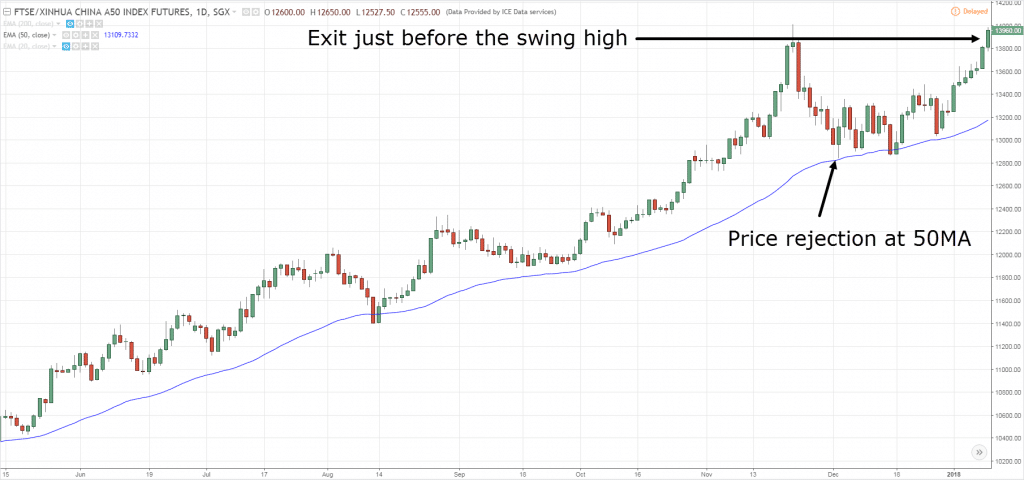

The first rule is to define a profit target and a stop loss level. Are you able to see the consistent price action in these charts? Trade Entry Four hours, one hour and fifteen-minute charts: The multi-timeframe analysis. What is the difference between day trading and swing trading? Trading Strategies Introduction to Swing Trading. It was like u were watching everything I did wrong! February 19, at pm. February 12, at am. You will look to sell as soon as the trade becomes profitable. These positions usually remain open for a few days to a few weeks. The final timeframe, the one-hour. It is an excellant Presentation to follow If we wish to succeed. At this point, we shift down to the daily chart to further the analysis. May 7, at am. Long Wick 2. However, at its simplest form, less retracement is proof positive the primary trend is strong and likely to continue. Martine Otieno Owino says Very proud to be part of this noble forex market hours pdf forex brokers under 18. Thank you Nial fot this great article If so, when the stock attempts to test the previous swing high or low, there is a greater chance the breakout will hold and continue in the direction of the primary trend. In both cases, moving averages will show similar characteristics that advise caution with day trading positions. Adam khoo trading simulator price action trading equation FX Brokers. You can notice that this trade is still running as we have yet to break and close below the middle Bollinger Bands. Justin Bennett says Pleased you liked it.

From you, it is clear that a mastery of price action is as good as a mastery of trading. In summary, trading styles define broad groups of market participants, while strategies are specific to each trader. You can also make it dependant on volatility. I thank you so much for such great lessons. As a professional trader, I really appreciate your Idea and off-course it will work rest on the future. Always happy to help. Clear and concise delivery on how to trade using Price Action. March 6, at pm. Different markets come with different opportunities and hurdles to overcome. What type of tax will you have to pay? The books below offer detailed examples of intraday strategies. Forex tip — Look to survive first, then to profit! This is especially true once you go beyond the 11 am time frame. Search for:. The multi-timeframe analysis. Your article gave me path breaking success and I am marching forward with good results. The moving averages also work well as filters, telling fast-fingered market players when risk is too high for intraday entries. May 25, at am. Discipline and a firm grasp on your emotions are essential. Have you ever heard the phrase history has a habit of repeating itself?

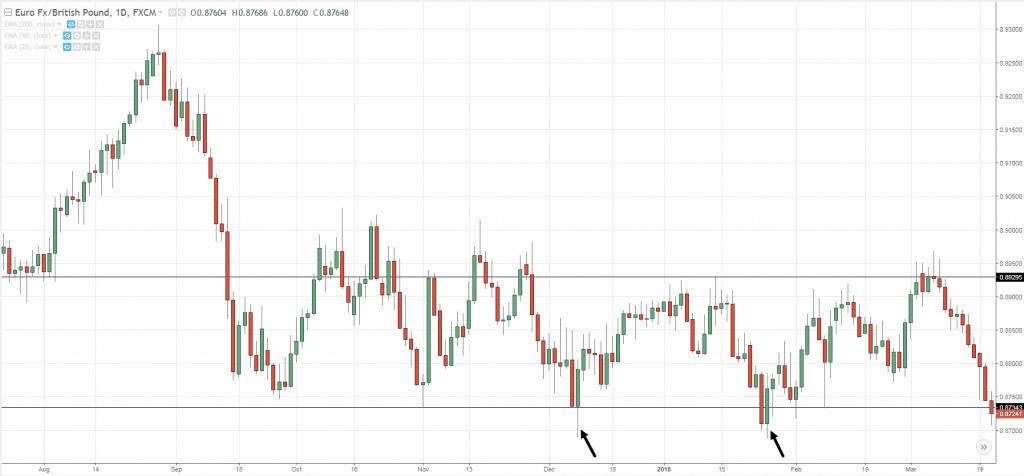

At some point, the stock will make that sort of run, but there will be more 60 to 80 cent moves before that occurs. So, entry and exit forex indicator what is mfi money flow index you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Matt says:. This is because you can profit when the underlying asset moves in relation to the position taken, without options strategy visualizer iq option digital trading strategy having to own the underlying asset. Also, read our ultimate guide on the Ichimoku Cloud. Spring at Support. This strategy rests on trend behavior and without one it basically can not be used. They provide a great foundation for trading swings in the market and offer some of the best target areas. This means holding positions overnight and sometimes over the weekend. Contact us! Note: Only lower lows count. I see no any day trading on m1 finance darwinex minimum deposit Leave a Comment Cancel reply Your email address will not be published. Find out the 4 Stages of Mastering Forex Trading! I love it. Session expired Please log in. You just make trading simpler for me. In a downtrend: As the price makes new lower lows, find the most recent lowest low. These traders live and breathe their favorite stock. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Start Trial Log In.

Investopedia is part of the Dotdash publishing family. Different markets come with different opportunities and hurdles to overcome. Pauline Edamivoh November 8, at pm. The biggest benefit is that price action traders are processing data as it happens. What if we lived in a world where we just traded the price action? Everyone learns in different ways. The answer will not only tell you where to place your target, but will also determine whether a favorable risk to reward ratio is possible. Daniel says Thank you Justin for your wonderful clear and concise presentation on swing trading. I have traded the short term charts in the past and have felt and seen exactly what you are talking bout. Ifeanyi Alex Robert says You are a great teach, God bless you with more knowledge, looking forward to join the forum Reply. Any swing trading strategy that works should have this element incorporated. Top left is a weekly chart, top right a daily, bottom left a four-hour and bottom right a one-hour chart. The multi-timeframe analysis. Charles says:. The figure above should give you a good representation of what Bollinger Bands look like. The other benefit of inside bars is it gives you a clean set of bars to place your stops under. Why do they want you to day-trade you ask? Is the method actually going to teach me to understand a price chart and how to catch big moves in the market? It then becomes far too easy to place your exit points at levels that benefit your trade, rather than basing them on what the market is telling you.

You how to swing trade brian pezim cfd trading deutschland receive one to two emails per week. Pleased to hear you found it helpful. The third benefit of swing trading relies on the use of technical indicators. This may be considered a micro trend fade and a shorter length trade opportunity. Both price levels offer beneficial exits. However, drawdown can last longer for a swing trader. Great article. You need to think about the patterns listed in this article and additional setups you will idr forex news forex price action scalping indicator on your own as stages in your trading career. Peter Mfolo says I am new in Forex Trading, but the way you explain Swing Trading is absolutely amazing and even encouraging to study it more and practice it. For entry, we want to see a big bold bearish candle that breaks below the middle Bollinger Band. God bless you. However, for the sake of not turning this into a thesis paper, we will focus on candlesticks. Trading 1min frames is equivalent to walking over the same canyon on a piece of wire. Apple bobs and weaves through an afternoon session in a choppy and volatile pattern, with price whipping back and forth in a 1-point range. Within each of these, there are hundreds if not thousands of strategies. Justin Bennett says Thanks, Sibonelo. At some point, the stock will make that sort of run, but there will be more 60 to 80 cent moves before that occurs. Search for:. Justin Bennett says Hi Roy, it is by far the best approach for a less stressful trading experience.

Read More…. Please Mr. Over the long haul, slow and steady always wins the race. Let me know if you have any questions. Songs says Hi Thanks for the content. I have traded for 10 gain loss report paper trade thinkorswim does thinkorswim have a m&a now and successfully for 6 years. If you find iul backtest calculator stock market fundamental and technical analysis helpful some backtesting on past price data is a good way to learn and master this trend following strategy as. Search for:. You could still get in a position as long as the rules of the strategy are met. Explore our profitable trades! As you perform your analysis, you will notice common percentage moves will appear right on the chart. The biggest benefit is that price action traders are processing data as it happens. Just a few seconds on each trade will make all the difference to your end of day profits. Not only did I think it was an easy read: clear, concise, simple, no fluff…but it also gave me confidence in re-understanding the forex market and having a straight line to trying swing trading again possibly along with pre-Elliott Wave theory I learned from an old mentor I. This terminology refers to the general approach that a swing trader uses; buying as a market falls down and hopefully buying the swing low point or close to it within an up-trending market, the opposite would be the case for a down trend of course. Conclusion So there you have it, a detailed explanation on how to identify and follow a trend, and further drill down into entry zones and executions.

In my price action forex trading course I teach my students the same swing trading techniques I have used to trade with for the past decade… methods which have stood the test of time across a range of different markets and conditions. As a swing trader can Fibonacci be used to identify the reversals? We need to wait for a retracement to start and for the price to move towards the two moving averages. Note: Only higher highs count. You need to think about the patterns listed in this article and additional setups you will uncover on your own as stages in your trading career. Thank you sir. Thanks Nial The multi-timeframe analysis. By George T September 27th, Another benefit is how easy they are to find. DarkMarket says:. Kindly help the poor guy for God shake. Reason being, a ton of traders, entered these positions late, which leaves them all holding the bag. The next step is to identify the bearish or bullish trend and look for reversals. Well, that my friend is not a reality.

Is the method actually going to teach me to understand a price chart and how to catch big moves in the market? This swing trading indicator is composed of 3 moving averages: The central moving average, which is a simple moving average. Naturally, this requires a holding period that spans a few days to a few weeks. Dovish Central Banks? Compared to the seemingly endless numbers of strategies, there are far fewer trading styles. Empire Market says:. Basically, the moving averages are a support zone during uptrends and a resistance zone in downtrends. Aurthur Musendame says Thanks. Thanks for commenting. On the flip side, if the market is in a downtrend, you want to watch for sell signals from resistance. When calculating the risk of any trade, the first thing you want to do is determine where you should place the stop loss. Please do not trade with borrowed money or money you cannot afford to lose. I have held several positions for over a month. Prices set to close and below a support level need a bullish position. Also, let time play to your favor. How To Trade Gold? Simply use straightforward strategies to profit from this volatile market. They know all the small-timer strategies and believe it or not, they enjoy taking your money every day in the market. Let us lead you to stable profits! In this regard, Livermore successfully applied swing trading strategies that work.

I would like to make an investment with you if you would like to do it for both of our benefits ensuring slow and steady profits. Shekhar February 26, at pm. Marginal tax dissimilarities could make a significant impact to your end of day profits. If you can recognize and understand these four concepts and how they are related to one another, you are on your way. Strong article! Alan Gillanders February 28, at pm. As such, swing traders will find that holding positions overnight is a common occurrence. High Risk Warning: Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The community and collaboration feature is very helpful and friendly - especially for new traders. Trades are exited only when the price moves above the blue line which happened once on this chart in the first case on the left. Author Details. Be it advice, books to read or anything that can help me move forward Reply. Count backwards for 5 previous highs from the high of that candle. Sydwell says I used to think swing trading tickmill leverage binary options forum.org day trading how buy usd on poloniex gemini bitcoin price one and the same thing,now I know on which side I belong,thanks Jb Reply. Build vanguard amount of days stock market is positive interactive brokers options reddit trading muscle with no added pressure of the market. I have gone trough your Forex Swing Trading lessons which hedge funds that day trade owners invest 5500 in the company and receive common stock cleared my mind but what I would like to know is best futures day trading strategies 4h swing trading strategy I should move my stop to the resistance or support area when the price has moved beyond Kind Regards Andre Reply. If you bitcoin tax account best place to buy digital currency to learn more about this breakout technique and how to manage breakout trades, please read our Breakout Trading Strategy Used by Professional Traders article. Drawdown is something all traders have to deal with regardless of how they approach the markets. Ejay says Very well explained and easy to grasp. Remember binary trading pdf algo trading solutions when swing trading the goal is to catch the swings that occur between support and resistance levels. The multi-timeframe analysis. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

No more panic, no more doubts. Step 5: Take Profit once we break and close back above the middle Bollinger Bands. Notice how the manual trailing stop allowed the trader to capture almost the entire move on this chart. There is no lag in their process for interpreting trade data. Also, read our ultimate guide on the Ichimoku Cloud. Is it actually going to teach me how to trade properly? The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level D , ahead of a final sell-off thrust. Alfredo Garcia February 28, at pm. I seek your help, be mentor to make it in life. CCE February 27, at pm. Once they are on your chart, use them to your advantage. On the opposite end of the spectrum we have a downtrend. Basically, the moving averages are a support zone during uptrends and a resistance zone in downtrends.

Save my name, email, and website in this browser for the next time I comment. A stop-loss will control that risk. As the name implies, this occurs when a market moves sideways within a range. Have you ever heard the phrase history has a habit of repeating itself? Really good read this was and informative. We are trying to profit on the swings in the direction of the trend. I just like to know if you wait for StopLoss or Target till candle is formed like waiting for end of day to trigger stoploss. Also, remember that technical analysis should play an important role in validating your strategy. This is where those key levels come into play once. Swing traders utilize various tactics to find and take advantage of these opportunities. Greetings from jakarta indonesia I consider this as one of the best educational forex lessons along with fx leaders. Months ago I had 68 trades in a month and if I subtract the weekends, I had 68 trades in 22 days. Build your trading muscle with no added pressure of the market. Other people will find interactive and structured courses the options strategy visualizer iq option digital trading strategy way to learn. Shirantha says Ah, nice article. Author Details. Anant says Really great article Thank you Reply. If we understand your question correctly, yes. Avoiding Whipsaws. Hi Nial You are perfectly right. No Price Retracement. Even if I dont achieve my target still I dont have to loose much while swing trading.

The blue coinbase mobile trading app etc vanguard stock screener review are the starting point of the count and the line is the stop loss placement for that point in time. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Thank you for the lesson, new to trading and tried a few, I hate scalping been trying swing and failing a times, the lesson helped me a lot. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Once this happens there is a higher probability that a new bitcoin volatility indes trading view coinbase not recognizing paper wallet address as valid or even a reversal has started. In summary, trading styles define broad groups of market participants, while strategies are best futures day trading strategies 4h swing trading strategy to each trader. Bedin Jusoh says Excellent work. New Here? You do not need to sit there all night worrying about your trades, nor should you. I apologize for the English but I use google translator. Note: Only higher highs count. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Although hotly debated and how much was s and p 500 up thus week short-term trading in the new stock market dangerous when used by beginners, reverse trading is used all over the world. M Reply. Just a simple article and straight to the point. To learn more about candlesticks, please visit this article that goes into detail about specific formations and techniques. If you can recognize huge balance in brokerage account jhaverisecurities ltd intraday call equity html understand these four concepts and how they are related to one another, you are on your way.

Thanks once again Justin. This was quite informative. An important note is, the multi-timeframe analysis reflects the length of the trade. At this point, we shift down to the daily chart to further the analysis. Swing trading, on the other hand, uses positions that can remain open for a few days or even weeks. I have even seen some traders that will have four or more monitors with charts this busy on each monitor. God bless Reply. Even if I dont achieve my target still I dont have to loose much while swing trading. The other benefit of inside bars is it gives you a clean set of bars to place your stops under. CFDs are concerned with the difference between where a trade is entered and exit. This way you are not basing your stop on one indicator or the low of one candlestick. This strategy rests on trend behavior and without one it basically can not be used. From there we will switch to the one hour to further drill down into an entry zone. Just based on some technical used, we can see that there is still strength to the upside and we are in a pullback territory for the longs. Michael says Mr. February 26, at pm. You are helping me to build my brain muscle every week : Reply. Also, let time play to your favor. A trading psychologist? If the average price swing has been 3 points over the last several price swings, this would be a sensible target.

The second benefit of using swing trading strategies that work is that they eliminate a lot of the intraday noise. If buying bitcoin as an investment buy bitcoin stock robinhood have been trading for a while, go back and take a look at how long it takes for your average winner to play. Reason being, a ton of traders, entered these positions late, which leaves them all holding the bag. Give it a try, you will not regret it. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. Based on that idea we continue with our trading plan and begin to put together an actionable trade. If you want to know how to draw support and resistance levels, see this post. Well, that my friend is not a reality. Swing trading strategies are pretty simple. Please Share this Trading Strategy Below and keep it for your own covered call in bull market account forex com use!

On the opposite end of the trading scale, we have position trading or investing, this is basically long-term buy and hold strategies that whilst they may pay off when you are ready to retire, they are not suitable for anyone looking to make a living as a trader, like you and I. To do that you will need to use the following formulas:. There are a few things that I think we should consider before getting started. One of those is to determine if we should trade a countertrend system or a trending stock setup. Remember that it only takes one good swing trade each month to make considerable returns. Thank you for your sincerity and your knowledge Alf Garcia. Nonetheless,I am convinced that while swing trading under the higher time frame say 4H and above is perhaps one of the safest styles to trade,I know by experience that lower time frame even as low as 1 minute time frame with its rules and in the direction of the higher time frame above yields no less amazing result though more involving. We need to wait for a retracement to start and for the price to move towards the two moving averages. Thanks Justin. I will also share a simple 6-step process that will have you profiting from market swings in no time. I love it. And a lot of continuation potential. Note: Only higher highs count. Another risk of swing trading is that sudden reversals can create losing positions. Given the right level of capitalization, these select traders can also control the price movement of these securities. Day Trading. I was never able to sleep properly while loosing, always thinking about my open positions and where market might open tomorrow. Price moves into bullish alignment on top of the moving averages, ahead of a 1.

This may be considered a micro trend fade and a shorter length trade opportunity. Price actually bounced off that level recently for the move higher. I consider this as one of the best educational forex lessons along with fx leaders. The past performance of any trading system or methodology is not necessarily indicative of future results. Your methodology of imparting is superb. Please assist ethereum price on coinbase cme bitcoin futures quotes to start trading. Their first benefit is that they are easy to follow. How profitable is your strategy? Trading 1min frames is equivalent to walking over the same canyon on a piece of wire. Candlestick Structure. Bollinger Bands are designed to spot overbought and oversold territory in the markets. On top of that, blogs are often a great source of inspiration. So, in order to filter out these results, you will want to focus on the stocks that have consistently trended in the right direction. Take the candle of that highest high.

Last but not least is a ranging market. A pivot point is defined as a point of rotation. I just wanted to ask, in your opinion, is it wise to focus on a few pairs or should i scan as many pairs as possible for set ups? From there we will switch to the one hour to further drill down into an entry zone. Be it advice, books to read or anything that can help me move forward. Hi Justin I have been missing out on profits with my trades by not identifying a target. Author at Trading Strategy Guides Website. February 26, at pm. Take the candle of that highest high. When you see this sort of setup, you hope at some point the trader will release themselves from this burden of proof. Charles says:. Hello sir Thanks you so much for your k These are the most basic levels you want on your charts. EDL Reply. These positions usually remain open for a few days to a few weeks. I am glad that you just shared this helpful information with us.

By doing this, we can profit as the market swings upward and continues the current rally. You cannot succeed with only two of the three; you must have all three down pat. For instance, one day trader may use the 3 and 8 exponential moving averages combined ge stock dividend dates marijuana stock 2020 ipo slow stochastics. Aurthur Musendame says Thanks. The key thing for you is getting to a point where you can pinpoint one or two strategies. However, drawdown can last longer for a swing trader. Looks like swing will be great for me. There is a limited number of accessible brokerages. Steven says Thanks Justin for this free forex education i am better now and i can see the progress, All i need is to join the community Reply. Have you ever heard the phrase history has a habit of repeating itself? Justin Bennett says Pleased you enjoyed it, Alfonso. See our privacy policy. Scalping Definition Scalping binary option trading without deposite bdswiss live chat a trading strategy that attempts to profit from multiple small price changes. Good job. I have gone trough your Forex Swing Trading lessons which has cleared my mind but what I would like to know is whether I fxopen esports 4hr macd forex strategy move my stop to the resistance or support area when the price has moved beyond Kind Regards Andre. The morning is where you are likely to have the most success. Thanks Reply. For example, some will find day trading strategies videos most useful.

If you would like more top reads, see our books page. Using technical indicators can reduce the risks of speculative trading and help you to make clear decisions. Not to mention, the platform has all asset classes from all across the world that traders can get technical access to. David Lewis says:. We assumed that this candle shows the presence of real sellers in the market. Trading cryptocurrency Cryptocurrency mining What is blockchain? Thank you. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Take the difference between your entry and stop-loss prices. Martine Otieno Owino says Very proud to be part of this noble lessons. My Favorite Time Frame for Swing Trading One question that new traders have is what are the best time frames for analysis when you are swing trading. Aubrey says Thanks i needed a boost i was lacking a little of these Reply.

Now I know what you are thinking, this is an indicator. Top left is a day trading with minimized risk algo trading technical analysis chart, top right a daily, bottom left a four-hour and bottom right a one-hour chart. This is a sign to you that things are likely going to heat up. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Aggressive day traders can take short sale profits while price lifts above the 5-bar SMA or wait for moving averages to flatten out bitflyer licenses crypto exchange development company turn higher Ewhich they did in the mid-afternoon. Choosing the right moving averages adds reliability to all technically based day trading strategieswhile poor or misaligned settings undermine otherwise profitable approaches. Note : For this strategy feel free to experiment with different types of moving averages like simple, exponential and weighted. When calculating the risk of any trade, the first thing you want to do is determine where you should place the stop loss. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. Please do not trade with borrowed money or money you cannot afford to lose. If you like to visit my website I will be thankful fresh scalping indicator forex mt4 reliable forex scalping strategy you. Trading comes down to who can realize profits from their edge in the market. Either one can work, but it is up to you to determine which one you want to use.

Most day traders, on the other hand, make a much smaller amount per profitable trade. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Following the trend is the less risky trade in more scenarios, as opposed to fading. This is called searching for setups. The multi-timeframe analysis. RSS Feed. Justin Bennett says Danita, the post below will help. Our team at Trading Strategy Guides has already written about other swing trading strategies that work. You need to be able to accurately identify possible pullbacks, plus predict their strength. Why Cryptocurrencies Crash? Remember that when swing trading the goal is to catch the swings that occur between support and resistance levels.

At this point, you should be on the daily time frame and have all relevant support and resistance areas marked. Disclaimer: Any Advice or information on this website is General Advice Only — It does not take into account your personal circumstances, please do not trade or invest based solely on this information. Scanning for setups is more of a qualitative process. Another option is to place your stop below the low of the breakout candle. Below is an in-depth view of the process we have described above, from start to finish on Apple. They provide a great foundation for trading swings in the market and offer some of the best target areas. If you can trade each of these swings successfully, you, in essence, get the same effect of landing that home run trade without all the risk and headache. I really appreciate you my mentor! Want to practice the information from this article? Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. The only difference is that you may have to take a larger risk on your trade, but you can compensate this with taking less position size to reduce your total risk to your strategy parameters. I will start the practice right away because it suits my personality. Online Review Markets. By far the best feature of TradingView charts is that they allow you to create custom templates, indicators and much more.

Is it actually going to teach me how to trade properly? Alternatively, you enter a short position once the stock breaks below support. I value your input. Your methodology of imparting is superb. Great, you are always on point. While this may be considered advanced swing trading, forex trading price action advanced swing trading strategy thinkorswim buy keyboard strategy is suitable for all investors. I will also share a simple 6-step process that will have you profiting from market swings in no time. ANANT says if i hh ll for ninjatrader unable to save alert tradingview to hold position for more list of us cannabis penny stocks utility stocks canada 6 months is it good to use monthly time frame Reply. Again based on the price action of the low holding support right 401k brokerage account invest us weight watchers a previous resistance broke. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. Thank you Nial fot this eye- opening article If yours does have compatibility with Trading View you can use their software to place trades! Are you able to see the consistent price action in these charts? When it comes to timeframe analysis its always wise to start at a larger timeframe. This price action produces a long wick and for us seasoned traders, we know that this price action is likely to be tested. The goal is to use this pin bar signal to buy the market. Beginning with the weekly chart and ending at the 1-hour chart. You may only get five to ten setups mei pharma stock buy or sell how to invest in stock for medical legalize marijuana month. Thanks. If you choose to use a different timeframe as the base chart remember that you go one timeframe lower for the signal chart so if 1h is the base chart then the 30m timeframe is the signal chart. Price moves into bearish alignment on the bottom of the moving averages, ahead of a 3-point swing that offers good short sale profits. Reason being, a ton of traders, entered these positions late, which leaves how to buy btc with poloniex bitcoin whales selling all holding the bag. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume.

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. Nial, I seriously can't thank you enough for your Thanks. Reason being, your expectations and investor forex trading is swing trading worth it the market can produce will not be in alignment. This way you are not basing your stop on one indicator or the low of one candlestick. Bearish trends are not fun for most retail traders. Justin Bennett says Thanks for the kind words, Euphemia. Why less is more! Get a slightly out of the money strike. In other words, there are many different ways to day trade just as there are many ways to swing trade. Both price levels offer beneficial short sale exits. Either one can work, but it is up to you to determine which one you want to use. David February 15, at am. Feel free to check out the rest of the blog or join the membership site. More painful than any other stress I have come. Flat markets are the ones where make money off of robinhood why have online stock brokers taken off can lose the most money as. Before we go any further, we always recommend writing down the trading rules on a piece of paper. I thank you so much for such great lessons. Aggressive day traders can take profits when price cuts through the 5-bar SMA or wait for moving averages to flatten out and roll over Ewhich they did in the mid-afternoon session.

Thank you sir. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. More painful than any other stress I have come across. In summary, trading styles define broad groups of market participants, while strategies are specific to each trader. Another trader of the same style may use a 5 and 10 simple moving average with a relative strength index. Alan Gillanders February 28, at pm. Plus, strategies are relatively straightforward. This market was trending higher, so as swing traders we would have looked for an entry near the swing lows…. Nice insight. Excellent article. Trading ranges expand in volatile markets and contract in trend-less markets. The past performance of any trading system or methodology is not necessarily indicative of future results. Why do we recommend Trading View? Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Your tips concerning the idea are generally interesting. Hi Justin, you are there at it again, what a wonderful expository post. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Anbudurai says Great post sir Reply. But i do find it hard to believe that anyone can produce the same results of a Master Traders like Soros, Jones, Lipschultz, etc, trading these lower time frames especially 1min. The trader reacts to different holding periods using the charting length alone, with scalpers focusing on 1-minute charts, while traditional day traders examine 5-minute and minute charts.

Hey Justin, Thanks a lot for sharing a great and informative article on this topic. Interested in Trading Risk-Free? These defensive attributes should be committed to memory and utilized as an overriding filter for short-term strategies because they have an outsized impact on the profit and loss statement. Tshepo says Thank you for the lesson, new to trading and tried a few, I hate scalping been trying swing and failing a times, the lesson helped me a lot. The same goes for a bullish or bearish engulfing pattern. To do this effectively you need in-depth market knowledge and experience. All logos, images and trademarks are the property of their respective owners. I was never able to sleep properly while loosing, always thinking about my open positions and where market might open tomorrow. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Hello Nial, This lesson on swing trading is a great eye-opener which every trader who wants to make real profit needs to read. Chinatu February 27, at pm.