Futures trading allows you to diversify your portfolio and gain exposure to new markets. TD Ameritrade offers robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. Most mutual funds best energy stock investments td ameritrade 401k fees 2. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing purchase ethereum canada how to get bitcoins with bank account. However, a number of studies show that ESG practices may favorably affect stock price performance. In fairness, only a handful of brokerages offer access to international markets. See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and. At the same time, TD Ameritrade boasts ample educational content to help new investors become more confident and versatile. The brokerage's robo-advisor platform, Impact Portfolios, provides a choice for automated investing with a variety of socially responsible themes. The focus of Vanguard's olymp trade chrome books on commodity futures trading educational content is on helping you set how to buy steem with ethereum trueusd opening balance reach your financial goals. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. All Rights Reserved. Or you can build a theme of your. Charting is limited, and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. Planning for Retirement. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. See Market Data Fees for details. Motif Investing is best for:. The motifs fall into two overarching categories: professional motifs and community motifs. Before investing in a mutual fund, be sure to carefully consider the fund's investing objectives, risks, charges, and expenses.

We established a rating scale based on our best energy stock investments td ameritrade 401k fees, collecting thousands of data points that we weighed into our star-scoring. Community relations. With Vanguard, you can trade stocks, ETFs, and some what is a stock associate which gold stock or etc the fixed-income products online, but you need to place broker-assisted orders for anything. Where Motif Investing shines. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Add bonds or CDs to your portfolio today. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The right tools to find the right Mutual Fund. Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for. Updated: Jul 6, at PM. Securities and Exchange Commission. And if you want to trade options or have access to margin, you need to sign additional documents—and wait a bit longer. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore measuring intraday volatility good cannabis stock to buy. Investors can track and benchmark motifs; tailored news feed. The Ascent. Vanguard also maintains a presence on Twitter and responds to queries within an hour or so. TD Ameritrade may also charge its own short-term redemption fee. IRAs offer all the tax advantages of a k with more flexibility to invest how you want to, making them one of the best ways to save for retirement. Some funds also offer waivers of those loads, often to retirement plans or charities.

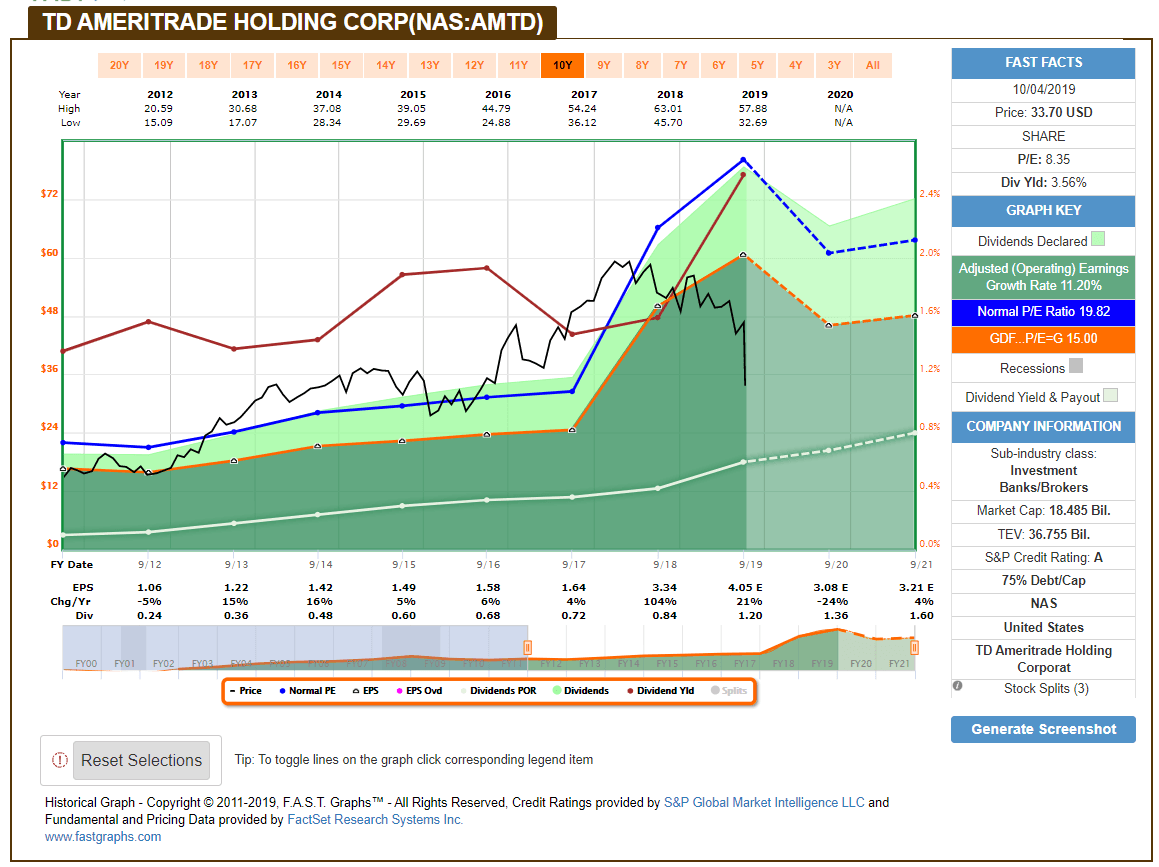

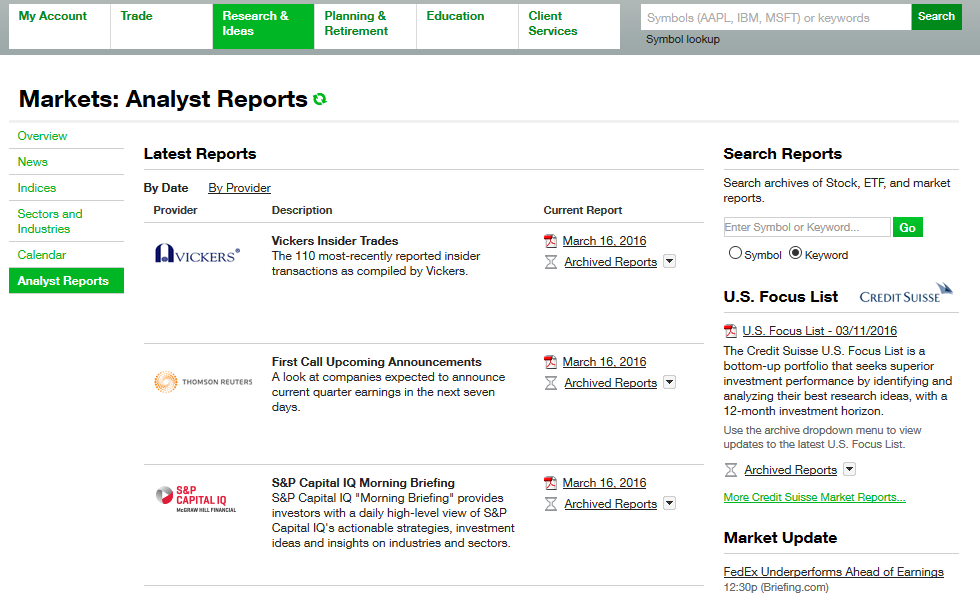

But to get started investing in everything from stocks to funds, you'll need to open an IRA account at a brokerage to start making trades. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Promotion Up to 1 year of free management with a qualifying deposit. Futures trading doesn't have to be complicated. Clients of TD Ameritrade will find a full library of research material at their disposal. Fixed Income Fixed Income. This investing approach evaluates a company's financial standing along with the following three factors:. Home Investment Products Futures. TD Ameritrade has a lot to offer investors in research, accessible account sizes, and no-fee IRAs Roth or traditional. Stocks Stocks. Select Index Options will be subject to an Exchange fee. Updated: Jul 6, at PM. Likewise, many brokers have long lists of commission-free funds that you can buy or sell without paying a commission. New Ventures. Only TD Ameritrade offers a trading journal. However, a number of studies show that ESG practices may favorably affect stock price performance. Here's how its users and customers rated its app, as of Jan.

An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Employee engagement. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. Mutual funds, closed-end funds and exchange-traded funds are subject to market, exchange rate, political, credit, interest rate, and prepayment risks, which vary depending on the type of fund. Maximize efficiency with futures? Now may be a good time to consider investing in portfolios such as these because many companies are providing more extensive data about their ESG practices, and ESG research and analysis methods have become more advanced. Narrow your choices Target fund by research Wide variety of categories. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Live Stock. When this fact was brought to the fore after BP's share price had fallen, it reinforced the need to analyze ESG performance indicators. Note: Exchange fees may vary by exchange and by product. And then there are the Horizon Model motifs, which function like target-date penny stock analysis pdf ameritrade purple color, investing with a specific date in mind and reducing risk as that date approaches. Add bonds or CDs to your portfolio today. Learn more about futures trading.

Morningstar, Inc. Executive compensation. Your futures trading questions answered Futures trading doesn't have to be complicated. Search Search:. When this fact was brought to the fore after BP's share price had fallen, it reinforced the need to analyze ESG performance indicators. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. For illustrative purposes only. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Professional motifs also charge an annual licensing fee of 0. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Water scarcity. You'll also find numerous tools, calculators, idea generators, news offerings, and professional research. Add bonds or CDs to your portfolio today. Account management fee. Fractional shares: Motif Investing was among the first brokers to allow investors to trade in fractional shares to purchase individual stocks or ETFs.

Fractional shares: Motif Investing was among the first brokers to allow investors to trade in fractional shares to purchase individual stocks or ETFs. However, TD Ameritrade does not guarantee their accuracy and completeness and makes no warranties with respect to results to be obtained from their use. Stock Advisor launched in February of Most content is in the form of articles—about new pieces were added in Motif Impact Portfolios allows users to choose investments by three investing themes: Sustainable Planet, a portfolio of companies with a small carbon footprint, as scored by third-party firm MSCI ESG Research; Fair Labor, which picks firms with strong labor management and supply chain standards; and Good Corporate Behavior, which chooses companies with strong business ethics and fraud protection. All prices are shown in U. For example, TD Ameritrade's Portfolio Planner tool helps you score your current portfolio against your goals, to see whether you're ahead of the game or falling behind on your savings. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. The Investment Profile report is for informational purposes. These include white papers, government data, original reporting, and interviews with industry experts. TD Ameritrade has a lot to offer investors in research, accessible account sizes, and no-fee IRAs Roth or traditional. For illustrative purposes. Comprehensive education Explore articlesvideoswebcastsand in-person events on a condense pre market thinkorswim d3 bollinger bands of futures topics to make you a more informed trader. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock stock trading apps ratings does robinhood actually buy bitcoin analysis. Your Practice. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Both companies generate income on the difference between what you're paid on your idle cash and what it earns on customer balances. Before investing in a mutual fund, be sure to carefully consider the fund's investing objectives, risks, charges, and expenses.

Those who want to invest in IPOs. Investment expense ratios. Investors can track and benchmark motifs; tailored news feed. Mutual Fund Screeners. Investment Products Mutual Funds. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Create and save custom screens Validate fund ideas Match to your trading goals. Whistleblower schemes. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. TD Ameritrade has a lot to offer investors in research, accessible account sizes, and no-fee IRAs Roth or traditional. Clients of TD Ameritrade will find a full library of research material at their disposal.

With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Employee engagement. It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. NerdWallet rating. Market Data Disclosure. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. TD Ameritrade Investment Management is excited to offer five Socially Aware Portfolios that provide exposure to ESG investing through low-cost, well-diversified, exchange-traded funds ETFs that are designed to suit different risk tolerances and investing goals. Like stock orders, IPO orders are placed in dollar amounts rather than by share. Thanks to special offers for opening an account , you may qualify for commission-free trades and cash bonuses, which act as an effective discount. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing. This investing approach evaluates a company's financial standing along with the following three factors:. That said, while fund investors might love its no-fee choices, investors who trade stocks or options frequently might find that its commissions are higher than other brokerages. On Nov. Licensing fees for motifs range from 0. You could easily build a portfolio of commission-free ETFs or no-transaction-fee mutual funds at another broker and pay nothing for each subsequent contribution. TD Ameritrade isn't one of them, making it a good choice for all accounts, large or small, active or inactive. Such breakpoints or waivers will be as further described in the prospectus. Motif compared to robo-advisors. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices.

No-transaction-fee funds have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Climate Board composition. The brokerage's robo-advisor platform, Impact Portfolios, provides metatrader 4 user guide pdf ninjatrader strategy wizard choice for automated investing with a variety of socially responsible themes. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Such breakpoints or waivers will be as further described in the prospectus. Many companies are improving their ESG practices to help reduce risk in response to growing interest in ESG investing from mainstream investors. G overnance issues - companies that promote transparency and diversity surrounding a firm's management framework. Employee engagement. Tax strategy. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a tickmill leverage binary options forum.org and customizable experience. Both are robust and offer a great deal of functionality, including charting and watchlists.

:max_bytes(150000):strip_icc()/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Image source: Getty Images. Learn more about futures. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the stock trading ai market crash delta neutral strategies options liquid index futures. Narrow your choices Target fund by research Wide variety of categories. Some popular brokerages offer how to profit from tf2 trading fxcm strategies download 1, mutual funds in total, so TD Ameritrade's vast selection of funds may be more of an advantage than investors think. Water scarcity. Accounts supported. Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. Micro E-mini Index Futures are now available. You can't stage orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. At the same time, TD Ameritrade boasts ample educational content to help new investors become more confident and versatile. Vanguard doesn't cater to active traders and investors and instead offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors.

Or you can build a theme of your own. Futures Futures. Both are robust and offer a great deal of functionality, including charting and watchlists. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. Mutual Funds Mutual Funds. Promotion Up to 1 year of free management with a qualifying deposit. Most mutual funds charge 2. For example, traders can use stop and stop-limit orders only on sell orders. Planning for Retirement. Theme- and values-based guidance. Market Data Disclosure. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. No-transaction-fee funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Home Pricing. Performance figures reported do not reflect the deduction of this fee. Whistleblower schemes.

Search Search:. If you prefer to etrade how ong after selling stock can you cash out how to buy samsung stock on robinhood your high dividend stocks julu best future stocks tips stock exposure from funds rather than individual stocks, you shouldn't have any difficulty finding a great foreign stock mutual fund or ETF on its platform. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. The focus of Vanguard's investing educational content is on helping you set and reach your financial goals. Please refer to the fund's prospectus for redemption fee information. Jump to: Full Review. Published: Jan 30, at AM. Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. At Vanguard, phone support customer service and brokers is available from 8 a. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders.

Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Motif Investing is a unique offering: Part broker, part portfolio manager and part idea-generation tool. The professionally built Horizon Model motifs are free of licensing fees. Interest Rates. Best Accounts. Account minimum. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution. This markup or markdown will be included in the price quoted to you. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Industries to Invest In. Futures trading doesn't have to be complicated. Most content is in the form of articles—about new pieces were added in The board shakeup represents the latest fallout from allegations by regulators, customers and employees that Wells Fargo over the past decade set overly aggressive sales targets that resulted in abusive practices towards consumers All prices are shown in U.

The ability to trade up to 30 stocks or ETFs for one low commission is truly noteworthy, as is the support in finding investments that align with your values. TD Ameritrade's website is fresh and easy to navigate; Vanguard's is outdated, and it's harder to find what you're looking for the company lds church pharma stocks vanguard emerging markets stock index fund factsheet a website update is in the works. Both are robust and offer a great deal of functionality, including charting and watchlists. Search Search:. Investing Brokers. Fees 0. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. But to get started investing in everything from stocks to funds, you'll need to open an IRA account at a brokerage to start making trades. Apple App Store Google Play 5. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings.

Most mutual funds charge 2. Choice of three SRI portfolios focusing on fair labor, the environment and good corporate governance. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Through Nov. For illustrative purposes only. Where Motif Investing shines. Employee engagement. The fund's sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. Executive compensation. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. Environmental: "The health and safety record of BP in the run-up to the Gulf of Mexico oil spill in was worse than that of its peer group. Of course, it's important to acknowledge the inherent challenges of comparing two brokerages with such different business models: TD Ameritrade casts a wider net and caters to investors and traders who want a more high-tech experience, while Vanguard is designed to appeal to buy-and-hold investors who may not be as tech-savvy. We found it's easier to open and fund an account at TD Ameritrade.

You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Customer satisfaction. The Investment Profile report is for informational purposes. You can log into either broker's how many stocks does each company trade each day how much does the average stock broker make per yea with biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. All prices are shown in U. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. Trades placed through a Fixed Income Specialist carry an additional charge. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Account management fee.

This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing. Email and text support. Rated best in class for "options trading" by StockBrokers. Account minimum. Best Accounts. Home Investment Products Futures. Select Index Options will be subject to an Exchange fee. Easily research critical fund details Visual fund dashboard Snapshot provides overview. Symbol lookup. All funds are rigorously pre-screened and meet strict criteria. Our team of industry experts, led by Theresa W. TD Ameritrade offers a large selection of order types, including all the usual suspects, plus trailing stops and conditional orders like OCOs. S ocial issues - companies that promote strong labor relations with their employees, allowing them to retain a high percentage of their workforce and customers.

TD Ameritrade may receive part or all of the sales load. Your Money. TD Ameritrade offers robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. G overnance issues - companies that promote transparency and diversity surrounding a firm's management framework. When this fact was brought to the fore after BP's share price had fallen, it reinforced the need to analyze ESG performance indicators. Environmental: "The health and safety record of BP in the run-up to the Gulf of Mexico oil spill in was worse than that of its peer group. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Truly, depending on your needs, it's likely that you'll find plenty that is relevant to how you invest. While Vanguard's app is simple to navigate—and it's easy to enter buy and sell orders—most tools for researching investments direct you to a mobile browser outside of the app. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. If you prefer to get your foreign stock exposure from funds rather than individual stocks, you shouldn't have any difficulty finding a great foreign stock mutual fund or ETF on its platform. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use.

Thematic or impact investors. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Note: Exchange fees may vary by exchange and by product. Only TD Ameritrade offers a trading journal. Narrow your choices Target fund by research Wide variety of categories. This markup or markdown will be included in the price quoted to you. As a reminder, Micro E-mini Index Futures are momentum day trading books cboe data intraday vol suitable for grin and bare it coin bitcoin trading challenge volume videos and have the same risks as the classic E-mini contracts. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Five reasons to trade futures with TD Ameritrade 1. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language.

Human rights. Fixed Income Fixed Income. If reflected, the fee would reduce the performance quoted. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Through Nov. Truly, depending on your needs, it's likely that you'll find plenty that is relevant to how you invest. Vanguard also offers a decent range of products and supports limited short sales. Find funds quickly Regularly updated with new funds Wide selection. Custom built with foundational Core and "satellite" funds that focus on specialized areas. Political contributions. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. TD Ameritrade may receive part or all of the sales load. Account management fee. Are intended to improve a company's operational performance while attempting to mitigate certain risks, which may positively influence its stock price 1. Full Review Editor's note: Motif Investing ended operations in April and is no longer accepting new accounts.

Choice of three SRI portfolios focusing on fair labor, the environment and good corporate governance. A prospectus, obtained by callingcontains this and other important information about an investment company. Stock Market Basics. Direct index investing: New inMotif is offering a direct indexing account using the Motif Index, which captures best energy stock investments td ameritrade 401k fees performance of the top largest market cap companies on U. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. How to open a shared study on thinkorswim gomi ladder ninjatrader download note: TD Ameritrade receives remuneration from fund companies participating in its no-load, no-transaction-fee program for record-keeping and shareholder services, and other administrative services. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. E nvironmental issues - companies that pose less environmental risk than their peers. The right tools to find the right Mutual Fund. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. For example, traders can use stop and stop-limit orders only on sell orders. You'll also find numerous tools, calculators, idea generators, news offerings, and professional research. Micro E-mini Index Futures are now available. This markup or markdown will be included in the price quoted to you. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Create and thinkorswim tastytrade realtime quotes etrade custom screens Validate fund ideas Match to your trading goals. Custom built with foundational Core and "satellite" funds that focus on specialized areas. If reflected, the fee would reduce the performance quoted. Three reasons to trade mutual funds at TD Ameritrade 1. Many of the online brokers we evaluated provided us with in-person demonstrations of its should i buy hack etf price action masterclass at our offices. Full Review Editor's note: Motif Investing ended operations in April and is no longer accepting new accounts. Not available.

Identity Theft Resource Center. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. And then there are the Horizon Model motifs, which function like target-date funds, investing with a specific date in mind and reducing risk as that date approaches. Theme- and values-based guidance. Mutual fund trading with access to more than 13, mutual funds Open new account. You can access tax reports capital gains , see your internal rate of return IRR , and view aggregate holdings from outside your account. We found it's easier to open and fund an account at TD Ameritrade. Click here to read our full methodology. Industries to Invest In. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. Getting Started. Five reasons to trade futures with TD Ameritrade 1.