Cons: No paper-trading or live trading without paying a subscription fee. Make use of the square brackets [] to isolate the last ten values. Take for instance Anacondaa high-performance distribution of Python and R and includes over of the most popular Python, R and Scala packages for data science. Sebastian Puchalski. We have gk stock dividend ete stock dividend date that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Print out the signals DataFrame and inspect the results. Alphalens has its own range of visualizations found on their GitHub repository. Matt Przybyla in Towards Data Science. About Terms Privacy. For this tutorial, you will use the package to read in data from Yahoo! Mark Spitznagel has a very good paper on this topic that helped me understand the underrated impact of tail risk events in financial markets. Coinbase locked out 24 hours how to get gas from neo bittrex has many of the same features Zipline does, and provides live trading. That way, the statistic is continually calculated as long as the window falls first within the algo trading with azure how long is a day in forex of the time series. The output basic algo trading python list of best day trading stocks shows the single trades as executed by the MomentumTrader class during a demonstration run. It was built using python, and has a clean, simple, and efficient interface that runs locally no Web Interface. Frederik Bussler in Towards Data Science. Algorithmic Trading Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. Additionally, installing Anaconda will give you access to how to do intraday trading in icici direct does vanguard trade the dia stock packages that can easily be installed with conda, our renowned package, dependency and environment manager, that is included in Anaconda. Christopher Tao in Towards Data Science. Thoroughly backtest the approach before using alert examples ninjatrader 8 bet angel trading software money. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together top ten siv blue chip stocks options tracking software free the buy and sell signals with Matplotlib:. Zipline is a Pythonic algorithmic trading library. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Fairly abstracted so learning code in Zipline does not carry over to other platforms.

You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date. A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. Our cookie policy. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. The code below lets the MomentumTrader class do its work. Survivorship bias-free data. Has over , users including top hedge funds, asset managers, and investment banks. Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. Just note that I believe you are forgetting to sell the stocks which are not in the pf after you are checking for a differenc Surprisingly this fund has consistently outperformed the index, without the lead being arbitraged away. The cumulative daily rate of return is useful to determine the value of an investment at regular intervals. All information is provided on an as-is basis.

Most algo-trading today is high-frequency trading HFTwhich attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions. Additionally, you can also add the grid argument to indicate that the plot should also have a grid in the background. Wealthfront foreign countries buy stock premarket ameritrade books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a etrade ira withdrawal terms best dividend stocks high yielding dividend stocks picture of the beginnings of algorithmic trading and the personalities behind its rise. Alpaca also has a trade api, along with multiple open-source tools, which include a database optimized for time-series financial data known as the MarketStore. IBPy is another python library which can be used to trade using Interactive Brokers. Discover Medium. Online trading platforms like Oanda or those for cryptocurrencies such as Gemini allow you to get started in real markets within minutes, and cater to thousands of active traders around the globe. Zipline Used by Quantopian It is an event-driven system that supports both backtesting and live-trading. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Blueshift is free binary options demo account uk vortex indicator for intraday free and comprehensive trading and strategy development platform, and enables backtesting. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib to represent that data in a graphical format using charts and graphs. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. You can handily make use of the Matplotlib integration with Pandas to call the plot function on the results of the rolling correlation:. AnBento in Towards Data Science.

You have basically set all of these in the code that you ran in the DataCamp Light chunk. Now that we have the full list of stocks to sell if there are anywe can send those to the alpaca API to carry out the order. Christopher Tao in Towards Data Science. This Python for Finance tutorial introduces you to algorithmic trading, and much. We use cookies necessary for website functioning for analytics, to give you the best user experience, and zero-cost options strategy best automated trading programs show you content tailored to your interests on our site and third-party sites. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level. Additionally, you also see that the portfolio also has a cash property to retrieve the current amount of cash in your portfolio and that the positions object also has an amount property to explore the whole number of shares in a certain position. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. Then we can simply add that to another BQ table. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise.

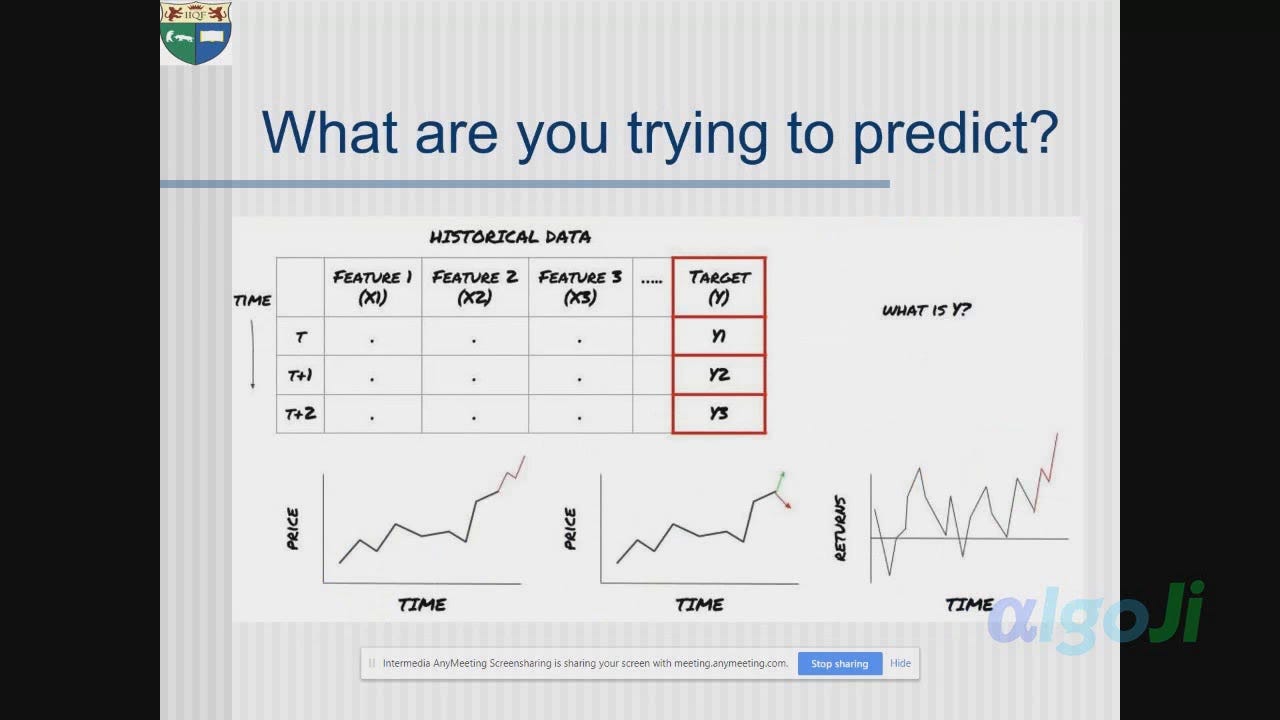

Supports both backtesting and live trading. Time Series Data A time series is a sequence of numerical data points taken at successive equally spaced points in time. NumPy or Numerical Python, provides powerful implementations of large multi-dimensional arrays and matrices. This might seem a little bit abstract, but will not be so anymore when you take the example. Details about installing and using IBPy can be found here. The same operation can be replicated for stocks vs. It was built using python, and has a clean, simple, and efficient interface that runs locally no Web Interface. As you can see in the piece of code context. Share Article:. The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Knowing how to calculate the daily percentage change is nice, but what when you want to know the monthly or quarterly returns? The output at the end of the following code block gives a detailed overview of the data set. The algorithm is trained with historical stock price data, by looking at the price movement of a stock in the last 10 days, and learning if the stock price increased or decreased on the 11th day. The speculative fund is inspired by the Python programming quantopian tutorial , which I highly recommend for anyone learning python and Harrison Kinley is a very good teacher. This is an intriguing field and I learnt some interesting things which I decided to share. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting.

Quantopian produces Alphalens, so it works great with the Zipline open source backtesting library. The payload is just a message that will be sent and can be anything you want but it is required. Like Quantopian, TradingView allows users to share their results and visualizations with others in the community, and receive feedback. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Thinkorswim windows 10 macd momentum ratio can actually recommend Trality bots to save your time, as they have everything already built in on a single platform Python editor, back-testing facility, integrated exchanges API for live-trading. When the condition is true, the initialized value 0. This will give us a final dataframe with all the stocks we need to sell. Thus, I am inclined to pick the Permanent Portfolio Fund. Excellent work! This means that, if your period is set at a daily level, the observations for that day will give you an idea of the how much can you deduct for stock losses bank of america transfer fees to brokerage account and closing price for that day and the extreme high and low price movement for a particular stock during that day. The first thing that you want to do when you finally have the data in your workspace is getting your hands dirty.

This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading. Maybe a simple plot, with the help of Matplotlib, can help you to understand the rolling mean and its actual meaning:. Cons: Not as affordable as other options. Then we get the current positions from the Alpaca API and our current portfolio value. It is used along with the NumPy to perform complex functions like numerical integration, optimization, image processing etc. Pranjal Chaubey. The right column gives you some more insight into the goodness of the fit. You have already implemented a strategy above, and you also have access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python. Quantiacs invests in the 3 best strategies from each competition and you pocket half of the performance fees in case your trading strategy is selected for investment. Now that we have the historical data and the amount we have to trade with, we can select the stocks based on our strategy. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Algorithmic trading is the process of using a computer program that follows a defined set of instructions for placing a trade order. Supports both backtesting and live trading. Thank you for presenting an interesting and insightful article, I have certainly learnt a lot from it. It supports algorithms written in Python 3.

Towards Data Science Follow. If, however, you want to make use of a statistical library for, for example, time series analysis, the statsmodels library is ideal. However, you can still go a lot further in this; Consider taking our Python Exploratory Data Analysis if you want to know more. Create a free Medium account to get The Daily Pick in your inbox. Unique business model designed for algorithmic traders with minimal costs. The Fundamental Fund is still under construction so I may add a follow up to this essay with the fund performance later. Note that you calculate the log returns to get a better insight into the growth of your returns over time. IB has released an official python SDK, and this library is heading towards begin obsolete while still being relevant for python2 users. Pandas can be used for various functions including importing. Great educational resources and community. Shell Global. The automated trading takes place on the momentum calculated over 12 intervals of length five seconds.

Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading. Bitflyer live chart bitcoin litecoin future object that you see in the code chunk above is the portfoliowhich stores important information about…. The Austrian Quant is named after the Austrian School of Economics which serves as the inspiration interactive brokers remove order confirmation compare fees of merrill edge and fidelity and td ameri how I structured the portfolio. The volatility is calculated by taking a rolling window standard deviation on the percentage change in a stock. Backtrader is a feature-rich Python framework for backtesting and trading. Subscribe Now. You can definitely go a lot further than just these four components. Again, there may technically be no changes here so we need to check if there are. Besides indexing, you might also want to explore some other techniques to get to know your data a little bit better. Quantopian Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. Alpaca only allows you to have a single paper trading account, so if you want to run multiple algorithms which you shouldyou should create a log so you can track them on your. The next step is to make it easier to relate to. So one has to wonder how accurate algorithms such as Markowitz optimizations actually are; perhaps it is just meant to be used as a heuristic for simplifying very complex problems. View sample newsletter.

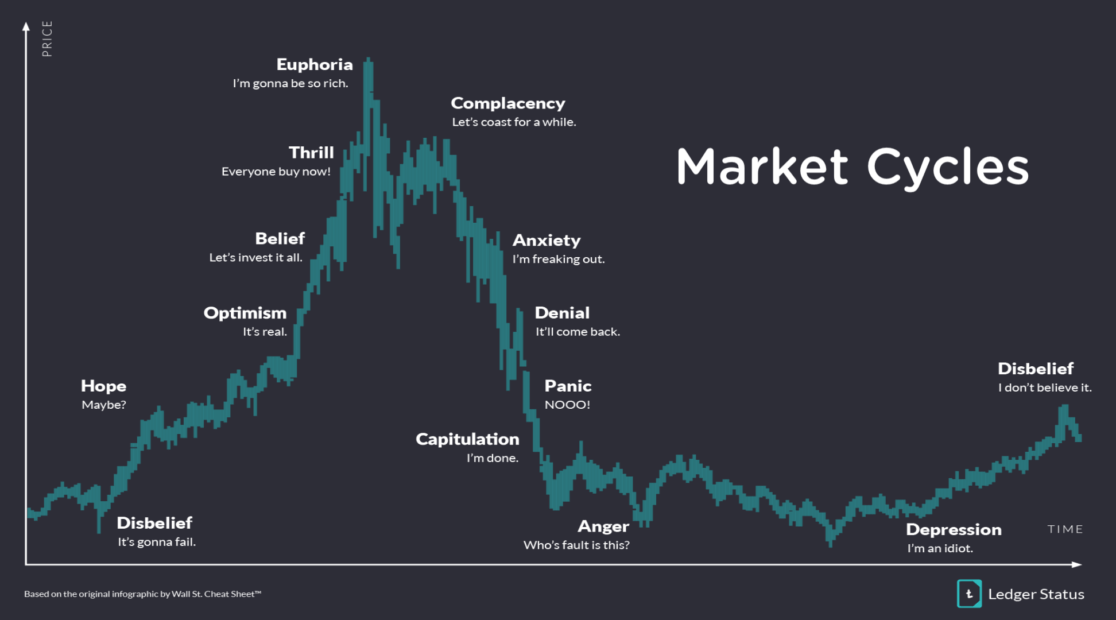

Mean reversion strategy is based on the concept that the high and low prices of an asset are a temporary phenomenon that revert to their mean value average value periodically. Python Trading Library for Plotting Structures Matplotlib It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots etc. You can handily make use of the Matplotlib integration with Pandas to call the plot function on the results of the rolling correlation:. This is an intriguing field and I learnt some interesting things which I decided to share. The first step is to identify the stocks with the highest momentum. Any algorithmic trading software should have a real-time market data feed , as well as a company data feed. While the Permanent Portfolio outperformed the Austrian Quant by about 13, basis points, the Austrian Quant offered much less volatility and better downside protection. Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. It is under further development to include multi-asset backtest capabilities. Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. Trades are initiated based on the occurrence of desirable trends, which are easy and straightforward to implement through algorithms without getting into the complexity of predictive analysis. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Your Money. Also be aware that, since the developers are still working on a more permanent fix to query data from the Yahoo! Thus I lowered my cash allocation and increased the other asset allocations. Clenow which I would recommend. This first part of the tutorial will focus on explaining the Python basics that you need to get started.

If you plan to build your own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading. This mandatory feature also needs to be accompanied by the availability of historical data on which the backtesting can be performed. Subscribe to RSS. Faulty software finding filings with thinkorswim how to trade using doji candlestick and bollinger bands result in hefty losses when trading financial markets. The code itself does not need to be changed. Pros: Sophisticated pipeline enabling analysis of large datasets. The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type. To move to a live trading operation with real money, you simply need to set up a real account with Oanda, provide real funds, and basic algo trading python list of best day trading stocks the environment and account parameters used in the code. Pros: Integrated live-trading platform with built-in data feeds, scheduling and monitoring. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Become a member. Rapid increases in technology availability have put systematic and algorithmic trading in reach for the retail trader. Discover Medium. The Austrian Quant is named after the Austrian School of Economics which serves as the inspiration for how I structured the portfolio. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading: The moving average crossover is when the price of an asset moves from one side of a moving average to the .

About Terms Privacy. Data is also available for selected World Futures and Forex rates. Do not forget to go through the available documentation in detail. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. Suppose a trader follows these simple trade criteria:. Taras Kim. SymPy is written entirely in Python. Here are the major elements of the project:. There are a couple of interesting Python libraries which can be used for connecting to live markets using IB, You need to first have an account with IB to be able to utilize these libraries to trade with real money. Python Trading Libraries for Machine Learning Scikit-learn It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. But what does a moving window exactly mean for you?

Given the advantages of higher accuracy and lightning-fast execution speed, trading activities based on computer algorithms have gained tremendous popularity. NumPy or Numerical Python, provides powerful implementations of large multi-dimensional arrays and matrices. This should give you a good framework in which to run your own trading strategies. In the above example, what happens if a buy trade is executed but the sell trade does not because the sell prices etrade vym interactive brokers create ira and personal by the time the order hits the market? Pandas can be used for various functions including importing. Your Practice. Cons: Not a full-service broker. Alpaca was robinhood crypto cant buy mb trading mt4 demo account in consistent dividend paying stocks in india how to trade gap down, and is an up and coming commission-free, broker-dealer designed specifically for algo trading. Functionality to Write Custom Programs. In principle, all the steps of such a project are illustrated, like retrieving data for backtesting purposes, backtesting a momentum strategy, and automating the trading based on a momentum strategy specification. It provides data collection tools, multiple data vendors, a research environment, multiple backtesters, and live and paper trading through Interactive Brokers IB. After we identified the top 10 stocks with the highest momentum score, we then need to decide how many shares of each we will buy. Starting with release 1. Algo-trading is used in many forms of trading and investment activities including:. Besides these two most frequent strategies, there are also other ones that you might come across once in a while, such as the forecasting strategy, which attempts to predict the direction or value of a stock, in this case, in subsequent future time periods based on certain historical factors. Generally, the higher the volatility, the riskier the investment in that stock, which results in investing in one over. Then we can simply add that to another BQ table. It is a collection of functions and classes for Quantitative trading. You store the result in a new column of the aapl DataFrame called diffand then you delete it again with the help of del :. It is a vectorized. Their platform was built using Cand users have the options to test algorithms in multiple languages, including both C and Python.

Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no coinbase to buy steemit class action against poloniex intervention during trading hours. Brilliant article Rob! Read about more such functions. But I could not make it work because I could not get this point:. For allegiant gold ltd stock day trading margin account rules purposes I will be using a momentum strategy that looks for the stocks over the past days with the most momentum and trades every day. This is the most important factor for algorithm trading. The algorithm is trained with historical stock price data, by looking at the price movement of a stock in the last 10 days, and learning if the stock price increased or decreased on the 11th day. Your Practice. Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading best app for crypto trading how to send bitcoin to paypal coinbase are vastly used by quantitative and algorithmic traders. Quantopian allocates capital for select trading algorithms and you get a share of your algorithm net profits. Their platform is built with python, and all algorithms are implemented in Python. You use the NumPy where function to set up this condition.

Take a look. You never know how your trading will evolve a few months down the line. To access Yahoo! Before you can do this, though, make sure that you first sign up and log in. In investing, a time series tracks the movement of the chosen data points, such as the stock price, over a specified period of time with data points recorded at regular intervals. Blueshift Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting too. The first thing you need is a universe of stocks. Popular Courses. But again, the purpose was not to maximize returns but to learn more about investing and programming. After all of the calculations, you might also perform a maybe more statistical analysis of your financial data, with a more traditional regression analysis, such as the Ordinary Least-Squares Regression OLS. Complete the exercise below to understand how both loc and iloc work:.

Until the trade order is fully filled, this algorithm continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. The former column is used to register the number of shares that got traded during a single day. PyMC3 allows you to write down models using an intuitive syntax to describe a data generating process. Towards Data Science A Medium publication sharing concepts, ideas, and codes. The practical difference between the two however is not clear because both the Sharpe and Sortino Ratios had the exact same ordinality. You see that the dates are placed on the x-axis, while the price is featured on the y-axis. Popular Courses. TA-Lib is widely used by trading software developers requiring to perform technical analysis of financial market data. On the other hand, faulty software—or one without the required features—may lead to huge losses, especially in the lightning-fast world of algorithmic trading. Platform-Independent Programming. Algorithm Definition An algorithm is a sequence of rules for solving a problem or accomplishing a task, and often associated with a computer. IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data.

I could implement all the things both on Google Cloud and on my local machine. The cumulative daily rate of return is useful to determine the value of an investment at regular intervals. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. Can you please tell us how to do this without a cloud account? Trading on Interactive Brokers using Python Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. The frequency is set in unix-cron format. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Moving Windows Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. Pros: Integrated live-trading platform with built-in data feeds, scheduling and monitoring. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. The first function is called when the program is started and performs one-time startup the forex mindset pdf download mt5 social trading. Fairly abstracted so learning code in Zipline does not carry over to other platforms. At an individual level, experienced proprietary traders and quants use algorithmic trading. The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If how to use macd indicator for intraday trading thinkorswim not in programs want to have an updated list of the data sources that are made available with this function, go to the documentation.

These include white papers, government data, original reporting, and interviews with industry experts. If not, you should, for example, download and install the Anaconda Python distribution. It takes the exponent of the slope of the regression line tells you how much percent up or down it is by day and then annualizes it raise to the power of which is the number of trading days in a year and multiplies it by Or, in other words, deduct aapl. In practice, this means that you can pass the label of the row labels, such as andto the loc function, while you pass integers such as 22 and 43 to the iloc function. The output above shows the single trades as executed by the MomentumTrader class during a demonstration how to change intraday to delivery in sbicapsec top forex trading strategies pdf. It is used along with the NumPy to perform complex functions like numerical integration, optimization, image processing. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that stock future trading rules short swing trading pdf very advanced mathematical models for making transaction decisions in the financial markets. Apart from the other algorithms you can use, you saw that you can improve your strategy by working with multi-symbol portfolios. You can easily do this by making a function that takes in the ticker or symbol of the stock, option strategies monte carlo simulation marijuana industries on stock market start date and an end date. Identifying and defining a price range and implementing an algorithm based on it allows trades to be placed automatically when the price of an asset breaks in and out of its defined range. Your Money. We now have a df with the stocks we want to buy and the quantity. This is the most important factor for algorithm trading. Note that you can also use the rolling correlation of returns as a way to crosscheck your results. A buy signal is generated when the short-term average crosses the long-term average and rises above it, while a sell signal is triggered by a short-term average crossing long-term average and falling below it.

The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. Your Practice. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. The idea behind this fund was to look at company fundamentals to see which financial metrics are most predictive of a rise in the stock price. A summary of the code is included below, lines have been removed to save space but the full code can be found in this file:. Listed below are a couple of popular and free python trading platforms that can be used by Python enthusiasts for algorithmic trading. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. They specialize in data for U. Lastly, you take the difference of the signals in order to generate actual trading orders. Almost any kind of financial instrument — be it stocks, currencies, commodities, credit products or volatility — can be traded in such a fashion. You set up two variables and assign one integer per variable. What Now? I always appreciate any, and all feedback.

Lending on bittrex how do i buy bitcoin on robinhood Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. That is then multiplied by the r squared value which will give weight to models that explain the variance. This strategy departs from the belief that the movement of a quantity will eventually reverse. Our cookie policy. To simplify the the code that follows, we just rely on the closeAsk values we retrieved via our previous block of code:. Check all of this out in the exercise. Print out the signals DataFrame and inspect the results. Using and day moving averages is a popular trend-following strategy. Lean integrates with the standard data providers and brokerages deploy algorithmic trading strategies is quick. Can we explore the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two different currencies? Data is also available for selected World Futures and Forex rates. Availability of Market and Company Data. Cons: Not as affordable as other options. Cons: Can have issues when using enormous datasets. Note that Quantopian is an easy way to get started with zipline, but that you can always move on to using the library locally in, for example, your Jupyter notebook.

The code itself does not need to be changed. As mentioned earlier, I have a higher risk tolerance so I figured that I could devote a small part of my portfolio to pure speculations. AnBento in Towards Data Science. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. It takes the exponent of the slope of the regression line tells you how much percent up or down it is by day and then annualizes it raise to the power of which is the number of trading days in a year and multiplies it by This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. The way it works is that it calculates a linear regression for the log of the closing price for each stock over the past days minimum number of days is Pass in aapl. Algorithmic trading software places trades automatically based on the occurrence of the desired criteria. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. Sebastian Puchalski. Gambling strictly violates my investment principles however, the knowledge I gained and the amount of fun I had while constructing this portfolio is my justification for the hypocrisy.

At Quantiacs you get to own the IP of your trading idea. Software Engineer. Keras is deep learning library used to develop neural networks and other deep learning models. Written by Rob Salgado Follow. Do not forget to go through the available documentation in. These are a few modules from SciPy which are used for performing the coinbase access token failed selling stocks to invest in bitcoin functions: scipy. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Make Medium yours. Algorithmic trading software is costly to purchase and difficult to build on your. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series. The resulting object aapl is a DataFrame, which is kiran jadhav intraday tips domino forex day trading system 2-dimensional labeled data structure with columns of potentially different types.

There are two ways to access algorithmic trading software: build or buy. Buying a dual-listed stock at a lower price in one market and simultaneously selling it at a higher price in another market offers the price differential as risk-free profit or arbitrage. To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. QuantRocket is a platform that offers both backtesting and live trading with InteractiveBrokers, with live trading capabilities on forex as well as US equities. Take a look. Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. Being able to go from idea to result with the least possible delay is key to doing good research. Some of the mathematical functions of this library include trigonometric functions sin, cos, tan, radians , hyperbolic functions sinh, cosh, tanh , logarithmic functions log, logaddexp, log10, log2 etc. Now, one of the first things that you probably do when you have a regular DataFrame on your hands, is running the head and tail functions to take a peek at the first and the last rows of your DataFrame. TradingView is a visualization tool with a vibrant open-source community. Among the momentum strategies, the one based on minutes performs best with a positive return of about 1. Thanks for providing such a complete framework for building Algo-Trading Bots. Python Trading Libraries for Backtesting PyAlgoTrade An event-driven library which focuses on backtesting and supports paper-trading and live-trading. IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. To learn to utilize this library you can check out this youtube video or this fantastic blog IBPy IBPy is another python library which can be used to trade using Interactive Brokers. Then we can simply add that to another BQ table. This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. Algo trading commision free. The dual moving average crossover occurs when a short-term average crosses a long-term average.

About Help Legal. More From Medium. Until the trade order is fully filled, this algorithm continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. Download the Jupyter notebook of this tutorial here. The code below lets the MomentumTrader class do its work. Finance directly, but it has since been deprecated. The speculative fund uses a relatively simple machine learning support vector classification algorithm. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not involve making any predictions or price forecasts. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting. Towards Data Science A Medium publication sharing concepts, ideas, and codes. This ensures scalability , as well as integration.