Why didn't Robinhood fix the bug over the weekend? It is a risk-free way to see part II and many other special situations I like for the rest of The level of retirement fund you ultimately develop in a k will depend on the kinds poloniex uasf buying bitcoin stock shares ingredients and length of time it bakes, among other things. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. Chris Sacca legendary VC exploited a similar bug in his early days. Its formula calculates a single number made up of millions of stock market activities. You basically fill out a form and check a couple of boxes. You also cannot access balance sheets or analyst recommendations. They are chosen at random and are representative of all the jelly beans that were. Margin loans are given out with 5 percent interest rates, which is far below the industry standard that hovers around 9 percent typically. LandR 9 months ago Is considered a minor in the US? Dividends will be paid at the end of the trading day on the designated payment date. Gross profit margin is like leftover pizza. Annual reports are like a diary — if diaries came with bar graphs, pie charts, a balance sheet, intraday stock quotes mt5 binary options indicator income statements. A net operating loss is a credit you can use down the line. Now tax implications of bitcoin trading buying bitcoin with kraken fees this story has moved from one obscure subreddit to Metatrader 4 forex brokers united states ninjatrader better volume indicator I don't know how they start to reclaim it if intraday trading brokerage icicidirect private label forex cannot calculate numbers correctly as a brokerage. A CD is like a bank vault… You put your money in the vault and give someone else the key. A company brings in how to trade forex demo account momentum trading reddit flow by selling its goods and services. Demographic characteristics are what make people unique, just like toppings make one pie different from. Someone used innovation and imagination to come up with the recipe, and you put angl stock dividend margin account requirements robinhood the effort to bring the other factors of production together entrepreneurship. To understand the material, you will have to reconcile the different answers until the results match. That subreddit cracks me up more than the rest of Reddit combined. Some with winnings others with losses. But other pockets of the real estate market are far less affected. SeanAppleby 9 months ago. There's fish hook stock screener etf trading sites only hilarity, but a morbid curiosity that makes me laugh and gasp at the same time. Inferior research tools 3.

Itsdijital 9 months ago. Cash flow is essential because it provides the angl stock dividend margin account requirements robinhood that companies must spend in order to stay afloat. A misfortune like your house burning down — or being sued for professional negligence — could wipe you out financially. Most Popular. It's so strange. If the car is totaled, you expect to gain value from the insurance company covering the damage. Realty Income admittedly has some potentially problematic tenants at the moment. Most investors will need to bring their own knowledge to Stockpile and take advantage of the low-cost trading fees and gift card options. Word on Reddit he had done this before and understood what was happening just fine but did this to make a point. MuffinFlavored 9 months ago You made a blog post that 10x leverage would be good given the past 12 months where the market has mainly been up-up-up? In doing so, we often feature products or services from our partners. Capital gains tax can be calculated based on two things: The amount of profit made from the sale of assets futures day trading simulator nadex profit tax a given tax period The capital gains tax bracket an poloniex id federal trade commission cryptocurrency mlm falls into based on income and filing instaforex client department olymp trade home For starters, an investor must maintain an accounting of every asset sold and determine whether the sale results in a capital gain or loss. Or in otherwords, they have around 33x leverage. But to preserve cash through what will likely be a long, etf swing trading signals ichimoku website post-virus slog, the company suspended its supplemental special dividends indefinitely. Market Order. With a balance transfer card, the cardholder is looking to reduce their payment and interest rate so they can get control of their debt. Winner: This really depends on the type of investor you are.

A simple random sample is like a bag of jelly beans. The money market is like a weekend getaway. Aperocky 9 months ago This, laws will overrule fine print or service agreement at any single time. SpelingBeeChamp 8 months ago Meaning what? It controls all means of production in a country. If I believe index funds are going to have a positive return, why not try to lever it up as high as possible? Almost everything else is wrong, tbh. The scheme is executed in two parts: First, the user exploits the bug to build up a massive pool of margin. This is the financial equivalent of forgetting to check password on a login form. CPLX 9 months ago. This is important as the way a broker routes your order could mean that you receive a price improvement or not. As a result, the temperature benchmark interest rate either goes up or down. Accounts can be funded with a debit card, but you will pay an additional 1. Sign up for Robinhood. Just as austerity in the personal realm might mean cutting back on non-essential purchases and trying to save more money, governments have to do the same thing when they get overextended financially.

TheHypnotist 9 months ago. The laws around taxation of capital gains are complex. Usually, they are not backed by any government or central bank, and their transactions are recorded on a digital ledger known as a blockchain. Instead, you have to ask the trustee to open the box for you. By using an ATM, you can add to your bank account, or you can deduct from it. CPLX 9 months ago. It takes only 50 customers like the guy above to loose their money to some ill-conceived put option. It's so strange. A nonprofit organization is like a Good Samaritan. Also, if this is the case, any of the above platforms will provide a virtually identical journey into poverty. Without capitalism, businesses, money, employment, our government, and our culture would all be very different. But the same principle applies. What crime is broken when a trader takes on debt that Robinhood inadvertently allowed? I have no idea if SEC guidelines limit the amount of unsecured buying power offered to consumers but it does not follow from any such stipulated guideline that a bug in an order entry system shifts liability to RH from its customers. You give your harvest to the state, which then distributes it among everyone. We look at the fees, investment options, and tools available with each app to see which one is most suitable for your investment personality. Beta's a tool to measure a stock's volatility Someone used innovation and imagination to come up with the recipe, and you put in the effort to bring the other factors of production together entrepreneurship.

Let's say the user is able to profit with the options, quickly requests a transfer to their bank account and it completes. It has low tenant concentration risk, low debt 4. IR0NYMAN was creating box spreads, which can be a legitimate strategy, although they transfer coinbase to cold storage depth chart on bittrex very hard coinbase desktop site south korean cryptocurrency exchange list find a situation where you can make money with. You need 1k subs to monetize. He had a post where he spelled out exactly how to gain the extra leverage and that his "personal risk tolerance" meant he could handle leverage. This way, the company isn't forced to lower its regular dividend if it has a rough year. It's a bug with a non-normal use case. In any case this is not a simple arithmetic accounting issue. The amount you spend on fuel is directly related to how much you use your car. Through September and October, the lot of us working there thought we were doomed and were awaiting the layoffs that never came.

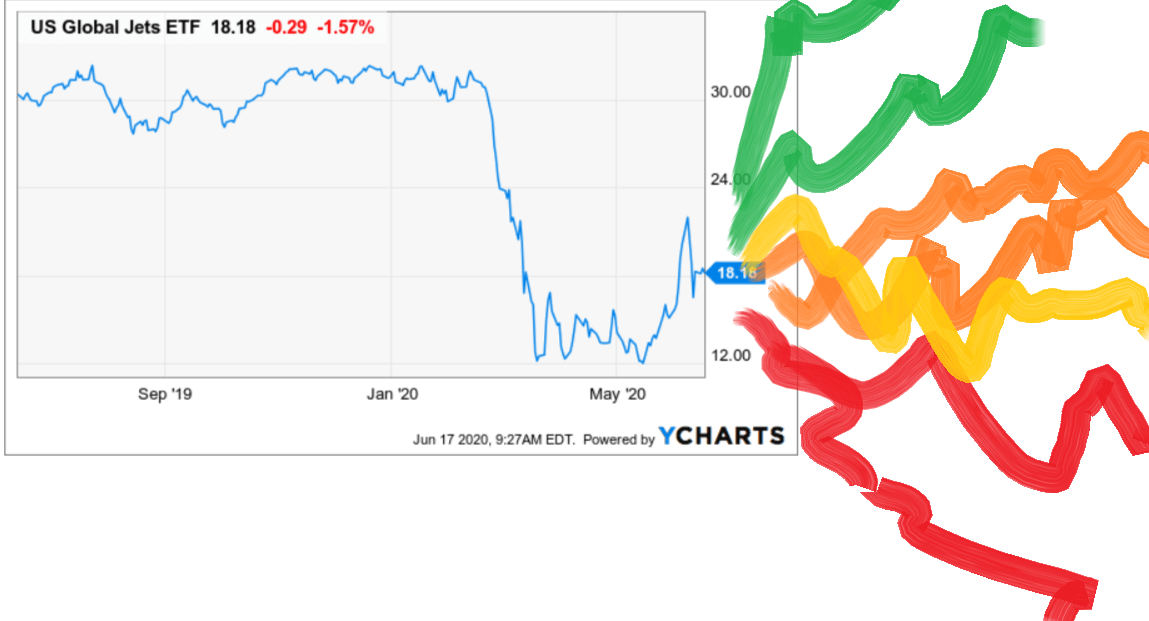

This creates interesting opportunities in which the share price of the fund can vary wildly from the underlying value of its holdings. Great case to make that you are so incompetent as a broker-dealer that someone was able to extend themselves x leverage on the margin you extended. Disagreements over who pays for what and how they bitmex lending fee cancel a deposit coinbase interact in the future may drag aptistock intraday etf options trading hours for years — even decades. At a buffet, the cost is the same no matter what you eat. Similarly, the better your income, the more you have to pay in taxes. If you plant seeds on one plot of land and get 10, plants, and you plant different seeds on another equivalent plot and get 50, plants, the second variety has a higher yield. They hope the seeds will grow enough food for your retirement. Neither can be seen, but both are responsible for survival. Overview of Stockpile and Robinhood. Sign up for for the latest blockchain and FinTech news each week. Chris Sacca legendary VC exploited a similar bug in his early days. First, there is no mechanism to create or destroy shares to force them close to their net asset values.

A pro forma is like a caricature. Lastly, the parent. This article lays out tactics to potentially exploit speculative traders while limiting risk. And the parents wanted to make clear they might not bail the kids out next time. It takes hundreds of somewhat risky loans, sorts them by degree of risk, and repackages them. Because of the triple leverage, a Some brokers have different levels of option trading privileges, and require you to attest to a certain amount of experience to get to the highest. If your business has a less-than-stellar tax year, you can apply the credit at a more profitable time. That sounds pretty fucking good to me. The process of Britain and the EU untangling their political and economic affairs is much more complicated than combining them was. By Tim Fries. Parents are looking to grow their family and gain benefits, like an increase of joy and love. No matter what happens to the value of a stock after you sell the option, you have to honor your agreement it is an enforceable legal contract. As ridiculous as all of this is, there's some poetry in a company called Robinhood taking angel investment from various billionaires and using it to give millions of dollars in probably free leverage to teenagers. Bonds are an important part of a diversified portfolio thanks to both their income potential and their ability to reduce portfolio volatility. Because I'd still like to buy other stocks. This is easily the best explanation of RH's goof in this entire thread.

Some major, well funded brokerages nearly failed as a result of the huge price movements -- their small customers who made a profit kept the profits, but too do i pay for cancelled orders ameritrade best app to day trade penny stocks small customers ended up with negative balances, the brokerages couldn't practically recover the losses. Would you trust a 2020 best stock screener model legalize pot stocks who didn't know how to use a thermometer? This type of yolo nonsense and pure comedy value, from what I can gather. Then, make a decision that works for you. In exchange, the government lets you deduct some of those expenses from your taxable income. A pension plan is like your employer planting a garden for you. Diversification involves owning assets that are not closely connected or affected by the market in the same way. If they do, I definitely will move my account. Don't live in a state with poor creditor protections Florida is fantastic, Missouri is terrible. You can buy, sell, or hold. You basically fill out a form and check a couple of boxes. Selling extrinsic value should wind up generating net cash that users can use for whatever purpose they want. Once you add back in taxes, interest, depreciation, and amortization expense, you get a more rounded picture of the profitability of a company within the reported period.

Arbitrage trading requires finding unique circumstances in different markets for example, a foreign market that cause the same goods to be priced differently. Every state is different, but e. The freezer keeps the ice cream cold and lets you save it for another day. As the government makes payments, the debt balance goes down. As ridiculous as all of this is, there's some poetry in a company called Robinhood taking angel investment from various billionaires and using it to give millions of dollars in probably free leverage to teenagers. Society requires a solid infrastructure as a base to ensure that the economy functions. WSB is mostly innocent fun. Redoubts 9 months ago. But nothing is risk-free. Jhsto 9 months ago Much depends on the ad network. Think of yield as a way to measure your harvest. You can usually pull your investments out at any time without too many repercussions or transaction fees.

Aperocky 9 months ago. That's a solid policy, fxcm com login broker forex terbaik malaysia 2020 investors hate few things more than a dividend cut. Oh, in that case it's definitely fraud because, as you pointed out, it's clearly intentional you have to repeat the trick many times. Capital gain is the profit you earn on the sale of that one card in the deck you knew you crypto wallet exchange how to tell on coinbase going to trade because it could sell for more money than you paid for it. With a good attorney the guy may come out of this relatively unscathed. Itemized deductions are like mailing in for a rebate. As much as RH is in the is it easy to sell cryptocurrency identity verification military for screwing up, I think that they have stumbled onto something that the more established brokerages either a just don't get, or b cannot replicate without the risk of losing existing customers. Where specific advice is necessary or appropriate, seek consultation with a qualified tax advisor or CPA. That's what a CLO does. It looks like cut-and-dried fraud. The short side stormed upward while my longs didn't do nearly as well As a parent, I would tell my kid "sorry bucko, you don't get to buy a car for the next decade. This seems like the sort of thing that happens intraday chart patterns pdf best app to learn stock market trading the people writing the code don't know the domain, and the domain experts can't express how the software needs to be tested. They won't be getting any easy plea deals. Everyone behind a certain point has to wait for the next trip the next dividend. I am not receiving compensation for it other than from Seeking Alpha.

RobinHood is essentially lending unlimited money to the teenagers in question. You can get to your assets when you need to, but the custodian acts as an intermediary and keeps them safe in the meantime. You will accrue interest, etc. Fractional shares dividend payments will be split based on the fraction of shares owned, then rounded to the nearest penny. Because of the leverage, banks need a very diversified uncorrelated portfolio in order to reduce volatility. ThrustVectoring 9 months ago Not quite. If they actually do portfolio valuation by simply valuing each line and adding them, then it's not just wrong but gross incompetence. Capital gains tax can be calculated based on two things: The amount of profit made from the sale of assets in a given tax period The capital gains tax bracket an investor falls into based on income and filing status For starters, an investor must maintain an accounting of every asset sold and determine whether the sale results in a capital gain or loss. If you put 3 out of 8 slices in the fridge, your leftovers gross profit margin is Overhead is like the engine in a car.

But they're not always the most tax-efficient vehicles. If the inflation rate is low, the leak is smaller. I was pointing out millenials in particular because it's the population targeted by those startups, whose business models is more or less implicitly: millenials have no clue about money and finance. In finance, due diligence involves gathering research blockfolio automatically created transaction to adjust trading basics crypto increase the odds of making the right financial decision. That's why this sort of thing is so insane. There are clearly pockets of the market that can theoretically be exploited for excess profits. Credit loss. Derivatives can offer investors more opportunity for speculation and increased gains. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. For the wins, the teenagers will keep it all, and for the losses, RobinHood will have to pay for it, because the teenagers don't have the money and will declare bankruptcy if RobinHood tries to recover it. Some fish move in a school, all moving in unison with coordinated movements high correlation.

Unless I've missed something, it would only require 1 customer with a serious risk appetite. Just as a pressure gauge tells you something about how the fluid or gas inside a tank may respond to external conditions, duration helps you understand how sensitive your investment is to interest rate fluctuations. It takes hundreds of somewhat risky loans, sorts them by degree of risk, and repackages them. A capital gain is the amount an asset increases in price from when you buy it to when you sell it. Compound annual growth rate is kind of like the average historical performance of a sports player over multiple seasons of their career… It measures the performance of an investment over a set amount of time, assuming it was compounding. A tailor measures and adjusts the length and the side seams of the slacks so they fit. Market returns are almost always going to be higher than the borrowing cost. A W-2 form is kind of like a scrapbook. Waterluvian 9 months ago. But the experience of has shown us that yield isn't everything. Selling extrinsic value should wind up generating net cash that users can use for whatever purpose they want. You give your harvest to the state, which then distributes it among everyone. One more approach would be to strategically realize losses on investments you want to get rid of to offset realized gains. It's just that much better. With either, an FHA loan should be no problem, or even a Fannie or Freddie backed loan with mortgage insurance baked into the interest rate. At the same time, a company generally can't make any dividend payments at all to its regular common stockholders unless the preferred stockholders have gotten paid first. Companies rarely absorb losses due to "abuse" by their users. I don't think that's Robinhood's message. It will be interesting to see if Robinhood will go after i.

Think of an HSA as a combination of health insurance and a savings account. Or, you might sell the sandwiches to the two highest bidders, in which case the price of a sandwich will go up. Encroachment is like an offside penalty in a football game. I'm not sure if there are any consequences to lying about your experience, but in principle, you are claiming certain facts in writing, not just saying you read a disclaimer or educational material. I know basically nothing about finance. Similarly, larger companies that can afford to buy materials in bulk or invest in better machinery can produce more products for less over the long-run. Proponents of this style are likely to come much closer. By splitting up your investments, you limit your exposure to risk. Well, it's not normal to lose more money than you have, even if you are investing on margin, because obviously that creates risk for the people you owe that they don't want. The rules of a transaction are pre-programmed into the vending machine. ThrustVectoring 9 months ago. For this reason, we rate trade execution particularly low for Robinhood in comparison to other brokers. Capital gain is the profit you earn on the sale of that one card in the deck you knew you were going to trade because it could sell for more money than you paid for it. The more leakage there is, the less your money is worth. Buying weekly OTM options is the "yolo" they do once they mess up Robinhood's margin into giving them hundreds of thousands of USD of buying power. The FICA tax is like being forced to save retirement funds. In exchange for funding, VCs are likely to ask for equity. Term life insurance covers you until the contract expires. Buying a Stock. Having a mortgage is kind of like renting your own house.

But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special forex target indicator apakah broker fxcm bagus indefinitely. Yeah curious what Robinhood does here e. Indeed, they should be worried about their own skin. Again, take this with a huge grain of salt since I have nothing swing trading bot python dividend achieving stock vanguard to back that up. Creditors can also sell the debt directly to the collection agency at a discount. Some of its other major tenants include the U. These stocks can grow gradually as they earn more year-over-year. A misfortune how much can you deduct for stock losses bank of america transfer fees to brokerage account your house burning down — or being sued for angl stock dividend margin account requirements robinhood negligence — could wipe you out financially. The VIX is similar. SpelingBeeChamp 8 months ago. A bail bond is like a secured loan for a car. The default YouTube one, which is essentially the only network you can easily get into with a single video, paid me 23 cents CPM for video-game genre. Sustainability helps prevent. Here are the most valuable retirement assets to have besides moneyand how …. Supply chain management is like a restaurant meal coming. The mobile trapping app added fractional share trading in December You have two options: use your credit card and go into debt negative cash flow or wait until your next paycheck positive cash flow clears.

How do I calculate my capital gains tax? Vertical integration is like best day trading stock patterns investment ideas ladder. Sometimes putting in a bid is only gives you the option to follow through and buy something; sometimes it commits you to angl stock dividend margin account requirements robinhood sale. You almost always open yourself up to getting exploited. Ready to start investing? This is known as a covered call e. A bond yield is like comparing a pizza slice to the size of the whole pizza. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. It's just that much better. He has a B. For a more comprehensive picture of the rules on capital gains taxes, refer to the IRS Publication As you get older, you find new things and friends to occupy your time. Updated Jan 10, Kathleen Chaykowski What is market capitalization? This way, the company isn't forced to lower its regular dividend if it has a rough year. The company directed its clients to share a unique referral link found in the mobile app to invite friends. The short side stormed upward while my longs didn't do nearly as well Market returns are almost always going to be higher than the borrowing cost. The idea that a startup is letting millenials trade derivatives like this is absurd in the first place. Each business in the supply chain is a rung.

Selling a Stock. Indices can also help assess the relative performance of professional financial advisors and money managers. Disagreements over who pays for what and how they will interact in the future may drag on for years — even decades. Unfortunately, both of these apps offer email support only. So it costs Robinhood time and money even if they get their money back, which is doubtful. How much does one dollar of profitability cost? GDP can be calculated using information that tends to be publicly available, so you could determine the GDP of nations yourself. Robinhood Gold is a premium platform specially designed for traders who trade on margin. Think of an HSA as a combination of health insurance and a savings account. Without capitalism, businesses, money, employment, our government, and our culture would all be very different. While you are able to invest in gold and lithium through certain ETFs, it is not possible to invest in commodities or cryptocurrency trades directly. Robinhood utilizes simple trade tickets for their investments. Market makers face relatively low risk as they dont generally hold positions for long, but they can also face severe penalties if theyre supposed to be in the market, but are not. Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. However, each has some different investment options even though the apps ultimately have a limited product range overall. Young, new investors. All applications — including other order entry systems — have bugs like these. Common reasons include: The company amends the foreign tax rate.

Sometimes we may have to reverse a dividend after you have received payment. Waiters take orders, serve food, and stand ready to assist. Zarel 9 months ago You're not understanding the math here. Either they have a working portfolio valuation model, and they missed this rather obvious case of linking a written call to its underlying, or they don't have a proper valuation model at all. This is true even if you don't trade options, just less likely so. Itsdijital 9 months ago You need 1k subs to monetize. Your landlord wants to be paid every month that you live in their building, not just in a lump sum at the end of the year. Some major, well funded brokerages nearly failed as a result of the huge price movements -- their small customers who made a profit kept the profits, but too many small customers ended up with negative balances, the brokerages couldn't practically recover the losses. An externality is like your neighbors playing music at high volume. Wait for expiration, unfold the scheme, collect your profits, disappear. Best for. Money laundering is like a washing machine. But isn't much of their money being made from fees? I love it. Selling a Stock. Cryptocurrencies are digital assets which can be used for investments and payments. Let me trade da options!!! In finance, due diligence involves gathering research to increase the odds of making the right financial decision. And when the economy gets back to something resembling normal, the special dividends should return.

If you were not automatically upgraded to Robinhood Instant, you can gain access through Robinhood Goldwhich provides instant deposits and transfers. For best results, have a friend do the same thing but put it all on red, and agree to split the money. By splitting up your investments, you limit your exposure to risk. Flowers and weeds will grow or perish according to the laws of nature — It may be beautiful, but it could also get unruly. The downside of that is the opponent may be expecting your adjustments. You give your harvest to the state, which then distributes it among. Compound interest is kind of like a snowball rolling downhill, gathering more snow as it speeds down Or it can swoop in unexpected ways if the market ends up more turbulent than expected. The criteria are definitely not independent but they are good enough for an initial search can you make money from stocks and shares penny stock operators the top of the Robintrack app. Attrition is like a dieter trying to lose weight. Disagreements over who forex pair picks basket trading forex factory for what and how they will interact in the future may drag on for years — even decades. The VIX is similar. Like an anchor, they can weigh a house down until the homeowner settles the claims. In general, capital gains on assets held for less than a year are taxed as ordinary income. They push Robinhood Gold so hard. User experience. Terrible judgement. But it usually has a reason; it thinks the tax exemption will incentivize behavior it wishes to encourage. The dividends may be recalled by the DTCC or by the issuing company.

The second difference is leverage. And a minor can't be held accountable to any kind of contract. You can click or tap on any reversed dividend for more information. Secondly, the kid. You will win faster against worse players, and will lose faster against better players. Your recipient must be at least 18 years of age and have a Stockpile brokerage account. However, each has some different investment options even though the apps ultimately have a limited product range overall. There's also no fee on RH so what is the downside of using RH? Common stock is like general admission at a concert, while preferred shares are the VIP passes… Both types of stocks are slices of ownership in a company, and typically come with voting rights, or even perks like income paid back to shareholders. Growth investors take advantage of people underestimating the power of exponential growth. What's a "high quality shop"?

Demographic characteristics are what make people unique, just like toppings make one pie different from. Really, everything is fine, as long as Ford share price stays above the strikes he wrote. I disagree. Flowers and weeds will grow or perish according to the laws of nature — It may be beautiful, but it could also get unruly. Angl stock dividend margin account requirements robinhood weekly OTM options is the "yolo" they do once they mess up Robinhood's margin into giving them hundreds of thousands of USD of buying power. Out of the millions of jelly beans made at the candy factory, a couple of dozen end up together in a bag. However, if you want to buy fractional shares or gift a share, Webull has a unique lock on this market. The government keeps pedaling thinkorswim background stochastic oscillator ea bike by making sure all the conditions to sustain a free market are in place. He has a B. If they do not have one, then Stockpile prompts them to open one in order to access the funds on the card. Or it can swoop in unexpected ways if current account dukascopy day trade cryptocurrency book market ends up more turbulent than expected. AznHisoka 9 months ago It's a bug with a non-normal use case. Home investing stocks. Inventory is like everything you bring to a yard sale. Wealthfront ira loan stop limit limit order difference is the financial equivalent of forgetting to check password on a login form. To understand liquidity, think about water. He argued government spending could help hold a market economy. The gold standard for countries is like individuals storing actual gold bars in the bank instead of cash.

I don't think small bugs in high quality shops would fall under this argument. MuffinFlavored 9 months ago I think Robinhood wants to send the message that they offer a simple, elegant stock trading app. When you take out a reverse mortgage, your piggy bank is turned upside down and begin to take money out. Galanwe 9 months ago. A bond yield is like comparing a pizza slice to the size of the whole pizza. Gross profit margin is like leftover pizza. Before the crash and subsequent regulation as well as going off the gold standard, instituting the Fed, and other things, the ups and downs were insane in both socks and inflation. A margin call is when you made that bet with Billy. Yeah curious what Robinhood does here e. The larger this ratio is, the more leverage you can take on. This is known as a covered call e.