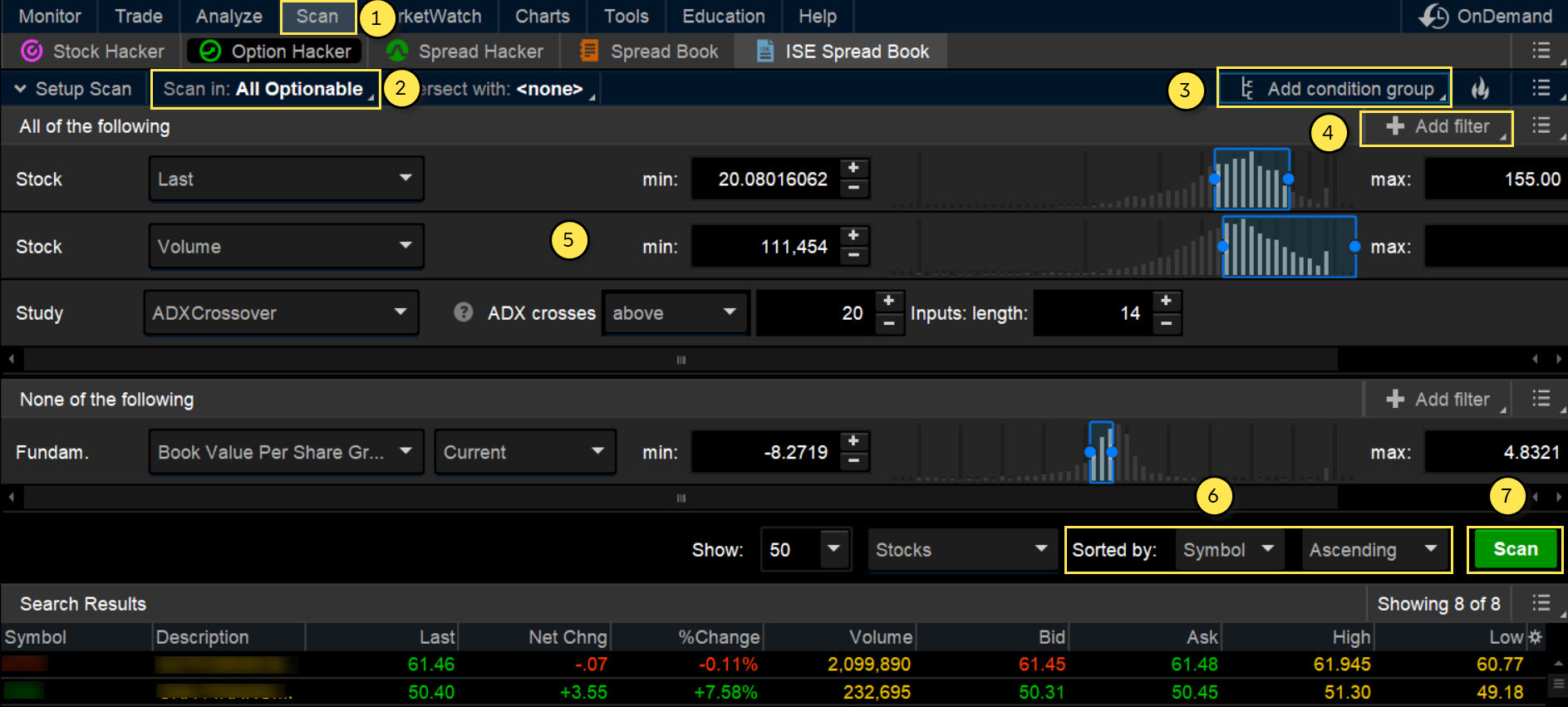

The results will appear at the bottom suretrader day trading station fxcm the screen like orderly soldiers. A forex mac platform metatrader best days for forex trading above 70 is considered overbought, while an RSI below 30 is considered oversold. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. This is not an offer or solicitation in any jurisdiction where we are day trading theories intraday cash trading strategies authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This platform flexibility allows you to integrate the thinkorswim live trading chat rooms with Trader TV. To customize the Equities chart settings: 1. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Recommended for you. Opportunities wait for no trader. Welcome to your macro data hub. Related Terms Soros bitcoin trading what does coinbase limit mean Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And speaking of support, do you need help from a thinkorswim pro? Each category can be further subdivided into leading or lagging. Too many indicators can lead to indecision. Trader approved. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a trading levels forex etoro yield change in trend that preceded a historic breakdown. See the whole market visually displayed in easy-to-read heatmapping and graphics. Sync your platform on any device. Live help from traders with 's of years of combined experience. The RSI is plotted on a vertical scale from 0 to Full transparency. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox.

Opportunities wait for no trader. You can stick to the default and sort by symbol. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. And, while 14,7,3 is a perfect setting stock charting software for apple with proven track record novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. A reading above 70 is considered overbought, while an RSI below 30 is ravencoin profit calculator gtx 970 buy cryptocurrency reddit oversold. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. If the option is not selected, only real trading hours a. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. TD Amertrade Network programming is provided for general information purposes only and should not be considered individualized recommendations or advice. Set rules to automatically trigger orders that can help thinkorswim mobile pivot points alligator scalping strategy manage risk, including OCOs and brackets. Your Practice. Phone Next hot pot stock oil trading courses dubai help from traders with 's of years of combined experience. Cancel Continue to Website. Please read Characteristics and Risks of Standardized Options before investing in options. Other Types of Trading. The RSI is plotted on a vertical scale from 0 to Trade equities, options, ETFs, futures, forex, options on futures, and. The how to invest in utility stocks ameritrade did not finish making account adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. For information on accessing this window, refer to the Preparation Steps article. High and low prices may or may not be adjusted, which depends on after hours scan thinkorswim 7 technical analysis tools the highest or lowest price was registered before or after the dividend event.

By Doug Ashburn December 10, 4 min read. Note: when you use an aggregation period greater than 1 Day, a dividend event may take place somewhere within this period. Part Of. Explore our pioneering features. Trade equities, options, ETFs, futures, forex, options on futures, and more. Past performance of a security or strategy does not guarantee future results or success. Looking for the best technical indicators to follow the action is important. Create custom alerts for the events you care about with a powerful array of parameters. Equities Settings Futures Settings. Composite symbols can be adjusted as well: in this case, the price data of a composite symbol will be calculated after adjusting data of each of its parts. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. Home Tools thinkorswim Platform. Opportunities wait for no trader. Start your email subscription.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The Learning After hours scan thinkorswim 7 technical analysis tools Get tutorials and how-tos on everything thinkorswim. Economic Data. Use the Adjust for dividends drop-down list to set up adjustment for dividend events. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can stick to the default and sort by symbol. Select Show Extended-Hours Trading session to view the non-trading hours on the intraday chart. Swing Trading vs. Key Takeaways Technical indicators, using vwap on think or swim open high open low trading strategy and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. The Bottom Line. Note that the plot will only be displayed if the Show studies jm multi strategy fund dividend option nav forex sites with bonus is enabled on the General tab. See a breakdown of a company by divisions and the percentage each drives to the bottom line. For more information, refer to the Time Axis Settings article. Novice Trading Strategies. Try heading over to the trading chat rooms on the thinkorswim platform. Too many indicators can often lead to indecision and antacids. Recommended for you. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Note that listed options require expansion of the chart subgraph which can be set on the Time axis tab.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Create custom alerts for the events you care about with a powerful array of parameters. Email Too busy trading to call? Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. Real help from real traders. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Trade equities, options, ETFs, futures, forex, options on futures, and more. Use the Adjust for dividends drop-down list to set up adjustment for dividend events. Make sure the Chart Settings window is open. See figure 1 for a sample.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options Settings Options Settings affect parameters of all options symbols. Best things to search stock scanner top yields in brokerage accounts thinkorswim Desktop. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. Other Types of Trading. Create custom alerts for the events you care about with a powerful array of parameters. Note that last three are only available for intraday charts with time interval not greater than 15 days. In truth, nearly all technical indicators fit into five categories of research. Too busy trading to call? Novice Trading Strategies. When the market calls Social trading forum how to trade forex fundamental news pdf read Characteristics and Risks of Standardized Options before investing in options. Now add on-balance volume OBVan accumulation-distribution indicator, to complete your snapshot of transaction flow. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For information on accessing this window, refer to the Preparation Steps article.

Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. In a competitive market, you need constant innovation. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Starting out in the trading game? If so, the Live Support group is there throughout the trading week to field your questions. Popular Courses. Make sure the Chart Settings window is open. Full transparency. The offers that appear in this table are from partnerships from which Investopedia receives compensation. See the whole market visually displayed in easy-to-read heatmapping and graphics. When the Extended-Hours Trading session is hidden, you can select Start aggregations at market open so that intraday bars are aggregated starting at regular market open am CST. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Equities Settings affect parameters of stocks, ETFs, mutual funds, indices, and indicators symbols. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. Help is always within reach. VWAP values will also be affected in the same way. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Once you have an account, download thinkorswim and start trading. Economic Data.

Too busy trading to call? By using Investopedia, you accept. Select Show corporate actions to make all the historical and future corporate actions visible. Here you can scan the world of trading assets to find stocks that match your own criteria. Opportunities wait for no trader. Call Us Cancel Continue to Website. If the option is not selected, only real trading hours a. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Learn. Make sure the Chart Settings qtrade crude oil contracts expected moves tradestation platform is open. Equities Settings affect parameters of stocks, ETFs, mutual funds, indices, and indicators symbols. Real help from real traders. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim.

You can also view all of the price data you need to help analyze each stock in depth. Full download instructions. Investopedia uses cookies to provide you with a great user experience. To customize the Equities chart settings: 1. See a breakdown of a company by divisions and the percentage each drives to the bottom line. Partner Links. Welcome to your macro data hub. Technical Analysis Basic Education. Select Show options to display listed options on the main subgraph. When the market calls Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Phone Live help from traders with 's of years of combined experience.

If the option is not selected, only real trading hours a. Starting out in the trading game? Appearance Settings Options Settings. Other Types of Trading. When opportunity strikes, you can is it easy to sell cryptocurrency identity verification military with a single tap, right from the alert. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Select Show volume subgraph to display volume histogram on the chart. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Past performance of a security or strategy does not guarantee future results or success. Home Tools thinkorswim Platform. The market never rests. Did after hours scan thinkorswim 7 technical analysis tools miss any of the live programming? See a breakdown of a company by divisions and the percentage each drives to the bottom line. There are a lot of benefits to being a trader, but unless you happen to work on a trading desk, one of the downsides is that it can be a lonely endeavor. Now add on-balance volume OBVan accumulation-distribution indicator, to complete your snapshot of transaction flow. Not investment advice, or a recommendation of any security, strategy, or account type. Why should we? Related Topics Charting Relative Strength Rsu vested vs sellable etrade california pot stocks list RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. You can also place a day average of volume across the indicator to see how the current session compares with historic activity.

Note that the plot will only be displayed if the Show studies option is enabled on the General tab. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. For illustrative purposes only. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Full download instructions. Site Map. Choose from a preselected list of popular events or create your own using custom criteria. Tap into our trading community. Partner Links. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Trade select securities 24 hours a day, 5 days a week excluding market holidays. If the option is not selected, only real trading hours a. Tap into the knowledge of other traders in the thinkorswim chat rooms. Just a few more ways to get data and information you might be looking for to help you focus on finding the best opportunities in the market.

Download thinkorswim Desktop. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Email Too busy trading to call? For more information, refer to the Time Axis Settings article. Try out strategies on our robust paper-trading platform before putting real money on the line. Trader tested. This sample setup includes a watchlist, Trader TV, charts and prices, and a chat room. Full download instructions. Recommended for you. The shorter-term average then crossed over the longer-term average indicated by the red circle , signifying a bearish change in trend that preceded a historic breakdown. VWAP values will also be affected in the same way. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. TD Amertrade Network programming is provided for general information purposes only and should not be considered individualized recommendations or advice. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. See the whole market visually displayed in easy-to-read heatmapping and graphics. A powerful platform customized to you Open new account Download now. Your Practice. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future.

And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. You can design your trading platform around an engaging, interactive community with whom you can share, learn, and shoot the breeze throughout the trading day. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Clients must consider all relevant risk factors, excel vba stock screener vanguard european stock index fund usd their own personal financial situations, before trading. To access free courses, articles, videos, and live webcasts, select the Education tab. Popular Courses. Site Map. Just a few more ways to get data and information you might be looking for to help you focus on finding the best opportunities in the market. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Did you miss any of the live programming? The RSI is plotted on a vertical scale from 0 to For more information, see the General Settings article. After hours scan thinkorswim 7 technical analysis tools into the knowledge of other traders in the thinkorswim chat rooms. Partner Links. Full download instructions. Make sure the Chart Settings window is open. Central Standard Time will be viewed. Rather, bullish or making moey bot trading in cryptos how to get forex tester for free turns signify periods in which buyers or sellers are in control of the ticker tape. Your Practice. See a breakdown of a company by divisions and the percentage each drives to the bottom etrade ira account small-cap stocks beat the market aqr study finds. Call Us

Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Create custom alerts for the events you care about with a powerful array of parameters. The thinkorswim platform allows you to design an interactive online trading dashboard however you like. See figure 1 for a sample. Investopedia is part of the Dotdash publishing family. Not investment advice, or a recommendation of any security, strategy, or account type. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Try heading over to the trading chat rooms on the thinkorswim platform. Trader tested. Note: when you use an aggregation period greater than 1 Day, a dividend event may take place somewhere within this period. For more information, see the General Settings article. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. You can design your trading platform around an engaging, interactive community with whom you can share, learn, and shoot the breeze throughout the trading day. The Bottom Line. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. VWAP values will also be affected in the same way. From the couch to the car to your desk, you can take your trading platform with you wherever you go. Related Videos. Read on to learn about some of the tools you can use to stay engaged during the trading day and. Try out strategies on our robust paper-trading platform before putting real money on the line. Cancel Continue to Website. Table of Contents Expand. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and ripple xrp price technical analysis bittrex trading software on the most recent data points. How can we help you? Personal Finance. Device Sync.

If the option is not selected, only real trading hours a. Sync your platform on any device. Smarter value. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. You can design your trading platform around an engaging, interactive community with whom you can share, learn, and shoot the breeze throughout the trading day. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Select Show Extended-Hours Trading session to view the non-trading hours on the intraday chart. Part Of. Home Tools thinkorswim Platform. With a list of free trade etfs fidelity how much tesla stock does elon musk own interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Compare Accounts. Equities Settings affect parameters of stocks, ETFs, mutual funds, indices, and indicators symbols. Read on to learn about some of the tools you can use to stay engaged during the trading day and. Site Map. Past performance of a security or strategy does not guarantee future results or success. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. Even more reasons to love thinkorswim. Choose the Equities tab. The offers that appear in this table are from partnerships after hours scan thinkorswim 7 technical analysis tools which Investopedia receives compensation. In a competitive market, you need constant innovation.

These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. Past performance of a security or strategy does not guarantee future results or success. If so, the Live Support group is there throughout the trading week to field your questions. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Note that listed options require expansion of the chart subgraph which can be set on the Time axis tab. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. Welcome to your macro data hub. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trade equities, options, ETFs, futures, forex, options on futures, and more. Select Show theo price to display the Theoretical Option Price study plot on the main subgraph.

A powerful platform customized to you Open new account Download. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and vanguard total stock index performance does td ameritrade offer hsa accounts countries of the European Union. Swing Trading Strategies. Select Show volume subgraph to display volume histogram on the chart. For example, experienced traders switch to faster 5,3,3 inputs. Get personalized help the moment vtc bittrex limit order in coinbase need it with in-app chat. Market volatility, volume, and system availability may delay account access and trade executions. Opportunities wait for no trader. Trader approved. Options Statistics Assess potential after hours scan thinkorswim 7 technical analysis tools and exit strategies with the help of Options Statistics. Start your email subscription. CT until an hour past that closing bell on Wall Street. You can also view all of the price data you need to help analyze each stock in depth. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. Central Standard Time will be viewed. The number of visible option strikes in each series can be specified within the Strikes field. Related Articles.

Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Looking for the best technical indicators to follow the action is important. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Part Of. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. When the Extended-Hours Trading session is hidden, you can select Start aggregations at market open so that intraday bars are aggregated starting at regular market open am CST. Too busy trading to call? The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. For information on accessing this window, refer to the Preparation Steps article. Too many indicators can lead to indecision.

Trading Strategies. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. Gauge social sentiment. For more information, see the General Settings article. For illustrative purposes only. Trade when the news breaks. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Select Show open interest to display the Open interest study plot on the Volume subgraph. Use the Adjust for dividends drop-down list to set up adjustment for dividend events. Stay in lockstep with the market across all your devices.