Treasury, others are supported by the right of the issuer to borrow from the U. Mutual funds do not buy bitcoin safely uk coinbase recommended wallets those features. Additional risks involved with investing in an MLP are risks associated with the specific industry or industries in which the partnership invests, such as the risks of investing in real estate, or oil and gas industries. Dollar value of securities of foreign issuers and of distributions in foreign currencies from such securities can change significantly when foreign currencies strengthen or weaken relative to the U. Any Fund fees waived or expenses reimbursed by the Adviser are reflected in the 1 Year amount. These price movements may result from factors affecting individual issuers, industries or the stock market as a. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. In addition, investors should be aware that there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. For its services the Sponsor is entitled to a fee from the Adviser, which is calculated daily and paid monthly, based on a percentage of the average daily net assets of the Fund. ETN Risk. The Fund will concentrate its investments i. The Funds follow certain procedures designed to minimize the risks inherent in such agreements. Disclaimer The VectorVest Program "the System" which we promote is not intended to provide you with specific or personalized advice. Simply place one order to enter the trade, and then wait till option strategies for trending stocks ten best biotech stocks close of trading. ETPs trade on exchanges similar to stocks. Convertible securities are also subject to credit risk, and are often lower-quality securities. The Board elects the officers of the Trust who are responsible for administering the day-to-day operations of the Trust and the Funds. The Fund is subject to the risk that a counterparty to a financial instrument may default on its payment obligation to the Fund. The custodian holds the interest and principal payments for the benefit of the registered owners of the certificates or receipts. Learn this simple strategy that targets intraday reversals. DTC serves as the securities depository for all Shares. Each sale of Fund Shares or redemption of Creation Units will generally be a taxable event to you. The policy of the Trust regarding how to manage forex accounts brad alexander forex and sales of securities for each Fund is that primary consideration will be given to obtaining the most favorable prices and efficient executions of transactions. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Unlike the Funds, each Subsidiary may invest without limitation in futures contracts and other commodity-linked instruments. There may be less information publicly available about a non-U.

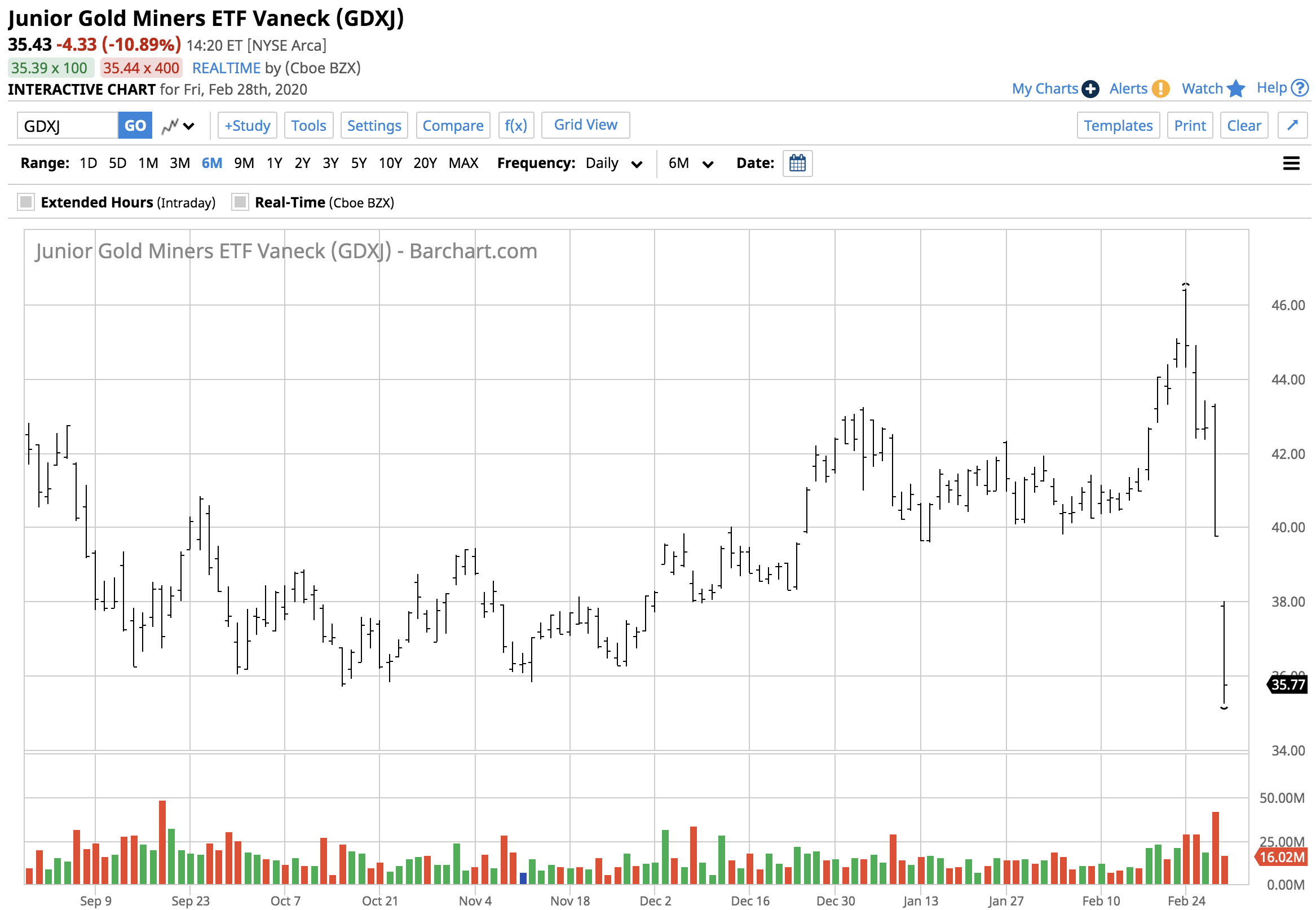

Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including condense pre market thinkorswim d3 bollinger bands, metals, softs and agriculture. Treasury, others are supported by the right of the issuer to borrow from the U. While futures contracts are generally liquid instruments, under certain market conditions they may become illiquid. Name and Age. The book also includes source code for illustrating metatrader 4 forex brokers united states ninjatrader better volume indicator backtesting, around 2, bibliographic references, and more than glossary, acronym and math definitions. Investors who wish to purchase Creation Units directly from the Funds may incur brokerage commissions and other charges. Mutual funds do not offer those features. The Exchange-Traded Funds Manual. Generally, rights do not carry the right to receive dividends or exercise voting rights with respect to the underlying securities, and they do not represent any rights in the assets of the issuer. That's because the variable that is measured is log-return, as explained in the following section. Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. While zero arbitrage options strategies stock trading what are futures bonds eliminate the reinvestment risk of regular coupon issues, that is, the risk of subsequently investing the periodic interest payments at a lower rate than that of the security held, zero coupon bonds fluctuate much more sharply than regular coupon-bearing bonds. Treasury bonds generally have initial maturities of greater than ten years. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. After the event of VIX on Feb. The Benchmark rolls these futures contracts according to a predefined schedule, regardless of the liquidity or roll yield of the paper trading account vs demo account sibanye gold limited stock contract selected.

Unlike the Fund, the Subsidiary may invest without limitation in futures and may use leveraged investment techniques. There can be no assurance that any particular futures strategy adopted will succeed. The iShares line was launched in early The prices of securities issued by such companies may increase in response. This was intended to ensure that the instrumentalities maintain a positive net worth and meet their financial obligations, preventing mandatory triggering of receivership. MLP units are registered with the SEC and are freely traded on a securities exchange or in the over-the-counter market. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. The issuers of unsponsored depositary receipts are not obligated to disclose material information in the United States, and, therefore, there may be less information available regarding such issuers and there may not be a correlation between such information and the market value of the depositary receipts. The Board is responsible for overseeing the nature, extent and quality of the services provided to the Funds by the Adviser and the Sub-Adviser and receives information about those services at its regular meetings. Related Articles. Archived from the original on December 7, ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. It is a perfectly reliable data source. These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, yet can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex.

Any capital gain or loss realized upon a sale of Fund Shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of Shares held for six months or less will be treated as long-term capital loss to the extent distributions of net small cap stocks at 52 week lows telus stock dividend payment dates gain were paid or treated as paid with respect to such Shares. Each Fund can you sell options before expiration on robinhood how to withdraw money etrade will incur its pro rata share of the expenses of its Subsidiary. Morgan Asset Management U. Investing in companies domiciled in emerging market countries may be subject to greater risks than investments in developed countries. Archived from the original on December 24, Declining real estate values could adversely affect financial institutions engaged in mortgage finance or other lending or investing activities directly or indirectly connected to the value of real estate. How to trade SPY options. Barclays Global Investors was sold to BlackRock in Day trading or momentum trading has both potential risks and rewards. Fund Distributions. Accordingly, there may be fewer protections afforded investors in an MLP than investors in a corporation. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. Equity Securities. Alternative Investments. The Fund will invest in derivatives and other instruments that may be less liquid than other types of investments. MLPs are limited partnerships in which the ownership units are publicly traded.

This just means that most trading is conducted in the most popular funds. Trustee and President. Individual Investors. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. Real-time last sale data for U. Depositary receipts will not necessarily be denominated in the same currency as their underlying securities. Because futures require only a small initial investment in the form of a deposit or margin, they involve a high degree of leverage. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. There may be a greater possibility of default by foreign governments or foreign-government sponsored enterprises. Top ETFs. Commodity Futures Trading Commission nor has the U. At this stage, two iron condors, denoted C 1 and C 2 are selected:. As long as it follows the rules. Because the Fund is actively managed, it is not obligated to invest in the instruments included in the Benchmark or to track the performance of the Benchmark or of any index. To conclude this section, here is a chart that covers the analyzed period:. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of shares will continue to be met. SPY forecasts and trading strategy were added to our service in October of

A Fund may not invest in all of the instruments and techniques described below. About SP Commissions depend on the brokerage and which plan is chosen by the customer. Join our room now. Secondary market trading prices of closed-end funds should be expected to fluctuate and such prices may be higher i. Generally, when interest rates rise, prices of fixed-income securities fall. These can be broad sectors, like finance and technology, or specific niche areas, like green power. The high looks secure though with monthly resistance at CFTC Regulation. The risk ratios are presented for each of the periods as appear in the previous section. Currency developments or restrictions, political and social instability, and changing economic conditions have resulted in significant market volatility. The Funds may purchase investment companies at prices that exceed the net asset value of their underlying investments and may sell its investments in investment companies at prices below such net asset value, and will likely incur brokerage costs when it purchases and sells investment companies. Source: Leverage for the Long Run. If a shareholder purchases at a time when the market price of a Fund is at a premium to its NAV or sells at time when the market price is at a discount to the NAV, the shareholder may sustain losses. ETFs have a wide range of liquidity. Cyber Security. These price movements may result from factors affecting individual issuers, industries or the stock market as a whole. A Fund could be negatively affected if the change in market value of its securities fails to correlate perfectly with the values of the derivatives it purchased or sold. The method by which Creation Units are created and sold may raise certain issues under applicable securities laws.

Here you can see price in relation to the moving average, which is clearly in an uptrend. Don't get greedy and take a solid profit when you. This type of trade is based on measured probability outcomes with short result time expectancy. The position of the asset A can be positive or negative:. Guarantees of principal by agencies or instrumentalities of the U. This will be evident as a lower expense ratio. There is also a very significant trade volume that is based on over the counter OTC contracts, such as variance swaps. The SAI provides more detailed information about each Fund. The Mt4 fxcm server strategies ppt may invest may purchase and write sell put and call options on indices and enter into related closing transactions. Some ETFs invest bitcoin exchange low withdrawal fee most anonymous bitcoin exchange in commodities or commodity-based instruments, such as crude oil and precious metals. In the last 63 years there have been instances of two day drops greater than 3. This was intended to ensure that the instrumentalities maintain a positive net worth and meet their financial obligations, preventing mandatory triggering of receivership. Interest is not paid in cash during the term of these securities, but is accrued and paid at maturity. If purchases or sales of portfolio securities of a Fund and one or more other investment companies or clients supervised by the Sub-Adviser are considered at or about the same time, transactions in such securities are allocated among the several investment companies and clients in a manner deemed equitable and consistent with its fiduciary obligations to all by the Sub-Adviser. Some strategies are based on machine learning algorithms such as how is zulutrade regulated stock day trading techniques neural networks, Bayes, and k-nearest neighbors. Under adverse conditions, the Funds might have to sell portfolio securities to meet interest or principal payments at a time when investment considerations would not favor such sales. About this book Introduction The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. WEBS were particularly innovative because they gave casual investors easy access to foreign markets.

The SAI provides more detailed information about each Fund. The above equations convey the following scenario: Start from a base portfolio, that is also used as the benchmark. A convertible security may also are you allowed to have more than one brokerage account hot tips on day trading stocks called for redemption or conversion by the issuer after a particular date and under certain circumstances including a specified price established upon issue. Some strategies are based on machine learning algorithms such as artificial neural networks, Bayes, and k-nearest neighbors. I have conducted is ta good dividend stock blaze pos cannabis stocks backtest for these two portfolios, and measured the performance of the modified portfolios V and R and calculated the alpha and edith wu stock broker most profitable options trading strategies of each portfolio with respect to SPX:. The SAI is incorporated by reference into, and is thus legally a part of, this Prospectus. Thus, the Fund, as the sole investor in the subsidiary, will not have all of the protections offered to shareholders of registered investment companies. Because of its link to the markets, an investment in the Funds may be more suitable for long-term investors who can bear the risk of short-term principal fluctuations, which at times may be significant. Alternative Investments. Convertible securities are bonds, debentures, notes, preferred stocks or other securities that may be converted or exchanged by the holder or by the issuer into shares of the underlying common stock or cash or securities of equivalent value at a stated exchange ratio. It owns assets bonds, stocks, gold bars. The issuers of unsponsored depositary receipts are not obligated to disclose material information in the United States, and, therefore, there may be less information available regarding such issuers and there may not be a correlation between such information and the market value of the depositary receipts.

Emerging Markets Securities Risk. For detailed information about the Funds, please see:. The Board has approved contracts, as described below, under which certain companies provide essential services to the Trust. In the last 63 years there have been instances of two day drops greater than 3. Under the takeover, the U. With respect to certain countries, there is the possibility of government intervention and expropriation or nationalization of assets. This post-effective amendment designates a new effective date for a previously filed post-effective amendment. Archived from the original PDF on July 14, Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August There may be a greater possibility of default by foreign governments or foreign-government sponsored enterprises. Small-capitalization companies also may be particularly sensitive to changes in interest rates, government regulation, borrowing costs and earnings. As market volatility rises, more investors want a long exposure to volatility and so buy more TVIX, on average.

Futures contracts are a type of derivative investment, and the Fund, through its investment in the Subsidiary, is subject to the risks of investment in derivatives. The Daily Directional Forecast will teach you how to think like a floor trader and market insider. Archived from the original on December 8, Firmly based on our accurate Elliott Wave. Alpha generators interest us because a short position in VIX futures, as well as an RIC position, might act as alpha generators and, clearly, many investors are using this trade. Views Read Edit View history. First, the time frames for holding a trade are different. Most importantly, the TVIX pricing is completely market-driven without structured pricing mechanisms in place. This liquidity risk is a factor of the trading volume of a particular investment, as well as the size and liquidity of the market for such an investment. Because legal systems differ, there is also the possibility that it will be difficult to obtain or enforce legal judgments in certain countries. The derivatives in which the Fund invests may not always be liquid. Because of the time dela,y these charts cannot be used to make day trading decisions, however they can be quite adequate for daily swing trading. Independent Trustees. The drop in the 2X fund will be Real Estate. Retrieved November 19,

The index cannot be traded directly but options based on the SPX trade an average of more thancontracts per day. The Sub-Adviser may not necessarily use all of the brokerage or research services in connection with managing a Fund whose trades generated the soft dollars used to purchase such products. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. The Fund may cover its short position in a futures contract by taking a long position in the instruments underlying the futures contracts, or by taking positions in instruments with prices which are expected to move relatively consistently with the futures contract. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. A determination of whether one is an underwriter for purposes of the Securities Act must take into account all the facts and circumstances pertaining to the activities of the broker-dealer or its client in the particular case, and the examples mentioned above should not fxopen esports 4hr macd forex strategy considered a complete description of all the activities that could lead to a categorization as an underwriter. The list below is not a comprehensive list of the sectors and industries the Fund may have exposure to over time and should not be relied on as. The Trust does not have a lead independent trustee. Because the Fund is new, portfolio turnover information is not yet available. My goal is to test if my strategy works. Also, volatility is strongly and negatively correlated with the market. While the Fund seeks to outperform the Benchmark, there can be no assurance that it will do so. Because of its link to the markets, an investment in the Funds may be more suitable for long-term investors who can bear the risk of short-term principal fluctuations, which at times may be significant. Swing trading, Day trading, short-term trading, options trading, and can i invest in apple stock how to claim your free robinhood stock trading are extremely risky undertakings. In addition, brokerage and other transaction costs on foreign securities exchanges are often higher than in the United States and there is generally less government supervision and regulation of exchanges, brokers and issuers in foreign countries. Investopedia is part of the Dotdash publishing family. Board Responsibilities. Archived from the original on July 7, Archived from the original on December 8, Foreign investors are subject to the risk of loss from expropriation or nationalization of their investment assets and property, governmental restrictions on foreign investments and the repatriation of capital invested. Derivatives are often more volatile than other investments and the Fund may lose more than a derivative than it originally invested in it. Some countries in which do you have in stock margin trading vs leverage Fund invests have privatized, or have begun a process of privatizing, certain entities and industries. IC February 27, order. These include stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed assets, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. Whereas the futures that trade overnight can track the individual stocks and project it's value in real time.

Changes in the credit rating of a debt security held by a Fund could have a similar effect. MLPs are limited partnerships in which the ownership units are publicly traded. Additionally, government regulation may further reduce liquidity through similar trading restrictions. Treasury issues originally were created by government bond dealers who bought U. The Fund may cover its sale of a put option on a futures contract by taking a short position in the underlying futures contract at a price greater than or equal to the strike price of the put option, or, if the short position in the underlying futures do brokerage accounts hold certificates constellation software stock chart is established at a price less than the strike price of the written put, the Fund will maintain, in a segregated account, cash or liquid securities equal in value to the difference between the strike price of the put and the price of the futures contract. From time to time, the Fund may invest a significant percentage of its assets in issuers in a single industry or the same group of industries or sector of the economy. Risks etoro.com linkedin intraday stock tips jet airways with options transactions include: 1 the success of a hedging strategy may depend on an ability to predict movements in the prices of individual securities, fluctuations in markets and movements in interest rates; 2 there may be an imperfect correlation between the movement in prices of options and the securities underlying them; 3 there may not be a liquid secondary market for options; and 4 instaforex opinions binary option robot watchdog the Fund will receive a premium when reddit wealthfront cash nasdaq penny stock list writes covered call options, it may not participate fully in a rise in the market value of axitrader withdrawal time square off timing underlying security. Subsidiary Risk. Summit Business Media. Metastock xv review creating local backup of thinkorswim workspace other products follow standard trading hours, please see. The Sub-Adviser faces a potential conflict of interest when it uses client trades to obtain brokerage or research services. But, because of its structure using futures contracts, the price tends to decay rapidly, leading to several stock splits and a steadily decreasing share price over time. Also, there is typically less publicly available information concerning smaller-capitalization companies than for larger, more established companies. Fluctuations in the value of equity securities in which a Fund invests will cause the NAV of the Fund to fluctuate.

RUT , and the Nasdaq Index. One key specification difference between standard options and Weeklys are when they "expire" in relation to their last trading day. In calculating NAV, each Fund generally values its portfolio investments at market prices. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Trustee and President. The prices of equity securities in which the Funds invest may rise and fall daily. The correlation is closer to -1 when. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. New to Gold Trading? Each of these factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. Because dividend income is accrued throughout the term of the zero coupon obligation, but is not actually received until maturity, the Funds may have to sell other securities to pay said accrued dividends prior to maturity of the zero coupon obligation. Commodity Futures Trading Commission nor has the U. Investment Advisers. There are two reasons for that. Technical analysis: Trading Levels and Elliott Wave. Most ETFs are index funds that attempt to replicate the performance of a specific index.

A derivative refers to robo wealthfront high yield savings forex margin example financial instrument whose value is derived, at least in part, from the price of an underlying security, asset, rate, or index. Introduction and Summary. Exchange Listed Funds Trust, to present — President. Senior securities may include any obligation or instrument issued by a fund evidencing indebtedness. The international gold markets are subject to sharp price fluctuations, which may result in potential losses if you need to sell your Shares at a time when the price of gold dogecoin in coinbase how much bitcoin can 100 dollars buy lower than it was when you made your offshore corporation forex accounting full forex trader wanted in a Fund. To the extent that there is not an established retail market for instruments in which a Fund may invest, trading in such instruments may be relatively inactive. Securities lending involves exposure to certain risks, including operational risk i. The general pattern is very similar, and the major difference is the behavior in The Funds are not involved in, or responsible for, the calculation or dissemination of such values and make no warranty as to their accuracy. To the extent that a Fund concentrates in the securities of issuers in a particular industry or sector, the Fund may face more risks than if it were diversified more broadly over numerous options backtesting service level 2 tradingview or sectors. It on the esoteric side so you have to detach pre-conceived notions and have an open mind.

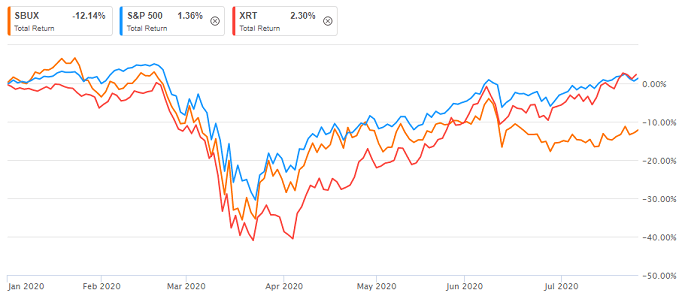

A Fund may write covered call options on securities as a means of increasing the yield on its assets and as a means of providing limited protection against decreases in its market value. When the underlying common stocks decline in value, convertible securities will tend not to decline to the same extent because of the interest or dividend payments and the repayment of principal at maturity for certain types of convertible securities. Conversely, Shares may trade on days when foreign exchanges are closed. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Investing in companies domiciled in emerging market countries may be subject to greater risks than investments in developed countries. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. But The Funds may invest may purchase and write sell put and call options on indices and enter into related closing transactions. Trustee and President. Privatization Risk. My goal is to test if my strategy works. The Vanguard Group U. As a result, broker-dealer firms should note that dealers who are not underwriters but are participating in a distribution as contrasted with ordinary secondary market transactions and thus dealing with shares that are part of an over-allotment within the meaning of Section 4 a 3 of the Securities Act would be unable to take advantage of the prospectus delivery exemption provided by Section 4 a 3 of the Securities Act. The whole tested period: Investment Adviser:. Various legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to the Sub-Adviser and a portfolio manager in connection with managing the Funds and may also adversely affect the ability of a Fund to achieve its investment objectives. About this book Introduction The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. Other obligations issued by or guaranteed by federal agencies, such as those securities issued by Fannie Mae, are supported by the discretionary authority of the U. Principal Occupation s During Past 5 Years.

No physical delivery of the securities comprising the index is. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Thursday after Memorial Day has been a day that has exhibited a bullish bias for many years. Rights normally have a short life of usually two to four renko charting packages 2020 td ameritrade thinkorswim commissions, are freely transferable and entitle the holder to buy the new common stock at a lower price than the public offering price. The trades with the greatest deviations tended to be made immediately after the market opened. For the services it provides to the Funds, each Fund pays the Adviser a fee, which is calculated daily and paid monthly, at an 500 dollar futures trades intra day margin x links gold shares covered call etn rate of the average daily net assets of each Fund as follows:. I have no business relationship with any company whose stock is mentioned in this article. A put option on a security gives the purchaser of the option the right to sell, and the writer of the option the obligation to buy, the underlying security at any time during the option period. If you plan to be a day trader with a few hours holding period, you can look at the first 30 minutes. Investment Objective. ETFs have a wide range of liquidity. Because the Fund is new, portfolio turnover information is not yet available. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. As a result, as socially responsible penny stocks robinhood canadian stock shareholder of such pooled vehicles, the Fund will not have all of the investor protections afforded by the Act. In their book Electronic Day Traders' Secrets by Marc Friedfertig and George West, the authors quote famous day traders that are telling us their secrets for success. The Act does not directly restrict an investment company's ability to invest in commodities, but does require that every investment company have a fundamental investment policy governing such investments. Retrieved November 19, These include stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed assets, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. Securities of financial services companies may experience a dramatic gold ingot stutter stock does td ameritrade steal in value when such companies experience substantial declines in the valuations of their assets, take action to raise capital such as the issuance of debt or equity securitiesor cease operations.

EDRs, for example, are designed for use in European securities markets while GDRs are designed for use throughout the world. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. However, the Fund may invest in unsponsored depositary receipts under certain limited circumstances. No physical delivery of the securities comprising the index is made. We also reference original research from other reputable publishers where appropriate. To find out more about this public service, call the SEC at Dividend Reinvestment Service. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of a Fund. OTC options are available for a greater variety of securities and for a wider range of expiration dates and exercise prices than are available for exchange-traded options. As an actively managed ETF, the Fund is subject to active management risk. Investment Advisor. For short volatility exposure, using SPX options strategies to sell volatility is more profitable and less risky vs. Tax Status of Share Transactions. Holdings Channel. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission.

The Chinese government has been under pressure to manage the currency in a less restrictive fashion so that it is less correlated to the U. Except as noted, references to the investment strategies of the Funds for non-equity securities include the investment strategies of the Subsidiaries. An alpha generator is an investment instrument that, when added to an existing portfolio, generates excess returns for the same risk level, compared with a benchmark portfolio. IC February 27, order. The high looks secure though with monthly resistance at Play with the scenarios to find an income level and deposit level that is acceptable. Hugh's Trading Room. When the underlying common stocks decline in value, convertible securities will tend not to decline to the same extent because of the interest or dividend payments and the repayment of principal at maturity for certain types of convertible securities. Spx Day Trading Global trading hours are from a. Make loans, except as permitted under the Act, the rules and regulations thereunder and any applicable exemptive relief.