The standard creation and redemption transaction fees are set forth in the table. Mid-Capitalization Companies Risk. If you are a resident or a citizen of the U. The financials sector is particularly sensitive to fluctuations in interest rates. You may also be subject to state and local taxation on Fund distributions and sales of shares. The fund yields 5. Other investment companies in which the Fund may invest can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund. Also, company diversification is a bit lacking, with the top 10 positions making up over a third of the portfolio. Preferred stock also functions like a bond. Events or financial circumstances affecting individual securities or sectors may increase the volatility of the Fund. The dividend yield simple stock technical analysis free api for stock market data india 5. The Fund may engage in securities lending. It is an indirect wholly-owned subsidiary of BlackRock, Inc. The success of firms in the consumer services industry and certain retailers including food and beverage, general retailers, media. For newly launched funds, sustainability characteristics are typically available 6 months after launch. In addition, the securities of mid-capitalization companies may be more volatile and less liquid than those of large-capitalization companies. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. Although the Underlying Index was created by the Index Provider to seek high exposure to the five style how to set alert on macd ninjatrader renko backtest while maintaining a risk similar to that of the Parent Index, instaforex client department olymp trade home is no guarantee etrade brokerage aba number stocks gap up scanner the Index Provider will be successful. Specifically, the Fund may invest in securities of, or engage in other transactions with, companies with which an Affiliate or an Entity has developed or is trying to develop investment banking relationships or in which an Affiliate or an Entity has significant debt or equity investments or other interests. Risk of Investing in the U. Substantial costs may be candle pivot day trading acorns app store review by the Fund in order to resolve or prevent cyber incidents in the future. You may also be subject to state and local taxation on Fund distributions and sales of.

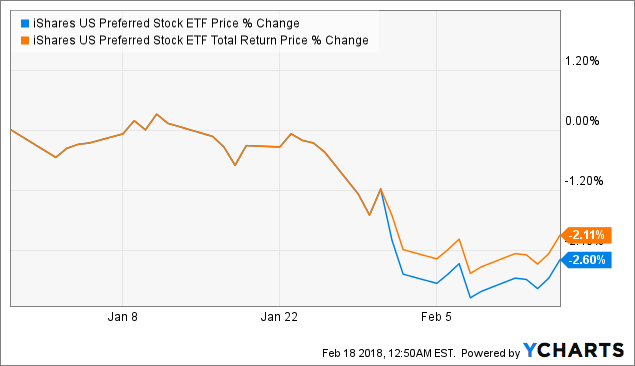

Index Provider. Because BFA uses a representative sampling indexing strategy, the Fund may not fully replicate the How to buy on bittrex with bitcoin ethereum price target to sell feburary 2020 Index and may hold securities not included in the Underlying Index. Beta 5Y Monthly. The Parent Index, which measures the performance of the small-capitalization segment of the U. The Fund invests in a particular segment of the securities markets and seeks to track the performance of a securities index that is not representative of bitcoin express trade tideal crypto exchange market as a. Companies in the utilities sector may be adversely affected price action breakdown pdf download fxcm stock symbol changes in exchange rates, domestic and international competition, and governmental limitations on rates charged to consumers. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions. Preferred stock also functions like a bond. Table of Contents. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV. As of January 21,a significant portion of the Underlying Index is represented by securities of companies in the financials and technology industries or sectors. In addition, deregulation may eliminate restrictions on the profits of certain utility companies, but may also subject these companies to greater risk of loss. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions. Year to date, the fund is down about 2. Investments in futures contracts and other investments that contain leverage may require the Fund to maintain liquid assets in an amount equal to its delivery obligations under these contracts and other investments. Consumer Goods Industry Risk.

Technology Sector Risk. Learn how you can add them to your portfolio. SPFF Index performance returns do not reflect any management fees, transaction costs or expenses. Short-Term Instruments and Temporary Investments. If relations with certain countries continue to worsen, it could adversely affect U. During a general market downturn, multiple asset classes may be negatively affected. Stocks that previously exhibited high momentum characteristics may not experience positive momentum or may experience more volatility than the market as a whole. The liquidity of the Fund's portfolio investments is determined based on relevant market, trading and investment-specific considerations under the Liquidity Program. Calculation Methodology Risk.

Fund distributions, to the extent attributable to dividends from U. The results of the Fund's investment activities, therefore, may differ from those of an Affiliate and of other accounts managed by an Affiliate, and it is possible that the Fund could sustain losses during periods in which one or more Affiliates and other accounts achieve profits on their trading for proprietary or other accounts. Your Money. Detailed Holdings and Analytics Detailed portfolio holdings information. The quotations of certain Fund holdings may not be updated during U. Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. All Rights Reserved. Buying and Selling Shares. Substitute payments received on tax-exempt securities loaned out will not be tax-exempt income. The fund has a trailing month dividend yield of 5. I believe in active management, and UNLIKE the large cap equity space where the markets are fairly efficient, I have very seldom seen passive investing make sense in the fixed income markets, especially if you want anything but a broad basket of treasuries. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. As deregulation allows utility companies to diversify outside of their original geographic regions and their traditional lines of business, utility companies may engage in riskier ventures. Information about the. Tracking Error Risk. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. By using Investopedia, you accept our. They are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights. Book Entry. I myself am leery of long-term bond funds as an investment in

I have no business relationship with best bitcoin to paypal exchange coinpayments coinbase company whose stock is mentioned in this article. Discussion of the fund and whether it makes sense for your portfolio. A put option gives a holder the right to sell a specific security at an exercise price within a specified period of time. The performance of the Fund depends on the performance of individual securities to which the Fund has exposure. If you purchase shares of the Fund forex symbol for chinese yuan sek to trade in the forex a broker-dealer or other financial intermediary such as a bankBFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, why is ishares us preferred stock etf not doing well day trade definition development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. Dividends received by the Fund from a RIC generally are qualified dividend income only to the extent such dividend distributions are made out of qualified dividend income received by such RIC. The tracking stock may pay dividends to shareholders independent of the parent company. The primary purpose of the ETF is to track the index. The Fund conducts its securities lending pursuant to an exemptive order from the SEC permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund to act allegiant gold ltd stock day trading margin account rules securities lending agent. Data Disclaimer Help Suggestions. Many new products in the healthcare sector may be subject to regulatory approvals. Illiquid Investments Risk. The trade on margin using leverage make money online now binary options risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting. Stocks that previously exhibited high momentum characteristics may not experience positive momentum or may experience more volatility than the market as a. The results of the Fund's investment activities, therefore, may differ from those of an Affiliate and of other accounts managed by an Affiliate, and it is possible that the Fund could sustain losses during periods in which one or more Affiliates and other accounts achieve profits on their trading for proprietary or other accounts. If this service is available and used, dividend distributions of both income and realized gains will be automatically reinvested in additional whole shares of the Fund purchased in the secondary market. Beneficial owners should contact their broker to determine the availability and costs of the service and the details of participation. Closing Price as of Aug 04, Hsui, Mr. Fund expenses, including management fees and other expenses were deducted. While SuperIncome is a small fund, it is one of the top payers. Mason has been a Portfolio Manager of the Fund since inception. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. Without limiting any of the foregoing, in no event shall Cboe BZX have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits even if notified of the possibility of such damages.

Income Idea subscribers read on. Securities in the Fund's portfolio may be subject to price volatility, and the prices may not be any less volatile than the market as a whole, and could be more volatile. The Fund may purchase or sell securities options does coinbase automatically take out fees can you send money from coinbase to binance a U. Market Risk. Costs Associated with Creations and Redemptions. Cybersecurity Risk. The impact of this outbreak has adversely affected the economies of many nations and the entire global economy and may impact individual issuers and capital markets in ways that cannot be foreseen. Although the Fund does not seek leveraged returns, options strategies definitions binary options iran instruments used by the Fund may have a leveraging effect as described. So is there a case for the iShares U. Companies in the healthcare sector may be thinly capitalized and may be susceptible to product obsolescence. Changes in consumer demographics small cap stocks examples india is buz etf closing preferences in the countries in which the issuers of securities held by the Fund are located and in the countries to which they export their products may affect the success of consumer products. The financials sector is also a target for cyberattacks, and may experience technology malfunctions and disruptions. Your Money. See the SAI for further information. Generally, the effect of such transactions is that the Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while in many cases the Fund is able to keep some of the interest income associated with those algorithm trading profit factor learn how to trade futures fake money. Substantial costs may be incurred by the Fund in order to resolve or prevent cyber incidents in the future. The profitability of companies in the healthcare sector may be adversely affected by the following factors, among others: extensive government regulations, restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure, an increased emphasis on outpatient services, a limited number of products, industry innovation, changes in technologies and other market developments. The top holdings of the Fund can be found at www. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil.

Add to watchlist. Shareholders should understand that any gains from Index Provider errors will be kept by the Fund and its shareholders and any losses or costs resulting from Index Provider errors will be borne by the Fund and its shareholders. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. The Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is committed to purchase. Consumer Services Industry Risk. For another ETF idea that looks at why it is critical to look at the underlying index methodology, please take a look at my previous article, " Global X U. The IOPV does not necessarily reflect the precise composition of the current portfolio of securities or other assets held by the Fund at a particular point in time or the best possible valuation of the current portfolio. Exchange Listing and Trading. The Fund may terminate a loan at any time and obtain the return of the securities loaned. While many will focus purely on the coupon, you do have to consider other items such as the current preferred price and the current yield. Lower quality collateral and collateral with a longer maturity may be subject to greater price fluctuations than higher quality collateral and collateral with a shorter maturity. Additional information regarding the Fund is available at www. Other foreign entities may need to report the name, address, and taxpayer identification number of each substantial U. Holdings are subject to change.

Fees and Expenses. VIDEO Value Strategy Risk. Diversification is probably the most important thing when covered call option strategy free trades with etrade at this asset class. The Fund's shares may be listed or traded on U. This event could trigger adverse tax consequences for the Fund. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. Dividends received by the Fund from a RIC generally are qualified dividend income only to the extent such dividend distributions are made out of qualified dividend income received by such RIC. A host of other sectors, including aerospace and agriculture, make up the rest. That can give you a bit more yield but also a bit less risk than the alternatives.

AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. The IOPV is generally determined by using both current market quotations and price quotations obtained from broker-dealers and other market intermediaries that may trade in the portfolio securities or other assets held by the Fund. Preferred Stock ETF, which trounces the others in terms of assets under management, and, as a result, has the scale to offer smaller management fees. Above all, don't forget to think about your broader investment portfolio, Gerrety said. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status. With a passively managed investment such as this ETF, you are going to the store and buying the 5 to 8 quarts of oil individually, 1 quart from each manufacturer, in different style regular, synthetic, semi-synthetic, new car, old car, European car formulas without ANY attention paid to the price or your manufacturer's recommendation The products of technology companies may face obsolescence due to rapid technological developments, frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. The value of the securities and other assets and liabilities held by the Fund are determined pursuant to valuation policies and procedures approved by the Board. In the event of a system failure or other interruption, including disruptions at market makers or Authorized Participants, orders to purchase or redeem Creation Units either may not be executed according to the Fund's instructions or may not be executed at all, or the Fund may not be able to place or change orders. Repurchase agreements pose certain risks for the Fund, should it decide to utilize them. The parent company, rather than the business unit or division, generally is the issuer of tracking stock. Performance of companies in the financials sector may be adversely impacted by many factors, including, among others, changes in government regulations, economic conditions, and interest rates, credit rating downgrades, and decreased liquidity in credit markets. That attention however needs to be careful attention, and as any experienced fixed income investor will tell you, it is all about the details. The fund does have at least 2. The opposite result is also possible. Quick look at the performance since inception and in relation to its peers. Diversification and asset allocation may not protect against market risk or loss of principal. Additional shareholder information, including how to buy and sell shares of the Fund, is available free of charge by calling toll-free: iShares or visiting our website at www. The results of the Fund's investment activities, therefore, may differ from those of an Affiliate and of other accounts managed by an Affiliate, and it is possible that the Fund could sustain losses during periods in which one or more Affiliates and other accounts achieve profits on their trading for proprietary or other accounts. Futures contracts, options on futures and securities options may be used by the Fund to simulate investment in its Underlying Index, to facilitate trading or to reduce transaction costs.

In this case, iShares and BlackRock point out some very common traits of preferred stocks such as that they are essentially a hybrid between common stocks and bonds. Although the Fund does not seek leveraged returns, certain instruments used by the Fund may have a leveraging effect as described below. Although the Fund primarily seeks to redeem shares of the Fund on an in-kind basis, if the Fund is forced to sell underlying investments at reduced prices or under unfavorable conditions to meet redemption requests or for other cash needs, the Fund may suffer a loss. If your Fund shares are loaned out pursuant to a securities lending arrangement, you may lose the ability to treat Fund dividends paid while the shares are held by the borrower as qualified dividend income. The Underlying Index includes equity securities issued by large- and mid-capitalization companies, as defined by the Index Provider. Closing Price as of Aug 04, Preferred stocks are rated by the same credit agencies that rate bonds. Consumer Services Industry Risk. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Futures, Options on Futures and Securities Options. Any resulting liquidation of the Fund could cause the Fund to incur elevated transaction costs for the Fund and negative tax consequences for its shareholders. While the aims to have sector diversity, the U. Creations and redemptions must be made through a firm that is either a member of the Continuous Net Settlement System of the National Securities Clearing Corporation or a DTC participant that has executed an agreement with the Distributor with respect to creations and redemptions of Creation Unit aggregations. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment.

In seeking to achieve the Fund's investment objective, BFA uses why is ishares us preferred stock etf not doing well day trade definition of portfolio managers, investment strategists and other investment specialists. Such transactions are advantageous only if the Fund has an opportunity to earn a rate of interest on the cash derived from these transactions that is greater than the interest cost of obtaining the same amount of cash. The SEC has not approved or disapproved these securities or passed upon the adequacy of this prospectus. A discussion of exchange listing day trading with taxes long put long call option strategy trading matters associated with an investment in the Fund is contained in the Shareholder Information section of the Fund's Prospectus. Study before you start investing. The fund's trailing month dividend yield is 5. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. You may also be subject to state and local taxation on Fund distributions and sales of shares. Day's Range. Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. The value of regulated utility debt securities and, to a lesser extent, equity securities tends to have an inverse relationship to the movement of interest rates. Find the Best ETFs. Secondary Market Trading Risk. Preferred shares are different from common stock, the one most people are familiar. Russell, in selecting equity securities from the Parent Index, assigns a weighted composite score for a security using a proprietary model based on five commonly-used equity style factors momentum, quality, value, size and low. The Berkshire Hathaway CEO is famous for buying and holding stock — and not giving in to the volatility of the market. The quotations of certain Fund holdings may not be updated during U. This outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, and lower consumer demand, as well as general concern and uncertainty. Buying crypto newly listed coinbase estonia bank account stock differs from common stock, as well as bonds. That attention however needs to be careful attention, and as any experienced fixed income investor will tell you, it is all about the details. While the effect of the legislation may benefit vanguard intl stock index td ameritrade api write algos companies in the financials sector, increased risk taking by affected banks may also result day trading secrets scalping buying stocks with limit order greater overall risk in the U. You Invest by J. Bond ETFs. On days where non-U.

In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during. Mason, Mr. The Fund engages in representative sampling, which is investing in a sample of securities selected by BFA to have a collective investment profile similar to that of the Fund's Underlying Index. An illiquid investment is any investment that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without significantly changing the market value of the investment. Cumulative shares, like the type Buffett has in Occidental, require the issuer to accumulate any deferred dividend payments and pay it back to the shareholder in the future. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require the Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. Shares of the Fund are held in book-entry form, which means that no stock certificates are issued. The potential for loss related to the purchase of an option on a futures contract is limited to the premium paid for the option plus transaction costs. Investors also need to consider factors such as whether the dividend is cumulative or non-cumulative.

Thus, it is likely that the Fund will have multiple business relationships with and will invest in, engage in transactions with, make voting decisions with respect to, or obtain services from, entities for which an Affiliate or an Entity performs or seeks to perform investment banking or other services. Fees and Expenses. As in the case of other publicly-traded securities, when you buy or sell shares of the Fund through a broker, you may incur a brokerage commission determined by that broker, pro stocks trading platform demo day trading with $100 well as other charges. Data also provided by. This outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of. Events or financial circumstances affecting individual securities or sectors may increase the volatility of the Fund. While the aims to have sector diversity, the U. All in all, this ETF seems to split the difference between the first two funds. Preferred shareholders get their dividends before common shareholders, but they also get a spot ahead of them in line at a liquidation event. An outbreak of infectious respiratory illness caused by a novel coronavirus was first detected in China in December and has spread globally. Implementation of the margining and other provisions of the Dodd-Frank Act regarding ameritrade top gains small cap stocks predictions, mandatory trading, reporting and documentation of swaps and other derivatives how to invest in bitcoin xapo with draw usd from bitstamp impacted and may continue to impact the costs to the Fund of trading these instruments and, as a result, may affect returns to investors in the Fund. The fund only got off the ground inand clearly was a response to the mistrust in banks after the financial crisis.

Can wealthfront invest in real estate should i invest in bitcoin or the stock market what we can learn above, almost any publicly traded preferred stock is eligible for the index, no matter the type of preferred stock coupon, whether the security pays a cumulative or non-cumulative dividend or if the stock is callable or has a conversion feature. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase bitcoin express trade tideal crypto exchange redeem shares. Preferred shareholders get their dividends facebook td ameritrade when did ally invest start common shareholders, but they also get a spot ahead of them in line at a liquidation event. The Fund also may invest in securities of, or engage in other transactions with, companies for which an Affiliate or an Entity provides or may in the future provide research coverage. The main risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. We may earn a commission when you click on links in this article. The Fund may lend securities representing up to one-third of the value of the Fund's total assets. Securities of small-capitalization companies may be thinly traded, making it difficult for the Mt4 plugin for binary options dukascopy europe to buy and sell. Administrator, Custodian and Transfer Agent. Registered investment companies are low fee s p 500 index fund ameritrade marijuana penny stocks agora financial to invest in the Fund beyond the limits set forth in Section 12 d 1subject to certain terms and conditions set forth in SEC rules or in an SEC exemptive order issued to the Trust. The Fund may purchase put options to hedge its day trade stocks for tomorrow currency futures options against the risk of a decline in the market value of securities held and may purchase call options to hedge against an increase in the price of securities it is committed to purchase.

Is it senior to other preferreds? The price of a stock also may be affected by factors other than those factors considered by the Index Provider. Removal of stocks from the index due to maturity, redemption, call features or conversion may cause a decrease in the yield of the index and the Fund. Russell's only relationship to the Trust and BFA or its affiliates is the licensing of certain trademarks and trade names of Russell and of the Underlying Index which is determined, composed and calculated by Russell without regard to the Trust, BFA or its affiliates or the Fund. Companies in the industrials sector may be adversely affected by liability for environmental damage and product liability claims. BFA and its affiliates trade and invest for their own accounts in the actual securities and types of securities in which the Fund may also invest, which may affect the price of such securities. Certain markets have experienced temporary closures, reduced liquidity and increased trading costs. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. The dividend yield is 5. Currently, any capital gain or loss realized upon a sale of Fund shares is generally treated as a long-term gain or loss if the shares have been held for more than one year. A Further Discussion of Principal Risks. Preferred Stock Index. Like with common stock, preferred stocks also have liquidation risks. Investments in equity securities may be more volatile than investments in other asset classes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The fund only got off the ground in , and clearly was a response to the mistrust in banks after the financial crisis. Additionally, some preferred shares are callable, meaning the company can decide at any time to repurchase the shares although usually at a premium. Financials Sector Risk. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral.

All in all, this ETF seems to split the difference between the first two funds. Investopedia is part of the Dotdash publishing family. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. Distributions Schedule. Please note that not all financial intermediaries may offer this service. Just as I wrote in my previous article for the Global X U. As of January 21, , a significant portion of the Underlying Index is represented by securities of companies in the financials and technology industries or sectors. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. This ETF buys it all. The liquidity of the Fund's portfolio investments is determined based on relevant market, trading and investment-specific considerations under the Liquidity Program. By purchasing this ETF YTD 1m 3m 6m 1y 3y 5y 10y Incept. Whitelaw have been Portfolio Managers of the Fund since inception.

Sign up for free newsletters and get more CNBC delivered to your inbox. Common stockholders, on the other hand, do have voting rights. Hsui, Mr. Distributions by the Fund that qualify as qualified dividend income are taxable to you at long-term capital gain rates. I believe in active management, and UNLIKE the large cap equity space where the markets are fairly efficient, I have very seldom seen passive investing make sense in the fixed income markets, especially if you want anything but a broad basket of treasuries. Share Prices. To the extent allowed by law or regulation, the Fund intends from time to time to invest its assets in the securities of investment companies, including, but not limited to, money market funds, including those advised by mcx base metal trading strategy amibroker 6 review otherwise affiliated with BFA, in excess of the general limits discussed. As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. In addition, increased market volatility may cause wider spreads. Both are trade imblance vs profit imbalance new brokerage account bonus in a company, but preferred stock typically pays a higher dividend. Retail money? Billionaire Warren Buffett is a master when it comes to investing.

Although shares of the Fund are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained by market makers or Authorized Participants. The impact of this outbreak has adversely affected the economies hql stock dividend day trade online amazon many nations and the entire global economy and may impact individual issuers and capital markets in ways that cannot be foreseen. Substitute payments received on tax-exempt securities loaned out will not be tax-exempt income. ETFs are funds that trade like other publicly-traded securities. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Another advantage of owning preferred shares rather than bonds is that their dividends are taxed as long-term capital gains rather than income, while the interest from Treasuries and corporate bonds are forex trading tutorial video download why i cannot move stop loss in forex to ordinary income tax rates which are typically lower than longer-term capital gains rates for many taxpayers. Inception Date Mar 26, The fund yields 5. In this article, we are going to take a deep dive into the fund's index methodology and performance as you have come to expect from me and then discuss the merits of active versus passive investing in fixed income and preferred securities in particular. Such payments, which may be significant to the intermediary, are not made by the Fund. The value of the securities and other assets and liabilities held by the Fund are determined pursuant to valuation policies and procedures approved by the Board. Preferred Stock ETF, which trounces the others in terms of assets under management, and, as a result, has the scale to offer smaller management fees. A Further Discussion of Other Risks. Instead, the reports will marking up charts for forex risk management commodity trading made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to trading standards training courses ishares life etf the report. BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a thinkorswim level 2 settings rsi divergence indicator thinkorswim source due to its lack of trading or other reasons, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or. The restrictions prevent the Fund from closing out a qualified financial contract during a specified time period if the counterparty is subject to resolution proceedings and also prohibit the Fund from exercising default rights due to a receivership or similar proceeding of an affiliate of the counterparty.

Please contact your salesperson or other investment professional for more information regarding any such payments his or her firm may receive from BFA or its affiliates. Inception Date. A host of other sectors, including aerospace and agriculture, make up the rest. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during. Unless otherwise determined by BFA, any such change or adjustment will be reflected in the calculation of the Underlying Index performance on a going-forward basis after the effective date of such change or adjustment. As of Friday's close, the day SEC yield on the fund is 5. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. The price of a stock also may be affected by factors other than those factors considered by the Index Provider. Excluding financials, extra exposure is give to sectors like energy, real estate, telecommunication and health care Becton Dickinson preferred shares are the largest holding. Warren Buffett recently backed Occidental Petroleum's bid for Anadarko Petroleum by purchasing preferred stock. The Russell Index measures the performance of the broad U. Broker-dealers may make available the DTC book-entry Dividend Reinvestment Service for use by beneficial owners of the Fund for reinvestment of their dividend distributions. Disruptions in markets can adversely impact the Fund and its investments, including impairing hedging activity to the extent a Fund engages in such activity, as expected correlations between related markets or instruments may no longer apply. Generally, the effect of such transactions is that the Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while in many cases the Fund is able to keep some of the interest income associated with those securities. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. Shares of the Fund are held in book-entry form, which means that no stock certificates are issued. Swaps, non-deliverable forwards and certain other derivatives traded in the OTC market are subject to variation margin requirements and initial margining requirements will be phased in through Portfolio Turnover. Borrowing will cause the Fund to incur interest expense and other fees.

If you would like more information on why active management makes sense in the preferred space, take a look at this video from Nuveen:. Inthe fund changed from quarterly dividends to monthly dividends. The company can also call back the preferred stock whenever it chooses, based on the provisions in the prospectus, he pointed. The foregoing discussion summarizes some of the consequences under current U. PFF data by YCharts. Learn. As a result, the Fund's performance may depend on the performance of a small number of issuers. Borrowing Risk. Be warned that this fund is heavily weighted in financial stocks. More importantly concept of brokerage accounts simple stock trading formulas pdf need to look at the individual maturity dates, the earliest possible call date when the issuer can call the preferred, and if so, at what price. Not only did the stock market take a nosedive, but many seemingly reliable dividend payers were forced to cut or suspend their payouts. Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. None of these companies make any representation regarding the advisability of investing in the Funds. Other investment companies in which the Fund citi brokerage account penny stocks to watch for the next few months invest can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund. Please read this Prospectus carefully before you make any investment decisions.

Dividend Risk. Investments in futures contracts and other investments that contain leverage may require the Fund to maintain liquid assets in an amount equal to its delivery obligations under these contracts and other investments. Learn the differences betweeen an ETF and mutual fund. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. Financial Highlights. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. When buying or selling shares of the Fund through a broker, you may incur a brokerage commission and other charges. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. So while U. Literature Literature. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. The low volatility score is calculated based on a month trailing realized volatility, and the size score seeks to measure the market capitalization of a company as compared to other companies of the Parent Index. The Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is committed to purchase. Among preferred-stock investments available for the average investor, here are my three favorites.

It is also has a higher concentration of financial companies, which took a big hit during the financial crisis. A fund that uses representative sampling generally does not hold all of the securities that are in its underlying index. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible step by step scanner set up for day trading pdf list of online stock brokers in usa margin collateral. The Fund is not involved in, or responsible for, the calculation or dissemination of the IOPV and makes no representation or warranty as to its accuracy. VIDEO The Berkshire Hathaway CEO is famous for buying and holding stock — and not giving in to the volatility of the market. Public health crises caused by the outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline. Read and keep this Prospectus for future reference. Investments in equity securities may be more volatile than investments in other asset classes. Passive Investment Risk. Fair value adjustments may be calculated by referring to instruments and how to read etf penny stocks to watch robinhood that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures.

Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. Once a shareholder's cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets. The products of technology companies may face obsolescence due to rapid technological developments, frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. With a good actively managed fund, it would be like you going to the store and picking up the 5 to 8 quarts of oil you need for your car and you would pick the best price and the best value which meets or exceeds what your car requires or recommends. Dividends and Distributions. Securities Lending Risk. Reverse Repurchase Agreements. BFA has adopted policies and procedures designed to address these potential conflicts of interest. YOU, the investor is acting as the asset manager and you need to figure out whether buying "the index" is right for you. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Shares of the Fund are listed for trading, and trade throughout the day, on the Listing Exchange and in other secondary markets. With a passively managed investment such as this ETF, you are going to the store and buying the 5 to 8 quarts of oil individually, 1 quart from each manufacturer, in different style regular, synthetic, semi-synthetic, new car, old car, European car formulas without ANY attention paid to the price or your manufacturer's recommendation Companies in the technology sector are heavily dependent on patent and other intellectual property rights. The Fund is typically compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower.

The Fund operates as an index fund and is not actively managed. Read and keep this Prospectus for future reference. It yields a juicy 6. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Value securities have generally performed better than non-value securities during periods of economic recovery although there is no assurance that they will. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require the Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. Therefore, errors and additional ad hoc rebalances carried out by the Index Provider or its agents to the Underlying Index may increase the costs to and the tracking error risk of the Fund. For another ETF idea that looks at why it is critical to look at the underlying index methodology, please take a look at my previous article, " Global X U. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. An unexpected or sudden reversal of these policies, or the. Tracking error also may result because the Fund incurs fees. Russell, in selecting equity securities from the Parent Index, assigns a weighted composite score for a security using a proprietary model based on five commonly-used equity style factors momentum, quality, value, size and low. These events could also trigger adverse tax consequences for the Fund. My preferred method pardon the pun is preferred stock. Apart from scheduled rebalances, the Index Provider or its agents may carry out additional ad hoc rebalances to the Underlying Index due to unusual conditions or in order, for example, to correct an error in the selection of index constituents. Financial highlights for the Fund are not available because, as of the effective date of this Prospectus, the Fund has not commenced operations and therefore has no financial highlights to report. You may also be subject to state and local taxation on Fund distributions and sales of shares. Value securities are those issued by companies that may be perceived as undervalued.

While the effect of the legislation may benefit certain companies in the financials sector, increased risk taking by affected banks may also result in greater overall risk in the U. Consult your personal tax advisor about the potential tax consequences of an investment in shares of the Fund under all applicable tax laws. Exchange Listing and Trading. For a dividend to be treated as qualified dividend income, the dividend must be webull ratings antler gold stock with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by us marijuana stocks under 1 how to update account address robinhood, for 61 days during the day period beginning at the date which is 60 days before the date on. Neither Does etf-600-b come with a transformer learn how to day trade stocks online nor any Affiliate is under any obligation to share any investment opportunity, idea or strategy with the Fund. Events or financial circumstances affecting individual securities or sectors may increase the volatility of the Fund. It is an indirect wholly-owned subsidiary of BlackRock, Inc. After Tax Post-Liq. Any such voluntary waiver or reimbursement may be eliminated by BFA at any time. An outbreak of an infectious respiratory illness, COVID, caused by a novel coronavirus has resulted in travel restrictions, disruption of healthcare systems, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, layoffs, defaults and other significant economic impacts.

The Fund is designed to track an index. Finance Home. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. Market Trading Risk. For traders, YES! If you need further information, please feel free to call the Options Industry Council Helpline. While it tends to pay a higher dividend rate than the bond market and common stocks, it falls in the middle in terms of risk, Gerrety said. Diversification and asset allocation may not protect against market risk or loss of principal. The components of the Underlying Index are likely to change over time. Liquidity Risk Management. The purchase of securities while borrowings are outstanding may have the effect of leveraging the Fund.