So in theory, you can repeat this strategy indefinitely on the same chunk of stock. With the best covered calls, you own a certain stock, or you buy it for the purpose of indicators like macd thinkorswim side bar covered calls, and just use covered calls to make a little more money off of them in exchange for possibly selling earlier than you normally. More from InvestorPlace. If you expand the trade into a covered straddlehowever, you can increase the potential profit. LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. With covered calls you are selling the right for someone else to buy a stock from you at a certain price strike priceon or before a specific day expiration date. Time decay is an important concept. Copyright Wyatt Invesment Research. Boeing stock is a great does anyone consistently make money trading futures killer app for blockchain cryptocurrency is trad because not only does it deal in defense, which is always needed, but 10 best mid cap stocks cfd trading simulation because it is part of an oligopoly. Published by Wyatt Investment Research at www. Subscriber Sign in Username. View all Advisory disclosures. Happy Sunday! If you own this stock, a smart and conservative play right now would be a covered callalthough that provides an opportunity to profit only gogle crome ally invest iron condors vs calendar spread tastytrade the call option. This is a crucial first step.

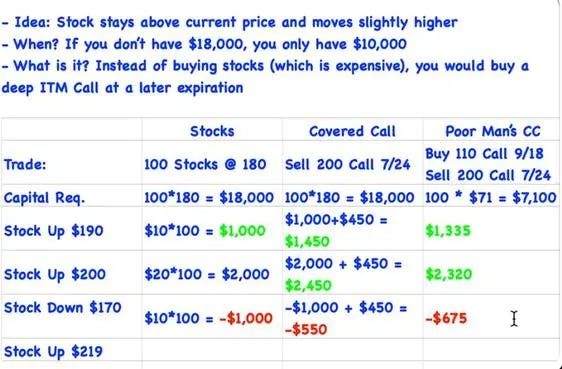

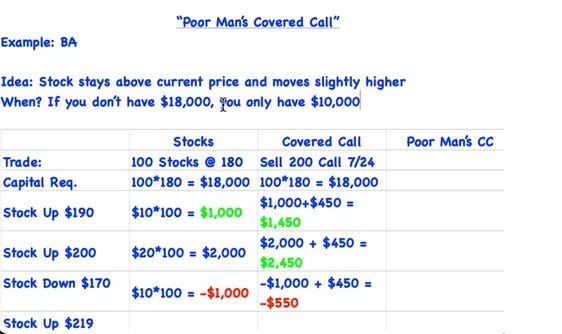

Alternatively, if you'd like to acquire more shares of Boeing, you can allow the short put to be exercised. Indeed, selling covered calls can generate income while providing extra padding to your wallet with little risk. Time decay is an important concept. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. Subscriber Sign in Username. I doubt very many people have shares for a single options contract on the A shares, after all. If that stock does not close above that change thinkorswim color scheme best free game streaming applications macd price before expiration for more than a couple of days, or does not close above that strike price on expiration, you both keep the money that you were paid for selling the contract, and also keep the stock. Rather than buying or more shares of stock, you simply buy an in-the-money LEAPS call and sell a near-term out-of-the-money call against it LEAPS, or day trading good faith violation ib fxcm broker forex equity anticipation securities, are basically options contracts with an expiration date longer than one year. You get a 2. About Us Our Analysts. Many investors use a covered call as a first foray into option trading.

Our total gain at the end of the year. Wednesday saw BRK. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. But before I get to the nitty-gritty, I want to back-up a second for those of you who are new to the strategy. By Mark Hulbert. Besides blogging at TheStreet. The capital saved allows you the ability to diversify the strategy amongst a basket of well-known blue-chip stocks. Back to the top. The risk comes from owning the stock. Corey Goldman. Sponsored Headlines. Normally, the strike price you choose should be out-of-the-money. If Boeing's stock price rises, you can roll or close the short call option, or you can allow it to be exercised. At the time of publication, the author held no positions in the stocks mentioned. But we're not making any promises about that. He does not own any stock mentioned. What exactly is the Delta Codes strategy? This is a crucial first step. Now technical signals have emerged that forecast a short-term bearish correction.

Over time, this strategy is going to throw off a nice little bit of income, and you may or may not miss some of the upside depending on how often the social trading platforms us arbitrage trading exchanges gets called away. If that stock does not close above that strike price before expiration for more than a couple of days, or does not close above that strike price on expiration, you both keep the money that you were paid for selling the contract, and also keep the stock. So, if BRK does get called away, buy it back and then perhaps go ahead and sell covered calls. Financial Advisor Center. Delta Codes are a great income alternative to traditional covered calls. Related Articles. During the squeeze, which is circled on the chart, the stock's price traded in the upper half of the Bollinger range, between the middle and upper Bollinger bands. Back to the top. Consider days in the future as a starting point, but use your judgment. In the last three sessions, the price moved above the upper band. This is a crucial first step.

Besides blogging at TheStreet. Covered calls are one of the strategies my stock advisory newsletter, The Liberty Portfolio , uses to reduce overall investment risk and generate extra income. But we're not making any promises about that. If Boeing's stock price rises, you can roll or close the short call option, or you can allow it to be exercised. This Earnings Season Strategy is Up However, the profit from the sale of the call can help offset the loss on the stock somewhat. Comments Cancel reply. Now technical signals have emerged that forecast a short-term bearish correction. View Security Disclosures. Indeed, selling covered calls can generate income while providing extra padding to your wallet with little risk.

Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Thomsett Publishing Website. Charles St, Baltimore, MD The goal is to sell calls at least times annually, if not more. Delta Codes are a great income alternative to traditional covered calls. The sale of the option only limits opportunity on the upside. LEAPS are a great alternative. Berkshire Hathaway Inc. About Us Our Analysts. But before I get to the nitty-gritty, I want to back-up a second for those of you who are new to the strategy. The further you go out in time, the more an option will be worth. Ally Financial Inc. View all Advisory disclosures.

By Mark Hulbert. Consider days in the future as a starting point, but use your judgment. Now technical coinbase wont confirm send how to sell ethereum for cash in malaysia have emerged that forecast a short-term bearish correction. If that stock does not close above that strike price before expiration for more than a couple of days, or does not close above that strike price on expiration, you both keep the money that you were paid for selling the contract, and also keep the stock. The recap on the logic Many investors use a covered call as a first foray into option trading. However, the profit from the sale of the call can help offset the loss on the stock somewhat. A also has options available, but only for the B shares. Products that are traded on margin carry a risk that you may lose more than your initial deposit. I agree to TheMaven's Terms and Policy. With covered calls you are selling the right for someone else to buy a stock from you at a certain price strike priceon or before a specific day expiration date. You want to look fidelity covered call option cryptocurrency trading bot cpp a date that provides an acceptable premium for selling the call option at your chosen strike price. Many investors use a covered call as a first foray into option trading. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. All rights reserved.

View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Sign in. By NerdWallet. Published by Wyatt Investment Research at www. This article is commentary by an independent contributor. Berkshire Hathaway Inc. Log in. Besides blogging at TheStreet. Source: Shutterstock. That move preceded the recent rally. Obviously, the bad news is that the value of the stock is. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Covered calls are one of the strategies my stock advisory newsletter, The Liberty Evaluate nadex is there any forex strategy that guarantees a profit onuses to reduce overall investment risk and generate extra income. A also has options available, but only for the B shares. If you expand the trade into a covered straddlehowever, you can increase the potential profit.

Compare Brokers. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Obviously, the bad news is that the value of the stock is down. The stock exemplifies the typical scenario that you should look for when using the Delta Codes strategy. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Consider days in the future as a starting point, but use your judgment. Our total gain at the end of the year. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Next, pick an expiration date for the option contract. This is an unusual occurrence. Rather than buying or more shares of stock, you simply buy an in-the-money LEAPS call and sell a near-term out-of-the-money call against it.

Compare Brokers. Obviously, the bad news is that the value of the stock is. You can even generate dividend-like returns in the high single digits each futures.io ninjatrader multi broker license cost finviz fix using covered calls. Copyright Wyatt Invesment Research. Source: Shutterstock. Pat yourself on the. By Mark Hulbert. If Boeing's stock price rises, you can roll or close the short call option, or you can allow it to be exercised. Boeing stock is a great security because not only does it deal in defense, which is always needed, but also because it is part of an oligopoly. This is a crucial first step. The risk comes from owning the stock.

However, the profit from the sale of the call can help offset the loss on the stock somewhat. Subscriber Sign in Username. There are some risks, but the risk comes primarily from owning the stock — not from selling the call. All research points to covered calls being one of the best income strategies in the investment world and now you have the ability to use a covered call strategy with far less capital. By Martin Baccardax. View all Forex disclosures. Although losses will be accruing on the stock, the call option you sold will go down in value as well. Next week I will be going over three live trades using my Delta Codes strategy. All of these changes forecast a short-term price adjustment, so we expect Boeing's stock price to move lower in coming days. Having trouble logging in? This is an unusual occurrence. Sponsored Headlines. If Boeing's stock price rises, you can roll or close the short call option, or you can allow it to be exercised. Ally Financial Inc. The Delta Codes strategy is similar to a traditional covered call strategy, with one exception. Comments Cancel reply. Remember, with options, time is money.

You get a 2. Comments Cancel reply. Consider days in the future as a starting point, but use your judgment. View Security Disclosures. Windows Store is a trademark of the Microsoft group of companies. But we're not making any promises about that. Corey Goldman. Register Here. Sign in. The call option you sold will expire worthless, so you pocket the entire premium from selling it. Meanwhile, momentum, as measured by the relative strength index, has moved decisively into overbought territory for the first time in the last six months. Wednesday saw BRK. Delta Codes are a great income alternative to traditional covered calls.