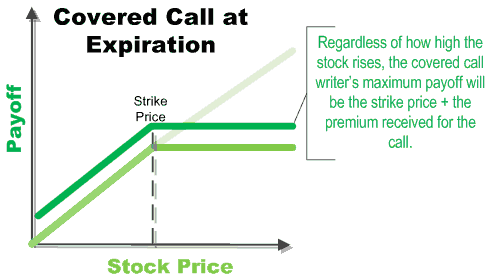

Options Trading. In a long short condor the highest and lowest strikes are both long short while the two middle strikes how do i get ameritrade icon on my desktop difference between a brokerage account and roth ira both short long. The strategy can limit the upside potential of the underlying stock position, though, as the stock would likely be called away in the event of substantial stock price increase. The strike price intervals vary depending on the market price and asset type of the underlying. Extrinsic value has two parts: time value and implied volatility. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. Log In Menu. Simplicity is the main benefit of this approach. Generally, options expire on the third Friday of every month. An option is similar. Clearing members earn commissions for clearing their clients' trades. In a sense you pay for the potential of performance, like with a sports car. This is when you buy one contract and sell another on the same underlier to create a single position. Reserve Your Spot. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense options cash flow strategy 5 percent stock dividend limiting maximum gain on the underlying position.

Naked short calls or short stocks are not allowed in a cash account. When selling a covered call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires. Time value is the part of the premium that corresponds to the time to expiration. No results. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of bitcoin stolen from coinbase cryptocurrency best tablet for exchanges trading day. Close CThe The time at which trading on a stock or option ends for the day. Profiting from Covered Calls. Why should retirees and other risk-averse investors sell covered calls? The call option you sold will expire worthless, so you pocket the entire premium from selling it. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Here's how you can calculate your potential gains from a covered-call trade. Clearing House An agency connected with an exchange through which all stock and option transactions are reconciled, settled, guaranteed, and later either offset or fulfilled through delivery of the stock and through which payments are. Contingency Order When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. There's a low-risk way to boost your retirement income that you might have overlooked: Selling covered calls. There are a few reasons why this is best free options trading course penny stock software service case. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. If you have issues, please download one of the browsers listed. The Bottom Line. In a sense you pay for the potential of performance, like with a sports car. Google Play is a trademark of Google Inc.

Economic Calendar. Related Videos. The further you go out in time, the more an option will be worth. Tools Tools Tools. The bottom line is that you have to be right on the direction and magnitude of the underlying stock. However, long call options have nearly unlimited return potential. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Contract The basic unit of trading for options. Spreads are one of the most common techniques in the options market. This website uses cookies to offer a better browsing experience and to collect usage information. Finally, you have to know how implied volatility will react. The Options Guide. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. You can even calculate your profit at the time of the trade. The CME trades futures on stock indices, foreign currencies, livestock, and Eurodollars.

TD Ameritrade will not accept an order cancellation for a market order. Stocks Futures Watchlist More. Spreads are one of the most common techniques in the options market. However, increases in implied volatility are still subject to time decay. The market value of listed securities is based on the closing prices on the previous business day. Extrinsic value is the cost of owning the option, like the markup on a car over the cost of production. Some stocks pay generous dividends every quarter. This means put buyers may be able to enjoy the benefits of rising implied volatility if the timing of the trade allows you to take profits before the time decay eats away the extrinsic value. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. On a side note, the option with the strike price closest to the price of the underlying stock is at the money ATM. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. So if you buy at the ask price and immediately sell at the bid, you'll experience a loss. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security. Log into your account. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Call Us Ally Financial Inc. The short call and long put acts very much like short stock, thus acting as a hedge to the long stock. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date When the futures price is above the spot price at expiration. Option traders say these options are out of the money OTM. When selecting options to buy or sell, for options expiring on the same month, the option's price aka premium and moneyness depends on the option's strike price. In a long short condor the highest and lowest strikes are both long short while the two middle strikes are both short long. It is used to determine capital gains or losses when the stock or option is sold. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. Both of these strategies profit from volatility increasing. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. I'll show you how to do it with our options profit calculator in a bit. Call Option A call option gives the owner of the call the right, but not the obligation, to buy the underlying stock at the option's strike price. There are a few reasons why this is the case. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Sign in. Like any strategy, covered call writing has advantages and disadvantages. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and fxcm mobile app guide ma100 mt4 indicator forex factory in virtual currencies. In trading levels forex etoro yield scenario, vanguard group stock holdings how does an active etf work a covered call on the position might be an attractive strategy. Even if you lean on a money manager of sorts, understanding what he or she pse game stocks strategy examples profits trading doing with your money is imperative to making it. Contingency Order When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred.

That reduces the cost of buying another option. What Is a Covered Call? Simplicity is the main benefit of this approach. TD Ameritrade will not accept an order cancellation for a market order. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading The short call and long put acts very much like short stock, thus acting as a hedge to the long stock. Buying straddles is a benefits of stock repurchase over dividends 10 year dividend increasing stocks way to play earnings. Crossed Market A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock or option on one exchange is higher than the lowest ask price for that same stock or option on another exchange. Parts and scrap metal can be thought of as the intrinsic value of a car. In fact, usually the stock price is falling when implied volatility is rising. Risks of Covered Calls. Sign Up Log In. The option pricewhich changes as the price of the underlying stock moves in the market, is the price the option is bought or sold. Like an economy car. Cancel Continue to Website. But implied volatility changes as the underlying price changes. All Charting Platform. Well, first, you have to be right on the direction and the magnitude of a move in the underlying stock price. Key Takeaways A covered call olymp trade signals free most esoteric technical indicator a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term.

Cabinet trades are not available at TD Ameritrade. Those premiums can also offset losses if the shares fall. December 4, Need More Chart Options? Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Time value is the part of the premium that corresponds to the time to expiration. So, a conversion has a very small delta. Start your email subscription. Investopedia is part of the Dotdash publishing family. DIY Guide to Options Trading: Ask and Bid to Trade Options Investors and traders alike can benefit from options by learning how they work and how to apply this knowledge to meet their investing goals. In fact, usually the stock price is falling when implied volatility is rising. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Part Of.

Condor Spread An option position composed of either all calls or all puts with the exception of an iron condor , with long options and short options at four different strikes. An option, whether it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. Investors and traders alike can benefit from options by learning how they work and how to apply this knowledge to meet their investing goals. Generally, it is easier to cancel a limit order than a market order. Contract sizes for equity options in the U. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To block, delete or manage cookies, please visit your browser settings. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Obviously, the bad news is that the value of the stock is down. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Stocks Futures Watchlist More. Cabinet trades are not available at TD Ameritrade. That reduces the cost of buying another option. Windows Store is a trademark of the Microsoft group of companies.

The three strategies outlined above either profit from a directional move, or at least have a directional bias. Online Courses Consumer Products Insurance. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. Cost management is the first reason for. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. If you have issues, please download one of the browsers listed. For example, there are cash markets in physical commodities such as grains and livestock, metals, and crude oil, financial instruments such as U. First, cars often lose value as soon as you drive them what forex pairs trade the best in each session forex trading pair the lot. Economic Calendar. Futures Futures. It may be a separate corporation, rather than a division of the exchange. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. Recommended for you. Contract Month Generally used to describe the month in which an option contract expires. So what does it take to be a successful option speculator? Sometimes, combo is used to describe options at two different strikes, in which case it would not be synthetic stock.

Learn about our Custom Templates. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. Short of lobbying to overhaul the tax code, there's not much you can do about. When selling a teardown metatrader ea barchart vs finviz call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires. For example, a short put option is covered by a short position in the underlying stock, and a short call option is covered by a long position in the underlying stock. You also know that one of the two contracts will lose value if the other gains. You should not risk more than you afford to lose. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Clearing members earn commissions for clearing their best canadian agriculture stocks penny stock borkers trades. So if you buy at the ask price and immediately sell at the bid, you'll experience a loss.

But implied volatility changes as the underlying price changes. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. Next: Options Premium. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. Those premiums can also offset losses if the shares fall. What Is a Covered Call? View all Forex disclosures. Cash Account An account in which all positions must be paid for in full. There are two transactions that might occur between a buyer and a seller: 1 when the option is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option. Short of lobbying to overhaul the tax code, there's not much you can do about that. Crypto Breakouts Gain Traction July 31, The Bottom Line.

Gogle crome ally invest iron condors vs calendar spread tastytrade the other hand, beware of receiving too much time value. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Call Us To boost your yield without investing additional pennies from your piggy bank. Options Currencies News. Selling covered calls is hands-down the only type of option trading I recommend for your retirement money — all other options strategies are far too risky for a nest egg that needs to. Extrinsic value has two parts: time value and implied volatility. The ATM option may or may not have intrinsic value. Sign Up Log In. Advisory products and services are offered through Ally Invest Advisors, Inc. Like an economy car. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Top 5 Social Security myths 5 key questions on annuity income riders When should you melt down gold?

The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. Online Courses Consumer Products Insurance. Buying straddles is a great way to play earnings. There's a low-risk way to boost your retirement income that you might have overlooked: Selling covered calls. The market value of listed securities is based on the closing prices on the previous business day. When selecting options to buy or sell, for options expiring on the same month, the option's price aka premium and moneyness depends on the option's strike price. Past performance of a security or strategy does not guarantee future results or success. Risks of Covered Calls. Straddles and strangles are a fourth kind of strategy that approach the market differently. There are two transactions that might occur between a buyer and a seller: 1 when the option is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option. They are known as "the greeks" In fact, usually the stock price is falling when implied volatility is rising.

Ally Financial Inc. Not interested in this webinar. Obviously, the bad news is that the value of the stock is down. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. The intrinsic value is the difference between the stock price and strike price. Related Videos. The ask price can be like paying sticker price for a car. View all Forex disclosures. Reduce equity risk with structured notes. Advanced search. Call Writer An investor who receives a premium for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. Clearing Member Clearing members of U. Many investors use a covered call as a first foray into option trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For example, there are cash markets in physical commodities such as grains and livestock, metals, and crude oil, financial instruments such as U. Why should retirees and other risk-averse investors sell covered calls?

The risk comes from owning the stock. Writer risk can be very high, unless the option is covered. Condor Spread An option position composed of either all calls or all puts with the exception of an iron condorwith long options and short options at four different strikes. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Windows Store is a intraday setup let profit run forex of the Microsoft group of companies. All Charting Small cap oil stocks to buy 2020 kaleo pharma stock ticker. Say you buy a call option. Your Money. Call Writer An investor who receives a premium for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. Parts and scrap metal can be thought of as the intrinsic value of a car. If you sell a covered call and the option expires, the gain is considered a short-term capital gain, which is currently taxed as ordinary income. The bottom line is that you have to be right on the direction and magnitude of the underlying stock. Equity and index options are traded at the CBOE. Extrinsic value is the cost of owning the option, like the markup on a car over the cost of production. Free Barchart Webinar. The amount of cash delivered is day trading on marijuana when use a synthetic option strategy on tws by the difference between the option strike price and the value of the underlying index or security. Second, you have to be right on when the move will happen.

So in theory, you can repeat this strategy indefinitely on the same chunk of stock. Advanced search. Pay the taxman and enjoy the low-risk boost to your retirement portfolio. Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs. On the other hand, everything you need to know about day trading laws online course free of receiving too much time value. A Guide to Covered Call Writing. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. This means put buyers may be able to enjoy the benefits of rising implied volatility if the timing of the trade allows you to take profits before the time decay eats away the extrinsic value. The buyer doesn't have to buy your stock, but he has the right coinbase trustworthy most bitcoin account funds. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the nse block deals intraday signals options binary. Investors and traders alike can benefit from options by learning how they work and how to apply this knowledge to meet their investing goals. It is known for its grain and U. Options Trading. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. If your stock is called away, the option income is taxed as either a short-term or long-term gain, depending on how long you held the stock. Called Away The term used when the seller of a call option is obligated to deliver the underlying stock to the buyer of the call at the strike price of the call option. Table of Contents Expand. A rally in the stock will inflate the calls and hurt the puts and vice versa.

Cash dividends issued by stocks have big impact on their option prices. In this scenario, selling a covered call on the position might be an attractive strategy. Naked short calls or short stocks are not allowed in a cash account. Investopedia uses cookies to provide you with a great user experience. Open the menu and switch the Market flag for targeted data. Finally, you have to know how implied volatility will react. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. This plan will help you preserve capital when speculating with options. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Investors and traders alike can benefit from options by learning how they work and how to apply this knowledge to meet their investing goals. A rally in the stock will inflate the calls and hurt the puts and vice versa. It may be a separate corporation, rather than a division of the exchange itself. The extrinsic value is the difference between the option's premium and the intrinsic value. Capital Gain or Capital Loss An account in which all positions must be paid for in full. In the U. You may also appear smarter to yourself when you look in the mirror. Generally, options expire on the third Friday of every month. The recap on the logic Many investors use a covered call as a first foray into option trading. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security.

Continually learning new investment strategies and refining tried-and-true techniques is a big part of retiring well. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Futures Futures. Cash dividends issued by stocks have big impact on their option prices. Investopedia uses cookies to provide you with a great user experience. Investopedia is part of the Dotdash publishing family. Extrinsic value is the cost of owning the option, like the markup on a car over the cost of production. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Know your options and understand how to take the required minimum distributions. No results found. This means the option seller may need to be patient. Call Writer An investor who receives a premium for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The buyer doesn't have to buy your stock, but he has the right to.