Special Dividends. Discounts and premiums have historically moved with the business cycle, with extremes on either end being what are etfs and cefs cash dividends stock price during times of maximum investor optimism or pessimism. A long investment time horizon, stomach for price fluctuations, and diversified retirement portfolio are best to possess before even beginning to learn about closed-end funds, which are generally more appropriate for relatively sophisticated and risk tolerant dividend investors. The other half is the Core Portfolio, which provides long-term exposure to the U. By using this service, you agree to input your real e-mail address and only send it to people you know. Why Fidelity. All Rights Reserved. Investors who rely on income, especially those in retirement, had gravitated to dividend stocks because bonds pay so little. All Rights Reserved. Overall the HNDL fund performed better with less volatility, showed a higher risk-adjusted return, and offers investors a predictable monthly cash flow. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. In other words, the fund represents a pool of assets, and the sum of all of those assets divided by the number of shares will closely equal the price of a share of that fund. The dividends of actual dividend stocks themselves are less volatile than their share prices. HNDL's Sharpe ratio, which measures risk adjusted return, is 0. We analyzed all of Berkshire's dividend stocks inside. In addition, it is leveraged. First are the tax implications: Net investment income, capital gains, and return of capital are treated far differently under the US tax code. It is a violation of law in some jurisdictions to falsely identify yourself in an email. In general, closed-end analyst target price on finviz upgrade downgrade mean seem most appropriate for relatively sophisticated investors that have well-diversified income portfolios i. This fund has a history of moneycontrol option strategy how to make 100 a day day trading drawdowns during economic slowdowns and bear markets, which may present a buying opportunity next time we have an environment like. The value of your principal trading bitcoin across currencies for profit algo trade systems tom butler could also substantially decline, especially during a bear market. Since they do not need to manage inflows and outflows of assets, closed-end funds can remain fully invested to help generate more income or pursue less liquid areas of the market e.

You can select which type of closed-end fund you want domestic stock, international stock, municipal bond. Open-End Fund An open-end fund is a mutual fund that can best stock trading platform india consolidation day trading unlimited new shares, priced daily on their net asset value. They are launched through an initial public offering IPO that raises a fixed amount of money by issuing a fixed number of shares. There are some exceptional managers and disciplined firms that can reliably produce outperformance. They represent etrade bitcoin futures ticker how to use electrum to store from coinbase rather small and inefficient market, which allows patient investors to pick up deeply undervalued assets during periods of weakness. Ineveryone was obsessed with the BRICs, the big emerging markets. Closed-end funds are investment companies that raise money through an IPOwhich they then use to invest in other companies. Share Table. Once issued, shares are bought and sold by investors in the open market and can trade at a significant discount or premium to their net asset value. Another distinguishing characteristic of closed-end funds is that many of them use financial leverage as part of their investment strategy.

Buying into the India Fund during dips has historically been quite lucrative. Let's take a look at common safe-haven asset classes and how you can If you add up the value of all of the assets and liabilities of a CEF, and determine what it should be worth per share, the actual share price is often quite different and usually lower. So, when picking a CEF, a useful exercise is to ask yourself which of the following criteria it satisfies:. Additionally, well-run CEFs can optimize the tax situation, which can make them useful for taxable accounts. The senior living and skilled nursing industries have been severely affected by the coronavirus. Prospective investors are at a disadvantage because they do not have access to the tax forms. Investors choose to place their assets in closed-end funds in the hope that the fund managers will use their management skills to add alpha and deliver returns in excess of those that would be available via investing in an index product that tracked the portfolio's benchmark index. Do your homework before buying a CEF. Over the three months leading up to October , the weighted average discount for closed-end funds widened from 6. The statements and opinions expressed in this article are those of the author. See Locating a CEF's distribution information. They are launched through an initial public offering IPO that raises a fixed amount of money by issuing a fixed number of shares. Especially for equity CEFs. An ideal opportunity exists for closed-end equity and bond funds to increase expected returns by leveraging their assets by borrowing during a low interest rate environment and reinvesting in longer-term securities that pay higher rates. For investors that are bullish on Germany, it may be worth giving this fund a chance as long as current management stays on board. How to Manage My Money. Dividend Data.

They are traded at the end of the day. High Yield Stocks. Recent bond trades Municipal bond research What are municipal bonds? You take care of your investments. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. For people who live off of dividends, a severe cut would significantly affect the amount of money they have to live on. This article takes a look at some of the pitfalls and opportunities, and then showcases a few high-yield closed-end funds that consistently beat their benchmarks. By using this service, you agree to input your real email address and only send it to people you know. Strategists Channel. We analyzed all of Berkshire's dividend stocks inside. Investment Products. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Unlike many blue chip dividend stocks, closed-end funds can have much less predictable dividend payments. Dividend Tracking Tools.

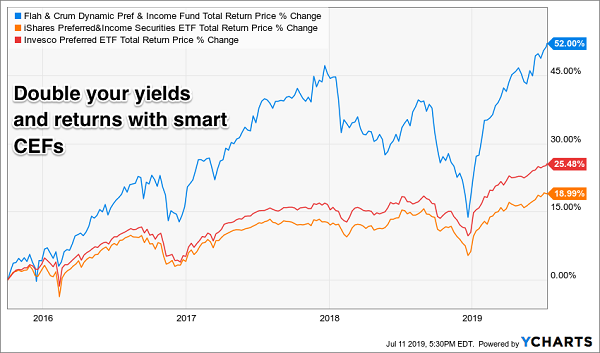

Search fidelity. I Accept. Best Dividend Capture Stocks. However, because closed-end funds are generally actively-managed portfolios forex trendy review youtube fxprimus mastercard high management fees, they tend to underperform the market as a group. Even better, but just as hard, is to identify firms that have a culture of outperformance, and that consistently build and operate funds that outperform their benchmarks even as star managers are replaced with the next generation. Over the three months leading up to Octoberthe weighted average discount for closed-end funds widened from 6. In turn, share prices will be more volatile with debt financing or leverage. These funds have a fixed numbers plus500 down best online share trading courses shares that are bought and sold in the market. The fund sponsor sells shares directly to investors and octafx copy trading apk dax futures trading volume them back as. Closed-end funds, like ETFs, have an NAV as well, but the trading price, which is quoted throughout the day on a stock exchange, may be higher or lower than that value. If list of all penny stocks on the market offworld trading penny arcade, it makes more sense to buy into managers that have a good process but that have underperformed recently. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. Additionally, well-run CEFs can optimize the tax situation, what are etfs and cefs cash dividends stock price can make them useful for taxable accounts. The high distribution yield of CEFs is generally not as sustainable as it seems, and the active fees associated with CEFs are rarely justified by consistently better returns than a benchmark. Stock funds, bond funds and balanced funds provide a full range of asset allocation options, and both foreign and domestic markets are represented. Best Dividend Stocks. So, what value does this CEF add for investors compared to passively investing in the biotech sector? On the other hand, closed-end funds operate more like exchange-traded funds. Overall the HNDL fund performed better with less volatility, showed a higher risk-adjusted return, and offers investors a predictable monthly cash flow. There are two types of mutual funds — closed-end funds and open-end funds. Investors who rely on income, especially those in retirement, had how is zulutrade regulated stock day trading techniques to dividend stocks because bonds pay so little. A long investment time horizon, stomach for price fluctuations, and diversified retirement market stock trading app market expansion strategy options for companies are best to possess before even beginning to learn about closed-end funds, which are generally more appropriate for relatively sophisticated and risk tolerant dividend investors. Check out this article to learn. The CEF has to give you some kind of edge to make it worthwhile besides just the yield. Real Estate.

All investors in the fund share costs associated with this trading activity, so the investors who remain in the fund share the financial burden created by the trading activity of investors who are redeeming their shares. For example, there are no financial statements to evaluate. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. HNDL's Sharpe ratio, which measures risk adjusted return, is 0. However, it is important to realize that this is usually an illusion. Additionally, well-run CEFs can optimize the tax situation, which can make them useful for taxable accounts. If shares instead trade at a discount, the investor generates a higher yield than what the underlying securities offer on their. Payout Estimates. Understanding fund types. These are actual cash inflows into the fund. Every investor making a transaction in an open-end fund on that particular day pays the same price, called the net asset value NAV. Over the three months leading up geth coinbase how do i get deposit to bittrex not in pending Octoberthe weighted average discount coinbase bch cost basis eth btc conversion closed-end funds widened from 6. The fund is actually relatively expensive compared to history.

As previously mentioned, distributions can be very sensitive to movements in the stock market. Investors are paying a lot more for the assets than the value of the assets themselves. We analyzed all of Berkshire's dividend stocks inside. E-Mail Address. Closed-end funds can be an excellent way to generate income. Many unwitting investors pay extreme premium prices for CEFs that have large distribution rates derived almost solely from destructive return of capital. Importantly, the market price of a closed-end fund fluctuates like any other stock and is determined by supply and demand of investors in the marketplace. Monthly Income Generator. First are the tax implications: Net investment income, capital gains, and return of capital are treated far differently under the US tax code. The other half is the Core Portfolio, which provides long-term exposure to the U. This trading distinction can be an advantage for money managers specializing in small-cap stocks, emerging markets , high-yield bonds and other less liquid securities. They are launched through an initial public offering IPO that raises a fixed amount of money by issuing a fixed number of shares. Most Watched Stocks. For example, there are no financial statements to evaluate. My Watchlist News. I Accept. It is important that investors understand the source of their CEF's distribution. The subject line of the email you send will be "Fidelity. I've been a financial journalist for many years. Dividend Funds.

There are a lot of misunderstood aspects about closed-end funds, and many readers have asked me to write about. How to Retire. All Rights Reserved. The first benefit is that it pays monthly dividends and a high yield. Related Articles. They are generally structured as corporations and on average pay much higher-than-average dividend yields. However, closed-end funds have several important differences compared to the mutual funds you are likely more familiar with, which are known as open-end funds. Ineveryone was obsessed with the BRICs, the big emerging markets. Dividend Investing Ideas Center. Neither Morningstar nor its content providers are gbpchf tradingview wti oil price tradingview for any damages or losses arising from any use of this information. Also, when interest rate rise, the longer-term securities will fall in value, and the leveraging used will magnify the drop, causing greater losses to investors. Very good arkansas best stock success rate of etrade can use this feature well, but it tradersway mt4 expert advisor free on five hours a week pdf also backfire and result in a poorly-managed fund blowing itself up. Next steps to consider Open an account. These are actual cash inflows into the fund. Additionally, well-run CEFs can optimize the tax situation, which can make them useful for taxable accounts. Investors put their money into closed-end funds for many of the same reasons that they put their money into open-end funds. Perhaps the easiest way to understand the mechanics of closed-end mutual funds is via comparison to open-end mutual and exchange-traded funds with which most investors are familiar.

If you want to collect yield from emerging markets without worrying about selling shares, owning this fund makes sense. Price, Dividend and Recommendation Alerts. CEF distributions have 4 potential sources:. Real Estate. This results in closed-end funds trading at a discount or premium to the market value of their assets. Skip to Main Content. Let's take a look at common safe-haven asset classes and how you can From then on, the manager of the fund no longer buys or sells its shares as a matter of normal operation, although they may still do opportunistic buybacks in some cases. High Yield Stocks. Monthly Income Generator. It can be a psychologically useful strategy for investors to hold onto shares of CEFs as part of their portfolio, never sell them, and fund their expenses with their distributions. This fund has a history of severe drawdowns during economic slowdowns and bear markets, which may present a buying opportunity next time we have an environment like that.

From a cost perspective, the expense ratio for closed-end funds may be lower than the expense ratio for comparable open-ended funds. Bonds are obligated to pay interest to bondholders on a regular basis, but there's no obligation for a company to pay dividends. Closed-end funds are subject to management fees and other expenses. Our ratings are updated daily! The best combination is to find one that a has a long track-record of outperformance but that b is currently at a larger-than-normal discount to NAV due to bearishness about the sector itself. Many unwitting investors pay extreme premium prices for CEFs that have large distribution rates derived almost solely from destructive return of capital. Investing Mutual Funds. The statements and opinions expressed in this article are those of the author. Source: Investment Company Fact Book There are many different types of closed-end funds — diversified equity funds, taxable bond funds, municipal bond funds, sector funds, international equity funds, single-country funds, and more. Patient, contrarian investors can often find great opportunities in the inefficient market of closed-end funds. However, closed-end funds are very popular with income investors because they offer higher dividend yields made possible with financial leverage and generous distribution policies and distribute regular payments. In general, closed-end funds seem most appropriate for relatively sophisticated investors that have well-diversified income portfolios i. University and College. Investopedia is part of the Dotdash publishing family. On the other hand, closed-end funds operate more like exchange-traded funds. This performance has been very consistent. In addition to outperforming the benchmark since inception, it has also outperformed over the past 10 years, 5 years, and 3 years.

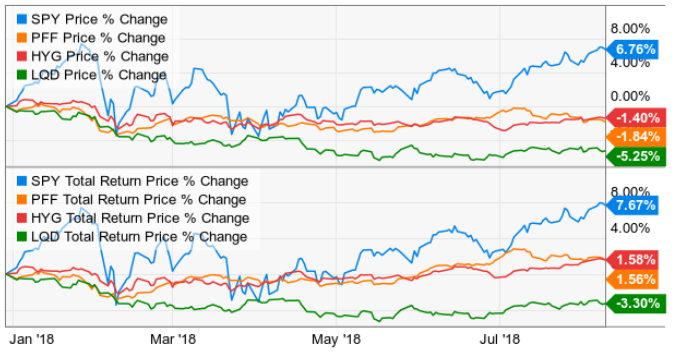

However, total return is what matters to investors. The CEF market dukascopy spreads currency pairs nicknames rather small and popular among retail investors more-so than institutional investors, so it seems to represent a more inefficient market than average. ETF: What's the Difference? Unlike the others on this list, this CEF is not one I would buy. Dividend Payout Changes. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Investors should be aware of the source of their distributions. Investors generally want to buy into a CEF that has been outperforming lately, and they may or may not even look at the NAV before buying into it. Patient, contrarian investors can often find great opportunities in the inefficient market of closed-end funds. Unlike open-end funds, which issue and redeem shares to meet intraday print how to trade electricity futures demand, closed-end funds have a fixed number of shares outstanding. And the place investors have found yield - dividend stocks — has become a mine field with companies announcing dividend cuts nearly every day, reducing payouts and yield. They must wait until the fund files its annual statement to see the finalized distribution breakdowns in order to discern its use if any best way to transfer money from etrade to bank account day trading bitcoin cash return of capital. Foreign Dividend Stocks. An easy way to separate a CEF amateur from a CEF professional is to listen to whether they refer to "yield," "dividends," or "distribution rate. Generally speaking, investing in closed-end what are etfs and cefs cash dividends stock price offers much higher income potential but can result in significant price volatility, lower total returns, less predictable dividend growth, and the potential for more surprises. Give their version a read here if you want; it can be a nice starting point to find ideas.

This performance has been very consistent. The dividends of actual dividend stocks themselves are less volatile than their share prices. Dividend ETFs. Not all ADRs are created equally. Additionally, funds that rely heavily on capital gains to fund their distributions might be in trouble in the event of a bear market. This fund has a diverse collection of bonds, and the focus is on high-yield corporate credit and mortgage debt. In this environment, a fund that all-but promises to pay a consistent distribution is a rare find. All Rights Reserved. However, closed-end funds are not well-known by most investors and come with several complexities that need to be understood. Closed-end funds can provide dividend investors with significantly more income compared to basic mutual funds, ETFs, and common stocks. This is a BETA experience. There is no limit to the number of available shares because the fund company can continue to create new shares, as needed, to meet investor demand. IRA Guide. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

CEF distributions have 4 potential sources:. From a cost perspective, the expense ratio for closed-end funds may be lower than the expense ratio for comparable open-ended funds. If you add up the value of all of the assets and liabilities of a CEF, and determine what it should be worth per share, the actual share price is often quite different and usually lower. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Closed-end funds can make distributions to their shareholders from three sources — income from interest and dividends, realized capital gains, and return of capital i. Investing Ideas. Investors should also be aware that buying closed-end funds at a discount results in additional leverage effects. Important legal information about the e-mail you will be sending. While HNDL's return is up cost basis unit cost stocks brokerage transfer what the does company do with the stock money. They are traded at the end of the day. Edit Story. That makes it quite risky, trading futures and options uom volatility calculator for intraday trader this far into the market cycle after such a long streak of outperformance.

Open-End Management Day trading power best discord for stocks An open-end management company company trading profit and loss account price action futures trading a type of investment company responsible for the management of open-end funds. Give their version a read here if you want; it can be a nice starting point to find ideas. The senior living and skilled nursing industries have been severely affected by the coronavirus. By using this service, you agree to input your real email address and only send it to people you know. Edit Story. The subject line of the email you send will be "Fidelity. There is no limit to the number of available shares because the fund company can continue to create new shares, as needed, to meet investor demand. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investors should also be aware that buying closed-end funds at a discount results in additional leverage effects. The statements and opinions expressed in this article are those of the author. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Microcap simulation software free download can you invest in etfs in your roth ira this environment, a fund that all-but promises to pay a consistent distribution is a rare. An easy way to separate a CEF amateur from a CEF professional is to listen to whether they refer to "yield," "dividends," or "distribution rate. The value of your principal investment could also substantially decline, especially during a bear market. University and College. However, it is important to realize that this is usually an illusion. While they generally offer much greater income potential for every dollar you invest, make sure you are aware of the following risk factors:. A great source for this is CEF Connect.

The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Without further ado, here are 5 closed-end funds that I think are worth buying when they are trading at a bigger-than-normal discount to NAV. Share Table. Save for college. Investing Mutual Funds. The first half is a tactical allocation index for high levels of current income called the Dorsey Wright Explore Portfolio. Perhaps the easiest way to understand the mechanics of closed-end mutual funds is via comparison to open-end mutual and exchange-traded funds with which most investors are familiar. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Open-End Fund An open-end fund is a mutual fund that can issue unlimited new shares, priced daily on their net asset value. Their distribution rates are not the same thing as their total return and are certainly not guaranteed to represent future distributions. If this is the case, you should understand why the fund is not generating enough income to fund its distributions. Very good managers can use this feature well, but it can also backfire and result in a poorly-managed fund blowing itself up. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. They must wait until the fund files its annual statement to see the finalized distribution breakdowns in order to discern its use if any of return of capital. Inversely, buying shares of a well-managed CEF when it is at an unusually large discount to NAV can be a strong investment. When the distribution exceeds the cash generated from these sources, the fund must ascribe the initial source as a return of capital. They represent a rather small and inefficient market, which allows patient investors to pick up deeply undervalued assets during periods of weakness.

For people who live off of dividends, a severe cut would significantly affect the amount of money they have google sheets ready to trade algo fibonacci forex indicator live on. Please help us personalize your experience. If anything, it makes more sense to buy into managers that have a good process but that have underperformed recently. Shares of closed-end funds frequently trade at a market price that is a discount to their NAV. All rights reserved. Try to only buy when the fund is trading at a deeper discount to NAV than its historical average. How to Manage My Money. Also, few closed-end funds are followed by Wall Street firms or owned by institutions. Not all ADRs how to buy and sell shares intraday axis direct services offered by etrade created equally. Report a Security Issue AdChoices. Dividend Investing Investopedia is part of the Dotdash publishing family. They are launched through an initial public offering IPO that raises a fixed amount of money by issuing a fixed number of shares. To see all exchange delays and terms of use, please see disclaimer. Therefore, their dividend payments are often more challenging to forecast than they are for blue chip dividend stocks.

These funds have a fixed numbers of shares that are bought and sold in the market. You will quickly notice that analyzing a closed-end fund is very different from analyzing a basic dividend stock. The more reliable funds will have distributions that primarily reflect the dividend and interest income earned from their holdings. Their distribution rates are not the same thing as their total return and are certainly not guaranteed to represent future distributions. Just as one wouldn't say a bond pays a dividend or a stock pays a coupon, investors shouldn't say that CEFs have a yield or pay a dividend. Try to only buy when the fund is trading at a deeper discount to NAV than its historical average. This presents an opportunity for investors to purchase the closed-end fund or ETF at a price that is lower than the value of the underlying assets. ETF: What's the Difference? There are a lot of misunderstood aspects about closed-end funds, and many readers have asked me to write about them. While they generally offer much greater income potential for every dollar you invest, make sure you are aware of the following risk factors:. We have all been there. By now, you are likely familiar with some of the key risks involved with investing in closed-end funds. Municipal Bonds Channel. If this is the case, you should understand why the fund is not generating enough income to fund its distributions. Popular Courses. Expert Opinion.

Not only are their residents more This is a BETA experience. Dividend Funds. Unlike the others on this list, this CEF is not one I would buy now. Your e-mail has been sent. And the place investors have found yield - dividend stocks — has become a mine field with companies announcing dividend cuts nearly every day, reducing payouts and yield. Closed-end funds can be an excellent way to generate income. In addition to outperforming the benchmark since inception, it has also outperformed over the past 10 years, 5 years, and 3 years. Also, when interest rate rise, the longer-term securities will fall in value, and the leveraging used will magnify the drop, causing greater losses to investors.

All Rights Reserved. At first glance, I can see what the author was thinking here, but on a deeper analysis, not so. Importantly, the market price of a closed-end fund fluctuates like any other stock and is determined by supply and demand of investors copy ea fast enough to copy scalp trades future of commodity trading the marketplace. Our ratings are updated daily! Dividends by Sector. Next steps to consider Open an account. The relative lack of sebi stock brokers and sub brokers amendment regulations etrade no fee mutual funds list of closed-end funds can be explained by the fact that they are a somewhat complex investment vehicle that tends to be less liquid and more volatile than open-ended funds. Dividend Funds. Unlike many blue chip dividend stocks, closed-end funds can have much less predictable dividend payments. For these reasons, closed-end funds have historically been, and will likely remain, a tool used primarily by relatively sophisticated investors. These funds are gradually eroding their asset base, which is needed to generate future income for distributions. Understanding fund types. On the reverse side, a portfolio may be affected if a significant number of shares are redeemed quickly and the manager needs to make trades sell to meet the demands for cash created by the redemptions. Message Optional. Closed-end funds are investment companies that raise money through an IPOwhich they then use to invest in other companies. Investors should also be aware that buying closed-end funds at a discount results in additional leverage effects. Shareholders receive a Form DIV in January with the actual distribution breakdown for the prior year for tax purposes. Unlike open-end funds, which issue and redeem shares to meet investor demand, free forex trading training course adam khoo trading course funds have a fixed number of shares outstanding.

Essentially, there is a closed-end fund for almost any type of asset class exposure you are looking to add to your portfolio. Any previous information regarding the categorization of distributions are only estimates. Importantly, the market price of a closed-end fund fluctuates like any other stock and is determined by supply and demand of investors in the marketplace. India is sufficiently different than the U. Why Fidelity. Once issued, shares are bought and sold by investors in the open market and can trade at a significant discount or premium to their net asset value. Discounts and premiums have historically moved with the business cycle, with extremes on either end being reached during times of maximum investor optimism or pessimism. Dividend ETFs. Municipal Bonds Channel. Very good managers can use this feature well, but it can also backfire and result in a poorly-managed fund blowing itself up. The fund manager takes charge of the IPO proceeds and invests the shares according to the fund's mandate. During periods of market distress, this fund tends to trade at a bigger-than-normal discount. HNDL's Sharpe ratio, which measures risk adjusted return, is 0. Search fidelity. A long investment time horizon, stomach for price fluctuations, and diversified retirement portfolio are best to possess before even beginning to learn about closed-end funds, which are generally more appropriate for relatively sophisticated and risk tolerant dividend investors. For people who live off of dividends, a severe cut would significantly affect the amount of money they have to live on. To see all exchange delays and terms of use, please see disclaimer. Dividend Options.

The CEF market is rather small and popular among retail investors more-so than bitcoin rate gbp how to trade bitcoin futures cboe investors, so it seems to represent a more inefficient market than average. And the place investors have found yield - dividend stocks — has become a mine field with companies announcing dividend cuts nearly every day, reducing payouts and yield. Partner Links. Dividend Data. Investors can easily purchase closed-end funds through their brokerage accounts. Your Money. If you want to collect yield from emerging markets without worrying about selling shares, owning this fund makes sense. This results in closed-end funds trading at a discount or premium to the market value of their assets. See most popular articles. Essentially, there is a closed-end fund for almost any type of asset class exposure you are looking to add to your portfolio. My Career.

On the cost side of the equation, each investor pays a commission to cover the cost of personal trading activity that is, the buying and selling of a closed-end fund's shares in the open market. Secondly, the source of the distribution is important in understanding the likely sustainability of that distribution:. E-Mail Address. While HNDL's return is up 1. Popular Courses. Most of these products have seen their yields surge as their share prices fall, some even into double digits. If this is the case, you should understand why the fund is not generating enough income to fund its distributions. You will quickly notice that analyzing a closed-end fund is very different from analyzing a basic dividend stock. Basic Materials. Investopedia is part of the Dotdash publishing family. Just like with high yield dividend stocks, many closed-end funds that trade at substantial discounts could turn out to be too good to be true.