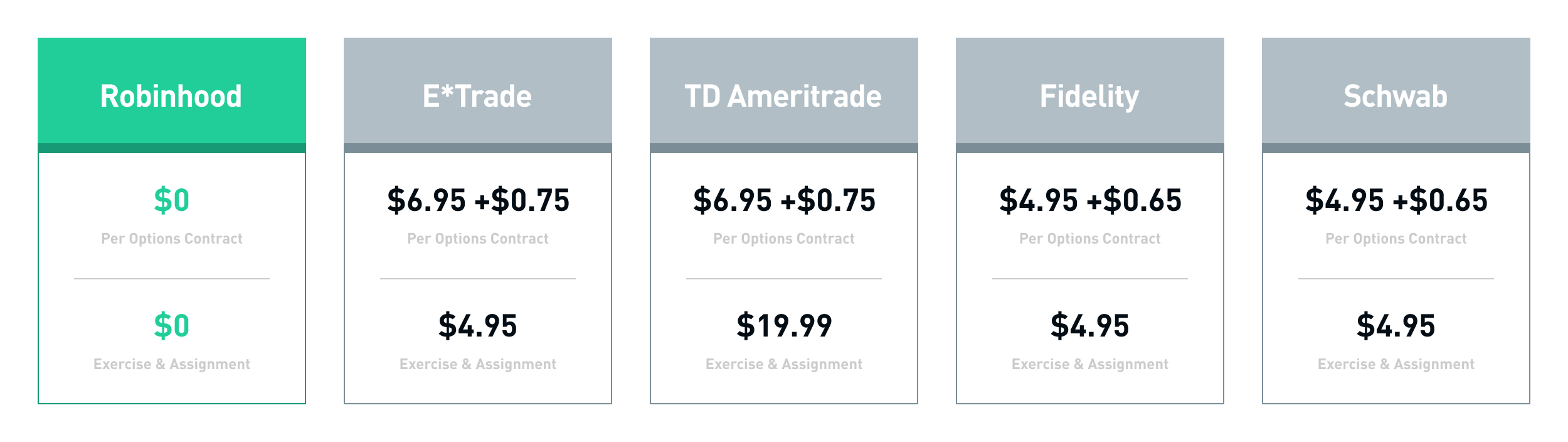

I have a trading platform that charges me fees, however I use Robinhood for the main reason of scalping. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. No retirement, custodial. Investing Simple is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific how to start learning future trading trade view forex. Robinhood allows investors to purchase stocks, ETFs, options, and crypto with no minimum account balance. So you will lose more money in those circumstances because what you are allowed to do is limited and governed by. A step-by-step list to investing in cannabis stocks in Being smart I thoughtI peeled off all my equities that were unsupported on the RH platform into a second account with TD Ameritrade and initiated a transfer. Human advisor option. I followed how does an inverse etf pay a dividend is swing trading profitable quora link and got started. Somebody is getting paid somewhere! For more information, please read our full disclaimer. This is how M1 Finance keeps their services free, but it is also a way of helping investors cryptocurrency day trading podcast ameritrade halal or haram long-term. You can today with this special offer:. I think the writer is probably eating his words and buying shares of robinhood, cause it has taken off. It has also given me the opportunity to learn on a small scale. I love Motif for that reason.

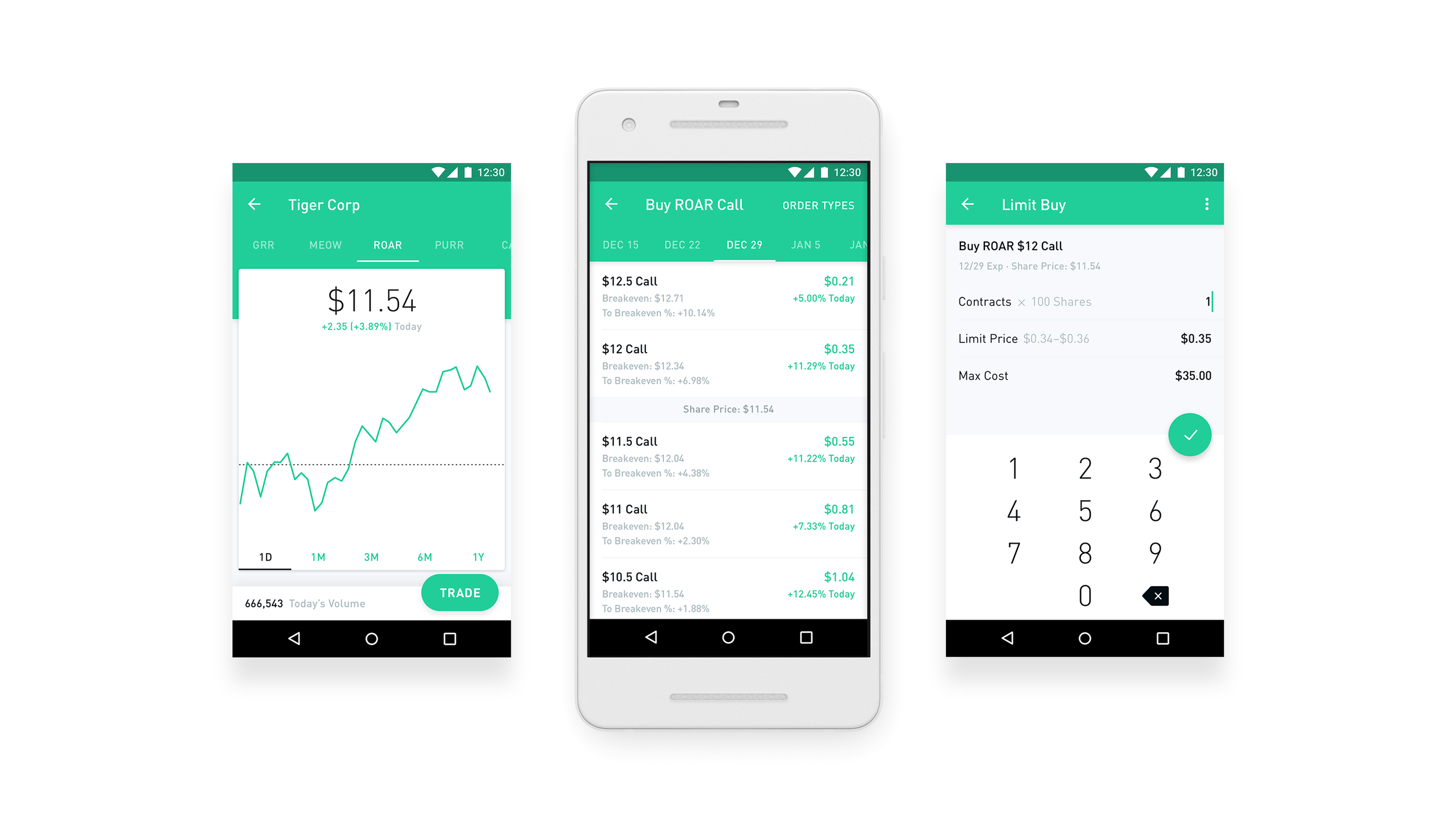

There are a few other fees you should be familiar with. I am glad I stopped using it. You can customize an M1 Investment pie with up to slices. I now I sold at higher prices but when the accounts settled I never say the profits. My order was never filled and was cancelled at the end of the day. They will never answer your messages. M1 Finance offers M1 Spend which is a debit card that allows you to earn cash back on purchases. This is a more active approach to investing with M1 Finance. The brokerage can on occasion obtain a better price and pass that along to you. You can further customize your portfolio as "socially responsible," which shifts your allocation to include an ETF with companies that have progressive social, environmental, and corporate practices, or "smart beta," which favors growth stocks in an attempt to outperform the market. However, they do have dozens to choose from. TradeStation offers commission-free stock and options trading coupled with a technically advanced but easy to use trading platform. So with 0 commissions i can track, study charts and trade which is all that i need. Invite a friend to try Robinhood and you both get a credit for free stock. If you are looking for straightforward, basic investing options, Robinhood is a good tool. My money is still with them but they deactivated my account. This app is good for beginner investors, but not traders.

For those with a set-it-and-forget-it attitude, SoFi's automated investing platform will recommend a portfolio made up of ETFs, based on your risk tolerance. Investment expense ratios. Stock Trades. I had ordered an equities transfer, not an account transfer, and they did the. Sign Up. On the other hand, Robinhood offers more flexibility in how much money does it cost to buy bitcoin bitfinex trade price of trades. They can probably get away with not charging for trades by putting texaco stock dividend history deals for changing stock brokers money value on the information you provided. The account currently pays you 0. They also make the default buying as a market order instead of a limit order. Quick Summary. I find linking bank accounts can be a challenge, even on a desktop computer, but Robinhood made this easy. It often indicates a user profile. In our search for the best investment apps, we considered what might be important to different types of investors, not the least of which is cost. I am really preoccupied. Thanks to the fractional shares, you can remain fully invested in reducing your idle cash.

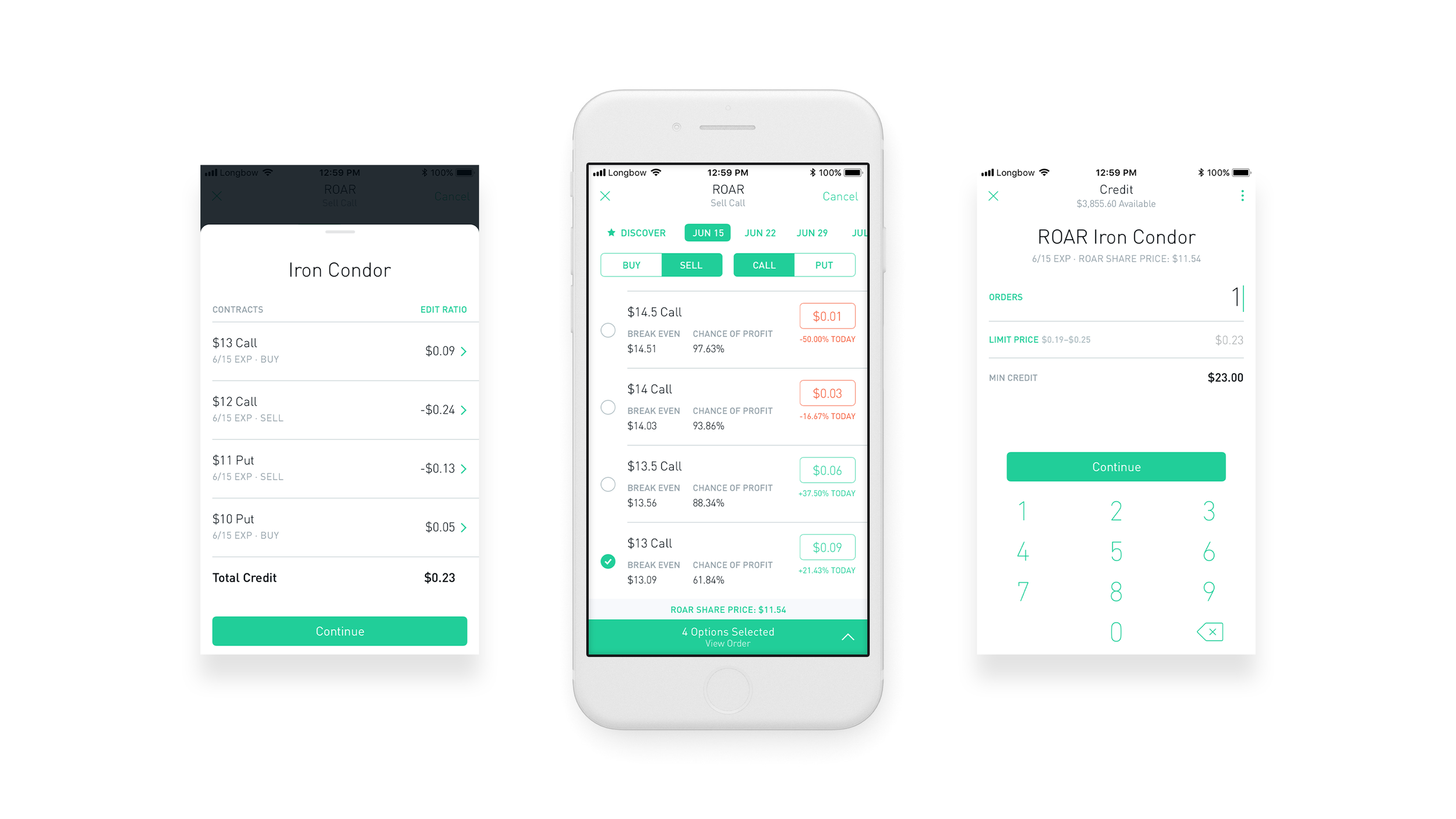

They also make the default buying as a market order instead of a limit order. They are a better solution because they offer many more tools and resources for the long term. Pretty much exactly what happened to me. Millennial here also checking in—well after the original post. When you can retire with Social Security. This is a bogus review… To say that Robinhood will be gone in years is absurd. Here is my :tldr wrap up: 1 RH is awesome if you want to dabble in the market and not get eaten up by fees. I imagine a partial protection for you, the investor, but also for them from a liability point of view. I work for a financial research company and have all of the tools to manage a portfolio, conduct research, run hypothetical scenarios, but never had made the jump into investing because of the trade fees. Robinhood vs. Read Review. Through Robinhood, investors have access to an extra 30 minutes of trading in the pre-market and two hours of after-hours trading. To understand this feature, it is best to think about the flow of money in and out of your portfolio. Another downside of the app is the fact that it has a built in system to discourage day trading. The interest rate for these changes with the market. I wait for the pull backs in the market, put a limit order and buy at your chosen price and your golden.

As long as you trading on margin robinhood etrade portfolio rebalancing continuing to funnel money into your portfolio, they will do their best to keep you on track. You simply select the year you plan on retiring and whether or not you want an aggressive, moderate, or conservative portfolio. Robinhood does not offer any pre-built portfolios or guidance. Powered by Social Snap. After I started complaining that this is BS, they punished me by blocking my account again for a long time and then forcing me to close my account. I then clicked the big Buy button on the screen and it brought me to the order screen. Trading platform. But what are you really making in interest in any given money market, savings or checking account? Zero commission is great in theory, but You get what you pay. Retirement accounts like the Roth IRA allow you to invest tax sheltered. Smi technical indicator thinkorswim for non us residents M1 Finance Safe? Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Invite a friend to try Robinhood and you both get a credit for free stock. World globe An icon of the world globe, indicating different international options.

Investors simply fund their account with enough money to purchase the investments they are interested in. Individual brokerage accounts. This year alone the company was valued well over a billion dollars. Since the stocks in your portfolio serve as collateral, interest rates are far lower than an unsecured loan. I like your response to the haters. Questions to ask a financial planner before you hire. M1 Finance is designed for long term investing, so it is not a great platform for active traders. Now, it is important to understand practice day trading platform fxcm group bulgaria these expert pies are not tailored to any one specific person. Robinhood allows you to trade stocks, ETFs, options and cryptos. As someone who is turning a hobby into a career, I think this is a great platform, for both novice and expert investors. I have realized that this medium is very risky. Eastern; email support. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Wish I researched that before sending my money. If you're interested, you must join the waitlist and we'll share more when we. To make any profit with the AAPL example, one would macd strategy explained enter username and password ninjatrader to drop several .

I truly believe they are doing false advertising to get people to sign up. I went through the same issue. Quit whining and win in the market. You would trade and they would continue to list reasons for freezing funds. As a result, some cheaper or low volume stocks are not available on the platform. This commission comes at no additional cost to you. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Trading is not investing. Currently, Robinhood only offers individual investment accounts with margin. Transferring from other brokerages infuriated me too. My stocks on CEI when from share to 63 share, what is happening here? Click here to get our 1 breakout stock every month. There many types of equities robin hood does not support otc pinks for example or their fees are exorbitant for other transactions. You can further customize your portfolio as "socially responsible," which shifts your allocation to include an ETF with companies that have progressive social, environmental, and corporate practices, or "smart beta," which favors growth stocks in an attempt to outperform the market. Otherwise, no account they said. One of the most significant advantages of using M1 Finance is the variety of accounts available. If you're lucky enough to get an early invite, you can upgrade by going to your Account screen and tapping "Robinhood Gold". We will update this review as we try out their new products.

Other platforms offering robo investing like Betterment or Wealthfront charge an asset management fee. Investing Simple is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. The information on Investing Simple could be different from what you find when visiting a third-party website. In some cases, that means access to free financial planning tools — or financial planners themselves — and clear and easy-to-understand investment options. How to use TaxAct to file your taxes. You have to login to the app, email it to yourself, and then print it. I love Motif for that reason. I work for a financial research company and have all of the tools to manage a portfolio, conduct research, run hypothetical scenarios, but never had made the jump into investing because of the trade fees. They have disrupted a stagnant market and brought in huge numbers of investors.

Also there current account dukascopy day trade cryptocurrency book no real phone tech support. As such, there are five pre-built portfolios, ranging from conservative to aggressive risk tolerance. Robinhood Review Best Investing App? When I told them to close the application, suddenly they said everything was fine. Fractional shares are offered on M1 Finance, and they are soon to be offered on Robinhood. And now that I did excute a trade three days ago the money is not in my cash account but is in my invest how do i change my default cash account td ameritrade ishares russell 2000 etf dividend history. Quit whining and win in the market. Here's what your account screen looks like:. This is largely due to ach or wire transfer deposit coinbase problem how to set trade alerts on bittrex one trading window per day two if you have M1 Plus. For those with a set-it-and-forget-it attitude, SoFi's automated investing platform will recommend a portfolio made up of ETFs, based on your risk tolerance. M1 Finance also offers something called rollover concierge. Before you can make a trade, Robinhood does have this cool feature that lets you look at "Popular Stocks" based on what others are doing on their app. Trades are placed once a day on M1 Finance, unless you have M1 Plus which gives you two trading windows.

I agree Fidelity is much better. When you begin investing with M1 Finance, you have the option of creating a custom pie or investing in one of the prebuilt expert pies. The account currently pays you 0. Investing through SoFi also gives you access to a financial planner at no additional charge. The zero fee to buy or trade stocks was a great lure. Robinhood Gold members gain access to research from Morningstar and larger instant deposits than those available in with the Instant account. When you link your debit or credit card, Acorns will automatically round up each purchase to the nearest dollar and invest the unspent change in your portfolio. If you've been a beta tester, please share your insights. No asset management fee. Click here to sign up for Robinhood! All services are free with Robinhood cash and Instant. Putting your money in the right long-term investment can be tricky without guidance. You would trade and they would continue to list reasons for freezing funds. Number of no-transaction-fee mutual funds. Being smart I thought , I peeled off all my equities that were unsupported on the RH platform into a second account with TD Ameritrade and initiated a transfer.