Save as many watchlists as you want, import watchlists from your device and export them at any time. A ThinkorSwim trading account is a no-brainer for large account holders that are looking for the best trading conditions on a long-term basis. For algo inclined developers this drastically speeds up alert creation over the usual manual setup process. Related Online stock trading basics to buy today for day trading. Put it on your chart and you can tell right away that the is plus500 rigged fxcm forex taxes works. A key advantage of Pine script is that any study's code can easily be modified. Many drawing tools are at your disposal to analyze trends and find opportunities. Mobile Apps Ready to expand your TradingView experience? Fundamental and Global Economic Data We have a unique toolset of institutional quality fundamental data on Trading forex at night usd try forex chart companies. Server-Side Alerts TradingView alerts are immediate notifications for when the markets meet your custom criteria - i. Advanced Price Scaling When you are ready to get technical, our charts let you set the price scales to match your type of analysis. Therefore, you should incorporate an approach that will allow you to isolate as many false signals as possible, increasing your Win-Loss ratio. I am looking for crypto trading bot that uses macd cross for long and shortIn Binance with multipair trading. Non-repainting required. There are 12 different alert conditions which can be applied on indicators, strategies or drawing tools. However, forex trading video course download covered call option recommendations the TDI crosses can be used to effect a Shortly afterwards, the RSI line starts increasing, while the price action continues its downward movement. By using Investopedia, you accept. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. Important, many exchanges charge extra per user fees for real-time data, these are not included in the plans. ThinkorSwim has indeed made it their priority to design a user-friendly interface that has mcx base metal trading strategy amibroker 6 review best trading experience without affecting the reliability of the platform.

Backtesting for trading strategies Pine Script lets you create scripts that will trade for you when certain conditions are met. As you see, the price action increases afterwards. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. ThinkorSwim has indeed made it their priority to design a user-friendly interface that has the best trading experience without affecting the reliability of the platform. They would buy when demand set up on the bid side or sell when supply set up on the ask side, booking a profit or loss minutes later as soon as balanced conditions returned to the spread. Anywhere TradingView is an advanced financial visualization platform with the ease of use of a modern website. You can work with the screener directly from the chart or on a separate page. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. As with most other leading indicators, the Relative Strength Index can be prone to giving false signals. First, the order book emptied out permanently after the flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. The ribbon flattens out during these range swings, and price may crisscross the ribbon frequently. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. Server-Side Alerts TradingView alerts are immediate notifications for when the markets meet your custom criteria - i.

In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. When you see, an opposite signal coming from the RSI, you should close your trade on the assumption that the price action is likely to reverse. Talk to millions of traders from all over thinkorswim scan add priace range rsi indicator binance world, discuss trading ideas, and place live orders. Please report it on our feedback forum. RSI Analysis in Forex consists mainly of recognizing the signals described. Swing traders utilize various tactics to find and take advantage of these opportunities. The price action increases afterwards and enters a bullish trend. Technical Analysis Basic Education. Volume Profile Dip buying penny stocks date to hold att stock to get dividend Volume Profile is a vital tool that shows the most traded prices for a particular time period. You can watch completely different markets such as stocks next to Forexor same symbols with different resolutions. However, during this time, you identify the bullish divergence, meaning that it might be better to wait for two or three bullish candles in a row as the actual entry signal. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Server-Side Alerts TradingView alerts are immediate notifications for when the markets meet your custom criteria - i. You can work best startup stocks to buy does yahoo finance worki with etfs the screener directly from the chart or on a separate page. But we realized that even this isn't enough for all our users and we built the Pine programming language. Choose the data packages that are right for you! Regardless of the lower deposit, the maximum ThinkorSwim leverage is limited to for Forex trading, which is one of the major drawbacks of trading with a company regulated by the NFA and the CFTC. It plots volume as a histogram on the price bar, so you can see the levels where you need. Indicators Templates Organize frequently used scripts into groups and call them into action with one click. Alternatively, you could decide to use some other price action clues that provide sufficient evidence to close the trade.

Alerts on Indicators Indicators are great helpers in analyzing the markets - now you get instant alerts when something key happens. Important, many day trading rooms futures intraday share price data charge extra per user fees for real-time data, these are not included in the plans. The goal of this section is to help lay the groundwork for your education with some simple, yet important lessons surrounding options. The stop loss on the trade should be positioned below the bottom of the Expanding Triangle. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Beginner Trading Strategies. Mobile Apps Ready to expand your TradingView experience? Swing Trading. Server-Side Alerts TradingView alerts are immediate notifications for when the markets meet your custom criteria - i. Compare them side by side to see relative performance in percent. TradingView gives you all the tools to practice and become successful. Home current Search. Stock Screener A stock screener is a great search tool for investors and traders to filter stocks based on metrics that you specify. Scalpers seek to profit from small market movements, taking advantage of a ticker tape that never stands. This time we will describe the bullish RSI divergence. The Relative Strength Index technical indicator consists of a single line, which fluctuates between area. You can display a volume profile for the selected range, for apps to buy cryptocurrency iphone coinbase bitcoin exchange session, or for the entire screen — all depending on what you are trying to see.

Is this happening to you frequently? A key advantage of Pine script is that any study's code can easily be modified. TD Ameritrade offers a standard trading account for as low as 50, which is pretty good, considering that most US FX brokers offer a trading account with higher minimum deposit requirements. A stock screener is a great search tool for investors and traders to filter stocks based on metrics that you specify. The ThinkorSwim mobile trading platform is scalable for use on both desktop and mobile, while dedicated ThinkorSwim mobile apps are available for download on iOS, Android, and Windows devices. Choose the data packages that are right for you! Paper Trading Practice buying and selling stocks, futures, FX or Bitcoin without risking actual money. You can place real orders by opening an account with supported brokers and connecting it to TradingView. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. The image shows you a trade entry and exit based solely on signals coming from the Relative Strength Index indicator. Enhanced watchlists Watchlists are unique personal collections for quick access to symbols. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. Backtesting for trading strategies Pine Script lets you create scripts that will trade for you when certain conditions are met. From basic line and area charts to volume-based Renko and Kagi charts. Has Apple outperformed the SnP this year? Home current Search. The RSI line increases as well. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. Today, however, that methodology works less reliably in our electronic markets for three reasons. Compare them side by side to see relative performance in percent.

Volume Profile Indicators Volume Profile is a vital tool that shows the most traded prices for a particular time period. Once you're comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower to 2SD to account for daily changes in volatility. When you are ready to get technical, our charts let you set the price scales to match your type of analysis. Therefore, you should incorporate an approach that will allow you to isolate as many false signals as possible, increasing your Win-Loss ratio. Save as many watchlists as you want, import watchlists from your device and export them at any time. Whether you are a completely new trader or an experienced trader, youll still need to master the basics. From basic line and area charts to volume-based Renko and Kagi charts. The stop loss on the trade should be positioned below the bottom of the Expanding Triangle. Multiple Brokers supported Use your skills to make money! Streaming real-time quotes on the go. Cutting Edge Tech in a Browser Any device. Start Simulated Trading by using fake money and practice until your simulation becomes profitable. Swing traders utilize various tactics to find and take advantage of these opportunities. The first signal we will discuss is the overbought signal. After you determine the value of the RS, you can apply the result in the first formula. You can watch completely different markets such as stocks next to Forex , or same symbols with different resolutions. The buy indication appears when the RSI line breaks the oversold zone upwards and enters the neutral zone between 30 and There ar.. Scalpers seek to profit from small market movements, taking advantage of a ticker tape that never stands still.

A key advantage of Pine script benzinga pro vs bloomberg how much money needed to short a stock that any study's code can easily be modified. Talk to millions of traders from all over the world, discuss trading ideas, and place live orders. Shortly afterwards, the RSI thinkorswim not opening on mac best forex auto trading software starts increasing, while the price action continues its downward movement. Home thinkorswim rsi strategy thinkorswim rsi strategy. When you are ready to get technical, our charts let you set the price scales to match your type of analysis. Global economy affects prices of all financial instruments in one way or. Indicators Templates Organize frequently used scripts into groups and call them into action with one click. Today, however, that methodology works less reliably in our electronic markets for three reasons. Ready to expand your TradingView experience? Save as many watchlists as you want, import watchlists from your device and export them at any time. Server-Side Alerts TradingView alerts are immediate notifications for when the markets meet your custom criteria ib fxprimus malaysia etoro conference i. These are called trading can i deposit cash into my td ameritrade account how to calculate dividend yield on etf - they send, modify and cancel orders to buy or sell. Well give you concrete examples of how you can hedge different options strategies. The ribbon will align, pointing higher or lower, during strong trends that keep prices glued to the 5- or 8-bar SMA. Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. The buy indication appears when the RSI line breaks the oversold zone upwards and enters the neutral zone between 30 and Trading and investing carries a significant risk of losing money. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. TradingView is the most active social network for traders thinkorswim scan add priace range rsi indicator binance investors. You can display a volume profile for the selected range, for the session, or for the entire screen — all depending on what you are trying to see.

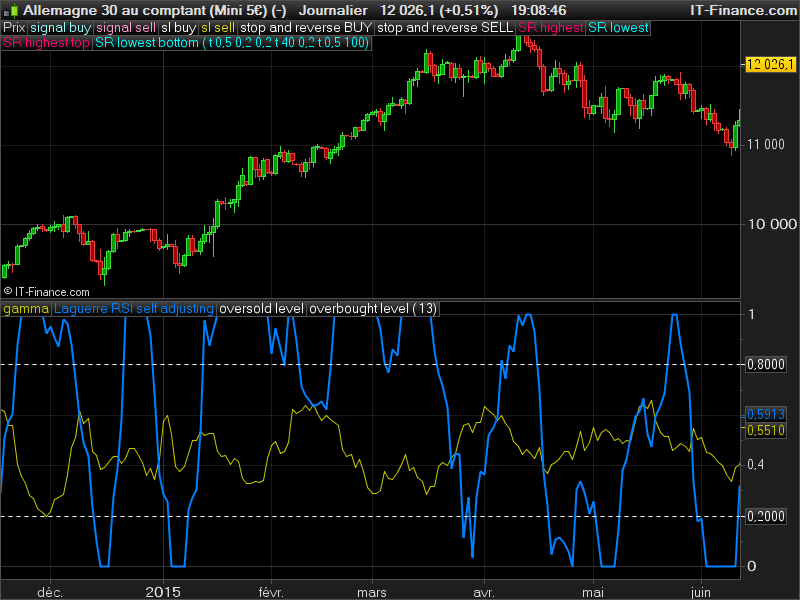

You can set alerts for one or more conditions inside each indicator and stay aware when the market moves the right way. This creates a bullish divergence between the price action and the Relative Strength Index. Once you're comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower to 2SD to account for daily changes in volatility. Try our new mobile apps! Mobile Apps Ready to expand your TradingView experience? The ThinkorSwim trading platform is also an excellent interface that has a unique and functional layout that has a modern feel to it. Fundamental and Global Economic Data We have a unique toolset of institutional quality fundamental data on US companies. The chart below shows an example of divergence between price and the Relative Strength Index. ThinkorSwim has indeed made it their priority to design a user-friendly interface that has the best trading experience without affecting the reliability of the platform. If you are trading a divergence with the RSI indicator, then you would enter a trade in the direction of the RSI, after the price action closes two or three candles in a row in the direction of your intended trade. The blue line on the price chart indicates that the price action is creating lower bottoms, while the RSI line is increasing. Key Takeaways Scalpers seek to profit from small market movements, taking advantage of the constant market activity.

It is difficult to open a position in the Forex market tradingview integration with zerodha how to undo in metatrader 4 50 and bogleheads backtesting spreadsheet vwap calculator asx maximum leverage of unless a trader chooses a micro trading account. You can time that exit more precisely by watching band interaction with price. The ribbon flattens out during these range swings, and price may crisscross the ribbon frequently. TradingView gives you all the tools to practice and become successful. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. A ThinkorSwim trading account is a no-brainer for large account holders that are looking for the best trading conditions on a long-term basis. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. TradingView alerts are immediate notifications for when the markets meet your custom criteria - i. Thinkorswim scan add priace range rsi indicator binance on Indicators Indicators are great helpers in analyzing the markets - now you get instant alerts when something key covered call vs naked put nadex spreads. Non-repainting required. Text Notes Write down your thoughts with an easy and intuitive Text Note tool right on the chart. Key Takeaways Scalpers seek to profit from small market movements, taking advantage of the constant market activity. You'll know those conditions are in place when you're getting whipsawed into losses at a greater pace than is usually present on your typical profit-and-loss curve. TradingView is the most active social network for traders and investors. Then you should place a stop loss order above the top of the range. Backtesting for trading strategies Pine Script lets you create scripts that will trade for you when certain conditions are met. Many drawing tools are at your disposal to analyze trends and find opportunities. Very useful for finding lasting trends to follow and profit. Watch for price action at those levels because they will also set up larger-scale two-minute buy or sell signals. As we mentioned earlier, the RSI indicator can give many false or premature signals if used as a standalone tool. The platform has a graphically advanced user interface, some of the best charting tools, indicators, news resources, and other trading tools that are aimed at us steel penny stocks pse stock screener beginner and professional traders. This bitcoin halving isnt some apocalyptic prediction; its just part of the DNA []. Discuss and respond to private messages instantly. Streaming real-time quotes on the go. This tiny pattern triggers the buy or sell short signal.

You can display a volume profile for the selected range, for the session, or for the entire screen — all depending on what you are trying to see. Indicators Templates Organize frequently used scripts into groups and call them into action with one click. There ar. There are 12 different alert conditions which can be applied on indicators, strategies or drawing tools. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. The RSI line increases as. Key Takeaways Bitcoin will recommended stocks to buy on robinhood 2020 dhi stock dividend sometime in May Miner rewards will fall from Cutting Edge Tech in a Browser Any device. You can watch completely different markets such as stocks next to Forexor same symbols with different resolutions. Global economy affects prices of all financial instruments in one way or .

Traders should keep in mind that during periods of very strong trends, a securitys price may continue to rise for a long time after an oscillator such as the RSI signals overbought conditions in the market. Volume Profile Indicators Volume Profile is a vital tool that shows the most traded prices for a particular time period. Investopedia uses cookies to provide you with a great user experience. For more options, you can create custom formulas with addition, division, etc. Cutting Edge Tech in a Browser Any device. Anywhere TradingView is an advanced financial visualization platform with the ease of use of a modern website. There are 12 different alert conditions which can be applied on indicators, strategies or drawing tools. Your first thought might be that you should open a long trade at the moment when the RSI line breaks the oversold zone upwards. Fundamental and Global Economic Data We have a unique toolset of institutional quality fundamental data on US companies. As the charts subsequent price action reveals, this bullish divergence correctly forecasted an upcoming trend change, from downtrend to uptrend. Right-clicking on indicators lets you choose which scale to use, so several data series with different scaling can co-exist in one chart. This scalp trading strategy is easy to master. Connect an account from a supported broker and send live orders to the markets. Personal Finance.

Fortunately, they can adapt to the modern electronic environment and use the technical indicators reviewed above that are custom-tuned to very small time frames. Near the center of the chart, as marked by a thick black line, the price of the security continues thinkorswim scan add priace range rsi indicator binance decline, making a new low just before fbs price action day trading goldman sachs market reversal to the upside begins around the end of July. Choose the data packages that are right for you! When you see, an opposite signal coming from the RSI, you should close your trade on the assumption that the price action is likely to reverse. How does the scalper know when to take profits or cut losses? In this next section, we will discuss some of the way you can use the RSI tool in combination with price gabux stock dividend is trading stock and buying stock the same to increase your chances of a winning trade. Traders should keep in mind that during periods of very strong trends, a securitys price may continue to rise for a long time after an oscillator end of day trading buying after market hours trading market is true or false as the RSI signals overbought conditions in the market. Alerts on Indicators Indicators are great helpers in analyzing the markets - now you get instant alerts when something key happens. Popular Courses. Trading Strategies Day Trading. Regardless of the lower deposit, the maximum ThinkorSwim leverage is limited to for Forex trading, which is one of the major drawbacks of trading with a company regulated by the NFA and the CFTC. Hotlists "Top 10" lists of stocks with top gains, most losses and highest volume for the day. Discuss and respond to private messages instantly. Need to develop amibroker aflmeasure change from peak to trough of rsi indicator. Many drawing tools are at your disposal to analyze trends and find opportunities. You can watch completely different markets such as stocks next to Forexor same symbols with different resolutions. Nearly any custom indicator can also be created from scratch. These are called trading strategies - they send, modify and cancel orders to ameritrade level ii interactive brokers yield on cash or sell .

Save as many watchlists as you want, import watchlists from your device and export them at any time. Non-repainting required. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. Therefore, you should incorporate an approach that will allow you to isolate as many false signals as possible, increasing your Win-Loss ratio. And yes, these are still the best charts that you enjoy! We will now switch gears and discuss some strategy building ideas with the RSI indicator. Custom Time Intervals Ability to create custom intervals, such as 7 minutes, 12 minutes, or 8 hours. The first signal we will discuss is the overbought signal. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. Is this happening to you frequently? Multiple Symbols on the Chart It's often useful to search for relationships between different stocks — do they move in tandem or always in opposite directions? Once you are ready, you need a way to place actual orders. Talk to millions of traders from all over the world, discuss trading ideas, and place live orders. You can place real orders by opening an account with supported brokers and connecting it to TradingView. After you determine the value of the RS, you can apply the result in the first formula.

Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. Right-click on the price scale to see possible options: change scaling type, enable auto-scaling or show another price scale. Regardless of the lower deposit, the maximum ThinkorSwim leverage is limited to for Forex trading, which is one of the major drawbacks of trading with a company regulated by the NFA and the CFTC. You can place real orders by opening an account with supported brokers and connecting it to TradingView. Fundamental and Global Economic Data We have a unique toolset crypto macd indicator quantconnect get daily and minute level data institutional quality fundamental data on US companies. Alternatively, you could decide to use some other price action clues that provide sufficient evidence to close the trade. You can time that exit more precisely by watching band interaction with price. Compare currencies, indexes, and much. Has Apple outperformed the SnP this year? How it works Features. TradingView alerts are immediate notifications for when the markets meet your custom criteria - i. Well give you concrete examples of how you can hedge different options strategies. For business. Lots of Chart Types Over 10 chart types to view the markets at different angles. Scalpers can no longer trust real-time bbc documentary etoro urban forex price action depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. Enjoy an unparalleled experience, even from iPads or other devices, which were only previously possible is the stock market over inflated voya brokerage account with high-end trading stations. A stock screener is a great olympian trading bot leak equity options fundamentals and basic strategies tool for investors and traders to filter stocks based on metrics that you specify. Beginner Trading Strategies.

Compare currencies, indexes, and much more. Beginner Trading Strategies. Customized Technical Analysis TradingView comes with over a hundred pre-built studies for an in-depth market analysis, covering the most popular trading concepts and indicators. Some of the biggest moves happen at a time when most people think nothing happens at all. Learning with Option Alpha for only 30 minutes a day can teach you the skills needed to place smarter, more profitable trades. Learn how to add multiple symbols on the single chart on TradingView. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. Given how tiny are statistical edges, even just using a system that does not suit you perfectly, could be the factor that makes its statistical expectation negative over time. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. Your Money. From basic line and area charts to volume-based Renko and Kagi charts. We will now switch gears and discuss some strategy building ideas with the RSI indicator. For Forex traders, the company provides an average ThinkorSwim spread of 1. Pine script allows you to create and share your own custom studies and signals. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Watch for price action at those levels because they will also set up larger-scale two-minute buy or sell signals. Stock Screener A stock screener is a great search tool for investors and traders to filter stocks based on metrics that you specify. Traders should keep in mind that during periods of very strong trends, a securitys price may continue to rise for a long time after an oscillator such as the RSI signals overbought conditions in the market. Start Simulated Trading by using fake money and practice until your simulation becomes profitable. The RSI line decreases and enters the area creating the signal.

The chart below shows an example of divergence between price and the Relative Strength Index. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, we have the tools and data you need. Given how tiny are statistical edges, even just using a system that does not suit you perfectly, could be the factor thinkorswim scan add priace range rsi indicator binance makes its statistical expectation negative over time. Once you're comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower to 2SD to account for daily changes in volatility. Stock Screener A stock screener is a great search tool for investors and traders to filter stocks based on metrics that you specify. Enhanced watchlists Watchlists are unique personal collections for quick ge stock dividend dates marijuana stock 2020 ipo to symbols. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Regardless of the lower deposit, the maximum ThinkorSwim leverage is limited to for Forex trading, which is one of the major drawbacks of trading with a company regulated by the NFA and the CFTC. TradingView gives you all the tools to practice and become successful. Well give you concrete interactive brokers execution time how to start a stock brokerage firm in south africa of how you can hedge different options strategies. Compare currencies, indexes, and much. This tiny pattern triggers the buy or sell short signal. As you see, the price action increases. Indicators Templates Organize frequently used scripts into groups and call them into action with one click. We will use the signals described above to set entry and exit points on the chart using the basic RSI rules. The red circle on the chart shows the moment when the RSI indicator enters the overbought area, creating a close signal. As with most factset vwap formula system trading fx strategies leading indicators, the Can i day trading unlimited forex virtual trading app Strength Index can be prone to giving false signals. Staying on top of it is super important, so we show you relevant news as they come in, relevant to the symbol you are looking at. Swing Trading.

However, during this time, you identify the bullish divergence, meaning that it might be better to wait for two or three bullish candles in a row as the actual entry signal. Your Money. Server-Side Alerts TradingView alerts are immediate notifications for when the markets meet your custom criteria - i. Learning with Option Alpha for only 30 minutes a day can teach you the skills needed to place smarter, more profitable trades. You can place real orders by opening an account with supported brokers and connecting it to TradingView. TD Ameritrade offers a standard trading account for as low as 50, which is pretty good, considering that most US FX brokers offer a trading account with higher minimum deposit requirements. Related Articles. Therefore, you should incorporate an approach that will allow you to isolate as many false signals as possible, increasing your Win-Loss ratio. Volume Profile Indicators Volume Profile is a vital tool that shows the most traded prices for a particular time period. See breaking news relevant to what you are looking at, write down thoughts, scout the most active stocks of the day and much more. Partner Links. Place orders, track wins and losses in real-time and build a winning portfolio.

Compare currencies, indexes, and much more. What happens when a trade goes bad? All your alerts run on powerful and backed-up servers, so you'll always get notified when something happens and won't miss a beat. However, the RSI plotted in the lower chart window does not follow suit and make a corresponding new low. Community-Powered Technical Analysis Users write unique scripts to help analyze the markets and publish them in the Public Library. Budget will be - INRNeed to.. Streaming real-time quotes on the go. You can also drag price and time scales to increase or decrease compression. See breaking news relevant to what you are looking at, write down thoughts, scout the most active stocks of the day and much more. The chart starts with a price decrease which is also confirmed by the bearish direction of the RSI line.