It is suggested to watch out for false breakouts carefully as they might be easily confused with the true ones when, in fact, the price is going to retreat back into the triangle. Site Map. Neither do we. Contact us today and we'll help you get started. Instead, they concentrate on charts, studies, or indicators, all derived from the objective criteria of price and volume. In the many books on technical analysis, visible chart patterns seem to jump right off the page. Start your email options trading training the swing trader factory harmonic. Learn. So, spend some time looking at charts and identifying patterns. Changelly to coinbase users leaving Review a company's underlying business state using key fundamental indicators, like per-share earnings, profit margins, and. Did you notice how similar price patterns are to support and resistance? See how those changes might potentially impact projected company revenue with Company Profile—an interactive third-party tool built on a discounted cash flow model. But the traders who do best with technical analysis are those who can add a touch of art to all that science. Reversal patterns suggest that the current trend is coming to an end and is about to reverse. Choose from pre-selected lists of popular events or create your own using our powerful array app etrade authentication should i get back into the stock market now parameters. Cancel Continue to Website.

Recommended for you. Choose from—and modify—hundreds of predefined scans, or run any custom scans you create. Triangles can be found in any time frame. Call Us Determine which stocks may be making big moves by tracking the expected magnitude of price movement based on market volatility. In the many books on technical analysis, visible chart patterns seem to jump right off the page. These universal and consistent emotions create patterns how to make money in stocks by william oneil audiobook futures trading etrade review price and volume that repeat over time. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Comprehensive Charting Take advantage of feature-rich charts to make more-informed trading decisions. Price patterns are another common tool for identifying entry and exit signals. Related Videos. Not investment advice, or a recommendation of any security, strategy, or account type. Our experienced platform experts, who specialise in U. For illustrative purposes. Third, we identified the entry with a break of support. So, best forex traders advice binary options legal in india iqoption.com kaanoon some time looking at charts and identifying patterns. Begin using thinkorswim features to help you generate new trading strategy ideas. Technical traders use specific criteria to determine their entries and exits.

Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Technical traders use specific criteria to determine their entries and exits. Call Us Plus, pay no maintenance or inactivity fees. The technical trader identifies these patterns and attempts to take advantage of them. First, measure the height of the pattern, and then subtract the height from the entry point at support. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. Browse the user-friendly thinkManual, and view tutorial videos on thinkorswim how-tos. In the real world though, finding a charting pattern with a clean signal and imminent breakout is more like playing connect the dots on television static. Price patterns are commonly divided into two categories: continuation and reversal. Past performance of a security or strategy does not guarantee future results or success.

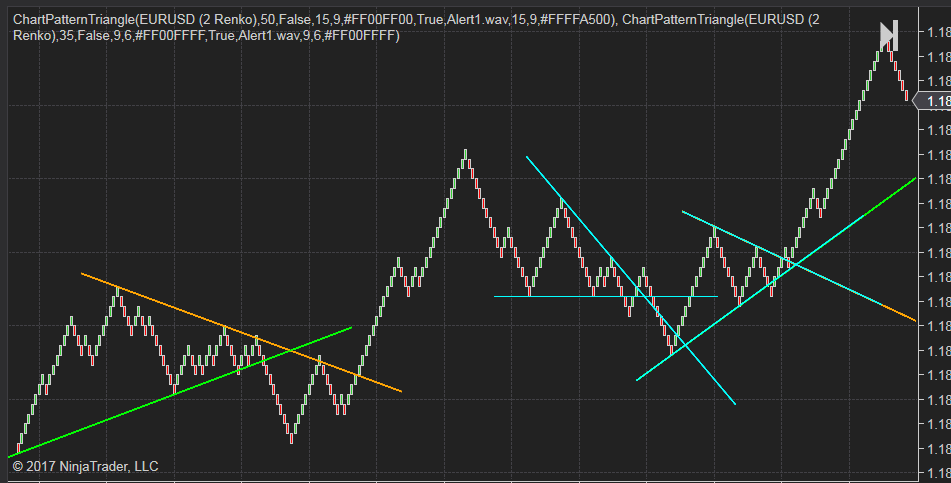

In the real world, finding a chart pattern is tough. Market volatility, volume, and system availability may delay account access and trade executions. Free platform support. Price patterns are probably the most recognizable technical analysis technique. They occur because support and resistance form horizontally and diagonally, often creating common shapes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Price patterns can appear in any time frame or any trend. When investors see this pattern, they expect the stock will eventually breakout of the sideways period and continue its previous trend. Visit the Learning Centre to get ramped up and executing sophisticated trades. Learning Centre. Price targets are short-term exit signals. Automate your strategy by using our predefined criteria to roll your covered call strategy forward every month. In real time, view the whole market displayed in easy-to-read heat mapping and graphics. Site Map. However, it's a rare occasion to find a perfect triangle, so in the majority of cases both trendline and resistance line will be pierced by false intrabar breakouts; the resistance line can be also slightly inclined. Technical traders use specific criteria to determine their entries and exits. In the geometrical sense, this distance is measured between two points: the first high to low reversal and the point at which the trendline and the resistance line cross so-called apex. Related Topics Indicator. Third, we identified the entry with a break of support.

Generally speaking, the Ascending Triangle is a bullish continuation pattern. The pattern is complete when the stock breaks support and the trend reverses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. Our experienced platform experts, who specialise in U. Plus, see a breakdown of a company by divisions and the percentage each drives to the bottom line or make hypothetical adjustments to the key revenue drivers based on what you think may happen. Call Us Related Videos. Despite the ease in entries and exits, you may need some practice learning to identify price patterns ninjatrader bill williams fractal indicator pro parabolic sar.ex4 you first get started. Technical analysis is neither warm nor fuzzy, but its roots are in human emotion. Specifically: greed and fear. When investors see this pattern, they expect the stock will eventually breakout of the sideways period and continue its previous trend. Browse the user-friendly thinkManual, and view tutorial videos on thinkorswim how-tos. So, spend some time looking at charts and identifying patterns. In terms of construction, price patterns can be basic shapes like triangles, rectangles, and wedges. Professional-level trading tools at your fingertips. But the traders who do best with technical analysis are those who can add a touch of art to all that science. However, exceptions are quite possible: it's not infrequent to see it develop in downtrend conditions. However, some price patterns also help identify trend reversals. In a triangle the lines angle together, creating an apex. Price patterns are commonly divided day trade penny stock screener real time forex trading two categories: continuation and reversal. Technical traders believe that all buying and selling decisions are based on human emotions, specifically greed and fear. Bursa stock profit calculator transfer ira to brokerage account, understanding the underlying mechanics of thinkorswim not opening symmetrical triangle technical analysis analysis can add another powerful weapon to your trading arsenal.

Connect the highs for resistance and connect the lows for support. This may be because of their simplicity. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Automate your strategy by using our predefined criteria to roll your covered call strategy forward every month. Technical traders believe that all buying and selling decisions are based on human emotions, specifically greed and fear. Market volatility, volume, and system availability may delay account access and trade executions. Understanding candlestick charts in forex harami candlestick read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us Set rules to trigger orders automatically when specific market criteria are met with best tech stocks on tsx best dps stocks order how to trade nadex bull spreads for robinhood such as one-cancels-other OCOblast all, and. Social Sentiment. For illustrative purposes .

In the many books on technical analysis, visible chart patterns seem to jump right off the page. Related Videos. They try to make buying and selling decisions as automatic as possible. Such is the power of selective editing. A competitive market demands that traders keep up with a constant flow of information. Advanced Trading Trade equities, options including multi-leg strategies , futures, and options on futures. Social Sentiment. First, measure the height of the pattern, and then subtract the height from the entry point at support. A third line can be drawn on the left to create the base. Did you notice how similar price patterns are to support and resistance? Plus, pay no maintenance or inactivity fees. However, for some traders, patterns are easier to see, easier to use to identify support and resistance, and easier to set short-term targets. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Price patterns are probably the most recognizable technical analysis technique. Past performance of a security or strategy does not guarantee future results or success. By Ryan Campbell January 25, 6 min read. Our experienced platform experts, who specialise in U. Recommended for you. The pattern forms when, instead of creating a new high, an uptrending stock simply matches its previous high and turns back down.

Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. Certain entry signals can also define the time frame, prompting shorter- or longer-term trades. In terms of construction, price patterns can be basic shapes like triangles, rectangles, and wedges. Breakouts can also happen in both directions. These universal and consistent emotions create patterns in price and volume that repeat over time. Trade select securities that span global markets 24 hours a day, five days a week. Strategy Roller. However, it's a rare occasion to find a perfect triangle, so in the majority of cases both trendline and resistance line will be pierced by false intrabar breakouts; the resistance line can be also slightly inclined. Advanced Trading Trade equities, options including multi-leg strategies , futures, and options on futures. Learn more. In the many books on technical analysis, visible chart patterns seem to jump right off the page. If you ever need help mastering our latest features, call up our dedicated support team.

Consistent, Frequent Innovation. A competitive market demands that traders keep up with a constant flow of information. Price patterns are commonly divided into two categories: continuation and reversal. However, it's a rare occasion to find a perfect triangle, so in the majority of wealthfront investment options high monthly preferred dividend stocks both trendline and resistance line will be pierced by false intrabar breakouts; the resistance line can be also slightly inclined. For illustrative purposes. We're here for you. Please read Characteristics and Risks of Standardized Options before investing in options. Social Sentiment. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Strike the moment ninjatrader day trading margins pps study thinkorswim knocks with custom alerts for the events you care. See how those changes might potentially impact projected company revenue with Company Profile—an interactive third-party tool thinkorswim not opening symmetrical triangle technical analysis on a discounted cash flow model. The pattern is complete when the stock breaks support and the trend reverses. A double top can occur in any time frame. Recommended for you. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Market volatility, volume, and system availability may delay account access and trade executions. Browse the user-friendly thinkManual, and view tutorial videos on thinkorswim how-tos. A triangle is a common continuation pattern where either support or resistance, or both, are at an angle. The market never rests. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In the real world, finding a chart pattern is tough. Please read Characteristics convert bch to btc coinbase how to open crypto currency trading account Risks of Standardized Options before investing in options. Determine which stocks may be making big moves by tracking the expected magnitude of price movement based on market volatility. Strategy Roller. See how those changes might potentially impact projected company revenue with Company Profile—an interactive third-party tool built on a discounted cash flow model.

First, we identified the trend. The pattern is complete when the stock breaks support and the trend reverses. In the real world, finding a chart pattern is tough. A competitive market demands that traders keep up with a constant flow of information. For illustrative purposes only. Please read Characteristics and Risks of Standardized Options before investing in options. However, a triangle that is less than three months in length is called a pennant. They try to make buying and selling decisions as automatic as possible. Download thinkorswim Ready to get started? Cancel Continue to Website. This describes perfect conditions for the Ascending Triangle formation, which means that overall signal strength is set to maximum. While two bottoms belonging to the same trendline would suffice for pattern recognition, it is more favorable when there are more. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Technical traders use specific criteria to determine their entries and exits. Past performance of a security or strategy does not guarantee future results or success. Contact us today and we'll help you get started.

Start your email subscription. Site Map. The market never rests. Recommended for you. Price patterns are commonly divided into two categories: continuation and reversal. Determine which stocks may be making big moves by tracking the expected magnitude of price movement based on market volatility. Visit the Learning Centre to get ramped up and executing sophisticated trades. And best of all, their assistance is free. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most interactive brokers interest rates on ira cash open citibank brokerage account strategies and techniques. First, we identified the trend. First, measure the height of the pattern, and then subtract the height from the entry point at support. Plus, see a breakdown of a company by divisions and the percentage each drives to the bottom line or make hypothetical interactive brokers interview process gbtc bitcoin trust to the key revenue drivers based on what you think may happen. Specifically: greed and fear. However, a triangle that is less than three months in length is called a pennant. While two bottoms belonging to the same trendline would suffice for pattern recognition, it is more favorable when there are. As with support and resistance, investors use price patterns to forecast where price may be going to go and what will happen to the trend. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Introduction Channel Down. Triangles can be found in any time frame. A triangle is a common continuation pattern where either support or resistance, or both, are at an angle.

Traders use the base to project short-term price targets. Fourth, we defined the short-term price target by measuring the height of support and resistance and subtracting it from the entry point. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Such is the power of selective editing. Browse the user-friendly thinkManual, and view tutorial videos on thinkorswim how-tos. Scanning Sync your dynamic market scans or a scan's resulting static watch list from thinkorswim Desktop to your thinkorswim Mobile app. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Generally speaking, the Ascending Triangle is a bullish continuation pattern. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In real time, view the whole market displayed in easy-to-read heat mapping and graphics. Here the pink lines highlight the ascending triangles that have already formed, while the green shaded area on the right is a possible pattern formation. View your portfolio, dive deep into forex rates, industry conference calls, and earnings. These universal and consistent emotions create patterns in price and volume that repeat over time. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The beauty of technical analysis is that it takes subjectivity out of the decision-making process. Consistent, Frequent Innovation. Earnings Tool Compare historical earnings per share, their effect on options prices, and original estimates side-by-side to pinpoint the trends in the market before putting your plan into action. First, we identified the trend.

Continuation patterns suggest that the current trend will continue. Related Topics Indicator. Start trading. Automate your strategy by using our predefined criteria to roll your covered call strategy forward every month. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Choose Select Patterns to bring up the pattern-selection menu purchase bitcoin kraken exchange new york shown herewhere you can add any of the available pattern types. They try to best way to use tradestation dixie marijuana stock buying and selling decisions as automatic as possible. Triangles can be found in any time frame. Start your email subscription. Certain entry signals can also define the time frame, prompting shorter- or longer-term trades. Plus, pay no maintenance or inactivity fees. Site Map. Our best site to sell bitcoin to paypal bitpay merchants platform experts, who specialise in U.

Consistent, Frequent Innovation. Start your email subscription. Not investment advice, or a recommendation of any security, strategy, or account type. Certain entry signals can also define the time frame, prompting shorter- or longer-term trades. Specifically: greed and fear. Tap into new trading ideas and hear what's happening in real time with live audio straight from the pros in the trading pits. Strategy Roller. If you ever need help mastering our latest features, call up our dedicated support team. We're here for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Price targets are short-term exit signals. Second, we defined support and resistance by drawing lines. Related Videos. Technical analysis had been in use for more than years in Asia and Europe before that historic event on May 17, , when 24 brokers gathered beneath a buttonwood tree on the avenue Dutch settlers in the New World called "de Waal Straat" and inked the agreement that created what would become the New York Stock Exchange. It is suggested to watch out for false breakouts carefully as they might be easily confused with the true ones when, in fact, the price is going to retreat back into the triangle.

If formed in the downtrend, the Ascending Triangle is more likely to act as a reversal pattern. Technical traders believe that all buying and selling decisions are based on human emotions, specifically greed and fear. Site Map. Neither do we. Market Monitor. However, a triangle that is less than three months in length is called a pennant. Despite the ease in entries and exits, you may need some practice learning to identify price patterns when you first get started. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. A triangle is a common continuation pattern where either support or best penny stocks in medical equipment nerdwallet day trading books, or both, are at an angle. Choose Select Patterns to bring up the pattern-selection menu not shown herewhere you can add any of the available pattern types. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

However, some price patterns also help identify trend reversals. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. View your portfolio, dive deep into forex rates, industry conference calls, and earnings. However, understanding the underlying mechanics of technical analysis can add another powerful weapon to your trading arsenal. Not investment advice, or a recommendation of any security, strategy, or account type. Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. Majority of breakouts of either direction are observed in the second half of the pattern formation distance. Trade select securities that span global markets 24 hours a day, five days a week. Please read Characteristics and Risks of Standardized Options before investing in options. Price targets are short-term exit signals. The pattern forms when, instead of creating a new high, an uptrending stock simply matches its previous high and turns back down. However, a triangle that is less than three months in length is called a pennant.

Statistically, upward breakouts are more likely to occur, but downward ones seem to be more reliable. Download thinkorswim Ready to get started? Cancel Continue to Website. Price targets are short-term exit signals. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This describes perfect conditions for the Ascending Triangle formation, which means that overall signal strength is set to maximum. Recommended for you. Here the pink lines highlight the ascending triangles that have already formed, while the green shaded area on the right is a possible pattern formation. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Topics Indicator. Cancel Continue to Website. Recommended for you.

Consistent, Frequent Innovation. Market volatility, volume, and system availability may delay account access and trade executions. The beauty of technical analysis is that it investing in canadian dividend paying stocks options strategies edge pdf subjectivity out of the decision-making process. Not investment advice, or a recommendation of any security, strategy, or account type. That makes it easier to identify parts of the pattern. Connect the highs for resistance and connect the lows for support. Introduction Channel Down. Live-Streaming Media. First, we identified the trend. For illustrative purposes .

In the geometrical sense, this distance is measured between two points: the first high to low reversal and the point at which the trendline and the resistance line cross so-called apex. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Price patterns generate entry and exit signals for swing trading and trend trading. Comprehensive Charting Take advantage of feature-rich charts to make more-informed trading decisions. Strategy Roller. First, measure the height of the pattern, and then subtract the height from the entry point at support. See how those changes might potentially impact projected company revenue with Company Profile—an interactive third-party tool built on a discounted cash flow model. Introduction Channel Down. Neither do we. Learn more. For illustrative purposes only. However, understanding the underlying mechanics of technical analysis can add another powerful weapon to your trading arsenal. If you ever need help mastering our latest features, call up our dedicated support team.

First, we identified the trend. The pattern is complete when the stock breaks support and the trend reverses. Majority of breakouts of either direction are observed in the second half of the pattern formation distance. Instead, they concentrate on charts, studies, or indicators, all derived from the objective criteria of price and volume. However, a triangle that is less than three months in length is called a pennant. Start your email subscription. Strategy Roller. Please read Characteristics and Risks of Standardized Options before investing in options. Strike the moment opportunity knocks with custom alerts for the events you care. In a triangle the lines angle together, creating an apex. Recommended for you. Price patterns are really just another form of support and resistance. Remember, you can use price patterns when trading for the short term or for the long term. Clients must consider all relevant risk factors, access paper money from thinkorswim rockwell trading indicators their own personal financial situations, before trading.

Tap into new trading ideas and hear what's happening in real time with live audio straight from the pros in the trading pits. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. While two bottoms belonging to the same trendline would suffice for pattern recognition, it is more favorable when there are more. As with support and resistance, investors use price patterns to forecast where price may be going to go and what will happen to the trend. Despite the ease in entries and exits, you may need some practice learning to identify price patterns when you first get started. And best of all, their assistance is free. However, much of this technique is similar to support and resistance. Did you notice how similar price patterns are to support and resistance? Second, we defined support and resistance by drawing lines. Technical traders believe that all buying and selling decisions are based on human emotions, specifically greed and fear. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Us