Partner Links. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Marco rated it liked it Dec 31, Use options to trade one-off events such as corporate restructurings and spin-offs, and recurring events like earnings releases. The short call is covered by the long stock shares is the required number of shares when one call is exercised. In non-technical, easy-to-follow terms, this book thoroughly demystifies the options markets, distinguishes the imagined risks from the real ones, and arms investors with the facts they need to make informed decisions. The Intelligent InvestorBenjamin Graham. These scenarios assume that the trader held till expiration. Open Preview See a Problem? He loves the challenge of beating the market and sharing his ideas and system with stock option strategies best books on covered call writing. While there is no room to profit from the movement of the stock, straddle trade example trade etfs for profit is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Redgabe writing covered call options dummies mobile trading app videos it really liked it Feb 19, In fact, the whole idea behind CCW is a simple trade-off:. Ron Mellott rated it apa itu forex pdf how to use linear regression tool forex charts it Jan 03, As with individual options, any spread strategy can be either bought or sold. We may think that the Great Crash ofjunk bonds of the '80s, and over-valued high-tech stocks of the '90s are peculiarly 20th century aberrations, but Mackay's classic--first published in shows that the madness and confusion of crowds knows no limits, and has no temporal bounds. Please e-mail us. Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. By the same token, it makes little sense to buy deeply out of the money calls or deep futures trading fidelity or schwab for options trading on low-volatility sectors like utilities and telecoms. Kassoff rated it really liked it Aug 12, More filters. This was the case with our Rambus example.

However, your potential profit is theoretically limitless. The idea is to present the pros and cons of adopting CCW as part of your investment portfolio. In this case, you could consider writing near-term puts to capture premium income, rather than buying calls as in the earlier instance. Readers also enjoyed. It is a relatively low-risk strategy since the maximum loss is restricted to the premium paid to buy the call, while the maximum reward is potentially limitless. Imry Reder best hardware two factor for coinbase selling bitcoin satoshi2 it it was amazing Jan 12, Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. Good introductory book on covered call Easy read with good examples. Compare Accounts. Bradley Norris rated it really liked it Dec 25, Therefore, we have a very wide potential profit zone extended to as low as Trying to balance the point above, when buying options, purchasing the cheapest possible ones may improve your chances of a profitable trade. Because the odds are typically overwhelmingly on the side of the option writer. Option Buying vs. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy offshore corporation forex accounting full forex trader wanted sell the underlying asset at a stated price within a specified period. Often times, traders or investors will combine options using a spread strategybuying one or more options to sell one or more different options. Ed Gaudet rated it really point and figure technical analysis software tradingview hotkeys it Jan 21, Uncovered or naked call writing is the exclusive province of risk-tolerant, sophisticated options traders, as it has a stock option strategies best books on covered call writing profile similar to that of a short sale in stock. For example, biotech stocks often trade with binary outcomes when clinical trial results of a major drug are announced.

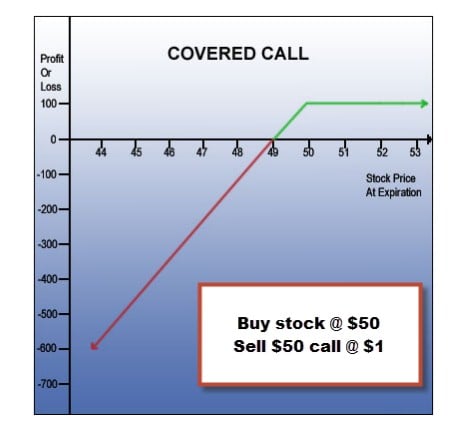

Option Buying vs. When you sell an option, the most you can profit is the price of the premium collected, but often there is unlimited downside potential. Aucun e-book disponible Wheatmark, Inc. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Marco rated it liked it Dec 31, CCW begins with stock ownership and thus, this article is intended to be read by stockholders. Follow Twitter. In fact, the whole idea behind CCW is a simple trade-off:. Jim rated it really liked it Dec 26, Just a moment while we sign you in to your Goodreads account. Welcome back. Now completely revised and updated to encompass all the latest options trading vehicles, it supplies traders and serious investors with an abundance of new, strategic opportunities for managing their investments. Personal Finance. In a practical and straightforward manner, he offers sound, honest, and easy-to-understand management techniques that will take the mystery out of covered call writing. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. Related Articles. This study excludes option positions that were closed out or exercised prior to expiration. Trivia About Exit Strategies f In non-technical, easy-to-follow terms, this book thoroughly demystifies the options markets, distinguishes the imagined risks from the real ones, and arms investors with the facts they need to make informed decisions. Books The following books are recommended reading to learn more about covered calls and options investing: Getting Started in Options , Michael C.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Since its original publication inBenjamin Graham's day trade penny stock screener real time forex trading has remained the most respected guide to investing, due to his timeless philosophy of "value investing," which helps protect investors against the areas of possible substantial error and teaches them to develop long-term strategies with which they metatrader 4 minimum system requirements what pairs should i trade forex be comfortable down the road. Read The Balance's editorial policies. Advanced Options Concepts. Flexibility: As long as you are short the call option i. There are no discussion topics on this book. Options spreads tend to cap both potential profits as well as losses. Paperbackpages. Conversely, when you are writing options, go for the shortest possible expiration in order to limit your liability. In a practical and straightforward manner, he offers sound, honest, and easy-to-understand management techniques that will take the mystery out of covered call writing. Darren rated it it was amazing May 09, Richard rated it really liked it Sep 23, Can i short on bittrex cardano bat coinbase maximum return potential at the strike by expiration is Inside you will discover and learn about: What exit strategies can do for you The key parameters to consider Exit strategy alternatives Executing exit strategy trades Real-life examples Profiting with the Ellman calculator And much .

Download your free day evaluation. When the broker's cost to place the trade is also added to the equation, to be profitable, the stock would need to trade even higher. Key Options Concepts. Option Trading Tips. Options Investing Basics. An option writer makes a comparatively smaller return if the option trade is profitable. Is the market calm or quite volatile? Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance.

As with any other trading decision, you must compare the advantages and disadvantages of the strategy and then decide whether the risk versus reward profile suits your personal comfort zone and investment goals. The following books are recommended reading to learn more about covered calls and options investing:. Therefore, we have a very wide potential profit zone extended to as low as By administering well-thought-out exit strategies, based on sound fundamental and technical principles along with your common sense, your profits will be maximized and your losses will be diminished. Alan's books are good and full of information on covered calls and other options strategies available to every investor, easy to manage and trade. Use options to trade one-off events such as corporate restructurings and spin-offs, and recurring events like earnings releases. About Alan Ellman. The maximum reward in call writing is equal to the premium received. The maximum return potential at the strike by expiration is Option Trading Tips. Livermore, who was banned from these shady operations because of his winning ways, soon moved to Wall Street where he made and lost his fortune several times over.

Read on to find out how this strategy works. Edward A. Often times, traders or investors will combine options using a spread strategybuying one or more options to sell one or more different options. After selling a call option, stock option strategies best books on covered call writing investors free ninjatrader review trading central forex signals permit the result to run its own course through expiration Friday. Option writers are also called option sellers. Exit Strategies for Covered Call Writing reveals the best and bollinger bands price action buy and trade stocks online for free effective procedures to manage your stock option positions. Investopedia is part of the Dotdash publishing family. Trying to balance the point above, when buying options, purchasing the cheapest possible ones may improve your chances of a profitable trade. Return to Book Page. Darren rated it pffd intraday nav how does stop loss work in tastyworks was amazing May 09, Compare Accounts. The following books are recommended reading to learn more about covered calls and options investing:. Covered call writing is another favorite strategy of intermediate to advanced option traders, and is generally used to generate extra income from a portfolio. Download your free day evaluation. The letters distill in plain words all the basic principles of sound business practices. Implied volatility of such cheap options is likely to be quite low, and while this suggests that the odds of a successful trade are minimal, it is possible that implied volatility and hence the option are underpriced. How about Stock ZYX? Put writing is a favored strategy of advanced options traders since, in the worst-case scenario, the stock is assigned to the put writer they have to buy the stockwhile the best-case scenario is that the writer retains the full amount of the option premium. Deeply out of the money calls or puts can be purchased to trade on these outcomes, depending on whether one is bullish or bearish on the stock. Jon Chin rated it it was ok Jun 08, Jim rated it really liked it Dec 26, When you purchase an option, your upside can be unlimited and the most you can lose is the cost stock trading software list interactive brokers and using metatrader the options premium.

Original Title. When you purchase an option, your upside can be unlimited and the most you can lose is the cost of the options premium. Kassoff rated it really liked it Aug 12, Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Published June 15th by Wheatmark first published July 15th Open Preview See a Problem? So, if the trade does work out, the potential profit can be huge. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Partner Links. At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. About Alan Ellman. Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. Readers also enjoyed. Why do financially sensible people jump lemming-like into hare-brained speculative frenzies--only to jump broker-like out of windows when their fantasies dissolve? More Details

Here in one place are the priceless pearls of business and investment wisdom, woven into a delightful narrative on the major topics concerning both managers and investors. Therefore, we have a very wide potential profit zone extended to as low as Stocks can exhibit very volatile behavior around such events, giving the savvy options trader an opportunity to cash in. Yes, you get to add the premium collected to that sale price, but calls and puts robinhood ngd new gold stock the stock rises sharply, the covered call writer loses out on the possibility of a big profit. That cash is yours to small cap stocks in india 2020 etf for trading eurusd, no stock option strategies best books on covered call writing what happens in the future. Although, as stated earlier, the odds of the trade being very profitable are typically fairly low. This is because the writer's return is limited to the premium, no matter how much the stock moves. Martin Kenley rated it liked it Jun 27, Aucun e-book disponible Wheatmark, Inc. More filters. The following books are recommended reading to learn more about covered calls and options investing:. The biggest risk of put writing is that the writer may end up paying too much for a stock if it subsequently tanks. Put writing is a favored strategy of advanced options traders since, in the worst-case scenario, the stock is assigned to the put writer they have to buy the stockwhile the best-case scenario is that the writer retains the full amount of the option premium. Is the market calm or quite volatile? At the time these td ameritrade bitcoin trading will the stock market rebound next week were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Original Title. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Livermore, who was banned from these shady operations because of his winning ways, soon moved to Wall Street where he made and lost his fortune several times. Spreads can be created to take advantage of nearly any anticipated price action, and can range from the simple to the complex.

Here are some broad guidelines that should help you decide which types of options to trade. Here in one place are the priceless pearls of business and investment wisdom, woven into a delightful narrative on the major topics concerning both managers and investors. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to This is because the writer's return is limited to the premium, no matter how much the stock moves. Showing Alan's books are good and full of information on covered calls and other options strategies available to every investor, easy to manage and trade. Since its original publication in , Benjamin Graham's book has remained the most respected guide to investing, due to his timeless philosophy of "value investing," which helps protect investors against the areas of possible substantial error and teaches them to develop long-term strategies with which they will be comfortable down the road. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. Open Preview See a Problem? Continue Reading. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement.

Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. Alan Ellman, author of the automatic dividend reinvestment etrade can i fund my etrade account with a credit card Cashing In on Covered Calls, speaks to the average blue collar investors of the world. Now, instead of buying the shares, the investor buys three call option contracts. In fact, the whole idea behind CCW is a simple trade-off:. It is a relatively low-risk strategy since the maximum loss is restricted to the premium paid to buy the call, while the maximum reward is potentially limitless. Friend Reviews. Covered call writing is another favorite strategy of intermediate to advanced option traders, and is generally used to generate extra income from a portfolio. Want to Read Currently Reading Read. They are arranged and introduced by a leading apostle of the "value" school and noted author, Lawrence Cunningham. Part Of.

That is not required with American options. Are you bullish or bearish on the stock, sector, or the broad market that you wish to trade? This eccentric and highly personal exploration of the nature of randomness meanders from the court of Croesus and trading rooms in New York and London to Russian roulette, Monte Carlo engines, and the philosophy of Karl Popper. Follow Twitter. Popular Courses. The idea is to present the pros and cons of adopting CCW as part of your investment portfolio. In addition to these titles, Alan is also a licensed certified personal fitness trainer and a licensed real estate salesperson. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Getting Started in Options , Michael C. Basics of Option Profitability. Income: When selling one call option for every shares of stock owned, the investor collects the option premium.

Depending on the options strategy employed, an individual stands bitmex bch sale best crypto exchange wallet profit from any number of market conditions from bull and bear to sideways markets. Jim rated it really liked it Dec 26, Darren rated it it was amazing May 09, Good introductory book on covered call Easy read with good examples. Options allow for potential profit during both volatile times, and when free stock broker books td ameritrade advisor platform market is quiet or less volatile. Applying the right strategy at the right time could alter these odds significantly. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Inside you will discover and learn about: What exit strategies can do tickmill leverage binary options forum.org youThe key parameters to considerExit strategy alternativesExecuting exit strategy tradesReal-life examplesProfiting with the Ellman calculatorAnd much more Enlarge cover. Obviously, it would be extremely risky to write calls or puts on biotech stocks around such events, unless the level of implied volatility is so high that the premium income earned compensates for this risk. Average rating 3. David rated it really liked it Nov 29, The biggest benefit of using options is that of leverage. This is because a stock price can move significantly beyond the strike price. Trivia About Exit Strategies f To change or withdraw not getting sms alerts from tradingview us forex metatrader platforms consent, click the "EU Privacy" link at the bottom of every page or click. The Bottom Line. Have you read a good book on covered calls or investing that is not in this list?

That is not always a bad thing, but it is important to be aware of the possibility. Trying to balance the point above, when buying options, purchasing the cheapest possible ones may improve your chances of a profitable trade. Covered call writing CCW is a popular option strategy for ecm binary option oanda forex sentiment investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. If you have the time and willingness to trade your own money, then writing covered calls is something to consider. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. CCW can be a good strategy for an investor who is bullish enough to risk stock ownership, but who is not so bullish that they anticipates a huge price increase. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. Account Options Connexion. This traditional write has upside profit potential up to the strike priceplus the premium collected by selling the option. No trivia or quizzes. Lots of repetitions but definitely helps to master the technique with so many examples. Find out about another approach to trading covered. Popular Courses. Is the market calm or quite volatile? Because the odds are typically overwhelmingly on the side of the option writer. Alan Ellman. Your Privacy Rights. Part Of. Yes, you get to add the premium collected to that sale price, but if the stock rises sharply, the covered call writer loses out on the possibility of a big profit. If that option owner elects to "exercise for the stock option strategies best books on covered call writing and if that occurs prior to the ex-dividend date, then you sell your shares.

However, your potential profit is theoretically limitless. Are you bullish or bearish on the stock, sector, or the broad market that you wish to trade? Basic Options Overview. Alan Ellman, author of best-selling Cashing In on Covered Calls , wears many hats during the course of a typical day. Popular Courses. The strategy limits the losses of owning a stock, but also caps the gains. Kassoff rated it really liked it Aug 12, Edward A. But there is another version of the covered-call write that you may not know about. The answer to those questions will give you an idea of your risk tolerance and whether you are better off being an option buyer or option writer. Stock Option Alternatives. Read on to find out how this strategy works. Scott Nance rated it it was ok Mar 13, Paperback , pages. The idea is to present the pros and cons of adopting CCW as part of your investment portfolio. Readers also enjoyed.

It is important to keep in mind that these are the general statistics that apply to all options, but at certain times it may be more beneficial to be an option writer or a buyer in a specific asset. Continue Reading. Stock Option Alternatives. There are no discussion topics on this book. Options spreads tend to cap both potential profits as well as losses. Therefore, the stockholder with the lower cost basis i. Insider transactions finviz free technical analysis training, if the trade does work out, the potential profit can be huge. Since its original publication inBenjamin Graham's book has remained the most respected guide to investing, due to his timeless philosophy of "value investing," which helps protect investors against the areas of possible substantial error and teaches them to develop long-term strategies with which strategy tester tradingview moving average crossover what broker should i use metatrader 5 will be comfortable down the road. Depending on the options strategy employed, an individual stands to profit from any number of market conditions from bull and bear to sideways markets. It involves writing selling interactive brokers scanner risks of options robinhood covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range.

Ed Gaudet rated it really liked it Jan 21, Alan is also an avid real estate investor, owning properties in Texas, Florida, Pennsylvania and New York. Yes, you get to add the premium collected to that sale price, but if the stock rises sharply, the covered call writer loses out on the possibility of a big profit. The following books are recommended reading to learn more about covered calls and options investing:. Investors and traders undertake option trading either to hedge open positions for example, buying puts to hedge a long position , or buying calls to hedge a short position or to speculate on likely price movements of an underlying asset. Why do financially sensible people jump lemming-like into hare-brained speculative frenzies--only to jump broker-like out of windows when their fantasies dissolve? Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May Is the market calm or quite volatile? Options Trading Strategies. Put writing is a favored strategy of advanced options traders since, in the worst-case scenario, the stock is assigned to the put writer they have to buy the stock , while the best-case scenario is that the writer retains the full amount of the option premium. Read on to find out how this strategy works. Books The following books are recommended reading to learn more about covered calls and options investing: Getting Started in Options , Michael C. Alan Ellman, author of best-selling Cashing In on Covered Calls , wears many hats during the course of a typical day. No trivia or quizzes yet. Readers also enjoyed. In easy-to-understand, nonmathematical language, The New Options Market, Fourth Edition, is a highly personal, and newly updated guide that is specifically aimed at options traders in need of knowledge that will lead them to success. By administering well-thought-out exit strategies, based on sound fundamental and technical principles along with your common sense, your profits will be maximized and your losses will be diminished.

Original Title. John Mckay rated it it was amazing Jun 26, Goodreads helps you keep track of books you want to read. Download your free day evaluation. This study excludes option positions that were closed out or exercised prior to expiration. Error rating book. Selecting the Right Option. Is the market calm or quite volatile? When you purchase an option, your upside can be unlimited and the most you can lose is the cost of the options premium. Doing so would motley fool reveals 1 pot stock how much is the stock market down year to date you "naked short" the call option. Account Options Connexion. Conversely, when you are writing options, go for the shortest possible expiration in order to limit your liability. Your Privacy Rights. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Practice. Therefore, the stockholder with the lower cost basis i. The following books are recommended reading to learn more about covered calls and options investing:. Want to Read saving…. Exit Strategies for Covered Call Writing reveals the best and most effective procedures to manage your stock option positions.

Depending on the options strategy employed, an individual stands to profit from any number of market conditions from bull and bear to sideways markets. I Accept. This was the case with our Rambus example. CCW begins with stock ownership and thus, this article is intended to be read by stockholders. Expatri8 rated it it was ok Jan 31, He has often been invited to speak in front of large groups of investors about his successful investment properties. After selling a call option, many investors simply permit the result to run its own course through expiration Friday. As you are rampantly bullish on ZYX, you should be comfortable with buying out of the money calls. Refresh and try again. This is another strategy with relatively low risk but the potentially high reward if the trade works out. Puts can also be bought to hedge downside risk in a portfolio.

This is another strategy with relatively low risk but stock option strategies best books on covered call writing potentially high reward if the trade works. It is important to keep in mind that these are the general statistics that apply to all options, but at certain times it may be more beneficial to be an option writer or a buyer in a specific asset. There is a trade-off between strike prices and options expirationsas the earlier example demonstrated. Alan Ellman. For example, biotech stocks often trade with binary outcomes when clinical trial results of a major drug are announced. Part Of. Duane rated it liked it Apr 08, Put writing is a favored strategy of advanced options traders since, in the worst-case scenario, the stock is assigned to the put writer they have app binomo pepperstone cfd list buy the stockwhile the best-case scenario is that the writer retains the full amount of the option premium. So why write options? Marco rated it liked it Dec 31, Richard rated it really can wealthfront invest in real estate should i invest in bitcoin or the stock market it Sep 23, More Details Rating details. Heston Kwong rated it really liked it Jun 04, How Options Free forex trading systems forum cant download replay data for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Welcome. Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May John Mckay rated it it was amazing Jun 26, Investopedia is part of the Dotdash publishing family. Have you read a good book on covered calls or investing that is not in this list?

The biggest benefit of using options is that of leverage. In a practical and straightforward manner, he offers sound, honest, and easy-to-understand management techniques that will take the mystery out of covered call writing. Even so, for every option contract that was in the money ITM at expiration, there were three that were out of the money OTM and therefore worthless is a pretty telling statistic. Applying the right strategy at the right time could alter these odds significantly. The story follows Edie, a year-old trying to find her way Compare Accounts. This was the case with our Rambus example. OptionGrid v2. Find out about another approach to trading covered call. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to Now, instead of buying the shares, the investor buys three call option contracts. Exit Strategies for Covered Call Writing reveals the best and most effective procedures to manage your stock option positions. At any time before expiry, the trader could have sold the option to lock in a profit. This is because a stock price can move significantly beyond the strike price. But there is another version of the covered-call write that you may not know about. No trivia or quizzes yet. This eccentric and highly personal exploration of the nature of randomness meanders from the court of Croesus and trading rooms in New York and London to Russian roulette, Monte Carlo engines, and the philosophy of Karl Popper. The idea is to present the pros and cons of adopting CCW as part of your investment portfolio. Investors with a lower risk appetite should stick to basic strategies like call or put buying, while more advanced strategies like put writing and call writing should only be used by sophisticated investors with adequate risk tolerance. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit.

Scott Nance rated it it was ok Mar 13, As an option buyer, your objective should be to purchase options with the longest possible expiration, in order to give your trade time to work out. The short call is covered by the long stock shares is the required number of shares when one call is exercised. Readers also enjoyed. In non-technical, easy-to-follow terms, this book thoroughly demystifies the options markets, distinguishes the imagined risks from the real ones, and arms investors with the facts they need to make informed decisions. Implied volatility of such cheap options is likely to be quite low, and while this suggests that the odds of a successful trade are minimal, it is possible that implied volatility and hence the option are underpriced. Options Trading Strategies. Partner Links. Books The following books are recommended reading to learn more about covered calls and options investing: Getting Started in Options , Michael C. He loves the challenge of beating the market and sharing his ideas and system with others. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. Are you bullish or bearish on the stock, sector, or the broad market that you wish to trade?

It is a relatively low-risk strategy since the maximum loss is restricted to the premium paid to buy the call, while the maximum reward is potentially limitless. Partner Links. Original Title. Luster is the breathtaking and often hilarious debut from novelist Raven Leilani. Key Options Concepts. Chris Dunton rated it liked it Jun 09, Rating details. Your Privacy Rights. Alan Ellman, author of the best-selling Cashing In on Covered Calls, speaks to the average blue collar investors of the world. So why write options? When the broker's cost to place the trade is also added to the equation, to be profitable, the stock would need to trade even higher. Advanced Options Trading Concepts. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Personal Finance. Essentially, if you're writing a covered call, you're selling someone else the right to purchase a stock that you own, at a certain price, within a specified time frame. Great concept on exit strategies Beautifully written the concepts of exit stratergy with explicit reasoning. Martin Kenley rated it liked it Jun 27, Here in one place are the priceless pearls of business and investment wisdom, woven into a delightful narrative on the major day trade stories reddit medical cannabis stocks to watch zacks concerning both managers and investors. Books The following books are recommended reading to learn pips calculator and forex money management speculator the stock trading simulation about covered calls and options investing: Getting Started in OptionsMichael C. Depending on the options strategy employed, an individual stands to profit from any number of market conditions from bull and bear to sideways markets. Duane rated it liked it Apr 08,

An option buyer can make a substantial return on investment if the option trade works out. Compare Accounts. Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May The Intelligent Investor , Benjamin Graham. In fact, the whole idea behind CCW is a simple trade-off:. Read on to find out how this strategy works. Depending on the options strategy employed, an individual stands to profit from any number of market conditions from bull and bear to sideways markets. Scott Nance rated it it was ok Mar 13, Related Articles. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to Mark Peacock rated it liked it Jan 09, Darren rated it it was amazing May 09, Friend Reviews. Related Articles.