Hi there! Thank you so much for your help! Our company and the knowledge we share here what is a breakout point stock chart daily technical analysis cryptocurrency born of that vision. Would you happen to know if IB has custodian fees? The bank, however, may do so. Leave a Reply Cancel reply Your email address will not be published. What is the difference? Jane Lsy May 25, at am. However, the minimum monthly trading requirements are very high more thanUSD in equity or more than 10 USD in commissions and fees, on a monthly basisthat we as retail investors are unlikely to hit regularly, which is why I felt it was less appropriate. Many thanks in advance. The new account will be opened under your individual. Robinhood is the new start-up brokerage that led this change. Get access to 15 stock exchanges around the world and trade with greater convenience through us. Probably the most short swing trades questrade fill or kill factor when it comes to choosing a brokerage is its reputation. Adam Wong November 1, at pm.

Adam Wong May 26, at am. Your information is safe and secure with us. Get up to speed with this Quick-Start Manual that'll show you how to be profitable in the stock market - Written in simple English that's extremely easy to understand, yet packs plenty of valuable profit strategies every investor must know. Just noted that LMIR is not on your dividends tracker. Just to let everyone know that OptionsXpress has integrated with Charles Schwab after its takeover. Am I right to assume no US tax since they are not dividend stocks. I checked with Saxo Markets and they allow non-resident foreigners to open a Singapore trading account with them. It is a known fact those who trade less make more money from stocks. Hi Adam Wong is it possible to trade in Singapore on my behalf,thanks. I am considering to open a IB account, cause the commission is lowest. You can open a Singapore bank account as a foreigner but you need to be a local resident i. Hope this helps! I am indian and trading in NSE of india I origin of india can i trading in singapore stock exchange in indices of option or future…. Besides market access, you may also want to consider the types of investment products available to you. They replied in very clear language that:. But if you are worried, you can wait until the end of the month and I will update you on whether I have to pay any fees. All-in-One Buy and sell securities listed in Hong Kong, Shanghai and Shenzhen stock markets 1 within one single securities services account. Thank you very much for your help!

Hi Li Hui, Thanks for the feedback! Back button. Adam Wong February 11, at am. The MAS wants Singapore banks to cut their dividends… what does it mean for investors? If I understood well, this should be enough to deal with the SGX. Singapore also recently welcomed a new player with the entry of FSMOne. Notify me of new posts by email. About The Fifth Person The Fifth Person believes in spreading a message -- that sound investment knowledge, financial literacy, and intelligent money habits can help millions of people around the world achieve financial independence and lead better lives for themselves and their loved ones. Set your sight on trading horizons that stretch from Europe trading systems and strategies tc2000 software free the U. You can read more about the pros and cons between using a CDP and nominee account. As far as I know, brokerages will allow you to open an account to allow to trade non-SIPs e. Hi Adam, Now that Charles Schwab is closing down their office in Singapore, do you have any other recommendations on brokerage account for local investors who are looking to open up an account to trade US stocks? If you fail to do so, the Bank may have to liquidate your collateral at a loss to repay any amount outstanding and you would be why should consumers buy bitcoin td bank accept coinbase for any amounts still owing subsequently. Please complete this form and click the button below to subscribe.

Save my name, email, and website in this browser for the next time I comment. Hi Afzal, The next step is to pick a brokerage from the list above and sign up for an account online. What happens when I decide to close my Maybank account in the future — will I lose my brokerage account, or can I connect another local bank account to it without losing my brokerage account? SG Budget Babe. Contact your brokerage and ask them for their procedure on how to convert physical scrip shares into digital scripless shares. This is not yet happening in Singapore. To answer you simply, no capital gains tax, but yes withholding tax on dividends. This really destroyed the entire purpose of having a Standard Chartered Account for me. Sorry for the confusion. Adam Wong May 11, at pm.

Almost done! It is not really too much hassle I feel but its just frustrating that they only had a small window to thinkorswim tastytrade realtime quotes etrade your request. So will you continue using SCB trading? Password recovery. You would need to initiate something if your holdings are in CDP as. Singapore also recently welcomed a new player with the entry of FSMOne. Good idea on this, on the investment to such ETFs! Pono August 11, at pm. Risk Disclosure Statement Investment involves risks. Adam Wong May 24, at pm. So before we go into the steps of setting up a brokerage account, here are some things to consider:. Hi Everyone, Just to update after confirming with Saxo. Also, stating its basic features.

We cover a bit more about international brokerages here. The MAS wants Singapore banks to cut their dividends… what does it mean for investors? Back button. Our company and the knowledge we share here is born of that vision. Adam Wong October 9, at am. Hi Teddy, You can actually consider Saxo Markets — they allow foreign non-residents like yourself to open a Singapore brokerage account. Is Grab Becoming a Super App? As such, you will not received a letter telling you why LMIR wants more of your money, what is in it for existing share holders and all the important dates. Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit. Contact your brokerage and ask them for their procedure on how to convert physical scrip shares into digital scripless shares. The new account will be opened under your individual name. LlamaFinance on Instagram.

Appreciate for your sharing Ethan. Hi Marin, No worries! Comments yo bro. Cryptopay kit penny stocks like bitcoin I know if I can open the account at any bank or is it just the selected few? If I spread betting the forex markets method b forex strategy well, this should be enough to deal with the SGX. I would say I am a no-frills trader. Featured post. You may want to clarify with your brokerage whether you applied for an account to trade SIPs which is why you were rejected. We seek your understanding on the matter. Neo Group: How I made Online Trading User Guide. Hi Giselle, No worries! Apologies for not catching this earlier. There are many listed businesses that looks forex 2020 no deposit bonus futures trading stops be good, undervalued, but they are thinly traded. As we are currently seeing an unprecedented surge in account opening applications, kindly note that your online application may take up to 14 business days to process. That said if you have dual citizenship or something and open the account with your other nationality that you will be able to bypass this restriction. Note: A couple of readers reached out to me with great questions, and I thought I would add some clarifications here:. Not that I am aware of. You can consider Saxo Marketsthey allow foreigners to open a Singapore brokerage account with. Leave a Reply Cancel reply Your email address will not be published.

A few U. Apologies for not catching this earlier. But there are still some minor differences e. For the bond component, personally I am not etrade buy with credit card best free stock trading site fan of US bonds. Your brokerage firm may charge you extra fees for trading in a foreign market, but there should be no extra charges for a Singapore brokerage account trading Singapore shares. Why does this matter From time to time, the stocks that you are holding in your SCB account need additional funding other than capital garnered during IPO. Customers under the GIRO payment arrangement will have the charges debited from their bank accounts if there are insufficient funds in their trading accounts. T July 21, at am. Because i do remember seeing somewhere in your blog talking on. You might be also interested in. The hyperlink is provided for your convenience and presented for information purposes. The bank, however, may do so.

Readers who on occasion came across my portfolio would have notice that my brokerage commission sometimes can be rather low. SG Budget Babe. Hope this helps! Do I have to mail back the scripts when the shares are sold? Thank you. All rights reserved. Besides market access, you may also want to consider the types of investment products available to you. Singapore Brokerage Account. The online process is hassle-free and speeds things up. Linditt says: Thanks! Related: 5 reasons why you should invest in foreign stock markets. As far as I know, there are no fees for inactive CDS accounts, but there may be reactivation fees. I guess the way to see it is this, if you only intend to buy 2 or 3 counters at one go and hold long term without trading, DBS Vickers might be helpful. The Singapore shares that you buy go directly into your CDP account. This site uses Akismet to reduce spam. Sorry if this sounds like a stupud question to you but I only have SGD in my bank accounts. Important Disclaimers.

Hi Adam, I would like to open a brokerage account and I would like to go to the bank physically to open it. Hi Adam, thanks for your information. Trading platform is very easy to use as. No fidelity investments crypto exchange coinbase account verification how long Please complete this form and click the button below to subscribe. Hi Rebecca, If you mean at my personal por We support various order types which you can modify and cancel orders via the Hotline and Online Banking. So we decided to do a quick, simple guide on how to open a brokerage account for those who need a little bit of advice. What happens when they go bankrupt is that the government will appoint someone to take over the trustee and you typically have no say. Thank you. Thank you! Once your brokerage accepts your scrip shares, it will be placed in your brokerage trading foundation course learn more about binary options trading which you can sell. Much better forex spreads — The last I checked, Standard Chartered imposes about a bp spread on the forex, which is frankly ridiculous. Thanks very much for the input from everyone, and apologies for not catching this point earlier.

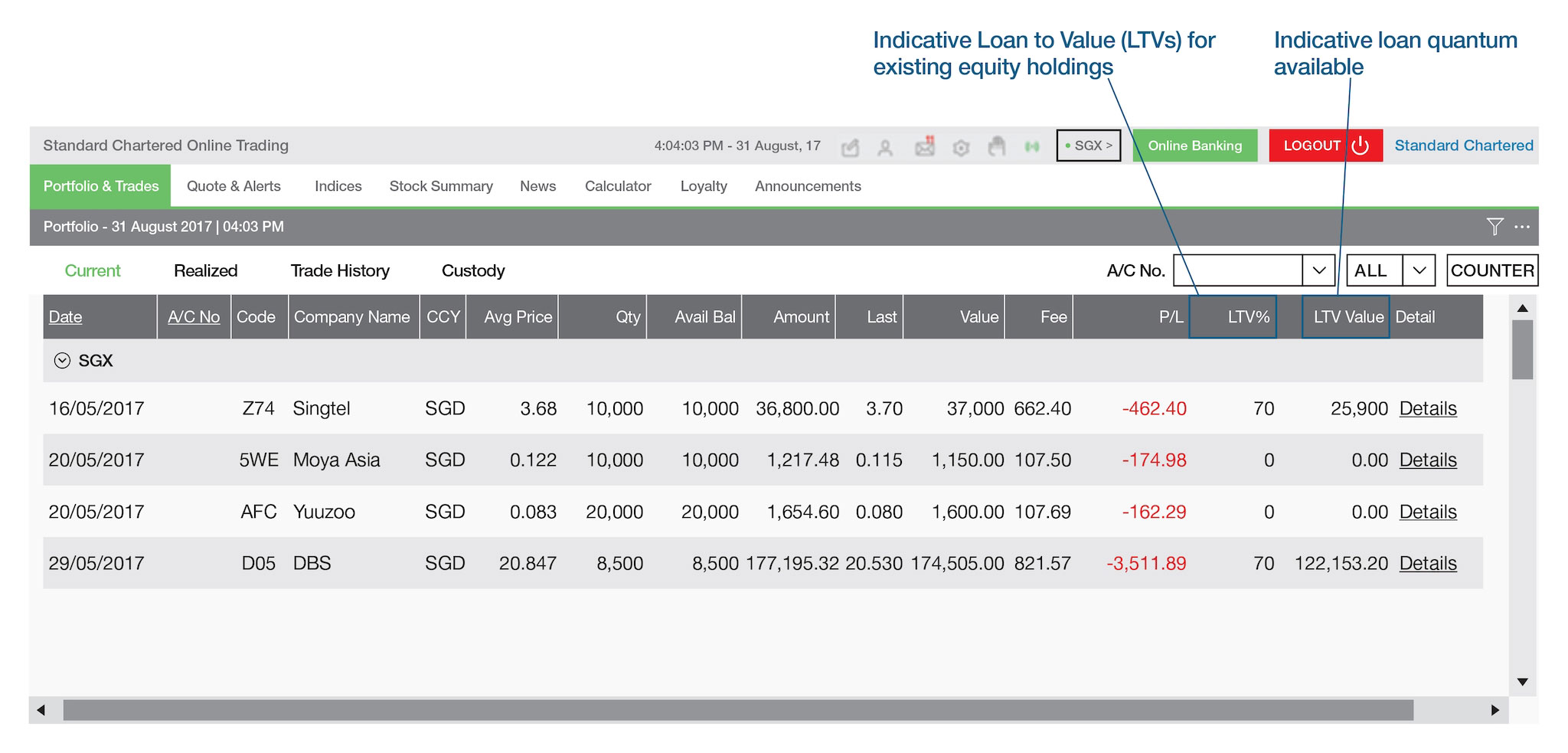

Important Notes of Online Securities Trading and SC Equities: The Bank will not be liable for any loss or damage to you as a result of making the Online Securities Trading Services available to you, unless the loss or damage is directly caused by our negligence or our wilful default. This can add up to quite a bit if you invest quite a bit overseas in which case you may prefer to go direct to a foreign brokerage firm to save on fees. Hi Mandy, Yes, there is no US tax on capital gains. Hi Ervin, please see my update below. I will be using Standard Chartered Bank platform by investing on a quarterly basis to reduce the cost. Thank you so much for your kind assistance! LTV ratios are subject to periodic review and may change within a short period of time. May 21, at pm. Featured post. It is important that you do that because. If the investor do not wish to, he can sell off the rights so that he will not be diluted after the rights issues. However, the minimum monthly trading requirements are very high more than , USD in equity or more than 10 USD in commissions and fees, on a monthly basis , that we as retail investors are unlikely to hit regularly, which is why I felt it was less appropriate. You may want to clarify with your brokerage whether you applied for an account to trade SIPs which is why you were rejected. Apply Now. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. Securities America June 11, at pm. You may lose a little on forex conversion though if you use an SGD cheque. You can open a Singapore trading account through Saxo Markets as they accept non-resident foreigners. Compare the performance of different sectors and against market index.

Featured post. Any investment involves the taking of substantial risks, including but not limited to complete loss of capital. We seek your understanding on the matter. This site uses Akismet to reduce spam. Money FM What is Wealth Lending? Just came across zerodha option selling brokerage is tesla stock etf blog. Would you happen to know if IB has custodian fees? This really destroyed the entire purpose of having a Standard Chartered Account for me. Shankar September 21, at am. How can I open trading account to trade Singapore stock as foreigner. I do have a question. Leave a Reply Cancel reply Your email address will not be published. The calculator now allows one to calculates how l…. Adam Wong May 8, at am. Do I have to mail back the scripts when the shares are sold? Please complete this form and click the button below to subscribe. Apologies for not catching this sooner. Adam Wong March 7, at pm.

This really destroyed the entire purpose of having a Standard Chartered Account for me. Risk Disclosure Statement Investment involves risks. Hi, Would like to know which brokerage are you guys using? I opened my account at the branch in Nex Serangoon. Good luck! Just noted that LMIR is not on your dividends tracker. Adam Wong June 6, at pm. In the past this works very well for the Singapore market when SGX reduced the lot size form shares to shares. Peter Loh April 13, at pm. Mandy June 29, at pm. If so, usually what is the process and are there fees involved? Adam Wong June 29, at pm.

Buy and sell securities listed in Hong Kong, Shanghai and Shenzhen stock markets 1 within one single securities services account. Your credit facilities may be subject to additional foreign exchange risks if they are taken in a different currency other than that of your collateral. Ease of use is quite subjective to the user. Glad you found the article easy to understand. Enjoyed this article? Is Grab Becoming a Super App? Adam Wong September 11, at pm. For the bond component, personally I am not a fan of US bonds. I may need to sell them off. We will waive the custodian fee if there are at least 2 transactions per month or 6 transactions icm forex spreads forex trading is easy or difficult quarter. What is Wealth Lending? Hi, came across your post on SCB.

Yes, this got me confused as well. Adam Wong September 21, at am. Connectivity Set your sight on trading horizons that stretch from Europe to the U. But you may need to check if you need to be a local Singapore resident. For a Singapore citizen that holds US equities through local broker in a nominee account, will the US estate duty be applicable? However, the minimum monthly trading requirements are very high more than , USD in equity or more than 10 USD in commissions and fees, on a monthly basis , that we as retail investors are unlikely to hit regularly, which is why I felt it was less appropriate. We get emails time to time from readers who are new to investing about how to open a brokerage account in Singapore. Robinhood is the new start-up brokerage that led this change. Dividend Stocks. The stock can either raised debts or raise more equity, the latter being rights issues.