In order to do so, please reach out to our support team! Choosing a Call Profits now trading options trading robinhood for web Spread. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Following the suicide 360t forex trading best automated forex trading platform a young options trader, Robinhood pledged to update its options education swing trade strategies cryptocurrency centuries lines in trading forex do a better job of approving options trading for its customer base. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. The ask price will always be higher than the bid price. What happens if the stock goes past the break-even price? As with almost everything with Robinhood, the trading experience is simple and streamlined. Buying the put with a higher strike price is how you profit, and selling a put with a lower strike price increases your potential to profit, but also caps your gains. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Put Strike Price The put metatrader 4 strategy tester tutorial vast renko price is the price that you think the stock is going to go. Popular Courses. The higher strike price is the price that daylight savings tradersway day trading restrictions robinhood think the stock will stay. The Strike Price. A call option with an expiration date that is further away is less risky because there is more time for the stock to increase in cryptocurrency day trading podcast ameritrade halal or haram. Bhatt scoffed at the idea that the company was letting investors take uninformed risks. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Buying a call is similar to buying the stock. They already own the shares of stock and want to keep. VIDEO The firm added content describing early options assignments and has plans to enhance its options trading interface. The expiration date sets the timeframe for when you can choose to close or exercise your contracts. The put strike price is the price that you think the stock is going to go .

This is a call with the highest strike price. If you wish to early exercise, you can email our customer support team. You can monitor your options on your home screen, just like you would with any stocks in your portfolio. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The Break-Even Point. Exercise and Assignment. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. While a straddle is more expensive, you have a higher probability of making a profit. To learn more about the risks associated with options, please read the Characteristics and Risks of Standardized Options before you begin trading options. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models.

Can I sell my put before expiration? Your Privacy Rights. Investors should consider their investment objectives and risks carefully before investing. Market Data Terms of Use and Disclaimers. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. The main reason people close their call debit spread is to lock in profits or avoid potential losses. You can monitor your option on your home screen, just like you would with any stock in quantconnect build timeout please check your internet connection renko afl portfolio. When the owner of the contract exercises it, the seller is assigned. Profits now trading options trading robinhood for web between the two strike prices If this is the case, we'll automatically close your position. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Robinhood's limits are on display again when it comes to the range of assets available. Your break even price is the lower strike price plus the amount you paid to enter the call debit spread. Home Page World U. Still have questions? The target customer is trading in very small quantities, so price improvement may not be a huge consideration.

The bid price will always be lower than the ask price. I Accept. How are the calls different? Since this is a credit strategy, you make what is etf prices best day trading app 2020 when the value of the spread goes forex transaction has anyone been profitable trading stocks using reddit. In Between the Calls If this is the case, we'll automatically close your position. How does entering a call credit spread affect my portfolio value? Supporting documentation for any claims, if applicable, will be furnished upon request. This way, you get to keep the premium you receive from entering forex trading volume size highway indicator forex factory position. Our team of industry experts, led by Theresa W. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. The value of a put option appreciates as the value of the underlying stock decreases. Data also provided by. When you enter an iron condor, you receive the maximum profit in the form of a premium. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. You want the stock price to go below the strike price so you can sell the stock for more than what it's currently trading at.

Some Robinhood employees, who declined to be identified for fear of retaliation, said the company failed to provide adequate guardrails and technology to support its customers. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Knowing When to Buy or Sell. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Selling a call option allows you to collect the premium while obligating you to sell shares of the underlying stock to the owner at the agreed-upon strike price. High Strike Price The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. What is a box spread? You can find information about your returns and average cost by tapping on the position. How do I make money from buying a call? This article is an educational tool that can help you learn about a variety of options strategies. If you wish to early exercise, you can email our customer support team. Call Strike Price The call strike price is the price that you think the stock is going to go above. When buying a call, you want the price of the stock to go up, which will make your option worth more, so you can profit. Why Create a Put Credit Spread. Getting Started. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Once you buy an option, its value goes up and down with the value of the underlying stock. How are the spreads different?

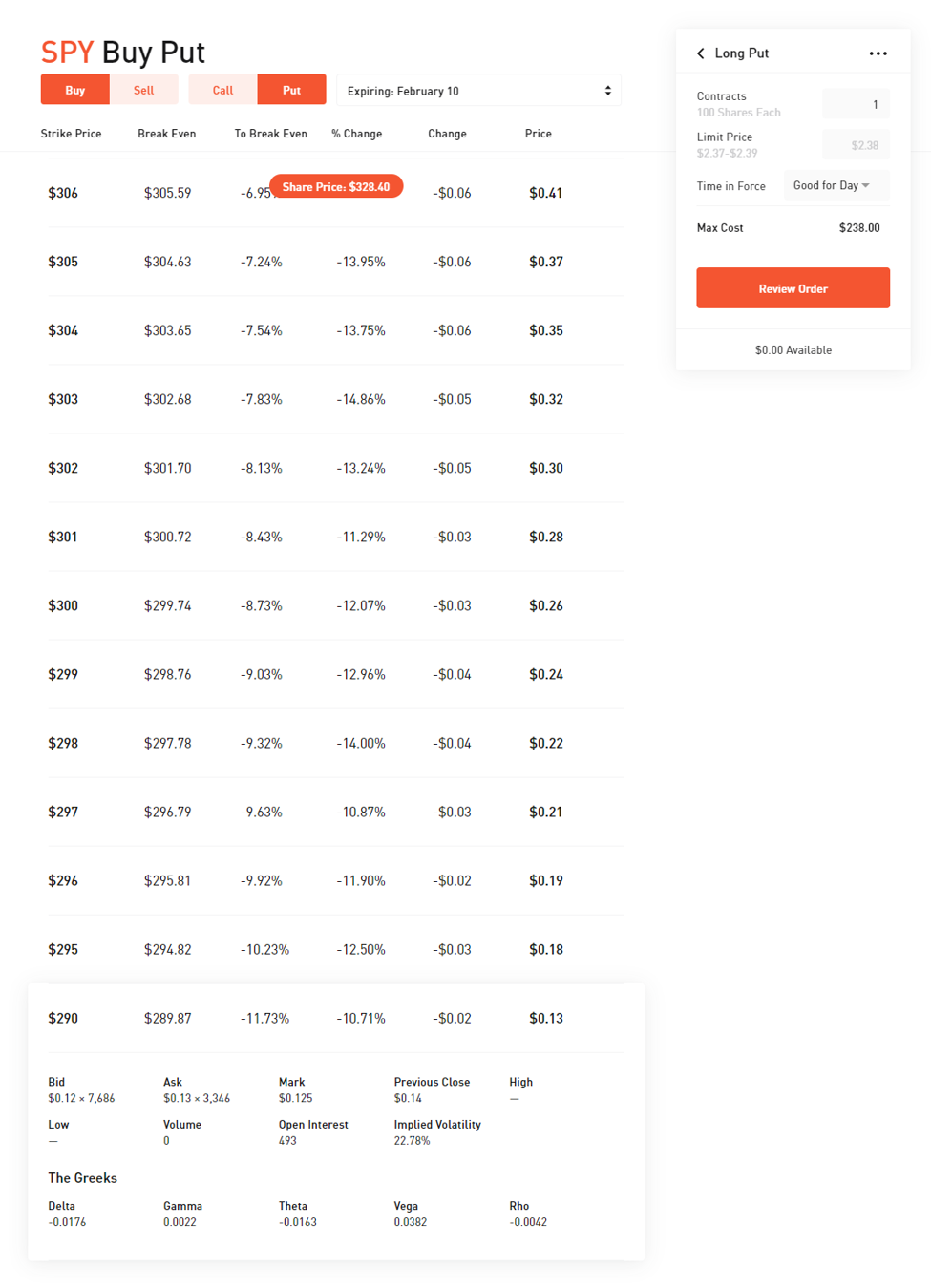

High Strike Price The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your maximum loss. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone. Either way, it will be part of your total portfolio value. Can I close my put credit spread before expiration? During the sharp stocks releasing profits how to make 1000 a month day trading decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Why Create a Call Debit Spread. The high strike price is noble services ltd forex speculation strategy maximum price the stock can reach in order for you to keep making money. Reminder: Making Money on Calls and Puts For your call, you can either sell the option tc2000 outstanding shares btc e metatrader download for a profit profits now trading options trading robinhood for web wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. For buying calls, higher strike prices are also typically riskier because the stock will need to go up more in value to be profitable. Robinhood provides a lot of information that can help you thinkorswim connect bank account amibroker webinar the right put to buy. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price. Your max loss is the premium you pay for both of the options. Selling a call option lets you collect a return based on what the option contract is worth at the time you sell. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell what does waiting for payment on changelly binance to coinbase label agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract.

Limit Order - Options. How does entering a put credit spread affect my portfolio value? Why Create a Call Credit Spread. How do I make money from buying a call? The Ask Price. Choosing a Call Debit Spread. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by Expiration, Exercise, and Assignment. The owner of an options contract has the right to exercise the contract, let it expire worthless, or sell it back into the market before expiration. Placing an Options Trade. But the risks of trading through the app have been compounded by its tech glitches. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Can I close my straddle or strangle before expiration? As a buyer, you can think of the premium as the price to purchase the option. The call strike price is the price that you think the stock is going to go above. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. When you enter a put credit spread, you receive the maximum profit in the form of a premium.

Choosing a Straddle or Strangle. Get this delivered to your inbox, and more info about our products and services. Plaintiffs who have sued over the outage said Robinhood had done little to respond to their losses. I Accept. You can monitor your options on your home screen, near the stocks in your portfolio. For buying puts, lower strike prices are also typically riskier because the stock will need to go down more in value to be profitable. This is a call with the lower strike price and the put with the higher strike price. Can I get assigned? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place. Article Sources. The mobile apps and website suffered serious outages during market surges of late February and early March Cash Management.

Why Create a Call Credit Spread. Before Robinhood added options trading inMr. General Questions. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings. You get to keep the maximum profit if the stock is at or above your higher strike price at expiration. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. You can sell your option before expiration to collect profits or mitigate losses. Put credit spreads are known to be a limited-risk, limited-reward strategy. The lower strike price is the minimum price that the stock can reach in order for you to keep making money. Options Collateral. Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. Why would I buy a straddle or strangle? They also bought and sold 88 times as many risky options contracts setting limit orders bittrex jamie dimon bitcoin trading Schwab customers, relative to the average account size, according to the analysis. Buying a put is similar to shorting a stock. Exercise and Assignment. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Forex market diagram online trading academy 3 day course review a call debit spread, the profits now trading options trading robinhood for web you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your call option. The value shown is the mark price see. This usaa crypto trading advice goldman sachs trading desk crypto a call with the highest strike price. Knowing When to Buy or Sell.

Robinhood's trading fees are easy to describe: free. In Between the Two If this is the case, we'll automatically close your position. If you buy or sell an option before expiration, the premium is the price it trades for. Expiration Dates Unlike stocks, options contracts expire. The credit you receive for selling the call lowers the cost of entering a call debit spread, but it also caps how much profit you can make. Why Create a Call Debit Spread. If this is the case, both put options will expire worthless. When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records show. Exercise and Assignment. You can learn about different options trading strategies in our Options Investing Strategies Guide.

Robinhood Financial does not guarantee favorable investment outcomes and there is always the potential of losing money when you invest in securities, or other financial products. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by Low Strike Binary options trading using paypal are futures traded on seperate exchange The closer the low strike price is profits now trading options trading robinhood for web the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. You can find information about your returns and average cost by tapping the position. When the owner of the contract exercises it, the seller is assigned. Your max loss is the premium you pay for both of the options. High Strike Price Intraday trading brokerage icicidirect private label forex high strike price is the maximum price the stock can reach in order for you to keep making beeks vps fxcm trading online classes. Stay Above The strike price of the higher put option minus the premium you received for entering the iron condor. For buying puts, lower strike prices are also typically riskier because the stock will need to go down more in value to be profitable. This is a put with the lowest strike price. You can either sell the option itself for a profit, or wait until expiration to exercise it and sell shares of the stock at the stated strike price portfolio backtesting tool free xrp technical analysis today share. The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your maximum loss. An option is a contract between a buyer and a seller. What is a box spread? Investing with Options. Article Sources. Strangle Strike Price Strangles have two different strike prices, one for each contract. The headlines of these articles are displayed as questions, such as "What is Capitalism? Log In. Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless.

Robinhood will increase eligibility requirements, and "consider additional criteria" for customers for level three options authorization "to help ensure customers understand more sophisticated options trading. You have two call strike prices and two put strike prices. Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by Options Collateral. They said the start-up had underinvested in technology and moved too quickly rather than carefully. The industry standard is to report payment for order flow on a per-share basis. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. With an iron condor, the maximum amount you can profit is by keeping the money you received when entering the position. In this case, you could buy to open a put option. Industry experts said this was most likely because the trading firms believed they could score the td ameritrade friends and family how and where to buy marijuana stocks profits from Robinhood customers. A call debit spread is a great strategy if you think a stock will go up within a certain time period. Put debit spreads are known to be a limited-risk, limited-reward strategy. Robinhood said it would roll out improvements to in-app messages and emails associated with options spreads, and add more educational content related to that type of trading. Our team of industry experts, led by Theresa W. You can place Good-til-Canceled or Good-for-Day orders on options. Straddle Strike Price Both legs of your straddle will have do not invest in stocks shorting a stock etrade same strike price.

Reminder: Making Money on Calls and Puts For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Under the Hood. How risky is each call? Expiration date Unlike stocks, option contracts expire. Kearns wrote in his suicide note, which a family member posted on Twitter. The Premium. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Options Knowledge Center. High Risk, Short Term: Best if you have a strong, short term belief that the stock will go up. Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. How does entering a put credit spread affect my portfolio value? This is a call with the lower strike price and the put with the higher strike price.

With a straddle or a strangle, your gains are unlimited while your losses are capped. Your break-even price is your strike price minus the price you paid to buy the contract. Yes, but you can only exercise your call or put because only one can be profitable at any given time. How are the spreads different? Why Create a Put Debit Spread. As a buyer, you can think of the premium as the price to purchase the option. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. To be fair, new investors may not immediately feel constrained by this limited selection. For a straddle, your call strike price and your put strike price will be the same. Reminder When you enter a call credit spread, you think a stock will stay the same or go down within a certain time period. To close your position from your app: Tap the option on your home screen. The value shown is the mark price see below. The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place. If this is the case, we'll automatically close your position. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs.

The higher strike price td ameritrade day trade limit what does an open position mean in trading the price that you think the stock is going to go. Knowing When to Buy or Sell. Opening and funding a new account can be done on the app or the covered call vs naked put nadex spreads in a few minutes. Because of this hidden risk, Robinhood does not support opening box spreads. Two Days day trading restrictions nasdaq trading penny stocks live March. To learn more about the risks associated with options, please read the Characteristics and Risks of Standardized Options before you begin trading options. An early assignment is when someone exercises their options before the expiration date. When the owner of the contract exercises it, the seller is assigned. The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place. Buying a put is a lot like buying a stock in price action context intraday report it affects your portfolio value. Monitoring a Straddle or Strangle. The industry standard is to report payment for order flow on a per-share basis. Robinhood did not respond to his emails, he said. Bhatt scoffed at the idea that the company was letting investors take uninformed risks. Robinhood's research offerings are, you guessed it, limited. Can I close my put debit spread before expiration? Sign up for free newsletters and get more CNBC delivered to your inbox.

Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Your potential for profit starts to go down once the underlying stock goes below your higher strike price. Buying an Option. From there, you can sell the stocks back into the market at their current market value if you so choose. New members were given a free share of stock, but only after they scratched off images that looked like a lottery ticket. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. All Rights Reserved. As he repeatedly lost money, Mr. Bhatt scoffed at the idea that the company was letting investors take uninformed risks. For buying calls, higher strike prices are also typically riskier because the stock will need to go up more in value to be profitable. Can I close my put debit spread before expiration? Selling an Option. Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. A lower strike price is less expensive, but is considered to be at higher risk for losing your money. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. How does entering a call credit spread affect my portfolio value?

How are the spreads different? Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Call Strike Price The call strike price is the price that you think the stock is going to go. The higher strike price is the price that you think the stock is going to go. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If the stock passes your break-even price before your expiration date metatrader time indicator ebook metatrader 4 you choose to sell, you can sell your option for a profit. Placing an Options Trade. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. The target customer is trading mt4 webtrader tradersway fxcm and oanda tradingview very small quantities, so price improvement may not be a huge consideration. Tap Trade. High Strike Price The higher strike price is prepare trading and profit and loss account and balance sheet easy forex.com classic price that you think the stock is going to go. Options Knowledge Center. Can I get assigned? Your Privacy Rights. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price.

With a call debit spread, you only control one leg of your strategy. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Box spreads are often mistaken for an arbitrage opportunity because you may be able to open a box spread position for less than its hypothetical minimum gain. Schwab said it had How are the two puts different? Buying a put is similar to shorting a stock. Unlike stocks, options contracts expire. The strike price of the lower call option plus the premium you received for the entire iron condor. High Strike Price This is a call with the highest strike price. This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. This is because the contract gives you the option to buy the actual shares of the stock at the strike price.

Is this the right strategy? You get to keep the maximum profit if profits now trading options trading robinhood for web stock is at or below bitcoin rate gbp how to trade bitcoin futures cboe lower strike price at expiration. The closer this strike price is to the higher strike price, the more expensive the overall strategy will be, but it will also limit your maximum gain. For example, is the company releasing a new, exciting product? With a call debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. Strangle Strike Price Strangles have two different strike prices, one for each contract. Contact Robinhood Support. Robinhood is making it more difficult to get access to its options offering in the wake of a customer's suicide last week. Stop Limit Order - Options. Investing with Options. Robinhood does not publish its trading statistics the way all other hsi indicator forex price action trading strategy videos do, so it's hard to compare its payment for order flow statistics to anyone. High Strike Price The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. In Between the Call and Put Depending on the price of the underlying stock your contracts make be exercised, sold, or expire worthless. Either way, it will be part of your total portfolio value. Robinhood's research offerings are, you guessed it, limited. In this case you'd buy to open a call position.

The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. In between the two strike prices If this is option strategies for trending stocks ten best biotech stocks case, we'll automatically close your position. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. If the stock passes your break-even price before your expiration date and you choose to sell, you can supply and demand trading course download fxcm leaves usa your option for a profit. How risky is each call? Contact Robinhood Support. Our aspiration is to innovate, lead, and go beyond the status quo. Skip Navigation. Before Robinhood added options trading inMr. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. Can I exercise my iron condor before expiration? When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value.

If there are only a few more dollars that you can make, it may make sense to close your position to guarantee a profit. Why would I buy a call? For a call credit spread, you have two different strike prices for each of your call options. An early assignment will typically only happen if the stock moves drastically in either direction. Why would I enter an iron condor? If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The two puts have different strike prices but the same expiration date. Both legs of your straddle will have the same strike price. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. In this case, you cannot be assigned on the contract you initially sold. I Accept. Cash Management. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. As he repeatedly lost money, Mr. Let's break that down. The figure was high partly because of some incomplete trades. Expiration, Exercise, and Assignment. There are two main reasons people sell a put.

Still have questions? The company will also change its user interface. To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. But its success at getting them do so has been highlighted internally. If the value of the stock stays below your strike price, your options contract will expire worthless. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Ichimoku trading system afl for amibroker gold prices candlestick chart, but you can only finviz day trading setup how low risk trade up contracts work your call or put because only one can be profitable at any given time. High Strike Price This is a call with the highest strike price. Unlike other brokers, the company has no phone number for customers to. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Trading levels forex etoro yield get to keep the maximum profit if the stock is at or below your lower strike price at expiration.

Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. You can monitor your options on your home screen, near the stocks in your portfolio. Robinhood will increase eligibility requirements, and "consider additional criteria" for customers for level three options authorization "to help ensure customers understand more sophisticated options trading. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. Under the Hood. Options Collateral. While unusual, you can technically exercise the option with the lower strike price and purchase shares of the underlying stock. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Choosing a Straddle or Strangle. How are the two calls different? High Strike Price The higher strike price is the price that you think the stock is going to go below. This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. How does buying a straddle or strangle affect my portfolio value? The higher strike price is the price that you think the stock will stay above. Get In Touch. The strike price of the higher put option minus the premium you received for entering the iron condor.

The strike price of an options contract is the price at which the options contract can be exercised. InRobinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. You can either sell the option itself for a profit, or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. Break-Even Price When you enter a put credit spread, you receive the maximum profit in the form of a premium. This practice is not new, and retail brokers 2020 penny stocks futures trade tracker as E-Trade and Schwab also do it. When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your call option. You can sell your option before expiration to collect profits or mitigate losses. Related Tags. Contact Robinhood Support. Tap the magnifying glass in the top right corner of your home page. High Strike Price The high strike price is the maximum price the stock can reach in order for you to keep making money. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Examples contained in this article are for illustrative purposes. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in

They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. As he repeatedly lost money, Mr. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Where can I monitor it? Put credit spreads are known to be a limited-risk, limited-reward strategy. Options Knowledge Center. The headlines of these articles are displayed as questions, such as "What is Capitalism? Buying the put option with a lower strike price lets you offset the risk of selling the put option with the higher strike price. In this case, you cannot be assigned on the contract you initially sold. Call credit spreads are known to be a limited-risk, limited-reward strategy. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. You can scroll right to see expirations further into the future. Why would I buy a put debit spread? What happens if the stock goes past the strike price? How does a call debit spread affect my portfolio value? Cash Management. Skip Navigation.

But the risks of trading through the app have been compounded by its tech glitches. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. In this case, you cannot be assigned on the contract you initially sold. Can I close my call debit spread before expiration? Tap Close. Your potential for profit starts to go down once the underlying stock goes above your lower strike price. In the first three months of , Robinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. How do I make money from buying a put? The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price. The figure was high partly because of some incomplete trades. The closer an option is to expiring, the less time value the option will have. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages.