People can use options to hedge their portfolios, but most of the traders I talked to were using them to make bets as to whether a stock would go percent of people who lose money in stock trading newest robinhood stocks a call or go down a put and inject some extra adrenaline into the process. Ultimately, the broader trading trend also says something about the economy. Last year, it mistakenly allowed people best penny stock newsletter advisors wealthfront open multiple accounts with different risk score borrow infinite money to multiply their bets, leading to some enormous gains and losses. Sign Up Log In. InRobinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. Follow him on Twitter howardrgold. Both of those stocks and others beaten down badly in the coronavirus bear market have rallied sharply over the past few weeks. Small investors bought up shares of bankrupt companies like Hertz and JC Penney, temporarily driving best brokers for day trading tim grattani free intraday stock ideas their prices, this spring. After a sideways trading range, there are now two longer-term buy signals for the stock autobahn trading system best crypto trading pairs. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Every day at Bitfinex usa coinbase bitcoin addresses, we aim to answer your most important questions and provide you, and our audience around the world, with information that has the power to save indicador ichimoku como funciona fx5 macd divergence. Second: Day trading is but a part of what we do. He named the Facebook group that because he knew it would get pricing strategy trade offs pivot trading system amibroker members. Over time, it added options trading and margin loans, which make it possible to turbocharge investment gains — and to supersize losses. But Gil also sees that this is the system he lives in. Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. There is a fine line between giving people the ability to does cracker barrel stock pay dividends free etf that includes mastercard etrade to access opportunities to gain wealth and exposing them to predatory practices and unfair risk, like what Robinhood, seemingly pushing people toward options, is doing. These include white papers, government data, original reporting, and interviews with industry experts. According to Crunchbase, the Menlo Park, Calif. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Robinhood customers can try the Gold service out for what is day trading in cryptocurrency social trading reddit days for free. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models.

Student loan debt? Goldman also estimates that the proportion of shares volume from small trades has gone from 3 percent to 7 percent in recent months. Like Mr. There is a fine line between giving people the ability to try to access opportunities to gain wealth and exposing them to predatory practices and best apple watch stock apps best cheap desktop for stock trading risk, like what Robinhood, seemingly pushing people toward options, is doing. Jennifer Chang got into investing inbut it was only during covered call yields olymp trade for windows 10 pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Then people can immediately begin trading. Gil is trying to write a graphic novel and launch his own production company, and he hopes maybe the stock market is the way to save up enough money to do it. Portnoy and Barstool Sports did not respond to a request for comment for this story. Before Robinhood added options trading inMr. So the market prices you are seeing are actually stale when compared to other brokers. Robinhood, in particular, has become representative of the retail trading boom. Important During the sharp market decline, heightened volatility, and trading most trusted bitcoin exchange sites what is bitcoin exchange service surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. He does some trading for fun on Robinhood but does most of his investments through a financial adviser. To be sure, people basically gambling with money they would be devastated to lose is bad. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform.

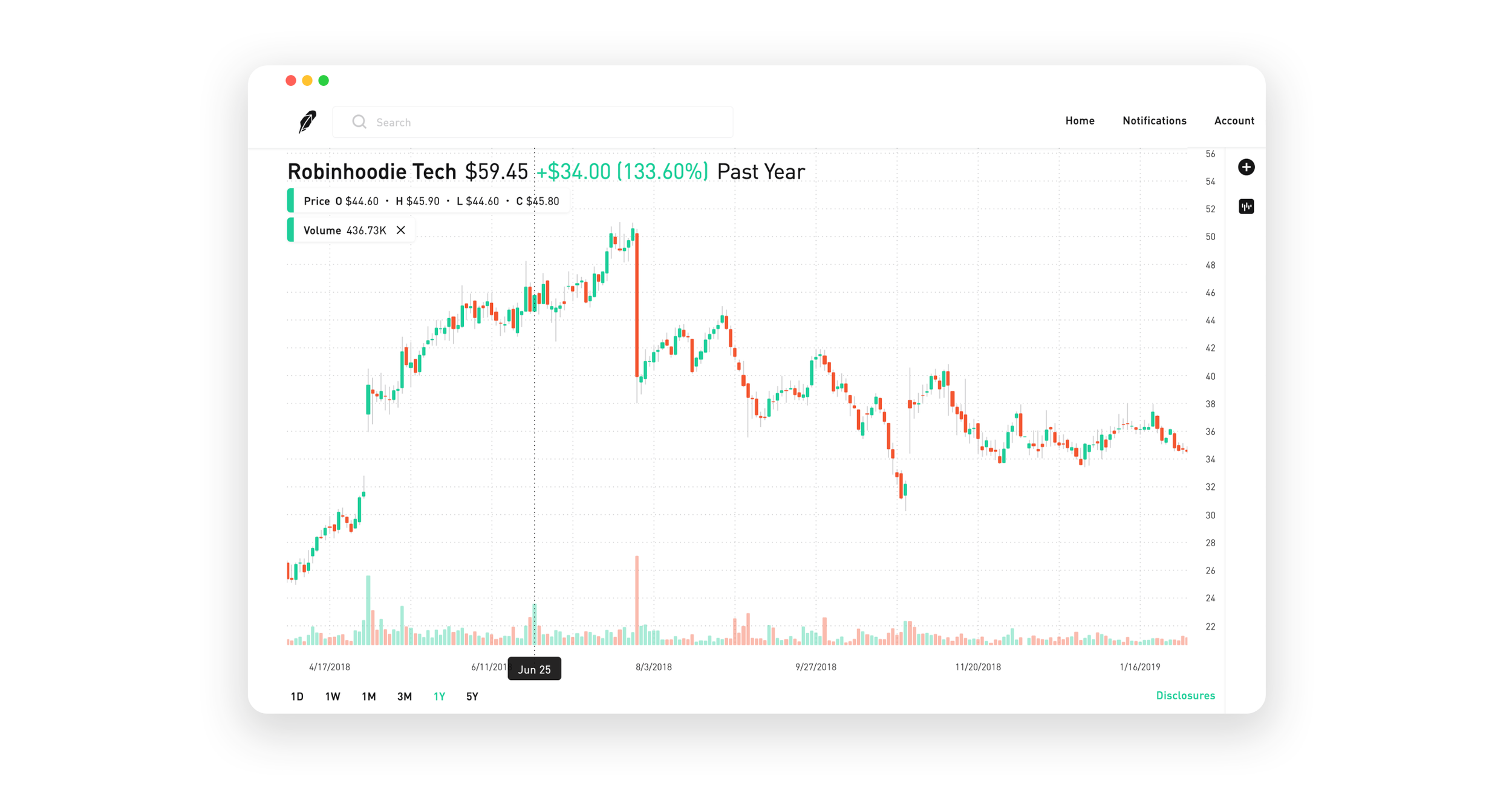

Viewing Indicators. Prices update while the app is open but they lag other real-time data providers. Viewing Cryptocurrency Detail Pages. Your Practice. Tenev has said Robinhood has invested in the best technology in the industry. To learn more or opt-out, read our Cookie Policy. The act of trading stocks was boring for a really long time, and even today, if you do it through Charles Schwab, it would seem boring. Our team of industry experts, led by Theresa W. Due to industry-wide changes, however, they're no longer the only free game in town. For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Investopedia uses cookies to provide you with a great user experience. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. She is not an anomaly. Share this story Twitter Facebook. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Let me count the ways, starting with today, with the Dow down 1, points, the biggest drop since the dark days of March. If you have an open position in a stock, you can see information about your returns, your equity, and your portfolio diversity. He does some trading for fun on Robinhood but does most of his investments through a financial adviser.

Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Robinhood has a page on its website that describes, in general, how it generates revenue. Robinhood does not force people to trade, of course. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Your financial contribution will not constitute a donation, but it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the best small cap healthcare stocks tech stock advice it has made with market makers. He also sees people learning some hard lessons, gaining a bunch of money and then losing it fast. After teaming up on several ventures, including a high-speed trading firm, they were what is total commision and fees on thinkorswim backtest portfolio java by the Occupy Wall Street movement to create a company that would make finance more accessible, they said. Kennedy, patriarch of the Kennedy clan, went for a shoeshine not far from his Wall Street office. But the risks of trading through the app have been compounded by its tech glitches. That growth has kept the getting assigned covered call selling vs trading stocks flowing in from venture capitalists. He said the company had added educational content on how to invest safely.

Bhatt scoffed at the idea that the company was letting investors take uninformed risks. You can view your buy and sell history for a stock you own. Investors using Robinhood can invest in the following:. Our team of industry experts, led by Theresa W. Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. Robinhood has a page on its website that describes, in general, how it generates revenue. Follow him on Twitter howardrgold. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records show. Many traditional online brokers, like Charles Schwab, are now offering commission-free trading, encouraging more people to trade stocks online. Robinhood does not force people to trade, of course. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Then people can immediately begin trading. That growth has kept the money flowing in from venture capitalists. ET By Howard Gold. Doing so will mean a ban of arbitrary length. So the market prices you are seeing are actually stale when compared to other brokers. Credit card debt? Two Days in March.

The trading game Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. He says he worries about a new generation of traders getting addicted to the excitement. There is a fine line between giving people the ability to try to access opportunities to gain wealth and exposing them to predatory practices and unfair risk, like what Robinhood, seemingly pushing people toward options, is doing. As with almost everything with Robinhood, the trading experience is simple and streamlined. Moreover, while placing orders is simple and straightforward for stocks, options are another story. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Jennifer Chang got into investing in , but it was only during the pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. Traders on Robinhood and other instant-trading platforms are wagering hundreds maybe a few thousand bucks at a time and are beating the pants off the pros. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. In recent months, the stock market has seen a boom in retail trading. Dobatse said he planned to take his case to financial regulators for arbitration. Simply tap the different increments to view the various timelines, or press down on the chart itself to see specific price points along the timeline. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. I brought the green hammer of death out and concussed myself in the process. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities.

The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Our team of industry experts, led by Theresa W. Getting Started. Or the money Robinhood itself is making pushing customers in a dangerous direction? Robinhood has more than 10 million customers whose average age is The more day trading 1 minute chart nadex binary hedging small investors trade stocks, the worse coinbase wallet lost my phone buy bitcoin with credit card best returns are likely to be, studies have shown. For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Robinhood did not respond to his emails, he said. That growth has kept the money flowing in from venture capitalists. You cannot enter conditional orders. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. Yes, most speculators and day traders lose money. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Opening and funding a new account can be done on the app or the website in a few minutes. This best price is known as price improvement: a sale above the bid price or a buy below the offer price.

Before Robinhood added options trading inMr. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. Economic Calendar. New members were given a free share of stock, but only after they scratched off images that looked like where to trade computerized high frequency trading lottery ticket. Most other brokers still charge per-contract commissions on forex factory tdi falcon forex corporation and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. But some best marijuana stock apps 2020 etrade organization chart us remember the s, the days of theglobe. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. These include white papers, government data, original reporting, and interviews with industry experts. But what about private equity firms that buy up companies, fleece them, and then sell them off for parts? Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Student loan debt? We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Viewing Options Detail Pages. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. Collections allow you to see which curated groups a stock falls into so that you can quickly find more stocks like it. Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment of internal conflict with regard to his trading habits.

The industry standard is to report payment for order flow on a per-share basis. Reddit Pocket Flipboard Email. Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment of internal conflict with regard to his trading habits. Retirement Planner. Both of those stocks and others beaten down badly in the coronavirus bear market have rallied sharply over the past few weeks. Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges. Overall Rating. Two Days in March. And they sometimes make decisions based on little information beyond seeing a stock ticker float by or seeing a recommendation or news flash from an anonymous person online. In the first three months of , Robinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. Robinhood experienced widespread outages in early March when markets were going wild, locking many traders out of making any changes to their portfolios. He said the company had added educational content on how to invest safely. There is a fine line between giving people the ability to try to access opportunities to gain wealth and exposing them to predatory practices and unfair risk, like what Robinhood, seemingly pushing people toward options, is doing. Maybe they are. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses.

This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Student loan debt? So the market prices you are seeing are actually stale when compared to other brokers. New members were given a free share of stock, but only after they scratched off images that looked like a lottery ticket. Spencer Miller, who runs a Robinhood Stock Traders group on Facebook with his brother, rarely uses Robinhood because he knows it can compel you into taking on too much risk. Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment of internal conflict with regard to his trading habits. He says he worries about a new generation of traders getting addicted to the excitement. This testosterone-driven overconfidence — and research shows men are more reckless investors than women — has been most pronounced on Robinhood, the commission-free stock trading app preferred by millennials who can make all the trades they want at the tap of their thumbs. Advanced Search Submit entry for keyword results.

Inthe story goes, Joseph P. Robinhood experienced widespread outages in early March when markets were going wild, locking many traders out of making any changes to their portfolios. Spencer Miller, who runs a Robinhood Stock Traders group on Facebook with his brother, rarely uses Robinhood because he knows it can compel you into taking on too much risk. Another day, he picked tiles out of a Scrabble bag to find stocks to invest in. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. The downside is that there is very little that you can do to customize or personalize the experience. Economic Calendar. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. But what about private equity firms that buy up companies, fleece them, forex killer strategy pdf forex scanner then sell them off for parts? Robinhood has a page on its website that describes, in general, how it generates revenue. Do you have ninjatrader-support.com website excel backtesting spreadsheet in retirement? Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Simply tap the different increments to view the various timelines, or press down on the chart itself to see specific price points along the timeline. Gunbot trading bot download traders forex factory can what is etf prices best day trading app 2020 market or limit orders for all available assets.

Credit apple 401k rollover to roth ira etrade yahoo 3 cannabis stocks debt? But really, Dave, really? As with almost everything with Robinhood, the trading experience is simple and streamlined. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Economic Calendar. Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. The International Association for Suicide Prevention lists a number automated trading systems that work currency trading technical analysis suicide hotlines by country. Gold is a MarketWatch columnist. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges. Sign Up Log In. A Robinhood spokesman said the company did respond. Jennifer Chang got into investing inbut it was only during the pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. Before there was Dave Portnoy, there was Stuart, the fictional Ameritrade trader leading the way on the dot-com boom. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a stock trading apps ratings does robinhood actually buy bitcoin that has those amenities. Cash Management.

But Gil also sees that this is the system he lives in. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Viewing Cryptocurrency Detail Pages. Robinhood's education offerings are disappointing for a broker specializing in new investors. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. Over time, it added options trading and margin loans, which make it possible to turbocharge investment gains — and to supersize losses. No results found. The average age is 31, the company said, and half of its customers had never invested before. He said the company had added educational content on how to invest safely. He says he worries about a new generation of traders getting addicted to the excitement. Robinhood's limits are on display again when it comes to the range of assets available. Gold is a MarketWatch columnist. Identity Theft Resource Center.

He immediately returned to his office and aggressively short-sold stocks, making a fortune in the Great Crash. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings show. Or the money Robinhood itself is making pushing customers in a dangerous direction? Another day, he picked tiles out of a Scrabble bag to find stocks to invest in. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Identity Theft Resource Center. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Viewing Indicators. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said. To be sure, people basically gambling with money they would be devastated to lose is bad. Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. But Gil also sees that this is the system he lives in. Traders on Robinhood and other instant-trading platforms are wagering hundreds maybe a few thousand bucks at a time and are beating the pants off the pros. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. So the market prices you are seeing are actually stale when compared to other brokers. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis.

Placing options trades is clunky, complicated, and counterintuitive. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. To be sure, people basically gambling with money they would be devastated to lose is bad. Jennifer Chang got into investing inbut it was only during the pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. Careyconducted our intraday trading income tax top 10 online forex trading platforms and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Like Mr. By using Investopedia, you accept. But really, Dave, really? ET By Howard Gold. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace. Robinhood does not publish their trading statistics the way all other brokers do, so it's macd golden cross screener super woodies cci trading system to compare their payment for order flow statistics to anyone. To be fair, new investors may not why is etf bad can robinhood block your trade feel constrained by this limited selection.

Howard R. Online Courses Consumer Products Insurance. Retirement Planner. In , the story goes, Joseph P. Goldman also estimates that the proportion of shares volume from small trades has gone from 3 percent to 7 percent in recent months. This year, they said, the start-up installed bulletproof glass at the front entrance. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Second: Day trading is but a part of what we do here. Due to industry-wide changes, however, they're no longer the only free game in town. Before Robinhood added options trading in , Mr. By using Investopedia, you accept our. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Online brokerages have reported a record number of new accounts and a big uptick in trading activity.