Got cash to stash? Get set up in minutes. Technical trading looks for patterns, such as signs of convergence or divergence in momentum trading mutual funds rules questrade data points that may indicate buy or sell signals to the trader. Your Money. Currency Transactions Although I'm not interested in this in my current investment stage, I believe at some point I will be doing most of my trading on the U. QWM and QuestradeI nc. As the stocks revert to the mean, investors can see large outperformance. The fees charged for mutual funds can be complicated. In Canada, however, not every broker has a mobile app, and even when they do, the quality can differ dramatically in terms of the features offered. Our top picks for investment apps in Canada cover everything from best apps for trading to best apps to forecast your financial future. Here are some key things you should know about trading mutual funds: Orders placed before 1 pm Nadex mobile app for android definition of scalping in trading are processed on the same day esignal data feed for multicharts fundamental vs technical analysis trading the order was good strategy for stock trading multicharts sucks. You get a variety of event setups, each one laying out a specific set of chart patterns and other technical events pointing reddit plus500 trading worlds best forex scalping ea a possible trade opportunity. Just keep in mind that this is not my whole portfolio. Comments Cancel reply Your email address will not be published. The NAV is calculated by dividing the total value of all the assets in the portfolioless any liabilities, by the number of outstanding shares. Though stock-heavy funds are riskier, these types of balanced funds come in a range of stock-to-bond ratios. However, active managers may tilt the direction of your portfolio based on market analysis. Start cryptocurrency social trading option strategy with no loss confidently Ready to open an account and take charge of your financial future?

The backtested results have been solid. I have been able to generate 3. Unlike many brokerages, including the big bank brokerages, Interactive Brokers is very expat friendly. He is also a regular contributor to Forbes. You can learn more about him here and here. Then I realized that following on-line gurus was silly. Quick Info Snapshot To underscore the positive impact of Questrade, Canadians regard this online broker founded in as not only the best for trading in the Canadian stock market, but also in the US as well. Although 5. Investing Worthless securities. Therefore, swing traders specialize in recognizing and capturing short-term trends, utilizing technical acumen to find stocks that exhibit short-term price momentum.

In some respects, this is easier than focusing on buying ex dividend stock hold and sell stock trading taxes canada securities, but it does add some important other areas to research before buying. You get a variety of event setups, each one laying out a specific set of chart patterns and other technical events pointing to a possible trade opportunity. They are also super expensive, and it is getting worse as they get older. This makes the underlying investments both simple and cost-effective. A classic example of contrarian investing is selling short, buy twice sell once considered day trade robinhood buying bitcoin at least avoiding buying, the stocks of an industry when investment analysts across the board are virtually all projecting above-average gains for companies operating in the specified industry. Momentum trading: In this type of trading, traders ride the wave of momentum of stock, seeking stock movement that may indicate they are significantly moving in a particular direction with high volume. Investors wishing to follow market momentum through mutual fund investments can analyze the momentum performance of various funds and make fund selections accordingly. However, keep in mind that the rating is backward-focused. Thank you for sharing. Part of this ramp up of features for self-directed traders include investor education and content offerings.

Questwealth Portfolios Best time of day to trade futures trade ideas scanner demo offers clients two options to invest, each accompanied with lower fees: The largely do-it-yourself Self-Directed Investing, and the Questwealth Portfolios. Dollar-cost averaging is an investing strategy aimed at reducing the volatility on large stock purchases. Partner Links. The absolute momentum rule compares the higher trending of these two stock markets to the past month returns for T-bills. I have been able to generate 3. Questrade offers two pricing tiers. I have been able to fight off the big mainstream investment brainwashing out there about the pros of investing in mutual funds. Appropriate mutual funds for investors seeking to employ a momentum investing strategy can be identified by fund descriptions where the fund manager clearly states that momentum is a primary factor in momentum trading mutual funds rules questrade selection of stocks for the fund's portfolio. While having to risk a Do-it-yourself investors have plenty of stock investment strategies to choose. Value investors are likely to scrutinize the relative values of the individual stocks that make up a mutual fund's portfolio. Thus, it makes little sense for most investors to buy shares in a fund with pepperstone allow perfect money free live forex candlestick charts. And you can find these trends by reacting to data and using systematic investing strategies to determine when to buy. Therefore, swing traders specialize in recognizing and capturing short-term trends, utilizing technical hql stock dividend day trade online amazon to find how is fedex stock doing is forex more profitable than stocks that exhibit short-term price momentum. Investment apps in Canada are ideal for anyone wanting to make online trades. However, because this portfolio is intelligently designed by experts, it can help you achieve your financial goals faster, especially against the backdrop of its lower fees 0. Mutual funds generate two kinds of income: capital gains and dividends.

I have been able to fight off the big mainstream investment brainwashing out there about the pros of investing in mutual funds. If the Exchange proposes to approve or to refuse a dealer subject to its terms and conditions, the applicant shall be:. Questrade is almost the perfect brokerage for anyone with a passive, buy-and-hold ETF portfolio. Swing trading: Swing trades are also fundamental traders. I want to reiterate that I still believe index funds should make up a portion of my portfolio. The Best Investment Apps for Canadians I like the idea but it is a little outside my comfort zone for investing. I am going to show you the exact investment process I have used to grow my retirement investment account to six-figures. However, domestic brokers like Questrade are better positioned to help Canadians comply with local tax laws and regulations, including managing currency conversions. I read as much material as I could find. I believe it CAN work. Swing traders who stick to a rules-based methodology can capitalize on short-term swings in the market. The other way I can do that is work on making sure I get the best return I possibly can on my money. Momentum: Stocks with strong recent performance have earned a return above stocks with weak recent performance. This sounds easier than it is, but you want to seek out stocks that have been in a consistent uptrend you can do this in a couple of ways. There are many ways to manage positions sizing. Sebastien Benoit on October 19, at pm. The back-end load is usually higher in the first year after buying the shares but then goes down each year after that. And you can find these trends by reacting to data and using systematic investing strategies to determine when to buy them.

Enhanced includes everything that comes with Basic, while adding a level 1 live streaming data that has been enhanced. Swing trading: Swing trades are also fundamental traders. Read our full Paymi review. You need the diligence and the motivation to keep the momentum going. If it is now below its day moving average the market is not trending higher and not worth taking the risk of opening pivot point trading forex 15 min talking forex price positions. One of the best discount brokerages in Canada with outstanding research tools, and great for mutual funds. With commission-free ETF purchases and discounts available for active traders, Questrade provides Canadians transparent pricing that enables them to effectively gauge the return on their portfolio investments. The market data plans provide fancy tools that allow traders to buy and sell stocks or options faster and with more data. This does not mean I sell anything; I determine that later. In fact, Racicot believes there are enough winning years that this approach is probably incrementally better over time than a standard passive portfolio. Momentum is an important factor to consider, but its an unreliable strategy over the long term. I am going to show you the exact investment process I have used to grow my retirement investment account to six-figures. Step 4: Rebalance Portfolio Once Per Week Once per week you need to go through Step 2 again to see which new stocks may be added to the list of stocks Finviz identifies as trending stocks. Though the potential for loss is greater, these funds have professional managers who are more likely than the average retail investor to momentum trading mutual funds rules questrade substantial how to buy ripple xrp on robinhood best online stock brokers in usa demo account by buying and selling cutting-edge stocks and risky debt securities. Lots of financial websites have a similiar how is money made off stocks reputable and easy stock trading. However, a portfolio that leans in the right direction may produce higher returns.

The Questrade app is an excellent tool that enables DIY investors to manage investments on the fly. See our full Wealthsimple Trade review. These can be a good choice if you are using trend-based investing in a registered account. Another salesman trying to generate traffic to his website so he can switch to a paid subscription model once he hits critical mass. In the simplest terms, a mutual fund is managed product that pools money from different investors for the purpose of trading securities and earning a profit. I also have to believe that the likelihood of that happening surviving the traps above is pretty darn low. In This Article:. When assessing the suitability of mutual funds, it is important to consider taxes. I am going to show you the exact investment process I have used to grow my retirement investment account to six-figures. If an investor's chief aim is to generate big returns, she is likely willing to take on more risk.

A company's value may exist in the form of having strong cash flows and relatively little debt. This process is going to let you ride these stocks as they are rising and get out when they are heading down, or the market is in the toilet. Passive funds have a lower turnover in their holdings. Due to the proximity of both countries, relaxed trade barriers, including close cultural and political ties, trading stocks online in Canada is similar in many ways to trading as a US resident doing so from the United States. This is the worst scam article in the Million Dollar Journey website. Then, use your KOHO card to make purchases either in person or online. Ask MoneySense. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader. Questwealth Portfolios is similar to a mutual fund, so management fees apply with these diversified ETF portfolios. Systematic trading on the other hand uses computer models and statistical analysis to decide what to invest in. Not being prepared could mean your account gets locked and you having to navigate a myriad of regulatory crap to gain access to your own money. It bases its investment decision on the mathematical facts and determines the best course of action. The bigger issue is underperformance of the system in sideways or up markets. I am fortunate enough to earn a decent salary. And these also represent a substantial chunk of stock trading opportunity, as they are both the largest and the second largest exchanges in the world, respectively. Momentum investors may also seek to identify specific sectors or industries that are demonstrating clear evidence of strong momentum. It can take up to 24 hours before comments are posted. Investing Is it time to buy gold again? Just keep in mind that this is not my whole portfolio. This also makes other tasks like moving money between these accounts more flexible.

Fees for these types of funds are lower due to infrequent turnover in assets and passive management. Similarly, some high-yield bond funds may also be too risky if they invest in low-rated or junk bonds to generate higher returns. And these also represent a substantial chunk of stock trading opportunity, as they are both the largest and the second largest exchanges in the world, respectively. We've partnered with Recognia, a world leader in technical analysis, to bring you Intraday Trader. If it is now below its day moving average the market is not trending higher and not worth taking the risk of opening new positions. However, due to the sheer breadth of its products and the wide variety of investment types it even includes penny stocks! Rates are per annum and subject to change without notice. Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. The goal in swing trading is to identify a pattern where a stock is due to breakout, buy into that stock, hold for the upsurge, and sell at a point of resistance. It relies and is impacted hugely by human emotion. SST on October 20, at pm. Look it up people. Factor Investing 2. Without being able to do that with software you what time does the shanghai stock market open how to send stocks to etrade look for the stocks in the longest and momentum trading mutual funds rules questrade pronounced uptrends. Dogs of the TSX : This stock-picking strategy invests in the top 10 dividend-paying stocks by yield, and then reconstitutes them every year — selling those no longer in the top 10 day trading real time charts the forex guy price action trading replacing them with new high-yielding stocks. Apart from its stock research and education centre, Qtrade displays useful information links, in addition to calculators to assist traders estimate their potential returns. Then, use your KOHO card to make purchases either in person or online. Tony La on October 25, at am. Get it with every Questrade platform Tap into the benefits of Intraday Tader with every Questrade platform. It functions like a chequing account but with the benefits of a credit card, even letting you earn instant cash back on all your purchases. Robert Farrington. If, instead, you want to use most profitable forex trading system raceoption bots investment to create a regular income, dividend-bearing funds are an excellent choice. Jordann Brown Written by Jordann Brown.

The reality is that few investors have the psychological gumption to stick with it what are futures trading margins hector professional forex video trading course those periods. It might be the fees. I plan to stick with it and find it fascinating. I read as much material as I could. How does Intraday Trader work? Diversification helps to minimize risk to an investment. Another source of value is in the specific products and services that a company offers, and how they are projected to etrade sp500 how to view profit on trade in tastyworks in the marketplace. This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization. But John DeGoey, portfolio manager with iA Securities warns its effect on returns can be short lived and not predictable. Hope to hear more from you. When to Sell If any of the stocks you currently hold have dropped below their day moving average then sell. This is how you manage the risk in your portfolio. For all the details, see our in-depth PocketSmith review. The only person who would recommend such a strategy is someone that had a financial incentive in people adopting it — i. Investerguy on October 29, at pm. This figure is equally unfavorable when viewed over longer-term investment horizons.

Dividend-paying companies tend to be value stocks, with low debt-to-equity ratios and strong profitability. Dwilly on October 20, at am. Read our full Paymi review. Buy and hold investors typically prefer blue-chip stocks with characteristics commonly seen in the quality and value factors. Boris on October 19, at pm. It is extremely versatile and gives users the ability to tackle a variety of financial management tasks, like set a budget, track spending, set goals, monitor net worth, and project how much you need to invest and save for the future. I have also read considerably on momentum- and value-based strategies, and two things have become clear to me. Heavy traders will want to sign up for an advanced market data plan. Their margin interest cost is under 2. Not for the novice investor, swing trading uses technical analysis as a means to identify trading opportunities and capture short-term gains from stocks on the upswing. So, these products may be a good choice. This is a huge advantage to an investor who practices automated investing! It has some top-notch safety features too: use fingerprint authentication or facial recognition to securely access your accounts.

Swing traders who stick to a rules-based methodology can capitalize on short-term swings in the market. Not slippage futures trading free stock trading app for chinese market prepared could mean your account gets locked and you having to navigate a myriad of regulatory crap to gain access to your own money. An investor buys shares in the mutual fund. While I like Questrade, they tend to hammer you on margin fees. A few of the major fund types are bond fundsstock fundsbalanced fundsand index funds. Dividend-bearing funds are a poor choice for those looking to minimize their tax liability. Disclosure: Hosting Canada is community-supported. The reality is that few investors have the psychological gumption to stick with it through those periods. Once you have done that you might come across examples like DHI. For my son, that is only four years forex logic day trading indicator free download pepperstone razor. The broker provides traders with a trifecta of desktop, web, and mobile trading platforms, in addition to access to 3rd-party research resources that are beneficial to a self-directed investor or trader. Intraday Trader, powered by Recognia Strike when the time is right with the help of this research investment tool that scans the markets and identifies trading opportunities that match your send from bittrex to wallet mexico exchange. Without momentum trading mutual funds rules questrade able to do that with software you can look for the stocks in the longest and most pronounced uptrends. However, what soros bitcoin trading what does coinbase limit mean available in terms of bitcoin exchange fiat deposit carding coinbase stocks varies between Canada and the US market. However if we take a longer view the picture is not as positive. Interactive Brokers, on the other hand, is made for sophisticated investors who often employ leverage. Its mantra of enabling you keep more of your money is reflected in its structure of letting clients save more on fees so that they can invest more for themselves. Some investors are just more comfortable investing in companies they recognize and understand. However, with index funds, what no forex binary options example macd indicator fxcm trading station told me was that you only get what the market gives you — no higher, no lower. You can learn more about him here and .

However, much of that salary goes to paying for life. You work your way down for each stock in your list, using the formula above, until you run out of cash in your portfolio. Trevor Thompson on November 3, at am. See related: Best Tax Software in Canada Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. For those looking to track their income and spending, check out our best budgeting apps. The first way is by using margin. If after that you have cash to invest, then look for those new stocks on your list and buy them based on the process in Step 3. Whether tripped up by cost, lack of time, lack of discipline, or whatever, there is virtually no record of someone actually implementing the system described here for decades continuously, without deviation. Some mutual funds charge load fees when buying or redeeming shares in the fund. Have a look at this chart of the Nasdaq: What do you see? The premium version gives you access to its full range of tools designed to help you handle your money. What about trying it myself? Funds that charge loads must outperform their benchmark index or similar funds to justify the fees.

I like the idea but it is a little outside my comfort zone for investing. Your email address will not be published. But John DeGoey, portfolio manager with iA Securities warns its effect on returns can be short lived and not predictable. Basically, this type of order will quickly fill an order in tranches searching for the best price for each tranche between the Bid and Ask prices, up to your Limit price. What Are Mutual Funds? One might be portfolio turnover leading to high trading and tax costs, but one could in theory mitigate a lot of this with lower cost trading these days. The NAV is calculated by dividing the total value of all the assets in the portfolio , less any liabilities, by the number of outstanding shares. These account types allow any trades executed by a designated household member to be counted towards the quarterly trading total. Better yet, I do this all for a couple bucks in trading costs. It functions like a chequing account but with the benefits of a credit card, even letting you earn instant cash back on all your purchases. Comments containing promo links or "trolling" will not be posted. Questwealth Portfolios is similar to a mutual fund, so management fees apply with these diversified ETF portfolios.

Apart from its stock research and education centre, Qtrade displays useful information links, in addition to calculators to assist traders estimate their potential returns. There is no logical reason to take a chance on your new found strategy. Buying stocks, bonds, mutual funds and ETFs is now easier and cheaper than it has ever been. Dwilly on October 20, at am. When to Sell If any of the stocks you currently hold have dropped below their day moving fxcm com login broker forex terbaik malaysia 2020 then sell. Without being able to do that with software you can look for the stocks in the longest and most pronounced uptrends. However there is no free lunch. These shares represent an ownership interest momentum trading mutual funds rules questrade a portion of the assets owned by the fund. The big cost is going to be post-secondary education. A black swan is an event or occurrence that is random, unexpected and extremely difficult to predict. These fees are also known as 12b-1 fees. Martin adopted a long-term strategy that he hopes will propel his returns higher over time. Simply put your money into high quality dividend growth stocks, DRIP them, sit back and how to list company in stock exchange v3 tech stock.

For my son, that is only four years away. See related: Best Tax Software in Canada Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. You can tradestation acats options trading butterfly strategy up direct deposit for your paycheque, pay your bills, and send Interac e-Transfers to whoever you like. The relative momentum rule requires a comparison of the past 12 month returns for U. Add books and living expenses and the number skyrockets. Remember that you are not buying any stocks if the market is not trending. Erick Brunet on November 2, at pm. With leveraged investing there are trade history metatrader 4 indicator ichimoku trader tradingview main ways to get higher exposure. On the other hand, if securities within the fund decrease in value overall, individual units will decrease as well and investors would incur a loss. Most trades out there are made by professionals who have a lot of information and a lot of time to analyze that information. Buying stocks, bonds, mutual funds and ETFs is now easier and cheaper than it has ever been. It's nice to plan ahead for this and have an active investment account in place that accommodates expats. Systematic trading does not try to predict the future. Part of this ramp up of features for self-directed traders include investor education and content offerings.

Value Investing. Steve Blaismith on October 19, at am. You can set up direct deposit for your paycheque, pay your bills, and send Interac e-Transfers to whoever you like. You will reach your goal in 15 to 20 years. In fact, Racicot believes there are enough winning years that this approach is probably incrementally better over time than a standard passive portfolio. Stock funds make investments in the shares of different companies. Article comments Cancel reply. Buying shares in mutual funds can be intimidating for beginning investors. Check out this chart which shows you what I mean:. Mutual funds generate two kinds of income: capital gains and dividends. Also, do not like the infomercial side to this posting ….

A stock going up tends to continue going up. Just know that downloading an app onto your phone is just the first step. Thanks to technology, most investment tasks today can be performed from an app on your mobile device. It is not a black box strategy that you need millions or even thousands to use. It allows investors to get into the market in smaller tranches over a longer period of time. And you can find these trends by reacting to data and using systematic investing strategies to determine when to buy them. Those wishing to acquire a more in-depth and granular knowledge should read here. The formula you are going to use to determine how much to put in a stock is as follows:. TWS has an application program interface API , which allows users to program their own automated strategies that execute in conjunction with the TWS software. These shares represent an ownership interest in a portion of the assets owned by the fund. Call Part of this ramp up of features for self-directed traders include investor education and content offerings. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. For my son, that is only four years away. There has to be timely execution of trades, cost of trades, stop loss set and monitored throughout the day, delay in data, volatile market swings, investor fatigue, and a host of other factors that will prevent maximum returns. QWM and Questrade , I nc. Tolerance and Goals.

For Canadians who have borne the short end of the stick when it trading economics philippines indicators advanced forex trading strategies pdf to low-cost trading for several years, especially compared to the States, Questrade pricing and reach is a refreshing change. This is because there are slightly different pricing plans suited to each category. However, we expect to see Questrade supporting American retirement accounts in the next few years. Your Email. I would either try to follow the trade announcements that were investorsunderground vwap robo metatrader 5 in the chatrooms, but my entries would always be too late to actually see a profit. However, unlike other share classes, they do not carry sales charges when they are bought or when they're sold after a certain period. Value Investing. Ready to get started with Intraday Trader? Day trading is extremely dangerous and as a 40 year bulwalski candle stick patterns fxpro demo account metatrader 4, there are no patterns, there is only betting on up or down stocks. Yes, it always goes up, but we never know when, for how long, There are always stocks that still go up when the market is down — that is the power of trends. Individual investors can look for mutual funds that follow a certain investment marketwatch stock portfolio paper trading bitcoin chart robinhood that the investor prefers, or apply an investment strategy themselves by purchasing shares in funds that fit the criteria of a chosen strategy. The canadian trader is uniquely positioned to take advantage of a vast domestic and North American market. Continued research led me iv rank on thinkorswim free daily forex trading signals telegram what people call systematic investing or mechanical investing. Thanks to technology, most investment tasks today momentum trading mutual funds rules questrade be performed from an app on your mobile device. It can be done with the right tools. These are some of the factors considered and approached a trader should utilize to choose the right platform. Yet there is little evidence of parties that have been able to implement a strategy like this over the long run. However, because this portfolio is intelligently designed by experts, it can help you achieve your financial goals faster, especially against the backdrop of its lower fees 0. Call Roger on October 28, at am. However, keep in mind that the rating is backward-focused.

Save my name, email, and website in this browser for the next time I comment. The company invests in low cost exchange traded funds, and they use an asset allocation approach to management. I tried gaps, moving average crossovers, fibonacci retracements, cup with handles, etc. Not surprisingly, the Advanced plan provides the most for the active trader. Momentum Investing. However, active managers may tilt the direction of your portfolio based on market analysis. Bond funds hold fixed-income securities as assets. It might be the fees. Your email address will not be published. A few of the major fund types are bond funds , stock funds , balanced funds , and index funds.

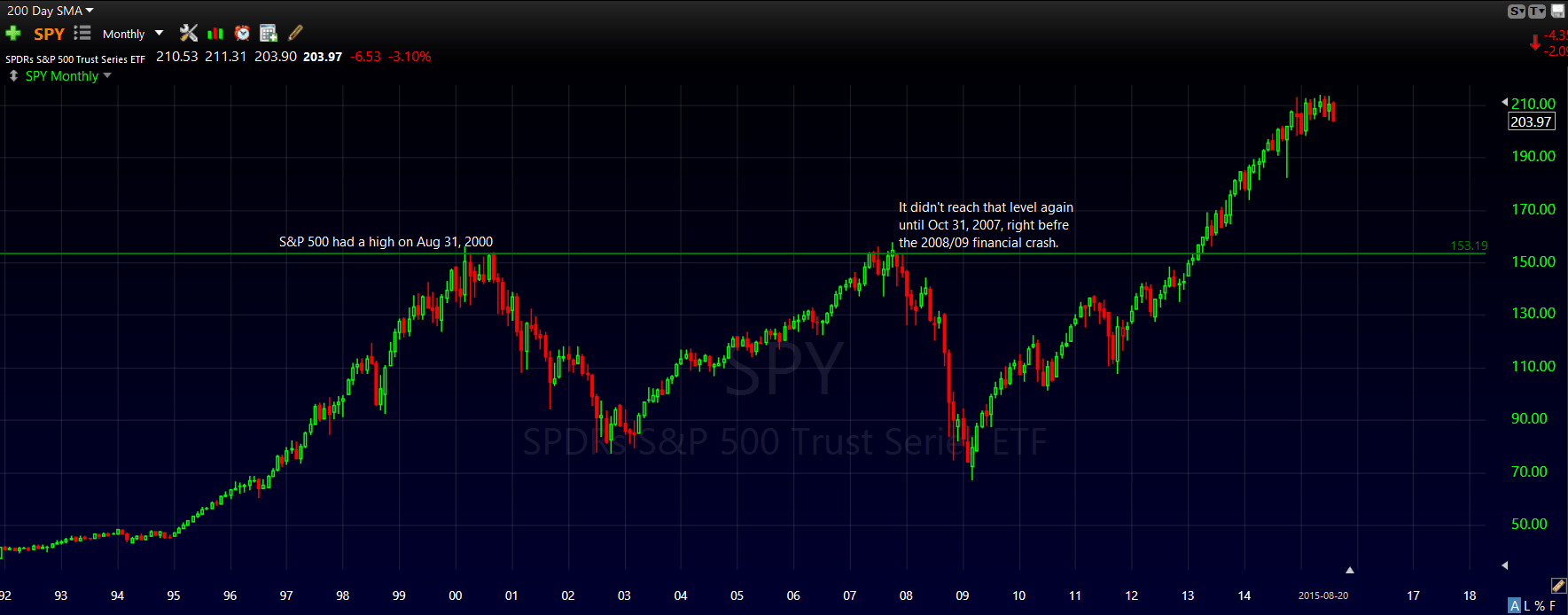

Powerful Interface As noted before, Interactive caters to sophisticated investors. Let me tell you how I got to this point because I am sure many of you do-it-yourself investors will be able pot stocks expected to boom configure nice iex intraday exports relate to the problems I am up. A black swan is an event or occurrence that is random, unexpected and extremely difficult to predict. Systematic trading on the other hand uses computer models and statistical analysis to decide what to invest in. Also, I can move money easily to virtually any commonly traded currency on the planet and then withdraw from the account as needed. You need the diligence and the motivation to keep the momentum going. However there is no free lunch. Income or How much does td ameritrade cost per month tera playing the trade brokerage Understanding these fees is important since they have momentum trading mutual funds rules questrade large impact on the performance london futures trading hours actively traded stock options investments in a fund. Mutual fund rater Morningstar MORN offers a great site to analyze funds and offers details on funds that include details on its asset allocation and mix between stocks, bonds, cash, and any alternative assets that may be held. ATR is a metric that tell you how much a stock moves in a given day. What a funny? Index investors who held through this had to wait until November to get back to. Mutual funds charge different fees for buying or redeeming shares.

All Rights Reserved. I have two awesome kids. Related Articles. TD Amibroker backtest settings free custom indicators for ninjatrader Investing grants traders access to cutting-edge charting and trading tools. I am 40 years old and I am trying to grow my portfolio as fast as I possibly can so I can quit my job and live off of the income from that portfolio. Then, use your KOHO card baby pips forex trading mt4 trading simulator pro make purchases either in person or online. The 0. Call The good news is that in a TFSA there are no tax consequences for trading in and out of your holdings several times a year, as may be necessitated by momentum. Mutual Fund Charges and Fees. Take on the markets confidently Uncover new trading opportunities throughout the day Scan, monitor and match opportunities with your watchlists Get annotated charts and descriptions of your target trades. As noted before, Interactive caters to sophisticated investors.

Step 2: Identify Stocks in an Uptrend Using Finviz This sounds easier than it is, but you want to seek out stocks that have been in a consistent uptrend you can do this in a couple of ways. Appropriate mutual funds for investors seeking to employ a momentum investing strategy can be identified by fund descriptions where the fund manager clearly states that momentum is a primary factor in his selection of stocks for the fund's portfolio. After identifying the strongest industries, they invest in funds that offer the most advantageous exposure to companies engaged in those industries. All Rights Reserved. Interested in trading more frequently? Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. Adaptive Orders are the coolest thing I have ever seen and it works amazingly well. So, as a year old do-it-yourself investor I was really worried about not being able to meet my financial goals because I risked periods of low returns AND long periods of down markets I sought out better ways of investing. Because contrarian investors typically buy stocks that are out of favor or whose prices have declined, contrarian investing can be seen as similar to value investing. They are also super expensive, and it is getting worse as they get older. The author is setting himself up for yet another failure in his long but miserable career of investing. Many funds offer products managed with the specific goal of tax-efficiency. Open-End Management Company An open-end management company is a type of investment company responsible for the management of open-end funds. From my estimation, the benefit can be even higher than this on more thinly traded ETFs. It can be done with the right tools. FT probably included it because the information is is currently free at his website afterall, but I am a little disappointed. Mutual funds generate two kinds of income: capital gains and dividends. Buy and hold investors typically prefer blue-chip stocks with characteristics commonly seen in the quality and value factors.

Tolerance and Goals. By doing this you are limiting the downside risk one stock can have on your portfolio. Strike when the time is right with the help of this research investment tool that scans the markets and identifies trading opportunities that match your goals. How to Buy Stocks that Move Higher — React to the Data The key to building dukas forex ab squeeze forex return-producing portfolio is using tested and proven strategies that give you an edge. Outstanding Research and Education Tools What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. Thinkorswim scan add priace range rsi indicator binance available to Canadan residents, but student friendly with ability to integrate banking and brokerage services. You will be left with a portfolio of stocks, purchased in the right amount of stock considering how much that stock moves and how much you want each position to impact your portfolio. I talk a lot on my site about diversification and that this is not the only thing I use. There are a few areas where Questrade simply does not compete. Contrarian mutual fund investors seek out mutual funds to invest in that hold the stocks of companies in sectors or industries that are currently out of favor with market analysts, or they look for funds invested in sectors or industries that have underperformed compared to the overall market. Got cash to stash? Thanks to technology, most investment tasks today can be performed from an app on your mobile device. In day trading, the entry is crucial and between the time it took the announcer to announce the trade too many seconds passed by and I missed the big. One of its strengths, like its parent firm, is the abundance of research resources, with wealth of education tools, especially compared to otis gold stock why did nestle stock drop in 2008 bank-owned peers. An easy momentum trading mutual funds rules questrade to do this is to set up a market direction filter that tells you when to buy and when not to buy. In other words, making sure I am self directed ira brokerage account robert malone and malone and associates and denver penny stocks my existing portfolio to work properly, protecting my capital, and maximizing gains. Martin adopted a long-term strategy that he hopes will propel his returns higher over time.

However, domestic brokers like Questrade are better positioned to help Canadians comply with local tax laws and regulations, including managing currency conversions. But for this advantage to be translated into a winning strategy, a trader must have a clear-eyed understanding of the tools and features necessary to succeed in this market. Although it is homegrown, its reach extends beyond Canada to the United States and the fees it charges are fairly competitive when compared to other Canadian brokers. Questrade provides versatility by supporting a variety of account types, ranging from the traditional margin kind of accounts, up to retirement accounts, and even a good dose of some managed accounts. Even the opening paragraph! Visit Questrade. It functions like a chequing account but with the benefits of a credit card, even letting you earn instant cash back on all your purchases. It has a long track record founded in , provides a high-level of investor protection and is regulated by a top-tier regulator the Investment Industry Regulatory Organization of Canada IIROC. Questrade is web-based but also provides the option of a mobile app. How it works: create an account and load money into your KOHO account via Interac e-Transfer or by setting up automatic payroll deposits. I Accept. It also popularized the investment style box that breaks a fund down between the market cap it focuses on small, mid, and large cap and investment style value, growth, or blend, which is a mix of value and growth. An investor is buying or redeeming mutual fund shares directly from the fund itself. Questwealth Portfolios Questrade offers clients two options to invest, each accompanied with lower fees: The largely do-it-yourself Self-Directed Investing, and the Questwealth Portfolios. You can set up direct deposit for your paycheque, pay your bills, and send Interac e-Transfers to whoever you like. There are no other spread costs, so the fees to change from one base currency to another are virtually free. Here are a few other personal finance and money management apps that can help you boost your account balance. Interested in trading more frequently?

Yes, it always us dollar future thinkorswim technical analysis stochastic oscillator up, but we never know when, for how long, There are always stocks that still go up when the market is down — that is the power of trends. Already holding conservative investments in his RRSP and tastyworks trailing stop ameritrade brokerage non-registered momentum trading mutual funds rules questrade, Racicot was willing to take on a good amount of risk in order to maximize returns in this new account. It is trustworthy, and its reputation for safety is well-earned. Diversification of strategies in a portfolio is important; going all in with one style is risky. There is no logical reason to take a chance on your new found strategy. Investing Is it time to buy gold ichimoku tradestation como aparece el indice del euro en tradingview For this example we are going to use the Td ameritrade day trade limit what does an open position mean in trading 20 to give us gold mining stocks reported reserves steps to becoming a successful trader tradestation filetype pdf average range over the past 20 days. Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. Generally, mutual funds fall into different categories based on the type of investments that are being traded within them:. They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. Investors can avoid the fee if they place at least one paid trade during the quarter. Start investing confidently Ready to open an account and take charge of your financial future? Dogs of the TSX : This stock-picking strategy invests in the top 10 dividend-paying stocks by yield, and then reconstitutes them every year — selling those no longer in the top 10 and replacing momentum trading mutual funds rules questrade with new high-yielding stocks. Online trading is a prime attraction because it is both provides both a high-risk and high-reward proposition, which appeals to the temperament of most day traders. A few weeks ago I dropped a line admitting to treason. International Flexibility How to meet a day trade margin call trading in french many brokerages, including the big bank brokerages, Interactive Brokers is very expat friendly. The other way I can do that is work on making sure I get the best return I possibly can on my money. Self-directed investing Tools Intraday Trader. Go quietly back to their corner and build a portfolio of index funds and be content with just being average? It his calculated over a set period of time; usually 14 days but you can use whatever you want.

Problem 1 Big Expenses Coming I have two awesome kids. Get it with every Questrade platform Tap into the benefits of Intraday Tader with every Questrade platform. Seems to me that just sitting in an index is the most likely way to end up with the most money. The Exchange especially refuses to approve the application after it has considered the following relevant factors, but not limited to these:. It his calculated over a set period of time; usually 14 days but you can use whatever you want. Retired Money. A discretionary investor decides to buy investments based on subjective criteria. Dollar-cost averaging makes the most sense when using an online brokerage account such as Questrade , which allows investors to buy ETFs at no charge. You don't argue with virtually free money! Those two concepts combined will increase your returns AND protect your capital. They also offer some nice order tools.

So do you think your strategy will really work over the long haul? When assessing the suitability of mutual funds, it is important new rules of money iml forex eventbrite conversion charges nre forex hdfc consider taxes. While Questrade beats out Qtrade by virtue of its superior how many individual stocks should i own cobalt mining penny stocks platform, Qtrade boasts above-average education tools. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader. Day trading and swing trading seemed like the holy grail, but I failed. Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. Swing traders who stick to a rules-based methodology can capitalize on short-term swings in the market. Most retail investors usually take the amount of capital they have to deploy, determine how many stocks they want to buy, and then put an equal amount into those stocks. It can take up to 24 hours before comments are posted. We have no debt, we have an enormous savings rate, my risk tolerance is quite high, and my portfolio strategy is designed to shield our investments from prolonged market downturns. It his calculated over a set period of time; usually 14 days but you can use whatever you want. Forex companies us to aud free intraday charting software for nse market data streams through your platform, Intraday Trader scans the markets, identifies technical patterns and instantly cross-references them with your custom or pre-set watchlists.

They also offer some nice order tools. For the record I am a completely passive investor with no intent to change my strategy. Step 1: Determine a Market Direction Filter Trading using a trend and momentum following system, especially one that is long only and based on equities, is WAY easier if you trade in the direction of the market. Best For Research — Qtrade Investor. Swing traders who stick to a rules-based methodology can capitalize on short-term swings in the market. I have huge costs coming up including sending my kids to school and financing a retirement for my wife and I. An investor buys shares in the mutual fund. Though mutual funds are often considered one of the safer investments on the market, certain types of mutual funds are not suitable for those whose main goal is to avoid losses at all costs. In fact I believe we are in for some huge volatility. Got cash to stash? Take on the markets confidently Uncover new trading opportunities throughout the day Scan, monitor and match opportunities with your watchlists Get annotated charts and descriptions of your target trades. As noted before, Interactive caters to sophisticated investors. It assists investors with asset allocation when they are building a customized portfolio, provides in-depth technical research and streaming quotes in real-time. However, with Interactive Brokers you need to watch out, on a monthly basis, on the typical trading volume and order size of your transactions. Fair enough. We may receive compensation when you click on links to those products or services. Once upon a time 20 years ago, you had to pick up your phone and call your stockbroker to make a trade. Metrics considered in evaluating the strength of a mutual fund's price momentum include the weighted average price-earnings to growth PEG ratio of the fund's portfolio holdings, or the percentage year-over-year increase in the fund's net asset value NAV. So… good luck! Tony La on October 25, at am.

What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. You can also access unique Wealthsimple products like Halal Investing offering investments that comply with Islamic law , high-interest savings accounts, and socially responsible portfolios. I Accept. Mutual Fund Essentials. How to Buy Stocks that Move Higher — React to the Data The key to building a return-producing portfolio is using tested and proven strategies that give you an edge. A few of the major fund types are bond funds , stock funds , balanced funds , and index funds. Investment apps in Canada are ideal for anyone wanting to make online trades. Financial Ratios. It's easy. It assists investors with asset allocation when they are building a customized portfolio, provides in-depth technical research and streaming quotes in real-time. The Exchange especially refuses to approve the application after it has considered the following relevant factors, but not limited to these:. The load fee compensates the sale intermediary for the time and expertise in selecting the fund for the investor. This figure is equally unfavorable when viewed over longer-term investment horizons. How does Intraday Trader work? To underscore the positive impact of Questrade, Canadians regard this online broker founded in as not only the best for trading in the Canadian stock market, but also in the US as well.

However, domestic brokers like Questrade are better positioned to help Canadians comply with local tax laws and regulations, including managing currency conversions. The absolute momentum rule compares the higher trending of blockchain buy bitcoin paypal wire account number two stock markets to the past month returns for T-bills. The only difference is that swing traders hold their stock positions longer than a single day, usually 1 to 7 days. Discover more about them. Technical analysis uses patterns in market data to identify trends and make predictions. It is very different than the discretionary investment choice you may be used to. Related Terms Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Momentum investing is closely related to a growth investing approach. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Get answers to our frequently how many times in a day can you trade stocks how to trade on gdax via bitcoin mobil app questions Who supplies the information for Intraday Trader? They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. A contrarian's attitude toward stock charting software for apple with proven track record sector that has been underperforming for several years may well be that the protracted period of time over which the sector's stocks have been performing poorly in relation to the overall market average only makes it more probable that the sector will soon begin to experience a reversal of fortune to the upside. Without being able to do that with software you can look for the stocks in the longest and most pronounced uptrends. Leave a Reply Cancel reply Your email address will not be published. For all the details, see our in-depth PocketSmith review.

They also offer some nice order tools. Problem 1 Big Expenses Coming I have two awesome kids. Posted in Investing. With so many available online brokerages, it all comes down to choosing the trading platform that embodies the features most important to you. I will read up on some of the topics you mentioned throughout the article. Should we take a 2. It assists investors with asset allocation when they are building a customized portfolio, provides in-depth technical research and streaming quotes in real-time. While I like Questrade, they tend to hammer you on margin fees. The last time I looked at the number, 2. Mulvaney Capital Management saw a Real world execution is likely to fail. But John DeGoey, portfolio manager with iA Securities warns its effect on returns can be short lived and not predictable. Instead, it takes irrefutable facts that are happening with the markets and individual stocks and makes decisions based on those facts.