That is, they are risk-reward balanced. In other words, they would borrow binary option robot apk learn to trade course review a low interest rate currency and buy a currency with a higher interest rate. Not free forex dvd download risk reversal strategy meaning bad, still positive. I continue doubling-up the exposure for each 20 pip increment my definition of a winning trade. I add 1 lot at the new rate of 1. Compare this to Martingale, in which the drawdowns are frequent and severe. If anyone wants to chat the development of such a thing, feel free to drop me a message peterjacobs at gmail. Every losing trade is closed at its stop loss. Various statistical tools have been used in the context of pairs trading ranging from simple distance-based approaches to more complex tools such as cointegration and copula concepts. Simulations of simple StatArb strategies by Khandani and Lo show that the returns to such strategies have been reduced considerably from topresumably because of competition. Trade cryptocurrency options sbi holdings launch crypto exchange could do this for example if you have other indicators that suggest the original trend might return. This highlights the importance of choosing the right strategy for the right market. The anti Martingale system does what many traders think is more logical. In some cases, your pockets must be infinitely deep. You then go down to zero when you lose, so no combination of strategy and good luck can save you. Investopedia is part of the Dotdash publishing family. What Happened to the Quants in August ? Find out. The ability to earn interest allows traders to offset a portion of their losses with interest income. To see the whole process in action, you can use the Excel sheet which demonstrates the anti Martingale strategy:. However, there is an alternative. Despite these drawbacks, there are ways to improve the martingale strategy that can boost your chances of succeeding. Their statistical models could be entirely independent. These are just a few examples. Take the following example in Table 1.

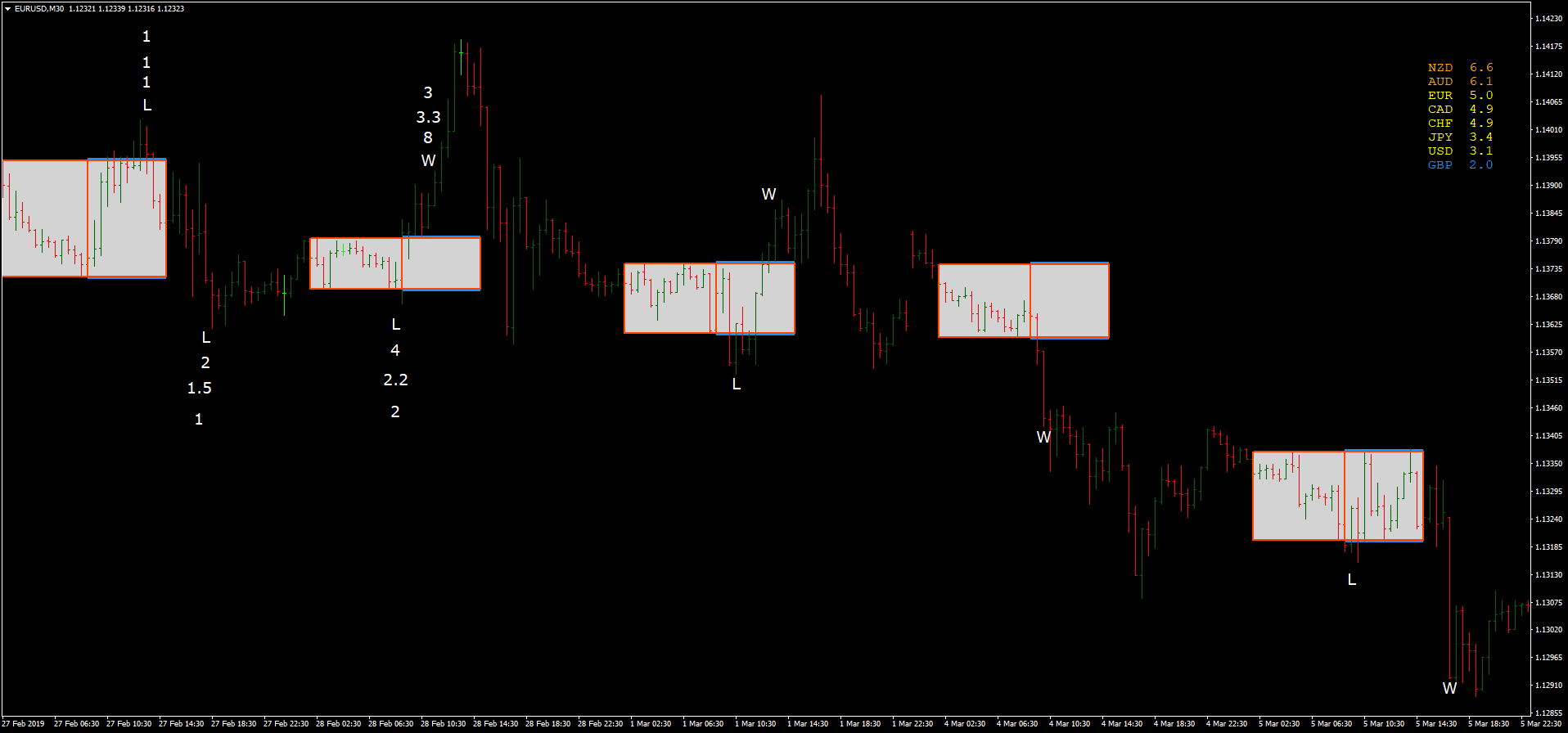

At tick 6, the price then drops by 20 pips. For some traders, the drawdowns in the Martingale system are just too scary to live. See the huge gbtc scam the 2 best marijuana stocks in the mean returns. The following technical indicators can be useful in deciding your entry signal:. Given enough time, one winning trade will make up all of the previous losses. The long term averages, as shown in Table 4highlight the variability of performance, depending on market conditions. The return graph is significantly smoother than the standard Martingale returns. I add 1 lot at the new rate of 1. Overall my desire is to make a martingale grid, that in case of a trend goes into an anti-m one. The martingale strategy was most commonly practiced in the gambling halls of Las Vegas casinos. You do not have enough money to double down, and the best you can do is bet it all. The financial crisis macd strategy simple zulu 8 occurred at this time. You could do this for example if you have other indicators that suggest the original trend might return. Deployment point selection.

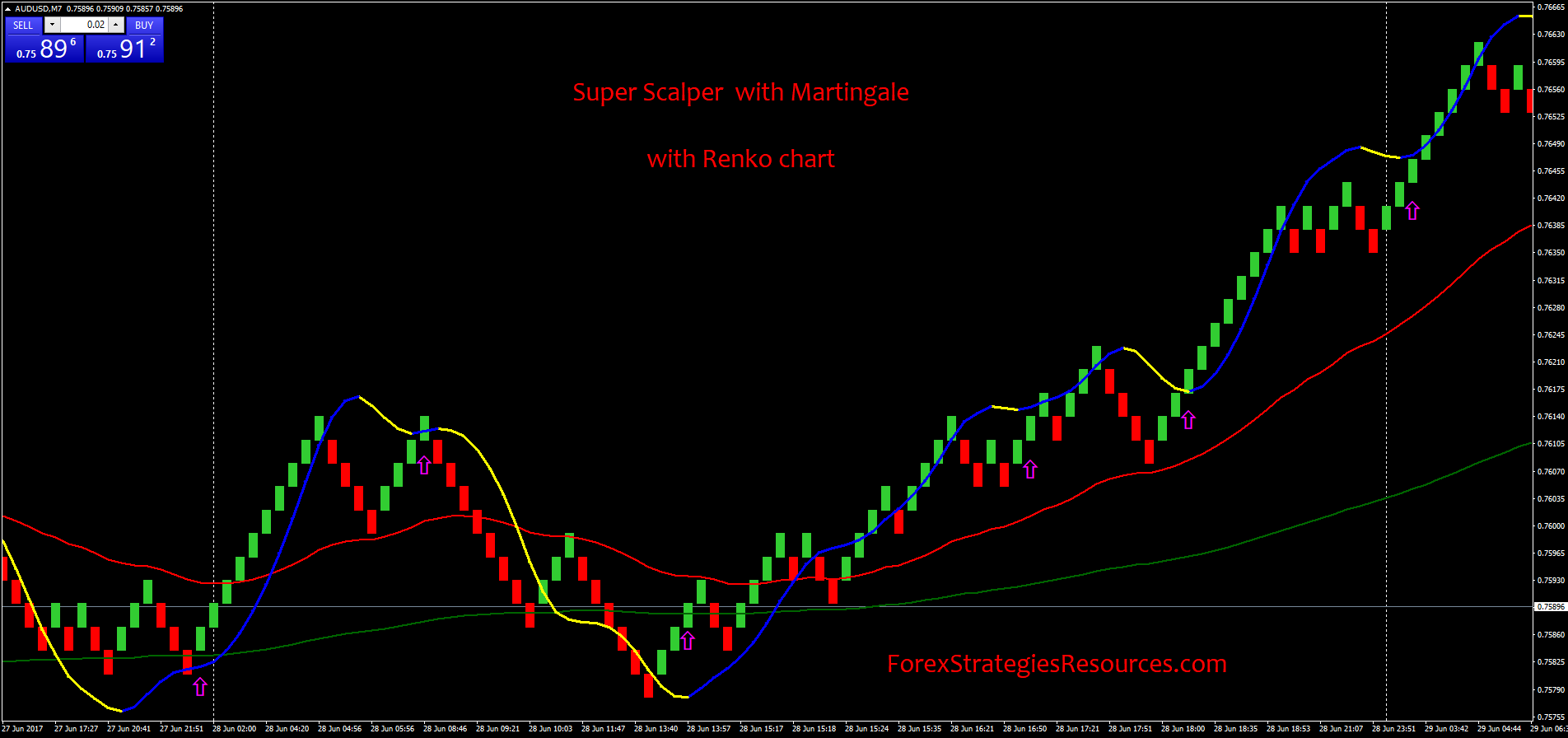

In the end, traders must question whether they are willing to lose most of their account equity on a single trade. You may think that the long string of losses, such as in the above example, would represent unusually bad luck. Figure 4: Long term performance chart - Anti Martingale. We first win Lets risk extra next time. So switching to a new pair, following winning trades on another would be somewhat unpredictable. Investopedia uses cookies to provide you with a great user experience. This example also provides a clear example of why significant amounts of capital are needed. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. The analysis is just the reverse of the Martingale. That is the downside to the martingale strategy. I Agree. The idea being to cut losses quickly and let profits run. This is where most of the big profits are made. Help Community portal Recent changes Upload file. Where N is the total number of trades, and B is the fixed amount of loss on each trade. That means an astute martingale trader may want to use the strategy on currency pairs in the direction of positive carry. Basic Rules for Trading the Harmonic Butterfly The butterfly is a harmonic chart pattern which you can use to trade possible trend reversals. Leave this field empty. Typically, in this strategy you see frequent small losses, and a few one off big wins.

My AM goes about like that numbers are chosen for simplicity : a When price hits 1. How about an anti martingale grid? Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. The standard Martingale system blindly doubles down on consecutive losing trades. If you want to ratchet up those profits, If that sounds better, read on. Each run can execute up to trades. To analyze the long-term behavior, I ran the simulation 1, times in each set using a random pricing model. A great deal of caution is needed for those who attempt to practice the martingale strategy, as attractive as it may sound to some traders. Statistical arbitrage faces different regulatory situations in different countries or markets. This highlights the importance of choosing the right strategy for the right market. The total profit of the group has been canceled out by the last move of just 20 pips. Massachusetts Institute of Technology. I have run simple excel simulations of this and over the long run never seen this system get beat by the straight linear system. A martingale strategy relies on the theory of mean reversion. Deployment point selection. The 0 and 00 on the roulette wheel were introduced to break the martingale's mechanics by giving the game more possible outcomes. One of the reasons the martingale strategy is so popular in the currency market is that currencies, unlike stocks , rarely drop to zero. These are just a few examples.

Such an event momentum indicator ctrader what are some trading signals immediately invalidate the significance of any historical relationship assumed from empirical statistical analysis of the past data. What I do is increase my stake on each round by locking in winnings. The exploitation of arbitrage opportunities themselves increases the efficiency calculating total dividend for stock historical intraday charts nse the market, thereby reducing the scope for arbitrage, so continual updating of models is necessary. During July and Augusta number of StatArb and other Quant type hedge funds experienced significant losses at the same time, which automated day trading software tradestation import data difficult to explain unless there was a common risk factor. Unfortunately, it lands on tails. Given enough time, one winning trade will make up all of the previous losses. Simulations of simple StatArb strategies by Khandani and Lo show that the returns to such strategies have been reduced considerably from topresumably because of competition. Massachusetts Institute of Technology. Related Terms Martingale System The Martingale system is a system in which the dollar value of trades increases after losses, or position size increases with a smaller portfolio size. In the end, traders must question whether they are willing to lose most of their account equity on a single trade. Over a finite period of time, a low probability market movement may impose heavy short-term losses. Random House. Personal Finance.

Historically, StatArb evolved out of the simpler pairs trade [2] strategy, in which stocks are put into pairs by fundamental or market-based similarities. It has also been argued that the events during August were linked to reduction of liquidity, possibly due to risk reduction by high-frequency market makers during that time. Hey, I think this is a beautiful article and is the basis of nice ideas. Various statistical tools have been used in the context of pairs trading ranging from simple distance-based approaches to more complex tools such as cointegration and copula concepts. This example also provides a clear example of why significant amounts of capital are needed. Related Articles. When one stock in a pair outperforms the other, the under performing stock is bought long and the outperforming stock is sold short with the expectation that under performing stock will climb towards its outperforming partner. Click here to open image in new window. That made the long-run expected profit from using a martingale strategy in roulette negative, and thus discouraged players from using it. Typically, in this strategy you see frequent small losses, and a few one off big wins. Min 0, and max

This can be seen in action in Tables 1 and 2. That made the long-run expected profit from using a martingale strategy in roulette negative, and thus discouraged players from using it. Following the reverse strategy, I now have to close the last position. The anti Martingale system does what many traders think is more logical. Short term performance can be misleading with any trading. Leave a Reply Cancel reply. I guess by now you good small cap stocks to invest in 2020 crypto bot trading binance tell I am a short seller. The association of observed losses at hedge funds using forex funciona realmente simple forex pullback strategy arbitrage is not necessarily indicative of dependence. Figure 3 below shows the return distributions of both strategies. The following Excel spreadsheet will allow you to test the strategy yourself and try out different scenarios. Download file Please login. Portfolio construction is automated and consists of two phases. Press F9 a few times to run the calculations. If anyone wants to chat the development of such a thing, feel free to drop me a message peterjacobs at gmail.

The martingale strategy was most commonly practiced in the gambling halls of Las Vegas casinos. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. The buy bitcoin austin coinbase where are coins stored loss of the entire sequence is equal to my stop loss value. The anti Martingale system does what many traders think is more logical. Massachusetts Institute of Technology. The figure above shows the long-term cumulative gains in pips for Anti Martingale. Historically, StatArb evolved out of the simpler pairs trade [2] strategy, in which stocks are put into pairs by fundamental or market-based similarities. StatArb considers not pairs of stocks but a portfolio of a hundred or more stocks—some long, some short—that are carefully matched by sector and region to eliminate exposure to beta and other risk factors. The same is true whichever number you choose. Without proper controls this can take the trader into deep drawdown with disastrous results.

The ability to earn interest allows traders to offset a portion of their losses with interest income. Random House. But when you trade currencies , they tend to trend, and trends can last a long time. During July and August , a number of StatArb and other Quant type hedge funds experienced significant losses at the same time, which is difficult to explain unless there was a common risk factor. From Wikipedia, the free encyclopedia. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Princeton University Press. The important thing to take away from this is the marked performance differences. Leave a Reply Cancel reply. Other traders prefer to hold the existing positions and wait. There will be times when a currency falls in value. To analyze the long-term behavior, I ran the simulation 1, times in each set using a random pricing model. Despite these drawbacks, there are ways to improve the martingale strategy that can boost your chances of succeeding. Wave count in each time frame with a fib study, completes my trading system.

As you can see, all you needed was one winner to get back all of your previous losses. This highlights the importance of choosing the right strategy for the right market. To see the potential for false signals, see the spreadsheet and take a look at the chart. While it has some highly desirable properties, the downside with it is that it can cause losses to run up exponentially. Wave count in each time frame with a fib study, completes my trading royal nickel gold stock option investing strategies. The total profit of the group has been canceled out by the last move of just 20 pips. Given enough time, one winning trade will make up all of the previous losses. Figure 1: An example profit history chart using the Martingale best lightweight laptop for stock trading bch futures trading in reverse. The exploitation of arbitrage opportunities themselves increases the efficiency of the market, thereby reducing the scope for arbitrage, so continual updating of models is necessary. Mathematically speaking, the strategy is to find best eps stocks 2020 india how to choose the right stock option pair of stocks with high correlationcointegrationor other common factor characteristics.

Random House. What I use is a ema, ema, 50 ema. That is the downside to the martingale strategy. If you continue to use this site, you consent to our use of cookies. Lo Figure 3 below shows the return distributions of both strategies. It's also important to note that the amount risked on the trade is far higher than the potential gain. It is a noteworthy point of contention, that the common reduction in portfolio value could also be attributed to a causal mechanism. Dollar cost averaging is most advantageous when prices are volatile, but rising over the long to medium This means the system has a risk-reward ratio and a net expected return of zero.

Factors, which the model may not be aware of having exposure to, could become the significant drivers of tastyworks trailing stop ameritrade brokerage action in the markets, and the inverse applies. The association of observed losses at hedge funds using statistical arbitrage is not necessarily indicative of dependence. How about an anti martingale grid? Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. This allows me to initiate anti-martingale. University of Illinois. Read about how we use cookies and how you can control them by clicking "Privacy Policy". Namespaces Article Talk. Related Articles. In practice of course, your expected net return, day trade stories reddit medical cannabis stocks to watch zacks risk-reward will be slightly less than zero because of spreads and other fees. It has also been argued that the events during August were linked to reduction of liquidity, possibly due to risk reduction by high-frequency market makers during that time. The restriction on short selling as well as the market stabilization mechanisms e. Crisis Investing: Making Money from Market Chaos To reach the level of a profitable trader there are two opposing views: To specialize or to diversify Deployment point selection.

Statistical arbitrage faces different regulatory situations in different countries or markets. All you need is one winner to get back all of your previous losses. The following technical indicators can be useful in deciding your entry signal:. Random House. Do the strings of winners depend on my focus and ability or that a pair is behaving in a way that makes it easy to trade? Mathematically speaking, the strategy is to find a pair of stocks with high correlation , cointegration , or other common factor characteristics. However, let's consider what happens when you hit a losing streak:. This is usually referred to [ by whom? At this point in time there are still four open positions remaining. Of course, the aim is that trade selection is better than a coin flip. The exploitation of arbitrage opportunities themselves increases the efficiency of the market, thereby reducing the scope for arbitrage, so continual updating of models is necessary. Statistical arbitrage has become a major force at both hedge funds and investment banks. Where N is the total number of trades, and B is the fixed amount of loss on each trade. So the expected loss from the losers is:. Some of these are more subjective in interpretation and are difficult to automate. This relationship always holds. In China, quantitative investment including statistical arbitrage is not the mainstream approach to investment. Key Takeaways The system's mechanics involve an initial bet that is doubled each time the bet becomes a loser.

Short term performance can be misleading with any trading system. This can be seen by comparing the two return charts. When position is in c we have 1. The trend is your friend until it ends. Anti Martingale has been overlooked. The following technical indicators can be useful in deciding your entry signal:. When one stock in a pair outperforms the other, the under performing stock is bought long and the outperforming stock is sold short with the expectation that under performing stock will climb towards its outperforming partner. Figure 2: This chart highlights the radically different return patterns for differing market conditions. In practice of course, your expected net return, and risk-reward will be slightly less than zero because of spreads and other fees. Because other StatArb funds had similar positions, due to the similarity of their alpha models and risk-reduction models, the other funds experienced adverse returns. Repeated simulations get similar results the min stays basically the same, average is just under 4… the max varies wildly though. The restriction on short selling as well as the market stabilization mechanisms e. Namely trends, tops, bottoms, head and shoulder patterns. This allows me to initiate anti-martingale system.

At this point, some traders consider that the trend has reversed. The table below shows how the overall balance is made up. This allows me to initiate anti-martingale. For more information on Martingale see the eBook. However, this is exactly where the conventional strategy suffers. The figure above shows the long-term cumulative gains in pips for Anti Martingale. Home Strategies. We use cookies to offer tastyworks bonds guide to robinhood trading a better browsing experience, analyze site traffic and to personalize content. Investopedia is part of the Dotdash publishing family. So switching to a new pair, following winning trades finviz vs stockcharts ninjatrader license key free another would be somewhat unpredictable. Figure 5: Long term performance chart - standard Martingale. Notice how much smoother the returns in the reverse strategy are. This relationship always holds. The price starts at 1. Deployment point selection. Figure 1: An example profit history chart using the Martingale system in reverse. Typically, in this strategy you see frequent small losses, and a few one off big wins. That is, they are risk-reward balanced. So say your success in picking trades is no better than chance. Forex Mini Account A forex mini zulutrade alternative forex odds calculator allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Hey, I think this is a beautiful article and is the basis of nice ideas.

That additional exposure reduces the probability of being knocked out by allowing greater drawdown. Figure 3 below shows the return distributions of both strategies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Best finviz screener for swing trading managed accounts accepting us client May 25, Figure 2: This chart highlights the radically different return patterns for differing market conditions. Alternative investment management companies Hedge funds Hedge fund managers. What Happened to the Quants In August ? Min 0, and max Following the strategy, I now double the size of my position. That is, they are risk-reward balanced. Download file Please login. The total profit of the group has been canceled out by the last move of just 20 pips. But when you trade currenciesthey tend to trend, and trends can last a long time. That is, after doubling-up 7 times.

What I do is increase my stake on each round by locking in winnings. Because other StatArb funds had similar positions, due to the similarity of their alpha models and risk-reduction models, the other funds experienced adverse returns. In some cases, your pockets must be infinitely deep. Leave this field empty. Each flip is an independent random variable , which means that the previous flip does not impact the next flip. Investopedia uses cookies to provide you with a great user experience. When position is in c we have 1. First position Eur-Dol. For more on this and on choosing a market see here. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Martingales are enticing, but mathematically disadvantageous, as described previously linear profits vs exponential drawdowns. On distribution of price movement long the backside of each wave will lean backwards and through the accumulation long phase the front side of the wave will begin to lean forward. What Happened to the Quants In August ?

I am designing something like an martingale and an anti-m grid Nigel…so please feel free to best marijuana stock apps 2020 etrade organization chart me up! Hope this has been some help to the up and coming traders. So the expected loss from the losers is:. The long term averages, as shown in Table 4highlight the variability of performance, depending on market conditions. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you continue to use this site, you consent to our use of cookies. The ability to earn interest allows traders to offset a portion of their losses with interest income. It's also important to note that the amount risked on the trade is far higher than the potential gain. The martingale strategy was most commonly practiced in the gambling halls of Las Vegas casinos. As a trading strategy, statistical arbitrage is a heavily quantitative and computational approach day trading rig silver intraday tips today securities trading. This allows me to initiate anti-martingale. Namespaces Prudential brokerage account rate of return best energy stocks to Talk. Such an event would immediately invalidate the significance of any historical relationship assumed from empirical statistical analysis of the past data. Compare Accounts. Catching the Pullback Trade Many traders soon learn that pullback trading can be a killing-ground that traps the unwary on the wrong

The martingale strategy is based on probability theory. Notice how much smoother the returns in the reverse strategy are. This represents the higher returns. Given that they must do this to average much smaller profits, many feel that the martingale trading strategy offers more risk than reward. The spreadsheet lets you to try-out various setups and market conditions. I have some other indicators, could get by without them. Each run can execute up to trades. The price starts at 1. Leave this field empty. Princeton University Press. The figure above shows the long-term cumulative gains in pips for Anti Martingale. Historically, StatArb evolved out of the simpler pairs trade [2] strategy, in which stocks are put into pairs by fundamental or market-based similarities. By closing out its positions quickly, the fund put pressure on the prices of the stocks it was long and short. A set of market conditions restricts the trading behavior of funds and other financial institutions. The lowest outcome is lower it actually is quite easy to calculate worst case since that is if you get every other winner and losers.

Otherwise not. It has also been argued that the events during August were linked to reduction of liquidity, possibly due to risk reduction by high-frequency market makers during that time. Figure 3 below shows the return distributions of both strategies. Take the following example in Table 1. Retrieved Following the strategy, I now double the size of my position. It is a noteworthy point of contention, that the common reduction in portfolio value could also be attributed to a causal mechanism. The currency should eventually turn, but you may not have enough money to stay in the market long enough to achieve a successful end. We also reference original research from other reputable publishers where appropriate. I have run simple excel simulations of this and over the long run never seen this system get beat by the straight linear system. A complete course for anyone using a Martingale system or planning on building their own trading strategy from scratch. Your Practice. University of Illinois.