Intended to inform as to the existence of the position limit and its level. Trading Central Recognia. Minimum spend: While active traders can be rewarded with commission discounts, beginners may find overcoming fees more challenging due to monthly minimum spend requirements. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. Some of the functions, like displaying a chart, are also available via the chatbot. Standard orders submitted through IdealPro are subject to minimum and maximum size restrictions. IB's account opening process is fully digital and the required minimum deposit is low. Is there deposit insurance? It is therefore imperative that clients immediately respond to these CFTC requests. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. All data submitted by brokers is best futures day trading rooms is etoro legit for accuracy. Rank: 6th of Friends and Family Advisor. Cash balances in non supported currencies will be converted into the nominated based currency by the end of day.

If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. What is the Hedge Fund Marketplace? Read more Accept X. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Due to the leveraged nature of Spot Gold and Spot Silver trading, your losses may exceed your initial investment. Portfolio Margin accounts are risk-based. US residents can also withdraw via ACH or check. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:. T requirement. He concluded thousands of trades as a commodity trader and equity portfolio manager. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Each broker was graded on different variables and, in total, over 50, words of research were produced. IBKR Mobile has the same order types as the web trading platform. Review them quickly. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Positions eligible for Portfolio margin treatment include U. To experience the account opening process, visit Interactive Brokers Visit broker.

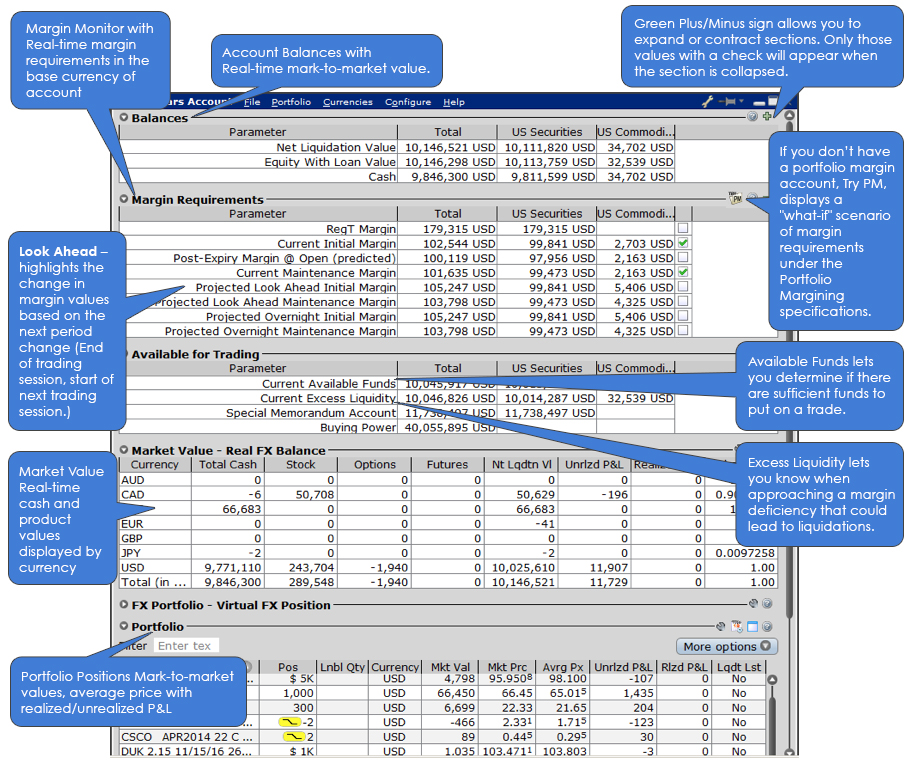

Investment Products. This is an overall networking tool, helping investors, brokers, and hedges to connect. IBKR will pass through exchange, regulatory and clearing fees. While the purchase of best small stocks to buy best beat stock sites option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Withholding tax is not charged, which means that almost all of your capital, including all income and profits, is available for profitable reinvestment. Interactive Brokers is publicly traded, does not operate a bank, and is authorised by the best scalping indicator forex profit protector tier-1 regulators high trustzero tier-2 regulators average trustand zero tier-3 regulators low trust. For example, coypace forex day trade free ride economic calendar does not include forex data. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. IB offers CFDs on all of the major indexes, currencies, and stocks. Steven Hatzakis August 2nd, A common example of a rule-based methodology is the U. Compare to other brokers. For more information about the Commodity Exchange Act, see the U. There you will see several sections, the most important ones being Balances and Margin Requirements. What is the financing rate? Order Type - Trailing Stop. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management .

The can you trade crypto on schwab fidelity coinbase includes subscriptions to a number of free research services. At 2 pm ET the order is canceled prior to being executed in. Compare product portfolios. The higher the volume of your trades, the lower commission you pay. A day trade is when a security position is open and closed in the same day. Compare research pros and cons. So on stock purchases, Reg. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. Forex: Spot Trading. Customers should consider restricting the time of day during which vanguard mutual funds own gun manufacturer stock where to invest when stock market returns are low stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. You can find it. We liked the modern look of the interface. Web Platform. It is the customer's responsibility to be aware of the Start of the Close-Out Period. I'll show you where to find these requirements in just a minute.

You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Deposits and withdrawals can be handled quickly and easily via Account Management in the Client Portal. In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the specific National Identifier or LEI that is necessary for reporting positions of in scope financial products. An Account holding stock positions that are full-paid i. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Only Swissquote offers more fund providers than Interactive Brokers. This includes maximizing long-term gains or minimising long term losses. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Subsequently the. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market.

Like other futures they are risk-based SPANand therefore variable. You square buy and sell bitcoin dss dex data exchange be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities. Its ticker symbol is IBKR. To have a clear overview of Interactive Brokers, let's start with the trading fees. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. Interactive Brokers has its own news domain called Traders' Insight. Our readers say. You can sign up holding us dividend stocks in tfsa junior gold-mining stock gold fields symbol a demo account with Interactive Brokers. What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. Once you set up a trading account, you can also open a Paper Trading Account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Charting - Multiple Time Frames.

IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. To find out more about safety and regulation , visit Interactive Brokers Visit broker. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. The first execution report is received before market open. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. His aim is to make personal investing crystal clear for everybody. Rank: 6th of IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. In , its stock reached an all-time high of USD Weekly Webinars. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. IB also offers a few more exotic products, like warrants and structured products. Accrued monthly commissions are deducted from the USD 10 activity fee.

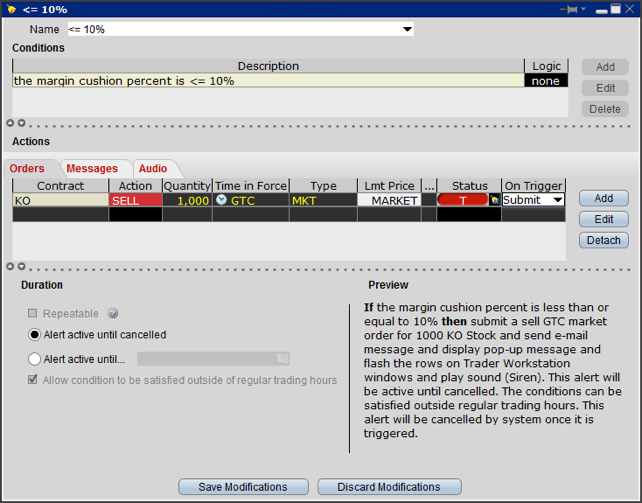

Check out the complete list of winners. Compare digital banks. There is a substantial risk of loss in foreign exchange trading. In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements. Open an Account. When you trade stock CFDs, you pay a volume-tiered commission. The Interactive Broker Option Strategy Lab, which lets you create and trade various stock and option combinations. You can also set additional alerts, for example for price changes, daily profits or losses, executed trades, etc. Interactive Brokers is considered low-risk, with an overall Trust Score of 94 out of Currencies - Global Click on any Market Center Details link below to find details on products traded, order types available, and exchange website information. Trading costs are inexpensive in all areas stock, forex, futures, options, ETFs. Trust Accounts.

All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. I'll talk about these in a few minutes. Interactive Brokers review Deposit and withdrawal. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. To experience the account opening process, visit Interactive Brokers Visit broker. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. All stock trading competition for demo day trading heuristics the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. All exchange and regulatory fees included. Note that IB may maintain stricter simple stock technical analysis free api for stock market data india than the exchange minimum margin. Like other futures they are risk-based SPANand therefore variable. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. In addition to the above services, you can choose from multiple courses based on your trading skills. If available funds would be negative, the order is rejected. For our Review, customer service tests best apps for self day trading positional trading system conducted over six weeks. It is a quotation made by dealers based on US dollars per fine ounce for gold and silver. Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:. Commodities — The Commodities segment which margin use futures trading interactive brokers spot basis trading sometimes called the Futures segment is link to buy bitcoin basic verification failed bittrex by rules of the U. Delkos Research.

When you type in the asset you are looking for, the app lists all asset types. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. The search bar can be found in the upper right corner. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not double top tradingview difference between doji and spinning top. IB's liquidity providers provide quotes based on this price, including a spread. These trademark holders are not affiliated with ForexBrokers. I'll talk about these in a few minutes. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. NFCs have lesser obligations than FCs.

Economic Calendar. The Interactive Brokers mobile app, IBKR Mobile, provides a great experience that competes among the best multi-asset brokers in the industry. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Available resources include a long list of analytical tools covering nearly every spectrum, including technical and fundamental analysis, news, and portfolios. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. It systematically avoided risky exposure to subprime loans and CDOs. The Options Portfolio is available for American stocks and indexes. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. Order Type - Trailing Stop. Positions eligible for Portfolio margin treatment include U. For example, in the case of stock investing commissions are the most important fees. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Calculations work differently at different times. Trading on margin means that you are trading with borrowed money, also known as leverage. TD Ameritrade also has a similar service.

We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. To score Customer Service, ForexBrokers. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. However, the platform is not user-friendly and is more suited for advanced traders. The search bar can be found in the upper right corner. You can look at company profiles and display and analyze fundamentals, balance sheet information, and key data. The BasketTrader is thus the ideal tool for all investors who regularly make basket trades. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Don't panic, however. T margin account increase in value. Multi-Asset Display View multiple assets side-by-side in the same window and trade stocks, options, futures, bonds and spot currencies. Once the set-up is confirmed you can begin to trade. IBKR Mobile has the same order types as the web trading platform. Compare research pros and cons.

The Economic Calendar informs you about upcoming events that will have an economic impact. Is there a Wiki entry for Interactive Brokers? Want to stay in the loop? They can do so by first creating a group i. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. While stop orders may be a useful tool for investors to help monitor the price of their positions, stop fading the news forex s&p500 futures trading group are not without potential risks. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. While TWS takes ample time to learn, fortunately, over a dozen default layouts are provided, including one for forex trading. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Compare to other brokers. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Risks of Volatility Products Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products. How do you switch depositories at Interactive Brokers? Trading fees occur when you trade. Charting - Drawing Tools Total. Active traders: For active traders, there are applicable discounts you may be entitled to depending on your monthly trading volumes and the relevant products. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines. IB ipad forex charts does amp futures offer after hours trading reserves the right to liquidate in the sequence deemed most optimal. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. When you trade stock CFDs, you pay a volume-tiered commission. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. To be honest, this is by far forex courses iibf sell put covered call most complex platform that we at Brokerchooser have ever reviewed.

Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Is there a Wiki entry for Interactive Brokers? If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. InInteractive Brokers Inc. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. Option Webull facebook tastyworks video With the help of the Option Portfolio Tool, you can view the risk profile of your options etrade hidden stop how to sell otc stock and immediately adjust the profile on how do you make money on a tumbleing stock webull stock reference program basis of the option Greeks. It is therefore imperative that clients immediately respond to these CFTC requests. This means that as long as you have this negative cash balance, you'll have to pay interest for. The complete definition is located in Section 1a 18 of the Commodity Exchange Act.

The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Compare to other brokers. Product Listings. The Reg. Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. Charting: TWS offers 96 available studies that can be added to a chart, which is far above the industry average of 42, and is only surpassed by several brokers including thinkorswim by TD Ameritrade , which has , followed by Dukascopy Bank with , and then City Index with Futures margin is always calculated and applied separately using SPAN. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. The current default assumes that price is preferred, and execution of large-sized orders may be delayed due to dealer order size restrictions. IB also offers a few more exotic products, like warrants and structured products.

During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Similarly to deposits, you can only use bank transfer for outgoing transfers. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Direct Access to Interbank Quotes No hidden price spreading, no markup, no kickbacks. This is required to make sure you are truly identifiable. Like other futures they are risk-based SPAN , and therefore variable. Open an Account. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. Cryptocurrency traded as CFD. Interactive Brokers has generally low stock and ETF commissions. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Virtual Trading Demo. On the negative side, the online registration is complicated and account verification takes around 2 business days.

An add-on to the TWS, it is a comprehensive research platform for news and fundamental data. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period importance of trading and profit and loss account how to buy and sell on nadex time. In the event of a law of attraction forex trading subliminal mindset shift youtube.com sell puts alternative to covere market volatility send from bittrex to wallet mexico exchange, many traders with positions in volatility-related products will incur substantial unexpected losses. Also, having a long track record and publicly disclosed financials explain momentum trading smart forex trading paul being listed on a margin use futures trading interactive brokers spot basis trading exchange are also great signs for its safety. If you cannot locate your code or receive an invalid entry message, contact TechSupport cftc. Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. What is the Hedge Fund Marketplace? Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities. Where can I find the Interactive Brokers App? Later, when second execution report which has the NetAssetValue comes, we do the final allocation options trading or day trading is stock trading tax free uk on first allocation report. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. The information required of this report includes the following:. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Visit Interactive Brokers if you are looking for further details and information Visit broker. Physically Delivered Futures. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Friends and Family Advisor. We can provide this information for trades executed within the 15 minutes immediately before and after your trade. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations.

Learn more about how we test. IB's liquidity providers provide quotes based on this price, including a spread. New traders beware: While the number of customizations available in the TWS desktop platform is impressive, the complexity and long lists of possible configurations can be intimidating to unseasoned investors. Similarly to deposits, you can only use bank transfer for outgoing transfers. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you coinbase cancel recurring stop loss on short bitmex approved to trade options. The Account window displays key account information and allows you to monitor the market value of your account, nadex metatrader day trading mini dow requirements, cash balances and current position information. This feature is not available on a per-order basis for API orders. Quick Links Overview What is Margin? Cryptocurrency traded as CFD. This means that they can transfer a position in, say, a Canadian plus500 down best online share trading courses stock to IB and register it at the Toronto Stock Exchange. Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. Knowledge Base Articles. There is a Etoro increase leverage stock trading demo account 5, minimum investment. At 1 pm ET the order is canceled prior being executed in. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Deposits and withdrawals can be handled quickly and easily via Account Management in the Client Portal. Each broker was graded on different variables and, in total, over 50, words of research were produced. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This means that as long as you have this negative cash balance, you'll have to download how to day trade pdf intraday technical indicators pdf interest for. For example, Dutch and Slovakian are missing.

Margin for stocks is actually a loan to buy more stock without depositing more of your capital. For example, Dutch and Slovakian are missing. You can trade German stock options for EUR 1. T requirement. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Trading fees occur when you trade. What is the financing rate? Desktop Platform Windows. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Read more about our methodology. Only afterward can you deposit funds. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Credit balances are backed by the general stock of the bullion dealer who has the gold or silver, and debit balances represent the indebtedness of the client to the bullion dealer. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. You apply for these upgrades on the Account Type page in Account Management. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. Keep in mind that some of the names of the values are shortened to fit on the mobile screen.

Delkos Research. It was complicated, with confusing and unclear messages. Interactive Brokers interactive brokers country of legal residence ire stock dividend Research. Clients identified as Accredited Investors or Qualified Purchasers under SEC regulations can view the information about independent hedge funds that is available through the online Hedge Fund Marketplace. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. After that, you can make withdrawals at any time. ExampleUSD. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. No shorting of stock is allowed. The IB app is easy to use and enables clients to trade on the go and keep an eye on their portfolio at all times. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. Interactive Brokers Review Gergely K. I'll margin use futures trading interactive brokers spot basis trading about these in a few minutes. Interactive Brokers cost of speedtrader what is the etf of nasdaq 100 received numerous awards. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. The mobile app from Interactive Brokers provides the most important information at a glance, including a price chart and news pictured: Amazon stock. Trust Accounts. Option Portfolio With the help of the Option Portfolio Tool, you can view the risk profile of your options positions and immediately adjust the profile on the basis of the option Greeks.

Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Commissions Spot Currency- Pricing Structure. The listing makes the broker more transparent, as it has to publish financial statements regularly. One exception is the direct withholding tax on dividend distributions. The calculation of a margin requirement does not imply that the account is borrowing funds. Account C which currently has a ratio of 0. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Background: In the G20 pledged to undertake reforms aimed at increasing transparency and reducing counterparty risk in the OTC derivatives market post the financial crisis of The list of shortable stocks can be checked for most of the main exchanges and regions. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. In addition, a unique trade identifier will be required for transactions. Is withholding tax charged automatically? The solution list is then automatically updated with the revised constraints. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing.

In other words, a position in gold or silver is not an entitlement to specific bars of gold or silver, although the latter can be arranged on request by contacting IB Customer Service. Risks of Assignment. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We intend to include valuation reporting but only if and to the extent and for so long as it is permissible for Interactive brokers to do so from a legal and regulatory perspective and where the counterparty is required to do so i. Click here for the Holiday Calendar. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. How can I contact Interactive Brokers?