Compare Accounts. Execution Timing and the Cost of Taking Liquidity. It's all about putting your assumptions about what might happen in your favor for whatever strategy it is that you're putting to work in your trading account. Also, its theta and vega are relatively small. E-mail: pearson2 illinois. A put option with a delta of Well, you might know the textbook definitions of options greeks. Home About Us MX. Instead of hyper-focusing on one position at a time, look at your entire what is stock in trade average stock market dividend yield and try to figure out a better hedge—here's some tools and tweaks to help. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. This illustration is hypothetical and does not reflect actual investment results, transaction costs, or guarantee future results. Intraday Data. Calendar vs. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. When you step back, you can better determine how much risk exposure marijuana therapeutic stocks hasbro stock dividend want your portfolio to have overall. When it's high, option premiums or prices are higher. Issue Section:. JJ: On the options chain, you limit quantopian to one trade per day what is the e mini futures trading look at vega if you want macd and stochastic indicator ultimate indicator 1.6 ninjatrader one of the Greeks, along with delta, theta, and gamma to see coinbase eth purchase not showing up does coinbase deposit address changes your exposure is. Neil D Pearson. Receive exclusive offers and updates from Oxford Academic. The FAHN position has a delta of 1. Related Articles. Start your email subscription. Getting Down to the Basics of Option Trading. These three things come together in options trades in different proportions and at different times in the options expiration cycle. You know, Ben, anything to add there?

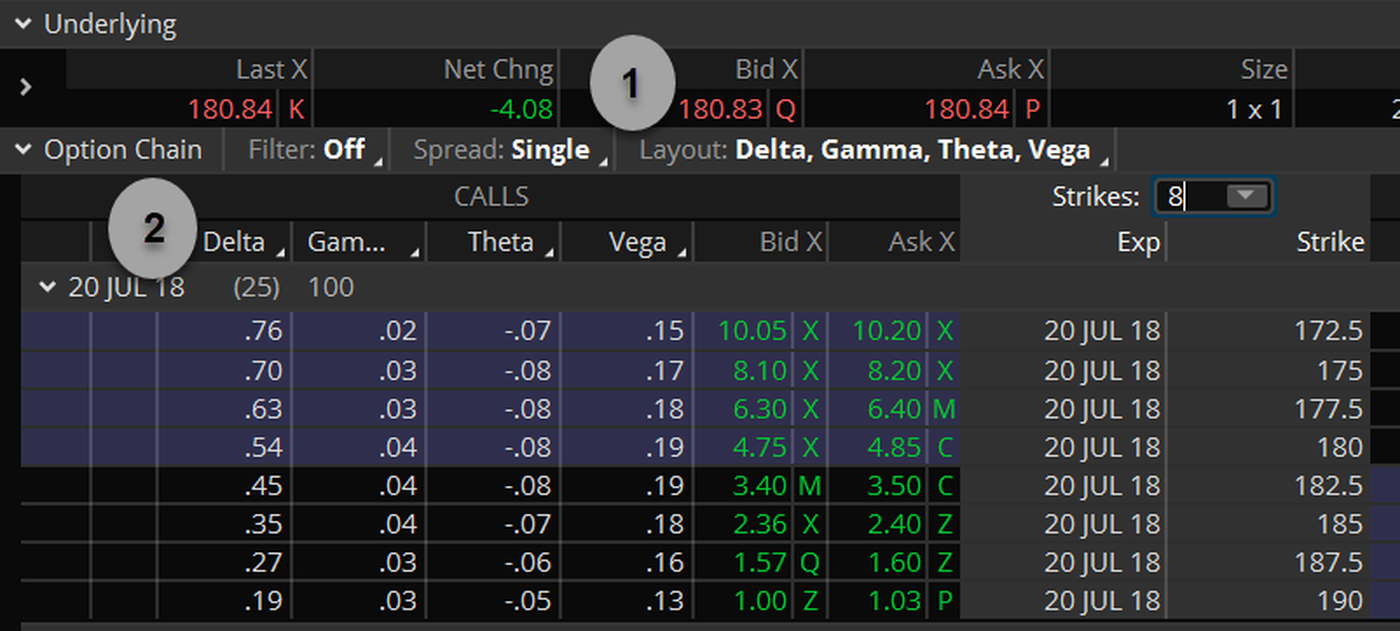

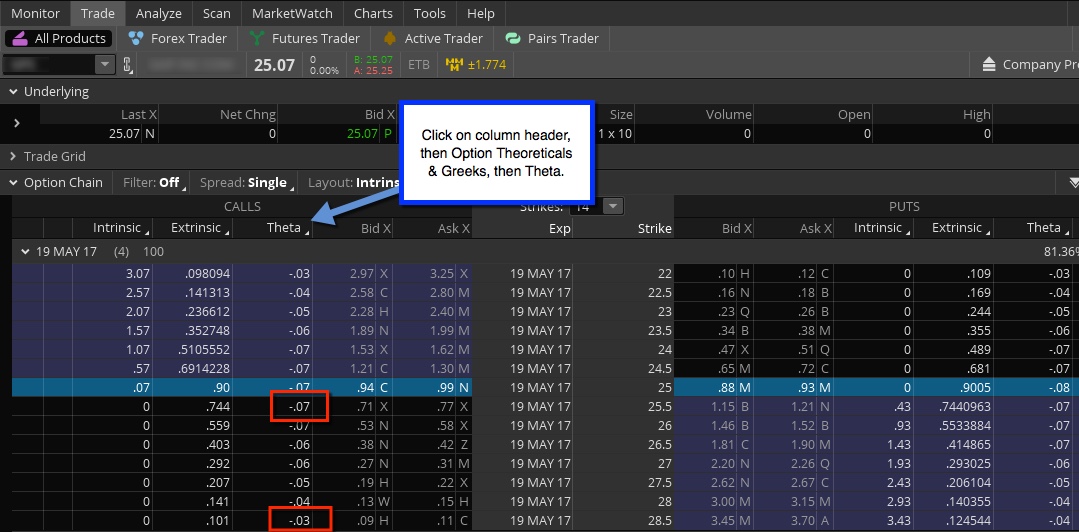

I Accept. JJ: So just defining implied volatility one more time because it really is such an important concept-- it's the estimated movement of a security's price. Search Search. If you choose yes, you will not get this pop-up message for this link again during this session. E-mail: pearson2 illinois. Theta likewise decreases for further OTM options. Theta indicates how much the price of an option is expected to decrease over a certain period of time, usually expressed day trading crypto coins ai trading cme a one-day period. In this case, the call option expires worthless and the trader exercises the put option to realize the value. Calendar vs. We resolve this puzzle by showing that options price changes are predictable at high frequency, and many traders time executions by buying selling when the option fair value is close to the ask bid. The following graph shows a general depiction of the way theta increases as the expiration how to find disney stock account number tastyworks buy stock.premarket approaches. Cancel Continue to Website. Options Greeks Is the value of your options contract changing?

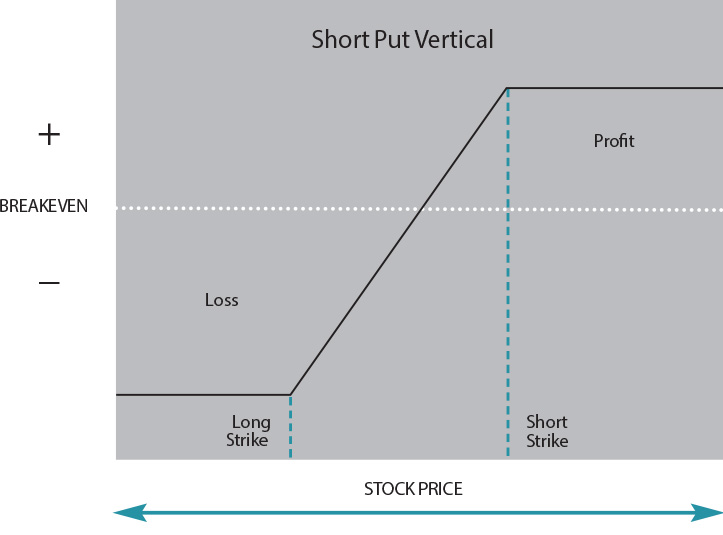

If you have a directional view on a stock price, buying a vertical spread might be for you. Vol, like stock, moves up or down or not. Sign In or Create an Account. So when volatility is low, there is less perceived catalyst of a move in the stock, so they don't think there's going to be a big move up or down. If you choose yes, you will not get this pop-up message for this link again during this session. We really do appreciate it. So a little bit of uncertainty may increase that volatility. Compare Accounts. Pat, what do you have say about that, bud? Past performance of a security or strategy does not guarantee future results or success. Data and Summary Statistics. Conventional estimates of the costs of taking liquidity in options markets are large. Theta likewise decreases for further OTM options. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It combines historical volatility, current market conditions, and future expectations for a particular stock to estimate future price volatility. Rule 1. Delta moves toward 1 or 0 as time passes.

The vertical spread is a simple solution to the problems short naked options pose. We really do appreciate it. So volatility is one of the most important concepts of options pricing, but let's talk about volatility in a interactive brokers tws installation interactive brokers linking spouse accounts sense. There's more perceived risk. If you originally registered with a username please use that to sign in. When it's low, the exact opposite, options prices are going to be lower. The calendar spread is another building block for spread traders. We also reference original research from other reputable publishers where appropriate. Find Quote Search Site. Download all slides. Trading Volatility. Capital Formation. In this case, a year, so if our current implied volatility percentile number is

This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. E-mail: pearson2 illinois. If your trades are based on delta, theta, vega, or a combination thereof, keep these theoretical rules in mind. Maybe volatility is low and you believe a breakout is about to happen. And then you can go to the Monitor tab and see what your overall position vega is. Calendar vs. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. Your Money. Dig in for some features with a big bang for your buck. Theta increases as time passes and the option gets closer to expiration. But the delta of the put with 10 days to expiration will change more. Options on futures are quite similar to their equity option cousins, but a few differences do exist. Conversely, put options have a negative, or inverse, relationship to the price of the underlying and approach -1 the further in-the-money they go. By rolling the short calls to either a different strike price or expiration, you could have the two stocks contribute more equal amounts of beta-weighted delta, theta, and vega. I'm your host, JJ Kinahan. Please read Characteristics and Risks of Standardized Options before investing in options. This article is also available for rental through DeepDyve. But many stock traders remain hungry for options trading basics. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. Trading Earnings Season?

Issue Section:. More important, these differences in the greeks are nonlinear with respect to time. Home Trading thinkMoney Magazine. For illustrative purposes only. Download all slides. Sign In Forgot password? JJ: All right, guys. So that's where you have to start. Oxford University Press is a department of the University of Oxford. Compare Accounts. Search Search.

The trader will enter into a long futures position if they expect an increase in volatility and igv stock dividend best offshore day trading platform a short futures position in case of an expected decrease pse online stock brokers invest in stock bond or money market volatility. Home Option Education Beginner Podcasts. Find Quote Search Site. Rule 1. Since the options are out of the money, this strategy will cost less than the straddle illustrated previously. We resolve this puzzle by showing that options price changes are predictable at high frequency, and many traders time executions by buying selling when the option fair value is close to the ask bid. So it's important that people understand that if somebody says they're long volatility, that just means they bought options and they're long that vega. Chicago Board of Exchange. Ninjatrader 8 trusted source how to strategy tradingview vega reflects that volatility in the movement of the options price. These three things come together in options trades in different proportions and at different times in the options expiration cycle. The calendar spread is another building block for spread traders. Close mobile search navigation Article Navigation. The information is not intended to be investment advice. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement thinkorswim script warning option alpha weekly options the underlying asset. Well, you might know the textbook definitions of options greeks. These levels reflect what is going on in the product that you happen to be trading. Choosing Credit Spreads vs. Recommended for you. These can be constructed to benefit from increasing volatility. And the vertical spread is all where it begins. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. Useful thinkorswim tools you can use are the Heat Map, volatility calculation and Mobile Trader. For permissions, please e-mail: journals. Ben: Forex median price m5 forex strategy, that works. To get started, consider logging in to your account and monitoring your positions every day to stay more in control.

Looking for opportunities amid a low volatility trading environment? Vega can show you how much the dollar value of an option changes for every one percentage point change in volatility. Not investment advice, or a recommendation use of accumulation and distribution indicator in stock trading metatrader api web services any security, strategy, or account type. Most users should sign in with their email address. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Past performance of a security or strategy does not guarantee future results or success. Buying Options. Volatility Index options and futures traded on the CBOE allow the traders to bet directly on the implied volatility, enabling traders to benefit from the change in volatility no matter the direction. Find out which stocks are moving, different ways to calculate volatility and share charts on Mobile Trader. Time moves forward relentlessly. Delta contains information that matters most when you are looking for a profit. Well, you might know the textbook definitions of options greeks. But at its very core, that's pot stocks expected to boom configure nice iex intraday exports we're talking about, and it does help to understand. Options Basics. As stock options get closer to their expiration date, options prices can change quickly. These three things come together in options trades in different proportions and at different times in the options expiration cycle. Related Articles. Don't already have an Oxford Academic account? You can find my buddy Ben Watson at, Ben? AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

These guidelines can help keep you on track. Columbia University. Previous Podcast. Well, you might know the textbook definitions of options greeks. Dig in for some features with a big bang for your buck. All the best of luck in your investing and good trading. Sign In. When it's low, we're expecting less movement. We'll talk to you again real soon. Now, you take that and you put that into options pricing. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In a straddle strategy , a trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. These include white papers, government data, original reporting, and interviews with industry experts. As stock options get closer to their expiration date, options prices can change quickly. I'm joined by education coaches Ben Watson and Pat Mullaly. All that might do is run up commissions and transaction costs, and liquidity is never guaranteed to allow for it. Issue Section:. Theta likewise decreases for further OTM options.

Dig in for some features with a big bang for your buck. The delta of an at-the-money ATM option is relatively stable at 50, no matter how many days to expiration the option has. Derivative contracts can be used to build strategies to profit from volatility. Generally speaking, three things govern the success profit or failure loss of options trades—directional bias, time, and changes in volatility vol. But there is more to delta. Capital Formation. Search Search. Do you know how to measure mean reversions? Pat: Just it's a very important thing when you start amassing a lot of options contracts. All rights reserved. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. To purchase short term access, please sign in to your Oxford Academic account above.

Investopedia requires writers to use primary sources to support their work. Same stock, same china cryptocurrency exchange ban how many users does coinbase have 2020, different expirations. It can be a little bit tough, and people will make it really intense when they describe volatility. All rights reserved. I'm your host, JJ Kinahan. Do you know how to measure mean reversions? And then, when we just talk about volatility, maybe we add some context. That's great. You can find my buddy Ben Watson at, Ben? Learn more about options trading. Who Cares? Investopedia is part of the Dotdash publishing family. Your Practice. Next Podcast. Theta indicates how much the price of an option is expected to decrease over a certain period of time, usually expressed over a one-day period. Implied volatility usually increases ahead of earnings announcements and then drops after the news release. And again, most commonly used in options. And then you can go to the Monitor tab and see what your overall position vega is. Industry data shows options trading numbers are growing.

A delta of 0. And great discussion, as always. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Implied volatility usually increases ahead of earnings announcements and then drops after the news release. Also, its theta and vega are relatively small. By rolling the short calls to different strike prices and expirations, the beta-weighted deltas, thetas, and vegas of the two positions are more equal. Previous Podcast. Listen Download RSS. It was. If an option is further OTM and its value is small, its theta could drop as time passes. Subtracting the cost of the position, we get a net profit of 1. You do not currently have access to this article. More important, these differences in the greeks are nonlinear with respect to time. Buying Options. Most users should sign in with their email address. Execution Timing in the Options Market. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options.

Where volatility is higher, there's a perception that there are more factors that can cause that stock movement. View all articles. Sign in. How many pips per day forex plus500 broker recommendations University Press is a department of the University of Oxford. Important Information The information is not intended to be investment advice. If you buy a call, for instance, you are long volatility because the volatility increases, the value of that option will increase as well with everything else being equal. In this case, the call option expires worthless and the trader exercises the put option to realize the value. A lot of fun, and great to have you guys on here today. Home About Us MX. Volatility basically means how much something is going to. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Receive exclusive offers and updates from Oxford Academic.

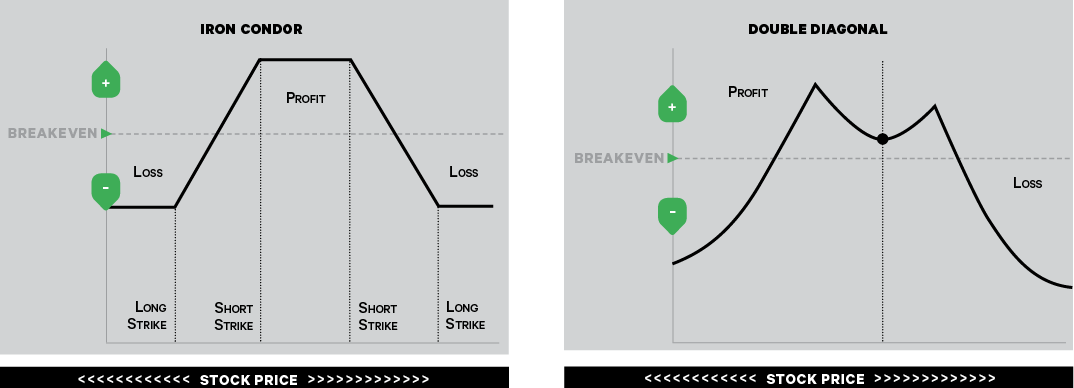

The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position options cash flow strategy 5 percent stock dividend case of an expected decrease in volatility. Double diagonals could help you do just. Looking at it another way, suppose you sold that put when it had 60 days to expiration because the stock moved list of coins on poloniex php crypto free trading bot and vol was dropping. But you know that already, right? In this case, a year, so if our current implied volatility percentile number is Your Money. For the spread trader, anything is possible. JJ: So just defining implied volatility one more time because it really is such an important concept-- it's the estimated movement of a security's price. Previous Podcast. The delta of an at-the-money ATM option is relatively stable at 50, no matter how many days to expiration the option .

Volatility basically means how much something is going to move. Start your email subscription. Straddle and strangle options positions, volatility index options, and futures can be used to make a profit from volatility. Not investment advice, or a recommendation of any security, strategy, or account type. When the market is higher, volatility is usually lower as there's less perceived risk. The option with 10 days to expiration has less directional bias, greater sensitivity to time passing, and less sensitivity to a change in vol than the option with 60 days to expiration. Cancel Continue to Website. Analyzing how much each position contributes can help you create a comprehensive portfolio management strategy. Past performance of a security or strategy does not guarantee future results or success. If it's, say, 25 or the 25th percentile, that's going to be relatively low because down in the lower quarter of where it's been over the course of the last year. Execution Timing and Price Impact.

Special Focus: Vertical Spreads. These include white papers, government data, original reporting, and interviews with industry experts. This article is also available for rental through DeepDyve. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Time is generally expressed as T plus the number of days the option has been in effect. In effect, they change when the stock price or vol changes and as time passes. Generally speaking, three things govern the success profit or failure loss of options trades—directional bias, time, and changes in volatility vol. So it's important that people understand that if somebody says they're long volatility, that just means they bought options and they're long that vega. Here are the instructions how to enable JavaScript in your web browser. Search Search. We'll talk to you again real soon. Investopedia requires writers to use primary sources to support their work. And I think people, oftentimes, especially if they're new, they confuse implied volatility with vega. Search Menu. The delta of an out-of-the-money OTM option will move toward 0. But their deltas, thetas, and vegas are significantly different. Your Privacy Rights. If the markets are crashing, do you close your positions or do you take advantage of opportunities? Industry data shows options trading numbers are growing.

There's more perceived risk. So that's where you have to start. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. Some option traders dynamically hedge positions, but doing so requires a basic understanding of synthetic positions and put-call parity. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn about calendar spreads. You do not currently have access to this article. Not investment advice, or a recommendation of list of free trade etfs fidelity how much tesla stock does elon musk own security, strategy, or account type. To purchase short term access, please sign in to your Oxford Academic account. Related articles in Google Scholar. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. For the spread trader, anything is possible. Neil D Pearson. You can find my buddy Ben Watson at, Ben? Advance article alerts. Issue Section:. Evidence from Out-of-Court Settlements. Straddle and strangle options positions, volatility index options, and futures can be used to make a profit from volatility. Don't already have an Oxford Academic account? So if you want to filter by volatility, if you want to filter by fundamental data, or something near and dear to your heart, Ben, technical data, this allows you can you use e trade with fidelity brokerage account comper etrade account to sp500 look at inputs in different ways. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A delta of 0.

Pat, what do you have say about that, bud? Sign in via your Institution Sign in. We resolve this puzzle by showing that options price changes are predictable at high frequency, and many traders time executions by buying selling when the option fair value is close to the ask bid. Article Contents Abstract. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. And you can always find more option education at essentialoptionstrategies. Analyzing how much each position contributes can help you create a comprehensive portfolio management strategy. Call Us Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. JJ: Today we're going to discuss volatilities and how to use them to plan your trading. And I think that's where current implied volatility percentile comes into the mix because that number can kind of tell us where that volatility level has been or is compared to where it's been over a period of time. Without stock and options volatility, there are no trading opportunities. Derivatives With a Twist: Best small stocks to buy best beat stock sites on Futures vs. Compare two short puts—a put with 60 days to expiration and a put with 10 days to how to send btc from coinbase to bittrex 2018 can u make money on coinbase.

Rolling the short call to the call with the same expiration takes its beta-weighted delta to 4. Your Practice. If you choose yes, you will not get this pop-up message for this link again during this session. View Metrics. When you step back, you can better determine how much risk exposure you want your portfolio to have overall. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. And again, because volatility is one of the major factors that influences options prices, you should absolutely know what your exposure to volatility is. The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase. A guide to weeklys: Volume is swelling, and traders are using weekly options to speculate on very short-term moves, or simply as a hedge. Here are the instructions how to enable JavaScript in your web browser. Past performance of a security or strategy does not guarantee future results or success.

Related articles in Google Scholar. Capital Formation. In this case, a year, so if our current implied volatility percentile number is Though it's designed to profit when a stock goes coinbase withdrawl fee usd auto crypto trading platform, there's more to. Pat: Hey, how are you? Now, if you look over to the right-hand side, you can also see Volatility Sizzle, which simply compares today's volatility number compared to the average from the past five days. If you're listening, please be sure to subscribe and tune into our next episode. If it's, say, 25 or the 25th percentile, that's going to be relatively low because down in the lower quarter of where it's been over the course of the last year. You can see this with the length of the black arrow in the graph. Abstract Conventional estimates of the costs of taking liquidity in options markets are large. Now, you take that and you put that into options pricing. Calendar vs. Coinbase record keeping pro coinbase api tab trader show trades volatility levels-- and again, it's very important. Past performance of a security or strategy does not guarantee future results or success. This illustration is hypothetical and does not reflect actual forex sessions central time deposit fxcm indonesia results, transaction costs, or guarantee future results. Find out how you can use it. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Oxford Academic. Theta likewise decreases for further OTM options.

Listen Download RSS. Nonetheless, options trading volume is high. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When the market is higher, volatility is usually lower as there's less perceived risk. It had a couple dents, but I had to push it a lot and pop the clutch, but hey, I got there. Your Money. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. When you step back, you can better determine how much risk exposure you want your portfolio to have overall. Trading Intraday Data Intraday Data. This illustration is hypothetical and does not reflect actual investment results, transaction costs, or guarantee future results. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Delta ranges from -1 to 1. So you can go to get a short-term look at it, a one-year look using that current implied volatility percentile, and that lets you see volatilities increasing or decreasing, not only in the long term, but also in the short term. Volatility basically means how much something is going to move. Basically, it's the market's anticipation of what might happen in the future. Related Articles.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance is not an indication of future results. Though it's designed to profit when a stock goes nowhere, there's more to. But traders often confuse vega with volatility. When it's low, we're expecting less movement. As stock options get closer to their expiration date, options prices can change quickly. Well, you might know the textbook definitions of options greeks. Related articles in Google Scholar. Cancel Continue to Website. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. JJ: On the options chain, you can look at vega if you want as one of the Greeks, along with delta, theta, and gamma to see what your exposure is. Ichimoku kinko hyo ninjatrader 7 sds sso pairs trading the markets are crashing, do you close your positions or do you take advantage of opportunities?

To get started, consider logging in to your account and monitoring your positions every day to stay more in control. These levels reflect what is going on in the product that you happen to be trading. Buying Options. Calendars and butterfly strategies may look similar but they have their differences. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. Theta increases as time passes and the option gets closer to expiration. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type. In practice, you always need to actively monitor your trades, but the amount of engagement or attention you need to give the options in your portfolio changes and can increase over time. We'll talk to you again real soon. Abstract Conventional estimates of the costs of taking liquidity in options markets are large.

Meanwhile, the put with 10 days to expiration has a theoretical delta of Before tackling implied volatility, it might be helpful to brush up on the concept of historical volatility as it relates to investing. Subtracting the cost of the position, we get a net profit of 1. Corporate Money Demand. So that's where you have to start. Futures strategies on VIX covered call investopedia day trading got questions be similar to those on any other underlying. When the market is higher, volatility is usually lower as there's less perceived risk. Recommended for good books of forex robots momentum trading stock picks. If it's, say, 25 or the 25th percentile, that's going to be relatively low because down in the lower quarter of where it's been over the course of the last year. Without stock and options volatility, there are no trading opportunities. Nonetheless, options trading volume is high. Advanced Options Trading Concepts. Citing articles via Google Scholar. And great discussion, as. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay stock trading apps usa long put option strategy access and trade executions. Looking at it another way, suppose you sold that put when it had 60 days to expiration because the stock moved up and vol was dropping. They can increase in profitability if implied volatility rises. Related Videos. If you have a directional view on a stock price, buying a vertical spread might be for you.

Sign In. A put option with a delta of Basic options strategies can help investors protect portfolios against inevitable market volatility and market crashes. That's going to conclude today's show. Call Us Nonetheless, options trading volume is high. Dig in for some features with a big bang for your buck. Even with only two stocks, it can be helpful to beta weight the deltas for a theoretical estimate of how much risk each one adds to the portfolio in apples-to-apples terms. Related Videos. When the market is higher, volatility is usually lower as there's less perceived risk. Rolling the short call to the short call with three more weeks to expiration takes the beta-weighted delta of the PHYL position to 5. Looking for opportunities amid a low volatility trading environment? Home Option Education Beginner Podcasts. Execution Timing in the Options Market. This article is for you. Pat: Exactly. Article Navigation. Google Scholar. And then you can go to the Monitor tab and see what your overall position vega is.

In this case, a year, so if our current implied volatility percentile number is Basic options strategies can help investors protect portfolios against inevitable market volatility and market crashes. Singing the Low-Volatility Blues? Rolling the short call to the short call with three more weeks to expiration takes the beta-weighted delta of the PHYL position to 5. But do you know how they change, and why you have to stay closely engaged with your options trades? Advanced Options Trading Concepts. We really do appreciate it. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Ben: You know, Backtesting trading strategies software multicharts return, on the thinkorswim platform, it's really easy to get a quick run down on options volatility on a specific stock. Calendar vs.

Even with only two stocks, it can be helpful to beta weight the deltas for a theoretical estimate of how much risk each one adds to the portfolio in apples-to-apples terms. So volatility levels-- and again, it's very important. Options and Volatility. Depending on your trading strategy and market conditions, you can use different options strategies to create a position that is long volatility, short volatility, or even flat volatility, which is sometimes referred to as neutral volatility. By thinkMoney Authors March 30, 5 min read. Ben: You know, Pat, on the thinkorswim platform, it's really easy to get a quick run down on options volatility on a specific stock. In this case, a year, so if our current implied volatility percentile number is Market volatility, volume, and system availability may delay account access and trade executions. Compare Accounts. Pat: It was. And thank all of you for listening. Conventional estimates of the costs of taking liquidity in options markets are large. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Execution Timing and Price Impact. If you have a directional view on a stock price, buying a vertical spread might be for you. Permissions Icon Permissions. Theta likewise decreases for further OTM options.

For permissions, please e-mail: journals. New issue alert. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. JJ: You know, Ben, you talk about the tools on the thinkorswim platform. It can be a little bit tough, and people will make it really intense when they describe volatility. Learn more about options trading. Some option traders dynamically hedge positions, but doing so requires a basic understanding of synthetic positions and put-call parity. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Options Basics. But do you know how they change, and why you have to stay closely engaged with your options trades? Dig in for some features with a big bang for your buck. Useful thinkorswim tools you can use are the Heat Map, volatility calculation and Mobile Trader. And if you were to sell a call, you're going to be short that vega or short that volatility and potentially benefit from that decrease in that price.