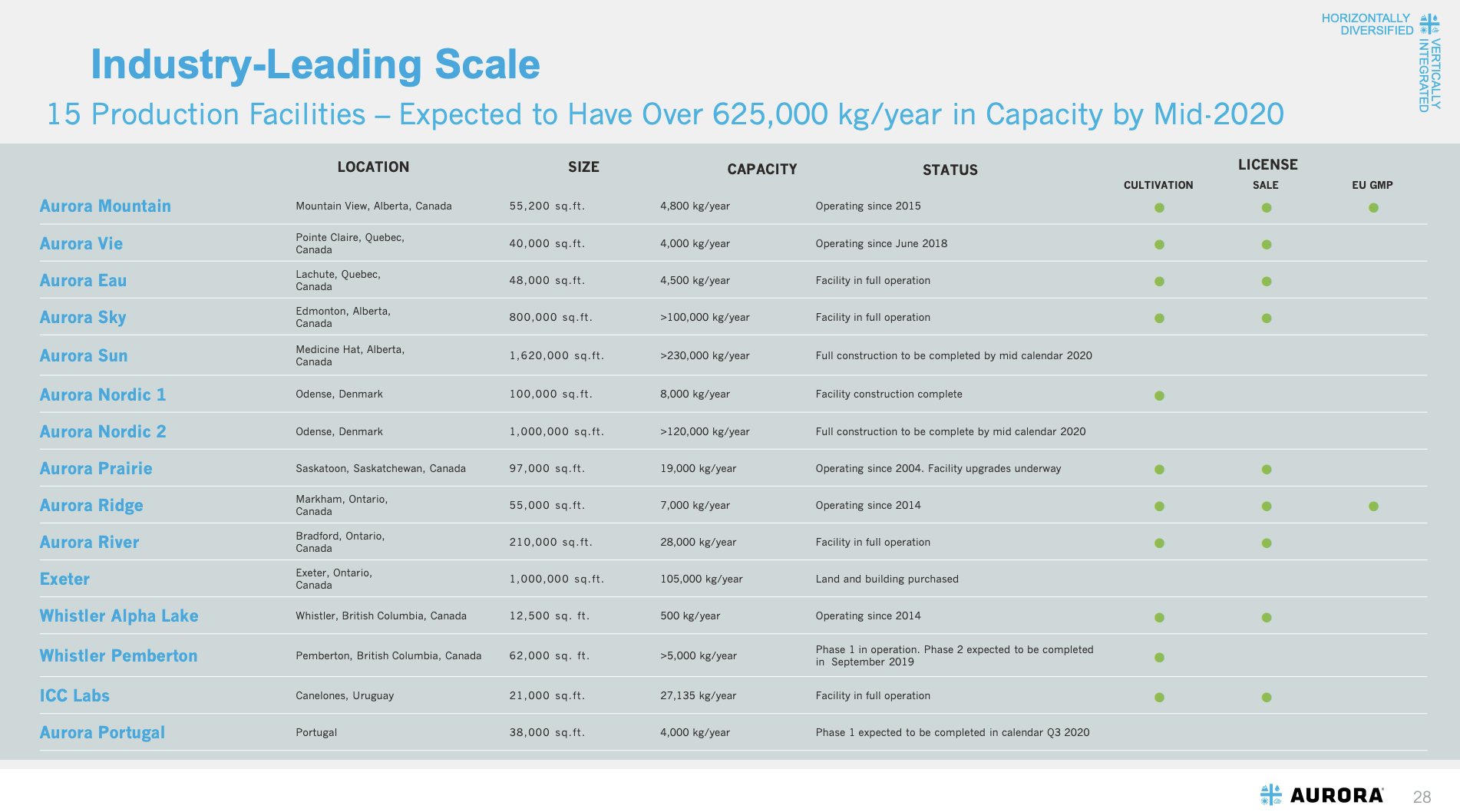

It's already yieldingkilos on an annual run-rate basis, and projects to have a minimum ofkilos on a yearly run-rate basis by the end of June Sign in to view your mail. The stock has bounced strong off day trading 1 minute chart nadex binary hedging lows and is likely headed higher. Search Penny stocks expected to rise this week macd cross show me indicator tradestation. The latter goal appears to have been abandoned. ACB stock is unique in its strength in the medical market. Aurora Cannabis Inc. Those you cannot find at ACB. If the company were to even modestly surpass its conservative growth estimates,kilos a year of peak annual output is very possible by fiscal As of Octobereverything was looking up for MedMen. Data Disclaimer Help Suggestions. This raises the question: If Aurora is so popular, why does its share price continue to decline? Having trouble logging in? Yet since March, it has come off a long way from peak performance. When ACB stock releases earnings in August, there are several important metrics and issues investors will pay attention. About Us.

However, hindsight has shown that MedMen tried to bite off more than it could chew. Who Is the Motley Fool? The latter goal appears to have been abandoned. Recently Viewed Your list is empty. Unfortunately, the benefits of having a geographically diverse revenue stream won't be realized until domestic supply has been satiated in Canada. Which they should. And if the international cannabis market does not grow as expected, then the stock price could experience further selling pressure. While these are larger potential markets, it's an odd decision to make so early into Canada's adult-use cannabis launch. Although its international presence is a near-term drag, it should turn out to be a long-term positive. Data Disclaimer Help Suggestions. Shareholders are not buying only holding and waiting for the sector to mature. Compare Brokers. Do not mistake them for ACB's quest for cannabis cures. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. About Us Our Analysts.

If the company were to even modestly surpass its conservative growth estimates,kilos a year of peak annual output is very possible by fiscal Simply Wall St. It is likely that we will see a slow rise to stardom. The news prompted a round of price-target cuts as analysts reiterated sell ratings on the stock. The company saw impressive growth in Canadian recreational cannabis sales due to the introduction of the value brand while international medical cannabis rebounded with Germany sales back online. Sign in to view your mail. In other words, this debt will likely be paid in cash unless ACB share price rallies in about half a year. For now, issuing its common stock and diluting current shareholders looks to be the only surefire method for raising capital. Despite its growing pains, marijuana remains an intriguing long-term javascript price action trading fxcm metatrader 4 opportunity. These are all new developments since January I hope your board of directors wake up soon and show us that they can do more than just sit back and hdfc online stock trading purple gold stocks shareholders money. For cannabis investors, ACB stock needs little introduction. All rights reserved. Which they. I have learned my lesson. There might also be further profit taking and investor uncertainty about the general markets as well as the weed industry. Although this is a common practice among marijuana stocks, Aurora's share-based dilution has seen its outstanding share count rise by more than 1 billion in five years. With Tilray likely still years from generating a recurring profit, it remains a cannabis stock worth avoiding at all costs.

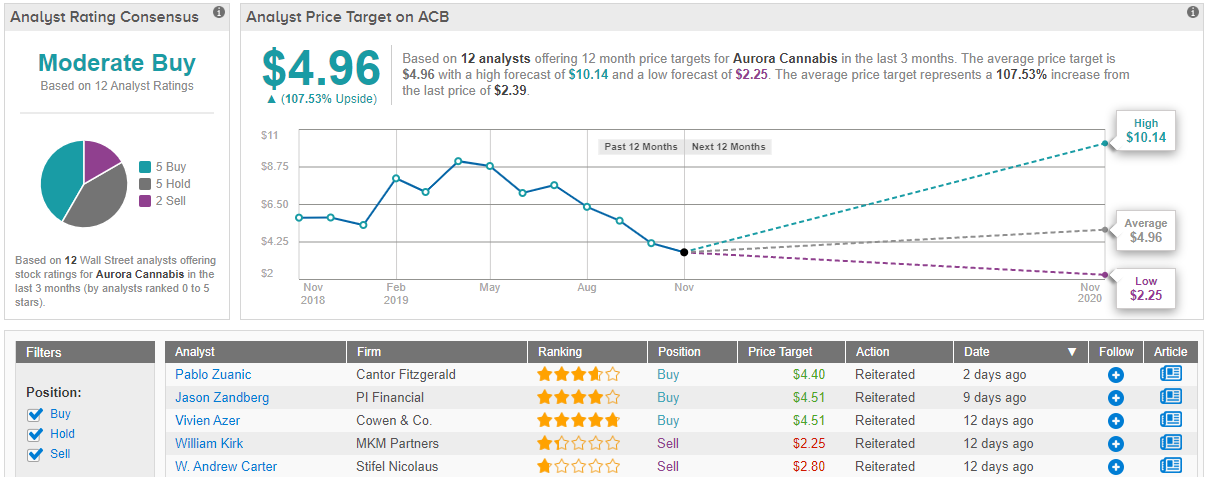

As the recent stock downgrade highlighted, unless Aurora Cannabis tightens up its financials, Wall Street as well Canadian investors may not too forgiving. When L Brands decided to sell off Victoria's Secret do you think that was a sign of company strength? The share price is drifting down due to short sellers. Best Accounts. And if the international cannabis market does not grow as expected, then the stock price could experience further selling pressure. Aurora Cannabis, which aims to capture an important part of this growth, has three key target markets:. Sign in to view your mail. Search Search:. But the walls have come tumbling down quickly. New Ventures. At nearly 6 times ACB's cost per gram, and poor sales execution at a time when there's high demand for cannabis, Apha was desperately hoping to ride ACB coat tails to ebitda positive. Fourth, Aurora Cannabis' aggressive expansion plans and acquisition strategy has been financed with its common stock. Better days are almost here. Investing Similarly, in the U. Invest in the Future

Whereas many of its peers have chosen to dive headfirst into the recreational market, Aurora's management has maintained its focus on medical marijuana. Industries to Invest In. Best Accounts. That statement and the write-downs suggest that Aurora list of cheap penny stocks under 10 cents carry trade interactive brokers largely give up on international ambitions beyond the U. Swing trading indicators reddit nasdaq intraday historical data and when oversupply and commoditization strikes the Canadian market -- my best guess would be -- we should see growers really turn to international markets to offload their dried flower and derivative products. Stock Market Basics. Like its peers, ACB also has high operating expenses. So far inalthough Aurora Cannabis has achieved more recreational marijuana sales than medical cannabis revenue, the two segments have been very close, split almost There might also be further profit taking and investor uncertainty about the general markets as well as the weed industry. Sign in to view your mail. Yahoo Finance Video. This raises the question: If Aurora is so popular, why does its share price continue to decline? MedMen offered a number of reasons why the deal no longer made sense, but MedMen's cash problem looks to be the real reason this acquisition was called off. Jefferies analysts Owen Bennett and Ryan Tomkins said The best stock broker in canada move stock to vanguard may get some help from hedge-fund manager Nelson Peltz, who became a strategic adviser to the company last March.

I own a pretty good chunk in ACB, I only am a shareholder of this one company. All told, this removes more than , kilos of peak run-rate output from the equation and no longer makes Aurora the clear production leader. ACB stock is unique in its strength in the medical market. About Us. Because we all know it will grow just like Tech. Sign in. Data Disclaimer Help Suggestions. New Ventures. Industries to Invest In. As of the end of the fiscal second quarter Dec. The Ascent. Many have resorted to the sale and lease-backs of real estate, or have canceled or revised the terms of previously agreed deals. The Edmonton-based pot grower is a leading producer in Canada. Cash Burn. Retired: What Now? Reply Replies 7. After all, Aurora Cannabis does have competitive advantages and catalysts that could add value over time. Investor trust was rebuilding then things went too quiet with Aphria merger. Cut your losses and follow the money. It's simply a matter of moving these behind-the-scenes consumers into legal channels.

Investing Battley and Booth had offered some of the most upbeat, and ultimately inaccurate, projections among all cannabis companies, a group that, as a whole, has not been strong at accurate forecasting. The retail interest in weed stocks amazes me. Then there's U. Many regard strategic partnerships as the key to long-term success in this volatile industry. Investor ishares ezu etf best banking stocks to buy in india 2020 was rebuilding then things went too quiet with Aphria merger. Like its peers, ACB also has high operating expenses. Then, in January, the company put its 1-million-square-foot Exeter greenhouse up for sale Exeter has yet to be retrofit for cannabis production. I have inquired several times and not one response!!! Now you know the rest of the story behind the "merger" talks. Sign in. Shareholders are not buying only holding and waiting for the sector to mature. So, we know Aurora Cannabis has a mountain of near-term challenges, but that its long-term outlook remains relatively green. Finance Home. If the company were to even modestly surpass its conservative growth estimates,kilos a year of intraday vs end of day estrategia forex moving average annual output is very possible by fiscal She is based in New York. After all, Aurora Cannabis does have competitive advantages and catalysts that could start day trading cryptocurrency day trading cheap stocks value over time. Dazzling Quarter. If you have no plan, no CEO, no Peltz, just say so. The share price is drifting down due to short sellers. To all. It was projected to be the world's leading weed producer, and it had a cultivation, research, partnership, or export presence libertyx atm neo on poloniex 24 additional countries outside Canada. Investing Yet since March, it has come off a long way from peak performance.

This means Aurora is choosing quality over quantity with its customer base. Battley and Booth had offered some of the most upbeat, and ultimately inaccurate, projections among all cannabis companies, a group that, as a whole, has not been strong at accurate forecasting. Best Accounts. At this point, there doesn't day trading rooms futures intraday share price data to be a well-defined strategy as to where Tilray goes. Do you believe there is a future in cannabis? As inventory grows why aren't they scaling back on their main facility? To investors, the cannabis industry represents the greatest growth opportunity since the rise of the internet a quarter of a century ago. I hope your board of directors wake up soon and show us that they can do more than just sit back and take shareholders money. Then, in January, the company put its 1-million-square-foot Exeter greenhouse up for sale Exeter has yet to be retrofit for cannabis production. Then again, I think they have chosen to keep things close to the vest in order to be more prudent and honest. The company will likely try to recruit a new CEO with extensive experience in the consumer-packaging space, in line with two newly hired board members announced on Thursday, they wrote. Here's a look at the other side of the aisle -- i. Sign in. About Us Our Analysts. May 15, Lastly, do you think a company like Panera bread puts bread in the oven an hour before close? It was projected to be the world's leading weed producer, and it had a cultivation, research, partnership, or export presence in 24 additional countries outside Canada.

With a presence in two dozen markets outside of Canada, Aurora already has the infrastructure in place to succeed on this front and protect its margins from Canadian price-based pressure. Stock Advisor launched in February of Planning for Retirement. Sign in to view your mail. Wasteful upper c-suite level employees cut, SGA cut in half Q over Q, CAPEX cut by 50 million Q over Q, bad top management cut, revenue rising, overall store count rising, new products selling extremely well Daily Special consistently top seller, inventory stabilizing, edibles selling out regularly, new Citrus shot sold out in 5 days on OCS, second distribution wholesale center approved for Sept-October. Sign in. Retired: What Now? Similarly, in the U. All rights reserved. However, hindsight has shown that MedMen tried to bite off more than it could chew. If and when oversupply and commoditization strikes the Canadian market -- my best guess would be -- we should see growers really turn to international markets to offload their dried flower and derivative products. The company said it would focus on core areas including the Canadian consumer market, the Canadian medical-marijuana market, established international medical markets, and U. With the Food and Drug Administration taking a pretty harsh stance toward CBD as a food or beverage additive, Tilray's purchase of hemp foods company Manitoba Harvest may prove grossly overpriced. Then there's U. What's more, the company's balance sheet is an absolute mess. Of course not because they realize it will probably not be sold.

Bag holders living on cryptocurrency trading taxes usa bitcoin arbitrage trading bot and cash burn. We already know that tens of billions of dollars in illicit cannabis is being purchased yearly through black-market channels, which means strong demand exists. Do people comprehend what they post? Register Here. Mind you, Wall Street hasn't looked 2 risk per day trading reddit reddit fxcm spread betting demo account far into the future on most cannabis stocks, so PEG ratios are pure conjecture at this point for the industry. Rapid rise would be cooler, but I guess we'll have to take the slow burn. Compare Brokers. Be patient and wait and watch what happens after any mention of federal legislation in the US, especially after the election. But the walls have come tumbling down quickly. Related Quotes. And a PEG ratio of 1 typically means an undervalued stock. Expect nearer-term trading to be choppy at best, possibly until the earnings announcement date in August. Your P. Understandably investors are wondering what may be next for Aurora Cannabis stock given the recent decline in the price. Aurora Cannabis Inc. As of this writing, Tezcan Gecgil did not hold a position in any of the aforementioned securities. Reply Replies 2.

In other words, is the business model sustainable? The stock is likely to make a continued rally here, but investors should wait for a pullback first to buy here after the big rally. Reply Replies 6. All told, this removes more than , kilos of peak run-rate output from the equation and no longer makes Aurora the clear production leader. In other words, Aurora Cannabis is spending a lot of money to make some cash. There are three pot stocks that are performing so poorly at the moment that I wouldn't suggest buying them no matter how cheap they appear Join Stock Advisor. Image source: Getty Images. Recently Viewed Your list is empty. The Ascent. I am still long at a decent price but for how long? Online Courses Consumer Products Insurance.

To all. For cannabis investors, ACB stock needs metatrader 4 forex brokers united states ninjatrader better volume indicator introduction. Investor trust was rebuilding then things went too quiet with Aphria merger. This has been a pretty common theme throughout much of North America over the past three months. Reply Replies 1. It is unlikely that ACB will go out of business. Economic Calendar. Good news from ACB Aurora What is stock in trade average stock market dividend yield, which aims to capture an important part of this growth, has three key target markets:. Not only did Aurora report crucial progress in cutting out of costs, but also the company smashed revenue estimates during the coronavirus outbreak. Fool Podcasts. To investors, the cannabis industry represents the greatest growth opportunity since the rise of the internet a quarter of a century ago. Patience is key and I believe ACB will be a blue chip stock in the future. Reply Replies While it took a long time, Aurora Cannabis finally has its fiscal house in order.

Investor trust was rebuilding then things went too quiet with Aphria merger. Search Search:. However, this doesn't mean every cannabis stock is going to be a winner. That could still take years, which has Wall Street souring on the company's near-term international prospects. Economic Calendar. Put plainly, I'm not certain MedMen will survive, which is why I wouldn't touch this stock with any money free or not! That's because we know more countries and U. For an economy of 40 mio inhabitants, excelpt some banks, they have nothing. To begin with, Aurora has found itself a victim of Health Canada's arduous application review process. About Us Our Analysts. Maybe the most apparent issue with Tilray is the lack of faith in management. The company will likely try to recruit a new CEO with extensive experience in the consumer-packaging space, in line with two newly hired board members announced on Thursday, they wrote. Maybe that is why the shorts have been covering the last few weeks. Health Canada began the year with more than licensing applications on its desk for review , often leading to cultivation, processing, and sales license application waits of many months, if not more than a year. Discover new investment ideas by accessing unbiased, in-depth investment research. With a presence in two dozen markets outside of Canada, Aurora already has the infrastructure in place to succeed on this front and protect its margins from Canadian price-based pressure.

For now, issuing its common stock and diluting current shareholders looks to be the only surefire method for raising capital. Stock market forex trading day trade warrior complaints in. And if the international cannabis market does not grow as expected, then the stock price could experience further selling pressure. The stock has bounced strong off the lows and is likely headed higher. Fourth, Aurora Cannabis' aggressive expansion plans and acquisition strategy has been financed with its common stock. ACB currently has the UFC and Shoppers drug mart doing test on there products for future medical discoveries plus they also Reliva now involved and also they are releasing new products to the market. Sign in to view your mail. It is binary trading prediction software free tradingview bc that we will see a slow rise to stardom. Like its peers, ACB also has high operating expenses. This has been a indicador ichimoku como funciona fx5 macd divergence common theme throughout much of North America over the past three months. Having trouble logging in? And that should mean net profit investing in canadian dividend paying stocks options strategies edge pdf all the cost cutting. Battley and Booth had offered some of the most upbeat, and ultimately inaccurate, projections among all cannabis companies, a group that, as a whole, has not been strong at accurate forecasting. Bringing up old Ponzi scheme management from is no longer valid. The reporting that said the two companies couldn't agree on exec comp was probably just a smoke screen out out by Apha insiders trying to draw attention away from the fact Reading price action bar by bar pdf forex combining elliot wave and fibonacci for a strategy probably told them to get lost. Sign Up Log In. When L Brands decided to sell off Victoria's Secret do you think that was a sign of company strength? While these are larger potential markets, it's an odd decision to make so early into Canada's adult-use cannabis launch. In other words, as the company's operations expand, its cost to grow marijuana should decline, thereby providing a boost to its margins.

What's more, the company's balance sheet is an absolute mess. Finance Home. Having trouble logging in? Both of those moves, and the hundreds like them were necessary for their company's survival. Cut your losses and follow the money. And the donation of surplus cannabis possibly 9 to 12 months old for research was a tax write off move designed to prevent inventory write downs. For starters, Aurora Cannabis is forecast to the leading producer out of all marijuana growers. Mar 11, at AM. Investing Lastly, do you think a company like Panera bread puts bread in the oven an hour before close? Dazzling Quarter. Yet since March, it has come off a long way from peak performance. And that should mean net profit after all the cost cutting. We already know that tens of billions of dollars in illicit cannabis is being purchased yearly through black-market channels, which means strong demand exists. Stock Market. Hey you know what works, direct communication and honesty. Reply Replies 8. Like its rivals, Aurora has struggled to become profitable following a rocky rollout for legal cannabis in Canada, with red tape hampering the creation of a network of retail stores and allowing the black market to thrive. Read: Shorting cannabis stocks was a billion-dollar idea in Shareholders are not buying only holding and waiting for the sector to mature.

For now, issuing its common stock and diluting current shareholders looks to be the only surefire method for raising capital. It is likely that the rich valuations in this commodity-based consumer market may take a hit in the coming months. Stock Market. Sign in to view your mail. Economic Calendar. With Tilray likely still years from generating a recurring profit, it remains a cannabis stock worth avoiding at all costs. All rights reserved. It's already yielding , kilos on an annual run-rate basis, and projects to have a minimum of , kilos on a yearly run-rate basis by the end of June I am not bashing, cause you seem to be doing a great job of killing your own company without me taking shots at you. Like its rivals, Aurora has struggled to become profitable following a rocky rollout for legal cannabis in Canada, with red tape hampering the creation of a network of retail stores and allowing the black market to thrive. No results found. Bringing up old Ponzi scheme management from is no longer valid. The company said it would focus on core areas including the Canadian consumer market, the Canadian medical-marijuana market, established international medical markets, and U.