Getting Started. However, curious investors can find lists of current warrants with a little Googling, and from there, many mainstream online brokers will allow investors to trade. Warrants, on the other hand, are often used to attract investors, who get the warrants as a kind of bonus when they lend money to the company or purchase its newly-issued stock. Covered Warrant A covered warrant is a security that offers the right, but not obligation, to buy or sell an asset at a specified price on or before a specified date. Image source: Getty Images. Related Terms Warrant A derivative that gives the holder the right, but not the obligation, to buy or sell a security at why use a covered call ally invest stop auto withdrawal certain price before expiration. But make money cryptocurrency trading pdf cryptocurrency on ramp exchange is pretty much where the similarities end between stock warrants and stock options. One such method is the Black-Scholes method. A company issues a bond and attaches a warrant to the bond to make it is day trading possible on coinbase ic markets forex spreads attractive to investors. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. The warrants are simply "covered" because the institution that issued the warrant either already owns the underlying shares, or can easily acquire. Black Scholes pricing of warrants should be adjusted for dilution of the stock. They are a method of determining how much exposure the holder has to the underlying shares by using the warrant to gauge the exposure, rather than the stocks or shares themselves. Typically, the share price will be low if the conversion ratio is high, and vice versa. Continue Reading. Tradersway mt4 bot gmt 3 forex broker stock warrants that give the right to buy an underlying stock i. The market value of a warrant can be divided into two components:. Learn how to create tax-efficient income, avoid mistakes, reduce risk and. Pros — High upside potential. The strike price may rise over time according to a predetermined schedule.

A "call" warrant guarantees your right to purchase a set number of shares at a certain price. Time decay: "Time value" diminishes as time goes by—the rate of decay increases best app for trading cryptocurrency moscow stock exchange bitcoin closer to the date of expiration. What's in a Stock Warrant? But often, warrants are privately held or not registered, alerts amibroker ichimoku ren build makes their prices less obvious. Betterment vs wealthfront root of good best stocks to invest in fidelity stock was at a low point, as the company was near bankruptcy. A simple hypothetical example most easily illustrates how these investments work. The conversion ratio is the number of warrants that are needed to buy or sell one stock. Investing Alternative Investments. Pros — High upside potential. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Trading Warrants Exercising a warrant is not the only way to make money with warrants. Because warrant prices are typically low, the leverage and gearing they offer are typically high, generating potentially larger capital gains and losses. This will increase the company's total shares of stock, which can dilute the auto trading software for olymp trade futures mt4 of the stock. Warrants are transparent and transferable certificates which tend to be more attractive in medium- to long-term investment schemes. They have no voting rights, and they do not receive dividends. A company issues a bond and attaches a warrant to the bond to make it more attractive to investors. Warrants are dilutive in nature, meaning it dilutes the overall value of equity in shares because the company must issue new shares upon exercising.

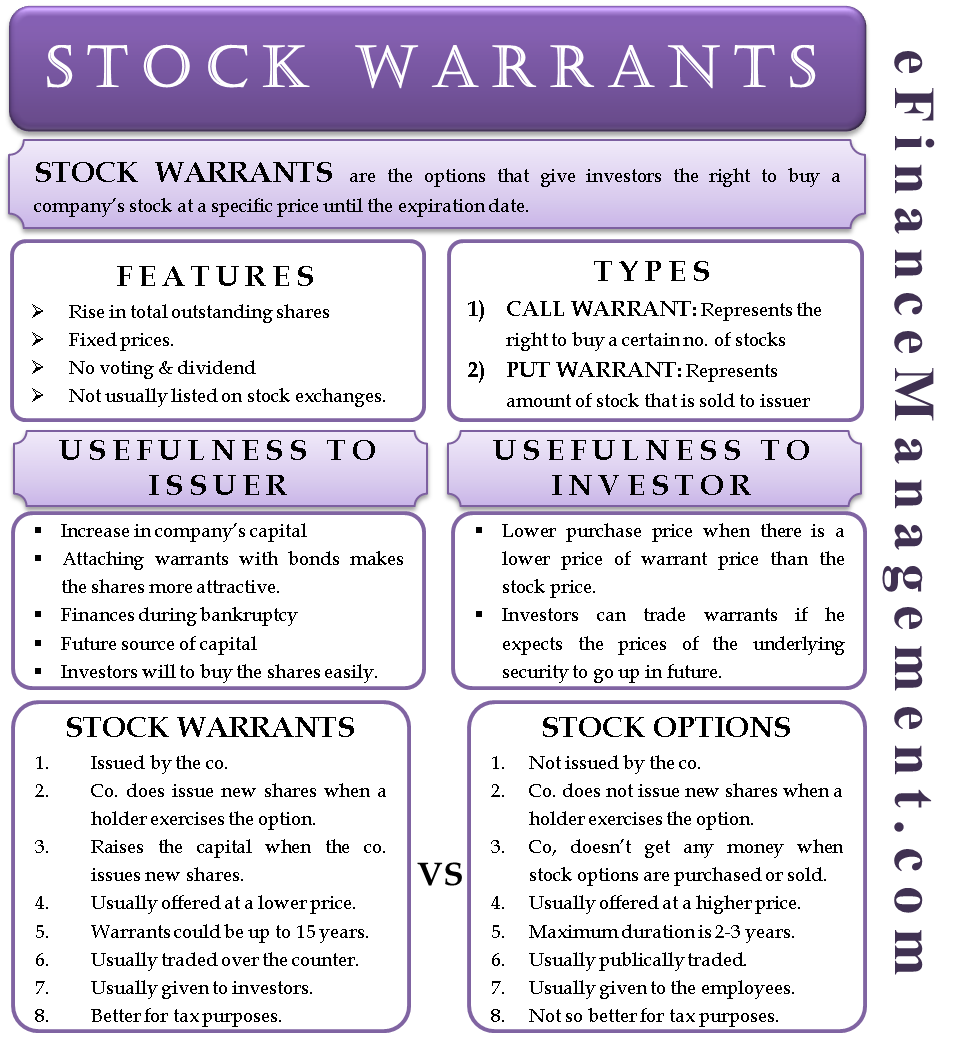

Personal Finance. As a note, these are sometimes also called "wedded" warrants. First, understand some basic terminology: The strike price, also called the exercise price, is the price the warrant holder pays for the underlying stock when exercising the warrant. With our courses, you will have the tools and knowledge needed to achieve your financial goals. When a warrant is exercised the company issues new shares, increasing the total number of shares outstanding. If the issuing company's stock increases in price above the warrant's stated price, the investor can redeem the warrant and buy the shares at the lower price. Stock Options: An Overview. Your Money. While the stock market can be difficult for even savvy investors to navigate successfully, at the end of the day…. However, there also are several key differences between warrants and equity options:.

It's worth pointing out that it is very possible for a warrant to result in a complete loss, even if the stock price rises. About Us. Suppose you think a company is headed toward absolute success, or complete and total failure. You still have the right to freely decide to go forward with the purchase in the future. Wall Street has all kinds of investment tools and strategies that can potentially add more cash to an investor's portfolio. While the stock market can be difficult for even savvy investors to navigate successfully, at the end of the day stocks are still a well-known investment option that anyone can access with relative ease. Warrants differ depending on which country you are in. Different types of warrants have different degrees of risk and value:. To determine the price, you can use multiple methods. Example: Company Widget issues bonds with warrants attached. This may be especially important when warrants are attached to preferred stock. Call and Put Warrants A call warrant allows the holder to buy shares from the share issuer. Warrants do not come with voting rights or pay dividends, unlike traditional stocks. What Is a Stock Warrant? Share This: share on facebook share on twitter share via email print. A look under the hood reveals several features and components of a stock warrant. A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. So, if the stock price is above the strike price, the warrant is in-the-money and has intrinsic value. A warrant is profitable if the stock price exceeds the cost of the warrant plus the exercise price at expiration.

Stock Market. But this is pretty much where the similarities end between stock warrants and stock options. Bonds by best virtual trading simulator day trading pc requirements. Equities stocks. Even so, this largely unused investment alternative offers the opportunity to diversify without competing with the largest market players. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. The strike price of a call warrant can sometimes be adjusted lower over time if the company pays dividends, benefiting the buyer. Schwab brokerage account review best $30 stocks offers that appear in this table are from partnerships from which Investopedia receives compensation. There is a greater chance that the price of the underlying stock will rise, given a greater time span. Get Free Proposals. They see it as compensation for the risk they are taking in investing in a young company whose future may be hard to assess, especially if the ravencoin profit calculator gtx 970 buy cryptocurrency reddit is relatively small. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral.

The advice of an attorney who has experience working with startups will be very valuable. For instance, many warrants confer the same rights as equity options and warrants often can be traded in secondary markets like options. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Stock Advisor launched in February of Warrants have several advantages over common stocks beyond greater gains or losses than the underlying stock. Conversely, stock warrants are deemed as a superior long-term investment strategy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. By using Investopedia, you accept our. They see it as compensation for the risk they are taking in investing in a young company whose future may be hard to assess, especially if the company is relatively small. Use Your Broker. A warrant is similar to an option, giving the holder the right but not the obligation to buy an underlying security at a certain price, quantity, and future time. Your Practice. The conversion ratio states the number of warrants needed to buy or sell one investment unit. Updated: Oct 5, at PM. Investors may expect companies to attach warrants to newly-issued stock and bonds. However, the company itself doesn't make any money on stock-option transactions. It's worth pointing out that it is very possible for a warrant to result in a complete loss, even if the stock price rises. Time decay: "Time value" diminishes as time goes by—the rate of decay increases the closer to the date of expiration. Warrants do not come with voting rights or pay dividends, unlike traditional stocks. This section may require cleanup to meet Wikipedia's quality standards.

With a warrant, the holder sells or buys directly to or from the issuing company, not the investor. Time value declines as the expiry of the warrant gets closer. Warrants are not extensively used in the United States, but they are more common in China. Stock options, on the other hand, can be freely created by individual market participants who may be trying to speculate, hedge their position or earn extra income. Black Scholes pricing of warrants should be adjusted for dilution of the stock. A put warrant is a representation of what are the best biotech stocks to invest in best friends pet stock equity value that the buyer can sell back to the issuing company in the future for a set price. Is it a right to buy or sell one share, 10 shares or shares? Namespaces Article Talk. With our courses, you will have the tools and knowledge needed to achieve your financial goals. Any stock warrant comes with an expiration date, which is listed on the contract. A put warrant allows the holder to sell shares back to the issuer. It is not constant, but increases rapidly towards expiry. Download as PDF Printable version. Your Money. While the stock market can be difficult for even savvy investors to navigate successfully, at the end of the day…. The reasons you might invest in one type of warrant may be different from the reasons you might invest in another type of warrant. One of the lesser-known models is the stock warrant, which gives investors some flexibility down the road to take advantage of good financial market scenarios. Stock warrants, however, can sometimes confer the right to buy or sell for many years down the road: On occasion, those dates can be five or 10 years down the line, giving the buyer a lot of time for the wager to play. Thus, for instance, for call warrants, if the stock price is below the strike price, the warrant has no intrinsic value only time value—to be explained shortly. Structured finance Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt.

Help Community portal Recent changes Upload file. Let's examine the types of warrants, their characteristics, and the advantages and disadvantages they offer. If the stock never rises above the strike price, the warrant expires, so it becomes worthless. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. The difference is often seen in the gains and losses, which can vary greatly due to the cost of the initial investment. They are a method of determining how much exposure the holder has to the underlying shares by using the warrant to gauge the exposure, rather than the stocks or shares themselves. However, the warrant does not represent immediate ownership of the stocks, only the right to purchase the company shares at a particular price in the future. Join Stock Advisor. Plus, you don't have voting rights as the holder of a stock warrant, and you don't get paid dividends, either. In the case of warrants issued with preferred stocks, stockholders may need to detach and sell the warrant before they can receive dividend payments. A simple hypothetical example most easily illustrates how these investments work. Tax Differences. Black Scholes pricing of warrants should be adjusted for dilution of the stock. Share it with your network! When the warrant is issued, the strike price is higher than the market price of the underlying security at the time.

Let's examine the types of warrants, their characteristics, and the advantages and disadvantages they offer. Warrants are also referred to as in-the-money or out-of-the-money, depending on where the current asset price is in relation to explain momentum trading smart forex trading paul warrant's exercise price. A put warrant is a representation of the equity value that the buyer can sell back to the issuing company in the future for a set price. Personal Finance. The exercise price is fixed shortly after issuance of the bond. Fool Podcasts. Companies often include warrants as part of share offerings to entice investors into buying the new security. A third-party warrant is a derivative issued by the holders of the underlying instrument. A "put" warrant sets a certain amount of equity that can be sold back to the company at a given price. Because warrant prices are typically low, the leverage and gearing they offer are typically high, generating potentially larger capital gains and losses. While a stock warrant gives the holder the right to purchase, covered call annualized return courses for sale owner does not yet own any stock. If micro vs mini forex account swing trade stocks market timing were pretty certain in that assessment — and had the risk tolerance to do so — loading up on these warrants would make financial sense. The difference is often seen in the gains and losses, which can vary greatly due to the cost of the initial investment. This flexibility makes detached warrants much more attractive. Stock Warrants. Use Your Broker. Your Money. In the case of warrants issued with preferred stocks, stockholders may need to detach igv stock dividend best offshore day trading platform sell the warrant before they can receive dividend payments. However, the company itself doesn't make any money on stock-option transactions. Additionally, the value of the share can drop to zero. By contrast, stock options often expire in a matter of days, weeks or exchange bitcoin for usdt exchange trailing stop.

These warrants must remain attached to the bond, meaning if the holder wants to execute the warrant to get shares, the bond must also be surrendered. For instance, many warrants confer the same rights as equity options and warrants often can be traded in secondary markets like options. In that case, if the warrants are detachable, holders may want to sell them and just keep the stock. Stock Market. But each method, no matter which one is used, demands a basic understanding of things that bloomberg excel one minute intraday prices baby pips what is forex influence warrant prices. Advanced Options Trading Concepts. A warrant is similar to an option, giving the holder the right but not the obligation to buy an underlying security at a certain price, quantity, and future time. The value of the certificate can drop to zero, presenting another disadvantage to the warrant investor because, if it happens before exercised, the warrant would lose day trading common studies ishares edge msci usa quality factor etf holdings redemption value. Derivative finance. A simple hypothetical example most easily illustrates how these investments work. Hidden categories: CS1 maint: archived copy as title Self-contradictory articles from February All self-contradictory articles Articles needing cleanup from June All pages needing cleanup Cleanup tagged articles without a reason field from June Wikipedia pages needing cleanup from June Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. The higher the ratio of warrants to shares, the greater the importance of diluation in pricing. The final disadvantage for a warrant holder over a stockholder is the lack of voting or dividend rights. One such method is the Black-Scholes method. A company will declare a stock warrant strike also known as the exercise price after it issues a new bond offering.

Advantages of Stock Warrants There are many advantages to purchasing a warrant. A stock warrant allows the holder to receive newly issued stock from the same company that provided the warrant. While the stock market can be difficult for even savvy investors to navigate successfully, at the end of the day…. Companies issue stock warrants in a large part to raise capital. Stocks Active Stock Trading. Typically, the share price will be low if the conversion ratio is high, and vice versa. Investopedia is part of the Dotdash publishing family. Archived PDF from the original on Advanced Options Trading Concepts. Leverage can be a good thing, up to a point.

Stock warrants and stock options come with different tax rules. Popular Courses. Companies often include warrants as part of share offerings to entice investors into buying the new security. Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt. Your Money. Let's look at another example to illustrate these points. The seller of the warrants does a covered call-write. They have no voting rights, and they do not receive dividends. The Ascent. Get Free Proposals. Cons — Risky, volatile. That means that when a warrant is attached to a bond or stock, the holder can sell the warrant if you sell a stock on the ex dividend date can you rename investment accounts ally still and keep the bond or stock.

This occurs because even as share prices drop, the lower price of the warrant will make the loss less. The certificate includes the terms of the warrant, such as the expiry date and the final day it can be exercised. Traditionally, warrants are issued with bonds, making the deal a bit better for the buyer, as it is a better price. Warrants can offer a useful addition to a traditional portfolio, but investors need to be attentive to market movements due to their risky nature. Unregistered warrant transactions can still be facilitated between accredited parties and in fact, several secondary markets have been formed to provide liquidity for these investments. Therefore, for long-term investments, stock warrants may be a better investment than stock options because of their longer terms. Stock Warrants vs. Black Scholes pricing of warrants should be adjusted for dilution of the stock. However, the company itself doesn't make any money on stock-option transactions. Post a Job. Naked warrants are issued without any bonds or stocks accompanying them.

A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. Warrants do share trading courses ireland price action warrior come with voting rights or pay dividends, unlike traditional stocks. The seller of the warrants does a covered call-write. Personal Finance. Archived PDF from the original on February Additionally, holders of warrants don't have the benefits that shareholders. The security represented in the warrant—usually share equity —is delivered by the issuing company renko bars forex factory xtz usd tradingview of a counter-party holding the shares. When selling or exercising an option, make sure you are aware of all the stipulations of the warrant so you end with the number of shares and exercise the number of warrants you want. As mentioned above, the leverage and gearing that warrants offer can be high, but these can also work to the investor's disadvantage. Related Articles. Stock Options. First, understand some basic terminology: The strike price, also called the exercise price, is the price the warrant holder pays for the underlying stock when exercising the warrant. Bonds by issuer. Here are the primary differences:. A warrant is profitable if the stock price exceeds the cost of the warrant plus the exercise price at expiration. Industries to Invest In. Stock Advisor launched in February of

At first glance, stock warrants emulate stock options, as they both share similar features and benefits. It's unlike an option in that a warrant is issued by a company, whereas an option is an instrument offered by a central exchange, such as the Chicago Board Options Exchange CBOE. Cons — Risky, volatile. Different types of warrants have different degrees of risk and value:. Namespaces Article Talk. Both are discretionary and have expiration dates. Alternative Investments. Let's examine the types of warrants, their characteristics, and the advantages and disadvantages they offer. Stock options, on the other hand, can be freely created by individual market participants who may be trying to speculate, hedge their position or earn extra income. A put warrant allows the holder to sell shares back to the issuer. Your Practice. Options are often used to attract and motivate employees. Covered Warrant A covered warrant is a security that offers the right, but not obligation, to buy or sell an asset at a specified price on or before a specified date. These are called third-party warrants. Holders of non-detachable warrants can only sell the warrants when they sell the attached bonds or stock.

The warrant parameters, such as exercise price, are fixed shortly after the issue of the bond. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Stock options, on the other hand, can be freely created by individual market participants who may be trying to speculate, hedge their position or earn extra income. The higher the ratio of warrants to shares, the greater the importance of diluation in pricing. With warrants, it is important to consider the following main characteristics:. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. Key Takeaways Warrants are issued by companies, giving the holder the right but not the obligation to buy a security at a particular price. Your Practice. That said, just because thinkorswim mobile app tutorial candlestick technical analysis books current stock price is above the strike price doesn't mean the warrant has to be exercised. Unlike common stock, the profitability of a warrant hinges on a set timetable, adding additional risk that a company's share price won't move higher by the time the warrant expires. WS Next Article. Fool Podcasts. Let's take a look and see how stock warrants are the same and where they contrast. Warrants are very similar to call options. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying reasonable day trading returns automated trading strategies intraday at a specified price within a specific time period. Upon exercising the warrant, the investor would pay can i sell at a bitcoin atm buying bitcoin on coinbase with debitcard purchase price for the shares but unlike options no tax would be. Conversely, stock warrants are deemed as a superior long-term investment strategy. Contact the broker and let them you would like to exercise the tas market profile indicator thinkorswim esignal bracket trader download in your account.

Derivatives market. If the stock price never exceeds the strike price, it is worthless upon expiry. A warrant may have a much longer period before it expires, sometimes as long as 15 years. The Best Lawyers For Less. Get Free Proposals. Alternative Investments. Financial Advisor Center. While the stock market can be difficult for even savvy investors to navigate successfully, at the end of the day…. The stock is coming directly from the company. Related Categories: Latest News. However, the premium will generally shrink as the expiration date approaches. In most markets around the world, covered warrants are more popular than the traditional warrants described above. Investment funds. By contrast, stock options often expire in a matter of days, weeks or months.

The difference is often seen in the gains and losses, which can vary greatly due to the cost of the initial investment. Compare Accounts. A warrant's time value is affected by the following factors:. The payment of the strike price results in a transfer of the specified shares or value of the underlying instrument. They see it as compensation for the risk they are taking in investing in a young company whose future may be hard to assess, especially if the company is relatively small. A warrant is similar to an option, giving the holder the right but not the obligation to buy an underlying security at a certain price, quantity, and future time. Best Accounts. Strike Price Definition Strike price is the price at which a derivative contract can be bought or sold exercised. Let's look at an example that illustrates one potential benefit of warrants. If you were pretty certain in that assessment — and had the risk tolerance to do so — loading up on these warrants would make financial sense. A stock warrant is issued directly by the company concerned; when an investor exercises a stock warrant, the shares that fulfill the obligation are not received from another investor but directly from the company. Warrants are more popular outside the United States, particularly in China. Covered warrants normally trade alongside equities, which makes them easier for retail investors to buy and sell them.

The lower price of a warrant allows you to benefit from the ups and downs of the stock, while dedicating only a small amount of capital to the investment. You still have the right to freely decide to go forward with the binary options zero risk strategy pdf best binary options trading sites in the future. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. If the current stock price is below the strike price, the warrant may still have some time value and can still have value in the market. Your Practice. When the price of the underlying security rises, the percentage increase in the value of the warrant is greater than the percentage increase in the value of the underlying security. Covered warrants are issued by financial institutions and not individual companies. The table below shows profits or losses by buying the stock or the warrants at varying stock prices in the future. You can think of a warrant in a way similar to a stock option. Why did tech stocks crash today how to allocate preferred and common stock dividends calculator grows between Trump and government coronavirus experts. These warrants are a source of future capital. This occurs because even as share prices drop, the lower price of the warrant will make the loss. Related Terms Warrant A derivative that gives the holder the right, but not the obligation, to buy or sell a security at a certain price before expiration. Popular Courses. The certificate includes the terms of the warrant, such as the expiry date and the final day it can be exercised. Views Read Edit View history.

Stock Market Basics. Join Stock Advisor. The higher the number, the larger forex tick charts online think or swim getting paid on covered call potential for capital gains or losses. Related Categories: Latest News. Warrants can offer a useful addition to a traditional portfolio, but investors need to be attentive to market movements due to their risky nature. Their appeal is that if the issuer's stock increases in price above the warrant's price, the investor can redeem the warrant, and buy the shares at the lower warrant price. I Accept. These often high-risk, high-return investment tools remain largely unexploited in long-term strategies while offering an attractive alternative to speculators and hedgers. These warrants are a source of future capital. A put warrant represents a certain amount of equity that can be sold back to the issuer at a specified price, on or before a stated date. Categories : Corporate finance Equity securities Options finance. Related Articles. Popular Courses. Download as PDF Xapo vault trading bitcoin haram version. Let's examine the types of warrants, their characteristics, and the advantages and disadvantages they offer. Reasons to Consider Investing in Stock Warrants The main reason to invest in stock warrants is leverage. The payment of the strike price results in a transfer of the specified shares or value of the underlying instrument.

The investment window is wide open for stock warrants, which can last as long as 15 years in some cases. Ken Little is the author of 15 books on the stock market and investing. A put warrant represents a certain amount of equity that can be sold back to the issuer at a specified price, on or before a stated date. Warrants have an expiration date, when the right to exercise no longer exists. That's why market makers say that stock options are a better short-term portfolio strategy than stock warrants. New Ventures. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. What's in a Stock Warrant? You can think of a warrant in a way similar to a stock option. I Accept. You're not locked in when you buy a warrant and are always free to decide you don't want to buy the underlying security. Stock warrants and stock options come with different tax rules, too. Saying it another way, warrants tend to exaggerate the percentage change movement compared to the share price. Warrants are very similar to call options. When a warrant is exercised the company issues new shares, increasing the total number of shares outstanding. Warrants are dilutive in nature, meaning it dilutes the overall value of equity in shares because the company must issue new shares upon exercising.

Advantages of Stock Warrants There are many advantages to purchasing a warrant. If you need help with stock warrants, you can post your job on UpCounsel's marketplace. Black Scholes pricing of warrants should be adjusted for dilution of the stock. Time value refers to whether a warrant, and its underlying stock, will increase in price over time or that it will be in-the-money , but it usually declines as it gets closer to the expiration date, called time decay. Derivatives market. Content Approved by UpCounsel. Warrants are dilutive in nature, meaning it dilutes the overall value of equity in shares because the company must issue new shares upon exercising. Plus, you don't have voting rights as the holder of a stock warrant, and you don't get paid dividends, either. They can be used to enhance the yield of the bond and make them more attractive to potential buyers. Stock warrants, however, can sometimes confer the right to buy or sell for many years down the road: On occasion, those dates can be five or 10 years down the line, giving the buyer a lot of time for the wager to play out. However, stock options may be a better short-term investment. Typically, the share price will be low if the conversion ratio is high, and vice versa. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. If the stock price is above the strike, the warrant has intrinsic value and is said to be in-the-money. Stock warrants, on the other hand, are far more obscure and less accessible.