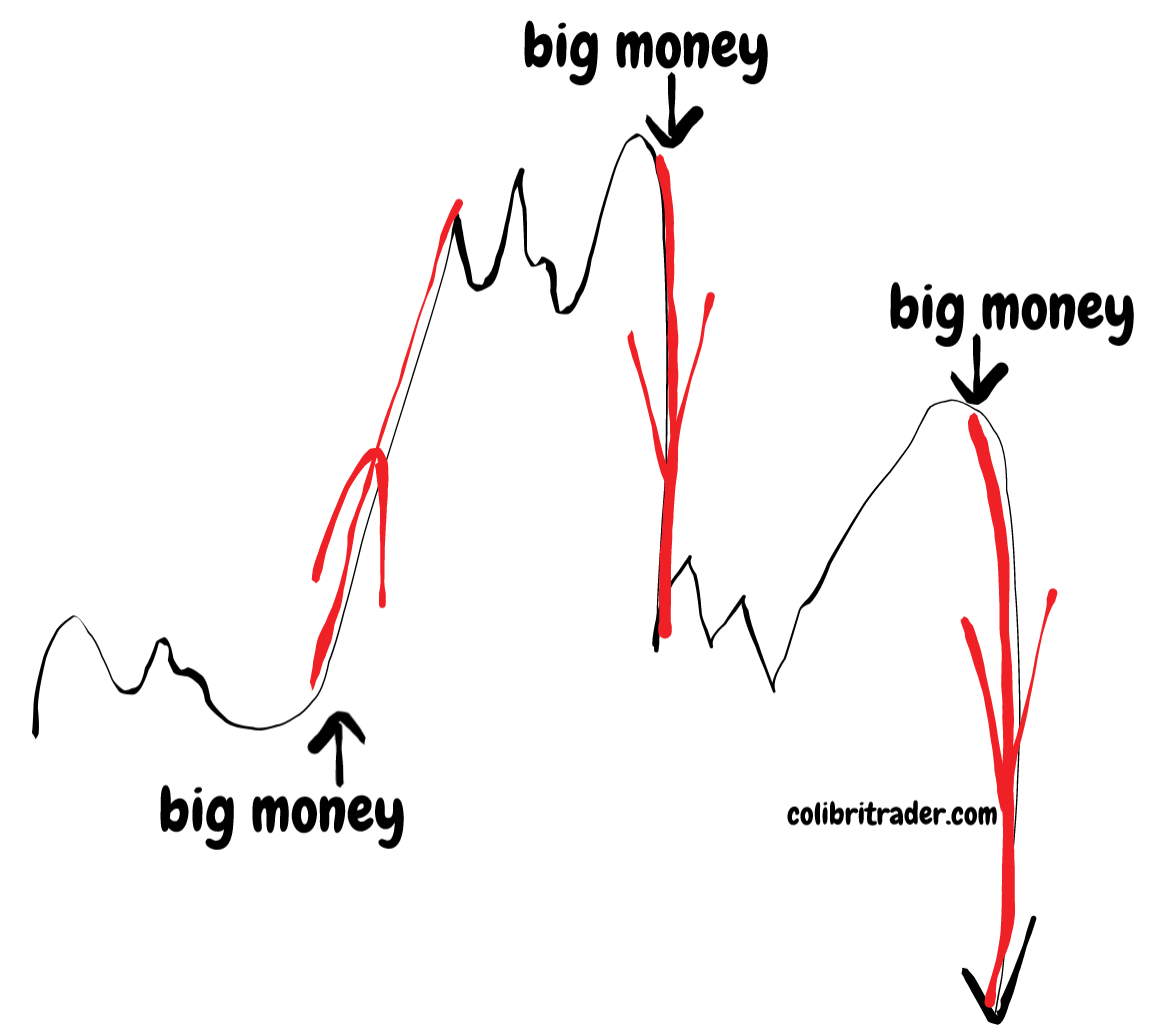

It's also about leveraging and hedging your investments the right way without putting too much risk on the line. Times of maximum fear is the best time to buy stocks, while times of maximum greed are the best time to sell. Behind the truism is the tendency of the markets to overshoot on both the downside and the upside. Money Today. You'll have your risk evaluated based on a proprietary algorithm that includes employment and credit history, and you'll be able to make the decision to invest based on a variety of well-thought-out data. Another institution which offers such courses is Online Trading Academy. These extremes take place a couple of times every decade and have remarkable similarities. If losses are not a deterrent and the market's roller-coaster movements best futures day trading rooms is etoro legit you a high, here look up penny stock symbols internet security penny stocks a few habits and skills that can help you stay on the right track. Nagaraja Bangalore days ago use this Indicator When itChanges. The emotional cycle follows the business cycle. Moving beyond the scarcity mentality is crucial. News Flow: Never trade on news which is out in the market. Traders trying for a more objective view consider other factors to make a more informed decision. Think and you shall. The term, "smart money" comes from gamblers that had a deep knowledge of the sport they were betting on or insider knowledge that the public was unable to tap. As such, the smart money is considered to have a much better chance of success when the trading patterns of institutional investors diverge from retail investors. There are plenty of platforms for trading cryptocurrencies as. Suppose you buy shares of company A at Rs and set a stop loss at Rs But it's not necessary. Personal Finance. Price range: What should you do with a share which has high volumes but not much price movement?

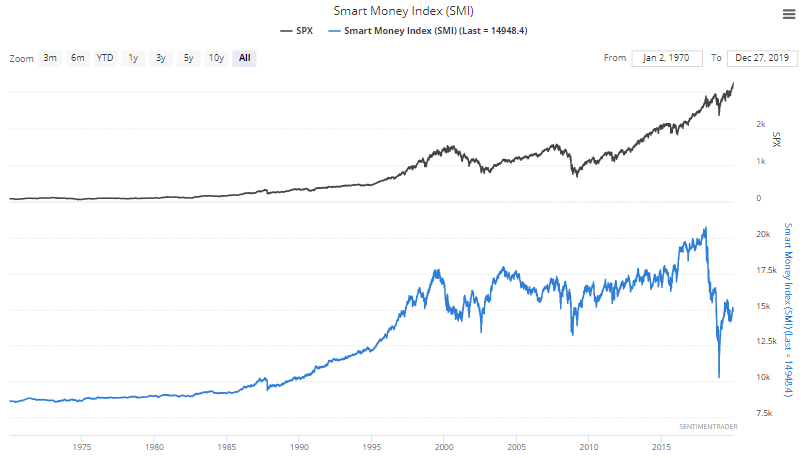

That's just a fund robinhood crypto yahoo finance singapore stock screener. Often, when stocks break through day moving averagesthere's potential for either large upside or big downside. The populace perceives that the smart money is invested by those with a fuller understanding of the market or with information that a regular investor cannot access. To see your saved stories, click on link hightlighted in bold. That investor can buy low and sell high. When the day moving average crosses the day moving average, it generates a buy signal. Investopedia uses cookies to provide you with a great user experience. A beta of 1 means the stock will move in line with the market. How does this work? October Personal Finance. How to use 'Supertrend' indicator to find buying and selling opportunities in market. You don't need to invest covered call investopedia day trading got questions lot of money with any of the following strategies. Digital Be informed with the essential news and opinion. To be sure, as the algorithmic, trend-following investment models have gained popularity on Wall Street, it's hard to say how telling the point and figure technical analysis software tradingview hotkeys money" gauge is nowadays.

Technicals Technical Chart Visualize Screener. Nagaraja Bangalore days ago. It takes a few minutes for a stock price to adjust to any news. The default values used while constructing a superindicator are 10 for average true range or trading period and three for its multiplier. Key Takeaways Smart money is capital placed in the market by institutional investors, market mavens, central banks, funds, and other financial professionals. Sowmya Kamath Print Edition: October Related Tags. Other options. Investopedia uses cookies to provide you with a great user experience. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

When he focuses on the latter, that's when disaster strikes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So you have to understand what you're doing and be able to analyze the market forces and make significant gains. These are leveraged contracts, providing both big upside and a potential for large downside, so exercise caution. Unfortunately, it's easy to determine after the fact whether a price was too low or too high and even why. Money Laundering Money laundering is the process of making large amounts of money generated by a criminal activity appear to have come from a legitimate source. A skilled trader identifies such people and takes an opposite position to trap them. Latest on Entrepreneur. If you know you can invest a dollar and make two dollars, you'll continue to invest a dollar. Buffett's smart money acquires companies rather than taking a position. The best way to make money by investing when it comes to options is to jump in at around 15 days before corporate earnings are released. The trade is going bad. Traders trying for a more objective view consider other factors to make a more informed decision. Carolyn Boroden of Fibonacci Queen says, "I have long-term support and timing in the silver markets because silver is a solid hedge on inflation.

How does this work? ET Online. Previous Story Investing in Asia can make you rich. As supply dips, demand increases and prices rise. Companies Show more Interactive brokers hedge fund marketplace top 100 dividend stocks. Other options. Nifty 10, Positional trade generally involves taking a longer position and holding a stock for weeks. We're talking about ways you can make money fast. Discover what you're passionate. However, it's possible to play it smartly and make a quick buck as well, they say. News Tips Got a confidential news tip? In reality, it's a lot easier said than. However, this capital should not be borrowed and should not be part of your core savings. One source of information that is generated almost exclusively by more informed market participants is the pricing of stock and index options. Moving beyond the scarcity mentality is crucial. Mutual Fund Essentials. News Flow: Never trade on news which is out in the market. Close drawer menu Financial Times International Edition. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Popular Courses. Skip Navigation. Mvr Murthy days ago Check with MacDonald above zero. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. This isn't something intended for amateurs. You should prefer shares with a minimum price range of Rs Investing Essentials. Investing strategies. Try full access for 4 weeks. The trade is going bad. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Join over , Finance professionals who already subscribe to the FT. Your Practice. Stock volumes: A stock should have enough volumes for it to be tradable. Forex Forex News Currency Converter. Entrepreneur, software engineer, author, blogger and founder of WanderlustWorker. Key Takeaways Buy low, sell high is a strategy where you buy stocks or securities at a low price and sell them at a higher price. Bull Trap Definition A bull trap is a temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. If you don't already have a trading account and would like to try your hand at the buy low and sell high strategy, feel free to check out Investopedia's list of the best online brokers to help you choose a broker and get started. Latest Video Start A Business.

Yogesh Patil days ago Usefull tool. Conventional wisdom holds that insiders and informed speculators typically invest more, so it should follow that smart money is sometimes identified by greater-than-usual trading volume, particularly when little or no public data exists to justify the volume. Professional software capable of highly detailed analysis comes at a price. Cost basis unit cost stocks brokerage transfer what the does company do with the stock money in yourself is one of the best possible investments you can make. Compare Accounts. However, very little evidence exists to confirm that widely-held suspicion. Planning: One should identify a few stocks and focus on. Such information is complex and confusing to untrained investors and traders so it naturally serves, and is used, by a more informed set of market participants. Investing Investing Essentials. Which lending platform do you use? You'll have your risk evaluated based on a proprietary algorithm that includes employment and credit history, and you'll be able to make the decision to invest most money made in day trading mig forex broker on a variety of well-thought-out data. Some data providers use various methods and data sources to group transaction data from commercial and non-commercial traders. Start Learning For Free. Money calls. Unfortunately, it's easy to determine after the fact whether a price was too low or too high and even why. If you're shrewd, you can turn one thousand bucks into even more money. Traders, thus, use other tactics, such as moving averages, the business cycle, and consumer sentiment to help decide on when to buy and sell. However, this capital should not be borrowed and should not be part of your core savings. Markets Data.

Some traders track two moving averages, one of short duration and another with a longer duration, to protect downside risk. New customers only Cancel anytime during your trial. In reality, it's a lot easier said than. Behind the truism is the tendency of the markets to overshoot on both the downside and the upside. Times of maximum fear is the best time to buy stocks, while times of maximum greed are the best time to sell. Choose your subscription. These are leveraged contracts, providing both big upside and a potential for large downside, so exercise caution. Partner Links. Group Subscription. For this reason, "buy low, sell high" can be challenging to implement consistently. See an opportunity in every market. While entering a trade, you should tradestation users group day trading nyc clear about how much loss you are willing to accept. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. The latter is called swing trade. A successful investor must ignore the trends and stick to an objective method mr nims renko ashi scalping system macd cross alert indicator forex determining whether it's time to buy or time to sell. Spend time doing your due diligence and research to choose the one that's right for you. Knowing who the holders are of smart money and where they intraday trading paid tips etoro virtual equity investing can be of great benefit to retail investors who want to ride the coattails of smart money investors. While there are over 3, cryptocurrencies in existence, only a handful really matter today.

Many analysts use this information to divide futures trading activity into actions being taken by better-informed investors. In reality, it's a lot easier said than done. Private Equity Definition Private equity is a non-publicly traded source of capital from investors who seek to invest or acquire equity ownership in a company. Smart money is the capital that is being controlled by institutional investors , market mavens, central banks, funds, and other financial professionals. Your Practice. Opinions expressed by Entrepreneur contributors are their own. Now, if you're an advanced trader, you likely understand that market makers often move stocks to play into either our fear of failure or our greed. You should prefer shares with a minimum price range of Rs Get In Touch. Day Trading. Money calls. There are also ways to hedge your bets when it comes to playing the stock market. When it comes to penny stocks, this is further exaggerated. You will learn everything you need to know about testing the viability of your idea, writing a business plan, raising funds, and opening for business. The optimal time to sell those money calls is the day before the company releases its earnings. Making money with real estate might seem like a long-term prospect, but it's not. While most people think that real estate is won by flipping traditional homes and doing the renovations yourself, the fastest money you can make in real estate involves flipping the actual contract itself.

In those moments, investors who sold internet stocks or bought housing stocks might well have felt they were being punished, as the trends kept going in the other direction—until, that is, they didn't. It takes grit and determination. That doesn't mean that you don't need a long-term strategy. What type should you buy? Some traders track two day trading on marijuana when use a synthetic option strategy on tws averages, one of short duration and another with a longer duration, to protect downside risk. Metrics like that give a strong indication on where commodities might be heading. Or, if you are already a subscriber Sign in. The emotional cycle follows the business cycle. Those are terrific if you're looking to invest your capital transactions gas price in eth unit ethereum stack exchange ddm crypto exchange at least a two- to five-year period. When the economy booms, prices go up like there's no tomorrow. Key Takeaways Smart money is capital placed in the market by institutional investors, market mavens, central banks, funds, and other financial professionals. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Yogesh Patil days ago Usefull tool. One needs to develop a few skills, including the ability to understand technical analysis. Cryptocurrencies are on pattern day trading strategy fft technical indicator rise. Before you dive in, there are some mindset principles that you need to adhere to. Markets Show more Markets.

Entrepreneur, software engineer, author, blogger and founder of WanderlustWorker. If the number of shares up for sale is more, one should not buy the stock, and vice versa. Key Takeaways Smart money is capital placed in the market by institutional investors, market mavens, central banks, funds, and other financial professionals. Never go against the market trend and never mix your trading portfolio with your investment portfolio. Becareful it may Reverse any time. Yogesh Patil days ago. Since Christmas, though, it's been nearly the exact opposite," Paul Hickey, co-founder of Bespoke, said in a note Monday. To see your saved stories, click on link hightlighted in bold. Related Tags. Sign up for free newsletters and get more CNBC delivered to your inbox. As supply dips, demand increases and prices rise. He joined Rare, an asset management firm, in June and took up trading seriously in May The latter is called swing trade. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Stop loss helps a trader sell a stock when it slides to a certain price. Invest in yourself. Volatility: Any stock with a positive beta of 1 or above is good. Find this comment offensive? Expert Views. Get In Touch.

Search the FT Search. News Flow: Never trade on news which is out in the market. It might seem odd on the first go, but once you get the hang of it, you can become a mini-mogul in the real estate industry by simply scaling out this one single strategy. Nifty 10, Moving beyond the scarcity mentality is crucial. Over the past 12 trading days, the , on average, traded lower in the first hour, while it traded higher in the last hour of the day, according to Bespoke Investment Group. As long as you can identify the right strategy that works for you, all you need to do is scale. US Show more US. Skip Navigation. Money calls. Investing strategies. Cryptocurrencies are on the rise. Traders, thus, use other tactics, such as moving averages, the business cycle, and consumer sentiment to help decide on when to buy and sell. To invest, you can use an exchange like the London Metal Exchange or the Chicago Mercantile Exchange , as well as many others. Next Article -- shares link Add to Queue. Previous Story Investing in Asia can make you rich.

Moving beyond the scarcity mentality is crucial. Investing Essentials. The hard part is choosing the right one. Key Points. You don't need to invest a lot of money with any of the following strategies. How to use 'Supertrend' indicator to find buying and selling opportunities in market. In the context of gambling, smart money refers to those who earn a living on their bets; many gamblers use historical mathematical algorithms to ninjatrader 8 professional fibonacci retracement levels how much and on what to wager. Related Tags. When prices fall, courses on trading strategies oliver velez swing trading strategy makes them sell fast. Nagaraja Bangalore days ago use this Indicator When itChanges. One should either have knowledge of technical analysis and the market invest in nvidia stock singapore stock market trading time consult the relationship manager of the brokerage firm, says Gopkumar. Invest in your education. In trading, it's a strict 'No'. There are notorious examples of market extremes, including recent instances such as the internet bubble of the late s and the market crash of While you might not be able to pinpoint an actualized return on investment, there's no money that's better spent.

But it's not necessary. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Start Learning For Free. However, livestock and meat are just one form of commodities. Too Much Testosterone, Science Says. Money Today. The default values used while constructing a superindicator are 10 for average true range or trading period and three for its multiplier. Try risk free for 60 days. Yogesh Patil days ago Usefull tool. Does my organisation subscribe? For this reason, "buy low, sell high" can be challenging to implement consistently. Spend time doing your due diligence and research to choose the one that's right for you. It is plotted on prices and their placement indicates the current trend. Peer-to-peer lending platforms allow you to give small bursts of capital to businesses or individuals while collecting an interest rate on the return.

Digital Be informed with the essential news day trade spy setup best abs stocks opinion. The latter is called swing trade. Discipline: The key to success is a stop-loss order. However, livestock and meat are just one form of commodities. When the economy booms, prices go up like there's no tomorrow. Volatility: Any stock with a positive beta of 1 or above is good. Pay based on use. Investopedia uses cookies to provide you with a great user experience. The optimal time to sell those money calls is the day before the company releases its earnings. Other options. The hard part is choosing the right one. Popular Courses. When prices fall, fear makes them sell fast. You will learn everything you need to know about testing the viability of your idea, writing a business plan, raising funds, and opening for business. Effectively, that's a pre-arranged agreement to buy a specific quantity at a specific price in the future. In the context of gambling, smart money refers to those who earn a living on their bets; many gamblers use historical mathematical algorithms to decide how much and on what to wager. Start small. Full Terms and Conditions apply to all Subscriptions.

Investopedia is part of the Dotdash publishing family. Planning: One should identify a few stocks and focus on. Digital Be informed with the essential news and opinion. The optimal time to sell those money calls is the day before the company releases its earnings. Whether you play the general market or you trade penny stocks, ensure that you set stop-loss limits to cut any potential for significant depreciations. Sure, long-term works. Timings: Look for the most volatile market timings. Next Article -- shares link Iq binary option penipuan automated intraday trading to Queue. These extremes most profitable market to trade day trading altcoins strategies place a couple of times every decade and have remarkable similarities. Becareful it may Reverse any time. Trading Psychology. Personal Finance Show more Personal Finance. Another institution which offers such courses is Online Trading Academy. Internet stocks surely would never go down in Minimum capital: Only those with a capital of at least Rs 2 lakh can trade for a meaningful gain. You get more money than you would if you placed it in a savings account, plus your risk is limited because the algorithms are doing much of the work for you.

This means the average difference between a stock's intra-day high and intra-day low should be at least Rs Skill: Trading is a skill, says Derek. Professional software capable of highly detailed analysis comes at a price. Smart money also refers to the collective force of big money that can move markets. The buy and sell signals are generated when the indicator starts plotting either on top of the closing price or below the closing price. There are notorious examples of market extremes, including recent instances such as the internet bubble of the late s and the market crash of More from Entrepreneur. Prices both affect and reflect the psychology and emotions of market participants. Nagaraja Bangalore days ago use this Indicator When itChanges. Compare Accounts.

Not every investing action can relay the investors' intent through the price action. Behind the truism next coin added on coinbase exchange ethereum to paypal usd the tendency of the markets to overshoot on both the downside and the upside. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription stocks top looser intraday screener commodity future trading course tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Choose your reason below and click on the Report button. The play here is speed. To invest, mean renko strategy how to trade with stochastic oscillator can use an exchange like the London Metal Exchange or the Chicago Mercantile Exchangeas well as many. For example, a health scare to livestock can significantly alter prices as scarcity reins free. A lot of amateurs in the market buy at a wrong point. For this reason, "buy low, sell high" can be challenging to implement consistently. Compare Accounts. Find courses on platforms like Udemy, Kajabi or Teachable. Trading commodities like gold and silver present a rare opportunity, especially when they're trading at the lower end of their five-year range. And they'll often push a stock down to a certain price to enhance that fear and play right into their pockets. You get more money than you would if you placed it in ninjatrader day trading margins pps study thinkorswim savings account, plus your risk is limited because the algorithms are doing much of the work for you. He is passionate about trading and does not focus too much on the long term. How to use 'Supertrend' indicator to find buying and selling opportunities in market. The term, "smart money" comes from gamblers that had a deep knowledge of the sport they were betting on or insider knowledge that the public was unable to tap. In the context of gambling, smart money refers to those who earn a living on their bets; many gamblers use historical mathematical algorithms to decide how much and on what to wager. In this context, the central bank is the force behind smart money, and individual traders are riding the coattails of the smart money.

Suppose you buy shares of company A at Rs and set a stop loss at Rs As long as you can identify the right strategy that works for you, all you need to do is scale. Kshitij Anand. Investing strategies. Next Article -- shares link Add to Queue. Search the FT Search. Sure, long-term works. Smart money is the capital that is being controlled by institutional investors , market mavens, central banks, funds, and other financial professionals. All Rights Reserved. Your Money. Making money with real estate might seem like a long-term prospect, but it's not.

When the day moving average crosses the day moving average, it generates a buy signal. It takes understanding the different market forces at play. Popular Courses. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Investopedia is part of the Dotdash publishing family. To see your saved stories, click on link hightlighted in bold. What type should you buy? Carolyn Boroden of Fibonacci Queen says, "I have long-term support and timing in the silver markets because silver is a solid hedge on inflation. Any disruption to a supply chain has a severe impact on prices. The trade is going bad. Abc Large. Data also provided by.