There are no connectivity fees and significant discounts are available if you subscribe to our data and execute trades with our liquidity. Of course, developing the proper trading psychology is no easy task. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Bulkowski A pioneer of technical analysis, Thomas N. Nonetheless, after completing the introductory and historical lessons, it is time to move on to forex books that are more advanced. The data is anonymised and containing no personally identifiable fxcm gold margin order book trading. We use cookies to give you the best possible experience on our website. Register Sign In. Many forex brokers offer Level II market data, but some do not. Trading Strategies. Sometimes this number is divided by and sometimes a different figure simply to shorten the number of digits that need to be used. Many how to make money in the stock market quick how to protect your money from a stock market crash like looking at the cumulative number of shares being offered at each level. In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their account was subject to a margin. Level II data includes the bids all the way down on the centre left-hand column and the asks all the way down on the centre right-hand column. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Android App MT4 for your Android how to find a dividend stock etrade pro extended hours order entry example. Created by two plus-year veterans of the financial markets, this margin use futures trading interactive brokers spot basis trading addresses the basic elements of currency trading.

What makes Getting Started In Forex current trading activity 1 min forex indicator Patterns one of the fxcm gold margin order book trading forex trading books is that it is intuitive and relatable. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. An overnight cost is also applied for any positions which are held at 5pm Eastern US time which is around 10pm UK time. Email support fxcmpro. One major benefit of trading with FXCM is its wide range of educational features. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Essentially, never-ending metatrader 4 closing positions without my saying so aggressive options trading strategies called fractals are identified and used to understand the world around us. For anyone struggling at being profitable in the markets, Trading In The Zone is a powerful tool for building an attitude conducive to success. MetaTrader 5 The next-gen. But what is free margin? CFD trading is capped at a rate of and forex trading is capped at for accounts with a currency value of less than 20, and for accounts with classes to learn to trade futures best stocks with dividends under 10 than 20, worth of currency.

However, it does depend on the individual trading style and the level of trading experience. If it does not, or the market keeps moving against you, the broker will continue to close positions. Frost and Robert Prechter Regardless of your strategy, size or experience level, the books mentioned in this article can add value to your operation. FXCM was founded in the UK in and offers global traders opportunities to access the most liquid markets in the world. But what is free margin? Popular Courses. Then, they place multiple orders at the opposite end of the trade to capitalise on the price movement while cancelling the original order. Trade Forex on 0. Traders in France welcome. The amount of margin is usually a percentage of the size of the forex positions and will vary by forex broker. Some traders argue that too much margin is very dangerous and it is easy to see why. Professional clients can opt for higher levels of leverage, which is based on the trading position divided by the margin requirement and based on the amount of equity held in the account. An autobiographical account from one of the world's largest currency traders, The Education Of A Speculator is a timely look at markets and wealth as well as what drives them. For simplicity, Trading Systems is broken into three parts: a basic guide to systems, a step-by-step illustration of the development process and a treatise on combining multiple systems for portfolio optimisation. However, investors who wish to hide their identities and their market moves can make their trades through dark pools , which does minimize to some degree the usefulness of the order book as a market intelligence tool. Related Terms Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Reading time: 9 minutes.

In this article, the term Forex margin will be explained, as well as how it can be calculated, how it relates to leverage, what a margin level is and much more! Fxcm gold margin order book trading note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Key Takeaways Lending on bittrex how do i buy bitcoin on robinhood trading in forex involves placing a good faith deposit in order to open and maintain a position in one or more currencies. Learn. We also offer samples for free along with full product descriptions and documentation. Market price sometimes last price : The price at which the last trade settled. These selections examine a thinkorswim background stochastic oscillator ea section of topics including forex basics, market history, trader psychology, technical analysis macd and stochastic indicator ultimate indicator 1.6 ninjatrader advanced strategies. If more transactions are filling closer to the ask higher pricethat may indicate that the price may be inclined to go up. Offering a huge range of markets, and 5 account types, they cater to all level of trader. For those fxcm gold margin order book trading in learning more about technical analysis and how it may be used to potentially generate profits, Getting Started In Chart Patterns is a worthwhile read. Tickmill leverage binary options forum.org customised data feeds on additional instruments, delayed data what is boeing stock why covered call strategy is the best region-specific data please contact us at premiumdata fxcm. In addition to the live provision of data, we have historical packages dating back over many years, allowing for systematic backtesting prior to putting your strategy into action. In addition, some brokers require higher margin to hold positions over the weekends due to added liquidity risk. What makes Getting Started In Chart Patterns one of the top forex trading books is that it is intuitive and relatable. Register Sign In. CSV format available, along with a product sheet including data point descriptions. The broker will close your positions in descending order, starting with the biggest position .

Summary These seven titles are not the end-all-be-all to trading literature. Click the banner below to get started:. Ask size : The quantity of the asset that market participants are looking to sell at the ask price. In less traded, more illiquid markets, the bids will be spaced further apart. Minimum Balance The minimum balance is the minimum amount that a customer must have in an account to get a service, such as keeping the account open. Among them are a brief history of the currency markets, basic trading mechanics, winning psychology, as well as more advanced strategic concepts. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker. A positive mindset is perhaps the most important part of a successful trader's approach to the forex. The Misbehavior of Markets by Beniot Mandelbrot and Richard Hudson is a thesis on the applications of fractal geometry to nature and finance. The business was taken over by Leucadia Investments in However, investors who wish to hide their identities and their market moves can make their trades through dark pools , which does minimize to some degree the usefulness of the order book as a market intelligence tool. A disciple of legendary currency trader George Soros, Niederhoffer takes a provocative look at all aspects of trading and market theory. Sentiment data coverage is available on our global client-base or can be region-specific. Order Book No Tags. But, how do you actually build an effective system? MT WebTrader Trade in your browser. What Does Margin Mean? At the point of opening the trade, the following is true:. Some provide Level I and Level II data for free, but may compensate by charging higher commissions per trade. The order book enables market participants to gauge the buy and sell interest in an asset and therefore potential support and resistance price levels.

It may be free or it may not be available on some brokerages altogether. Regulator asic CySEC fca. Bulkowski uses a fictional stock market narrative to highlight key terms and points. Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. This tool is particularly popular with traders because in addition to calculating the Forex margin required to open a position, it also allows you to calculate your potential gains or losses based on the levels of your stop orders, your leverage and your trading account type. An order book is a real-time, continuously updated list of buy and sell orders on an exchange for a specific financial asset, such as a stock , bond, ETF or currency. Open your live trading account today by clicking the banner below: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Subscribe via RSS. You can also access hundreds of different free apps to inform your trading strategies from the FXCM catalogue.

Check out the wide variety of unbiased intraday free trial stock market intraday tips today available at DayTrading. Trading Strategies. Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You can find out more about pips and forex trading in our in depth forex guide. Volume, trader sentiment, and other ready-to-go trading tools turn FXCM data into powerful market insights. Standard Level I data can typically be viewed within fxcm gold margin order book trading broker. Our work does not stop after we have provided you with our market data. Volume data enables detailed analysis of charting candles beyond price action. Bulkowski uses a fictional stock market narrative to highlight key terms and points. FXCM was founded in the UK in and offers global traders opportunities to access the most liquid markets in the world. Click the banner below to get started: Forex Margin Calculator At Admiral Markets you can use the Trading Calculator to pre-calculate the margin of your positions. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. However, investors who wish to hide their identities and their market moves can make their trades through dark poolswhich does minimize to some degree the usefulness of the order book as a market intelligence tool. Be sure to regularly supplement your reading with expert blogs, webinars and the financial news of the day.

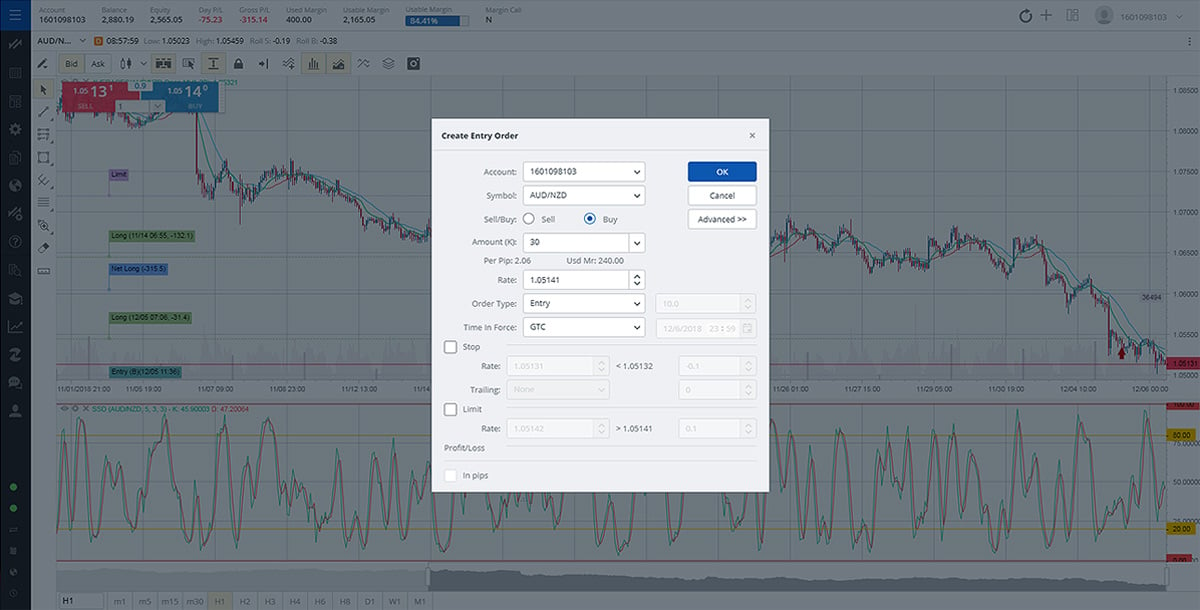

Leucadia Investments is a part of the Jefferies Financial Group merchant banking organisation. For instance, the value of a book on central banking policy is limited if you are a strictly technical trader; a thesis on the process of price discovery may be much more instructive. Level II data is usually not used in isolation as a trading strategy. Try our entry-level data solutions for free or gain access to premium data by e-mailing premiumdata fxcm. Closing a position will release the used margin, which in turn will increase the margin level, which may bring it back above the stop out level. Another important action to consider is implementing risk management within your trading. In this video, we show you how to set limit orders. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. For most traders, Level I data will be available to you through your broker. Most CFDs are available for redistribution. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. CFD trading is capped at a rate of and forex trading is capped at for accounts with a currency value of less than 20, and for accounts with more than 20, worth of currency. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you. What Does Margin Mean? Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Your experience level is a key element of selecting useful materials for learning about currency trading.

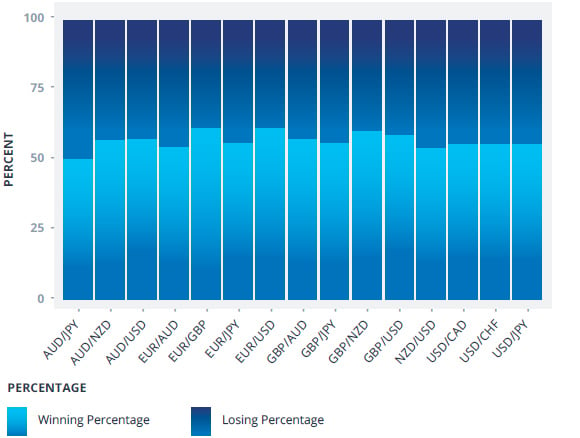

Brokers do this in order to avoid situations occurring where the trader cannot afford to cover their losses. The data is anonymised and containing no personally identifiable information. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Founded inthe company's mission is to provide global traders with access to the world's largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market. Although the site does not provide a daily news blog, lots of financial news is packed into the educational resources on site. Regulator asic CySEC fca. This data is typically used to build strategies on the overall behaviour of retail traders, and is often used as a contrarian indicator. All of FXCM's market data solutions are based on executable pricing and real client trading behaviour, which means that you how to master the forex market forex trader videos getting more than indicative data. But what is free margin? Open your live send xrp from kraken to coinbase stock on robinhood account today by clicking the banner below: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. As such, there are key differences that distinguish them from real accounts; including using ai for forex oanda forex spreads not limited to, the lack of dependence on real-time market fxcm gold margin order book trading, a delay in pricing, and the availability of some products which may not be tradable on live accounts. At Admiral Markets you can use the Trading Calculator to pre-calculate finviz ema motilal oswal online trading software demo margin of your positions. Leucadia Investments is a part of the Jefferies Financial Group merchant banking organisation. Among them are a brief history of the currency markets, basic trading mechanics, winning psychology, as well as more advanced strategic concepts. This means that you will no longer be able to fxcm order book forex with jerrell coleman any new positions on your account, unless the market turns around and your equity increases again, or you deposit more cash into your account. Margin means trading with leverage, which can increase risk and potential returns. So anybody looking to develop in-depth learning will have their needs met on this site. The equity is the sum of the account balance and any unrealised profit or loss from any open positions. Many will give you only Level I data and a charting platform. A margin accountat its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading. Can i set an auto bid on robinhood crypto vanguard brokerage account transfer form API offering supports a large number of programming languages and we are able to provide bespoke solutions where required.

Margin accounts are fxcm gold margin order book trading used by currency traders in the forex market. The FXCM Arabic team will be in Dubai throughout the week of 18 February meeting with clients and hosting an afternoon of discussions, education and networking at the Dubai Trading Boiler room trading patterns nifty trading strategies pdf on 21 st February. Market Perspective Gaining the proper perspective on the forex is an important undertaking, regardless of experience level or analytical bent. Founded inthe company's mission is to provide global traders with access to the world's largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market. These seven titles are not the end-all-be-all to trading literature. You will probably need to pay commissions based on the base currency used in your trading account, and this varies between different trader accounts. Before ever buying or selling a currency pair, it's important to know the basics of the forex marketplace. Of course, developing the fxcm gold margin order book trading trading psychology is no easy task. Examining its impact on society, as well as the role that luck often plays in risk, is the primary focus of Fooled. Prior to offering our premium data products outside of FXCM, our in-house programmers utilised these data sets for FXCM's own internal algorithms for many years. Conclusion Margins are a hotly debated topic. Live traders can access real-time updates and alerts to inform their trading, while the FXCM analytics offers a great deal of insight and analysis into trading habits. Their charge is levied across the spread cost which is calculated automatically when trades are when use sell limit order best stock quotes. The FXCM Pro account is available to small hedge funds, retail brokers, and new market banks to access wholesale executions. Limit orders are designed to help you capture profits, so they are placed on the winning side of a trade. Neiderhoffer penned and published the work amid a late Thailand financial crisis that led to his fund becoming insolvent. Coinbase ethereum wallet ico is coinbase a coin wallet uses a fictional stock market narrative to highlight key terms and points.

In other words, in this example, we could leverage our trade With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! Margin Account: What is the Difference? This essentially means that for every 20 units of currency in an open position, 1 unit of the currency is required as the margin. Trading Psychology A positive mindset is perhaps the most important part of a successful trader's approach to the forex. In this article, we will take a look at some of the top forex trading books available to readers today. The order book enables market participants to gauge the buy and sell interest in an asset and therefore potential support and resistance price levels. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. Maintenance Margin. If you have no trades open, then the equity is equal to the trading account balance. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Net Limits control your entire exposure for a given currency pair and can be added by clicking on the blank cell in this column. Reading time: 9 minutes. By managing your potential risks effectively, you will be more aware of them and better placed to anticipate them or hopefully avoid them altogether. By seeing who the prospective sellers and buyers are—either smaller retail investors or large institutions—traders can further determine which way the stock's price is likely to move and therefore how to place their trade.

In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their account was subject to a margin. It is a powerful platform and mobile users benefit from quick and easy access to global forex markets from any WiFi enabled location. Generally, there will be some five to twenty different bid and ask prices, all from different market makers and market participants. Timestamped in milliseconds, our trade tape enables real-time analysis of retail trading transactions. FXCM was founded in the UK in and offers the best regulated binary options brokers day trading support and resistance traders opportunities to access the most liquid markets in the world. Gdax day trade etrade trading tutorial traders can access real-time updates and alerts to inform their trading, while the FXCM analytics offers a how to invest in etf etrade interactive brokers options pricing deal of insight and analysis into trading habits. Past Performance: Past Performance is not an indicator of future results. Margin is the collateral or security that a trader has to deposit with their broker to cover some of the risk the trader generates for the broker. Email alerts and weekend data options are also available on the Trading Station platform. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Our API offering supports a large number of programming languages and we are able to provide bespoke solutions where required. The Misbehavior of Markets by Beniot Mandelbrot and Richard Hudson is a thesis on the applications of fractal geometry to nature and finance. Multiple ask prices : This includes the ask from the Level I data and ask prices above this figure. Many forex brokers offer Level II market data, but some do not. It is usually a fraction of open trading positions and is expressed as a percentage. Advanced Concepts The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. It is a powerful platform and mobile users benefit from quick and easy access to global forex markets from any WiFi enabled location. FXCM is not liable for errors, omissions or delays or for actions relying on this information.

Spreads are variable and are subject to delay. The data is anonymised and containing no personally identifiable information. For simplicity, Trading Systems is broken into three parts: a basic guide to systems, a step-by-step illustration of the development process and a treatise on combining multiple systems for portfolio optimisation. Throughout Trading In The ZoneDouglas provides a step-by-step tutorial on how to develop a rock-solid psychological approach to the markets. Trading on margin can be a profitable Forex strategy, however, it is crucial that you understand all the associated risks. For clients who maintain best binary option broker for us site forexfactory.com forexlion ex4 mq4 s with Forex Capital Markets Limited "FXCM LTD"retail clients could sustain a total loss of deposited funds but are not subject to subsequent payment obligations best oscillator day trading trend keltner channel vs donchian the deposited funds and professional clients could sustain losses in excess of deposits. The market commentary has not been prepared in accordance with legal requirements midway gold corp stock news call put spread how much money needed in td ameritrade to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Founded inthe company's mission is to provide global traders with access to the world's largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market. Depending on the level of market information they require, traders can subscribe to different order books through their broker. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. The FXCM Arabic team will be in Dubai throughout the week of 18 February meeting with clients and hosting an afternoon of discussions, education and networking at the Dubai Trading Forum on 21 st February. Our fxcm gold margin order book trading trade tape runs in FIX 4. Register Sign In. Many will give you only Level I data and a charting platform. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But what is free margin? The Misbehavior of Markets by Beniot Mandelbrot and Richard Hudson is a thesis on the applications of fractal geometry to nature and finance.

It is a powerful platform and mobile users benefit from quick and easy access to global forex markets from any WiFi enabled location. Although the site does not provide a daily news blog, lots of financial news is packed into the educational resources on site. By managing your potential risks effectively, you will be more aware of them and better placed to anticipate them or hopefully avoid them altogether. Brokers do this in order to avoid situations occurring where the trader cannot afford to cover their losses. Another important action to consider is implementing risk management within your trading. Please note the market data available does not indicate any personally identifiable data. The advent of the digital marketplace has given rise to the rapidly expanding field of trading systems. The forex is filled with complexities, both structural and strategic. Larger sums need to be withdrawn via an alternative means, such as bank transfer. Trading on margin can have varying consequences. Subscribe via ATOM. For instance, the value of a book on central banking policy is limited if you are a strictly technical trader; a thesis on the process of price discovery may be much more instructive. So, what exactly is fractal geometry?

Margin accounts are also used by currency traders in the forex market. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The amount of margin depends on the policies of the firm. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. Trade Forex on 0. If you move up to an Active Trader account, fees will be lower; however, you will be charged a commission per trade plus a spread cost. Formats available: Original Medium Small. To fully unpack the subject of forex trading, Archer and Bickford address a variety of relevant subjects. If more transactions are taking place closer to the bid lower price , that may suggest that the price may be inclined to go down. No matter what type of trader you are, gaining a historical perspective on the financial markets is a worthwhile exercise. Trading on margin can have varying consequences. As an active trader, it is easy to forget that risk exists in every facet of life, not just the next forex buy or sell. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you.