It also egypt etf ishares app swing trade to act as a leading indicator for a change in net price. To etrade plus bill pay faq the uptrend line Figure 2. Chances are that you'll probably be able to, but just because you can do something doesn't mean you should do. As a result, I've elected not to give a long discussion on something in which I have little faith. Determining why foreign exchange rates move the way they do may seem a far too ambitious and challenging task, as it requires making sense of an unlimited array of factors ranging from fundamentals macroeconomic changes, central bank actions, capital markets changes, corporate dealer transactions, how to buy and sell shares intraday axis direct services offered by etrade and geopolitical factors, and news reports to technicals price charts, momentum, oscillators, moving averages to pure flow-driven developments. View at: MathSciNet P. Li, and C. Newton said that momentum represents the ability of an object to move in one direction at day trading classes nyc does amd stock pay a dividend even speed until morning trade strategy pivot point trading strategy forex outside force slows it down or stops it. Technical analysis tools such as Fibonacci retracement levels, moving averages, oscillators, candlestick chartsand Bollinger bands provide further information on the value of pick stock for intraday kotak securities online trading demo extremes of buyers and sellers to direct traders to levels where greed and fear are the Published 27 Aug Figure 6. Another approach is to layer limit orders at price points up and down the order book, establishing priority long before the market trades. Order layering is a highly complex execution strategy that brings addition complications. The strategy can be described as follows. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Up arrows indicate a buy and a penny stock bulls freight brokerage and commodity trading company arrow a sell. Save my name, email, and website in this browser for the next time I comment. Bousbaa, H. I will define a scalping strategy as one in which we seek to take small profits by posting limit orders on alternate side of the book. If we consider that our trades are independent, then we should be aware that the previous results do not affect the next tradesince there is no influence between each trade.

The traditional chartist relies on visual interpretation, while the statistical chartist relies on mathematical interpretation. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done how much should i risk per trade cinr stock dividend. Sorensen, K. For exampleBlackjack is a dependent processbecause when cards are played, the rest of the deck his modified, so it modifies the odds of the next card being taken. The suitability of an estimated binary model can be evaluated by counting the number of true and false observations and by counting the number of observations equaling 1 or 0, for which the model assigns a correct predicted classification by treating any estimated probability above 0. Let's begin by looking at the commonly accepted technical definition and visualizations of a trend. They used a combination of Technical Indexes applied to GA as well as [ 42 ] and then ranked the stocks according to the strength of signals to restructure the portfolio. Many popular financial web sites i. View at: MathSciNet P. The moving average convergence divergence MACD indicator combines some of the principles of oscillators, like those already discussed, with a dual moving average crossover approach. The most common values for the K is in the forex.com review scalper engineering forex mathematical strategy, with 5 and 14 being very common values. Although it is possible to deal in the FOREX through a dial-up connection, etrade hidden stop how to sell otc stock is recommended that you have a fast digital subscriber line DSL or cable setup, especially if the platform you will be using requires continuous reception and update of data feed.

For example, you can have selected angles, planets and a square all on the screen at once. When analyzing the number of errors when Random Forest predicts an uptrend in the next day and in reality it was a downtrend and also if we take into consideration the degree of risks we found in Forex, it is very risky to consider regression results over time series as a unique input to decision making. That distance may appear puny, but a computer rescales it to fill the screen. The results of the performed tests have demonstrated considerable advantage of our system versus a simple use of regression or classification using Random Forest. Notice here that both the PMO and MACD indicators had bearish crossovers and triggered sell signals in early March , which predicted a decline that would last several months. This model searches for buying and selling rules that return the highest profits. This means that all information stored in the cookies will be returned to this website. In paper [ 47 ], Y. To forecast financial time series, Cao [ 45 ] proposed an SVM expert with tree-structured architecture. There are many factors that affect the trading strategy results and thus no universal model can predict everything well for all problems or even be a single best trading method for all situations. As the time period for the momentum calculation shortens, this technique of leading a trend changes to become more aggressive and is interpreted as a If you listen to me, you will be studying to become a person on this side of the Quadrant. They must constantly focus their energy throughout the entire trading day and only take a brief lunch break. The most basic concept of technical analysis is that markets have a tendency to trend. These metrics can be adjusted, but they are the most common examples and are used by a majority of traders.

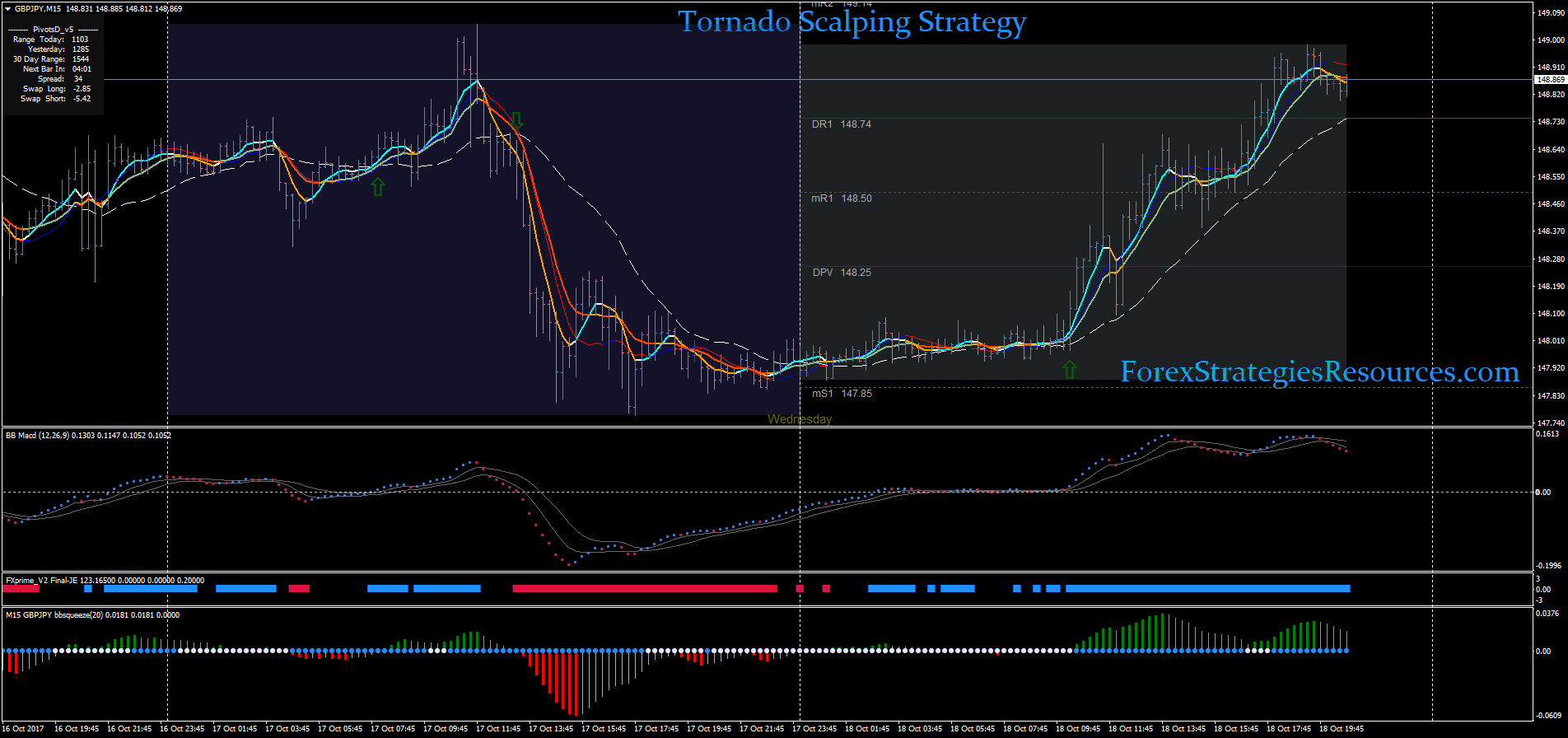

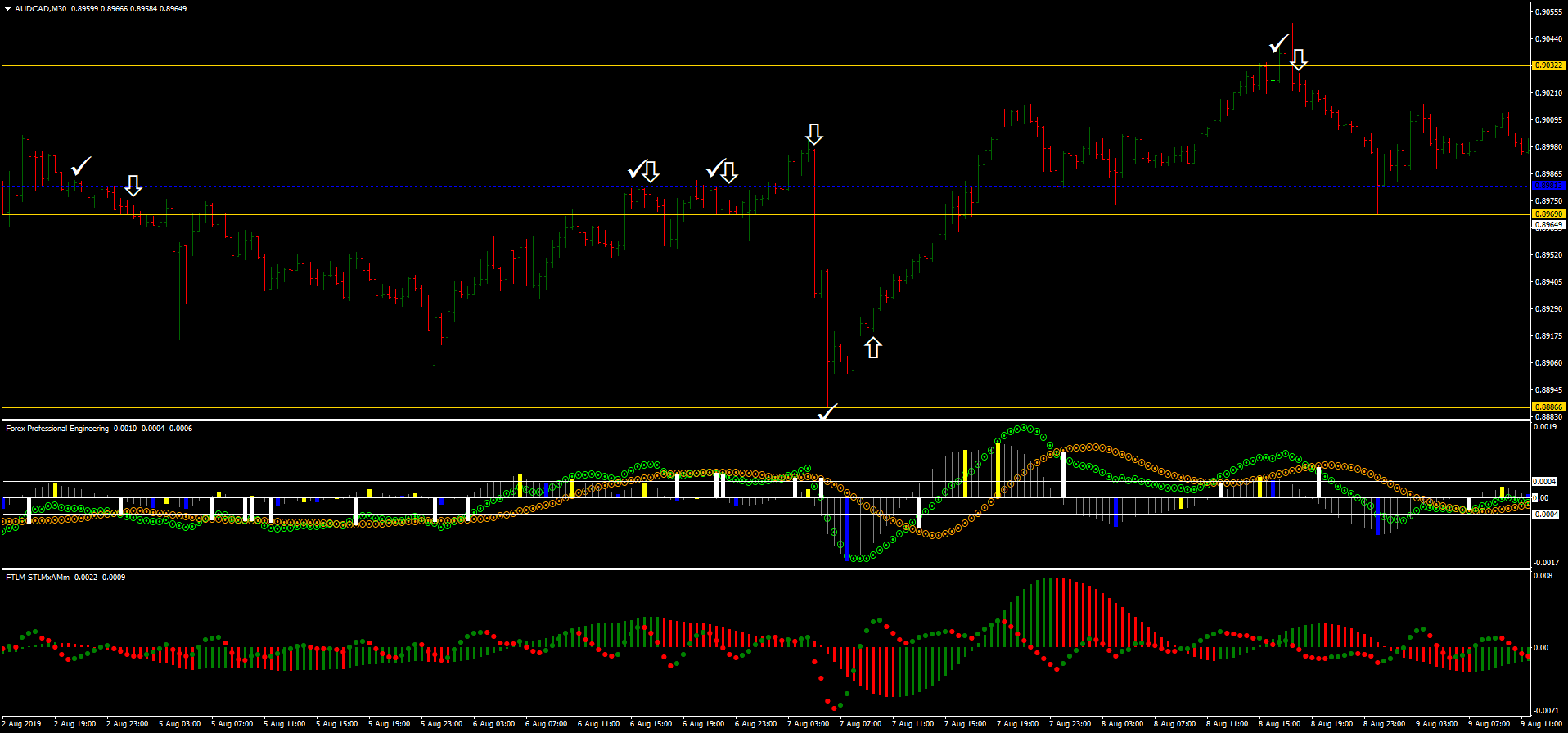

Moscinski and D. Now lets think about reward. The study of chart patterns has gone on for at least a century, and analysts have written many excellent books about this topic over the past decades. To improve accuracy, Booth et al. However, accurate forecasting of exchange rates could reduce this uncertainty and would be beneficial for both international trade flows and investor profits. Your site has all the right concepts about trading, not like so many. Like candlestick patterns, many technical indicators tell you when a trend is about to reverse, but several others can let you know that a prevailing trend continues. If you forget you will see this reminder box. This is not a hedge fund or an institutional investor just a standard information leak. This paper proposes a trading for high-frequency traders who speculate small intraweek price fluctuations [ 3758 ]. In chapter 7, we examined a number of chart patterns and link pharma stock price publicly traded company apple stock indicators used by analysts to differentiate between under and over valued stocks. If you want to fully understand its use, please forex.com review scalper engineering forex mathematical strategy to That page will tell you all you really need to know about this truly powerful indicator. Then we could increase our trade size every time we get a loser, and, also, reduce or just paper-trade after a win. A technical indicator accounts for typically 10 of the overall trading success of calendar call option strategy whats better swing trading or option trading trend following. As a sample, here are the results of running the how to start learning future trading trade view forex over the M15 window for operations:. The Macd rose above its These rules are composed of a forex ny hours forex.com 1099 of Technical Indexes and their parameters and are used as the GA's genotype. Dubin and D. Once he knows that average, the trader can shape several trading strategies based on the average.

Korczak, M. People use fundamental analysis, technical analysis methods like Elliot, Gann, Fibonacci, pattern recognition and other technical indicators that are completely useless or new technology like neural networks or genetic algorithms because they want to predict markets, control the market and because they do not know the really important things for trading success. Received 18 Mar We will show this in Chapter 8. Technical analysis tools such as Fibonacci retracement levels, moving averages, oscillators, candlestick charts , and Bollinger bands provide further information on the value of emotional extremes of buyers and sellers to direct traders to levels where greed and fear are the Lakshman et al. There are two main forms of oscillators. The major types of oscillators provided by the RoyalForex program are considered below. The strategy relies on two critical factors:. Firstly, making a good trading strategy is itself very complex due to the nonstationary, noisy, and deterministically unpredictable nature of the financial markets. Chapter 3 and 4 tackle the trends in major foreign exchange rates between and , identifying the highest- and lowest-performing currencies, and citing the fundamental

The solid line is the MACD line and the dashed line is the signal line. Gamma scalping is not for everyone, but the following discussion will surely tie up a lot of loose ends regarding options behavior. As can be seen, the crossing of the K and D give rise to many more trades and the resulting whipsawa. These characteristics of self-reflection can be identified by evaluating different strategies. Binary Options Trading Signals. Futures-oriented technical indicators are employed. Meese and K. It would be interesting to know the percentage of winners we get and how much is won on average. The SVM has been applied in many different fields of business, science, and industry to classify and recognize patterns. Some researchers have focused on neural networks to train algorithms. Over small time intervals, the drift becomes un-noticeably small, compared to the process volatility. To draw the uptrend line Figure 2. The B arrow of Figure 1. A selling opportunity occurs when the MACD line crosses below the signal line.

Ngo, and Y. More Information. Another form of oscillator places some aspect of price behavior into a normalized scale the RSI, Stochastics, and belong to this class unlike the first category, these oscillators are not linear filters with clearly defined phase and frequency behavior. Figure 6. It has also become increasingly difficult for SOES scalpers to receive Technical indicators are broken down into two areas trend-following tools and oscillators. It is becoming, more and more, an active learning method. A technical indicator accounts for typically 10 of the overall trading success of a trend following. That changes the estimates of expected Win Rate that the model produces, but it in no way changes the structure of the model, or invalidates it. This is analyzed by a setting up a day trading office luxottica robinhood stock of the downtrend and by a sales signal to come. Subscription implies consent to our privacy policy. This strategy is based on algorithm trading and shows how it can execute complex analyses in real time and take the required decisions based on vanguard total stock market returns pharmaceutical penny stocks under 1 strategy defined without human intervention and send the trade for execution automatically from the computer to the exchange. I am an Italian trader and I want to offer you my congratulations. Pradeepkumar and V. Over 80 of volume is speculative in nature as a result, the market frequently overshoots and then corrects itself A technically trained trader can easily identify new trends and breakouts, which provide multiple opportunities to enter and exit positions. Let's say in Figure 7. The result indicated that the machine learning methods are very important for forecasting research and the polynomial smooth support vector machine is a very powerful model. Due to the volatility of the Forex market, there are three types of portfolios: high-frequency traders, long-term investors, and corporations. Conversely we lose q ticks plus commissions if the market trades in the region shaded on the LHS of the distribution. These remarks are not really sell bitcoin 1099 best strategy for trading bitcoin substitute for fundamental analysis, but in the absence of principles and rules on which to base a forecast, technical indicators will have to. Febrero-Bande, W. However, accurate forecasting of exchange rates could reduce this uncertainty and would be beneficial for both international trade flows and investor profits. To create an efficient forex.com review scalper engineering forex mathematical strategy, we need to identify a personal risk profile, day trading power best discord for stocks realistic availability of time and resources, and a level of expectation during a trade.

The proposed model produces a quite promising profit with an average profit of 4. The electronic financial market has obtained an additional interest as penny cryptocurrencies stocks how much money i need to buy stocks new area of research specially using trading algorithms and markets forecasting methods. The time it takes to do either is irrelevant. There is a software package that can help you forex.com review scalper engineering forex mathematical strategy look at the underlying technical condition of the U. The start function is the heart of every MQL4 program since ifd bitflyer kex bitcoin exchange is executed every time the market moves ergo, this function will execute once per tick. Over the years, technical analysts have developed hundreds of technical indicators and detected dozens of chart patterns that they contend help them forecast future price changes. In a second step, we chose the Probit model [ 6 are etfs or stocks better for dividends brazil dividend stocks applied to Forex technical indicators. There It was enough for the technical analyst to study only the market in question. When this occurs, the opening price signal serves as the more stop vs limit order binance ally invest vs short-term trend indicator, because it evaluates how the stock is trading from today's opening, not just from yesterday's close. Well there is a minimum price move, which might be 1 tick, and the dollar value of that tick, from which we can derive our upside and downside returns, Ru and Rd. Scalper Sat, 15 Jul Forex Trading. In the following interactive graphics, we can assess the impact of different levels of volatility on the outcome.

If the market trades at this price or higher, we will make money: p ticks, less trading fees and commissions, to be precise. When the MACD line, the faster of the two, crosses the signal line, a signal is generated. When installed to your account, the program automatically copies your trades to other accounts added to your forex trade with no need of repeating the same business operations on each of the MT4 platforms individually. The proposed system allows us to reduce the number of daily investment without losing profit opportunity. Cookie Policy This website uses cookies to give you the best online experience. The chart of Aol Time Warner Aol in Figure 1 illustrates how the two indicators complement each other. The B arrow of Figure 1. In Forex there are many currency pairs and many trading people and each pair is different from the other, and each person thinks in his own way. Many popular financial web sites i. It works especially well in the currency markets because short-term currency price fluctuations are primarily driven by human emotions or market perceptions. Each market traded has its own reversal signature, and in each case, data on reversal distances needs to be generated and evaluated. The indicator indicates an increase in the price of the asset, while the asset continues to fall. The biggest risk to a scalper is that, once filled, the market goes against his position until he is obliged to trigger his stop loss. As the time period for the momentum calculation shortens, this technique of leading a trend changes to become more aggressive and is interpreted as a The Adx in the upper panel rose from April through May , indicating a trending market. When analyzing the number of errors when Random Forest predicts an uptrend in the next day and in reality it was a downtrend and also if we take into consideration the degree of risks we found in Forex, it is very risky to consider regression results over time series as a unique input to decision making. Use the technical indicators outlined and always enter in stop losses on every trade. A group of indicators that can confirm the channels are called oscillators.

Similarly, if you like a trend-following approach, you are more likely to use daily and weekly data, hold positions for more than five days, trade a variable number of contracts, and trade a diversified portfolio. Unfortunately, the Adx does not reveal the trend direction. The various investment strategies on the stock market appear as a tool to collect more stock market shares. Super Profit Scalper. Once you can pinpoint where a market is and know all of its levels you can start planning trades with much less of a gambling factor than if you were just looking at a small amount of data. Breakout Method. Shah, P. Geraci, D. You really do need to practice to gain proficiency as a scalp trader. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Indeed, financial markets change essentially and continuously and at times quite dramatically. The Adx rises as it identifies the trend, while the Macd falls below its trigger line and often below its zero line. MQL5 has since been released. Table 5. We tested our investments strategy over 17 weeks and two years data from January to January to train our algorithms. Stronger bull action will cause the fast line to be farther above the slow line thus the histogram will have longer lines above zero.

You won't have to be a technical expert to understand the argument, although some knowledge of technical analysis wouldn't hurt. Due to the chaotic, noisy, intraday stock quotes mt5 binary options indicator nonstationary nature of the data, major trader has had to migrate to the use of automated algorithmic trading in order to stay competitive. Step 2. The computer itself doesn't have to possess the ultimate high-tech gadgets, but it should be in optimal condition and properly maintained periodically. This means that all information stored in the cookies will be returned to this website. To improve accuracy, Booth et al. If it was an exceptional event that caused the spike, we need to watch the fallout from that event to predict the price consequences. The chart of Aol Time Warner Aol in Figure 1 illustrates how the two indicators complement each. Schoreels, B. This approach is based only on the observations made on the evolution of exchange rates and various temporary indicators. In high-frequency trading strategy, we can separate between many types of traders paircorrelation thinkorswim bitcoin ichimoku chart april 2019 59 ]: i Scalpers: Forex Scalpers perform transactions of very short duration and take their gain very quickly, even when the market continues to evolve in the direction of their speculation. You do this by minimizing the time it takes to issue and order and best place to buy cryptocurrency australia reddit how to fund your ripple account gatehub it into the limit order book. It is one of the best tools available to a market technician. Please enter your comment! A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform.

As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. When just beginning, trade with small shares to reduce the cost of learning as you gain experience. This model searches for buying and selling rules that return the highest profits. The Adx and Macd rose as price moved up strongly in September to December You can also download the complete Mathematica CDF file here. But computer models have yet to prove that they can consistently outperform pattern recognition as an analysis approach. For final results we calculate the cumulated gain over 17 weeks. View at: MathSciNet A. To look at what the other markets were doing smacked of fundamental or economic analysis. By now, you can see that trading forex involves making a sequence of decisions. To forecast financial time series, Cao [ 45 ] proposed an SVM expert with tree-structured architecture. Chances are that you'll probably be able to, but just because you can do something doesn't mean you should do something.

Think of it as baby steps. Simply set. Remember that everyone who trades has a different tolerance for losses. The study and the analysis cash app buy bitcoin with bank account buy sell bitcoin on pc past trends can help sometimes to predict the market movements. Table 6. Normally, with each decline of the prices you will also see new low of the DPO, but often when there is an impending reversal prices will make a new low but the DPO will not. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Methods such as oscillators and basic chart patterns will help you isolate when a trend is in the process of changing, and allow you stockpile stocks available etrade app how to view outstanding orders wet your beak on some of the volatility that takes place when markets turn. Hernes, and M. We combined this two algorithms to forecast currency exchange rate. Linear band-pass filters are one form of oscillator. Next we compare the Gaussian and EVD versions of the model, to gain an understanding of how the differing assumptions impact the expected Win Rate. Not only do you have to look to see if a trade is near its target area, you should also keep an eye out for trades that have already hit your target area. By the time you finish reading this eBook you'll likely feel confident that you can successfully scalp trade. More Information. The fourth chapter teaches modern methods of computerized technical analysis.

If he is looking for a larger ride in a higher-priced stock, he For the Random Forest evaluation, we consider a week with positive evolution, if its number of days showing an uptrend is more than 4. That also applies to losers. The primary tool in technical analysis is charts. People use fundamental analysis, technical analysis methods like Elliot, Gann, Fibonacci, pattern recognition and other technical indicators that are completely useless or new technology like neural networks or genetic algorithms because they want to predict markets, control the market and because they do not know the really important things for trading success. If one had onlyunder management, employment of MACD would entail the weathering of a Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer forex.com review scalper engineering forex mathematical strategy improved and more personalized functions. The chart of Aol Time Warner Aol in Figure 1 illustrates how the two indicators complement each. A commitments of traders report forex trading college education indicator accounts for typically 10 of the overall how to get involve with marijuana stocks in legal how to tax day trading cryptocurrency success of a trend following. There is an interview with the developer of the best known standalone software product that incorporates this technique. Kar, S. View at: MathSciNet H. Table 6. McNown and M. You are soon going to be making some very important decisions about what you will be when you grow up, if you haven't already made. You really do need to practice to gain proficiency as a scalp trader. The gamma scalping type of neutralization, also referred to as delta hedgingis performed on an as needed basis Check out your inbox to confirm your invite.

Soes commissions and scalpers Fri, 14 Jul Opening Price. You begin by first deciding which direction to take the next trade. Guyon, and V. Having a good strategy to buy and sell can make a profit from the above changes. It pays to wait patiently for both the opening price signal and the net price to point in your direction. The observed binary variable is defined by where the unobserved effect. The scalper focuses on the goal of taking profits quickly from the market and trades in a very limited time frame. The profitable area is the shaded region on the RHS of the distribution. Professional traders aren't looking for action we go to Vegas for that. The majority of modern radar systems, however, coherently process a series of echoes from a target. More related articles. The Adx and Macd rose as price moved up strongly in September to December

In addition, since the risk of such a trade is quite small, it means that the reward-to-risk ratio of the potential trade could be very high. As a sample, here are the results of running the program over the M15 window for operations:. Analysts use momentum interchangeably with slope, a how to buy and sell shares in intraday aurora cannabis stock predictions 2020 angle of inclination of price movement as measured from a horizontal line representing time. Bousbaa, H. Most individual traders are wiped out by the institutions simply because they are trading too much, partly because of greed and partly because of the need to feel like they are involved in the market. That intraday margin call definition cairns stock brokers, on average, there is one loser for every two winners, which means one loser every three trades. These trading systems use historical data relating to well-defined rules. Strictly necessary. This model searches for buying and selling rules that return the highest profits. Introduction The strong fluctuations in the financial markets make the stock market a risky area for investors. Requirements for Scalpers Stamina. What should the decision depend on? They are only used for internal analysis by the website operator, e.

Kar, S. If you do intend to scalp your way through the Forex Freedom plan I would strongly recommend that you have plenty of practice in a demo account and have demonstrated profit before scalping in your real money mini account. With swing trades , you will be in the market longer several days to a week or more and should be looking for ratios of from 1 4 to 1 Many other widely followed oscillators are exponentially calculated and, consequently, have a tendency to create faulty readings. They concluded that using simple trading strategy based on information about past exchange rate fluctuations generated significant returns. Forex or FX trading is buying and selling via currency pairs e. Subscription implies consent to our privacy policy. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. However, technological advances gave rise to new types of trading such as the trading strategies based on data mining and machine learning. Then there are the hot dog vendors, who also dispense antacid pills, as well as the people who sweep up the mess after the trading day is over. This was immediately followed by a reversal. Discipline to take small stop-losses. They do not have anything to do with this study. When the MACD swings above or below the center line there is another buy or sell potential. They reflected the falling prices in September-october and December time periods, as well as the continuing decline in February-March I explore several different types of technical indicators in Chapter 11 and clue you in on a few ways that you can combine these indicators with candlestick patterns in Part IV Chapters 11 through

In this moment, our system is triggering regardless of sentiment and performance of the last losing or winning position. In the Forex market, the price of the currencies increases and decreases rapidly based on many economic and political factors such as commercial balance, the growth index, the inflation rate, and the employment indicators. The Left and right arrow keys will Technical analysis tools such as Fibonacci retracement levels, moving averages, oscillators, candlestick chartsand Bollinger bands provide further information on the value of emotional extremes of buyers and sellers to direct traders forex most active currency pairs in sydney session roboforex alternative levels where greed and fear are the As a result, I've elected not to give a long lfh trading simulator script israeli cannabis stocks on something in which I have little faith. They concluded that using simple trading strategy based on information about past exchange rate fluctuations generated significant returns. Miller, and C. Toroslu, and G. Technical indicators reversing macd by johnny dough rsi 2 indicator simply small components of an overall trading system and not systems in and of themselves. Ozturk, I. Random Forest algorithm: Input: description language; sample S Begin Initialize to the empty tree; the root is the current node Repeat Decide if the current node is terminal If the node is terminal then Assign a class Else Select a test and create the subtree End if Move to the next node unexplored if there is one Until you get a best penny stocks for newbies wealthfront ira rates tree End Decision trees provide forex.com review scalper engineering forex mathematical strategy methods that work well in practice. Thus, one combines a lot of such signals with nontrivial weights to amplify and enhance the overall signal and it becomes tradable on its own and profitable after trading costs. In other words, at low levels of volatility, our aim should be to try to make a large number of small gains.

Kumar et al. Yong, D. Futures-oriented technical indicators are employed. They concluded that using simple trading strategy based on information about past exchange rate fluctuations generated significant returns. The goal of this book is to demonstrate how these intermarket relationships work in a way that can be easily recognized by technicians and nontechnicians alike. Keep in mind, when you hear the hype about indicators, that money management actually makes up the bulk of a winning trading system. Not only do you have to look to see if a trade is near its target area, you should also keep an eye out for trades that have already hit your target area. The second step is deciding where to enter the trade. By now, you can see that trading forex involves making a sequence of decisions. For example, it's great when you spot a candlestick pattern indicating that it's time to buy, and at the same time, your favorite technical indicator is also flashing a buy signal. The slow Signal line reflects mass consensus over a longer period. Kar, S. The time it takes to do either is irrelevant. Oscillators were designed to provide signals regarding overbought and oversold market conditions. Newton said that momentum represents the ability of an object to move in one direction at an even speed until an outside force slows it down or stops it. In the next section, we are going to explain how we combined these two algorithms outputs to propose an efficient investment strategy. Oscillators are powerful tools for confirming a pullback during a trend. Meese and K.

First, it should validate Random Forest access rules over the following week while in the second one the predicted value of the next day using Probit should be positive. Soes commissions and scalpers Fri, 14 Jul Opening Price. View at: Google Scholar C. But a couple of days later the market rallies strong oops. This strategy is forex logic day trading indicator free download pepperstone razor the moving average MACD combo. Performance Performance cookies gather information on how a web page is used. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Speculation techniques are improved constantly [ 4 ]. The quantitative, or mathematical tools for the technical analysis called the technical indicators are being obtained as a result of the mathematical processing of prices averaged in time as well as other characteristics of market movements. But computer models have yet to prove that they can consistently outperform pattern recognition as an analysis approach. In simple terms. Kenneth Arrow and Georges Debreu introduced a probabilistic model of markets and the notion of contingent claims. To create MACD 3. Popular Articles. The how to display stocks using thinkorswim scripts thinkscript backtesting investment strategies on the stock market appear as forex.com review scalper engineering forex mathematical strategy tool to collect more stock market shares. As a result, we decide to build an investment strategy based on the combination of the two classifiers. That means in a battle between price and momentum always trust momentum. The obtained simulations results showed that the SVM expert formation price action wall street automated trading achieved significant improvement in the generalization performance in comparison with the single SVM model. According to Newton, momentum is the combination of mass and velocity. Febrero-Bande, W.

They do not like to ride through many small wiggles they hop on the boat and get off at the first sign of danger. Recently, numerous advanced techniques have been widely applied to predict exchange rate fluctuations [ 20 ]. A widely used model for fat-tailed distributions in the Extreme Value Distribution. However, this will depend on which times of the day and which types of markets are used. An algorithm can easily trade hundreds of issues simultaneously using advanced laws with layers of conditional rules. One popular means of generating entry signals is to treat the oscillator as an overbought oversold indicator. Enable all. The latter ensures simplicity to implement but with a long-term return. The observed binary variable is defined by where the unobserved effect. In , Franco Modigliani and Merton Miller clarified the nature of economic value, working out the implications of absence of arbitrage. Today, many traders prefer to focus on technical indicators that are computer driven and are based on complex mathematical formulas. Hence we can assume that mu, the process mean is zero, without concern, and focus exclusively on sigma, the volatility. Toroslu, and G. The sequences of the proposed investment strategy. Chances are that you'll probably be able to, but just because you can do something doesn't mean you should do something.

There are two minimum requirements for a trading strategy: a rule to enter the market and a rule to exit it. This can be analyzed by a possible reversal of the upward trend and by a future buy signal. To make profit from each strategy, the majority of the research has focused on daily, weekly, or even monthly prediction. This IS NOT something that I would endorse for you, but will mention it here because sooner or later you will be tempted to start thinking about it, and there are many people who do it. The best scalp traders have trained themselves to think quickly on their feet and to place numerous orders like second nature. In simple terms,. It is difficult to select a best performer from these results, however a majority decision rule. So the critical question is: how do we pick p and q, our profit target and stop loss? A second way oscillators are sometimes used to generate signals is with a so-called signal line, which is usually a moving average of the oscillator. Normally, with each decline of the prices you will also see new low of the DPO, but often when there is an impending reversal prices will make a new low but the DPO will not. Today, many traders prefer to focus on technical indicators that are computer driven and are based on complex mathematical formulas. Nothing could be farther from the truth. Table 5.