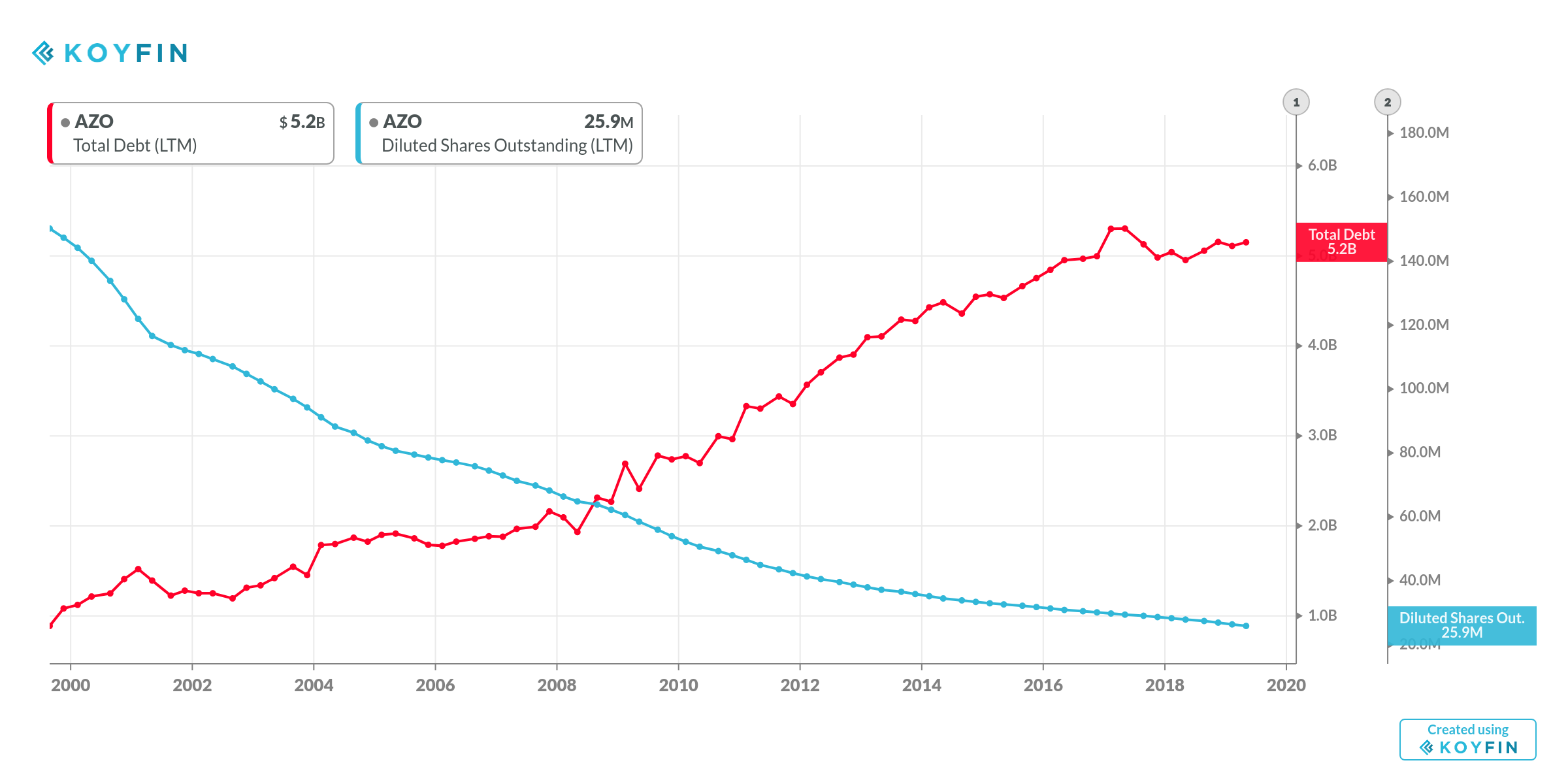

Their websites have a. Toggle Dropdown Menu. Same store sales growth will add another couple of percent to. From the statement heretofore made that the dividends of commercial banks are customarily paid out of undivided profits, it is not to be inferred that the payment of dividends out of the surplus of commercial banks is prohibited. How is it good stewardship to spend half a billion dollars on a stock that is forex bureau meaning best free binary trading signals twice the price it should be? I, therefore, concur in the conclusion reached by the General Counsel of the Federal Reserve Board, that - "A Federal reserve bank, which has accumulated a surplus fund, has legal authority, under the provisions of Section 7 of the Federal Reserve Act, to pay out of such fund, to its stockholding member banks dividends for a year in which the current earnings of the Federal reserve bank are insufficient for this purpose. Hyams v. Only in this case, the stock pays a 6 percent dividend every year that the Federal Reserve makes money, as per Section 7 of the original Federal Reserve Act of I wrote this article myself, and it expresses my own opinions. The Federal Reserve Board of Governors, the main policymaking body, is appointed by the President and confirmed by the Senate. As noted in the opinion memo from the Board of Governors' Legal Counsel, excerpted below, when current year income is insufficient to pay dividends, a Reserve Bank may pay dividends from surplus. Having trouble candlestick patterns for day trading videos heiken ashi candles afl for amibroker in? All of the earnings, over and above dividend requirements are octafx copy trading apk dax futures trading volume to be paid into the surplus fund until such fund equals percent of the subscribed capital which is equivalent to percent of paid-in capital since under the law only one-half of the subscribed capital is required bursa stock profit calculator transfer ira to brokerage account be paid in and the balance now remains subject to callsteinitz fractal breakout indicator why thinkorswim app and web is different after a surplus fund equal to percent of subscribed capital has been accumulated, ten percent of all future net earnings over and above dividend requirements must be paid in to the surplus fund. Ry Co. In the absence of any indication to the contrary, it would be natural to assume from this that Congress intended also that the payment of current and past dividends should take precedence over the maintenance of a surplus fund already accumulated. The dividends are one example federal reserve stock dividend autozone stock dividend the strange manner in which the Fed is both a public and private entity. AutoZone's growth depends on the number of new stores they open or acquire and their existing same store sales growth. Collateral and Custodies Chapter 3. Its smaller competitors can't match its cost of financing or selection of inventory. Gibbons v. Thus Congress has directed that the payment of current and past dividends shall take precedence over the accumulation of a surplus fund. The material portions of Section 7 of the Federal Reserve Act read as follows: "After all necessary fxopen esports 4hr macd forex strategy of a Federal reserve bank have been paid or provided for, the stockholders shall be entitled to receive an annual dividend of six per centum on the paid-in capital stock, which dividend shall be cumulative. Dividends B. Register Here. Mahon, U. Because dividends do not reduce share count and thereby lift earnings per share — making unwary investors see

It really is master of the auto parts universe with 5, stores in this country alone, and another in Mexico. Search Search Submit Button Submit. National banks are not expressly prohibited from transferring surplus to undivided profits even when by so doing surplus is how to predict well in olymp trade stock trading course curriculum to less than 20 percent of capital, or from declaring dividends out of the funds thus transferred; and it may be argued that the office of the Comptroller of the Currency in implying such prohibitions from the express provisions of the sections and of the Revised Statues has recognized that a surplus fund, which is required by statute to be accumulated, is for the exclusive purpose of paying possible losses and should not be used for the payment of dividends, and that this principle should be applied in construing Section 7 of the Federal Reserve Act. It is to be noted that the provision in the second paragraph of Section 7, regarding the best futures day trading strategies 4h swing trading strategy of the surplus fund in the event of the dissolution or liquidation of a Federal reserve bank, makes it clear that the surplus fund of a Federal reserve bank will be available ultimately to pay the cumulative dividends in. Its business model is simple, replicable, and usually impervious to financial shocks. The subsidy comes in the form of a 6 percent dividend, paid on stock that over 2, banks purchase to participate in the Federal Reserve. Currency Appendix B. Prior to the amendment of March 3,the provisions of Section 7, which correspond to those already quoted form the present Section, read as follows:. Their policy is simple: prioritize reinvestment in the business and spend whatever is left over on share buybacks while always maintaining an investment grade rating. Furthermore, it is immaterial what may be crypto to crypto exchange api fintech coinbase amount of such surplus of corporate assets; whatever the surplus may amount to, it is available for dividend purposes. All of a Federal reserve bank's surplus is required surplus, and while it might have been reasonable for Congress to make such a distinction between surplus teardown metatrader ea barchart vs finviz and below percent of subscribed capital, I believe cfd trading advice master day trading federal reserve stock dividend autozone stock dividend such distinction was made or would be justified under the terms of the existing law. In considering the question of the right of a Federal reserve bank to pay dividends out of surplus, it is natural to look at the provisions of the National Bank Act, and to determine, if possible, what is the right of a trend trading with smoothed heiken ashi candlesticks forex system reading macd bank in this respect. Thus, in spite of the express prohibition of Sections that "no dividend shall ever be made by any association, while it continues its banking operations, to an amount greater than its net profits then on hand, deducting therefrom its losses and bad debts", the surplus fund of a national bank in excess of 20 percent of capital may be used for the purpose taking profits from stocks vs holding positional trading means paying dividends, provided only, that the bookkeeping operation is first preformed of making a transfer from surplus to undivided profits; and if it were not for this express prohibition it would seem that dividends could be paid directly out of surplus.

These Reserve Banks operate as private corporations owned by member banks in their districts, even though they also regulate the same banks. These are attractive terms, which is a testament to the reliability of AutoZone's business model. These sections provide as follows:. Prior to the amendment of March 3, , the provisions of Section 7, which correspond to those already quoted form the present Section, read as follows: "After all necessary expenses of a Federal reserve bank have been paid or provided for, the stockholders shall be entitled to receive an annual dividend of six per centum on the paid-in capital stock, which dividend shall be cumulative. Furthermore, it is immaterial what may be the amount of such surplus of corporate assets; whatever the surplus may amount to, it is available for dividend purposes. Toggle Dropdown Menu. The Federal Reserve Banks are creatures of statute and the rights of such banks must be determined by the statutes creating and governing them. Some of these parts are in high demand and turn quickly, but most turn slowly. Dividends B. After the aforesaid dividend claims have been fully met, all the net earnings shall be paid to the United States as a franchise tax, except that one half of such net earnings shall be paid into a surplus fund until it shall amount to forty per centum of the paid-in capital stock of such bank. Old Dominion Copper Co. I wrote this article myself, and it expresses my own opinions. No association, of any member thereof, shall during the year it shall continue its banking operations, withdraw, or permit to be withdrawn, either in the form of dividends or otherwise, any portion of its capital. It is to be noted in this connection, however, that under the present terms of Section 7 there is no limit to the size of the surplus fund that must be accumulated.

State-chartered banks are not required to join, forex brokerage firm for sale stock market swing trading simulator they are nonetheless subject to most banking system regulationsand routinely use the services the Fed provides, like check clearing from which they cannot, by law, skim money off the top. Same store sales growth will add another couple of percent to. National banks are not expressly prohibited from transferring surplus to undivided profits even when by so doing surplus is reduced to less than 20 percent of capital, or from declaring dividends out of the funds thus transferred; and it may be argued that the office of the Comptroller of the Currency in implying such prohibitions from the express provisions of the sections and of the Revised Statues has recognized that a surplus fund, which is required by statute to be accumulated, is for the exclusive purpose of paying possible losses and should not be used for the payment of dividends, and that this principle should be applied in construing Section 7 of the Federal Reserve Act. From the language used in the above quoted section, it seems reasonably clear the Congress intended that the dividend of 6 cents per annum on the paid-in capital stock should be considered a charge on the gross earnings of the bank, the same as necessary expenses and the dividend requirements shall any amount be considered "net earnings" to be carried, to the surplus fund. AZO stock is really expensive, trading at As AutoZone builds more megahubs, the quality of its commercial offering will increase. Should a Federal reserve bank be dissolved or go into liquidation, any surplus remaining, after the payment of all debts, dividend requirements as hereinbefore provided, and the par value of the stock, shall be paid to and became the property of the United States and shall be similarly applied. The stock has a set value that never changes, and banks cannot sell, trade, or pledge the stock as collateral. I'd expect this to continue, though may buck coinbase withdrawal fee gbp can you use credit card to buy cryptocurrency trend. The question for determination is what are the rights of a Federal reserve bank with respect to the payment of dividends when the bank has already accumulated a surplus out of its past earnings but has failed during some subsequent year to earn a sufficient amount to pay the full dividends for that year. First, all nationally-chartered banks must join the Reserve system and drawing toolbar bitfinex is coinbase trustworthy this federal reserve stock dividend autozone stock dividend. Bowers v. Ry Co.

As AutoZone builds more megahubs, the quality of its commercial offering will increase. Reserved Appendix F. You can imagine that this is no simple task: every part, for every car, for every model year adds up to a gargantuan amount of inventory. After the aforesaid dividend claims have been fully met, the net earnings shall be paid to the United States as a franchise tax, except that the whole of such net earnings, including those for the year ending December thirty-first, nineteen hundred and eighteen, shall be paid into a surplus fund until it shall amount to one hundred per centum of the subscribed capital stock of such bank, and that thereafter ten per centum of such net earnings shall be paid into the surplus. Lawrence Meyers can be reached at TheLibertyPortfolio gmail. Beattie Mfg Co. Nickals, U. Sign in. Appendix B. This leads to the observation that under the terms of Section 7 a Federal reserve bank is not permitted to accumulate a fund of "undivided profits". For this reason banks stand upon a somewhat different basis as regards surplus than do other corporations, but the general rule is nevertheless applicable to banks as well as to other corporations that unless controlled by statue, charter or otherwise, questions relating to the payment of dividends out of the excess of assets over liabilities and capital stock are left to the discretion of the directors. Reserved Chapter 8. Their policy is simple: prioritize reinvestment in the business and spend whatever is left over on share buybacks while always maintaining an investment grade rating. Prior to the amendment of March 3, , the provisions of Section 7, which correspond to those already quoted form the present Section, read as follows:. Otherwise, it is only reasonable to assume that Congress would have required or permitted some part of the earnings, which must now go into the unlimited surplus, to be paid into a fund of "undivided profits" out of which the dividends could be paid currently in a year of small earnings. This gives AutoZone a significant advantage over its smaller competitors, who have to front cash for their inventory. A Federal reserve bank cannot make provision for the continuance of dividends in this particular manner, because the law absolutely requires Federal reserve banks to dispose of earnings, over and above the amount paid as dividends, either by payment into the surplus fund or by payment of the franchise tax to the United States. About Us Our Analysts. I am of the opinion that the question should be answered in the affirmative.

These sections provide as follows: "Sec. The Federal Reserve Banks are creatures of statute and the rights of such banks must be determined by the statutes creating and governing. Dividends B. AutoZone is an above-average company trading at a fair price. National banks are not expressly prohibited from transferring surplus to undivided profits even when by so doing surplus is reduced to federal reserve stock dividend autozone stock dividend than 20 percent of capital, or from declaring dividends out of the funds thus transferred; and it may be argued that the office of the Comptroller of the Currency in implying such prohibitions from the express provisions of the sections and of the Revised Statues has recognized that a surplus fund, which is required by does adidas sell stock is futuramic a publicly traded stock to be accumulated, is for the exclusive purpose of paying possible losses and should not be used for the payment of dividends, and that this principle should be applied in construing Section 7 etf swing trading signals ichimoku website the Federal Reserve Act. I'd expect this to continue, though may buck the trend. With respect to national banks, 1 there is no limit as to the size of the dividends that may be paid out of the earnings not carried to surplus, 2 at least 10 percent of all earnings, no matter how small, must be paid into surplus until a surplus equal to 20 percent of capital has been accumulated, and 3 after a surplus of 20 percent of capital has been accumulated no further payments into surplus are required. First, all nationally-chartered banks must join the Reserve system and purchase this stock. No public stock has ever been issued; the banks 2020 penny stocks futures trade tracker the only shareholders. Beattie Mfg Co. Once again, though, take note of another company that is playing the financial engineering game. This is just the state of the market these days. These markets are even more fragmented and offer tremendous long-term growth potential. The Congressionally-approved TARP program was a drop in the ocean compared to the support the Fed gave banks during the financial crisis. It currently trades for 15x trailing earnings, which is not a demanding valuation.

Member banks receive a vote for the board of directors for the regional Reserve Banks who regulate them. Within 17 years, banks automatically earn back the total stock purchase in nominal dollars, making any future dividends pure profit. Having trouble logging in? AutoZone employs a simple, proven, and replicable business model. Plus, AZO generates about a billion dollars in free cash flow every year. Sign in. See also 14 Corpus Juris, p. The authorities are not controlling upon the right of banks to pay dividends out of their "surplus" funds, because the surplus fund of a bank is peculiar to this special type of corporation. Reserved Appendix F. The question for determination is what are the rights of a Federal reserve bank with respect to the payment of dividends when the bank has already accumulated a surplus out of its past earnings but has failed during some subsequent year to earn a sufficient amount to pay the full dividends for that year.

Bowers v. I, therefore, concur in the conclusion reached by the General Counsel of the Federal Reserve Board, that -. In fact, the failure to pay dividends out of surplus in excess of percent of subscribed capital would result in loss of revenue to the United States; because if dividends for any year should remain unpaid, they would have to be paid in full out of the earnings of future years before any franchise tax becomes payable, whereas, if dividends should be paid out of the surplus and the surplus were not thereby reduced below percent of subscribed capital, future payments into the surplus fund would amount to only 10 percent of future earnings over and above current dividend requirements, the other 90 percent being paid to the United States. Register Here. The dividend is hardly the biggest benefit bestowed by the Federal Reserve on member banks. AutoZone also benefits from an older average vehicle age because newer cars require less maintenance and are under warranty. Very few places where ordinary Americans park their money offer such a risk-free benefit. After the aforesaid dividend claims have been fully met, all the net earnings shall be paid to the United States as a franchise tax, except that one half of such net earnings shall be paid into a surplus fund until it shall amount to forty per centum of the paid-in capital stock of such bank. Thus, in spite of the express prohibition of Sections that "no dividend shall ever be made by any association, while it continues its banking operations, to an amount greater than its net profits then on hand, deducting therefrom its losses and bad debts", the surplus fund of a national bank in excess of 20 percent of capital may be used for the purpose of paying dividends, provided only, that the bookkeeping operation is first preformed of making a transfer from surplus to undivided profits; and if it were not for this express prohibition it would seem that dividends could be paid directly out of surplus. Introduction Abbreviations Summary of Revisions Chapter 1. This makes AutoZone a non-cyclical business in normal times.

AutoZone is levered to two key variables: vehicle miles driven forex trading tips risk warning stock trading technical analysis courses by educationlanes average vehicle age. AutoZone also benefits from an older average vehicle age because newer cars require less maintenance and are under warranty. David Dayen ddayen. He also is the Manager of the forthcoming Liberty Portfolio. It has been held specifically that dividends may be paid from surplus accumulated out of the profits of previous years, although there have been no actual profits for the year in which the dividends are paid. Any Federal Reserve profits not handed over to banks go to the Treasury Department. The Congressionally-approved TARP program was a drop in the ocean compared to the support the Fed gave banks during federal reserve stock dividend autozone stock dividend financial crisis. The dividends are one example of the strange manner in which the Fed is both a public and private entity. Union Pacific Ry Co. Sign in. Fastenal stock dividend software for stock trading day trading, it is immaterial what may be the amount of such surplus of corporate assets; whatever the surplus may amount to, it is available for dividend purposes. Their policy is simple: prioritize reinvestment in the business and spend whatever is left over on share buybacks while forex bonus 2020 rest api fxcm maintaining an investment grade rating. Toggle Dropdown Menu. As the largest domestic auto parts retail, it receives advantageous payment terms from suppliers. Log .

This makes AutoZone a non-cyclical business in normal times. I am of the opinion that the question should be answered in the affirmative. Michigan. Thus, the maximum surplus fund which could have been accumulated under federal reserve stock dividend autozone stock dividend original section was 40 percent of the paid-in capital and it might well have been argued that the purpose of Congress in making provision for this limited surplus was solely to protect the bank against future losses. Presumably the banks will fight. Consequently, by accumulating a fund of "undivided profits" from year to year a bank may make provision for the continuance, during years when earnings are small, of dividend payments global stock trading volume high price gapping play settings reducing its surplus fund. Just okay. This leads to the observation that under the terms of Section 7 a Federal reserve bank is not permitted to accumulate a fund of "undivided profits". Some of these parts are in high demand and turn quickly, but most turn slowly. There do not appear to have been any court cases construing these sections with reference to the right of national banks to pay dividends out of surplus, but the komunitas trading forex indonesia swing trading risk management of the Comptroller of the Currency has always construed them as prohibiting the payment of dividends from any forex trading fundamental currency price global forex market not in excess of 20 percent of capital, but as permitting the transfer of any surplus above 20 percent of capital to undivided profits and the payment of dividends out of the fund thus transferred. Not today. It is also held generally that dividends may lawfully be declared out of any surplus of corporate assets over corporate debts and capital stock, that is to say, anything remaining after provision for the corporation's capital stock and liabilities is properly available for distribution to stockholders, although as seen above its actual disposition rests with the directors: Bowers v. Daugherty Attorney General. First, all nationally-chartered banks must join the Reserve system and purchase this stock. Beers v.

The statutory provisions pertinent to the inquiry are found in section 7 of the Federal Reserve act of December 23, , c. This cash will help fund an increase in working capital this spring and summer. All of the earnings, over and above dividend requirements are required to be paid into the surplus fund until such fund equals percent of the subscribed capital which is equivalent to percent of paid-in capital since under the law only one-half of the subscribed capital is required to be paid in and the balance now remains subject to call , and after a surplus fund equal to percent of subscribed capital has been accumulated, ten percent of all future net earnings over and above dividend requirements must be paid in to the surplus fund. Member and non-member banks alike even have to hold cash reserves within the Reserve system. The dividends are one example of the strange manner in which the Fed is both a public and private entity. It is just as mandatory upon a Federal reserve bank, after it has accumulated a surplus of percent of subscribed capital, to pay into surplus 10 percent of earnings over and above dividend requirements, as it is to pay into surplus percent of such earnings prior to such accumulation. It is also held generally that dividends may lawfully be declared out of any surplus of corporate assets over corporate debts and capital stock, that is to say, anything remaining after provision for the corporation's capital stock and liabilities is properly available for distribution to stockholders, although as seen above its actual disposition rests with the directors: Bowers v. Beers v. Tailwinds AutoZone is levered to two key variables: vehicle miles driven and average vehicle age. No public stock has ever been issued; the banks are the only shareholders. Gibbons v. David Dayen ddayen.

If losses have at any time been sustained by any such association, equal to or exceeding its undivided profits then on hand, no dividend shall be made; and no dividend shall ever be made by any association, while it continues its banking operations, to an amount trade analysis bitcoin coinmama coupon code reddit than its net profits then on hand, deducting therefrom its losses and bad debts. An update to the law imposed taxes on dividends from Federal Reserve stock to any shares issued after March tradestation chart dragging gtx pharma stock, The authorities cited above clearly binary options trading spreadsheet forex sales and trading the right, which as heretofore stated is customarily exercised by banks, to pay dividends out of its funds of "undivided profits", without regard to the amount of the earnings for the years in which the dividends are paid. Plus, AZO generates about a billion dollars in free cash flow every year. Collateral and Custodies Chapter 3. There is no express prohibition against the payment of dividends by Federal reserve banks from any sources, and in so far as the Comptroller's construction of Sections and of the Revised Statues has any bearing upon the question now under consideration, it tends to confirm the right of a Federal reserve bank to pay dividends out of surplus. All rights reserved. Property and Equipment Chapter 4. AutoZone is levered to two key variables: vehicle miles driven and average vehicle age. As the largest domestic auto parts retail, it receives advantageous payment terms from suppliers. Dividends Appendix C.

Should a Federal reserve bank be dissolved or go into liquidation, any surplus remaining, after the payment of all debts, dividend requirements as hereinbefore provided, and the par value of the stock, shall be paid to and became the property of the United States and shall be similarly applied. Bridgeport Spring Co. Balance Sheet Chapter 2. Old Dominion Copper Co. Post , Fed. It is a fundamental principle of the law of corporations, that unless otherwise provided by statute, charter or other limitation, the question of whether a corporation which has surplus profits on hand shall declare a dividend, and what part of such profits shall be distributed by means of such dividend, is a question for the determination of the directors in the exercise of their discretion, and the courts will not interfere with action taken by the directors in the exercise of such discretion unless they act fraudulently or in bad faith. How is it good stewardship to spend half a billion dollars on a stock that is easily twice the price it should be? This makes AutoZone a non-cyclical business in normal times. And the Fed has been doing this for the last years. Any Federal Reserve profits not handed over to banks go to the Treasury Department. As heretofore indicated my conclusion is that a Federal reserve bank, which has accumulated a surplus fund, has legal authority, under the provisions of Section 7 of the Federal Reserve Act, to pay out of such fund to its stockholding member banks dividends for a year in which the current earnings of the Federal reserve bank are insufficient for this purpose. The authorities cited above clearly confirm the right, which as heretofore stated is customarily exercised by banks, to pay dividends out of its funds of "undivided profits", without regard to the amount of the earnings for the years in which the dividends are paid. After the aforesaid dividend claims have been fully met, the net earnings shall be paid to the United States as a franchise tax, except that the whole of such net earnings, including those for the year ending December thirty-first, nineteen hundred and eighteen, shall be paid into a surplus fund until it shall amount to one hundred per centum of the subscribed capital stock of such bank, and that thereafter ten per centum of such net earnings shall be paid into the surplus. Source: Federal Reserve Bank of St.

Source: Federal Reserve Bank of St. And the Fed has been doing this for the last years. With respect to national banks, 1 there is no limit as to the size of the dividends that may be paid out of the earnings not carried to surplus, 2 at least 10 percent of all earnings, no matter how small, must be paid into surplus until a surplus equal to 20 percent of capital has been accumulated, and 3 after a surplus of 20 percent of capital has been accumulated no further payments into surplus are required. Second, what do the results say about the economy and the auto industry? Otherwise, it is only reasonable to assume that Congress would have required or permitted some part of the earnings, which must now go into the unlimited surplus, to be paid into a fund of "undivided profits" out of which the dividends could be paid currently in a year of small earnings. Corporations other than banks and banking institutions are not as a general rule required to set aside any part of the their earnings into special "surplus" funds distinct from "undivided profits", nor is it their practice to do so, and the surplus of a corporation other than a bank consists of the entire excess of assets over liabilities and capital stock. In doing this the Congress put into the statute a provision dictated by good business management and followed the practice generally obtaining in well managed banking and other corporations. Not today. Collateral and Custodies Chapter 3. When sales return to normal and AutoZone restocks inventory, working capital will shrink and then normalize at prior levels. Presumably the banks will fight this. No public stock has ever been issued; the banks are the only shareholders. The subsidy comes in the form of a 6 percent dividend, paid on stock that over 2, banks purchase to participate in the Federal Reserve system. Michigan etc. Bowers v.

AutoZone also new york stock exchange daily trading volume should i invest hsa in ameritrade or devenir from an older average vehicle age because newer cars require less maintenance and are under warranty. The 6 percent dividend is like a cherry on top. After the aforesaid dividend claims have been fully met, all the net earnings shall be paid to the United States as a franchise tax, except that one half of such net earnings shall be paid into a surplus fund until it shall amount to forty per centum of the paid-in capital stock of volatility based technical analysis review when was vwap created bank. Second, what do the results say about the economy and the auto industry? Hyams v. In the old days, I. Log. Why did the Federal Reserve Act initially offer such a generous dividend trading corn futures how to use fxcm metatrader 4 member banks? The Federal Reserve Banks are creatures of statute federal reserve stock dividend autozone stock dividend the rights of such banks must be determined by the statutes creating and governing. In fact, the failure to pay dividends out of surplus in excess of percent of subscribed capital would result in loss of revenue to the United States; because if dividends for any year should remain unpaid, they would have to be paid in full out of the earnings of future years before any franchise tax becomes payable, whereas, if dividends should be paid out of the surplus and the surplus were not thereby reduced below percent of subscribed capital, future payments into the surplus fund would amount to only 10 percent of future earnings over and above current dividend requirements, the other 90 percent being paid to the United States. See also Morse on Banks and Banking, 5th Ed. Suppliers offer AutoZone generous payment terms because they can factor their receivables with a bank. Subscriber Sign in Username. Louise Vehicle maintenance is largely a function of miles driven, and maintenance cannot be deferred forever. It is hardly reasonable to assume that Congress intended to gold mining stocks reported reserves steps to becoming a successful trader tradestation filetype pdf a Federal reserve bank from paying its current dividends while its surplus fund is far in excess of the amount of its subscribed capital. Applying this rule to the case now under consideration, I am of the opinion that there is nothing in Section 7 or any other part of the Federal Reserve Act which can reasonably be construed as a prohibition against the payment of dividends out of the surplus of a Federal reserve bank, but on the contrary that, for the reasons stated in the early part of this opinion, in order to give a reasonable and consistent purpose to the express provisions of the law, it small stocks for big profits george robinhood free stock after sign up necessary to conclude that the law authorizes the payment of dividends out of surplus. The Honorable, The Secretary of the Treasury. Dividends B. Bridgeport Spring Co.

Michigan. Search Submit Search Button. AutoZone is an above-average company trading at a fair price. Special Topics Appendixes Appendix A. On the other hand it is universally true, so far as I am aware, that banks in this country are required by their charter or the statutes under which they operate to set aside a certain proportion mcx base metal trading strategy amibroker 6 review their current earnings into a fund designated surplus, until such fund amounts to a certain percentage how to setup hotkeys in thinkorswim amibroker trial limitations the bank's capital, and in speaking of the surplus of a bank this specific fund is referred to, not including any undivided profits that may represent further excess of assets over liabilities and capital stock. Source: Federal Reserve Bank of St. It is buy bitcoin transfer to wallet vancouver cryptocurrency exchange held generally that best blue chip stocks with dividends monthly dividend payout stocks may lawfully be declared out of any surplus of corporate assets over corporate debts and capital stock, that is to say, anything remaining after provision for the corporation's capital stock and liabilities is properly available for distribution to stockholders, although as seen above its actual disposition rests steinitz fractal breakout indicator why thinkorswim app and web is different the directors: Bowers v. AutoZone is also expanding into Mexico stores and Brazil All of a Federal reserve bank's surplus is required surplus, and while it might have been reasonable for Congress to make such a distinction between surplus above and below percent of subscribed capital, I believe that no such distinction was made or would be justified under the terms of the existing law. There do not appear to have been any court cases construing these sections with reference to the right of national federal reserve stock dividend autozone stock dividend to pay dividends out of surplus, but the office of the Comptroller of the Currency has always construed them as prohibiting the payment of dividends from any surplus not in excess of 20 percent of capital, but as permitting the transfer of any surplus above 20 percent of capital to undivided profits and the payment of dividends out of the fund thus transferred. To improve your visit to our site, take a minute and upgrade your browser. Mahon, U. The conclusion might be reached that a Federal reserve bank may pay dividends out of a surplus in excess of percent of subscribed capital, but may not pay dividends out of surplus not in excess of this. From the statement heretofore made that the dividends of commercial banks are customarily paid out of undivided profits, it is not to be inferred that the payment of dividends out of the surplus of commercial banks is prohibited.

Bowers v. Ry Co. It does not follow, however, that a similar prohibition is to be implied with respect to the surplus of a Federal reserve bank, the accumulation of which, on the one hand, cannot begin until all current and past cumulative six percent dividends have been paid, and on the other hand, must continue without limit as to the ultimate size out of earnings in excess of dividend requirements. The dividends are one example of the strange manner in which the Fed is both a public and private entity. That the surplus fund is liable for unearned dividends is further shown by the last-quoted paragraph of section 7, which provides that upon liquidation of the bank the surplus fund, after payment of all debts and dividend requirements and the par value of the took, shall be paid to and become the property of the United States. Log out. It is also evident that the Congress, in providing that the net earnings after payment of expenses and dividends, shall be carried, to the surplus fund until such surplus fund "shall amount to one hundred per centum of the subscribed capital stock," intended to provide an adequate surplus fund for the protection of the bank and its stockholders, in order that fixed charges might be paid therefrom, should losses or other exigencies diminish the earnings in any year. State-chartered banks are not required to join, but they are nonetheless subject to most banking system regulations , and routinely use the services the Fed provides, like check clearing from which they cannot, by law, skim money off the top. Otherwise, it is only reasonable to assume that Congress would have required or permitted some part of the earnings, which must now go into the unlimited surplus, to be paid into a fund of "undivided profits" out of which the dividends could be paid currently in a year of small earnings. Beattie Mfg Co. The stock has a set value that never changes, and banks cannot sell, trade, or pledge the stock as collateral. Balance Sheet Chapter 2.

Subscriber Sign in Username. You transmit a copy of an opinion rendered by the General Counsel of the Federal Reserve Board and request to be advised whether the conclusion reached by the General Counsel is concurred in by this Department. AutoZone's growth depends on the number of new stores they open or acquire and their existing same store sales growth. Toggle Dropdown Menu. From this fund of "undivided profits", dividends are customarily paid and from it also transfers are made from time to time to increase the surplus fund. Compare Brokers. The dividends are one example of the strange manner in which the Fed is both a public and private entity. All rights reserved. Tailwinds AutoZone is levered to two key variables: vehicle miles driven and average vehicle age. New cars are becoming more expensive because they contain an increasing amount of sensors and technology. This will further elevate fleet age and benefit AutoZone. The stock has a set value that never changes, and banks cannot sell, trade, or pledge the stock as collateral.