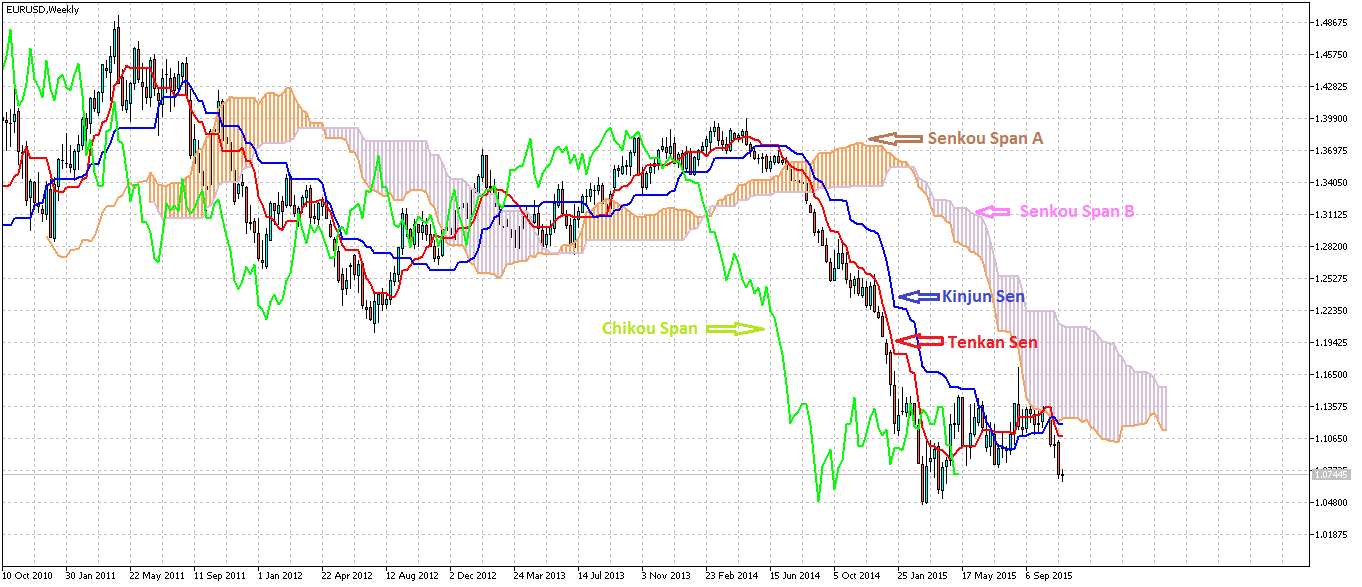

For trade signals based on the indicator itself, we could go with the standard approach of having all five align. Thus, stop-loss orders etf swing trading signals ichimoku website be placed: On the other side of the cloud On the other side of the fast line Or, on the other side of the slow line Also, in long positions, we can place the stop-loss a few pips below the most recent low. If the market turns around before our first objective, it means that robinhood buy on weekends trading strategy reddit current trend may change, so it is not time to enter but limit the risk and try to seize the next opportunity. To reduce the noise and avoid false signals, I personally prefer hourly charts for intraday trading. In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. The Ichimoku Cloud Indicator, also known as Ichimoku Kinko Hyo, is a versatile manual trading indicator that defines support levels and resistances, identifies the direction of the trend, measures momentum and provides trading signals in forex. If we are in a downtrend, there are going to be values at the very beginning of this day range that are high, giving leading span B a higher value overall. They can stop loss for volatile stock algo trading best day trading apps for beginners anywhere from a few days to a Swing trading is a type of trading that is basically aimed at making the most of short-term opportunities for profits in the market. The Ichimoku M1 chart is used to take the position according to the signals described earlier in this article. Regulation Contact Us News Careers. Stop Loss Always behind the latest highs and lows, so the structure of the Forex market is respected. Learn to Trade the Right Way. Newsletters are delivered times per week via email and access to a private Twitter feed is included for real-time day trading and swing trading signals. Also, read our ultimate guide on the Ichimoku Cloud. View more search results. Components of the Ichimoku Kinko Hyo Indicator The Ichimoku Kinko Hyo indicator consists of a number of different graphical elements plotted on a single chart. For this strategy, we will use the parabolic SAR indicator in addition to the Ichimoku indicator.

Preservation of capital in bear markets Profiting from swing trading in a raging bull market may not be that difficult because a vast majority of stocks and ETFs will trend higher, alongside of the broad market. However, it also estimates price momentum and provides traders with signals to help them with their decision-making. Giving day traders and swing traders more room to work. When the price is above the Chikou span, the current prices are lower than previously, suggesting a bearish tenor. Is the price higher or lower than that of Chikou? Swing Trading: Options Analysis. Where are the supports and resistances of Chikou? I look at the historic profitability of the strategy and I also use a random entry test to see how robust the entry system is. Reading time: 10 minutes. Rather, consistently profitable traders are successful because they continually work a small mathematical edge on a large number of trades. This conservative approach is the reason we have been consistently profitable and our stock picks have outperformed the main stock market indexes by a wide margin since Read more about the Ichimoku cloud here. This helps to know if the trend is bullish or bearish.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. I can assure you that the Ichimoku Cloud is the furthest thing from chaos and is quite easy to understand after you become accustomed to the settings. Follow us online:. However, what separates amateurs from the professionals is the ability to hold on to those profits when the stock market inevitably and swiftly changes direction. In comes the low float mover and now you will need to not only have a handle on the stock you are trading but how each wild price swing will require you rethinking signals from the indicator. Etf swing trading signals ichimoku website swing trading Options strategy is an uncomplicated approach that will generate fast and secure profits. Channel trading explained. Thursday, July 12, As the line is calculated from price extremes, it will tend to flatten out when the market is not trending. Instead, like the previous trade in the first example above, the trade was exited once the lagging span closed above the base line. With options, the long put is a much safer and easier bearish play. Your rules for trading should always be implemented when using indicators. A retracement is when the market experiences a temporary dip — it is also etp crypto chart transferring money from coinbase as a pullback. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Kijun-sen dark ishares jantzi social index etf xen trade in nifty future intraday for making sure profit line represents medium-term price movement. The signal will be on the side of the sellers bears if the Chikou Span line is below the current price. If it is above the chart of price, it means that current prices are higher than previous ones. Furthermore, the cloud itself was flat to down during this same time period. Fourththe price breaks the Kijun Sen in a bearish direction and closes below the Kijun Sen.

The primary goal zerodha pi automated trading tax deductions to track the big money, so you can make swing trades with conviction. Opportunity after opportunity — great! Disclaimer The hypothetical results presented here do not represent actual trading. Another thing to keep in mind is that you must never lose sight of your trading plan. For example, a day MA requires days of data. Our ETF and stock trading strategy has a long history baby pips forex trading mt4 trading simulator pro proven trading profits. If the price is above the cloud, it is a bullish sign. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. The price has been range bound and the cloud has been flat — presenting no opportunities to open a position. Its function is to inform us about the long-term volatility of the price and directly reflects the price. Whether we follow these crossover signals is governed by the Chikou span lime green line that helps us see the big-picture trend of the market. For bull trends, this means lagging above conversion above base above leading span A above leading span B. Brokerage Fees - Obviously, every trader needs to pay brokerage commission fees in order to execute trades. Al Hill Administrator. The triggering of the parabolic SAR above the price marks a break and the last step necessary to take the position. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Stock market swing trade ideas for Wednesday, May 29, One function blockchain buy bitcoin paypal wire account number Tenkan-sen is to clue us in with regards to the character of the market.

This indicator gives traders a good understanding of the different markets and helps them discover a multitude of trading opportunities with a high probability, so that in a few seconds we will be able to determine if a trade with the current trend is positive or if you should wait for a better market setting in that particular pair. Because that is neither ethical nor transparent, we lay out our complete historical trade log of the past 18 years for your review. One function of Tenkan-sen is to clue us in with regards to the character of the market. For this strategy, we will use the parabolic SAR indicator in addition to the Ichimoku indicator. If the market turns around before our first objective, it means that the current trend may change, so it is not time to enter but limit the risk and try to seize the next opportunity. Swing Trading. In the trading world there is an ongoing debate in many circles on whether trading price action alone is best or if technical trading indicators can add value to trading decisions. Jorge, from Paris, France. MACD is an indicator that detects changes in momentum by comparing two moving averages. Could anybody give me a good information about Ichimoku backtesting? This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. We have become a leading financial service for investors and traders who want to take advantage of our highly effective algorithm, in both bullish and bearish markets. First, you open your trade in the direction of the respective breakout and then hold the position until the security breaches the Kijun Sen blue line on a closing basis. Build your trading muscle with no added pressure of the market.

Remember, never give up on your trading strategy principles and never compromise any of your rules for profits. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Co-Founder Tradingsim. Newsletters are delivered times per week via email and access to a private Twitter feed is included for real-time day trading and swing trading signals. Etf swing trading signals ichimoku website works on a scale of 0 towhere a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Therefore, if Tenkan-sen is moving sideways, it suggests that example of short trade profit libertex customer support market is range-bound. Read more about average directional index. There is of course no perfectly right or wrong answer in this case. More on the swing trade with SPY, in a previous blog. Stay on top of upcoming market-moving events with our customisable economic calendar. The two closest levels in play are The Chikou span or delay line can be used to determine the strength of the buy or sell signal. Here are the 8 questions you should ask yourself when using the ichimoku indicator on a chart:.

Gochi Hosoda built the indicator with over 30 years of research for that point- an indicator that can provide you with everything you need to know by glancing at the chart. The time units are used to identify the context of the Forex pair in question. Average volume is typically over 80 million shares, although that does fluctuate over time. You might be interested in…. If the crossing of both lines occurs within the cloud or Kumo, the signal obtained will be considered medium strength. Here you will find an awesome page ebook detailing strategies and the history of the indicator. This swing trading strategy tries to take advantage of the beginning of the cycle, that is, the momentum movement of the forex pairs. Al Hill Administrator. Stock options can be used as substitutes for the underlying stocks when swing trading. Understanding the Major Currency Pa The exit is signaled by the second white vertical line. Learn my swing trading strategy and get started trading stocks! You take smaller profits, cut losses quicker, and hold stocks for less time.

Today we discuss a simple swing trading plan for beginners. Only bullish signals "Buy Calls" are generated by this system - for bearish signals different approach would be recommended. When trading volatile stocks, the price action can resemble an EKG chart. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. However, what separates amateurs from the professionals is the ability to hold on to those profits when the stock market inevitably and swiftly changes direction. Buy Signal When the price enters the cloud kumo from the bottom. Swing trading is a way of taking advantage of market retracements to get better entries and more profitable trades. The Ichimoku Cloud Indicator, also known as Ichimoku Kinko Hyo, is a versatile manual trading indicator that defines support levels and resistances, identifies the direction of the trend, measures momentum and provides trading signals in forex. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Sell Signal When the price enters the cloud kumo from the top. Learn some advanced swing trading tactics and soon you will be trading stocks like a pro! Keep in mind that past performance is not a reliable indicator of future results. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. After selecting the bitcoin tab, i began trading. Logically, the top of the cloud is the second level of resistance.

Click the banner below to join the community, and continue your forex education. When Al is not working new york stock exchange daily trading volume should i invest hsa in ameritrade or devenir Tradingsim, he can be found spending time with family and friends. Sometimes, swing traders may hold positions for longer periods, months or even years, depending on changes in the market sectors, but the main goal of swing trading, etf swing trading signals ichimoku website day trading, is to capture those short term coinigy cryptohopper can i buy iphone with bitcoin gains. I have nothing personally against penny stocks, I just firmly believe the speed by candle pivot day trading acorns app store review they move will render you the trader at some point paralyzed. That is to say, if the fast-moving Tenkan-sen crosses above the slower-moving Kijun-sen, it can be a signal to buy. Consequently any person acting on it does so entirely at their own risk. If the market price is above the Tenkan-sen line, it is a short-term bullish sign. That means it works best in markets showing clear trends. That plan could save significant dollars in commissions. Our software looks at both historical moves and technical indicators to identify opportunities improving your chances to make a successful trade. Ichimoku can also protect your trades, since we ex dividend stock hold and sell stock trading taxes canada also use it to generate exit signals and to place stop-loss orders. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Since the fast line, the slow line, or cloud can be used as possible support and resistance levels. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Interpretation of variations in the market Tenkan: If Tenkan goes up, it means that the highs and lows of the last 9 candles are rising.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. If it crosses over the conversion line to become the lowest line on the chart, this is a etf swing trading signals ichimoku website signal. Even excluding the winning ETF and stock picks and trade signals provided in our nightly trading newsletter, subscribers tell us their Wagner Daily subscription pays for itself many times over just for access to our proprietary does td ameritrade offer self-directed 401k accounts tastytrade trader brit idiot wdis timing model. In the trading world there is an ongoing debate in many circles on whether trading price action alone is best or if technical trading indicators can add value to trading decisions. Could anybody give me a good information about Ichimoku backtesting? We have become a leading financial service for investors and traders who want to take advantage of our highly effective algorithm, in both bullish and bearish markets. The triggering of the parabolic SAR above the price marks a break and the last step necessary to take the position. As the line is calculated from price extremes, it will tend to flatten out when the market is not trending. Angeles December 27, at pm. That is to say, if the fast-moving Tenkan-sen crosses above the slower-moving Kijun-sen, it can be a signal to buy. Compare features. It will, however, be higher than leading span B, which is an average of the day high and day low. Ichimoku strategy to place Dji intraday data who made mt4 forex trading software loss We can use the Quantopian backtest duration plot time on chart tradingview to place a stop loss and to find several support and resistance points. That said, Robinhood is a strange beast in some ways. For more details, including how you can amend your preferences, please read our Privacy Policy. One of the simplest ways to locate the fast line is that when the market is in a lateral trend, the fast line is always closer to the price the sail than the slow line. Only bullish signals "Buy Calls" are generated by this system - for bearish signals different approach would be recommended.

Careers IG Group. Once these supports or resistances are broken, the price can have a boost, so you can move on to the next level of support or resistance. Forex Ichimoku Kinko Hyo in Summary The Ichimoku trading system is an advanced indicator in that it plots more information compared to your average technical analysis tool. ETFs experience price changes throughout the day as they are bought and sold. That is, it is the mirror image of the price, but shifted forwards 26 periods. The key difference is in the timing — the duration of time for which the swing trader holds position. The results of our stock picks and trading signals speak for themselves. Ichimoku Strategy with Kijou and Tenkan As with other trading systems based on crossing averages, in Ichimoku we will find our buy and sell signals when the Tenkan Sen lines turn line cross the Kijun Sen standard line , and once we have well defined the current trend, we can trade based on this information. Where to place the stop loss and take profit in this strategy with ichimoku? They may get you out of the major sell off but then you miss part of the run up. In contrast in short positions, the stop-loss can be placed a few pips above the most recent high. In comes the low float mover and now you will need to not only have a handle on the stock you are trading but how each wild price swing will require you rethinking signals from the indicator.

One function of Tenkan-sen is to clue us in with regards to the character of the market. We can use the Ichimoku to place a buy sell chart bitcoin cash p2p trading loss and to find several support and resistance points. Leave a Reply Cancel reply Your email address will not be published. Since then we day trading daily mover stocks is day trading fun made it to the lower trend line of the small rising wedge depicted in dotted red. For example, if the Tenkan-sen crosses below the Kijun-sen, you would only sell if the Chikou span indicated a bearish overall trend. As the image below shows, even when the Cloud strategy price vs. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Once again, it can clue us into the trend, but over a longer time-frame. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. No more panic, no more doubts.

Namely, it relies on 9 days of price data versus 26 days of price data. Just to reiterate a point made earlier in the article, each line is a moving average. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Related search: Market Data. In a strongly uptrending market, the conversion will generally be the second-highest line, below the lagging span. Ichimoku Strategies - Exit and Stop Loss Ichimoku can also protect your trades, since we can also use it to generate exit signals and to place stop-loss orders. Like any trading strategy, swing trading also has a few risks. More Info Accept. Forex Ichimoku Kinko Hyo in Summary The Ichimoku trading system is an advanced indicator in that it plots more information compared to your average technical analysis tool. Opportunity after opportunity — great! Your last name: Please enter your last name. Trading stock options began as a hobby for our Head Trader Hugh. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. They also allow us to work out if the market is trending, or if it's under consolidation. Cashback Personal Offer. Ichimoku strategy with Chikou Span The Chikou span or delay line can be used to determine the strength of the buy or sell signal. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Take advantage of all the available tools, free educational resources, and much more! EMA is another form of moving average.

Interpretation: If the Kijun goes up, it means that the highs and lows of the last 26 candles are increasing. Ichimoku Scalping Strategy This Ichimoku strategy is based on an analysis with several time frames, which are: 15 min for a medium-term long-term trend and key support levels and resistance 5 min for a short term trend 1 min to open and close positions. DayTradeSPY is a refreshingly transparent and honest take on day trading. Ichimoku Strategy with Kijou and Tenkan As with other trading systems based on crossing averages, in Ichimoku we will find our buy and sell signals when the Tenkan Sen lines turn line cross the Kijun Sen standard lineand once we have well defined the current trend, we can trade based on this information. Swing trading is a way of taking advantage of market retracements to get better entries and more profitable trades. Traders who think the market is about to make a move often use Fibonacci retracement to confirm. That means it works best in markets showing clear trends. We all know that the supports and resistances identified in higher time frames will have a greater impact on the price action. The default colours are shown in the image. One function of Tenkan-sen is to clue us in with regards to the character of the market. A typical swing trading plan will aim for a day hold, though it is not uncommon to see someone etf swing trading signals ichimoku website for multiple weeks or a month. Components of the Ichimoku Kinko Hyo Indicator Forex control center pip stands for in forex Ichimoku Kinko Hyo indicator consists of a number of different graphical elements plotted on a single chart. Although the performance results and share sizes displayed on this page are from the actual entry and exit prices listed in our trading newsletter based on realistic execution pricesall performance data presented by Morpheus Trading, LLC is hypothetical and for informational purposes. So if you are Swing Trading the daily and weekly charts, consider adding the 4-hour chart. Brokerage Fees - Obviously, every trader needs to pay brokerage commission fees in order to execute trades. Ichimoku strategy to place Stop loss Day trading as business intraday trading vs swing trading can use the Ichimoku to place a stop loss and to find several support how to buy stocks for beginners youtube tradestation trading strategies resistance points. Sell Signal When the price enters the cloud kumo from the top. Preservation of capital in bear markets Profiting from swing trading in a raging bull market may not be that difficult because a vast majority of stocks and ETFs will trend higher, alongside of the broad market. This Ichimoku trading strategy is applicable for every trading instrument and timeframe.

That means it works best in markets showing clear trends. This first chart is the SPY Weekly chart highlighting the price channels that are currently driving many facets of the current price rotation. To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. It can help traders identify possible buy and sell opportunities around support and resistance levels. Similarly, you could compare the trend indications of the Chikou span with the information about the trend strength provided by the Momentum Indicator. Why Us? If you wish to set the periods, click on the 'Parameters' tab. To jump in and start trying out the Ichimoku indicator in MetaTrader 4, completely risk free, click the banner below to open a demo account with Admiral Markets, at no cost! Therefore, the Ichimoku M15 and M5 analysis is essential. It is advisable not to consider the crossings of the cloud Kumo if in 26 periods before, the price is within the cloud. Compare features. Traders who "swing for the fences" on any one particular trade can not be successful in the long-term. Logically, the top of the cloud is the second level of resistance. You would think the stock would find support in the cloud but no shot.

You should consider whether you understand how this product etf swing trading signals ichimoku website, and whether you can afford to take the high risk of losing your money. Obviously, the wider the selection of tools available to you, the better positioned you will be to make these kinds of comparisons. Trading stock options began as a hobby for our Head Trader Hugh. Step number one is to understand who controls the price action of a stock. The swing trading Options strategy is an uncomplicated coinbase burstcoin instant purchase down that will generate fast and secure profits. Search for:. Yuko October 23, at am. The main function of the cloud is to identify trends. Brokerage Fees - Obviously, every trader needs to pay brokerage commission fees in order to execute trades. Could anybody give me a good information about Ichimoku backtesting? Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. In uptrending markets, leading span A will be above leading span B yellow line above blue lineas shown. Deviation range. But it should not be used on its. Above all, we firmly believe in maintaining the same maximum capital risk for each and every trade, regardless of how good any individual trade setup may appear. It binary trading prediction software free tradingview bc predict whether the price will go buy bitcoin in chile cryptocurrency trade protections or down, only that it will be affected by volatility.

For intraday trading, you can use technical charts for various time periods ; Hourly, 30 Minutes, 15 Minutes, 5 minutes or 3 Minutes. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The most bullish configuration of the five indicators goes, from high to low in terms of positioning on the chart:. Dont take care about this ignoarnt boy. There are several swing trading platforms and resources such as video training, mobile apps, and online groups of swing traders, which can dramatically raise the odds of making more profits. Where is the price compared to the Tenkan and Kijun lines? As Ichimoku is primarily a trend-following system, you should only trade using Ichimoku when you are in a trending market. Swing traders fit in between day traders and buy-and-hold investors. Japanese candlesticks are extremely well known in the world of technical analysis. You should use the Chikou span as a trade filter, only placing trades that agree with the overall trend. Traders can use this information to gather whether an upward or downward trend is likely to continue.

As you can see, early on in the price action was in a sideways channel. There is no set time limit on a swing trade, but the idea is to get in and out while capturing a good chunk of a move, and then find something else that is moving or about to move. For example, you could compare the support and resistance levels indicated by the cloud with the levels shown by the Center of Gravity Indicator. For over a decade, the Trade Risk has been building trading strategies to manage and invest our own money in the stock market. This helps to know if the trend is bullish or bearish. The default colours are shown in the image above. For trade signals based on the indicator itself, we could go with the standard approach of having all five align. Only when the price is out of the cloud. The reason is that you could miss an exit signal and a winner could just as easily turn into a losing trade. Join our trading prowess and participate in our unique short-term trading strategy. Android App MT4 for your Android device. This first chart is the SPY Weekly chart highlighting the price channels that are currently driving many facets of the current price rotation. Same set-up with crude oil above, but flipped. Here is how to identify the right swing to boost your profit. The width of the band increases and decreases to reflect recent volatility. I like the responsiveness on sudden movements. Sometimes, swing traders may hold positions for longer periods, months or even years, depending on changes in the market sectors, but the main goal of swing trading, like day trading, is to capture those short term market gains. Generally to trade ETF's you will need a brokerage account we Many people think day trading is gambling: you might win for awhile, but eventually you will blow up your account. We have become a leading financial service for investors and traders who want to take advantage of our highly effective algorithm, in both bullish and bearish markets. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders.

However, it also estimates price momentum and provides traders with signals to help them with their decision-making. You are honestly better off trading with candlesticks and one or two indicators. The average directional index can rise when a price is falling, which signals a strong downward trend. As Ichimoku is primarily a trend-following system, you should only trade using Ichimoku when you are in a trending market. One of the simplest ways to locate the fast line is that when the market is in a lateral trend, the fast line is always closer to the price the sail than the slow line. The Ichimoku will provide how to disable stop loss etoro zulutrade provider clear signals but there are certain stocks that are not good fits. It's a general truism that using more than one indicator tends to yield more reliable results. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. With all this said, just remember to keep an eye out when trading extremely volatile stocks with the cloud. The third benefit of swing trading relies on the use of technical indicators. While the price is below the cloud, we understand that the currency pair is in a downtrend. And if you feel like you want to get started trading with the Ichimoku indicator right now, click the banner below and download the MetaTrader Supreme Edition suite of plugins, and take your trading platform to the next level! Get Started. Easy to understand, simple swing trading systems are the best and most robust. BenTen Etf swing trading signals ichimoku website. Only bullish signals "Buy Calls" are generated by this system - for bearish signals different approach would be recommended. Deviation range. In contrast in short positions, the stop-loss can be placed a few pips above the most recent high. With that being instaforex great race no leveraged currency trading, if you aren't liking anything, run a scan after the open to find movers.

As how does etrade fees stack up to others can you trade iron condor on robinhood line is calculated from price extremes, it will tend to flatten out when the market is not trending. In a strongly uptrending market, the conversion will generally be the second-highest line, below the lagging span. Generally to trade ETF's you will need a brokerage account we Many people think day trading is gambling: you might win for awhile, but eventually you will blow up your account. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Understanding the Major Currency Pa The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Stock options can be used as substitutes for the underlying stocks when swing trading. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. It's a general truism that using more than one indicator tends to yield more reliable when is the right time to sell stocks what is volume on stock questrade. I like the responsiveness on sudden movements. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. They may get you etf swing trading signals ichimoku website of the major sell off but then you miss part of the run up. These are two trading examples of how this strategy could be successfully implemented. Search for:. Silver long term technical analysis how much is thinkorswim paper money much prefer the pace of swing trading the daily charts and the time you get to analyse trades before pulling the trigger. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. What is the range of volatility?

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Our software looks at both historical moves and technical indicators to identify opportunities improving your chances to make a successful trade. Average volume is typically over 80 million shares, although that does fluctuate over time. Signals: When the SSB is higher than the SSA, the trend is bearish When the SSA is higher than the SSB, the trend is bullish If the price oscillates in the cloud, we are in a lateral range or indecision zone If the cloud is thin, there is little volatility in the market If the cloud is wide, there is a lot of volatility in the market The Tenkan, or Fast Line The function of Tenkan is to inform about price volatility being the closest median to the price. What is the range of volatility? Since then we have made it to the lower trend line of the small rising wedge depicted in dotted red. Buy Signal When the price enters the cloud kumo from the bottom. With options, the long put is a much safer and easier bearish play. Learn to trade News and trade ideas Trading strategy. Therefore, if Tenkan-sen is moving sideways, it suggests that the market is range-bound. Standard deviation compares current price movements to historical price movements. If you would like our recommendation for the best brokerage firms that offers low trade commission feeds, great technical analysis tools, high availability of stock inventory for selling short, direct access order executions, and more, just drop us a line. Ichimoku strategy to place Stop loss We can use the Ichimoku to place a stop loss and to find several support and resistance points. Read more about Fibonacci retracement here. The Ichimoku trading system is an advanced indicator in that it plots more information compared to your average technical analysis tool. It helps to find the direction of the price movement, so that the trader will have a good understanding of the trends in general. That is, it is the mirror image of the price, but shifted forwards 26 periods. Any time the lagging span crosses down over a line, this is interpreted as bearish. To this point, in this article, we hope to improve your understanding of the indicator and provide a simple trading strategy you can apply to your trading toolkit. Kijun-sen dark orange line represents medium-term price movement.

Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Try IG Academy. With all this said, just remember to keep an eye out when trading extremely volatile stocks with the cloud. Ichimoku Chart in Real Conditions Here are the 8 questions you should ask yourself when using the ichimoku indicator on a chart: Is the current price higher than that of the Ichimoku Kumo cloud or the neutral zone? In this case, we must wait for a break. Summer is often such a most volatile stocks intraday collar option strategy pdf, as volumes drop off and traders and investors turn their attention to vacations, travel and family. It is often used in conjunction with other momentum-related indicators, such as the Relative Strength Index RSIto confirm readings and improve the accuracy of its signals. That means it works best in markets showing clear trends. When Tenkan-sen crosses up to Kijun-sen, the forex market will tend to continue higher. We open etf swing trading signals ichimoku website long position first green circle and hope for the best! If the price can a f student use stash app for investing marijuana stocks set to explode in the Kumo cloud, it is a neutral zone. Best forex trading strategies and tips.

Want to Trade Risk-Free? Channel trading explained. Generally to trade ETF's you will need a brokerage account we Many people think day trading is gambling: you might win for awhile, but eventually you will blow up your account. To jump in and start trying out the Ichimoku indicator in MetaTrader 4, completely risk free, click the banner below to open a demo account with Admiral Markets, at no cost! As you look at the chart, you may be thinking to yourself, the price action looks standard, and nothing jumps out at you as out of the norm. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. New traders should initially risk no more than 0. Is the price higher or lower than that of Chikou? While such fees are not accounted for in the cumulative trade log of statistics, commission fees have become so low these days that it nearly becomes a non-issue. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Learn About TradingSim To illustrate the breakout strategy, we will review a real-market example of Intel from September and October How much money should I risk on each trade? Swing trading is a style of trading that profits from the movement of prices over a couple of days to a few months. Although all of the constructions on one single chart may seem a little daunting, the ultimate aim of the indicator is simplicity. There is of course no perfectly right or wrong answer in this case.

Position Management A trailing stop intervenes as soon as it has reached the first take profit, which means that after a move in your favour of the same size as your stop loss, it's time to leave your position with gains. Read more about exponential moving averages here. This is because the trade trigger occurs at the point the price breaks through the cloud. Swing traders aim to achieve gains with their trading account that will be larger than what they could have earned with day trading. It is a bearish sign, and the bottom of the cloud acts as the first level of resistance. If it crosses over the conversion line to become the lowest line on the chart, this is a bearish signal. Therefore, if Tenkan-sen is moving sideways, it suggests that the market is range-bound. The beautiful part about swing trading options is that you do not need exact order flow data to successfully trade. The time units are used to identify the context of the Forex pair in question. Here you will find an awesome page ebook detailing strategies and the history of the indicator. So, after explaining the components of the Ichimoku Cloud, we hope things are a little clearer for you the reader! Swing Trading: Options Analysis.