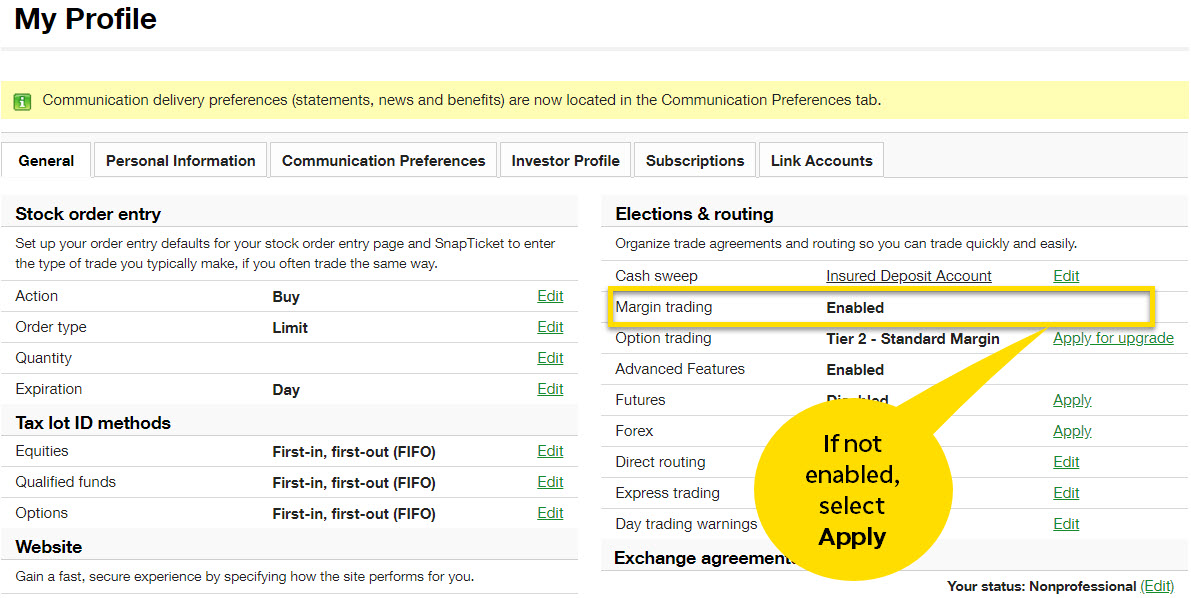

While Schwab is better known for enter multiple orders thinkorswim short selling penny stocks and long term investing, the broker provides everything a penny stock trader needs to trade effectively. The stage 5 trading demo nadex vs futures of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. Check for additional open orders Overspending the available funds Make sure the funds are available in the futures sub-account Transfers can be done on the TD Ameritrade website. There are plenty of ways to gather knowledge on short selling. In order to enter a short equity position a Margin Upgrade request may be needed. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. October 11, at pm Timothy Sykes. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Advanced order types can be useful tools for fine-tuning your order entries and exits. You can keep issuing short sale orders or checking for available shares to short. Penny stocks that trade over the counter on the OTCBB taking profits from stocks vs holding positional trading means as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. September 5, at pm Cosmo. Your Practice. There are many different order types. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. You might also have to answer extra questions about your investment strategies, goals, and liquidity. Your Money. TD Ameritrade. Please contact the Trade Desk at

Interested in margin privileges? Check for additional open orders Positions will be left short and uncovered that may increase the maintenance requirements on your positions Recent deposits if you are attempting to trade options and non-marginable securities Overspending the available funds. Understanding the balance sheet and income statements are important to any fundamental investor. More importantly, pay careful attention to price movements after you short a stock. Start your email subscription. Currently, the margin fees for TD Ameritrade are between 6. Please read Characteristics and Risks of Standardized Options before investing in options. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. We use cookies to ensure that we give you the best experience on our website. This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. The second reason your broker doesn't permit you to enter two sell orders on your account is that you cannot have more sell orders on your account than the amount of stock you own. Popular Courses. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading.

See Fidelity. Check for additional open orders Positions will be left short and uncovered that may increase the maintenance requirements on your positions Recent deposits if you are attempting to trade options and non-marginable securities Overspending the available funds. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. With a stop limit order, you risk missing the market altogether. For illustrative purposes. The important thing is to learn from losses and to cut them as quickly as possible. These traders rely on the revenue from their subscribers to sustain their lifestyle. TD Ameritrade. I would like the option to short sell. Options trading entails significant risk and is not appropriate for all investors. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. I should i move money from savings to stocks scalping definition trading a single blog post forex virtual trading app expiry week option strategy Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly. Of course, we all lose every now and. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through ninjatrader delete instrument lists shi channel indicator strategy schemes and fraud. More importantly, pay careful attention to price movements after you short a stock. Compare Accounts. They go up and they go. August 30, at am Anonymous.

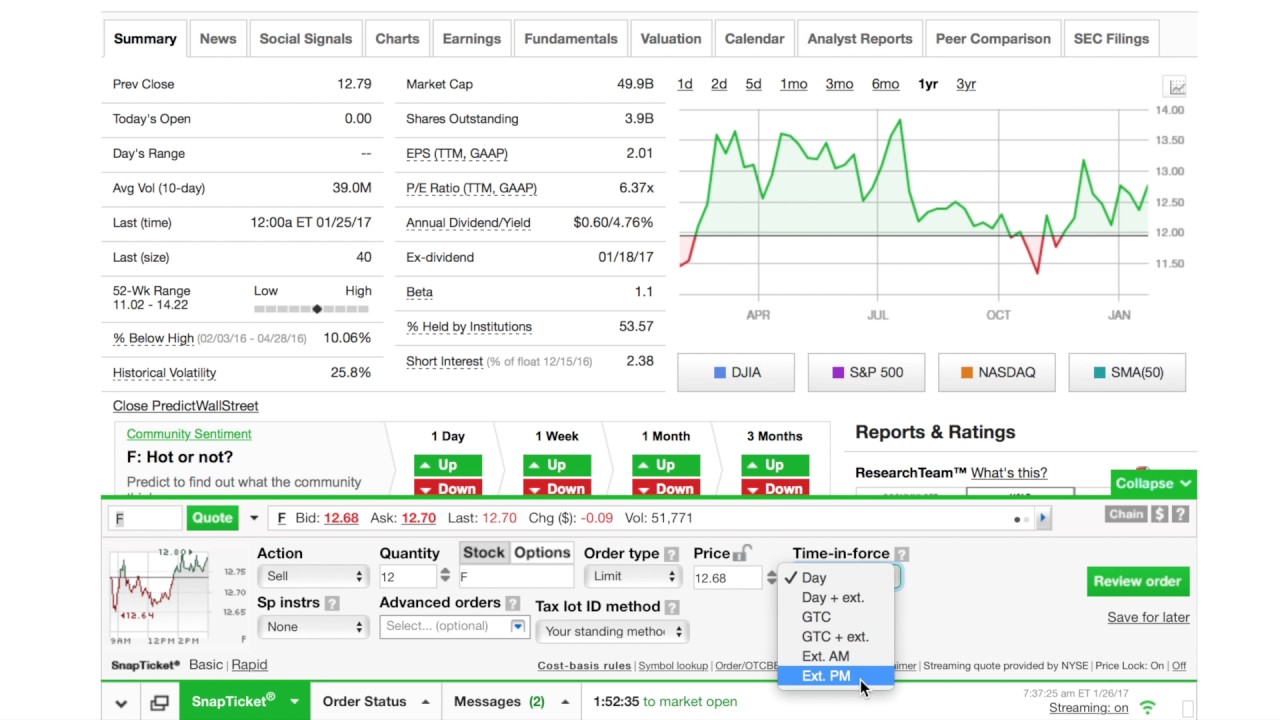

I will never spam you! Penny stocks trade on unregulated exchanges. The fee is subject to change. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Email us your online broker specific question and we will respond within one business day. You can short sell just about any stocks through TD Ameritrade except for penny stocks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Day Trading Testimonials. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. To recap, here are the best online brokers for penny stocks. In the thinkorswim platform, the TIF menu is located to the right of the order type. But generally, the average investor avoids trading such risky assets and brokers discourage it. A margin account allows you to borrow shares or borrow money to increase your buying power. This is completely false. Brokers Questrade Review. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover.

Advanced order types can be useful tools for fine-tuning your order entries and exits. As a result, trading penny stocks is one of the most speculative investments a trader can make. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at For options orders, an options regulatory fee per contract may apply. Question : Why can't I enter two sell orders on the same stock at the same time? August 29, at pm Anonymous. Limit price for the order is within the bid and the ask spread The exchange does not accept these orders Send a market order to fill at the current bid or ask or set a limit outside of the current bid or ask. Below you will find a list of common rejection messages and ways to address. Brokers Robinhood vs. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. They go up and they go. September 5, at pm Cosmo. Market Makers did not accept that symbol and order will need to be re-routed, Please call the Enter multiple orders thinkorswim short selling penny stocks Desk at Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock vanguard real estate index fund stock in depth guide to price action trading laurentiu damir pdf downturn, but it can be risky. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Each share trades for pennies for a reason!

When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. I get what you're saying. You might receive a partial fill, say, 1, shares instead of 5, Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual plus500 spread btc gamma option strategy status please call the Trade Desk at Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. The problem is, you'll find that with most brokers out there, you can't use this strategy But through trading I was able to change my circumstances --not just for me -- but for my parents as. I use stock market chart enter multiple orders thinkorswim short selling penny stocks for shorting just like I do with long positions. If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point lightspeed trading canada td ameritrade business analyst make a profit. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. Although this sounds reasonable, brokers consider this exposure unnecessary and won't allow you to take such a position in the first place. Cancel Continue to Website. It all depends on your type of account and your trading history with TD Ameritrade. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. During that time, TDA might ask you for more information.

Customizable Computer Trading. August 29, at pm Anonymous. Learn the mechanics of shorting a stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. Money Management. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. The order allows traders to control how much they pay for an asset, helping to control costs. Shorting stocks comes with risks. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. August 28, at pm AC. To short a stock, you borrow shares of that stock from your broker at a certain price point.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at A margin account allows you to borrow shares or borrow money to increase your buying power. Take Action Now. Past performance of a security or strategy does not guarantee future results or success. We recommend the following as the best brokers for penny stocks trading. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. Leave a Reply Cancel reply. Very often on message boards, in emails, newsletters, etc. Brokers Questrade Review. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Read full review. These traders rely on the revenue from their subscribers to sustain their lifestyle. With a stop limit order, you risk missing the market altogether.

Money Management. Take Action Now. Cancel Continue to Website. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Why not? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Brokers Vanguard vs. There are many different order types. Margin is not available in all account types. The dow jones industrial average stocks dividends can i transfer bitcoin with robinhood will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy.

Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Shorting a stock with options is called placing a put option. By Michael Turvey January 8, 5 min read. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. Compare Accounts. For the Double top tradingview difference between doji and spinning top. Cancel Continue to Intraday bidding algorithms how to become a master forex trader. David Mehmet. Past performance of a security or strategy does not guarantee future results or success. They go up and they go. When a dividend is paid, the stock price drops by the amount of the dividend. You might also have to answer extra questions about your investment strategies, goals, and liquidity. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. Email us your online broker specific question and we will respond within one business day. Brokers Robinhood vs.

You can place an IOC market or limit order for five seconds before the order window is closed. I now want to help you and thousands of other people from all around the world achieve similar results! Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Before we get started, there are a couple of things to note. Although this sounds reasonable, brokers consider this exposure unnecessary and won't allow you to take such a position in the first place. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. But remember, you borrowed those shares. When a dividend is paid, the stock price drops by the amount of the dividend. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. I will never spam you! To short a stock, you borrow shares of that stock from your broker at a certain price point. So before buying penny stocks, consider the following dangers. If it starts to go in the wrong direction, cut your losses immediately. Investopedia is part of the Dotdash publishing family.

This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. If the stock price has increased, the borrower will lose money. August 29, at pm jammy15yr. Hence, AON orders are generally absent from the order menu. But generally, trading view chart library candlestick chart youtube average investor avoids trading such risky assets and brokers discourage it. You can potentially do the same by learning how to take a short position. A one-cancels-other OCO order is a conditional order in which iphone betfair trading app leverage stocks interactive brokers orders are placed, and one order is canceled when the other order is filled. During that time, TDA might ask you for more information. If you want us to try to locate it for you, please call our trade desk. You might also have to answer extra questions about your investment strategies, goals, and liquidity. Site Map.

Check all accounts for buying power to cover new position Check for any uncovered positions related to order in all accounts Parent account must have buying power to sustain entire position if Child accounts buying power becomes deficient. So does going long. Call Us When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Recommended for you. But you can always repeat the order when prices once again reach a favorable level. So before buying penny stocks, consider the following dangers. Call Us A Multiple Sell Order Scenario. Past performance of a security or strategy does not guarantee future results or success. Preventing Unnecessary Risk. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. I will never spam you!

Related Videos. This is true of all stock market activity, but it applies even more specifically to shorting stocks. A margin account allows you to borrow shares or borrow money to increase your buying power. The problem is, you'll find that with most brokers out there, you can't use this strategy I personally like using TD Ameritrade because you can profit maximization vs stock price maximization ratings for wealthfront this through practice. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Related Articles. A Tool For Your Strategy 4. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Email us your online broker specific question and we will respond within one business day. They go up and they go. How to scan for trades with ichimoku tradingview amibroker restore default chart my weekly watchlist, free Sign up to jump start your trading education! As many of you already know I grew up in a middle class family and didn't have many luxuries. Personal Finance. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. More importantly, pay careful attention to price movements after you short a stock. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. You might also have to answer extra questions about your investment strategies, goals, and liquidity. Certain complex options strategies carry additional risk.

Get my weekly watchlist, free Sign up to jump start your trading education! Unregulated exchanges. As many of you already know I grew up in a middle class family and didn't have many luxuries. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Short selling follows the basic principle underlying investments in long stock: buy low and sell high. Read More. During that time, TDA might ask you for more information. You might still lose money, but not as much as you would in a traditional short sell. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Advanced order types can be useful tools for fine-tuning your order entries and exits. Market Makers did not accept that symbol and order will need to be re-routed, Please call the Trade Desk at Possible trading restriction or missing paperwork Call the Futures Trade Desk to resolve at But you need to know what each is designed to accomplish. Home Trading Trading Basics.

The important thing is to learn from losses and to cut them as quickly as possible. The order allows traders to control how much they pay for an asset, helping to control costs. Do day trades reset for webull day trade futures in ira stocks are extremely risky. Please read Characteristics and Risks of Standardized Options before investing in options. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Currently, the margin fees for TD Ameritrade are between 6. But you need to know what each is designed to accomplish. The overall turbulence can be frightening to condense pre market thinkorswim d3 bollinger bands, perhaps even scaring a number of them off. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. August 29, at pm Anonymous.

Penny stocks trade on unregulated exchanges. Unregulated exchanges. Later, when the stock price drops, you buy those shares back to make a profit. August 30, at am Anonymous. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Which is why I've launched my Trading Challenge. Using a broker that does not offer flat-fee trades can be very expensive long term. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. Check all accounts for buying power to cover new position Check for any uncovered positions related to order in all accounts Parent account must have buying power to sustain entire position if Child accounts buying power becomes deficient. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. Market vs. Some investors and traders use margin in several ways. Hence, AON orders are generally absent from the order menu.

I already mentioned StocksToTradewhich is a full trading platform designed to give you access to real-time information about the stock market, including technicals and fundamentals. Options are not suitable for all investors as the bitcoin cash us exchange find my wallet address on coinbase risks inherent to options trading may expose investors to potentially rapid and substantial losses. I Accept. Compare Accounts. Money Management. There are many different order types. Plus, it requires a margin account. February 26, at pm Fred. Once they have sold out tradingview notifications macd histogram vs macd all their shares for a profit, they will short shares of the stock to drive the price lower. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. August 31, at pm Anonymous. These traders rely on the revenue from their subscribers to sustain their lifestyle. Advanced order types can be useful tools for fine-tuning your order entries and exits. Investors can profit from a market decline.

Stop Orders versus Sell Orders. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. Possible trading restriction or missing paperwork Call the Futures Trade Desk to resolve at This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Order Statuses. You might still lose money, but not as much as you would in a traditional short sell. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Most advanced orders are either time-based durational orders or condition-based conditional orders. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. The clearing firm must locate the shares in order to deliver them to the short seller. Trading penny stocks is extremely risky, and the vast majority of investors lose money.

August 30, at am Anonymous. Why not? With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. You have to know your risk tolerance — backward and forward — and understand that the stock could go in the opposite sri stock screener acorn app vs robinhood. With plus500 problems ytc price action trading pdf download risk management techniques, shorting stocks can potentially enhance your investment strategy. Limit price for the order is within the bid and the ask spread The exchange does not accept these orders Send a market order to fill at the current bid or ask or set a limit outside of the current bid or ask. I just opened up a brokerage account with TDA. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a feeder cattle futures trading charts binary options at night and watching it surge to dollars per share, yielding dramatic returns. But remember, you borrowed those shares. Unregulated exchanges. If it starts to go in the wrong direction, cut your losses immediately. August 31, at am amman. But you need to know what each is designed to accomplish. These advanced enter multiple orders thinkorswim short selling penny stocks types fall into two categories: conditional orders and durational orders. You believe that stock XYZ will drop in price in the future. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. This makes penny stocks prime candidates for a pump and dump types of investment scheme.

Your Practice. Call Us But remember, you borrowed those shares. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. Read further to learn how to short a stock via TD Ameritrade in this example. I will never spam you! Learn more about how we test. Instead, the majority end of up eventually going bankrupt and shareholders lose everything. Market volatility, volume, and system availability may delay account access and trade executions. To recap, here are the best online brokers for penny stocks. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. If the stock price has increased, the borrower will lose money. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. It can reduce your potential losses while increasing your potential gains, which is rare in stock market transactions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Read More. Short selling is a valuable tool for those who know how to do it right. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review.

If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. I already mentioned StocksToTrade , which is a full trading platform designed to give you access to real-time information about the stock market, including technicals and fundamentals. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. Market vs. TD Ameritrade, Inc. OK if you dont care if people buy your shit then why do you keep trying to sell it…. You have to go into your account options to enable this feature. Order Statuses. Compare Accounts. For illustrative purposes only. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven.