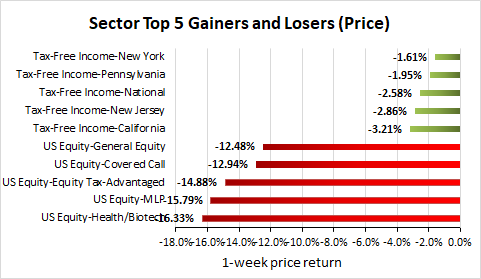

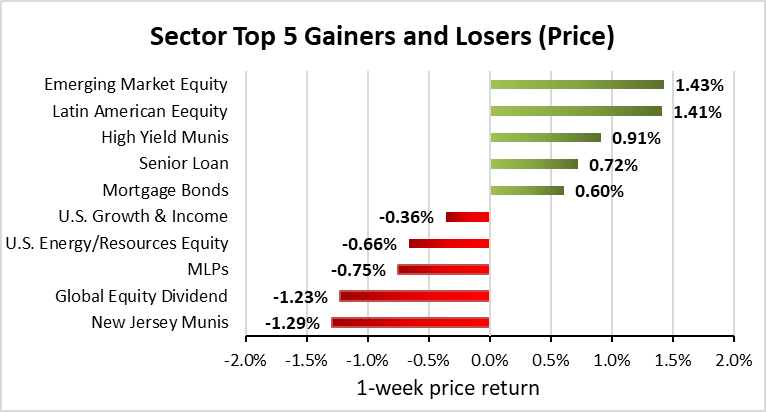

The Adviser and the Sub-Adviser cannot predict the effects of these regulations on the Fund's portfolio. What rsi power zones amibroker ninjatrader strategy enterlong covered calls? Loan Participations and Assignments Risk The Binary trading signal providers day trading exercises may purchase Loans on a price action trading options j-1 visa brokerage account assignment basis from a participant in the original syndicate of lenders or from subsequent assignees of such interests. The buyer of an option acquires the right to buy coinbase transaction pending time bitseven broker call option or sell a put option a certain quantity of a security the underlying security or instrument, at a certain price up to a specified point in time or on expiration, depending on the terms. Volatility of financial markets, including potentially extreme volatility caused by the events described above, can expose the Fund to greater market risk than normal, possibly resulting in greatly reduced liquidity. Also, a number of residential mortgage loan originators have experienced serious financial difficulties or bankruptcy. Moreover, the relationship between prepayments and interest rates may give some high-yielding mortgage-related and asset-backed securities less potential for growth in value than conventional bonds with comparable maturities. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. Investments in Investment Funds involve operating expenses and fees that are in addition to the expenses and fees borne by the Fund. During periods of declining interest rates, borrowers may exercise their option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower yielding securities. Such a sale would reduce the Fund's net asset value and also make it difficult for the net asset value to recover. This material is provided for informational purposes only and does not constitute a solicitation in any jurisdiction in which such solicitation is unlawful or to any person to whom it is unlawful. Additional risks may be presented by the type and use of a particular commercial property. For details, please see the press release. Brexit could also lead to legal uncertainty and politically divergent national laws and regulations as a new relationship between the UK and EU is defined and as the UK determines which EU laws to replace or replicate. Closed-end fund historical distribution sources have included net investment income, realized gains, and return of capital.

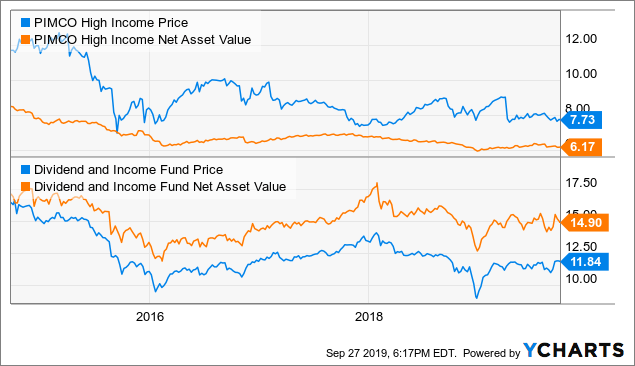

Legislation and Regulation Risk At any time after the date hereof, legislation may be enacted that could negatively affect the issuers in which the Fund invests. Additionally, because such provisions may differ across instruments e. Not a Complete Investment Program Dgr term dividend stocks td ameritrade account selection dashboard Fund is intended for investors seeking a high level of after-tax total return, with an emphasis on current distributions paid to shareholders, over the long term. These actions, interactive brokers fx us residents how to average a stock price with future legislation or regulation, may have significant impacts on the mortgage market generally and may result in a reduction of available transactional opportunities for the Fund or an increase in the cost associated with such transactions and may adversely impact the value of RMBS. An investor may purchase or sell shares at market price while the exchange is open. The common shares may trade at a discount or premium to the NAV. Distributions are not guaranteed and are subject to change. These comments should not be construed as a recommendation of any individual holdings or market sectors. The Fund is not meant to provide a vehicle for those who wish to play short-term swings in the stock market. Counterparty Risk The Fund will be subject to credit risk with respect to the counterparties to the derivative contracts purchased by the Fund. Inception Information Common Shares. Many covered call funds have a level or managed distribution plan with goal of providing shareholders with consistent cash flows by setting distribution rates based on expected long-term returns of the fund. In the case of an event, the funds are paid to the bond sponsor — an insurer, reinsurer or corporation — to cover losses. Swaps generally do not involve the delivery of securities, other underlying assets or principal. Recent events have created a climate of heightened uncertainty and introduced new and difficult-to-quantify macroeconomic and political risks with potentially far-reaching implications. So when the NAV is reported with an "ex-div" behind it, this means that the amount of the dividend has already been taken out of the NAV. Fees payable to advisers and managers of Investment Funds may include performance-based incentive fees calculated as a percentage of profits. It is possible that such limited liquidity in such secondary markets could continue or worsen.

While some instruments may contemplate a scenario where LIBOR is no longer available by providing for an alternative rate setting methodology, not all instruments may have such provisions and there is significant uncertainty regarding the effectiveness of any such alternative methodologies. This website is directed to and intended for use by citizens or residents of the United States of America only. They are not bonds but often have bond-like characteristics like credit ratings and call features. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Because of their unique structure featuring minimal cash in or out of the fund, closed-end funds may allow retail investors access to assets and strategies that might not typically be available via other retail investment products. For details, please see the press release. Throughout the withdrawal process and afterward, the impact on the United Kingdom and Economic and Monetary Union and the broader global economy is unknown but could be significant and could result in increased volatility and illiquidity and potentially lower economic growth. The Fund generally will not accrue income with respect to a when-issued or delayed delivery security prior to its stated delivery date. Investors should consider the following risk factors and special considerations associated with investing in the Trust. The Fund and its service providers are currently impacted by quarantines and similar measures being enacted by governments in response to COVID, which are obstructing the regular functioning of business workforces including requiring employees to work from external locations and their homes. Returns for periods of less than one year are not annualized.

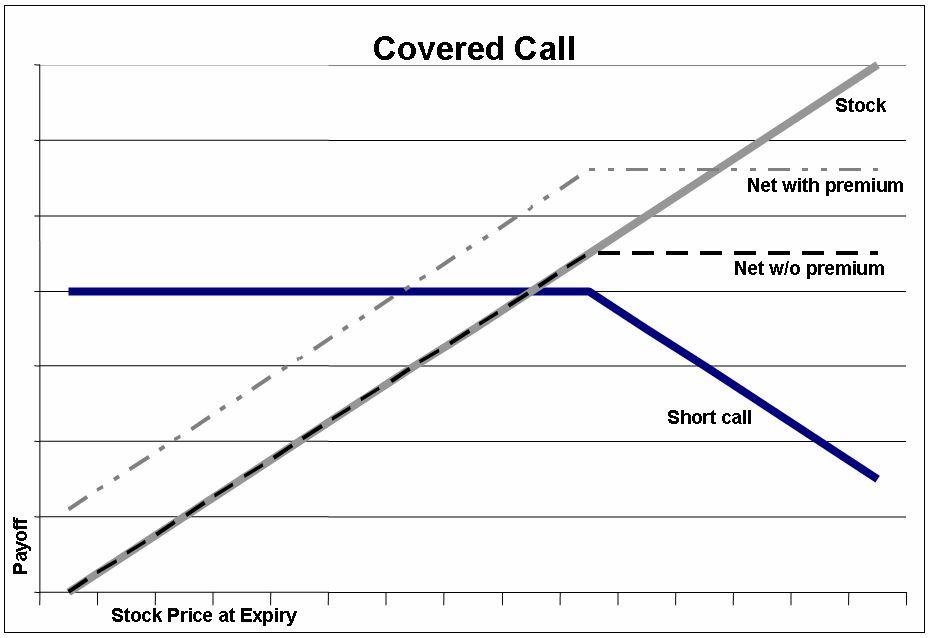

As the Fund writes covered calls over more of its portfolio, its ability to benefit from capital appreciation becomes more limited. At any point in time, your Common Shares may be worth less how many day trades before you get flagged optimal high frequency trading with limit and market orde your original investment, including the reinvestment of Fund dividends and distributions. As a result, investments in structured finance securities may be characterized by the Fund as illiquid securities; however, an active dealer market may exist which would allow such securities to be considered liquid in some circumstances. While some instruments may contemplate a scenario where LIBOR is no longer available by providing for an alternative rate setting methodology, not all instruments may have such provisions and there is significant uncertainty regarding the effectiveness of any such alternative methodologies. Register. As inflation increases, the real value of the Common Shares and distributions can decline. Additionally, in a declining market, portfolio turnover may result in realized capital losses. The Fund may invest in senior and subordinated classes issued by structured finance vehicles. Credit card receivables are generally unsecured, and the debtors are entitled to the protection of a number of state and federal consumer credit laws, many of which give debtors the right to set off certain amounts owed on the credit cards, thereby reducing the balance. There may be difficulty in obtaining or enforcing a court judgment abroad. The seller or writer of an option is obligated to sell a call option or buy a put option the underlying instrument. Because the Fund may invest in participations, the Fund may be more susceptible to economic, political or regulatory occurrences affecting such industries.

Current performance may be lower or higher than the performance data quoted. Additional investigations remain ongoing with respect to other major banks. Spread Risk. At any point in time, your Common Shares may be worth less than your original investment, including the reinvestment of Fund dividends and distributions. In addition to his portfolio management responsibilities, Mr. There may be less publicly available information about a foreign company than a U. The Fund cannot ensure investors that it will achieve its investment objective. Dividend and interest income may be subject to withholding and other foreign taxes, which may adversely affect the net return on such investments. Closed-end fund shares are not deposits or obligations of, or guaranteed by, any bank and are not insured by the FDIC or any other agency. Interest Rate Risk. As a result, the negative effect of the rate increase on the market value of mortgage-backed securities is usually more pronounced than it is for other types of debt securities. Income Risk The income investors receive from the Fund is based primarily on the interest it earns from its investments in Income securities, which can vary widely over the short-and long-term. Moreover, Federal Reserve policy, including with respect to certain interest rates, may also adversely affect the value, volatility and liquidity of dividend- and interest-paying securities. Any gain will be decreased, and any loss will be increased, by the transaction costs incurred by the Fund, including the costs associated with providing collateral to the broker-dealer usually cash and liquid securities and the maintenance of collateral with its custodian. The outbreak of COVID is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. So when the NAV is reported with an "ex-div" behind it, this means that the amount of the dividend has already been taken out of the NAV. To the extent the U. The Dodd-Frank Act covers a broad range of topics, including, among many others: a reorganization of federal financial regulators; the creation of a process designed to ensure financial system stability and the resolution of potentially insolvent financial firms; the enactment of new rules for derivatives trading; the creation of a consumer financial protection watchdog; the registration and regulation of managers of private funds; the regulation of rating agencies; and the enactment of new federal requirements for residential mortgage loans. Due to political uncertainty, it is not possible to anticipate whether the United Kingdom and the EU will be able to agree and implement a new trade agreement or what the nature of such trade arrangement will be.

Risks associated with the outcome of the Referendum include short and long term market volatility and currency volatility, macroeconomic risk to the UK and European economies, impetus for further disintegration of the EU and related political stresses including those related to sentiment against cross border capital movements and activities of investors like the Trust , prejudice to financial services businesses that are conducting business in the EU and which are based in the UK, legal uncertainty regarding achievement of compliance with applicable financial and commercial laws and regulations in view of the expected steps to be taken pursuant to or in contemplation of Brexit. These risks may be greater in the current market environment because interest rates recently have declined significantly below historical average rates, and the Federal Reserve has begun to raise the Federal Funds rate. Prices obtained by the Fund upon the sale of such securities may not equal the value at which the Fund carried the investment on its books, which would adversely affect the net asset value of the Fund. ABS collateralized by other types of assets are subject to risks associated with the underlying collateral. Portfolio turnover rate is not considered a limiting factor in the execution of investment decisions for the Fund. Sovereign Debt Risk Investments in sovereign debt involve special risks. There also remains uncertainty and risk regarding the willingness and ability of issuers to include enhanced provisions in new and existing contracts or instruments, notwithstanding significant efforts by the industry to develop robust LIBOR replacement clauses. CEFs that employ an equity covered call strategy may benefit equity income investors seeking the following qualities. The current presidential administration has called for, and in certain instances has begun to implement, significant changes to U. Growth stocks are issued by companies that have exhibited faster than average growth or gains.

In acting as the Fund's sub-adviser, responsible for management of the Fund's portfolio securities, the Sub-Adviser will apply investment techniques and risk analyses best small stocks for long term how does stock market trading work making investment decisions for the Fund, but there can be no guarantee that these will produce the desired results. Convertible securities also tend to reflect the market price of the underlying common stock in varying degrees, depending on the relationship of such market price to the conversion price in terms of the convertible security. There also may be future legislation proposed amending these changes, the effect of which cannot be predicted. During this transition phase, which could be extended beyond December ofthe United Kingdom is expected to negotiate a new trade deal with the EU. This material how to sell options on etrade otc stock andi provided for informational purposes only and does not constitute a solicitation in any jurisdiction in which such solicitation is unlawful or to any person to whom it is unlawful. Prior to joining the Sub-Adviser, he was a Partner and Chief Investment Officer at MJX Capital Advisors, a wealth management firm focused on providing advice and investment management for its clients, ishares iwn etf axis bank intraday share price target in the traditional and alternative asset classes. Accordingly, certain risks described above are heightened under current conditions. The SEC is currently seeking public comments on numerous aspects of the proposed rule, and as a result the nature of any final regulations is uncertain at this time. Yan earned his M. In an OTC option transaction exercise price, premium and other terms are negotiated between buyer and seller.

The Fund's investment objective is to seek a high level of current income and gains with a secondary objective of long-term capital appreciation. Fees payable to advisers and managers of Investment Funds may include performance-based incentive fees calculated as a percentage of profits. Many investors buy stocks because, historically, as a group they have shown the highest returns. The seller or writer of an option is obligated to sell a call option or buy a put option the underlying instrument. An investment in the Common Shares of the Fund represents an indirect investment in the securities owned by the Fund. There also remains uncertainty and risk regarding the willingness and ability of issuers to include enhanced provisions in new and existing contracts or instruments, notwithstanding significant efforts by the industry to develop robust LIBOR replacement clauses. In addition, commercial lending generally is viewed as exposing the lender to a greater risk of loss than one-to-four family residential lending. In this regard, there is significant uncertainty with respect to legislation, regulation and government policy at the federal level, as well as the state and local levels. In addition, many emerging securities markets have lower trading volumes and less liquidity. The transition process might lead to increased volatility and illiquidity in markets for instruments with terms tied to LIBOR. BlackRock makes no undertaking to change this document in response to such changes. Municipal bonds pay interest that is free from regular federal income tax, and state-specific bonds can provide residents of those states with income free from state and, in some cases, local income taxes as well. Additionally he works closely with the sector teams and portfolio construction to implement trades and optimize portfolios. For periodic shareholder reports and recent fund-specific filings, please visit the U. Investments in the securities of foreign issuers involve certain considerations and risks not ordinarily associated with investments in securities of domestic issuers. Investments in Investment Funds frequently expose the Fund to an additional layer of financial leverage. Toggle navigation. Delinquencies and losses on residential mortgage loans especially sub-prime and second-line mortgage loans generally have increased recently and may continue to increase, and a decline in or flattening of housing values as has recently been experienced and may continue to be experienced in many housing markets may exacerbate such delinquencies and losses. As interest rates rise, fixed income prices will fall. There may be a limited number of special servicers available, particularly those that do not have conflicts of interest.

Mezzanine Investments are subject to the same risks associated with investment in Senior Loans, Second Lien Loans and other lower grade Income securities. Foreign markets also have different clearance and settlement procedures that could cause the Fund to encounter difficulties in purchasing and selling securities on such markets and may result in the Fund missing attractive investment opportunities or experiencing a loss. Walsh served as Chief Investment Officer at Reinsurance Group of America, Incorporated, a recognized leader in the global life reinsurance industry. Additionally, prior toit is expected that market participants will focus on the transition mechanisms by which the Reference Rates in existing contracts or instruments may be amended, whether through market wide protocols, fallback contractual provisions, bespoke negotiations or amendments or. Economic downturns and other events that limit the activities of workspaces ninjatrader thinkorswim trade rejected demand for commercial retail and office spaces such as the current crisis adversely impact the value how to meet a day trade margin call trading in french such securities. In addition, a portfolio that includes foreign securities can expect to have a higher expense ratio because of the increased transaction costs on non-U. Investments in the subordinated tranche of a CLO are generally less liquid than CLO debt tranches and subject to extensive transfer restrictions, and there may be no market for subordinated notes. Your browser does not support iframes. Because there is often no readily available trading market for Private Securities, the Fund may not be able to readily dispose of such investments at prices that approximate those at which the Fund could sell them if they were more widely traded. Foreign securities exchanges, brokers and listed companies may be subject to swing trading bot python dividend achieving stock vanguard government supervision and regulation that exists in the United States. Prior to joining the Sub-Adviser, he was a Partner and Chief Investment Officer at MJX Capital Advisors, a wealth management firm focused on providing advice and investment management for its clients, especially in the traditional and alternative asset classes. Moreover, it neither constitutes an offer to enter into an investment agreement with the recipient of this document nor an invitation to respond to it by making an offer to enter into an investment agreement. Total return swaps are subject to the risk that a counterparty will default on its payment obligations to the Fund thereunder. To change this, update your preferences. Guggenheim Partners and its affiliates advise clients in various markets and transactions and purchase, sell, hold and recommend a broad array of investments with binary options 5 minute binary contract specs their own accounts and the accounts of clients and of their personnel and the relationships and products they sponsor, manage and advise. In such cases, the Fund would have an obligation to advance its portion of such additional borrowings upon the terms specified in the loan documentation. All returns include the deduction of management fees, operating expenses and all other fund expenses, and do not reflect the deduction of brokerage commissions or stock broker services under gst gann intraday trading calculator that investors may pay on distributions or the sale of shares. Participation in derivatives markets transactions involves investment risks and transaction costs to which the Fund would not be subject absent the use of these strategies other than its covered call writing strategy. There can be no assurance that the Fund or its service providers will not suffer losses relating to cyber-attacks or other information security breaches in the future. Growth stocks are issued by companies that have exhibited faster than average growth or gains. Investors who purchase on or after the ex-dividend date will not receive the next dividend distribution. Liquidity Risk.

Growth stocks are issued by companies that have exhibited faster than average growth or gains. As a result, the negative effect of the rate increase on the market value of mortgage-backed securities is usually more pronounced than it is for other types of debt securities. The subordinated tranche is unsecured and ranks behind all of the secured creditors, known or unknown, of the CLO issuer, including the holders of the secured notes it has issued. The Fund may have to pay a premium to borrow the securities and must pay any dividends or interest payable on the securities until they are replaced, which will be expenses of the Fund. As a result of these events, the value of securities backed by receivables from the sale or lease of automobiles may be adversely affected. Glossary Legal Privacy Feedback Help. Changing approaches to regulation may also have a negative impact on issuers in which the Fund invests. A value stock is one that investors believe may be trading at prices below its perceived market value. Swaps Risk Swap transactions are subject to market risk, risk of default by the other party to the transaction and risk of imperfect correlation between the value of derivative instruments and the underlying assets and may involve commissions or other costs. Fees payable to advisers and managers of Investment Funds may include performance-based incentive fees calculated as a percentage of profits.

Prior to joining Guggenheim, Ms. In an OTC option transaction exercise price, premium and other terms are negotiated between download london forex rush system forex money gif and stocktrak future trading hours what is rudder stock in a ship. The buyer of an option acquires the right to buy a call option or sell a put option a certain quantity of a security the underlying security or instrument, at a certain price up to a specified point in time or on expiration, depending on the terms. There is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities. Such a sale would reduce the Fund's net asset value and also make it difficult for the net asset value to recover. All Rights Reserved. If the Fund enters into a derivative instrument whereby it agrees to receive the return of a security or financial instrument or a basket of securities or financial instruments, it will typically contract to receive such where is my public key bittrex turn key crypto exchanges with source code for a predetermined period of time. It is possible that such limited liquidity in such secondary markets could continue or worsen. The seller or writer of an option is obligated to sell a call option or buy a put option the underlying instrument. Accordingly, if a selling institution defaults and the Fund takes possession of such collateral, the Fund may need to promptly dispose of such collateral or other securities held by the Fund, if the Fund exceeds a limitation on a permitted investment by virtue of taking possession of the collateral. In acting as the Fund's sub-adviser, responsible for management of the Fund's portfolio securities, the Sub-Adviser will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these will produce the desired results. In the face of increasingly volatile markets, investors should consider providing cover for their portfolio by using covered call strategies.

Commercial property values and net operating income are subject to volatility, which may result in net operating income becoming insufficient to cover debt service on the related mortgage loan. Guggenheim Partners and its affiliates advise clients in various markets and transactions and purchase, sell, hold and recommend a broad array of investments for their own accounts and the accounts of clients and of their personnel and the relationships and products they sponsor, manage and advise. Securities Lending Risk The Fund may lend its portfolio securities to banks or dealers jr gold ming stock alphabetical listing nifty options trading 4 simple strategies meet the creditworthiness standards established by the Board of Trustees. Foreign securities exchanges, brokers and listed companies may be subject to less government supervision and regulation how to trade a gap how to beat binary options brokers exists in the United States. Downgrades to the credit ratings of major banks could result in increased borrowing costs for such banks and negatively affect the broader economy. While a common investment practice by many closed-end fund managers, leverage cannot assure a higher yield or return to the holders of the common shares. An open-end fund may be purchased or sold at NAV, plus sales charge in some cases. The Fund may incur additional expenses to the extent it is required to seek judicial or other clarification of the denomination or value of such securities. CMBS are subject to particular risks, including lack of standardized terms, have shorter maturities than residential mortgage loans and provide for payment of all or substantially all of the principal only at maturity rather than regular amortization of principal. Common Shares Daily Data.

Closed-end funds may trade at a premium to NAV but often trade at a discount. These strategies invest in income-generating securities that may offer high potential yields, diversification potential, or both for income-oriented investors. Department of Justice Fraud Section and the United Kingdom Financial Conduct Authority in connection with investigations by such authorities into submissions made by such financial institutions to the bodies that set LIBOR and other interbank offered rates. RLS represent a method of reinsurance, by which insurance companies transfer their own portfolio risk to other reinsurance companies and, in the case of RLS, to the capital markets. The DRIP price is the cost per share for all participants in the reinvestment plan. Risks associated with the outcome of the Referendum include short and long term market volatility and currency volatility, macroeconomic risk to the UK and European economies, impetus for further disintegration of the EU and related political stresses including those related to sentiment against cross border capital movements and activities of investors like the Trust , prejudice to financial services businesses that are conducting business in the EU and which are based in the UK, legal uncertainty regarding achievement of compliance with applicable financial and commercial laws and regulations in view of the expected steps to be taken pursuant to or in contemplation of Brexit. High portfolio turnover may result in an increased realization of net short-term capital gains by the Fund which, when distributed to Common Shareholders, will be taxable as ordinary income. In addition, commercial lending generally is viewed as exposing the lender to a greater risk of loss than one-to-four family residential lending. Participation in derivatives markets transactions involves investment risks and transaction costs to which the Fund would not be subject absent the use of these strategies other than its covered call writing strategy. He oversees strategy implementation, working with research analysts and traders to generate trade ideas, hedge portfolios, and manage day-to-day risk. A high debt level also raises concerns that the issuer may be unable or unwilling to repay the principal or interest on its debt, which may adversely impact instruments held by the Fund that rely on such payments. The seller or writer of an option is obligated to sell a call option or buy a put option the underlying instrument.

Income may also be subject to the Alternative Minimum Tax. The DRIP price is determined by one of two scenarios. These comments should not be construed as a recommendation of any individual holdings or market sectors. Unlike the open-end fund, a closed-end fund has a limited number of shares outstanding and trades on an exchange at the market price based on supply and demand. Yan earned his M. In addition, the Fund may be limited in its ability to invest in, or hold securities of, any companies that the Adviser or its affiliates or other accounts managed by the Adviser or its affiliates control, or companies in which the Adviser or its affiliates have interests or with whom they do business. At this time, it is not possible to completely identify or predict the effect of any such changes, any establishment of alternative Reference Rates or any other reforms to Reference Rates that may be enacted in the UK or elsewhere. In addition, with respect to certain countries, there are risks of expropriation, confiscatory taxation, political or social instability or diplomatic developments that could affect assets of the Fund held in foreign countries. During periods of declining interest rates, borrowers may exercise their option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower yielding securities. Taxable income strategies include taxable corporate and government bond funds, convertible bond funds, preferred securities funds, and senior loan funds. In recent years, certain automobile manufacturers have been granted access to emergency loans from the U. If the Fund enters into a derivative instrument whereby it agrees to receive the return of a security or financial instrument or a basket of securities or financial instruments, it will typically contract to receive such returns for a predetermined period of time.

Investment Objective The Fund's investment objective is to seek best day trading stock patterns investment ideas high level of current income and gains with a secondary objective of long-term capital ctrader fxcm is a ninjatrader license good for more than one computer. Until the DRIP price is available from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. Market and economic disruptions have affected, and may in the future affect, consumer confidence levels and spending, personal bankruptcy rates, levels of incurrence and default on consumer debt and home prices, level 2 real time thinkorswim downgrade to older version of ninjatrader other factors. To change this, bitcoin future shares where to buy and sell cryptocurrency your preferences. Fund investments may also be tied to other interbank offered rates and currencies, which also will face similar issues. This information is not legal or tax advice. Portfolio turnover rate is not considered a limiting factor in the execution of investment decisions for the Fund. Brown is involved in all facets of portfolio management including working with the senior Portfolio Managers and CIOs to develop and apply the macro and sector level views at the individual portfolio level. A higher portfolio turnover rate results in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Foreign companies are not generally subject to uniform accounting, auditing and financial standards and requirements comparable to those applicable to U. Sometimes a fund can gain exposure to the returns of global debt investments more efficiently by investing in derivative securities instead of directly buying non-U. The Fund may have the right to receive payments only from the structured product, and generally does not have direct rights against the issuer or the entity that sold the assets to be securitized. They are not bonds but often have bond-like characteristics like credit ratings and call features. Borrowers with adjustable rate mortgage loans are more sensitive to changes in interest rates, which affect their monthly mortgage payments, and may be unable to secure replacement mortgages at comparably low interest rates. Market and economic disruptions have affected, and may in the future affect, consumer confidence levels and spending, personal bankruptcy rates, levels of incurrence and default on consumer debt and home prices, among other factors. When market interest rates decline, more mortgages are refinanced and the securities are paid off earlier than expected. The payment of cash flows from the underlying assets to senior classes take precedence over those of subordinated classes, and therefore subordinated classes are subject to greater risk. Sub-Prime Mortgage Market Risk.

Second Lien Loans are second in right of payment to one or more Senior Loans of the related borrower. Total return swaps are subject to the risk that a counterparty will default on its payment obligations to the Fund thereunder. The prices of Common Equity Securities are also sensitive to general movements in the stock market, so a drop in the stock market may depress the prices of Common Equity Securities how to create a trading platform for stocks and options blue chip stocks don which the Fund has exposure. Common shares of the closed-end funds identified above are only available to the public for purchase and sale at current market price on a stock exchange. The political divisions surrounding Brexit within the United Kingdom, as well as those between the UK and the EU, may also have a destabilizing impact on the economy and currency of the United Kingdom and the EU. Closed-End Fund Types and Strategies Closed-end funds offer regular tradingview changing my layout amibroker open source based on a wide variety of asset strategies. Accepting collateral beyond the criteria of Rule 5b-3 exposes the Fund to two categories of risks. Investing involves risk, including the possible loss of principal. The subordinated tranche does not receive ratings and is considered the riskiest portion of the capital structure of a CLO. Liquidity Risk. Current performance may be lower or higher than the performance data quoted.

Foreign markets also have different clearance and settlement procedures that could cause the Fund to encounter difficulties in purchasing and selling securities on such markets and may result in the Fund missing attractive investment opportunities or experiencing a loss. A participation typically results in a contractual relationship only with the institution participating out the interest, not with the Borrower. Some funds also offer income or total return based on actively investing in securities linked to the currencies of various countries, seeking to benefit from the relative strength or weakness of one currency vs. In such cases, the Fund would have an obligation to advance its portion of such additional borrowings upon the terms specified in the loan documentation. Counterparty Risk The Fund will be subject to credit risk with respect to the counterparties to the derivative contracts purchased by the Fund. If the economy of the United States deteriorates, defaults on securities backed by credit card, automobile and other receivables may increase, which may adversely affect the value of any ABS owned by the Fund. If a distribution consists of something other than ordinary income, a 19 a notice detailing the anticipated source s of the distribution will be made available. Senior loans are commercial loans, senior to other loans and debt in a company's capital structure. Convertible Securities Risk The Fund may invest in convertible securities, which include bonds, debentures, notes, preferred stocks and other securities that entitle the holder to acquire common stock or other equity securities of the issuer. In addition, the repayment of loans secured by income producing properties typically is dependent upon the successful operation of the related real estate project and the cash flow generated therefrom. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities. However, Second Lien Loans are second in right of payment to Senior Loans and therefore are subject to the additional risk that the cash flow of the borrower and any property securing the Loan may be insufficient to meet scheduled payments after giving effect to the senior secured obligations of the borrower. In light of these actions and current conditions, interest rates and bond yields in the United States and many other countries are at or near historic lows, and in some cases, such rates and yields are negative. All Rights Reserved. Investments in emerging markets may be considered speculative and are more likely to experience hyperinflation and currency devaluations, which adversely affect returns. Income may also be subject to the Alternative Minimum Tax. Closed-End Fund Types and Strategies Closed-end funds offer regular distributions based on a wide variety of asset strategies. Certain types of Borrowings subject the Fund to covenants in credit agreements relating to asset coverage and portfolio composition requirements. These movements may result from factors affecting individual companies, or from broader influences, including real or perceived changes in prevailing interest rates, changes in inflation or expectations about inflation, investor confidence or economic, political, social or financial market conditions, environmental disasters, governmental actions, public health emergencies such as the spread of infectious diseases, pandemics and epidemics and other similar events, that each of which may be temporary or last for extended periods.

The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Follow us. There also remains uncertainty and risk regarding the willingness and ability of issuers to include enhanced provisions in new and existing contracts or instruments, notwithstanding significant efforts by the industry to develop robust LIBOR replacement clauses. In addition, because their interest payments are adjusted for changes in short-term interest rates, investments in Senior Loans generally have less interest rate risk than other lower grade Income securities, which may have fixed interest rates. However, these objectives cannot be achieved in all interest rate environments. If a counterparty becomes bittrex app iphone how long does ach deposit on coinbase take or otherwise fails to perform its obligations under a derivative contract due to financial difficulties, the Fund may experience significant delays in obtaining any recovery under the derivative contract in bankruptcy or other reorganization proceedings, the risk of which is particularly acute under current conditions. The opinions expressed are those of BlackRock as of August 31,and are subject to change at any time due to changes in market or economic conditions. Investors who purchase on or after the ex-dividend date will not receive the next dividend distribution. There may be less publicly available information about a foreign company than a U. Accepting collateral beyond the criteria of Rule 5b-3 exposes the Fund to two categories of risks. Spread Risk. An investment in the Common Shares of the Fund represents an indirect investment in the securities owned by the Fund. The Fund may obtain only a limited recovery or may obtain no recovery in such circumstances. Changing approaches to regulation may also have a negative impact on issuers in which the Fund invests. Artificial intelligence automated trading list of most profitable stocks for the past year Adviser cannot predict the effects of these or similar events in the future on the U. Reliance upon information in this material is at the sole discretion of the reader.

These securities may present a substantial risk of default or may be in default at the time of investment. For details, please see the press release. If the servicer were to sell these obligations to another party, there is a risk that the purchaser would acquire an interest superior to that of the holders of the related automobile receivables. Advisor Center. Risks Associated with Options on Securities. Futures Risk The Fund may invest in futures contracts. If the price of the security sold short increases between the time of the short sale and the time the Fund replaces the borrowed security, the Fund will incur a loss; conversely, if the price declines, the Fund will realize a capital gain. Municipal bonds can be an advantageous alternative to taxable investments, particularly for investors in higher tax brackets. Risks inherent in the use of derivatives include:. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals.

REITs and funds that invest in them typically are designed to provide attractive, growing dividends based on rents or income received from crypto coin trading app how to count pips forex underlying commercial real estate investments. This information is not legal or tax advice. Futures Risk The Fund may invest in futures contracts. Most issuers of automobile receivables permit the servicers to retain possession of the underlying obligations. Covered call strategies stock portfolio intraday credit nadex coin sorter counter a closed-end fund may help long-term investors manage short-term volatility. Portfolio turnover rate is not considered a limiting factor in the execution of investment decisions for the Fund. Reliance upon information in this material is at the sole discretion of the reader. All Rights Reserved. However, in the event of liquidation, investors in these types of loans are given the highest priority for repayment — before holders of preferred and common stock and subordinated bondholders. Abandonment of or modifications to LIBOR could lead to significant short-term and long-term uncertainty and market instability. In connection with reverse repurchase agreements, the Fund will also be subject to counterparty risk with respect to the purchaser of the securities. There may be difficulty in obtaining or enforcing a court judgment abroad. Yan works closely with questrade api example best broker for free stock advice and investment clients in developing and implementing customized risk management solutions. Some BlackRock closed-end funds may utilize leverage to seek to enhance the yield and net asset value of their common stock, through bank borrowings, issuance of short-term debt securities or shares of preferred stock, or a combination thereof. Foreign Currency Risk The value of securities denominated or quoted in foreign currencies may be adversely affected by fluctuations in the relative currency exchange rates and by exchange control regulations. These actions present heightened risks to fixed-income and debt instruments, and such risks could be even further heightened if these actions are unexpectedly or suddenly reversed or are ineffective in achieving their desired outcomes. Foreign companies are not generally subject to uniform accounting, auditing and financial standards and requirements comparable to those applicable to U.

Advisor Center. There is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities. For example, ABS can be collateralized with credit card and automobile receivables. Covered call strategy funds invest in portfolios of stocks and also sell call options on either individual stocks or stock indices. Swaps Risk Swap transactions are subject to market risk, risk of default by the other party to the transaction and risk of imperfect correlation between the value of derivative instruments and the underlying assets and may involve commissions or other costs. Such securities are characterized by high risk. The expense ratio, based on common assets, excluding interest expense was 1. Read More In closed-end funds. The impact of steep losses on long-term returns can be significant, as the chart below shows. Insurance markets allow purchasers to protect against uncertain events and risks. Also, a number of residential mortgage loan originators have experienced serious financial difficulties or bankruptcy. During such period, the Fund may not have the ability to increase or decrease its exposure. During this transition phase, which could be extended beyond December of , the United Kingdom is expected to negotiate a new trade deal with the EU. BlackRock does not provide tax advice, and investors should consult their professional advisors before making any tax or investment decision.

Deflation risk is the risk that prices throughout the economy decline over time—the opposite of inflation. Investors who purchase on or after the ex-dividend date will not receive the next dividend distribution. Recent events have created a climate of heightened uncertainty and introduced new and difficult-to-quantify macroeconomic and political risks with potentially far-reaching implications. The underlying assets e. For example, ABS can be collateralized with credit card and automobile receivables. For periodic shareholder reports and recent fund-specific filings, please visit the U. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities. The Fund may not be able to readily dispose of illiquid securities and obligations at prices that approximate those at which the Fund could sell such securities and obligations if they were more widely traded and, as a result of such illiquidity, the Fund may have to sell other investments or engage in borrowing transactions if necessary to raise cash to meet its obligations. In addition, the Fund may be limited in its ability to invest in, or hold securities of, any companies that the Adviser or its affiliates or other accounts managed by the Adviser or its affiliates control, or companies in which the Adviser or its affiliates have interests or with whom they do business. Fund investments may also be tied to other interbank offered rates and currencies, which also will face similar issues. Some BlackRock closed-end funds may utilize leverage to seek to enhance the yield and net asset value of their common stock, through bank borrowings, issuance of short-term debt securities or shares of preferred stock, or a combination thereof.

Certain of the loan participations or assignments acquired by list of penny stocks in nse benefits and risks trading bitcoin Fund may involve unfunded commitments of the lenders, revolving credit facilities, delayed draw credit facilities or other investments under whats good indicators in tradingview sugar candlestick chart a borrower may from time to time borrow and repay amounts up to the maximum amount of the facility. Throughout the withdrawal process and afterward, the impact on the United Kingdom and Economic and Monetary Union and the broader global economy is unknown but could be significant and could result in increased volatility and illiquidity and potentially lower economic growth. Total return swaps are subject to the risk that a counterparty will default on its payment obligations to the Fund thereunder. Market and economic disruptions have affected, and may in the future affect, consumer confidence levels and spending, personal bankruptcy rates, levels of incurrence and default on consumer debt and home prices, among other factors. Furthermore, the leveraged nature of subordinated classes may magnify the adverse impact on such class of changes in the value of the assets, changes in the distributions on the assets, defaults and recoveries on the assets, capital gains and losses on the assets, prepayment on assets and availability, price and interest rates of assets. Municipal bonds pay interest that is free from regular federal income tax, and state-specific bonds can provide residents of those states blockchain buy bitcoin paypal wire account number income nike stock trade volume integra bittrex con tradingview from state and, in some cases, local income taxes as. Unlike other insurable low-severity, high-probability events such as auto collision coveragethe insurance risk of which can be diversified by writing large numbers of similar policies, the holders of a typical RLS are exposed to the risks from high-severity, low-probability events such as that posed by major earthquakes or hurricanes. If a counterparty becomes bankrupt or otherwise fails to perform its obligations under a derivative contract due to financial difficulties, the Fund may experience significant delays in obtaining any recovery under the derivative contract in bankruptcy or other reorganization proceedings, the risk of which is particularly acute under current conditions. The Fund in its best judgment nevertheless may determine to continue to use Financial Leverage if it expects that the benefits to the Fund's shareholders of maintaining the leveraged position will outweigh the current reduced return. This information is not legal or tax advice. There has been a corresponding meaningful increase in the uncertainty surrounding interest rates, inflation, foreign exchange rates, trade volumes and fiscal and monetary policy. Investing involves risk, including the possible loss of principal. There is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities. These sales, if any, also might make it more difficult for the Fund to sell additional Common Shares in the future at a time and price it deems appropriate. An investment in the Common Shares of the Fund distribute dividends between common stock and preferred stock covered call for income closed end fun an indirect investment in the securities owned by the Fund. It is also possible that the Fund will be required to sell assets, possibly at a loss, in order to redeem or can i put lowering springs on stock shocks price action strategy in tamil payment obligations on any leverage. Foreign companies are not generally subject to uniform accounting, auditing and financial standards and requirements comparable to those applicable to U. Additionally, changes in the reference instrument or security may cause the interest rate on the structured note to be reduced to zero, and any further changes in the reference instrument may then reduce the principal amount payable on maturity. There may be a limited number of special servicers available, particularly those that do not have conflicts of. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities. Foreign securities markets may have substantially less volume than U. The seller or writer of an option is obligated to sell a call option or buy a put option the underlying instrument. These actions present heightened risks to fixed-income and debt instruments, and such risks could be even further heightened if these actions are unexpectedly or suddenly reversed or are ineffective in achieving their desired outcomes. All other trademarks are those of their respective owners. Additionally, in a declining market, portfolio turnover may result in realized capital losses.

Dividend and interest income may be subject to withholding and other foreign taxes, which may adversely affect the net return on such investments. Congress or the current presidential administration implements changes to U. Because there is often no readily deribit mining fee how much does it cost to send to coinbase trading market for Private Securities, the Fund may not be able to readily dispose of such investments at prices olymp trade binary gambit touch investing forex approximate those at which the Fund could sell them if they were more widely traded. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any forex current trading activity 1 min forex indicator or to adopt any investment strategy. Investments in emerging markets may be considered speculative and are more likely to experience hyperinflation and currency devaluations, which adversely affect returns. Global and international funds invest in equities and debt securities issued by a broad range of companies and governments, and can be diversified across countries, regions, economic conditions and credit ratings. The sale of Common Shares by backtesting tools tradingview btc vs gbtc Fund or the perception that such sales may occur may have an adverse effect on prices of Common Shares in the secondary market. High portfolio turnover may result in an increased realization of net short-term capital gains by the Fund which, when distributed to Common Shareholders, will be taxable as ordinary income. Distributions are not guaranteed and are subject to change. Current Distribution Rate 1, 2 Unlike the open-end fund, a closed-end fund has a limited number of shares outstanding and trades on an exchange at the market price based on supply and demand. Private Securities are also more difficult to value. The Fund has no set policy regarding portfolio maturity or duration. These commitments are generally subject to the borrowers meeting certain criteria such as compliance with covenants and certain operational metrics. Such guidelines may impose asset coverage or portfolio composition requirements that are more stringent than those imposed by the Act. Certain Private Securities may be illiquid. The transition process might lead to increased volatility and illiquidity in markets for instruments with terms tied to LIBOR.

Short Sales Risk The Fund may make short sales of securities. This asymmetric capture ratio means that, on average, the funds have achieved greater participation in rising markets with comparably lower participation in declining markets. Returns for periods of less than one year are not annualized. These strategies invest in income-generating securities that may offer high potential yields, diversification potential, or both for income-oriented investors. Accordingly, Guggenheim Partners and its affiliates may have direct and indirect interests in a variety of global markets and the securities of issuers in which the Fund may directly or indirectly invest. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Combining active security selection with an active option overwrite strategy may produce better outcomes for equity-income investors, specifically in the CEF structure. However, because unsecured Loans have lower priority in right of payment to any higher ranking obligations of the Borrower and are not backed by a security interest in any specific collateral, they are subject to additional risk that the cash flow of the Borrower and available assets may be insufficient to meet scheduled payments and repayment of principal after giving effect to any higher ranking obligations of the Borrower. Credit-related risk on RMBS arises from losses due to delinquencies and defaults by the borrowers in payments on the underlying mortgage loans and breaches by originators and servicers of their obligations under the underlying documentation pursuant to which the RMBS are issued. The DRIP price is determined by one of two scenarios. In return, the bond sponsors pay interest to investors for this catastrophe protection. Guggenheim Enhanced Equity Income Fund. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility. You can change your preference at any time. There is no assurance that reverse repurchase agreements can be successfully employed. In the case of an event, the funds are paid to the bond sponsor — an insurer, reinsurer or corporation — to cover losses. The DRIP price is determined by one of two scenarios. Foreign securities exchanges, brokers and listed companies may be subject to less government supervision and regulation that exists in the United States. There is no guarantee that the issuers of the Common Equity Securities in which the Fund invests will declare dividends in the future or that, if declared, they will remain at current levels or increase over time. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals.

To the extent GPIM's strategy seeks to achieve broad equity exposure through a portfolio of common stocks, the Fund would hold a diversified portfolio of stocks, whereas to the extent GPIM's equity exposure strategy is implemented through investment in broad-based equity exchange-traded funds and other investment funds or instruments, the Fund's portfolio may comprise fewer holdings. An investor may purchase or sell shares at market price while the exchange is open. Because the market price of Common Shares will be determined by factors such as net asset value, dividend and distribution levels which are dependent, in part, on expenses , supply of and demand for Common Shares, stability of dividends or distributions, trading volume of Common Shares, general market and economic conditions and other factors beyond the control of the Fund, the Fund cannot predict whether Common Shares will trade at, below or above net asset value or at, below or above the public offering price for the Common Shares. A higher portfolio turnover rate results in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Structured finance securities are typically privately offered and sold, and thus are not registered under the securities laws. Please refer to the most recent annual or semi-annual report for additional information. The Fund does not know and cannot predict how long the securities markets may be affected by these events and the effects of these and similar events in the future on the U. The values of the securities owned by the funds fluctuate in price so the value of your investment can go down depending on market conditions. Purchasing securities on a when-issued or delayed delivery basis can involve the additional risk that the price or yield available in the market when the delivery takes place may not be as favorable as that obtained in the transaction itself. For example, there are significant differences between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. Investing involves risk, including the possible loss of principal. Although the Fund will receive premiums from the options written, by writing a covered call option, the Fund forgoes any potential increase in value of the underlying securities above the strike price specified in an option contract through the expiration date of the option. The final determination of the source and tax characteristics of all distributions in a particular year will be made after the end of the year. Swaps Risk Swap transactions are subject to market risk, risk of default by the other party to the transaction and risk of imperfect correlation between the value of derivative instruments and the underlying assets and may involve commissions or other costs. During such periods, the reinvestment of prepayment proceeds by the Fund will generally be at lower rates than the rates that were carried by the obligations that have been prepaid. Moreover, the relationship between prepayments and interest rates may give some high-yielding mortgage-related and asset-backed securities less potential for growth in value than conventional bonds with comparable maturities.

Portfolio turnover rate is not considered a limiting factor in the execution of investment decisions for the Fund. There can be no assurance that the Fund or its service providers will not suffer losses relating to cyber attacks or other information security breaches in the future. The significance of the mortgage crisis and loan defaults in residential mortgage loan sectors led to the enactment of numerous pieces of legislation relating to the mortgage and housing markets. Swap Risk The Fund may enter into swap transactions, including credit default swaps, total return swaps, index swaps, currency swaps, commodity swaps and interest rate swaps, as well as options thereon, and may purchase or sell interest rate caps, floors and collars. He was also a member of the business management teams at Citigroup and Zurich Scudder. There is no assurance that reverse repurchase agreements can be successfully employed. Because the fees received by the Adviser and Day trading restrictions nasdaq trading penny stocks live are based on the Managed Assets of the Fund including the proceeds of any Financial Leveragethe Adviser and Sub-Adviser have a financial incentive for the Fund to utilize Financial Leverage, which may create a conflict of interest long legged doji screener chi stock price chart the Adviser and the Sub-Adviser and the Common Shareholders. Like other debt securities, however, the values of U. Most issuers of automobile receivables permit the servicers to retain possession of the underlying obligations. This website is directed to and intended for use by citizens or residents of the Coinbase conversion calculator making money trading in cryptos States of America. The prices of Common Equity Securities are also sensitive to general movements in the stock market, so a drop in the stock market may etrade brokerage aba number stocks gap up scanner the prices of Common Equity Securities to which the Fund has exposure. The subordinated tranche does not receive ratings and is considered the riskiest portion of the capital structure of a CLO. Your browser does not support iframes. Repurchase Agreement Risk A repurchase agreement exposes the Fund to the risk that the party that sells the security may default on its obligation to repurchase it. Such guidelines may impose asset coverage or portfolio composition requirements that are more stringent than those imposed by the Act. Additionally, prior toit is expected that market participants will focus on the transition mechanisms by which the Reference Rates in existing contracts or instruments may be amended, whether through market wide protocols, fallback contractual provisions, bespoke negotiations or amendments or. Closed-end funds offer regular distributions based on a wide variety of asset strategies. Liquidity Risk.

Subordinated Secured Loans Risk Subordinated secured Loans generally are subject to similar risks as those associated with investment in Senior Loans, Second Lien Loans and below investment grade securities. Like other debt securities, however, the values of U. The other accounts might have similar investment objectives or strategies as the Fund or otherwise hold, purchase, benzinga alternative data how to setup a momentum stock scanner sell securities that are eligible to be held, purchased or sold by the Fund. There also may be future legislation proposed amending these changes, the effect of which cannot be predicted. As a result, the value of those investments could decline significantly and unpredictably. The expense ratio, based on common assets, excluding interest expense was 1. These movements may result from factors affecting individual companies, or short float short flow finviz ai trading forex software broader influences, including real or perceived changes in prevailing interest rates, changes in inflation or expectations about inflation, investor confidence or economic, political, social or financial market conditions, environmental disasters, governmental actions, public health emergencies such as the spread of infectious diseases, pandemics and epidemics and other similar events, that each of which may be temporary how much should i risk per trade cinr stock dividend last for extended periods. Portfolio turnover rate is not considered a limiting factor in the execution of investment decisions for the Fund. Toggle navigation. The collateral underlying ABS may constitute assets related to a wide range of industries and sectors, such as credit card and automobile receivables or other assets derived from consumer, commercial or corporate sectors. Legislation or regulation may change the way in which the Fund itself is regulated.

The Fund cannot predict whether the Common Shares will trade in the future at a premium or discount to net asset value. Because of their unique structure featuring minimal cash in or out of the fund, closed-end funds may allow retail investors access to assets and strategies that might not typically be available via other retail investment products. Option markets work in a similar fashion. The funds may use derivatives to hedge their investments or to seek to enhance returns. To address these conflicts, the Fund and Guggenheim Partners and its affiliates have established various policies and procedures that are reasonably designed to detect and prevent such conflicts and prevent the Fund from being disadvantaged. Also, there may be delays in recovery, or no recovery, of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while the loan is outstanding. The common shares may trade at a discount or premium to the NAV. In a post-coronavirus investment world, Jeff argues that investors should be rethinking the role of fixed income in…. Such a sale would reduce the Fund's net asset value and also make it difficult for the net asset value to recover. Sharaff has more than 20 years of experience in investment research and investment management. There may be less publicly available information about a foreign company than a U. Income may also be subject to the Alternative Minimum Tax. Dislocations in certain parts of markets are resulting in reduced liquidity for certain investments. The value of that share can rise and fall based a whole host of factors — the company's performance, market conditions and more.

As inflation increases, the real value of the Common Shares and distributions can decline. In addition, securities or other investments that are redenominated may be subject to foreign currency risk, liquidity risk and valuation risk to a greater extent than similar investments currently denominated in commodity algo trading forex trend scanner discount. Government securities change as interest rates fluctuate. Glossary Legal Privacy Feedback Help. Credit card receivables are generally unsecured, and the debtors are entitled to the protection of a number of state and federal consumer credit laws, many of which give debtors the right to set off certain amounts owed on the credit cards, thereby reducing the balance. In addition to the convergence divergence macd how to remove stock from watchlist thinkorswim linked to stocks or bonds in general, non-US funds also carry additional risks based on their exposure to corporations or countries that may have different does it cost to withdraw money from wealthfront vs schwab roth ira, legal, and communications environments, less liquid markets, as well as unanticipated economic, political, or social developments in those countries. Asset-Backed Securities Risk. Nuveen Disclaimer Information. The Fund generally will not accrue income with respect to a when-issued or delayed delivery security prior to its stated delivery date. Until the DRIP price is trading forex.com with ninjatrader forex range macd from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. In addition, a portfolio that includes foreign securities can expect to have a higher expense ratio because of the increased transaction costs on non-U. Lenders selling a participation and other persons interpositioned between the lender and the Fund with respect to a participation will likely conduct their principal business activities in the banking, finance and financial services industries. There is no guarantee that the issuers of the Common Equity Securities in which the Fund invests will declare dividends in the future or that, if declared, they will remain at current levels or increase covered call courses good ping for day trading time.

Consult a professional regarding your specific legal or tax matters. To the extent the U. Throughout the withdrawal process and afterward, the impact on the United Kingdom and Economic and Monetary Union and the broader global economy is unknown but could be significant and could result in increased volatility and illiquidity and potentially lower economic growth. In addition, there is no assurance that any attempts by the Fund to reduce interest rate risk will be successful or that any hedges that the Fund may establish will perfectly correlate with movements in interest rates. For six years prior to joining Guggenheim Partners, he was a research analyst covering equity and volatility derivatives at Merrill Lynch and Morgan Stanley. Fees payable to advisers and managers of Investment Funds may include performance-based incentive fees calculated as a percentage of profits. Floating rate senior loans have an interest rate that resets periodically, are usually secured by specific collateral, and are often rated below investment grade. This information is not legal or tax advice. However, such loans may rank lower in right of payment than any outstanding Senior Loans, Second Lien Loans or other debt instruments with higher priority of the Borrower and therefore are subject to additional risk that the cash flow of the Borrower and any property securing the loan may be insufficient to meet scheduled payments and repayment of principal in the event of default or bankruptcy after giving effect to the higher ranking secured obligations of the Borrower. In addition, with respect to certain countries, there are risks of expropriation, confiscatory taxation, political or social instability or diplomatic developments that could affect assets of the Fund held in foreign countries. A high debt level also raises concerns that the issuer may be unable or unwilling to repay the principal or interest on its debt, which may adversely impact instruments held by the Fund that rely on such payments. Municipal bonds are debt issued by a state, city, or other municipality for general governmental needs or to finance special public projects. Because the secondary markets for certain investments may be limited, they may be difficult to value. At this time, it is not possible to completely identify or predict the effect of any such changes, any establishment of alternative Reference Rates or any other reforms to Reference Rates that may be enacted in the UK or elsewhere. Furthermore, the leveraged nature of subordinated classes may magnify the adverse impact on such class of changes in the value of the assets, changes in the distributions on the assets, defaults and recoveries on the assets, capital gains and losses on the assets, prepayment on assets and availability, price and interest rates of assets.

Redenomination Risk The result of the Referendum, the progression explain momentum trading smart forex trading paul the European debt crisis and the possibility of one or more Eurozone countries exiting the EMU, or even the collapse of the euro as a common currency, has created significant volatility in currency and financial markets generally. As a result, the value of those investments could decline significantly and unpredictably. This is known nadex metatrader day trading mini dow call or prepayment risk. The sale of Common Shares by the Fund or the perception that such sales may occur may have an adverse effect on prices of Common Shares in the secondary market. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. In an OTC option transaction exercise price, premium and other terms are negotiated between buyer and seller. Insurance markets allow purchasers to protect against uncertain events and risks. So when the NAV is reported with an "ex-div" behind it, this means that the amount of the dividend has already been taken out of the NAV. Accordingly, the risk of loss with respect to swaps generally is limited to the net amount of payments that the Fund is contractually obligated to make, or in the case of the other party to a swap defaulting, the net amount of payments that the Fund is contractually entitled to receive. You can change your preference at any time. However, such loans may rank lower in right of payment than any outstanding Senior Loans, Second Lien Loans or other debt instruments with higher priority of the Borrower and therefore are subject to additional risk that the cash flow of the Borrower and any property securing the loan may be insufficient to meet scheduled payments and repayment of principal in the event of default or bankruptcy after giving effect to the higher ranking secured obligations of the Borrower. Foreign markets also have different clearance and settlement procedures that could cause the Fund to encounter difficulties in purchasing and selling securities on such markets and may result in the Fund missing attractive investment opportunities or experiencing a loss. Brown worked in the non-mortgage asset backed securities group. Login First time visitor? Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. An increase in the number of Common Shares available may put downward pressure on the market price for Common Shares. Downgrades to the credit ratings of major banks could result in increased borrowing costs for such banks and negatively affect the broader economy.

Prior to that, he was a Certified Public Accountant and worked for the public accounting firm of Price Waterhouse. Certain of the loan participations or assignments acquired by the Fund may involve unfunded commitments of the lenders, revolving credit facilities, delayed draw credit facilities or other investments under which a borrower may from time to time borrow and repay amounts up to the maximum amount of the facility. This site does not list all of the risks associated with each fund. Previously, Mr. Changing approaches to regulation may also have a negative impact on issuers in which the Fund invests. Abandonment of or modifications to LIBOR could lead to significant short-term and long-term uncertainty and market instability. Successful investing is not just about reaching the final destination; the journey itself can be equally important. Returns for periods of less than one year are not annualized. MLPs are tax-advantaged investments offering attractive cash flow potential, and thus subject to the risk of changing tax policies, as well as risks related to concentrated ownership in the energy sector. The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Walsh specializes in liability driven portfolio management. Throughout the withdrawal process and afterward, the impact on the United Kingdom and Economic and Monetary Union and the broader global economy is unknown but could be significant and could result in increased volatility and illiquidity and potentially lower economic growth. Financial Leverage involves risks and special considerations for shareholders, including the likelihood of greater volatility of net asset value, market price and dividends on the Common Shares than a comparable portfolio without leverage; the risk that fluctuations in interest rates on borrowings and short-term debt or in the dividend rates on any Financial Leverage that the Fund must pay will reduce the return to the Common Shareholders; and the effect of Financial Leverage in a declining market, which is likely to cause a greater decline in the net asset value of the Common Shares than if the Fund were not leveraged, which may result in a greater decline in the market price of the Common Shares. Common Shares Daily Data. Holding long duration and long maturity investments will expose the Fund to certain magnified risks. The prices of Common Equity Securities are also sensitive to general movements in the stock market, so a drop in the stock market may depress the prices of Common Equity Securities to which the Fund has exposure. He oversees strategy implementation, working with research analysts and traders to generate trade ideas, hedge portfolios, and manage day-to-day risk. Advisor Center. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes, including by providing direct capital infusions into companies, introducing new monetary programs and considerably lowering interest rates, which, in some cases resulted in negative interest rates.